by Calculated Risk on 8/15/2012 02:38:00 PM

Wednesday, August 15, 2012

WSJ: Articles on Shadow Inventory

Two articles on shadow inventory ...

Yesterday morning from Nick Timiraos at the WSJ: Shadow Inventory: It’s Not as Scary as It Looks

While the shadow is very large, one often-overlooked fact is that the shadow isn’t nearly as large as it was two years ago.And today from Timiraos at the WSJ: Shadow Inventory: Monitor Banks’ Speed, Not Just Volume

...

Barclays Capital estimates that at the end of May there were around 1.8 million mortgages in the foreclosure process and another 1.45 million where borrowers have missed at least three payments. That puts the total number of properties that could be repossessed and resold by banks at around 3.25 million mortgages.

...

But it is down from a peak of 4.25 million in February 2010.

...

[Housing analyst Ivy Zelman] published an in-depth research note earlier with the title: “Shining a bright light on the shadow: Why what’s lurking doesn’t concern us.” In it, she explains how it’s more important to focus on the pace at which foreclosures are being liquidated, and not the absolute number.

“Just like the Wizard of Oz, shadow inventory is not very intimidating once you pull back the curtain,” the report said.

“If you don’t understand the shadow inventory, it’s very ominous and concerning,” says Ivy Zelman, chief executive of Zelman & Associates. “But if you understand the flows and how it is brought to market” it looks less intimidating, she says.I discussed some of this yesterday in House Prices and a Foreclosure Supply Shock

...

Nationally, Barclays estimates that the number of bank-owned properties will decline a bit more this year, before accelerating next year to a peak of around 575,000 in early 2014.

...

Meanwhile, as the shadow inventory has dropped over the past year and as banks and states have slowed down the process, demand has picked up. That’s especially the case for foreclosed properties at low price points ...

Key Measures show slowing inflation in July

by Calculated Risk on 8/15/2012 12:10:00 PM

Note: This is the last inflation report before the September FOMC meeting (the August report will be released September 14th and the FOMC meeting is Sept 12th and 13th).

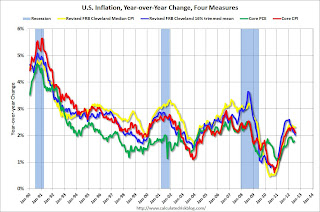

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.5% annualized rate) in July. The 16% trimmed-mean Consumer Price Index increased 0.1% (1.3% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed has the median CPI details for July here.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers was virtually flat at 0.0% (0.6% annualized rate) in July. The CPI less food and energy increased 0.1% (1.1% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.3%, the trimmed-mean CPI rose 2.0%, and core CPI rose 2.1%. Core PCE is for June and increased 1.8% year-over-year.

These measures suggest inflation is now at the Fed's target of 2% on a year-over-year basis and it appears the inflation rate is slowing. On a monthly basis (annualized), two of these measure were well below the Fed's target; trimmed-mean CPI was at 1.3%, Core CPI at 1.1% - although median CPI was at 2.5% and and Core PCE for June was at 2.5%. Based on initial data - and comparing to the increase in August 2011 - it is very likely that the August report will show a further decline in the year-over-year inflation rate.

NAHB Builder Confidence increases in August, Highest since February 2007

by Calculated Risk on 8/15/2012 10:00:00 AM

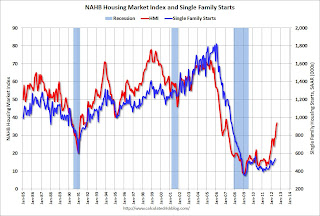

The National Association of Home Builders (NAHB) reported the housing market index (HMI) increased 2 points in August to 37. Any number under 50 indicates that more builders view sales conditions as poor than good.

From the NAHB: Builder Confidence Continues To Improve in August

Builder confidence in the market for newly built, single-family homes improved for a fourth consecutive month in August with a two-point gain to 37 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI), released today. This gain builds on a six-point increase in July and brings the index to its highest level since February of 2007.

“From the builder’s perspective, current sales conditions, sales prospects for the next six months and traffic of prospective buyers are all better than they have been in more than five years,” said Barry Rutenberg, chairman of the National Association of Home Builders (NAHB) and a home builder from Gainesville, Fla. “While there is still much room for improvement, we have come a long way from the depths of the recession and the outlook appears to be brightening.”

...

Every HMI component posted gains in August. The components gauging current sales conditions and traffic of prospective buyers each rose three points, to 39 and 31, respectively, while the component gauging sales expectations in the next six months inched up one point to 44. All were at their highest levels in more than five years.

Regionally, builder confidence rose nine points to 42 in the Midwest and two points to 35 in the South, but declined nine points to 25 in the Northeast and three points to 40 in the West in August. For the August HMI release, NAHB is introducing an alternative trend comparison of regional HMIs by also showing a three-month moving average of each region’s index. The current three-month moving averages show a two-point decline to 29 in the Northeast, a five-point gain to 35 in the Midwest, a three-point gain to 32 in the South and a three-point gain to 38 in the West.

Click on graph for larger image.

Click on graph for larger image.This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the August release for the HMI and the June data for starts (July housing starts will be released tomorrow). A reading of 37 was above the consensus.

Industrial Production increased 0.6% in July, Capacity Utilization increased

by Calculated Risk on 8/15/2012 09:15:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production increased 0.6 percent in July after having risen 0.1 percent in both May and June. Revisions to the rates of change for recent months left the level of the index in June little changed from its previous estimate. Manufacturing output rose 0.5 percent in July, the same rate of increase as was recorded for June. In July, the output of mines increased 1.2 percent, and the output of utilities rose 1.3 percent. At 98.0 percent of its 2007 average, total industrial production in July was 4.4 percent above its year-earlier level. Capacity utilization for total industry moved up 0.4 percentage point to 79.3 percent, a rate 1.0 percentage point below its long-run (1972--2011) average.

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 12.5 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 79.3% is still 1.0 percentage points below its average from 1972 to 2010 and below the pre-recession levels of 80.6% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in July to 98.0. This is 17.4% above the recession low, but still 2.7% below the pre-recession peak.

The consensus was for Industrial Production to increase 0.5% in July, and for Capacity Utilization to increase to 79.2%. The increase in IP and Capacity Utilization was above expectations.

NY Fed Manufacturing Survey indicates contraction, CPI unchanged in July

by Calculated Risk on 8/15/2012 08:30:00 AM

• From the NY Fed: Empire State Manufacturing Survey

The general business conditions index slipped below zero for the first time since October 2011, falling thirteen points to -5.9. At -5.5, the new orders index was below zero for a second consecutive month, and the shipments index fell six points to 4.1.This was the first regional manufacturing survey released for August. The general business conditions index was worse than expected and new orders were down.

...

The index for number of employees inched lower, but remained positive at 16.5, suggesting a moderate increase in employment levels, and the average workweek index rose to 3.5.

...

Indexes for the six-month outlook were generally positive but lower than in July, indicating that respondents expected business conditions to improve little in the months ahead.

The Philly Fed index was especially weak in June and July, and the August index will be released tomorrow.

• From the BLS:

The Consumer Price Index for All Urban Consumers (CPI-U) was unchanged in July on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 1.4 percent before seasonal adjustment.I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI. This was below the consensus forecast of a 0.2% increase for CPI and a 0.2% increase in core CPI and makes QE3 more likely in September.

...

The index for all items less food and energy rose 0.1 percent in July, ending a streak of four consecutive 0.2 percent increases.

Report: Housing Inventory declines 19.3% year-over-year in July

by Calculated Risk on 8/15/2012 06:00:00 AM

From Realtor.com: July 2012 Real Estate Data

The total US for-sale inventory of single family homes, condos, townhomes and co-ops (SFH/CTHCOPS) remains at historic lows across the country, with 1.866 million units for sale in July, down -19.25% compared to a year ago and -39.80% below its peak of 3.10 million units in September, 2007 when Realtor.com began monitoring these markets.The NAR is scheduled to report July existing home sales and inventory next week on Wednesday, August 22nd. The key number in the NAR report will be inventory, and inventory will be down sharply again year-over-year in July.

The median age of the inventory of for sale listings was 88 days in July 2012, up slightly from June (84), but -9.27% below the median age one year ago (July 2011). While the median age of the inventory is highly seasonal, the year-over-year decline is consistent with other data showing a significant improvement in market conditions compared to one year ago.

For sale inventories of SFH/CTHCOPS in July declined on an annual basis in all but two of the 146 MSAs monitored by Realtor.com, with for-sale inventory dropping -20% or more in 67 of the 146 markets covered. Eight out of 10 MSAs with the largest year-over-year declines in their for-sale inventories in July 2012 are in California.

Only two areas experienced a year-over-year increase in their for-sale inventories— Shreveport, LA (+23.06%), and Philadelphia, PA (+3.04%).

Tuesday, August 14, 2012

Wednesday: CPI, Industrial Production, NY Fed Manufacturing Survey, Homebuilder Confidence

by Calculated Risk on 8/14/2012 09:15:00 PM

First on Europe, from the WSJ: Euro Zone Economy Shrinks, Darkening Outlook

Economic activity in the 17-country currency bloc fell at an annualized rate of 0.7% in the second quarter after stagnating in the first three months of 2012, according to data from the European Union's statistics arm.And on Greece from the Financial Times: Greece seeks two-year austerity extension

The extension plan calls for a slower adjustment with cuts spread over four years until 2016 ... Greece would need additional funding of €20bnEurope will be a hot topic in September and October (a few key dates here).

Excerpt with permission

• On Wednesday, at 8:30 AM ET, the Consumer Price Index for July will be released. The consensus is for CPI to increase 0.2% in July and for core CPI to increase 0.2%.

• Also at 8:30 AM, the NY Fed Empire Manufacturing Survey for August will be released. The consensus is for a reading of 7.0, down from 7.4 in July (above zero is expansion).

• At 9:15 AM, theThe Fed will release Industrial Production and Capacity Utilization for July. The consensus is for Industrial Production to increase 0.5% in July, and for Capacity Utilization to increase to 79.2%.

• At 10:00 AM, The August NAHB homebuilder survey. The consensus is for a reading of 35, unchanged from 35 in July.

For the August economic prediction contest:

DataQuick: SoCal Home Sales increase year-over-year in July

by Calculated Risk on 8/14/2012 06:54:00 PM

From DataQuick: Southland Home Sales Up Again From 2011; Median Price Nears 4-Yr High

Southern California home sales rose above the year-ago level for the seventh consecutive month in July despite continued declines in low-end distress sales. Increased activity in move-up and high-end submarkets also contributed to a significant rise in the region’s median sale price, which neared a four-year high, a real estate information service reported.The percent of distressed sales is still very high, but this is the lowest level since January 2008 - something we are seeing in most areas.

“Even adjusting for changes in market mix, there’s growing evidence prices have crept up in areas where more demand has met a shrinking number of homes for sale. But we’re approaching the peak of the traditional spring-summer home-buying season. Whether these trends hold into the fall and winter isn’t clear. If they do, then logically the number of homes on the market would eventually rise to meet the demand. More owners will be interested in selling, knowing their homes are likely to fetch a higher price, and more people will shift from a negative to at least a slightly positive equity position, enabling them to sell. Home builders could rev up operations and lenders could push more distressed properties onto the market sooner. It would tame any price appreciation,” said John Walsh, DataQuick president.

In July, a total of 20,588 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties. That was down 6.7 percent from 22,075 in June, and up 13.8 percent from 18,090 in July 2011.

Distressed property sales – the combination of foreclosure resales and short sales – made up 39.7 percent of last month’s resale market. That was the lowest level since the figure was 36.0 percent in January 2008.

The median price is being impacted by the mix, with fewer low end distressed sales pushing up the median. This is why I focus on the repeat sales indexes.

The NAR is scheduled to report July existing home sales and inventory next week on Wednesday, August 22nd.

A couple earlier posts on housing:

• House Prices and a Foreclosure Supply Shock

• Lawler: Table of Short Sales and Foreclosures for Selected Markets

Lawler: Table of Short Sales and Foreclosures for Selected Markets

by Calculated Risk on 8/14/2012 03:18:00 PM

CR Note: Yesterday I posted some distressed sales data for Sacramento. I'm following the Sacramento market to see the change in mix over time (short sales, foreclosure, conventional). Economist Tom Lawler has been digging up similar data, and he sent me the table below for several more distressed areas. For all of these areas, the share of distressed sales is down from July 2011 - and for the areas that break out short sales, the share of short sales has increased (except Minneapolis) and the share of foreclosure sales are down. In most areas, short sales are higher than foreclosures, and for some areas like Phoenix, Reno and Las Vegas, short sales are now double the rate of foreclosures.

From Lawler:

Below is a table showing the share of home sales by realtors in various markets identified in local MLS as being “distressed,” as reported by local realtor associations or MLS.

As the table indicates, the distressed sales share of total sales last month was down compared to last July in all of the above markets, in some (but not all) cases by significant amount. And for those areas breaking out “distressed” sales by short sales or foreclosures, in most (but not all) cases the short sales share was higher, and the foreclosure sales share significantly lower, than a year ago.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | ||||

|---|---|---|---|---|---|---|

| 12-July | 11-July | 12-July | 11-July | 12-July | 11-July | |

| Las Vegas | 40.0% | 20.2% | 20.7% | 50.2% | 60.7% | 70.4% |

| Reno | 38.0% | 28.0% | 15.0% | 37.0% | 53.0% | 65.0% |

| Phoenix | 29.5% | 23.6% | 14.6% | 43.1% | 44.1% | 66.7% |

| Sacramento | 32.0% | 22.3% | 22.4% | 39.0% | 54.4% | 61.3% |

| Minneapolis | 9.3% | 11.0% | 24.8% | 34.4% | 34.1% | 45.4% |

| Mid-Atlantic (MRIS) | 11.3% | 10.2% | 8.7% | 15.1% | 20.0% | 25.2% |

| Hampton Roads VA | 29.1% | 30.3% | ||||

| Northeast Florida | 39.0% | 44.1% | ||||

[The second table shows] the YOY growth in total home sales and in “non-distressed” home sales for each of the these areas, as reported by local realtor associations/MLS.

While home sales for these markets combined this July were actually down a bit from last July, “non-distressed” home sales were up by almost 23%.

CR Note: In the post Home Sales Reports: What Matters, I noted: "When we look at sales for existing homes, the focus should be on the composition between conventional and distressed." Even if existing home sales declined in July, the composition appears to be shifting towards more conventional sales - a positive.

| YOY % Growth, Home Sales (July 2012) | ||

|---|---|---|

| Total | Non-Distressed | |

| Las Vegas | -11.5% | 17.6% |

| Reno | -3.1% | 30.0% |

| Phoenix | -14.8% | 43.1% |

| Sacramento | 4.7% | 23.4% |

| Minneapolis | 14.6% | 38.3% |

| Mid-Atlantic (MRIS) | 4.7% | 12.0% |

| Hampton Roads VA | 20.1% | 22.1% |

| Northeast Florida | 1.3% | 10.5% |

| Total of Above Markets | -0.9% | 22.8% |

House Prices and a Foreclosure Supply Shock

by Calculated Risk on 8/14/2012 12:25:00 PM

Those making the argument for further house price declines usually start with “shadow inventory”. Although there is no formal definition of “shadow inventory” it usually includes 1) some properties with homeowners who are current on their mortgages, but have negative equity in their homes, and 2) properties not listed for sale, but where the homeowner is seriously delinquent on their mortgage or already in the foreclosure process.

This can lead to some pretty scary numbers being bandied about. As an example, CoreLogic recently reported that “11.4 million, or 23.7 percent, of all residential properties with a mortgage were in negative equity at the end of the first quarter of 2012”. And LPS reported 1.6 million loans were 90+ days delinquent at the end of June, and another 2.1 million are in the foreclosure process.

These numbers suggest a coming “flood” of foreclosures to those arguing house prices will fall further. I think this is incorrect.

If we look at negative equity, it is a serious issue for many homeowners, but it seems unlikely they will default en masse. Recent homebuyers who have negative equity are probably less than 10% underwater. And homeowners with significant negative equity probably bought in the 2004 through 2006 period; and they’ve been paying their mortgage for 6 to 8 years – so it is unlikely they will just default without some unfortunate event (divorce, death, disease).

Probably the biggest impact on the housing market is that people with negative equity can’t sell, and this restricts supply (the opposite of the “shadow inventory” argument). For more on this, see: Zillow chief economist Stan Humphries has been discussing this: The Connection Between Negative Equity, Inventory Shortage and Increasing Home Values: Why the Bottom Won’t Be as Boring as We Expected

And I expect with the recent increase in house prices that the number of reported homeowners with negative equity will be down sharply in Q2. The HARP refinance program will help too.

A more immediate concern is the 3.7 million homeowners currently 90+ days delinquent or in the foreclosure process. Many of these properties will eventually be a distressed sale, either a foreclosure or short sale, although some will receive loan modifications. It is important to remember that some of these homes are already listed for sale (so they are included in the “visible inventory”), and there has been a significant shift by lenders from foreclosures to short sales (short sales have less of an impact on prices than foreclosures).

But here is the key: Although forecasting house prices is very complex, we can make some simplifying assumptions and think in terms of supply and demand with foreclosures being a supply shock (increased supply). It is important to remember that national prices are an aggregate of many local prices (although there are national impacts, housing markets are local). And housing prices are more complex than say commodity prices (as an example, house prices tend to be stick downwards).

Imagine a multi-year supply shock with a bell curve shape. The supply shock shifts the supply curve to the right relative to the height of the bell curve. Prices will bottom when the supply shock is at the peak, NOT when the supply shock is over.

The supply shock from foreclosures probably peaked in late 2008, with a second smaller peak in 2010. Prices didn’t bottom in 2008 because 1) prices are sticky downwards (so the bottom happens after the peak of the supply shock) and 2) fundamentals such as price-to-income and price-to-rent were still out of line.

Now fundamentals are close to normal, and any supply shock will probably be smaller than the 2008 or 2010 peaks. And this analysis assumed demand was stable. Actually there was a demand shock too (less demand) due to tighter lending, and buyer psychology (potential buyers were afraid that prices would fall further). There were few investors in 2008 when the supply shock hit – just a few individual and small group investors buying REOs. Now there are large well capitalized groups looking to buy. Of course lending standards are still tight, but as the recent Senior Loan Officer showed, demand is picking up.

The bottom line is house prices have probably bottomed, and the concern about more distressed sales coming is real – but will probably not push house prices to new post-bubble lows.

Note: For reference, back in April 2005 I argued that prices were way out of line and that speculation was the key, and that speculation could be modeled as storage, see: Housing: Speculation is the Key