by Calculated Risk on 8/27/2012 01:08:00 PM

Monday, August 27, 2012

Fed's Pianalto discusses Benefits and Costs of QE3

From Cleveland Fed President Sandra Pianalto: The Federal Reserve and Monetary Policy

I am expecting the U.S. economy to continue to grow, but at a moderate pace. I expect economic growth of about 2 percent this year. And with this moderate GDP growth forecast, my outlook is for very slow improvement in the jobless rate. I expect the pace of GDP growth to pick up gradually through 2014, and for the unemployment rate to remain above 7 percent through 2014. Given my outlook for slow economic growth, I also expect slow wage growth, and I anticipate that core inflation will remain near the FOMC's 2 percent long-term objective over the next few years. While inflation remains close to our objective, unemployment is still well above the FOMC's estimate of the longer-term normal rate. The monetary policy debate is whether the FOMC should take further actions to stimulate today's slow-growth economy to bring down unemployment.Pianalto is a voting member of the FOMC and her views are considered to be in the middle. Her concern about "a meaningful deterioration in securities market functioning" was addressed in the last meeting in a staff report, from the FOMC minutes:

Monetary policy should do what it can to support the recovery, but there are limits to what monetary policy can accomplish. Monetary policy cannot directly control the unemployment rate. It can only foster conditions in financial markets that are conducive to growth and a lower unemployment rate. At times, significant obstacles can get in the way.

...

... large-scale asset purchases can be effective. But our experience with these programs is limited, and as a result, they justify more analysis. For example, as the structure of interest rates has moved lower over time, it is possible that future large-scale asset purchase programs will yield somewhat smaller interest-rate declines than past programs. A related issue to evaluate is whether further reductions in longer-term interest rates would stimulate economic activity to the same degree as they have in the past.

Let me now turn to some of the potential costs. It is conceivable that, at some point, policies designed to promote further declines in rates could interfere with financial stability. Some financial institutions find themselves challenged today by the low-interest-rate environment, and they might take actions to remain profitable that could affect risk in the financial system. ...

Finally, it is also conceivable that, at some point, the Federal Reserve's presence in certain securities markets would become so large that it would distort market functioning. It is important to have good estimates of how large the Federal Reserve's participation would have to be to cause a meaningful deterioration in securities market functioning, and to better understand the potential costs of such deterioration for the economy as a whole.

The bottom line is this: I am supportive of actions that provide economic benefits with manageable risks. The FOMC's policy actions to date have been important economic stabilizers and have acted to support the expansion. Yet today, we still find ourselves in a challenging economic environment – one in which we continue to rely on nontraditional policy tools. These new tools come with benefits and with risks ... and we must constantly weigh both in our efforts to meet our dual mandate of maximum employment and stable prices.

In reviewing the costs that such a program might entail, some participants expressed concerns about the effects of additional asset purchases on trading conditions in markets related to Treasury securities and agency MBS, but others agreed with the staff's analysis showing substantial capacity for additional purchases without disrupting market functioning.Some reports will probably focus on Pianalto's comment that "there are limits to what monetary policy can accomplish", but she clearly outlined the dual mandate, noted that unemployment was forecast to be very high for years, while inflation is forecast to be "close" to the FOMC objective - and there has already been a staff report addressing her concern about market functioning. My guess is she is leaning towards additional accommodation.

Dallas Fed: "Growth Slows" in August Regional Manufacturing Activity

by Calculated Risk on 8/27/2012 10:30:00 AM

From the Dallas Fed: Texas Manufacturing Growth Slows but Six-Month Expectations Improve

Texas factory activity increased but at a slower pace in August, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, fell from 12 to 6.4, suggesting softer output growth.This was above expectations of a -6.0 reading for the general business activity index.

The general business activity index remained negative but climbed nearly 12 points from -13.2 to -1.6.

...

Labor market indicators reflected stronger labor demand but unchanged workweeks. Employment growth picked up in August, with the index rising to 14.2, its highest reading in five months. Twenty-four percent of firms reported hiring new workers, while 10 percent reported layoffs. The hours worked index was near zero, suggesting little change in workweek length.

So far all of regional manufacturing surveys have been weak in August.

Fed's Evans supports Open-Ended QE

by Calculated Risk on 8/27/2012 08:50:00 AM

From Chicago Fed President Charles Evans: Some Thoughts on Global Risks and Monetary Policy

Evans concludes with an impassioned plea to do more to help reduce unemployment:

Finding a way to deliver more accommodation — whether it is monetary or fiscal — is particularly important now because delays in reducing unemployment are costly. An unusually large percentage of the unemployed have been without work for quite an extended period of time; their skills can become less current or even deteriorate, leaving affected workers with permanent scars on their lifetime earnings. And any resulting lower aggregate productivity also weighs on potential output, wages and profits for the economy as a whole. The damage intensifies the longer that unemployment remains high. Failure to act aggressively now could lower the capacity of the economy for many years to come.Evans once again proposes keeping the Fed funds rate low until unemployment falls below some target (he suggests 7%), unless inflation rises above 3%.

...

I have outlined some policy actions that I think can take us in the direction of a more vibrant and resilient economy. Given the risks we face, I think it is vital that we make such moves today. I don’t think we should be in a mode where we are waiting to see what the next few data releases bring. We are well past the threshold for additional action; we should take that action now.

Evans also supports open-ended QE until the economic conditions clearly improve:

I support further use of our balance sheet to provide even more monetary accommodation. ... I believe it is time to take even stronger steps, such as the purchase of more mortgage-backed securities, to increase the degree of monetary support for the recovery. As suggested recently by my colleagues Eric Rosengren and John Williams, these could be open-ended purchases, meaning that they would continue at a certain rate until there was clear evidence of improvement in economic conditions.This is not a new position for Evans, but this is an especially strong speech.

Sunday, August 26, 2012

Sunday Night Futures:Isaac, ECB and Fed

by Calculated Risk on 8/26/2012 09:07:00 PM

Tropical Storm Isaac in the Gulf (soon to be a hurricane). Fed Chairman Ben Bernanke and ECB President Mario Draghi speak later this week at the Jackson Hole Symposium. It will be a busy week!

From Reuters: Isaac heads for U.S. Gulf Coast, Landfall likely on anniversary of Hurricane Katrina

Isaac is expected to strengthen to a Category 2 hurricane and hit the Gulf Coast ... on or near the seventh anniversary of Hurricane Katrina - the U.S. National Hurricane Center (NHC) said in an advisory.It was the storm surge during Katrina that damaged the Gulf Coast refineries - and the NHC doesn't expect Isaac to be as large or powerful as Katrina, but Isaac is still a very dangerous storm.

With the threat to offshore oil infrastructure and Louisiana refineries, U.S. crude oil prices traded up 75 cents to $96.90 a barrel in Asia trading early Monday.

Once ashore, the storm could wreak havoc on low-lying fuel refineries along the Gulf Coast that account for about 40 percent of U.S. refining capacity.

From the WSJ: ECB Weighs Flexible Targets on Bond Yields

[O]fficials are moving in the direction of informal, flexible yield objectives for shorter-maturity bond yields of Spain and other at-risk countries, according to the person familiar with the matter.No denial yet from Germany.

The central bank is unlikely to finalize anything before its Sept. 6 policy meeting, at the earliest. Yet the basic contours are starting to take shape.

The thinking, the person said, is that the ECB would guide investors toward a target, or range, for government bond yields of Spain and others by publicly communicating specifics about the amount of the bond purchases it conducts, as well as the details on the types of bonds it buys.

And from Jon Hilsenrath at the WSJ: Will Fed Act Again? Sizing Up Potential Costs

Federal Reserve Chairman Ben Bernanke delivers what could be his closing argument in deliberations about launching a new bond-buying program when he speaks Friday at the central bank's Jackson Hole, Wyo., conference.The Asian markets are mixed tonight, with the Nikkei up 0.8% and the Shanghai Composite down 1%.

The argument comes down to weighing costs and benefits.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P future are up 2, and the DOW futures up 25 points.

Oil prices are moving up again with WTI futures are at $96.88 and Brent is at $114.27 per barrel. Using the calculator at Econbrowser suggests national gasoline prices at about $3.69 per gallon.

Yesterday:

• Summary for Week Ending Aug 24th

• Schedule for Week of Aug 26th

Three more questions for the August economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

"Serial Refinancers" and Percent of Refinance Loans with Cash Out

by Calculated Risk on 8/26/2012 04:06:00 PM

From Annamaria Andriotis at the WSJ: The Serial Refinancers

To keep up with falling rates, almost 2.2 million homeowners have refinanced their mortgages at least twice since 2009, according to data compiled for The Wall Street Journal by SMR Research, a mortgage-research firm in Hackettstown, N.J.Refinance activity has picked up again this year, but this is very different from the mortgage equity withdrawal surge during the housing bubble.

From 2006 through 2008, some 3.5 million homeowners refinanced at least twice.

...

The last time homeowners were so eager to refinance, it was a more expensive proposition. At the height of the housing boom, 86% of borrowers who refinanced took out cash and ended up with a higher loan amount, according to Freddie Mac.

Freddie Mac has some great data in their refinance activities reports.

Click on graph for larger image.

Click on graph for larger image. This graph uses the Freddie Mac data. This year, close to 60% of loans have no change in the loan balance, and another 20%+ were "Cash-in" refinances (with the borrower putting money into the house to obtain the refinance loan). Last year, in Q4, almost half of all loans were "cash-in"!

Here are the definitions from Freddie Mac:

"Higher Loan Amount" refers to loan amounts that were at least 5 percent greater than the amortized unpaid principal balance (UPB) of the original loan. "No Change In Loan Amount" refers to loans on which the principal balance was unchanged during refinance or loans that increased less than 5 percent of the original loan balance due to the inclusion of closing costs for the refinance. "Lower loan amount" refers to loan amounts that were less than the amortized UPB of the original loan. These three columns may not sum to 100% due to rounding.Yesterday:

• Summary for Week Ending Aug 24th

• Schedule for Week of Aug 26th

Zillow: House Prices increased 1.2% Year-over-year in July

by Calculated Risk on 8/26/2012 10:18:00 AM

Notes: Every month Zillow uses their data to estimate the Case-Shiller index. On Friday I posted their estimate for the June Case-Shiller Composite 20 index showing a 0.3% year-over-year increase.

Of course Zillow has their own house price index that excludes foreclosure resales and they released their report for July last week and I rarely mention it - so here is their most recent release.

From Zillow: U.S. Home Values Climb for Eighth Consecutive Month; Over 60% of Metros Show Increasing Values

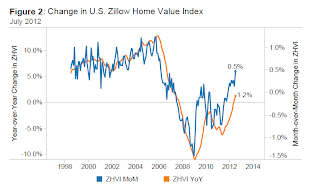

Zillow’s July Real Estate Market Reports ... show that home values increased 0.5 percent to $151,600 from June to July (Figure 1), marking another month of healthy monthly appreciation. Compared to July 2011, home values are up by 1.2 percent (Figure 2), supported in many places by low for-sale inventory. Inventory shortages are being fueled by negative equity and a slowed distribution of REOs. ... On an annual basis, rents across the nation are up by 5.4 percent

Click on graph for larger image.

Click on graph for larger image. This graph from Zillow shows the national Zillow HPI.

The index was up 0.5% in July, and is up 1.2% over the last year.

The index is off 21.7% from the peak in April 2007. (This excludes foreclosures).

From Zillow:

The Zillow Real Estate Market Reports cover 167 metropolitan areas (metros) of which 102 showed monthly home value appreciation. Among the top 30 metros, 21 experienced monthly home value appreciation and 14 saw annual increases. The largest monthly decline among the top 30 metros took place in St. Louis, where home values fell by 0.4 percent from June to July. Leading the pack on the appreciation side are Phoenix, San Jose and San Francisco, which experienced 2.2, 1.2 and 1.2 percent home value appreciation, respectively

The second graph is also from Zillow. The year-over-year comparison has turned positive this year, and is positive for the first time since the housing bubble burst.

The second graph is also from Zillow. The year-over-year comparison has turned positive this year, and is positive for the first time since the housing bubble burst.Zillow also has data on rents and the rate of foreclosed homes.

Note: At the peak of the bubble, we only had the OFHEO HPI (now FHFA and for GSE loans only), and some median price indexes that are impacted by the mix. Now we have a number of house price indexes released every month: Case-Shiller, CoreLogic, LPS, Zillow, FNC and several others.

Saturday, August 25, 2012

Unofficial Problem Bank list declines to 898 Institutions

by Calculated Risk on 8/25/2012 06:39:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Aug 24, 2012. (table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

Only one change for the Unofficial Problem Bank List this week as the FDIC held to form and did not release its actions until the last Friday of the month. For next week, that means we will should get the second quarter industry earnings and the Official Problem Bank List on the 28th and FDIC's actions for July on the 31st.Earlier:

The Federal Reserve terminated the action against Valley Bank, Roanoke, VA ($781 million Ticker: VYFC). After removal, the Unofficial Problem Bank List holds 898 institutions with assets of $346.7 billion. A year ago, the list held 988 institutions with assets of $415.9 billion.

• Summary for Week Ending Aug 24th

• Schedule for Week of Aug 26th

Schedule for Week of Aug 26th

by Calculated Risk on 8/25/2012 01:05:00 PM

Earlier:

• Summary for Week Ending Aug 24th

The most anticipated events this coming are the speeches by Fed Chairman Ben Bernanke (Friday) and ECB President Mario Draghi (Saturday) at the Jackson Hole Economic Symposium .

Key economic releases include the Case-Shiller house price index on Tuesday, the second estimate of Q2 GDP on Wednesday, and July Personal Income and Spending on Thursday.

Note: The FDIC is expected to release the Q2 Quarterly Banking Profile this week.

10:30 AM: Dallas Fed Manufacturing Survey for August. The consensus is for -6.0 for the general business activity index, up from -13.2 in July.

12:15 PM: Cleveland Fed President Sandra Pianalto speaks on the economic outlook and monetary policy in Newark (voting member of FOMC).

9:00 AM: S&P/Case-Shiller House Price Index for June. Although this is the June report, it is really a 3 month average of April, May and June.

9:00 AM: S&P/Case-Shiller House Price Index for June. Although this is the June report, it is really a 3 month average of April, May and June. This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indexes through May 2012 (the Composite 20 was started in January 2000).

The consensus is for a no change year-over-year in the Composite 20 prices (NSA) for June. The Zillow forecast is for the Composite 20 to increase 0.3% year-over-year, and for prices to increase 0.9% month-to-month seasonally adjusted. The CoreLogic index increased 1.3% in June (NSA).

10:00 AM: Conference Board's consumer confidence index for August. The consensus is for a decrease to 65.0 from 65.9 last month.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for August. The consensus is for an increase to -10 for this survey from -17 in July (above zero is expansion).

8:30 AM: Gross Domestic Product, 2nd quarter 2012 (second estimate); Corporate Profits, 2nd quarter 2012 (preliminary estimate). This is the second estimate from the BEA. The consensus is that real GDP increased 1.7% annualized in Q2, revised up from 1.5% in the advance release.

10:00 AM ET: Pending Home Sales Index for August. The consensus is for a 1.0% increase in the index.

11:00 AM: New York Fed to Release Q2 2012 Report on Household Debt and Credit.

2:00 PM: Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts. This will receive extra attention this month as investors look for any sign of a "a substantial and sustainable strengthening in the pace of the economic recovery" that might derail QE3. (quote from the recent FOMC minutes).

8:30 AM ET: Personal Income and Outlays for July. The consensus is for a 0.3% increase in personal income in July, and for 0.4% increase in personal spending. And for the Core PCE price index to increase 0.1%.

11:00 AM: Kansas City Fed regional Manufacturing Survey for August. This is the last of the regional surveys for August. The consensus is for an a reading of 5, unchanged from 5 in July (above zero is expansion).

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (final for August). The consensus is for a reading of 73.5, down from the preliminary August reading of 73.6, and up from the July reading of 72.3.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for July. The consensus is for a 0.9% increase in orders.

10:00 AM, Speech by Fed Chairman Ben Bernanke, "Monetary Policy Since the Crisis", At the Federal Reserve Bank of Kansas City Economic Symposium, Jackson Hole, Wyoming

Summary for Week ending August 24th

by Calculated Risk on 8/25/2012 08:03:00 AM

The key sentence of the week was from the FOMC minutes of the last meeting: “Many members judged that additional monetary accommodation would likely be warranted fairly soon unless incoming information pointed to a substantial and sustainable strengthening in the pace of the economic recovery.”

“Substantial and sustainable”? Not any time soon. So the question is what is the meaning of “fairly soon”, and does that mean QE3, or an extension of the exceptionally low levels of interest rates until 2015?

We might get some hints next week when Fed Chairman Ben Bernanke speaks at the Jackson Hole Economic Symposium. But “fairly soon” probably means September ... for something!

The only significant economic releases this week were housing related – July new and existing home sales - and of course both were fairly positive.

For new homes, sales increased to 372,000 on an annual rate basis in July. New home sales have averaged a 360,000 pace through July, and that means sales are on pace to increase 18% from 2011 (with coming revisions, I expect sales to be up 20%+ this year). This is from a very low level, but how many sectors are seeing a 20% year-over-year increase in 2012?

For existing home sales, the key number is inventory. Although the NAR reported inventory increased slightly in July from June, inventory is still down 23.8% compared to July 2011. Another positive is that conventional sales in many areas are up sharply from last year, offsetting the decline in distressed sales.

Another key sentence (and an old theme for this blog): As goes housing, so goes the economy. The general rule is housing leads the economy – there are exceptions like in 2001 following the popping of the stock bubble, and recently we’ve seen a recovery without housing – but the housing recovery suggests, barring a significant policy mistake in the US or Europe, the pace of the economic recovery should increase in 2013. Will it be “substantial and sustainable”? I doubt it will be "substantial" in the near term.

Here is a summary of last week in graphs:

• New Home Sales increased in July to 372,000 Annual Rate

Click on graph for larger image.

Click on graph for larger image.

The Census Bureau reported New Home Sales in July were at a seasonally adjusted annual rate (SAAR) of 372 thousand. This was up from a revised 359 thousand SAAR in June (revised up from 350 thousand). Sales in May were revised down.

The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

On inventory, according to the Census Bureau:

"A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

This graph shows the three categories of inventory starting in 1973.

This graph shows the three categories of inventory starting in 1973.The inventory of completed homes for sale was at a record low 38,000 units in July. The combined total of completed and under construction is at the lowest level since this series started.

This was another fairly solid report and indicates an ongoing sluggish recovery in residential investment.

• Existing Home Sales in July: 4.47 million SAAR, 6.4 months of supply

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993. Sales in July 2012 (4.47 million SAAR) were 2.3% higher than last month, and were 10.4% above the July 2011 rate.

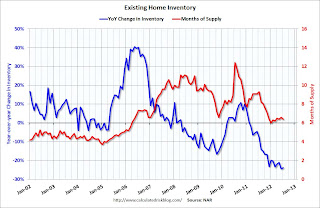

The second graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 23% year-over-year in July from July 2011. This is the seventeenth consecutive month with a YoY decrease in inventory, and near the largest year-over-year decline reported.

Inventory decreased 23% year-over-year in July from July 2011. This is the seventeenth consecutive month with a YoY decrease in inventory, and near the largest year-over-year decline reported.Months of supply decreased to 6.4 months in July.

This was slightly below expectations of sales of 4.50 million. However, as I've noted before, those focusing on sales of existing homes, looking for a recovery for housing, are looking at the wrong number. For existing home sales, the key number is inventory - and the sharp year-over-year decline in inventory is a positive for housing.

• AIA: Architecture Billings Index Downturn Moderates as Negative Conditions Continue in July

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

This graph shows the Architecture Billings Index since 1996. The index was at 48.7 in July, up from 45.9 in June. Anything below 50 indicates contraction in demand for architects' services.

This graph shows the Architecture Billings Index since 1996. The index was at 48.7 in July, up from 45.9 in June. Anything below 50 indicates contraction in demand for architects' services.Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This suggests further weakness in CRE investment later this year and into next year (it will be some time before investment in offices and malls increases).

• Weekly Initial Unemployment Claims increased to 372,000

From the DOL: "In the week ending August 18, the advance figure for seasonally adjusted initial claims was 372,000, an increase of 4,000 from the previous week's revised figure of 368,000."

From the DOL: "In the week ending August 18, the advance figure for seasonally adjusted initial claims was 372,000, an increase of 4,000 from the previous week's revised figure of 368,000."The dashed line on the graph is the current 4-week average. The 4-week average post-bubble low is 363,000; this week the average was at 368,000.

This was above the consensus forecast of 365,000.

• Other Economic Stories ...

• FOMC Minutes: Discussion of policy tools the FOMC mioght use "fairly soon"

• From the Census Bureau: Durable Goods orders increase 4.2% in July

• From Zillow: Negative Equity Falls in Second Quarter; Nearly Half of Borrowers Under 40 Remain Underwater

• From the FHFA: U.S. House Prices Rose 1.8 Percent From First Quarter to Second Quarter 2012

Friday, August 24, 2012

Zillow forecasts Case-Shiller House Price index to show small Year-over-year increase for June

by Calculated Risk on 8/24/2012 08:22:00 PM

Note: The Case-Shiller report is for June (really an average of prices in April, May and June).

Zillow Forecast: Zillow Forecast: June Case-Shiller Composite-20 Expected to Show 0.3% Increase from One Year Ago

On Tuesday, August 28th, the Case-Shiller Composite Home Price Indices for June will be released. Zillow predicts that the 20-City Composite Home Price Index (non-seasonally adjusted [NSA]) will be up by 0.3 percent on a year-over-year basis, while the 10-City Composite Home Price Index (NSA) will be flat on a year-over-year basis. The seasonally adjusted (SA) month-over-month change from May to June will be 0.9 percent for both the 20-City Composite and the 10-City Composite Home Price Index (SA). All forecasts are shown in the table below and are based on a model incorporating the previous data points of the Case-Shiller series and the June Zillow Home Value Index data, and national foreclosure re-sales.Zillow's forecasts for Case-Shiller have been pretty close.

This will be the first month with positive annual appreciation in the 20-City Index since September of 2010. In 2010, home prices showed increases due to the Federal home buyer credit, which artificially lifted the market. This time around the home price appreciation is organic and represents a recovering housing market. Zillow has called a home value bottom for the national real estate market with many regional markets experiencing inventory shortages and strong near-term price appreciation. While the Case-Shiller indices have been appreciating at a healthy clip for the past few months, we do expect them to moderate and likely report monthly declines towards the end of the year, largely as a function of declining overall monthly sales volume which will increase the percentage of foreclosure re-sales in the transactional mix being tracked by Case-Shiller.

For those of you interested in more recent data on the housing market, Zillow’s July 2012 data was released this week, Tuesday, August 21st and can be found here. The Zillow Home Value Index does not include foreclosure re-sales, and we expect it to increase 1.2% between June 2012 and June 2013.

If the Zillow forecast is correct, this will be a significant milestone for the Case-Shiller as year-over-year prices turn positive.

| Case Shiller Composite 10 | Case Shiller Composite 20 | ||||

|---|---|---|---|---|---|

| NSA | SA | NSA | SA | ||

| Case Shiller (year ago) | June 2011 | 154.87 | 154.35 | 141.50 | 140.78 |

| Case-Shiller (last month) | May 2012 | 151.79 | 152.88 | 138.96 | 139.93 |

| Zillow June Forecast | YoY | 0.0% | 0.0% | 0.3% | 0.3% |

| MoM | 2.1% | 0.9% | 2.2% | 0.9% | |

| Zillow Forecasts1 | 154.9 | 154.3 | 142.0 | 141.2 | |

| Current Post Bubble Low | 146.51 | 149.21 | 134.08 | 136.49 | |

| Date of Post Bubble Low | Mar-12 | Jan-12 | Mar-12 | Jan-12 | |

| Above Post Bubble Low | 5.7% | 3.4% | 5.9% | 3.4% | |

| 1Estimate based on Year-over-year and Month-over-month Zillow forecasts | |||||