by Calculated Risk on 11/15/2012 09:18:00 PM

Thursday, November 15, 2012

Friday: Industrial Production and Capacity Utilization

Note: The report linked to in 2012 FHA Actuarial Review Released: Negative $13.5 Billion economic value appears to have been taken down (maybe released early by mistake). Nick Timiraos at the WSJ writes: Report: FHA to Exhaust Capital Reserves

[T]he latest forecasts show that while the FHA currently has reserves of $30.4 billion, it expects to lose $46.7 billion on the loans it has guaranteed, resulting in a $16.3 billion deficit.Friday:

...

"If [the FHA] were a private company, it would be declared insolvent and probably put under conservatorship like Fannie and Freddie," said Thomas Lawler, an independent housing economist in Leesburg, Va.

...

Overall, the FHA insured nearly 739,000 loans that were 90 days or more past due or in foreclosure at the end of September, an increase of more than 100,000 loans from a year ago. That represents about 9.6% of all insured loans.

Most of the agency's losses stem from loans made between 2007 and 2009, as the housing bust deepened. Loans made since 2010 are expected to be very profitable.

• At 9:15 AM ET, the Fed will release Industrial Production and Capacity Utilization for October. The consensus is for 0.2% increase in Industrial Production in October, and for Capacity Utilization to increase to 78.4%.

Another question for the November economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

2012 FHA Actuarial Review Released: Negative $13.5 Billion economic value

by Calculated Risk on 11/15/2012 06:08:00 PM

From HUD: Actuarial Review of the Mutual Mortgage Insurance Fund. Excerpts:

Based on our stochastic simulation analysis, we estimate that the economic value of the Fund as of the end of FY 2012 is negative $13.48 billion. This represents a $14.67 billion drop from the $1.19 billion estimated economic value as of the end of FY 2011.Update: A few comments from Tom Lawler:

...

We project that there is approximately a 5 percent chance that the Fund’s capital resources could turn negative during the next 7 years. We also estimate that under the most pessimistic economic scenario, the economic value could stay negative until at least FY 2019.

The latest review concluded that the “economic value” of the FHA MMIF (ex HECMs) – defined as the sum of the MMIFs existing capital resources plus the present value of the current books of business, was NEGATIVE $13.478 billion at the end of FY 2012. Stated another way, the present value of expected future cash flows on outstanding business – a sizable negative $39.052 billion – outstrips the MMIF’s current capital resources (of $25.574 billion) by $13.478 billion. The FY actuarial review of FHA’s HECM business concluded that the “economic value” of the current FHA HECM book was NEGATIVE $2.799 billion at the end of FY 2012.

In last year’s actuarial review the “economic value” of the FHA MMIF (ex HECMs) at the end of FY 2011 was +$1.193 billion, and the projected economic value of the MMIF at the end of FY 2012 (under the “base case) scenario) was a POSITIVE $9.351 billion. In recent years, however, these “projections,” based on “reasonable” benign projections, have been ridiculously optimistic.

Contrary to what at least one press report said, the actuarial “unsoundness” of the FHA MMIF is NOT the result of mortgage loans insured at or near the peak of the housing bubble. The “honkingly big” losses (in dollars) are concentrated in the FY 2008 and FY 2009 “books (October 2007 – October 2009) – that is, loans insured in the first few years AFTER the peak in the housing bubble, when “private capital” for risky loans dried up and FHA experienced a surge in market share, AND took on a lot of very risky (by any standard) mortgages, a significant % of which should not have been made.

The “walk-forward” of the FY 2012’s economic value from a projection of positive $9.351 billion a year ago to negative $13.478 billion today is a little hard to follow or understand. On the positive side, the money FHA extorted from lenders in the mortgage settlement added about $1.1 billion, and higher-than-projected 2011-12 volumes, actual performance, and different-than-projected portfolio composition added about $3.8 billion. On the negative side, various model changes, especially in the loss severity model, took out about $11.0 billion; lower interest rate assumptions took out $8.4 billion; just slightly lower home price assumptions (beyond 2012) took out a surprisingly large $10.5.

Key Measures show low inflation in October

by Calculated Risk on 11/15/2012 03:57:00 PM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.3% annualized rate) in October. The 16% trimmed-mean Consumer Price Index increased 0.1% (1.7% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed has the median CPI details for October here.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.1% (1.8% annualized rate) in October. The CPI less food and energy increased 0.2% (2.2% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.2%, the trimmed-mean CPI rose 1.9%, the CPI rose 2.2%, and the CPI less food and energy rose 2.0%. Core PCE is for September and increased 1.7% year-over-year.

On a monthly basis, two of these measure were above the Fed's target; median CPI was at 2.3% annualized, core CPI increased 2.2% annualized. However trimmed-mean CPI was at 1.7% annualized, and core PCE for September increased 1.4% annualized. These measures suggest inflation is close to the Fed's target of 2% on a year-over-year basis.

The Fed's focus will probably be on core PCE and core CPI, and both are at or below the Fed's target on year-over-year basis.

Bernanke suggests Mortgage Lending Standards are "Overly Tight", "Pendulum has swung too far"

by Calculated Risk on 11/15/2012 01:20:00 PM

From Fed Chairman Ben Bernanke: Challenges in Housing and Mortgage Markets. Excerpt:

Although the decline in the number of willing and qualified potential homebuyers explains some of the contraction in mortgage lending of the past few years, I believe that tight credit nevertheless remains an important factor as well. The Federal Reserve's Senior Loan Officer Opinion Survey on Bank Lending Practices indicates that lenders began tightening mortgage credit standards in 2007 and have not significantly eased standards since. Terms and standards have tightened most for borrowers with lower credit scores and with less money available for a down payment. For example, in April nearly 60 percent of lenders reported that they would be much less likely, relative to 2006, to originate a conforming home-purchase mortgage to a borrower with a 10 percent down payment and a credit score of 620--a traditional marker for those with weaker credit histories. As a result, the share of home-purchase borrowers with credit scores below 620 has fallen from about 17 percent of borrowers at the end of 2006 to about 5 percent more recently. Lenders also appear to have pulled back on offering these borrowers loans insured by the Federal Housing Administration (FHA).Clearly Bernanke and the Fed are concerned that credit isn't flowing to a large segment of the population.

When lenders were asked why they have originated fewer mortgages, they cited a variety of concerns, starting with worries about the economy, the outlook for house prices, and their existing real estate loan exposures. They also mention increases in servicing costs and the risk of being required by government-sponsored enterprises (GSEs) to repurchase delinquent loans (so-called putback risk). Other concerns include the reduced availability of private mortgage insurance for conventional loans and some program-specific issues for FHA loans as reasons for tighter standards. Also, some evidence suggests that mortgage originations for new purchases may be constrained because of processing capacity, as high levels of refinancing have drawn on the same personnel who would otherwise be available for handling loans for purchase. Importantly, however, restrictive mortgage lending conditions do not seem to be linked to any insufficiency of bank capital or to a general unwillingness to lend.

Certainly, some tightening of credit standards was an appropriate response to the lax lending conditions that prevailed in the years leading up to the peak in house prices. Mortgage loans that were poorly underwritten or inappropriate for the borrower's circumstances ultimately had devastating consequences for many families and communities, as well as for the financial institutions themselves and the broader economy. However, it seems likely at this point that the pendulum has swung too far the other way, and that overly tight lending standards may now be preventing creditworthy borrowers from buying homes, thereby slowing the revival in housing and impeding the economic recovery.

emphasis added

Q3 MBA National Delinquency Survey Graph and Comments

by Calculated Risk on 11/15/2012 11:13:00 AM

A few comments from Mike Fratantoni, MBA’s Vice President of Research and Economics, on the Q3 MBA National Delinquency Survey conference call.

• Significant drop in "shadow inventory" with the declines in the 90+ day delinquency and in foreclosure categories.

• This was the largest decline in foreclosure inventory ever recorded.

• Significant difference between judicial and non-judicial states. The judicial foreclosure inventory was at 6.61%, and the non-judicial inventory was at 2.42%. Both are now declining.

• There has been "dramatic" improvement in California and Arizona. Overall there is continued improvement, "perhaps more quickly than expected".

• There has been some improvement in FHA delinquencies because of the strong credit quality of recent originations. Most of the delinquent loans are from the 2008 and 2009 vintages.

This graph is from the MBA and shows the percent of loans in the foreclosure process by state. Posted with permission.

The top states are Florida (13.04% in foreclosure down from 13.70% in Q2), New Jersey (8.87% up from 7.65%), Illinois (6.83% down from 7.11%), New York (6.46% down from 6.47%) and Nevada (the only non-judicial state in the top 13 at 5.93% down from 6.09%).

As Fratantoni noted, California (2.63% down from 3.07%) and Arizona (2.51% down from 3.24%) are now well below the national average.

The second graph shows the percent of loans delinquent by days past due.

The second graph shows the percent of loans delinquent by days past due.

Loans 30 days delinquent increased to 3.25% from 3.18% in Q2. This is just above 2007 levels and around the long term average.

Delinquent loans in the 60 day bucket decreased to 1.19% in Q3, from 1.22% in Q2.

The 90 day bucket decreased to 2.96% from 3.19%. This is still way above normal (around 0.8% would be normal according to the MBA).

The percent of loans in the foreclosure process decreased to 4.07% from 4.27% and is now at the lowest level since Q1 2009.

Note: "MBA’s National Delinquency Survey covers 41.8 million loans on one-to-four-unit residential properties, representing approximately 88 percent of all “first-lien” residential mortgage loans outstanding in the United States. This quarter’s loan count saw a decrease of about 733,000 loans from the previous quarter, and a decrease of 1,752,000 loans from one year ago. Loans surveyed were reported by approximately 120 lenders, including mortgage banks, commercial banks and thrifts."

MBA: Mortgage Delinquencies decreased in Q3

by Calculated Risk on 11/15/2012 10:00:00 AM

The MBA reported that 11.47 percent of mortgage loans were either one payment delinquent or in the foreclosure process in Q3 2012 (delinquencies seasonally adjusted). This is down from 11.85 percent in Q2 2012.

From the MBA: Mortgage Delinquency and Foreclosure Rates Decreased During Third Quarter

The delinquency rate for mortgage loans on one-to-four-unit residential properties fell to a seasonally adjusted rate of 7.40 percent of all loans outstanding as of the end of the third quarter of 2012, a decrease of 18 basis points from the second quarter of 2012, and a decrease of 59 basis points from one year ago, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey.Note: 7.40% (SA) and 4.07% equals 11.47%.

...

The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. ... The percentage of loans in the foreclosure process at the end of the third quarter was 4.07 percent, down 20 basis points from the second quarter and 36 basis points lower than one year ago. The serious delinquency rate, the percentage of loans that are 90 days or more past due or in the process of foreclosure, was 7.03 percent, a decrease of 28 basis points from last quarter, and a decrease of 86 basis points from the third quarter of last year.

...

“Mortgage delinquencies decreased compared to last quarter overall, driven mainly by a decline in loans that are 90 days or more delinquent,” observed Mike Fratantoni, MBA’s Vice President of Research and Economics. “The 90 day delinquency rate is at its lowest level since 2008, and together with the decline in the percentage of loans in foreclosure, this indicates a significant drop in the shadow inventory of distressed loans-a real positive for the housing market. The 30 day delinquency rate increased slightly, but remains close to the long-term average for this metric. Given the weak economic and job growth in third quarter, it is not surprising that this metric has not improved. ”

“The improvement in total delinquency rates was accompanied by a further drop in the foreclosure starts rate, which hit its lowest level since 2007. Moreover, the foreclosure inventory rate decreased by 20 basis points over the quarter, the largest quarterly drop in the history of the survey. The level however, is still roughly four times the long-run average for this series as we continue to see back logs of loans in the foreclosure process in states with a judicial foreclosure system. The foreclosure rate for judicial states decreased slightly to 6.6 percent and the foreclosure rate for non-judicial states showed a steeper drop to 2.4 percent. The difference in the foreclosure rates of the two regimes is at its widest since we started tracking this metric in 2006."

I'll have more (and graphs) later after the conference call this morning.

Weekly Initial Unemployment Claims increased sharply to 439,000

by Calculated Risk on 11/15/2012 08:30:00 AM

The DOL reports:

In the week ending November 10, the advance figure for seasonally adjusted initial claims was 439,000, an increase of 78,000 from the previous week's revised figure of 361,000. The 4-week moving average was 383,750, an increase of 11,750 from the previous week's revised average of 372,000.The previous week was revised up from 355,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 383,750.

This sharp increase is due to Hurricane Sandy as claims increased significantly in the impacted areas. Note the spike in 2005 related to hurricane Katrina - we are seeing a similar impact, although on a smaller scale.

Weekly claims were higher than the consensus forecast.

And here is a long term graph of weekly claims:

Mostly moving sideways this year ...

Zillow: 1.3 million fewer U.S. homeowners were in negative equity in Q3

by Calculated Risk on 11/15/2012 12:01:00 AM

From Zillow: Negative Equity Recedes in Third Quarter; Fewer than 30% of Homeowners with Mortgages Now Underwater

Negative equity fell in the third quarter, with 28.2 percent of all homeowners with mortgages underwater, down from 30.9 percent in the second quarter, according to the third quarter Zillow® Negative Equity Report. ...According to Zillow, 1.7 homeowners have moved out of negative equity over the least two quarters.

Slightly more than 14 million U.S. homeowners with a mortgage were in negative equity, or underwater, in the quarter, owing more on their mortgages than their homes are worth. That was down from 15.3 million in the second quarter.

Much of the decline in negative equity can be attributed to U.S. home values rising 1.3 percent in the third quarter compared to the second quarter ...

“The fall in negative equity rates means homeowners have additional options for refinancing or selling their homes,” said Zillow Chief Economist Dr. Stan Humphries. “But while we’re moving in the right direction, a substantial number of homes are still locked up in negative equity, unable to enter the existing re-sale market despite the desires of their owner. The housing market has found real momentum of its own, but is not immune from shocks to the broader economy. If negotiations centered on resolving the fiscal cliff don’t inspire confidence in investors and consumers alike, recent home value gains – and, as a result, falling negative equity rates – could stall.”

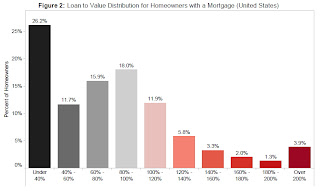

Click on graph for larger image.

Click on graph for larger image.Zillow provided this chart of Zillow's estimate of the Loan-to-Value (LTV) for homeowners with a mortgage.

The homeowners with a little negative equity are probably at low risk of foreclosure, but at the far right - like the 3.9% who owe more than double what their homes are worth - are clearly at risk.

Here is an interactive map of Zillow's negative equity data.

Wednesday, November 14, 2012

Thursday: Unemployment Claims, CPI, MBA Mortgage Delinquency Survey, Bernanke and much more

by Calculated Risk on 11/14/2012 08:01:00 PM

November 15th is Doris "Tanta" Dungey's birthday. Happy Birthday T!

For new readers, Tanta was my co-blogger back in 2007 and 2008. She was a brilliant, writer - very funny - and a mortgage expert. Sadly, she passed away in 2008, and I like to celebrate her life on her birthday.

I strongly recommend Tanta's "The Compleat UberNerd" posts for an understanding of the mortgage industry. And here are many of her other posts.

On her passing, from the NY Times: Doris Dungey, Prescient Finance Blogger, Dies at 47, from the WaPo: Doris J. Dungey; Blogger Chronicled Mortgage Crisis, from me: Sad News: Tanta Passes Away

Thursday:

• At 8:30 AM, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 376 thousand from 355 thousand. Note: Claims are expected to increase following Hurricane Sandy.

• Also at 8:30 AM, the Consumer Price Index for October will be released. The consensus is for CPI to increase 0.1% in October and for core CPI to increase 0.2%.

• Also at 8:30 AM, the NY Fed Empire Manufacturing Survey for November. The consensus is for a reading of minus 5, up from minus 6.2 in October (below zero is contraction). I'm expecting a decline due to Hurricane Sandy.

• At 10:00 AM, MBA's 3rd Quarter 2012 National Delinquency Survey. As usual, I will be on the conference call and take notes.

• Also at 10:00 AM, the Philly Fed Survey for November. The consensus is for a reading of minus 4.5, down from 5.7 last month (above zero indicates expansion).

• At 1:20 PM, Fed Chairman Ben Bernanke will speak, Housing and Mortgage Markets, At the HOPE Global Financial Dignity Summit, Atlanta, Georgia.

WSJ: FHA Close to Exhausting Reserves

by Calculated Risk on 11/14/2012 04:07:00 PM

As we discussed last week, the FHA Fiscal Year 2012 Actuarial Review is due this week. Nick Timiraos at the WSJ has a preview: Housing Agency Close to Exhausting Reserves

The Federal Housing Administration is expected to report later this week that it could exhaust its reserves because of rising mortgage delinquencies ... That could result in the agency needing to draw on taxpayer funding for the first time in its 78-year history.As Timiraos notes, the FHA's market share was small during the peak of the bubble (luckily) and most of the really horrible loans were made by Wall Street related mortgage lenders. However, Timiraos doesn't mention that many of the loans that the FHA insured at the peak were so-called Downpayment Assistance Programs (DAPs). These DAPs circumvented the FHA down payment requirements by having the seller funnel the "down payment" to the buyer through a "charity" (for a small fee of course). The FHA attempted to stop this practice - the IRS called it a "scam" - but thanks to Congress, the DAPs led to billions of losses for the FHA.

... The New Deal-era agency, which doesn't actually make loans but instead insures lenders against losses, has played a critical role stabilizing the housing market by backing mortgages of borrowers who make down payments of as little as 3.5%—loans that most private lenders won't originate without a government guarantee. ... Overall, the FHA insured nearly 739,000 loans that were 90 days or more past due or in foreclosure at the end of September, an increase of more than 100,000 loans from one year ago. That represents around 9.6% of its $1.08 trillion in mortgages guarantees.

The FHA's annual audit estimates how much money the agency would need to pay off all claims on projected losses, against how much it has in reserves. Last year, that buffer stood at $1.2 billion ...

The decision over whether the FHA will need money from Treasury won't be made until next February, when the White House typically releases its annual budget. Because the FHA has what is known as "permanent and indefinite" budget authority, it wouldn't need to ask Congress for funds; it would automatically receive money from the U.S. Treasury.

Most of the agency's losses now stem from loans made as the housing bust deepened. Around 25% of mortgages guaranteed in 2007 and 2008 are seriously delinquent, compared with around 5% of those insured in 2010.

Of course, as Timiraos mentioned, the FHA also saw a sharp increase in demand in the 2007 through 2009 period as private lenders disappeared and Fannie and Freddie tightened standards - and those loans have performed poorly. Now the bill is coming due ...