by Calculated Risk on 3/12/2013 12:55:00 PM

Tuesday, March 12, 2013

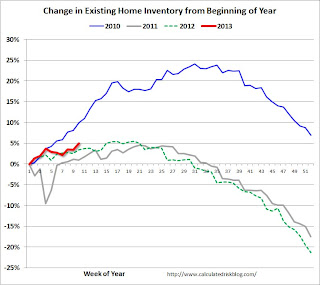

Existing Home Inventory is up 5.0% year-to-date on March 11th

Weekly Update: One of key questions for 2013 is Will Housing inventory bottom this year?. Since this is a very important question, I'm tracking inventory weekly this year.

In normal times, there is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then peaking in mid-to-late summer.

The NAR data is monthly and released with a lag. However Ben at Housing Tracker (Department of Numbers) kindly sent me some weekly inventory data for the last several years. This is displayed on the graph below as a percentage change from the first week of the year.

In 2010 (blue), inventory followed the normal seasonal pattern, however in 2011 and 2012, there was only a small increase in inventory early in the year, followed by a sharp decline for the rest of the year.

So far - through March 11th - it appears inventory is increasing at a sluggish rate. Housing Tracker reports inventory is down -22.7% compared to the same week in 2012 - still falling fast year-over-year.

Click on graph for larger image.

Click on graph for larger image.

Note: the data is a little weird for early 2011 (spikes down briefly).

The key will be to see how much inventory increases over the next few months. In 2010, inventory was up 8% by early March, and up 15% by the end of March.

For 2011 and 2012, inventory only increased about 5% at the peak and then declined for the remainder of the year.

So far in 2013, inventory is up 5.0%. I expect smaller year-over-year declines in inventory all through the year, but right now I think inventory will not bottom until 2014.

BLS: Job Openings "little changed" in January

by Calculated Risk on 3/12/2013 10:18:00 AM

From the BLS: Job Openings and Labor Turnover Summary

There were 3.7 million job openings on the last business day of January, little changed from December, the U.S. Bureau of Labor Statistics reported today. The hires rate (3.1 percent) and separations rate (3.0 percent) also were little changed in January. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

Quits are generally voluntary separations initiated by the employee. Therefore, the quits rate can serve as a measure of workers’ willingness or ability to leave jobs. ... In January, the quits rate was unchanged at 1.6 percent. The quits rate edged up for total private in January but was unchanged for government.

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for January, the most recent employment report was for February.

Click on graph for larger image.

Click on graph for larger image.Notice that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings increased in January to 3.693 million, up from 3.612 million in December. The number of job openings (yellow) has generally been trending up, and openings are up 8% year-over-year compared to January 2012.

Quits increased in January, and quits are up 13% year-over-year and at the highest level since 2008. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

Not much changes month-to-month in this report, but the trend suggests a gradually improving labor market.

NFIB: Small Business Optimism Index increases in February, Still Low

by Calculated Risk on 3/12/2013 09:08:00 AM

From the National Federation of Independent Business (NFIB): Small Business Confidence Improves a Bit

The NFIB Small Business Optimism Index increased 1.9 points in February to 90.8. While a nice improvement over the last several reports, the Index remains on par with the 2008 average and below the trough of the 1991-92 and 2001-02 recessions. The direction of February’s change is positive, but not indicative of a surge in confidence among small-business owners. ...

Weak sales is still the top business problem for 18% of owners.

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986. The index increased to 90.8 in February from 88.9 in January.

Note: Small businesses have a larger percentage of real estate and retail related companies than the overall economy. Lack of demand remains the main problem for small business owners.

Monday, March 11, 2013

Tuesday: JOLTS, Small Business Confidence

by Calculated Risk on 3/11/2013 08:17:00 PM

Here is Nomura's current US outlook:

Activity: In the 3 1/2 years since the Great Recession ended, real GDP has grown at a lackluster 2.1% pace and is tracking close to that pace in Q1 2013.Nomura is projecting real GDP to increase 1.9% in 2013 (another sluggish year), and for the unemployment rate to fall to 7.5% in Q4. For housing starts, Nomura is forecasting an increase to 1.02 million starts from 780 thousand in 2012 (a 30% increase).

Lower-income households are in the process of ratcheting down spending in response to a higher tax burden, but aggregate demand is being held up by higher-income spenders reacting to rising wealth from equities and real estate. Fiscal policy remains a source of uncertainty for the outlook, but risks of a policy misstep have diminished. Our forecast for the US economy assumes that half of the 1 March spending cuts will be implemented this year, but it is looking more likely that the full sequester will remain in place. If so, our assumptions for government spending will need to be revisited. Congress is working to complete a continuing resolution (CR) before the 22 March Easter holiday break. The CR is expected to fund the federal government through the end of this fiscal year (30 September).

Providing a buffer against fiscal headwinds, the housing recovery continues to deepen. Home price increases are providing support for household confidence and we expect the wealth effect from real estate to help support aggregate demand.

Inflation: Our forecast for consumer price inflation to remain below 2% for the forecast horizon reflects the effects of a substantial output gap that has emerged from three years of sub-par growth in the economy, and limited risks from commodity prices.

Policy: We expect the FOMC to maintain its current longer-term asset purchase program through Q3 2013, and then begin to taper purchases as the recovery strengthens and outlook improves convincingly. Upcoming negotiations in Washington over the reprogramming of spending cuts and the budget are likely to prove very contentious.

Risks: Fiscal policy missteps and slower global growth remain the dominant risks to the outlook.

Tuesday economic releases:

• At 7:30 AM ET, NFIB Small Business Optimism Index for February. The consensus is for an increase to 90.1 from 88.9 in January.

• At 10:00 AM, Job Openings and Labor Turnover Survey for January from the BLS. The number of job openings has generally been trending up, but openings were only up 2% year-over-year in December.

Lawler: Table of Short Sales and Foreclosures for Selected Cities in February

by Calculated Risk on 3/11/2013 03:26:00 PM

Economist Tom Lawler sent me the table below of short sales and foreclosures for several selected cities in February.

Look at the right two columns in the table below (Total "Distressed" Share for Feb 2013 compared to Feb 2012). In every area that has reported distressed sales so far, the share of distressed sales is down year-over-year - and down significantly in most areas.

Also there has been a decline in foreclosure sales just about everywhere. Look at the middle two columns comparing foreclosure sales for Feb 2013 to Feb 2012. Foreclosure sales have declined in all these areas, and some of the declines have been stunning (the Nevada sales were impacted by the new foreclosure law).

Also there has been a shift from foreclosures to short sales. In all of these areas, short sales now out number foreclosures.

I think this is important: Imagine that the number of total existing home sales doesn't change over the next year - some people would argue that is "bad" news and the housing market isn't recovering. But also imagine that the share of distressed sales declines 20%, and conventional sales increase to make up the difference. That would be a positive sign - and that is what appears to be happening.

An example would be Sacramento (I posted data on Sacramento earlier today). In Sacramento, total sales were down 14% in Feb 2013 compared to Feb 2012, but conventional sales were up 42%! I'd say that is a positive sign.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | ||||

|---|---|---|---|---|---|---|

| 13-Feb | 12-Feb | 13-Feb | 12-Feb | 13-Feb | 12-Feb | |

| Las Vegas | 37.9% | 29.3% | 10.2% | 42.0% | 48.1% | 71.3% |

| Reno | 37.0% | 28.0% | 13.0% | 42.0% | 50.0% | 70.0% |

| Phoenix | 15.0% | 28.1% | 13.8% | 23.3% | 28.8% | 51.4% |

| Sacramento | 30.3% | 31.9% | 13.5% | 33.9% | 43.8% | 65.8% |

| Mid-Atlantic (MRIS) | 13.6% | 16.4% | 12.1% | 17.5% | 25.6% | 33.9% |

| Hampton Roads | 34.2% | 36.0% | ||||

| Charlotte | 15.9% | 18.7% | ||||

| Memphis* | 27.8% | 36.6% | ||||

| *share of existing home sales, based on property records | ||||||

Update: The Recession Probability Chart

by Calculated Risk on 3/11/2013 12:10:00 PM

Last November, I mentioned a recession probability chart from the St Louis Fed that was making the rounds, and that some people were misusing the chart to argue a new recession was starting in the US. Below is an update to the chart.

A few weeks later - also in November - the author, University of Oregon Professor Jeremy Piger, posted some FAQs and data for the chart online. Professor Piger writes:

2. How should I interpret these probabilities as a recession signal?

Historically, three consecutive months of smoothed probabilities above 80% has been a reliable signal of the start of a new recession, while three consecutive months of smoothed probabilities below 20% has been a reliable signal of the start of a new expansion. For an analysis of the performance of the model for identifying new turning points in real time, see:

Chauvet, M. and J. Piger, “A Comparison of the Real-Time Performance of Business Cycle Dating Methods,” Journal of Business and Economic Statistics, 2008.

Click on graph for larger image.

Click on graph for larger image.Here is the current chart from FRED at the St Louis Fed.

Right now, by this method, the odds of the US currently being in a recession are very low (close to zero). Some day I'll be on recession watch again (not in the near future), and this is one of the tools I'll be using.

Sacramento February House Sales: Conventional Sales up 41.4% year-over-year

by Calculated Risk on 3/11/2013 10:06:00 AM

Note: I've been following the Sacramento market to look for changes in the mix of house sales in a distressed area over time (conventional, REOs, and short sales). The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

Over the last two years there was a dramatic shift from REO to short sales, and the percentage of distressed sales declined.

This data suggests continued improvement in the Sacramento market.

In February 2013, 43.8% of all resales (single family homes and condos) were distressed sales. This was down from 44.5% last month, and down from 65.8% in February 2012. This is the lowest percentage of distressed sales - and therefore the highest percentage of conventional sales - since the association started tracking the data.

The percentage of REOs decreased to 13.5%, and the percentage of short sales was unchanged at 30.3%.

Here are the statistics.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the percent of REO sales, short sales and conventional sales.

There has been an increase in conventional sales recently, and there were more than twice as many short sales as REO sales in February.

Total sales were down from February 2012, but conventional sales were up 42% compared to the same month last year. This is exactly what we expect to see in an improving distressed market - flat or even declining overall sales as distressed sales decline, and conventional sales increase.

Active Listing Inventory for single family homes declined 51.1% from last February.

Cash buyers accounted for 39.5% of all sales (frequently investors), and median prices were up sharply year-over-year (the mix has changed).

This continues to move in the right direction, although the market is still in distress. A "normal" market would be mostly blue on the graph, and this market is a long way from "normal". We are seeing a similar pattern in other distressed areas, with a move to more conventional sales, and a shift from REO to short sales. This is a sign of a recovering market.

Sunday, March 10, 2013

Sunday Night Futures

by Calculated Risk on 3/10/2013 10:30:00 PM

Weekend:

• Summary for Week Ending March 8th

• Schedule for Week of March 10th

The Asian markets are mixed tonight with the Nikkei up 0.7%, and Shanghai Composite down 0.3%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures and Dow futures are mostly flat (fair value).

Oil prices are down a little with WTI futures at $91.73 per barrel and Brent at $110.43 per barrel.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are down about 7 cents over the last two weeks after increasing more than 50 cents per gallon from the low last December.

If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Business Cycles and Markets

by Calculated Risk on 3/10/2013 02:44:00 PM

I've been asked several times about the recent ECRI recession call (obviously I disagreed with their incorrect recession call in 2011 - I wasn't even on recession watch then and I'm not on recession watch now - and I also think ECRI is wrong about a recession starting in mid-2012). Several people have written about ECRI's call, see Menzie Chinn at Econbrowser, NDD at the Bonddad blog, and Henry Blodget at Business Insider.

It seems to me ECRI is trying to make this an academic exercise and hoping for some significant downward revisions. Right now the data doesn't indicate a recession in 2012, but, as Menzie Chinn notes, "all of these series will be revised, so one wouldn’t want to state definitively we are not in a recession – therein lies the path to embarrassment. But the case still has to be made for recession."

But why do we care? Here is a repeat of a post I wrote in early 2011 (with updated tables and charts):

From 2011 [updates in brackets]: Here is something very different. This is NOT intended as investment advice.

Why is there so much focus on the business cycle? For companies, especially cyclical companies, the reason is obvious – it helps with planning, staffing and investment. [Update: Most cyclical companies are expanding now]

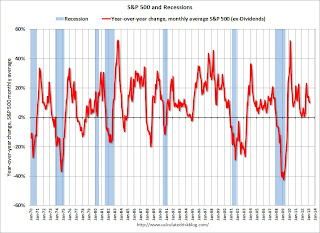

But why are investors so focused on the business cycle? Obviously earnings decline in a recession, and stock prices fall too. The following graph shows the year-over-year (YoY) change in the S&P 500 (using average monthly prices) since 1970. Notice that the market usually declines YoY in a recession.

Note: Because this is “year-over-year” there is a lag to the S&P 500 data. [Graph updated to March 2013]

Click on graph for larger image.

Click on graph for larger image.

So calling a recession isn’t just an academic exercise, there is some opportunity to preserve capital.

Not all downturns in the stock market are associated with recessions. As an example, the 1987 market crash was during an economic expansion. And the stock bubble collapse lasted from March 2000 through early 2003 – and the only official economic recession during that period was 7 months in 2001.

Although I don’t give investment advice, I think investors should measure their performance with some index. Warren Buffett likes to use the S&P 500 index, so I also used the S&P 500 for this exercise.

Imagine if we could call recessions in real time, and if we could predict recoveries in advance. The following table shows the performance of a buy-and-hold strategy (with dividend reinvestment), compared to a strategy of market timing based on 1) selling when a recession starts, and 2) buying 6 months before a recession ends.

For the buy and sell prices, I averaged the S&P 500 closing price for the entire month (no cherry picking price – just cherry picking the timing with 20/20 hindsight).

I assumed an investor started at four different times, in January of 1970, 1980, 1990, and 2000 [UPDATE: added 2010 start].

| Return from Start Date | Recession Timing Sensitivity | |||||

|---|---|---|---|---|---|---|

| Start Investing | Buy and Hold | Recession Timing | Two Months Early | One Month Early | One Month Late | Two Months Late |

| Jan-70 | 8.92% | 13.09% | 12.15% | 12.81% | 13.01% | 12.46% |

| Jan-80 | 9.90% | 13.52% | 13.37% | 13.38% | 13.71% | 12.97% |

| Jan-90 | 7.80% | 12.30% | 11.91% | 12.20% | 12.23% | 11.65% |

| Jan-00 | 1.37% | 6.88% | 7.49% | 7.22% | 7.02% | 7.17% |

| Jan-10 | 11.18% | 11.18% | --- | --- | --- | --- |

The “recession timing” column gives the annualized return for each of the starting dates. Timing the recession correctly always outperforms buy-and-hold. The last four columns show the performance if the investor is two months early (both in and out), one month early, one month late, and two months late. The investor doesn’t have to be perfect!

Note: This includes dividends, but not taxes. Also I assumed no interest earned when the investor is out of the market (money in the mattress).

The second table provides the same information, but this time in dollars (assuming a $10,000 initial investment). Notice that someone could have bought the S&P 500 index in January 2000, and they’d be up about $150 [March 2013 Update: Up $1,970] now using buy-and-hold even though the market is still below the January 2000 average price of 1425 [Update: Now above January 2000]. The positive return is due to dividends.

| Value based on Start Date | Recession Timing Sensitivity | |||||

|---|---|---|---|---|---|---|

| Start Investing | Buy and Hold | Recession Timing | Two Months Early | One Month Early | One Month Late | Two Months Late |

| Jan-70 | $399,910 | $1,582,190 | $1,120,170 | $1,426,530 | $1,537,910 | $1,257,860 |

| Jan-80 | $228,630 | $520,810 | $499,670 | $500,540 | $549,080 | $447,700 |

| Jan-90 | $56,920 | $116,550 | $108,230 | $114,250 | $115,050 | $103,010 |

| Jan-00 | $11,970 | $21,020 | $22,400 | $21,770 | $21,330 | $21,680 |

| Jan-10 | $13,990 | $13,990 | --- | --- | --- | --- |

Unfortunately forecasters have a terrible record of predicting downturns. The running joke is that forecasters have predicted 9 of the last 5 recessions! Although a forecaster doesn’t have to be perfect, they still have to be right. And that is very rare.

As economist Victor Zarnowitz said way back in 1960: “The record of predicting turning points — changes in the direction of economic activity — is on the whole poor." Forecasting hasn't improved much since then.

As an example, here are some comments from then Fed Chairman Alan Greenspan in 1990 (a recession began in July 1990):

“In the very near term there’s little evidence that I can see to suggest the economy is tilting over [into recession].”I'd say he missed that downturn. Of course Wall Street and Fed Chairmen are notoriously bad at calling downturns.

Chairman Greenspan, July 1990

“...those who argue that we are already in a recession I think are reasonably certain to be wrong.”

Greenspan, August 1990

“... the economy has not yet slipped into recession.”

Greenspan, October 1990

But the track record for calling recoveries isn’t much better. ... Calling recessions is a mug’s game, but I like to play. I was very lucky with the recent recession, but the key wasn’t calling the end in June 2009 (I thought it ended in July), but looking for the bottom in early 2009 (that is why I posted several times in early 2009 that I was looking for the sun).

This is NOT intended as investment advice. I am NOT an investment advisor. Just some (hopefully) fun musing ...

[Final Update: If investors sold when ECRI first made their recession call in Sept 2011, they would have a missed around a 30% increase in the market This shows why trying to add recession timing is difficult; investors have to be correct on the business cycle].

Graphs for Duration of Unemployment, Unemployment by Education and Diffusion Indexes

by Calculated Risk on 3/10/2013 11:31:00 AM

Earlier on the employment report:

• February Employment Report: 236,000 Jobs, 7.7% Unemployment Rate

• Employment Report Comments and more Graphs

• All Employment Graphs

A few more employment graphs ...

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.The general trend is down for all categories, but only the less than 5 weeks is back to normal levels.

The the long term unemployed is around 3.1% of the labor force - and the number (and percent) of long term unemployed remains a serious problem.

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).Unfortunately this data only goes back to 1992 and only includes one previous recession (the stock / tech bust in 2001). Clearly education matters with regards to the unemployment rate - and it appears all four groups are generally trending down.

Although education matters for the unemployment rate, it doesn't appear to matter as far as finding new employment (all four categories are only gradually declining).

Note: This says nothing about the quality of jobs - as an example, a college graduate working at minimum wage would be considered "employed".

This is a little more technical. The BLS diffusion index for total private employment was at 63.6 in February, down slightly from 64.7 in January. This was the fifth consecutive month over 60. This index has averaged 60.5 over the last 36 months; the best three year period since the '90s.

This is a little more technical. The BLS diffusion index for total private employment was at 63.6 in February, down slightly from 64.7 in January. This was the fifth consecutive month over 60. This index has averaged 60.5 over the last 36 months; the best three year period since the '90s.For manufacturing, the diffusion index increased to 60.6, up from 57.4 in January.

Think of this as a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.Job growth for both total private employment and manufacturing were fairly widespread in February (both above 60). This is a good sign and suggests many industries are hiring (not just a few).

Earlier:

• Summary for Week Ending March 8th

• Schedule for Week of March 10th