by Calculated Risk on 11/22/2012 11:58:00 AM

Thursday, November 22, 2012

Zillow forecasts Case-Shiller House Price index to increase 3.0% Year-over-year for September

Note: The Case-Shiller report to be released next Tuesday is for September (really an average of prices in July, August and September).

Zillow Forecast: September Case-Shiller Composite-20 Expected to Show 3% Increase from One Year Ago

On Tuesday November 27th, the Case-Shiller Composite Home Price Indices for September will be released. Zillow predicts that the 20-City Composite Home Price Index (non-seasonally adjusted [NSA]) will be up by 3 percent on a year-over-year basis, while the 10-City Composite Home Price Index (NSA) will be up 2.3 percent on a year-over-year basis. The seasonally adjusted (SA) month-over-month change from August to September will be 0.4 percent for the 20-City Composite, as well as for the 10-City Composite Home Price Index (SA). All forecasts are ... are based on a model incorporating the previous data points of the Case-Shiller series, the September Zillow Home Value Index data and national foreclosure re-sales.Zillow's forecasts for Case-Shiller have been pretty close.

CR Note: It looks like house prices will be up about 5% this year based on the Case-Shiller indexes.

| Case Shiller Composite 10 | Case Shiller Composite 20 | ||||

|---|---|---|---|---|---|

| NSA | SA | NSA | SA | ||

| Case Shiller (year ago) | Sept 2011 | 155.61 | 152.55 | 141.96 | 139.12 |

| Case-Shiller (last month) | Aug 2012 | 158.62 | 155.35 | 145.87 | 142.7 |

| Zillow Sept Forecast | YoY | 2.3% | 2.3% | 3.0% | 3.0% |

| MoM | 0.3% | 0.4% | 0.3% | 0.4% | |

| Zillow Forecasts1 | 159.1 | 156 | 146.3 | 143.3 | |

| Current Post Bubble Low | 146.5 | 149.38 | 134.08 | 136.65 | |

| Date of Post Bubble Low | Mar-12 | Jan-12 | Mar-12 | Feb-12 | |

| Above Post Bubble Low | 8.6% | 4.4% | 9.1% | 4.9% | |

| 1Estimate based on Year-over-year and Month-over-month Zillow forecasts | |||||

Europe Summit Update

by Calculated Risk on 11/22/2012 09:24:00 AM

No announcements yet. There is much more being dicussed at the summit than just the Greek situation. Here are a few articles ...

From the WSJ: EU Leaders Prepare for Battle Royal at Summit

European Union leaders are headed to Brussels on Thursday for a big showdown over the bloc's spending budget, in a battle that pits richer against poorer member states, the East of the continent against the West, and the U.K. against almost everyone else.From the Financial Times: German Doubts Force Rethink on Greece

...

European Council President, Herman Van Rompuy, who will preside over the two-day meeting, has vowed repeatedly to keep heads of state in Brussels through the weekend to avert a collapse of the talks, arguing that a deal is needed urgently to ensure the EU and its institutions continue to function properly.

The Multiannual Financial Framework, as the 2014 to 2020 budget is known, sets out the headline figures allocated to different EU programs and activities, ranging from foreign policy to transport and infrastructure.

After almost 10 hours of intense talks on Tuesday night, eurozone finance ministers failed to agree on how fast to cut Greece’s debt pile. They called a further meeting next week to settle differences and release €44bn of long-overdue aid.From Reuters: EU's Rehn Sees Definitive Deal on Greek Aid on Monday

excerpt with permission

Greece has taken all the steps necessary to secure its next tranche of aid and euro zone finance ministers should be able to sign off definitively on the assistance on Monday, the European commissioner for economic affairs said on Wednesday.And from Reuters: Spain Kicks Off 2013 Funding With Strong Bond Sale

"I trust everyone will reconvene in Brussels on Monday with the necessary constructive spirit, and move beyond the detrimental mindset of red lines," Olli Rehn told the European Parliament.

Spain sold nearly 4 billion euros of bonds with ease at an auction on Thursday that kicked off its funding program for a daunting 2013 ...

Wednesday, November 21, 2012

Thursday: Happy Thanksgiving!

by Calculated Risk on 11/21/2012 08:22:00 PM

Happy Thanksgiving to all!

The US markets are closed on Thursday, however there might be some news from the European Union Summit Meeting. CR is always open.

Thanks again to Joe Weisenthal at Business Insider for his nice comments today, and to Paul Krugman for adding even more: All Hail Calculated Risk.

While I'm giving thanks - I'm forever thankful for having the privilege of knowing and sharing this blog with Doris "Tanta" Dungey, thanks to my friend Tom Lawler for all of our data discussions and for allowing me to excerpt from his newsletter, to surferdude808 for all his work on tracking problem banks, and to Ken Cooper for his help with the comments. I'm thankful for all the wonderful people I've met while blogging. And thanks to all the commenters too, and to all the readers!

And on topic, Jon Hilsenrath at the WSJ interviewed San Francisco Fed President John Williams today: Fed's Williams: Fed Not Near Limit on Bond Buying. A short excerpt:

WSJ: Would a reduction in the monthly flow of the Fed's purchases right now be counterproductive?What to do when Twist expires will be a key topic at the December FOMC meeting. It seems likely the $85 billion a month in purchases of mortgages and long-term Treasury securities will continue next year.

WILLIAMS: I would say that interest rates and financial conditions today in the market are based on the expectation that we will continue these policies into next year. That would include long-term Treasury purchases. A decision not to continue buying long-term Tereasurys when Twist expires I think that would be a surprise to markets and that would be counterproductive. In my view it would push long-term rates up and cause financial conditions to be a little less supportive of growth. That's my interpretation of market expectations today.

DOT: Vehicle Miles Driven decreased 1.5% in September

by Calculated Risk on 11/21/2012 04:52:00 PM

I first started tracking monthly vehicle miles to see the impact of the recession on driving. Since then we've seen the impact of demographics and changing preferences ... very interesting.

The Department of Transportation (DOT) reported today:

Travel on all roads and streets changed by -1.5% (-3.6 billion vehicle miles) for September 2012 as compared with September 2011. ◦Travel for the month is estimated to be 237.1 billion vehicle miles.The following graph shows the rolling 12 month total vehicle miles driven.

Cumulative Travel for 2012 changed by 0.6% (14.2 billion vehicle miles).

The rolling 12 month total is still mostly moving sideways.

Click on graph for larger image.

Click on graph for larger image.In the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months.

Currently miles driven has been below the previous peak for 58 months - and still counting.

The second graph shows the year-over-year change from the same month in the previous year.

Gasoline prices were up in September compared to September 2011. In September 2012, gasoline averaged of $3.91 per gallon according to the EIA. Last year, prices in September averaged $3.67 per gallon, so - just looking at gasoline prices - it is no surprise that miles driven decreased year-over-year in September.

Gasoline prices were up in September compared to September 2011. In September 2012, gasoline averaged of $3.91 per gallon according to the EIA. Last year, prices in September averaged $3.67 per gallon, so - just looking at gasoline prices - it is no surprise that miles driven decreased year-over-year in September.Just looking at gasoline prices suggest miles driven will be down again in October - especially with the very high prices in California. Nationally gasoline prices averaged $3.81 in October, up sharply from $3.51 a year ago.

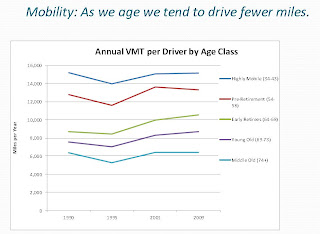

However, as I've mentioned before, gasoline prices are just part of the story. The lack of growth in miles driven over the last 5 years is probably also due to the lingering effects of the great recession (high unemployment rate and lack of wage growth), the aging of the overall population (over 55 drivers drive fewer miles) and changing driving habits of young drivers.

This graph from the Federal Highway Administration is based on the National Household Travel Survey shows the miles driven by certain age groups over time. The key is a large group is moving into the older age brackets, so their miles driven will decline - a large group is moving the from the "54 to 58" age group into the higher age groups.

This graph from the Federal Highway Administration is based on the National Household Travel Survey shows the miles driven by certain age groups over time. The key is a large group is moving into the older age brackets, so their miles driven will decline - a large group is moving the from the "54 to 58" age group into the higher age groups.Also miles driven has been falling for lower age groups over the last few years, and the next survey will probably show that decline. Here is an article on younger drivers: Young People Are Driving Less—And Not Just Because They're Broke (ht KarmaPolice)

An April study by the U.S. Public Interest Research Group found that between 2001 and 2009 the average annual vehicle miles traveled by Americans ages 16 to 34 fell by close to a quarter, from 10,300 to 7,900 per capita (four times greater than the drop among all adults), and from 12,800 to 10,700 among those with jobs.With all these factors, it may be years before we see a new peak in miles driven.

...

The PIRG researchers concluded that this change couldn’t simply be pegged to the economy, but indicates a value shift.

Business Insider Interview

by Calculated Risk on 11/21/2012 02:07:00 PM

I spoke with Joe Weisenthal at Business Insider yesterday. He wrote a way too nice article and included some of our conversation: The Genius Who Invented Economics Blogging Reveals How He Got Everything Right And What's Coming Next

Genius? Hardly. I just paid attention and put 2 plus 2 together.

And I didn't get "everything right", but I did get most of the US macro trends correct over the last 8 years. I started blogging in January 2005, and most of my early posts were about housing, as an example: Housing: Speculation is the Key

And I definitely didn't invent economics blogging. Barry Ritholtz and others were ahead of me.

In the interview, I mentioned the "doomer" mentality. Many people now think of the '90s as a great decade for the economy - and it was. But there were doomsday predictions every year. As an example, in 1994 Larry Kudlow was arguing the Clinton tax increases would lead to a severe recession or even Depression. Wrong. By the end of the '90s, there were many people concerned about the stock bubble and I shared that concern, but there were doomers every year (mostly wrong).

In the Business Insider interview, I said: "I’m not a roaring bull, but looking forward, this is the best shape we’ve been in since ’97". Obviously the economy is still sluggish, and the unemployment rate is very high at 7.9%, but I was looking forward. I mentioned the downside risks from Europe and US policymakers (the fiscal slope), but I think the next few years could see a pickup in growth.

In the article I highlighted two of the reasons I expect a pickup in growth that I've mentioned before on the blog; a further increase in residential investment, and the end of the drag from state and local government cutbacks.

I also mentioned an excellent piece on autos from David Rosenberg back in early 2009. His piece made me think about auto sales - and I came to a different conclusion than Rosenberg, see: Vehicle Sales. I started expecting auto sales to bottom, and that led me to be more optimistic for the 2nd half of 2009.

I enjoyed talking with Joe - although he was way too nice - and, yes, that is a picture of me.

AIA: Architecture Billings Index increases in October, Highest in Two Years

by Calculated Risk on 11/21/2012 11:49:00 AM

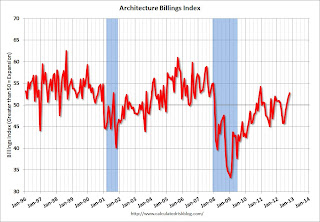

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From AIA: Architecture Billings Index Positive for Third Straight Month

Billings at architecture firms accelerated to their strongest pace of growth since December 2010. As a leading economic indicator of construction activity, the Architecture Billings Index (ABI) reflects the approximate nine to twelve month lag time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the October ABI score was 52.8, up from the mark of 51.6 in September. This score reflects an increase in demand for design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 59.4, compared to a mark of 57.3 the previous month.

“With three straight monthly gains – and the past two being quite strong – it’s beginning to look like demand for design services has turned the corner,” said AIA Chief Economist, Kermit Baker, PhD, Hon. AIA. “With 2012 winding down on an upnote, and with the national elections finally behind us, there is a general sense of optimism. However, this is balanced by a tremendous amount of anxiety and uncertainty in the marketplace, which likely means that we’ll have a few more bumps before we enter a full-blown expansion.”

• Regional averages: South (52.8), Northeast (52.6), West (51.8), Midwest (50.8)

• Sector index breakdown: multi-family residential (59.6), mixed practice (52.4), institutional (51.4), commercial / industrial (48.0)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 52.8 in October, up from 51.6 in September. Anything above 50 indicates expansion in demand for architects' services.

This increase is mostly being driven by demand for design of multi-family residential buildings - and this suggests there are more apartments coming (there are already quite a few apartments under construction). New project inquiries are also increasing. Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This suggests some increase in CRE investment next year (it will be some time before investment in offices and malls increases significantly).

Final November Consumer Sentiment at 82.7, MarkIt Flash PMI shows Improvement in Manufacturing

by Calculated Risk on 11/21/2012 09:58:00 AM

Click on graph for larger image.

The final Reuters / University of Michigan consumer sentiment index for November declined to 82.7 from the preliminary reading of 84.9, and was up from the October reading of 82.6.

This was below the consensus forecast of 84.0. Overall, consumer sentiment has been improving; the recent decline in sentiment might be related to the stock market decline (the consumer sentiment index is impacted by employment, gasoline prices, the stock market and more).

From MarkIt: Manufacturing growth strengthens to five-month high in November

The Markit Flash U.S. Manufacturing Purchasing Managers’ Index™ (PMI™)1 signalled the strongest improvement in U.S. manufacturing business conditions for five months in November. The preliminary ‘flash’ PMI reading, which is based on around 85% of usual monthly replies, rose to 52.4 from 51.0 in October to indicate a moderate manufacturing expansion overall.

Weekly Initial Unemployment Claims decline to 410,000

by Calculated Risk on 11/21/2012 08:30:00 AM

The DOL reports:

In the week ending November 17, the advance figure for seasonally adjusted initial claims was 410,000, a decrease of 41,000 from the previous week's revised figure of 451,000. The 4-week moving average was 396,250, an increase of 9,500 from the previous week's revised average of 386,750.The previous week was revised up from 439,000.

[New York] +43,956 Increase in initial claims due to Hurricane Sandy. These separations were primarily in the construction, food service, and transportation industries.

[New Jersey] +31,094 Increase in initial claims due to Hurricane Sandy. These separation were primarily in the accommodation and food services, manufacturing, transportation and warehousing, administrative service, healthcare and social assistance,construction, retail, professional, trade, educational service, and public administration industries.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 396,250.

This sharp increase in the 4 week average is due to Hurricane Sandy as claims increased significantly in the impacted areas. Note the spike in 2005 related to hurricane Katrina - we are seeing a similar impact, although on a smaller scale.

Weekly claims were about at the consensus forecast.

And here is a long term graph of weekly claims:

Mostly moving sideways this year until the recent spike due to Hurricane Sandy. Weekly claims should continue to decline over the next few weeks.

MBA: Purchase Mortgage Applications increase, Refinance Applications decrease

by Calculated Risk on 11/21/2012 07:01:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Refinance Index decreased 3 percent from the previous week. The seasonally adjusted Purchase Index increased 3 percent from one week earlier.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) increased to 3.54 percent from 3.52 percent, with points decreasing to 0.40 from 0.41 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans. The effective rate increased from last week.

Click on graph for larger image.

Click on graph for larger image.This graph shows the MBA mortgage purchase index.

The purchase index has been mostly moving sideways over the last two years, however the purchase index has increased 7 of the last 9 weeks and is now near the high for the year - but this index still isn't showing an increase like other housing reports.

Zillow: House Prices increased 4.7% Year-over-year in October

by Calculated Risk on 11/21/2012 12:22:00 AM

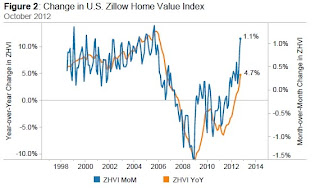

From Zillow: October Marks 12th Consecutive Month of National Home Value Increases

Zillow’s October Real Estate Market Reports, released today, show that national home values rose 1.1% from September to October to $155,400. This is the largest monthly increase since August 2005 when home values rose 1.2% month-over-month. October 2012 marks the 12th consecutive month of home value appreciation, further evidence of a durable housing market recovery. On a year-over-year basis, home values were up by 4.7% in October 2012 – a rate of annual appreciation we haven’t seen since September of 2006 ...

In October, 276 (75%) of the 366 markets showed monthly home value appreciation, and 228 (62%) of the 366 markets saw annual home value appreciation. Among the top 30 metros, 29 experienced monthly home value appreciation and 26 saw annual increases.

Click on graph for larger image.

Click on graph for larger image. The graph from Zillow shows both the year-over-year and month-over-month change for the Zillow HPI.

This is a very strong month-over-month increase, and the largest year-over-year increase since 2006.