by Calculated Risk on 11/01/2012 02:02:00 PM

Thursday, November 01, 2012

Q3 2012 GDP Details: Office and Mall Investment very low, Single Family investment increases

The BEA released the underlying details for the Q3 Advance GDP report.

The first graph shows investment in offices, malls and lodging as a percent of GDP. Office, mall and lodging investment has increased slightly, but from a very low level.

Investment in offices is down about 59% from the peak (as a percent of GDP). With the high office vacancy rate, investment will probably not increase significantly (as a percent of GDP) for several years.

Click on graph for larger image.

Click on graph for larger image.

Investment in multimerchandise shopping structures (malls) peaked in 2007 and is down about 61% from the peak (note that investment includes remodels, so this will not fall to zero).

Lodging investment peaked at 0.32% of GDP in Q2 2008 and is down about 74%.

The second graph is for Residential investment (RI) components as a percent of GDP. According to the Bureau of Economic Analysis, RI includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories (dormitories, manufactured homes).

The second graph is for Residential investment (RI) components as a percent of GDP. According to the Bureau of Economic Analysis, RI includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories (dormitories, manufactured homes).

Usually the most important components are investment in single family structures followed by home improvement.

Investment in single family structures is finally increasing after mostly moving sideways for almost three years (the increase in 2009-2010 was related to the housing tax credit).

Investment in home improvement was at a $155 billion Seasonally Adjusted Annual Rate (SAAR) in Q3 (just under 1.0% of GDP), still above the level of investment in single family structures of $131 billion (SAAR) (or 0.8% of GDP). In the next year or two, single family structure investment will overtake home improvement as the largest category of residential investment.

Brokers' commissions increased slightly in Q3 as a percent of GDP. And investment in multifamily structures increased in Q3. This is a small category, and even though investment is increasing, the positive impact on GDP will be relatively small.

These graphs show there is currently very little investment in offices, malls and lodging. And residential investment is starting to pickup, but from a very low level.

Construction Spending increased in September

by Calculated Risk on 11/01/2012 11:54:00 AM

Three key construction spending themes:

• Private residential construction spending is still very low, but increasing. Residential construction declined sharply for four years following the peak of the housing bubble, and then move mostly sideways for another three years.

• Private non-residential construction spending picked up last year mostly due to energy spending (power and electric), but spending on office buildings, hotels and malls is still very low.

• Public construction spending is down 4% year-over-year and has been declining for several years.

The Census Bureau reported that overall construction spending increased in September:

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during September 2012 was estimated at a seasonally adjusted annual rate of $851.6 billion, 0.6 percent above the revised August estimate of $846.2 billion. The September figure is 7.8 percent above the September 2011 estimate of $790.3 billion.Private construction spending increased and public spending declined:

Spending on private construction was at a seasonally adjusted annual rate of $580.5 billion, 1.3 percent above the revised August estimate of $572.8 billion. ... In September, the estimated seasonally adjusted annual rate of public construction spending was $271.1 billion, 0.8 percent below the revised August estimate of $273.4 billion.

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending is 58% below the peak in early 2006, and up 29% from the post-bubble low. Non-residential spending is 29% below the peak in January 2008, and up about 29% from the recent low.

Public construction spending is now 17% below the peak in March 2009 and at the post-bubble low.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is now up 21%. Non-residential spending is also up 9% year-over-year mostly due to energy spending (power and electric). Public spending is down 4% year-over-year.

ISM Manufacturing index increased slightly in October to 51.7

by Calculated Risk on 11/01/2012 10:00:00 AM

The ISM manufacturing index indicated expansion in October. PMI was at 51.7% in October, up from 51.5% in September. The employment index was at 52.1%, down from 54.7%, and the new orders index was at 54.2%, up from 52.3%.

From the Institute for Supply Management: October 2012 Manufacturing ISM Report On Business®

Economic activity in the manufacturing sector expanded in October for the second consecutive month following three months of slight contraction, and the overall economy grew for the 41st consecutive month, say the nation's supply executives in the latest Manufacturing ISM Report On Business®.

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management™ Manufacturing Business Survey Committee. "The PMI™ registered 51.7 percent, an increase of 0.2 percentage point from September's reading of 51.5 percent, indicating growth in manufacturing at a slightly faster rate. The New Orders Index registered 54.2 percent, an increase of 1.9 percentage points from September, indicating growth in new orders for the second consecutive month. The Production Index registered 52.4 percent, an increase of 2.9 percentage points, indicating growth in production following two months of contraction. The Employment Index registered 52.1 percent, a decrease of 2.6 percentage points, and the Prices Index registered 55 percent, reflecting a decrease of 3 percentage points. Comments from the panel this month reflect continued concern over a fragile global economy and soft orders across several manufacturing sectors."

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was slightly above expectations of 51.0% and suggests manufacturing expanded in October.

Weekly Initial Unemployment Claims decline to 363,000

by Calculated Risk on 11/01/2012 08:30:00 AM

The DOL reports:

In the week ending October 27, the advance figure for seasonally adjusted initial claims was 363,000, a decrease of 9,000 from the previous week's revised figure of 372,000. The 4-week moving average was 367,250, a decrease of 1,500 from the previous week's revised average of 368,750.The previous week was revised up from 369,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 367,250. This is about 4,000 above the cycle low for the 4-week average of 363,000 in March.

Weekly claims were slihgtly lower than the consensus forecast of 365,000.

And here is a long term graph of weekly claims:

Mostly moving sideways this year, but near the cycle bottom.

SPECIAL NOTE: Due to Hurricane Sandy, we will probably see an increase in initial unemployment claims over the next few weeks.

ADP: Private Employment increased 158,000 in October

by Calculated Risk on 11/01/2012 08:23:00 AM

ADP reported that employment in the U.S. nonfarm private business sector increased by 158,000 from September to October, on a seasonally adjusted basis.

This was above the consensus forecast for private sector jobs added, and is a little surprising given the change in methodology. Note: The BLS reports on Friday, and the consensus is for an increase of 125,000 payroll jobs in October, on a seasonally adjusted (SA) basis.

ADP hasn't been very useful in predicting the BLS report (maybe the new method will work better), but this suggests a stronger than consensus report.

Wednesday, October 31, 2012

Thursday: ADP Employment, Weekly Unemployment Claims, Auto Sales, ISM Mfg

by Calculated Risk on 10/31/2012 09:10:00 PM

Here are the winners for the October economic question contest:

1st: Don Durito

2nd tie: Pat MacAuley, Vijay Kumar, Christopher Brandow, Daniel Brawdy and 2 OpenID Users.

Congratulations all!

Thursday:

• At 8:15 AM: ADP will release their Employment Report for October. This report is for private payrolls only (no government). The consensus is for 155,000 payroll jobs added in October. However this is the first report using a new methodology, and the consensus probably doesn't reflect that change. I expect something significantly lower than the "consensus". This doesn't mean the labor market is weaker than originally thought - just that the ADP methodology has been changed.

• At 8:30 AM, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 365 thousand from 369 thousand. Note: There will probably some increase in weekly unemployment claims over the next few weeks related to Hurricane Sandy.

• Also at 8:30 AM, Productivity and Costs for Q3. The consensus is for a 1.3% increase in unit labor costs.

• At 10:00 AM, the ISM Manufacturing Index for October will be released. The consensus is for a decrease to 51.0, down from 51.5 in September. (above 50 is expansion).

• Also at 10:00 AM, the Census Bureau will released the Construction Spending report for September. The consensus is for a 0.7% increase in construction spending.

• All day: Light vehicle sales for October. The consensus is for light vehicle sales to increase to 15.0 million SAAR in October (Seasonally Adjusted Annual Rate).

Here are the first four questions for the November economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

Restaurant Performance Index declined in September

by Calculated Risk on 10/31/2012 06:27:00 PM

From the National Restaurant Association: Restaurant Performance Index Declined in September Due to Softer Sales, Traffic

The RPI – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 100.4 in September, down 0.3 percent from August. Despite the decline, September represented the 11th consecutive month that the RPI stood above 100, which signifies continued expansion in the index of key industry indicators.

“Although restaurant operators reported softer same-store sales and customer traffic levels in September, they are somewhat more bullish about sales growth in the months ahead,” said Hudson Riehle, senior vice president of the Research and Knowledge Group for the Association. “Forty-five percent of restaurant operators expect their sales to improve in the next six months, while only 11 percent expect weaker sales.”

The Current Situation Index, which measures current trends in four industry indicators (same-store sales, traffic, labor and capital expenditures), stood at 99.9 in September – down 0.7 percent from a level of 100.6 in August. Although same-store sales remained positive in September, the softness in the labor and customer traffic indicators outweighed the performance, which led to a Current Situation Index reading below 100 for the second time in the last three months.

Click on graph for larger image.

Click on graph for larger image.The index declined to 100.4 in September, down 0.3% from August (above 100 indicates expansion).

Restaurant spending is discretionary, so even though this is "D-list" data, I like to check it every month.

NMHC Apartment Survey: Market Conditions Tighten, Growth Rate Moderates

by Calculated Risk on 10/31/2012 04:00:00 PM

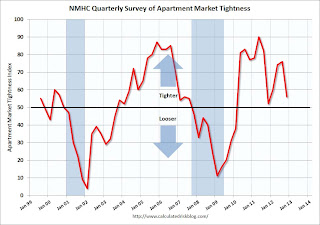

From the National Multi Housing Council (NMHC): Apartment Market Expansion Continues as Growth Rate Moderates

Apartment markets improved across all areas for the seventh quarter in a row, but the pace of improvement moderated according to the National Multi Housing Council’s (NMHC) Quarterly Survey of Apartment Market Conditions. The survey’s indexes measuring Market Tightness (56), Sales Volume (51), Equity Financing (56) and Debt Financing (65) all measured at 50 or higher, indicating growth from the previous quarter.

“Even after nearly three years of recovery, apartment markets around the country remain strong as more report tightening conditions than not,” said NMHC Chief Economist Mark Obrinsky. “The dynamic that began in 2010 remains in place: the increase in prospective apartment residents continues to outpace the pickup in new apartments completed. While development activity has picked up considerably since the trough, finance for both acquisition and construction remains constrained, flowing mainly to the best properties in the top markets.”

...

Market Tightness Index declined to 56 from 76. Marking the 11th straight quarter of the index topping 50, the majority (62 percent) reported stable market conditions. One quarter reported tighter markets and 14 percent indicated markets as looser.

Click on graph for larger image.

This graph shows the quarterly Apartment Tightness Index. Any reading above 50 indicates tightening from the previous quarter. The index has indicated tighter market conditions for the last eleven quarters and suggests falling vacancy rates and or rising rents.

This fits with the recent Reis data showing apartment vacancy rates fell in Q3 2012 to 4.6%, down from 4.7% in Q2 2012, and down from 8.0% at the end of 2009. This was the lowest vacancy rate in the Reis survey in over 10 years.

Even though multifamily starts have been increasing, completions lag starts by about a year - so the builders are still trying to catch up. There will be many more completions in 2012 than in 2011, increasing the supply.

As I've mentioned before, this index helped me call the bottom for effective rents (and the top for the vacancy rate) early in 2010 - and will probably be useful in indicating when the vacancy rate will stop falling.

Fed: Some domestic banks "reported easing standards", Many banks seeing "strengthening of demand"

by Calculated Risk on 10/31/2012 02:30:00 PM

From the Federal Reserve: The October 2012 Senior Loan Officer Opinion Survey on Bank Lending Practices

In the October survey, small fractions of domestic banks, on net, reported easing standards for business lending and some categories of consumer lending over the past three months. Respondents reported little change in residential real estate lending standards on balance. Significant fractions of banks reported a strengthening of demand for commercial real estate loans, residential mortgages, and auto loans, on balance, while demand for most other types of loans was about unchanged.

...

Within consumer lending, modest fractions of respondents continued to report an easing of standards on credit card and auto loans; respondents indicated that their standards on other types of consumer loans were about unchanged.

...

Special questions on lending to and competition from European banks. The October survey also included questions about European banking institutions and their affiliates that have been asked on several recent surveys. Respondents to the domestic and foreign survey again reported that their lending standards to European banks and their affiliates had tightened over the past three months, but the fractions of respondents indicating that they had tightened standards declined significantly between the July and October surveys, on net. As in the July survey, domestic banks reported that they had experienced little change in demand for loans from European banks and their affiliates and subsidiaries.

Of the respondents that indicated that their banks compete with European banks for their business, a slight majority reported that they had experienced a decrease in competition from European banks over the past three months, but the decrease did not appreciably boost business at their banks. A smaller but significant fraction of respondents indicated that a decrease in competition from European banks had increased business at their banks to some extent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here are some charts from the Fed.

This graph shows the change in demand for CRE (commercial real estate) loans.

Increasing demand and some easing in standards suggests some increase in CRE activity.

The second graph shows the change in demand for residential mortgages. Note the break in the graph - in recent years, the Fed has asked about demand for different types of mortgages.

The second graph shows the change in demand for residential mortgages. Note the break in the graph - in recent years, the Fed has asked about demand for different types of mortgages.The survey also has some discussion on Europe. Whereas domestic banks are easing standards slightly and seeing an increase in demand, they are tightening standards for lending to European banks.

CoreLogic: 57,000 Completed Foreclosures in September

by Calculated Risk on 10/31/2012 12:42:00 PM

From CoreLogic: CoreLogic® Reports 57,000 Completed Foreclosures in September

CoreLogic ... today released its National Foreclosure Report for September that provides monthly data on completed U.S. foreclosures and the overall foreclosure inventory. According to the report, there were 57,000 completed foreclosures in the U.S. in September 2012, down from 83,000 in September 2011 and 59,000 in August 2012. Prior to the decline in the housing market in 2007, completed foreclosures averaged 21,000 per month between 2000 and 2006. Completed foreclosures are an indication of the total number of homes actually lost to foreclosure. Since the financial crisis began in September 2008, there have been approximately 3.9 million completed foreclosures across the country.Note: The foreclosure inventory reported by CoreLogic is lower than the number reported by LPS of 3.87% of mortgages or 1.9 million in foreclosure.

Approximately 1.4 million homes, or 3.3 percent of all homes with a mortgage, were in the national foreclosure inventory as of September 2012 compared to 1.5 million, or 3.5 percent, in September 2011. Month-over-month, the national foreclosure inventory was down 1.1 percent from August 2012 to September 2012. The foreclosure inventory is the share of all mortgaged homes in any stage of the foreclosure process.

“The continuing downward trend in foreclosures along with a gradual clearing of the shadow inventory are signs of stabilization and improvement in the housing market,” said Anand Nallathambi, president and CEO of CoreLogic. “Increasingly improving market conditions and industry and government policy are allowing distressed homeowners to pursue refinancing, loan modifications or short sales rather than foreclosures.”

...

“Homes lost to foreclosure in September 2012 are down 50 percent since the peak month in September 2010 and 22 percent less than the beginning of the year,” said Mark Fleming, chief economist for CoreLogic. “While there is significant progress to be made before returning to pre-crisis levels, the trend is in the right direction as short sales, up 27 percent year over year in August, continue to gain popularity.”

Many observers expected a "surge" in foreclosures this year, but that hasn't happened. However there are still a large number of properties in the foreclosure inventory in some states:

The five states with the highest foreclosure inventory as a percentage of all mortgaged homes were: Florida (11.5 percent), New Jersey (7.3 percent), New York (5.3 percent), Illinois (5.2 percent) and Nevada (4.9 percent).