by Calculated Risk on 9/19/2012 12:48:00 PM

Wednesday, September 19, 2012

Existing Home Sales: Inventory and NSA Sales Graph

A few comments on existing home sales and inventory ...

This was a decent report, not because sales increased, but because of the level of inventory. Based on historical turnover rates, I think "normal" sales would be in the 4.5 to 5.0 million range. So existing home sales at 4.82 million are in the normal range. However, a "normal" market would have very few distressed sales, so there is still a long ways to go. As I've noted before, no one should expect existing home sales to go back to 6 or 7 million per year. Instead the key to returning to "normal" is more conventional sales and fewer distressed sales.

And it appears the shift from distressed to conventional is ongoing, from the NAR this morning:

Distressed homes - foreclosures and short sales sold at deep discounts - accounted for 22 percent of August sales (12 percent were foreclosures and 10 percent were short sales), down from 24 percent in July and 31 percent in August 2011.I'm not confident in the NAR measurement, but other sources suggest distressed sales have fallen in many areas.

Of course what matters the most in the NAR's existing home sales report is inventory. It is active inventory that impacts prices (although the "shadow" inventory will keep prices from rising). For existing home sales, look at inventory first and then at the percent of conventional sales.

The NAR reported inventory increased to 2.47 million units in August, up from 2.40 million in July. This is down 18.2% from August 2011, and down 13% from the inventory level in August 2005 (mid-2005 was when inventory started increasing sharply). This is about the same level for inventory as in August 2004.

I expect that the largest year-over-year declines in inventory are now behind us. It is very likely that each reported price increase will be met with more supply from sellers "waiting for a better market". I don't expect prices to fall to new lows in most areas, but this new inventory will probably limit any price increases.

Important: The NAR reports active listings, and although there is some variability across the country in what is considered active, most "contingent short sales" are not included. "Contingent short sales" are strange listings since the listings were frequently NEVER on the market (they were listed as contingent), and they hang around for a long time - they are probably more closely related to shadow inventory than active inventory. However when we compare inventory to 2005, we need to remember there were no "short sale contingent" listings in 2005. In the areas I track, the number of "short sale contingent" listings is also down sharply year-over-year.

Click on graph for larger image.

Click on graph for larger image.The following graph shows inventory by month since 2004. In 2005 (dark blue columns), inventory kept rising all year - and that was a clear sign that the housing bubble was ending.

This year (dark red for 2012) inventory is at the lowest level for the month of August since 2003, and inventory is below the level in August 2005 (not counting contingent sales). However inventory is still slightly elevated using months-of-supply, but I expect months-of-supply to be below 6 later this year.

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Sales NSA in August (red column) are above the sales for 2008 through 2011. Sales are well below the bubble years of 2005 and 2006, and also below 2007.

Sales NSA in August (red column) are above the sales for 2008 through 2011. Sales are well below the bubble years of 2005 and 2006, and also below 2007.Earlier:

• Housing Starts increased to 750 thousand in August

• Existing Home Sales in August: 4.82 million SAAR, 6.1 months of supply

• Existing Home Sales graphs

Existing Home Sales in August: 4.82 million SAAR, 6.1 months of supply

by Calculated Risk on 9/19/2012 10:00:00 AM

The NAR reports: August Existing-Home Sales and Prices Rise

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, rose 7.8 percent to a seasonally adjusted annual rate of 4.82 million in August from 4.47 million in July, and are 9.3 percent higher than the 4.41 million-unit level in August 2011.

...

Total housing inventory at the end August rose 2.9 percent to 2.47 million existing homes available for sale, which represents a 6.1-month supply at the current sales pace, down from a 6.4-month supply in July. Listed inventory is 18.2 percent below a year ago when there was an 8.2-month supply.

Click on graph for larger image.

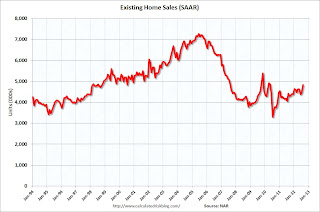

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in August 2012 (4.82 million SAAR) were 7.8% higher than last month, and were 9.3% above the August 2011 rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory increased to 2.47 million in August up from 2.40 million in July. Inventory is not seasonally adjusted, and usually inventory increases from the seasonal lows in December and January to the seasonal high in mid-summer.

According to the NAR, inventory increased to 2.47 million in August up from 2.40 million in July. Inventory is not seasonally adjusted, and usually inventory increases from the seasonal lows in December and January to the seasonal high in mid-summer.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 18.2% year-over-year in August from August 2011. This is the eighteenth consecutive month with a YoY decrease in inventory.

Inventory decreased 18.2% year-over-year in August from August 2011. This is the eighteenth consecutive month with a YoY decrease in inventory.Months of supply declined to 6.1 months in August.

This was above expectations of sales of 4.55 million. For existing home sales, the key number is inventory - and the sharp year-over-year decline in inventory is a positive for housing. I'll have more later ...

Housing Starts increased to 750 thousand in August

by Calculated Risk on 9/19/2012 08:30:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in August were at a seasonally adjusted annual rate of 750,000. This is 2.3 percent above the revised July estimate of 733,000 and is 29.1 percent above the August 2011 rate of 581,000.

Single-family housing starts in August were at a rate of 535,000; this is 5.5 percent above the revised July figure of 507,000.

Building Permits:

Privately-owned housing units authorized by building permits in August were at a seasonally adjusted annual rate of 803,000. This is 1.0 percent below the revised July rate of 811,000, but is 24.5 percent (±1.7%) above the August 2011 estimate of 645,000.

Single-family authorizations in August were at a rate of 512,000; this is 0.2 percent above the revised July figure of 511,000.

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years. Starts are slowing increasing.

Total housing starts were at 750 thousand (SAAR) in August, up 2.3% from the revised July rate of 733 thousand (SAAR). Note that July was revised from 746 thousand.

Single-family starts increased 5.5% to 535 thousand in August.

The second graph shows total and single unit starts since 1968.

This shows the huge collapse following the housing bubble, and that total housing starts have been increasing lately after moving sideways for about two years and a half years.

This shows the huge collapse following the housing bubble, and that total housing starts have been increasing lately after moving sideways for about two years and a half years. Total starts are up 57% from the bottom start rate, and single family starts are up 51% from the low.

This was below expectations of 768 thousand starts in August - mostly because of the volatile multi-family sector - but the key is starts are up solidly from last year. Right now starts are on pace to be up about 25% from 2011. Also note that total permits are up sharply from last year.

MBA: Mortgage Applications decrease, Mortgage Rates decline to Survey Lows

by Calculated Risk on 9/19/2012 07:03:00 AM

From the MBA: Mortgage Rates Drop to New Survey Lows

The Refinance Index increased 1 percent from the previous week. The HARP 2.0 share of refinance applications was 22 percent this past week. The seasonally adjusted Purchase Index decreased 4 percent from one week earlier.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) decreased to 3.72 percent, the lowest rate in the history of the survey, from 3.75 percent, with points increasing to 0.45 from 0.44 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans. The effective rate decreased from last week.

Click on graph for larger image.

Click on graph for larger image.This graph shows the MBA mortgage purchase index.

The purchase index has been mostly moving sideways over the last two years.

It looks like refinance activity is picking up again as mortgage rates decline.

Tuesday, September 18, 2012

Wednesday: Housing Starts, Existing Home Sales

by Calculated Risk on 9/18/2012 08:30:00 PM

Tomorrow will be about housing, and recently that has meant a little better news ...

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. Purchase applications have mostly been moving sideways this year at a low level.

• At 8:30 AM, Housing Starts for August will be released. The consensus is for total housing starts to increase to 768,000 (SAAR) in August, up from 746,000 in July.

• At 10:00 AM, the National Association of Realtors (NAR) will release the existing Home Sales report for August. The consensus is for sales of 4.55 million on seasonally adjusted annual rate (SAAR) basis. Housing economist Tom Lawler expects sales to be about 4.87 million SAAR.

A key will be inventory and months-of-supply. It is possible that months-of-supply will be close to 6.0 months; the lowest level for August since 2005.

• During the day: The AIA's Architecture Billings Index for August (a leading indicator for commercial real estate).

Two more questions for the September economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

Report: Saudi offers more oil, Gasoline prices still near highs

by Calculated Risk on 9/18/2012 06:18:00 PM

From the Financial Times: Saudis offer extra oil to control prices

Saudi Arabia has offered ... extra oil supplies through the end of the year, a sign the world’s largest exporter is worried about the impact of rising prices on the global economy.This might just be talk ... oil prices are down sharply over the last two days, however Brent futures are still at $112.52 per barrel according to Bloomberg.

...

“The current price is too high,” a senior Gulf-based oil official told the Financial Times. “We would like to see oil prices back to $100 a barrel.”

excerpt with permission

Meanwhile, gasoline prices are still very high. From the Oregonian: Oregon, Washington gas prices moving in reverse, but still at historic highs

In the past week, the average price of a gallon of regular unleaded in Oregon dropped three centers to $4.01, the nation’s 10th most expensive.The following graph shows the recent increase in gasoline prices. Gasoline prices peaked in early April, then fell sharply in May and June - and have increased sharply since early July.

Washington has the nation’s sixth most-expensive gasoline for the second week in a row at $4.05, down a penny from last week.

The national average -- at $3.86 -- actually added a cent-and-a-half. For the first time since early April, Dodds said, 10 states, including California, Washington and Oregon, have averages at or above $4 a gallon, up from nine a week ago.

Note: If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Update: The Mortgage Debt Forgiveness Tax Break

by Calculated Risk on 9/18/2012 03:19:00 PM

I expect this to get extended, but it is probably motivating some people to try to close their short sale before the end of the year.

From Carolyn Said at the San Francisco Chronicle: Clock ticking on forgiven-debt tax break

Before the housing downturn hit, "forgiven debt" on home mortgages could be taxed as income. For instance, if your lender lopped $50,000 off what you owed (a type of loan modification called principal reduction), if you short-sold the property for $50,000 less than your mortgage or if your lender foreclosed on a property worth $50,000 less than you owed, the $50,000 would be treated as income, adding up to a potential big bill for state and federal taxes.

But with millions of struggling homeowners in such situations, both the Congress and the California Legislature passed bills to exempt forgiven home debt from taxes.

But now the Mortgage Forgiveness Debt Relief Act of 2007 is due to expire on Dec. 31. The election-year Congress, already famously fractious, is not expected to act on it in 2012, although industry experts hope it could get extended next year. ...

Even if the act eventually gets renewed, it doesn't cover all homeowners.

"It applies only to the mortgage you originally got to acquire the home or to a refi used to improve the home," said Stephen Moskowitz, a tax attorney in San Francisco.

Homeowners who did cash-out refinances and used the money for any other purpose than fixing up their house could still be on the hook for forgiven debt.

Mortgage Lending Declined in 2011, FHA share declined to 31%

by Calculated Risk on 9/18/2012 12:55:00 PM

From the Federal Financial Institutions Examination Council (FFIEC): Federal Financial Institutions Examination Council Announces Availability of 2011 Data on Mortgage Lending

The 2011 data include information on 11.7 million home loan applications (of which nearly 7.1 million resulted in loan originations) and 2.9 million loan purchases, for a total of nearly 14.7 million actions. The data also include information on 186,000 requests for preapprovals related to a home purchase that did not result in a loan. The total number of originated loans of all types and purposes reported fell by about 780,000, or 10 percent, from 2010, in part because of a 13 percent decline in refinancings. Home purchase lending also fell, but by a more modest 5 percent.Refinance activity has picked up in 2012, although purchase activity has been at about the same level in 2011 according to the MBA.

The 2011 HMDA data reflect a continued heavy reliance on loans backed by the Federal Housing Administration (FHA) insurance that began several years ago with the onset of problems in the mortgage market. For home purchase lending, the FHA’s share of first-lien loans showed a continued increase from 7 percent in 2007 to 26 percent in 2008, and then to 37 and 36 percent, respectively, in 2009 and 2010. In 2011, the FHA share fell to 31 percent. First-lien lending for home purchases backed by Veterans Administration (VA) guarantees also has increased in recent years, although VA-backed lending represents a smaller share of the market than FHA-backed lending. The VA market share of first-lien home purchase loans increased from nearly 3 percent in 2007 to about 7 percent in 2009 and 2010. The VA market share of home purchase lending increased to 8 percent in 2011.

The overall volume of reported conventional, FHA-, and VA-related refinancing activity diminished slightly from 2010 to 2011. Although both the number of conventional and FHA-related refinancings fell from 2010 to 2011 (decreases of about 12 percent and 37 percent, respectively), the volume of VA-guaranteed refinancing activity rose significantly, increasing about 41 percent.

This is still a very high percentage of FHA loans, although the percentage is down from the peak in 2009 and 2010 (probably because of higher fees).

NAHB Builder Confidence increases in September, Highest since June 2006

by Calculated Risk on 9/18/2012 10:00:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) increased 3 points in September to 40. Any number under 50 indicates that more builders view sales conditions as poor than good.

From the NAHB: Builder Confidence Continues to Gain Momentum in September

Builder confidence in the market for newly built, single-family homes rose for a fifth consecutive month in September to a level of 40 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI), released today. This latest three-point gain brings the index to its highest reading since June of 2006.

“Builders across the country are expressing a more positive outlook on current sales conditions, future sales prospects and the amount of consumer traffic they are seeing through model homes than they have in more than five years,” noted NAHB Chief Economist David Crowe. “However, against the improving demand for new homes, concerns are now rising about the lack of building lots in certain markets and the rising cost of building materials. Given the fragile nature of the housing and economic recovery, these are significant red flags.”

...

All three HMI components posted gains in September. While the component gauging current sales conditions increased four points to 42, the component gauging sales prospects in the next six months rose eight points to 51 and the component measuring traffic of prospective buyers edged up one point to 31.

Builder confidence also rose across every region of the country in September. Looking at the three-month moving average for each region, the Midwest and West each registered five-point gains, to 40 and 43, respectively, while the South posted a four-point gain to 36 and the Northeast posted a two-point gain to 30.

Click on graph for larger image.

Click on graph for larger image.This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the September release for the HMI and the July data for starts (August housing starts will be released tomorrow). This was above the consensus estimate of a reading of 38.

Report: Housing Inventory declines 18.7% year-over-year in August

by Calculated Risk on 9/18/2012 08:01:00 AM

From Realtor.com: August 2012 Real Estate Data

The total US for-sale inventory of single family homes, condos, townhomes and co-ops (SFH/CTHCOPS) remained at historic lows, with 1.84 million units for sale in August, down -18.68% compared to a year ago and 40% below its peak of 3.10 million units in September 2007, when Realtor.com began monitoring these markets.The NAR is scheduled to report August existing home sales and inventory on Wednesday. The key number in the NAR report will be inventory, and inventory will be down sharply again year-over-year in August.

The median age of inventory of for sale listings was 91 days in August, up by 3.41% from July, but -11.65% below the median age one year ago (August 2011). While the median age of the inventory is highly seasonal, the year-over-year decline is consistent with other data showing a significant improvement in market conditions.

For sale inventories of SFH/CTHCOPS in August declined on an annual basis in all but two of the 146 MSAs monitored by Realtor.com, with for-sale inventory dropping by -20% or more in 62 of the 146 markets covered. ... Eight out of [top] 10 of these markets are in California, with Seattle, WA, and Atlanta, GA, also registering declines of -41% and -37%, respectively.

Only two areas experienced a year-over-year increase in their for-sale inventories— Shreveport, LA (+17.87%), and Philadelphia PA (+3.51%). Increasing inventories in these markets most likely reflect the impact of continued weaknesses in their local economies.