by Calculated Risk on 11/16/2012 12:22:00 PM

Friday, November 16, 2012

2012 FHA Actuarial Review Press Release and Report

Note: Apparently the web release yesterday was accidental. Oops!

Here is the press release: FHA ISSUES ANNUAL FINANCIAL STATUS REPORT TO CONGRESS

The U.S. Department of Housing and Urban Development (HUD) today released its annual report to Congress on the financial condition of the Federal Housing Administration (FHA) Mutual Mortgage Insurance (MMI) Fund. In reporting on findings of the independent actuarial study, HUD indicates that while FHA continues to be impacted by losses from mortgages originated prior to 2009, this report does not directly affect the adequacy of capital balances in the MMI Fund.On earlier loans and DAPs (DAPs were a hot topic on this blog from early 2005 until they were banned):

The independent study found that as the housing market continues to recover, the capital reserve ratio of the MMI Fund used to support FHA’s single family mortgage and reverse mortgage insurance programs fell below zero to -1.44 percent. This represents a negative economic value of $16.3 billion. This does not mean FHA has insufficient cash to pay insurance claims, a current operating deficit, or will need to immediately draw funds from the Treasury. The need to draw on Treasury funds is determined not by the economic assumptions of this actuarial review but those used in the President’s FY 2014 budget proposal to be released in February, with a final determination on a potential draw made in September. Also, the actuary’s estimate of the Fund’s economic value excludes $11 billion in expected capital accumulation through the end of FY 2013. Finally, HUD’s report includes additional actions designed to contribute billions of dollars in added value to the MMI Fund over the next several years.

...

Three factors are driving the change in FHA’s position compared to last year:

First, the house-price appreciation forecasts used for this actuarial review are significantly lower than those used in last year’s report, as the actual turnaround in the housing market occurred later than was projected last year. These house-price appreciation estimates do not include improvements to home prices that occurred since June and were depressed by a high level of refinance activity.

Second, the continued decline in interest rates, while good for the overall economy, costs the FHA revenue as its borrowers pay off their mortgages to refinance into lower rates. Again, this is clearly a positive, but it impacts the actuary’s estimate of the value of the Fund. In addition, the actuary predicts that borrowers with higher interest rates who are unable to refinance will default at higher than normal rates, increasing losses from foreclosures for FHA.

Third, based on recommendations made by the Government Accountability Office (GAO), HUD’s Inspector General and others, FHA directed the actuary to employ a refined methodology this year to more precisely predict the way losses from defaulted loans and reverse mortgages are reflected in the economic value of the MMI Fund.

Losses on loans insured between Fiscal Years 2007 and 2009 continue to place a significant strain on the Fund with $70 billion in FHA claims attributable to loans insured in those years. Though they were prohibited in 2009, the ongoing effect of “seller-funded downpayment assistance loans” is still significant. The net expected cost of those loans, as projected by the independent actuaries, is more than $15 billion. By contrast, the actuary found that the FHA’s books of business since FY2010 are expected to be very beneficial, providing billions of dollars in net revenues to offset losses on earlier books.The FHA had a very low market share in 2005 and 2006, but many of those insured loans were "seller-funded downpayment assistance loans" - and those loans performed horribly (as expected with no money down and buying at the peak).

Mortgage Delinquencies by Loan Type in Q3

by Calculated Risk on 11/16/2012 11:25:00 AM

The following graphs show the percent of loans delinquent by loan type based on the MBA National Delinquency Survey: Prime, Subprime, FHA and VA. First a table comparing the number of loans in Q2 2007 and Q3 2012 so readers can understand the shift in loan types.

Both the number of prime and subprime loans have declined over the last five years; the number of subprime loans is down by about 32%. Meanwhile the number of FHA loans has more than doubled and VA loans have increased sharply.

Note: There are about 41.8 million first-lien loans in the survey, and the MBA survey is about 88% of the total. In the MBA universe, there are under 600 thousand seriously delinquent FHA loans. However, in the entire market, according to the FHA, there are over 700 thousand seriously delinquent FHA loans.

For Prime and Subprime, a majority of the seriously delinquent loans were originated in the 2005 to 2007 period - and these loans are still in the process of being resolved through foreclosure or short sales. However, for the FHA, about 45% of the seriously delinquent loans were originated in 2008 and 2009. That is the period when private capital disappeared, and the FHA share of the market increased sharply.

Luckily the FHA had a small market share in 2005 and 2006; however they did make quite a few bad loans in that period because of seller financed Downpayment Assistance Programs (DAPs). These were programs that allowed the seller to give the buyer the downpayment through a 3rd party "charity" (for a fee of course). The buyer had no money in the house and the default rates were absolutely horrible. (The DAPs were finally eliminated in late 2008).

| MBA National Delinquency Survey Loan Count | ||||

|---|---|---|---|---|

| Q2 2007 | Q3 2012 | Change | Q3 2012 Seriously Delinquent | |

| Prime | 33,916,830 | 29,242,787 | -4,674,043 | 1,371,487 |

| Subprime | 6,204,535 | 4,207,315 | -1,997,220 | 914,670 |

| FHA | 3,030,214 | 6,770,134 | 3,739,920 | 578,169 |

| VA | 1,096,450 | 1,553,812 | 457,362 | 68,989 |

| Survey Total | 44,248,029 | 41,774,048 | -2,473,981 | 2,933,316 |

Click on graph for larger image.

Click on graph for larger image.First a repeat: This graph shows the percent of loans delinquent by days past due. Loans 30 days delinquent increased to 3.25% from 3.18% in Q2. This is just above 2007 levels and around the long term average.

Delinquent loans in the 60 day bucket decreased to 1.19% in Q3, from 1.22% in Q2.

The 90 day bucket decreased to 2.96% from 3.19%. This is still way above normal (around 0.8% would be normal according to the MBA).

The percent of loans in the foreclosure process decreased to 4.07% from 4.27% and is now at the lowest level since Q1 2009.

Note: Scale changes for each of the following graphs.

The second graph is for all prime loans.

The second graph is for all prime loans. This is the category with the most seriously delinquent loans. Back in early 2007 when Fed Chairman Ben Bernanke said "the problems in the subprime market seems likely to be contained", my former co-blogger Tanta responded "We are all subprime!" - she was correct.

Since there are far more prime loans than any other category (see table above), about 47% of the loans seriously delinquent now are prime loans - even though the overall delinquency rate is much lower than other loan types.

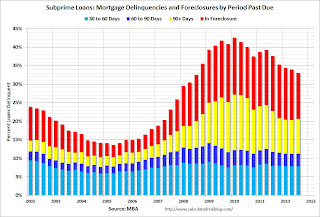

This graph is for subprime. This category gets most of the attention - mostly because of all the terrible loans made through the Wall Street "originate-to-distribute" model and sold as Private Label Securities (PLS). Not all PLS was subprime, but the worst of the worst loans were packaged in PLS.

This graph is for subprime. This category gets most of the attention - mostly because of all the terrible loans made through the Wall Street "originate-to-distribute" model and sold as Private Label Securities (PLS). Not all PLS was subprime, but the worst of the worst loans were packaged in PLS.Although the delinquency rate is still very high, the number of subprime loans has declined sharply.

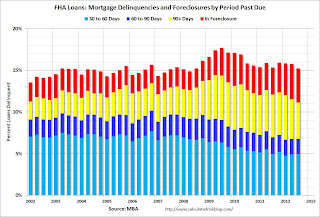

This graph is for FHA loans. It might surprise people, but the percent of FHA delinquent loans (not including in foreclosure) is at the lowest level in a decade. That is because the recently originated loans (2010 through 2012) are performing very well, and the FHA originated a large number of loans in that period.

This graph is for FHA loans. It might surprise people, but the percent of FHA delinquent loans (not including in foreclosure) is at the lowest level in a decade. That is because the recently originated loans (2010 through 2012) are performing very well, and the FHA originated a large number of loans in that period.Of course there are still a large number of loans in the foreclosure process, and the remaining DAPs and the loans originated in 2008 and 2009 are performing poorly.

The last graph is for VA loans. This is a fairly small but growing category (see table above).

The last graph is for VA loans. This is a fairly small but growing category (see table above).The good news is every category is improving. There are still quite a few subprime loans that are in distress, but the real keys going forward are prime loans and FHA loans.

Industrial Production decreased 0.4% in October due to Hurricane Sandy, Capacity Utilization decreased

by Calculated Risk on 11/16/2012 09:15:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production declined 0.4 percent in October after having increased 0.2 percent in September. Hurricane Sandy, which held down production in the Northeast region at the end of October, is estimated to have reduced the rate of change in total output by nearly 1 percentage point. The largest estimated storm-related effects included reductions in the output of utilities, of chemicals, of food, of transportation equipment, and of computers and electronic products. In October, the index for manufacturing decreased 0.9 percent; excluding storm-related effects, factory output was roughly unchanged from September. The output of utilities edged down 0.1 percent in October, and production at mines advanced 1.5 percent. At 96.6 percent of its 2007 average, total industrial production in October was 1.7 percent above its year-earlier level. Capacity utilization for total industry decreased 0.4 percentage point to 77.8 percent, a rate 2.5 percentage points below its long-run (1972--2011) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 10.9 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 77.8% is still 2.5 percentage points below its average from 1972 to 2010 and below the pre-recession level of 80.6% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

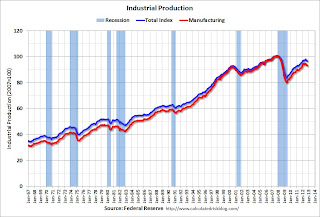

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production decreased in October to 96.6. This is 15% above the recession low, but still 4.1% below the pre-recession peak.

IP was slightly below expectations due to the impact of Hurricane Sandy. We will probably see some bounce back over the next couple of months.

Thursday, November 15, 2012

Friday: Industrial Production and Capacity Utilization

by Calculated Risk on 11/15/2012 09:18:00 PM

Note: The report linked to in 2012 FHA Actuarial Review Released: Negative $13.5 Billion economic value appears to have been taken down (maybe released early by mistake). Nick Timiraos at the WSJ writes: Report: FHA to Exhaust Capital Reserves

[T]he latest forecasts show that while the FHA currently has reserves of $30.4 billion, it expects to lose $46.7 billion on the loans it has guaranteed, resulting in a $16.3 billion deficit.Friday:

...

"If [the FHA] were a private company, it would be declared insolvent and probably put under conservatorship like Fannie and Freddie," said Thomas Lawler, an independent housing economist in Leesburg, Va.

...

Overall, the FHA insured nearly 739,000 loans that were 90 days or more past due or in foreclosure at the end of September, an increase of more than 100,000 loans from a year ago. That represents about 9.6% of all insured loans.

Most of the agency's losses stem from loans made between 2007 and 2009, as the housing bust deepened. Loans made since 2010 are expected to be very profitable.

• At 9:15 AM ET, the Fed will release Industrial Production and Capacity Utilization for October. The consensus is for 0.2% increase in Industrial Production in October, and for Capacity Utilization to increase to 78.4%.

Another question for the November economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

2012 FHA Actuarial Review Released: Negative $13.5 Billion economic value

by Calculated Risk on 11/15/2012 06:08:00 PM

From HUD: Actuarial Review of the Mutual Mortgage Insurance Fund. Excerpts:

Based on our stochastic simulation analysis, we estimate that the economic value of the Fund as of the end of FY 2012 is negative $13.48 billion. This represents a $14.67 billion drop from the $1.19 billion estimated economic value as of the end of FY 2011.Update: A few comments from Tom Lawler:

...

We project that there is approximately a 5 percent chance that the Fund’s capital resources could turn negative during the next 7 years. We also estimate that under the most pessimistic economic scenario, the economic value could stay negative until at least FY 2019.

The latest review concluded that the “economic value” of the FHA MMIF (ex HECMs) – defined as the sum of the MMIFs existing capital resources plus the present value of the current books of business, was NEGATIVE $13.478 billion at the end of FY 2012. Stated another way, the present value of expected future cash flows on outstanding business – a sizable negative $39.052 billion – outstrips the MMIF’s current capital resources (of $25.574 billion) by $13.478 billion. The FY actuarial review of FHA’s HECM business concluded that the “economic value” of the current FHA HECM book was NEGATIVE $2.799 billion at the end of FY 2012.

In last year’s actuarial review the “economic value” of the FHA MMIF (ex HECMs) at the end of FY 2011 was +$1.193 billion, and the projected economic value of the MMIF at the end of FY 2012 (under the “base case) scenario) was a POSITIVE $9.351 billion. In recent years, however, these “projections,” based on “reasonable” benign projections, have been ridiculously optimistic.

Contrary to what at least one press report said, the actuarial “unsoundness” of the FHA MMIF is NOT the result of mortgage loans insured at or near the peak of the housing bubble. The “honkingly big” losses (in dollars) are concentrated in the FY 2008 and FY 2009 “books (October 2007 – October 2009) – that is, loans insured in the first few years AFTER the peak in the housing bubble, when “private capital” for risky loans dried up and FHA experienced a surge in market share, AND took on a lot of very risky (by any standard) mortgages, a significant % of which should not have been made.

The “walk-forward” of the FY 2012’s economic value from a projection of positive $9.351 billion a year ago to negative $13.478 billion today is a little hard to follow or understand. On the positive side, the money FHA extorted from lenders in the mortgage settlement added about $1.1 billion, and higher-than-projected 2011-12 volumes, actual performance, and different-than-projected portfolio composition added about $3.8 billion. On the negative side, various model changes, especially in the loss severity model, took out about $11.0 billion; lower interest rate assumptions took out $8.4 billion; just slightly lower home price assumptions (beyond 2012) took out a surprisingly large $10.5.

Key Measures show low inflation in October

by Calculated Risk on 11/15/2012 03:57:00 PM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.3% annualized rate) in October. The 16% trimmed-mean Consumer Price Index increased 0.1% (1.7% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed has the median CPI details for October here.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.1% (1.8% annualized rate) in October. The CPI less food and energy increased 0.2% (2.2% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.2%, the trimmed-mean CPI rose 1.9%, the CPI rose 2.2%, and the CPI less food and energy rose 2.0%. Core PCE is for September and increased 1.7% year-over-year.

On a monthly basis, two of these measure were above the Fed's target; median CPI was at 2.3% annualized, core CPI increased 2.2% annualized. However trimmed-mean CPI was at 1.7% annualized, and core PCE for September increased 1.4% annualized. These measures suggest inflation is close to the Fed's target of 2% on a year-over-year basis.

The Fed's focus will probably be on core PCE and core CPI, and both are at or below the Fed's target on year-over-year basis.

Bernanke suggests Mortgage Lending Standards are "Overly Tight", "Pendulum has swung too far"

by Calculated Risk on 11/15/2012 01:20:00 PM

From Fed Chairman Ben Bernanke: Challenges in Housing and Mortgage Markets. Excerpt:

Although the decline in the number of willing and qualified potential homebuyers explains some of the contraction in mortgage lending of the past few years, I believe that tight credit nevertheless remains an important factor as well. The Federal Reserve's Senior Loan Officer Opinion Survey on Bank Lending Practices indicates that lenders began tightening mortgage credit standards in 2007 and have not significantly eased standards since. Terms and standards have tightened most for borrowers with lower credit scores and with less money available for a down payment. For example, in April nearly 60 percent of lenders reported that they would be much less likely, relative to 2006, to originate a conforming home-purchase mortgage to a borrower with a 10 percent down payment and a credit score of 620--a traditional marker for those with weaker credit histories. As a result, the share of home-purchase borrowers with credit scores below 620 has fallen from about 17 percent of borrowers at the end of 2006 to about 5 percent more recently. Lenders also appear to have pulled back on offering these borrowers loans insured by the Federal Housing Administration (FHA).Clearly Bernanke and the Fed are concerned that credit isn't flowing to a large segment of the population.

When lenders were asked why they have originated fewer mortgages, they cited a variety of concerns, starting with worries about the economy, the outlook for house prices, and their existing real estate loan exposures. They also mention increases in servicing costs and the risk of being required by government-sponsored enterprises (GSEs) to repurchase delinquent loans (so-called putback risk). Other concerns include the reduced availability of private mortgage insurance for conventional loans and some program-specific issues for FHA loans as reasons for tighter standards. Also, some evidence suggests that mortgage originations for new purchases may be constrained because of processing capacity, as high levels of refinancing have drawn on the same personnel who would otherwise be available for handling loans for purchase. Importantly, however, restrictive mortgage lending conditions do not seem to be linked to any insufficiency of bank capital or to a general unwillingness to lend.

Certainly, some tightening of credit standards was an appropriate response to the lax lending conditions that prevailed in the years leading up to the peak in house prices. Mortgage loans that were poorly underwritten or inappropriate for the borrower's circumstances ultimately had devastating consequences for many families and communities, as well as for the financial institutions themselves and the broader economy. However, it seems likely at this point that the pendulum has swung too far the other way, and that overly tight lending standards may now be preventing creditworthy borrowers from buying homes, thereby slowing the revival in housing and impeding the economic recovery.

emphasis added

Q3 MBA National Delinquency Survey Graph and Comments

by Calculated Risk on 11/15/2012 11:13:00 AM

A few comments from Mike Fratantoni, MBA’s Vice President of Research and Economics, on the Q3 MBA National Delinquency Survey conference call.

• Significant drop in "shadow inventory" with the declines in the 90+ day delinquency and in foreclosure categories.

• This was the largest decline in foreclosure inventory ever recorded.

• Significant difference between judicial and non-judicial states. The judicial foreclosure inventory was at 6.61%, and the non-judicial inventory was at 2.42%. Both are now declining.

• There has been "dramatic" improvement in California and Arizona. Overall there is continued improvement, "perhaps more quickly than expected".

• There has been some improvement in FHA delinquencies because of the strong credit quality of recent originations. Most of the delinquent loans are from the 2008 and 2009 vintages.

This graph is from the MBA and shows the percent of loans in the foreclosure process by state. Posted with permission.

The top states are Florida (13.04% in foreclosure down from 13.70% in Q2), New Jersey (8.87% up from 7.65%), Illinois (6.83% down from 7.11%), New York (6.46% down from 6.47%) and Nevada (the only non-judicial state in the top 13 at 5.93% down from 6.09%).

As Fratantoni noted, California (2.63% down from 3.07%) and Arizona (2.51% down from 3.24%) are now well below the national average.

The second graph shows the percent of loans delinquent by days past due.

The second graph shows the percent of loans delinquent by days past due.

Loans 30 days delinquent increased to 3.25% from 3.18% in Q2. This is just above 2007 levels and around the long term average.

Delinquent loans in the 60 day bucket decreased to 1.19% in Q3, from 1.22% in Q2.

The 90 day bucket decreased to 2.96% from 3.19%. This is still way above normal (around 0.8% would be normal according to the MBA).

The percent of loans in the foreclosure process decreased to 4.07% from 4.27% and is now at the lowest level since Q1 2009.

Note: "MBA’s National Delinquency Survey covers 41.8 million loans on one-to-four-unit residential properties, representing approximately 88 percent of all “first-lien” residential mortgage loans outstanding in the United States. This quarter’s loan count saw a decrease of about 733,000 loans from the previous quarter, and a decrease of 1,752,000 loans from one year ago. Loans surveyed were reported by approximately 120 lenders, including mortgage banks, commercial banks and thrifts."

MBA: Mortgage Delinquencies decreased in Q3

by Calculated Risk on 11/15/2012 10:00:00 AM

The MBA reported that 11.47 percent of mortgage loans were either one payment delinquent or in the foreclosure process in Q3 2012 (delinquencies seasonally adjusted). This is down from 11.85 percent in Q2 2012.

From the MBA: Mortgage Delinquency and Foreclosure Rates Decreased During Third Quarter

The delinquency rate for mortgage loans on one-to-four-unit residential properties fell to a seasonally adjusted rate of 7.40 percent of all loans outstanding as of the end of the third quarter of 2012, a decrease of 18 basis points from the second quarter of 2012, and a decrease of 59 basis points from one year ago, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey.Note: 7.40% (SA) and 4.07% equals 11.47%.

...

The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. ... The percentage of loans in the foreclosure process at the end of the third quarter was 4.07 percent, down 20 basis points from the second quarter and 36 basis points lower than one year ago. The serious delinquency rate, the percentage of loans that are 90 days or more past due or in the process of foreclosure, was 7.03 percent, a decrease of 28 basis points from last quarter, and a decrease of 86 basis points from the third quarter of last year.

...

“Mortgage delinquencies decreased compared to last quarter overall, driven mainly by a decline in loans that are 90 days or more delinquent,” observed Mike Fratantoni, MBA’s Vice President of Research and Economics. “The 90 day delinquency rate is at its lowest level since 2008, and together with the decline in the percentage of loans in foreclosure, this indicates a significant drop in the shadow inventory of distressed loans-a real positive for the housing market. The 30 day delinquency rate increased slightly, but remains close to the long-term average for this metric. Given the weak economic and job growth in third quarter, it is not surprising that this metric has not improved. ”

“The improvement in total delinquency rates was accompanied by a further drop in the foreclosure starts rate, which hit its lowest level since 2007. Moreover, the foreclosure inventory rate decreased by 20 basis points over the quarter, the largest quarterly drop in the history of the survey. The level however, is still roughly four times the long-run average for this series as we continue to see back logs of loans in the foreclosure process in states with a judicial foreclosure system. The foreclosure rate for judicial states decreased slightly to 6.6 percent and the foreclosure rate for non-judicial states showed a steeper drop to 2.4 percent. The difference in the foreclosure rates of the two regimes is at its widest since we started tracking this metric in 2006."

I'll have more (and graphs) later after the conference call this morning.

Weekly Initial Unemployment Claims increased sharply to 439,000

by Calculated Risk on 11/15/2012 08:30:00 AM

The DOL reports:

In the week ending November 10, the advance figure for seasonally adjusted initial claims was 439,000, an increase of 78,000 from the previous week's revised figure of 361,000. The 4-week moving average was 383,750, an increase of 11,750 from the previous week's revised average of 372,000.The previous week was revised up from 355,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 383,750.

This sharp increase is due to Hurricane Sandy as claims increased significantly in the impacted areas. Note the spike in 2005 related to hurricane Katrina - we are seeing a similar impact, although on a smaller scale.

Weekly claims were higher than the consensus forecast.

And here is a long term graph of weekly claims:

Mostly moving sideways this year ...