by Calculated Risk on 8/12/2012 09:36:00 PM

Sunday, August 12, 2012

Sunday Night Futures

This will be a busy week for economic data, but there are no releases scheduled for Monday.

The Asian markets are mixed tonight, with the Nikkei up slightly and the Shanghai Composite down slightly.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P future are down slightly, and the DOW futures up slightly.

Oil prices are moving up again with WTI futures are at $93.30 and Brent is at $113.40 per barrel. Using the calculator at Econbrowser suggests national gasoline prices at about $3.67 per gallon.

Yesterday:

• Summary for Week Ending Aug 10th

• Schedule for Week of Aug 12th

Four more questions for the August economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

Europe and US: A few misc dates in September and October

by Calculated Risk on 8/12/2012 04:43:00 PM

A few miscelleneous dates (just making some notes).

First, for Europe it looks like September and October will be very busy (after the Europeans get back from vacation). Greece will be back in the headlines in October according to the WSJ: Troika to Spend 'All of September' in Greece -EU Official

"The mission in September will stay the whole month in order to report to the October Eurogroup," the official said, referring to the ministers' meeting scheduled to take place in Luxembourg on Oct. 8.Here are a few key European dates:

• September 6th, Governing Council meeting of the European Central Bank in Frankfurt with a press conference to follow. ECB President Mario Draghi is expected to discuss how the ECB will help lower Spanish and Italian borrowing costs.

• September 12th, Germany's Constitutional Court is expected to rule on the new eurozone bailout fund and fiscal treaty.

• Mid-September: Euro-zone finance ministers' informal meetings in Nicosia.

• October 8th, Finance Ministers meeting in Luxembourg.

• European Council meeting, October 18th and 19th in Brussels.

And in the US:

• (Not key) Political conventions: Republicans August 27–30 in Tampa, and Democrats September 3–6 in Charlotte. The election is on November 6th.

• September 12th and 13th: the Federal Open Market Committee (FOMC) meets. After this meeting the FOMC will release updated Summary of Economic Projections, and Fed Chairman Ben Bernanke will hold a press conference. Major economic releases before the FOMC meeting: August 29th, second estimate of Q2 GDP, and September 7th, the August employment report.

Yesterday:

• Summary for Week Ending Aug 10th

• Schedule for Week of Aug 12th

Mortgage Delinquencies by Loan Type

by Calculated Risk on 8/12/2012 10:06:00 AM

The following graphs show the percent of loans delinquent by loan type based on the MBA National Delinquency Survey: Prime, Subprime, FHA and VA. First a table comparing the number of loans in Q2 2007 and Q2 2012 so readers can understand the shift in loan types.

Both the number of prime and subprime loans have declined over the last five years; the number of subprime loans is down by about 35%. Meanwhile the number of FHA loans has more than doubled and VA loans have increased sharply.

An interesting point: Each loan type improved in Q2 2012, but the total delinquency rate increased. The reason is the shift in loan types - from prime loans to more FHA and VA loans.

Note: There are about 42.5 million first-lien loans in the survey, and the MBA survey is about 88% of the total.

| MBA National Delinquency Survey Loan Count | ||||

|---|---|---|---|---|

| Q2 2007 | Q2 2012 | Change | Q2 2012 Seriously Delinquent | |

| Prime | 33,916,830 | 30,120,941 | -3,795,889 | 1,500,023 |

| Subprime | 6,204,535 | 4,031,216 | -2,173,319 | 918,714 |

| FHA | 3,030,214 | 6,827,727 | 3,797,513 | 614,495 |

| VA | 1,096,450 | 1,526,913 | 430,463 | 70,696 |

| Survey Total | 44,248,029 | 42,506,797 | -1,741,232 | 3,103,928 |

Click on graph for larger image.

Click on graph for larger image.First a repeat: This graph shows the percent of loans delinquent by days past due. Loans 30 days delinquent increased to 3.18% from 3.13% in Q1. This is at about 2007 levels and around the long term average.

Delinquent loans in the 60 day bucket increased to 1.22% in Q2, from 1.21% in Q1.

The 90 day bucket increased to 3.19% from 3.06%. This is still way above normal (around 0.8% would be normal according to the MBA).

The percent of loans in the foreclosure process decreased to 4.27% from 4.39% and is now at the lowest level since Q1 2010.

Note: Scale changes for each of the following graphs.

The second graph is for all prime loans.

The second graph is for all prime loans. This is the category with the most seriously delinquent loans. Back in early 2007 when Fed Chairman Ben Bernanke said "the problems in the subprime market seems likely to be contained", my former co-blogger Tanta responded "We are all subprime!" - she was correct.

Since there are far more prime loans than any other category (see table above), about half the loans seriously delinquent now are prime loans - even though the overall delinquency rate is lower than other loan types.

This graph is for subprime. This category gets most of the attention - mostly because of all the terrible loans made through the Wall Street "originate-to-distribute" model and sold as Private Label Securities (PLS). Not all PLS was subprime, but the worst of the worst loans were packaged in PLS.

This graph is for subprime. This category gets most of the attention - mostly because of all the terrible loans made through the Wall Street "originate-to-distribute" model and sold as Private Label Securities (PLS). Not all PLS was subprime, but the worst of the worst loans were packaged in PLS.Although the delinquency rate is still very high, the number of subprime loans has declined sharply.

This graph is for FHA loans. In Q2, there was a shift from 90+ days deliquent to in-foreclosure, but the overall percent of loans delinquent or in-foreclosure declined in Q2.

This graph is for FHA loans. In Q2, there was a shift from 90+ days deliquent to in-foreclosure, but the overall percent of loans delinquent or in-foreclosure declined in Q2. The improvement in late 2010 was a combination of the increase in number of loans (recent loans have lower delinquency rates) and eliminating Downpayment Assistance Programs (DAPs). These were programs that allowed the seller to give the buyer the downpayment through a 3rd party "charity" (for a fee of course). The buyer had no money in the house and the default rates were absolutely horrible.

The last graph is for VA loans. This is a fairly small but growing category (see table above).

The last graph is for VA loans. This is a fairly small but growing category (see table above).There are still quite a few subprime loans that are in distress, but the real keys are prime loans and FHA loans.

Saturday, August 11, 2012

Update: Real GDP Percent Change Graph, 1980-Q2 2012

by Calculated Risk on 8/11/2012 08:32:00 PM

Earlier:

• Summary for Week Ending Aug 10th

• Schedule for Week of Aug 12th

When the Q2 GDP report was released, I focused on the revisions and didn't post the usual graph showing the real GDP change since 1980. By request, here is an update.

The graph shows the annualized real quarterly change in GDP from 1980 through Q2 2012.

Click on graph for larger image.

For Q2, the BEA's advance estimate was 1.5%. Since Q3 2009, GDP has been positive every quarter and averaged about 2.2% real growth.

Another way to look at GDP is on a rolling year-over-year basis. See Tim Duy's graphs at US Baseline

Note: I've also update several graphs in the GDP graph gallery. See: GDP Graphs

Unofficial Problem Bank list increases to 900 Institutions

by Calculated Risk on 8/11/2012 06:09:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Aug 10, 2012. (table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

Activity by the Federal Reserve was responsible for most of the changes to the Unofficial Problem Bank List this week. The list pushed back up to 900 institutions but assets dropped by $780 million to $348.6 billion after three additions and two removals. A year ago, the list held 988 institutions with assets of $411.3 billion.Earlier:

The Federal Reserve terminated actions against LegacyTexas Bank, Plano, TX ($1.6 billion) and Coastal Community Bank, Everett, WA ($311 million). The additions were Beacon Federal, East Syracuse, NY ($1.0 billion Ticker: BFED); Asian Bank, Philadelphia, PA ($71 million); and The State Bank of Blue Mound, Blue Mound, IL ($37 million). The Federal Reserve issued a Prompt Corrective Action order against Gold Canyon Bank, Gold Canyon, AZ ($60 million).

Other news to report is the bankruptcy filing by Capitol Bancorp LTD (See Form 8-K) on August 9th. Back in the middle part of last decade, Capitol Bancorp owned/controlled more than 50 banks. After divestitures in an effort to prevent the collapse of the company, Capitol Bancorp is down to owning/controlling 15 banks, with 11 on the Unofficial Problem Bank List. The FDIC has issued cross-guaranty waivers in conjunction with several of the divestitures. This will bear watching to see if the bankruptcy filing results in any closings of the banks that Capitol Bancorp owns/controls.

• Summary for Week Ending Aug 10th

• Schedule for Week of Aug 12th

Schedule for Week of August 12th

by Calculated Risk on 8/11/2012 01:05:00 PM

Earlier:

• Summary for Week Ending Aug 10th

This will be a very busy week for economic data. There are two key housing reports to be released this week: August homebuilder confidence on Wednesday, and July housing starts on Thursday.

Another key report is retail sales for July. For manufacturing, the August NY Fed (Empire state) and Philly Fed surveys, and the July Industrial Production and Capacity Utilization report will be released this week.

On prices, PPI for July will be released on Tuesday, and CPI will be released on Wednesday.

No releases scheduled.

7:30 AM ET: NFIB Small Business Optimism Index for July. The consensus is for a decrease to 91.3 in July from 91.4 in June.

8:30 AM: Producer Price Index for July. The consensus is for a 0.2% increase in producer prices (0.2% increase in core).

8:30 AM ET: Retail Sales for July.

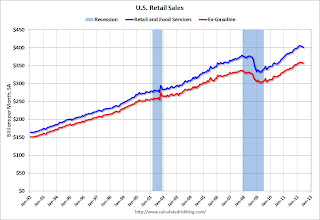

8:30 AM ET: Retail Sales for July. This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline). Retail sales are up 21.2% from the bottom, and now 6.0% above the pre-recession peak (not inflation adjusted)

The consensus is for retail sales to increase 0.3% in July, and for retail sales ex-autos to increase 0.4%.

10:00 AM: Manufacturing and Trade: Inventories and Sales for June (Business inventories). The consensus is for 0.2% increase in inventories.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index.

8:30 AM: Consumer Price Index for July. The consensus is for CPI to increase 0.2% in July and for core CPI to increase 0.2%.

8:30 AM: NY Fed Empire Manufacturing Survey for August. The consensus is for a reading of 7.0, down from 7.4 in July (above zero is expansion).

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for July.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for July.This shows industrial production since 1967.

The consensus is for Industrial Production to increase 0.5% in July, and for Capacity Utilization to increase to 79.2%.

10:00 AM: The August NAHB homebuilder survey. The consensus is for a reading of 35, unchanged from 35 in July. Although this index has been increasing lately, any number below 50 still indicates that more builders view sales conditions as poor than good.

8:30 AM: Housing Starts for July.

8:30 AM: Housing Starts for July. Total housing starts were at 760 thousand (SAAR) in June, up 6.9% from the revised May rate of 711 thousand (SAAR).

The consensus is for total housing starts to decrease to 750,000 (SAAR) in July, down from 760,000 in June.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 365 thousand from 361 thousand.

10:00 AM: Philly Fed Survey for August. The consensus is for a reading of -5.0, up from -12.9 last month (above zero indicates expansion).

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (preliminary for August). The consensus is for sentiment to decrease slightly to 72.0 from 72.3 in July.

10:00 AM: Conference Board Leading Indicators for August. The consensus is for a 0.2% increase in this index.

10:00 AM: Regional and State Employment and Unemployment (Monthly) for July 2012

Summary for Week ending Aug 10th

by Calculated Risk on 8/11/2012 08:01:00 AM

Note: For amusement, here are the original Ryan plan projections. Enjoy. Note: I know numbers, and these are hilarious (look at the unemployment rate and residential investment). I saved these immediately after they were released because I expected them to be changed or deleted. They quickly disappeared.

The few economic releases this week were mostly a little more upbeat than we’ve seen recently.

The trade deficit declined in June as exports increased and oil prices declined. Also - so far - there is little evidence of the Eurozone problems significantly impacting US exports to the euro area. Another positive was the decline in initial weekly unemployment claims. The 4-week average of unemployment claims is near the low for the year, and might signal a little improvement in the labor market.

For housing, CoreLogic reported a 2.5% year-over-year increase in house prices, and both Fannie and Freddie credit the increase in house prices for their improved results. The slight increase in house prices, along with the ongoing, albeit sluggish recovery in housing is having a positive impact on the economy.

Here is the summary from Jan Hatzius, chief economist at Goldman Sachs:

“We expect a moderate pickup in US growth from the dreary 1%-1½% pace of the past few months. The data released this week, while sparse, were consistent with our view. Jobless claims logged a surprise decline, which looks potentially meaningful now that the seasonal adjustment distortions related to the summer auto shutdowns are behind us. The June wholesale inventory report showed much less accumulation than expected, which explains some of the recent weakness in the goods-producing sector and should be positive for the near-term production outlook. Combined with a narrowing of the June trade deficit, this boosted our Q3 GDP estimate to 2.2%, compared with 2.0% at the start of the week."Here is a summary of last week in graphs:

• Trade Deficit declined in June to $42.9 Billion

Click on graph for larger image.

Click on graph for larger image.The Department of Commerce reported:

"[T]otal June exports of $185.0 billion and imports of $227.9 billion resulted in a goods and services deficit of $42.9 billion, down from $48.0 billion in May, revised. June exports were $1.7 billion more than May exports of $183.3 billion. June imports were $3.5 billion less than May imports of $231.4 billion."

The second graph shows the U.S. trade deficit, with and without petroleum, through June.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil averaged $100.13 in June, down from $107.91 per barrel in May. The decline in oil prices contributed to the overall decline in the trade deficit. The trade deficit with China increased to $27.4 billion in June, up from $26.6 billion in June 2011. Once again most of the trade deficit is due to oil and China.

Exports to the euro area were $17.4 billion in June, up from $16.4 billion in June 2011; so the euro area recession didn't lead to less US exports to the euro area in June.

• MBA: Mortgage Delinquencies increased in Q2

The MBA reported that 11.85 percent of mortgage loans were either one payment delinquent or in the foreclosure process in Q2 2012 (delinquencies seasonally adjusted). This is up slightly from 11.79 percent in Q1 2012. This graph shows the percent of loans delinquent by days past due.

The MBA reported that 11.85 percent of mortgage loans were either one payment delinquent or in the foreclosure process in Q2 2012 (delinquencies seasonally adjusted). This is up slightly from 11.79 percent in Q1 2012. This graph shows the percent of loans delinquent by days past due.Loans 30 days delinquent increased to 3.18% from 3.13% in Q1. This is at about 2007 levels and around the long term average.

Delinquent loans in the 60 day bucket increased to 1.22% in Q2, from 1.21% in Q1.

The 90 day bucket increased to 3.19% from 3.06%. This is still way above normal (around 0.8% would be normal according to the MBA).

The percent of loans in the foreclosure process decreased to 4.27% from 4.39% and is now at the lowest level since Q1 2010.

This graph is from the MBA and shows the percent of loans in the foreclosure process by state. Posted with permission.

This graph is from the MBA and shows the percent of loans in the foreclosure process by state. Posted with permission.The top states are Florida (13.70% in foreclosure down from 14.31% in Q1), New Jersey (7.65% down from 8.37%), Illinois (7.11% down from 7.46%), New York (6.47% up from 6.17%) and Nevada (the only non-judicial state in the top 13 at 6.09% down from 6.47%).

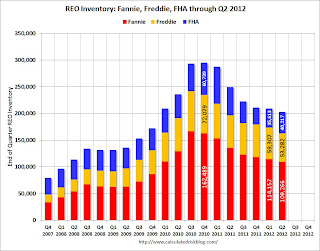

• Fannie, Freddie, FHA REO declined 18% Year-over-year

The combined Real Estate Owned (REO) by Fannie, Freddie and the FHA declined to 202,765 at the end of Q2 2012, down from 209,077 in Q1, and down 18% from 249,501 in Q2 2012. The peak for the combined REO of the F's was 295,307 in Q4 2010.

The combined Real Estate Owned (REO) by Fannie, Freddie and the FHA declined to 202,765 at the end of Q2 2012, down from 209,077 in Q1, and down 18% from 249,501 in Q2 2012. The peak for the combined REO of the F's was 295,307 in Q4 2010.This graph shows the REO inventory for Fannie, Freddie and the FHA.

This is only a portion of the total REO. There is also REO for private-label MBS, FDIC-insured institutions, VA and more. REO has been declining for those categories too. Most analysts expect an increase in foreclosures, and the number of REO might increase over the next several quarters.

• BLS: Job Openings increased in June

This graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

This graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS. Jobs openings increased in June to 3.762 million, up from 3.657 million in May. The number of job openings (yellow) has generally been trending up, and openings are up about 16% year-over-year compared to June 2011. This is the most job openings since mid-2008.

Quits decreased slightly in June, however quits are up about 9.5% year-over-year. These are voluntary separations and more quits might indicate some improvement in the labor market. (see light blue columns at bottom of graph for trend for "quits").

• CoreLogic: House Price Index increases in June, Up 2.5% Year-over-year

This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.The index was up 1.3% in May, and is up 2.5% over the last year.

The index is off 29% from the peak - and is up 7% from the post-bubble low set in February (the index is NSA, so some of the increase is seasonal).

The second graph is from CoreLogic. The year-over-year comparison has turned positive.

The second graph is from CoreLogic. The year-over-year comparison has turned positive.This is the fourth consecutive month with a year-over-year increase, and excluding the tax credit bump, these are the first year-over-year increases since 2006.

“Home prices are responding positively to reductions in both visible and shadow inventory over the past year,” said Mark Fleming, chief economist for CoreLogic. “This trend is a bright spot because the decline in shadow inventory translates to fewer distressed sales, which helps sustain price appreciation.”

• Weekly Initial Unemployment Claims decline to 361,000

The DOL reports:"In the week ending August 4, the advance figure for seasonally adjusted initial claims was 361,000, a decrease of 6,000 from the previous week's revised figure of 367,000. The 4-week moving average was 368,250, an increase of 2,250 from the previous week's revised average of 366,000."

The DOL reports:"In the week ending August 4, the advance figure for seasonally adjusted initial claims was 361,000, a decrease of 6,000 from the previous week's revised figure of 367,000. The 4-week moving average was 368,250, an increase of 2,250 from the previous week's revised average of 366,000."The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 368,250.

This was below the consensus forecast of 367,000 and is near the lowest level for the four week average this year.

• Other Economic Stories ...

• Fed: Some domestic banks "eased lending standards", seeing "stronger demand"

• Housing: Inventory down 23% year-over-year in early August

• The economic impact of a slight increase in house prices

• Trulia: Asking House Prices increased in July

• Freddie Mac: Increase in Home Prices contributes to Lower Credit Losses

• Fannie Mae reports $5.1 Billion Net Income, Improvement due to increase in house prices, REO sales prices

Friday, August 10, 2012

WSJ: More Pain for Cities

by Calculated Risk on 8/10/2012 09:20:00 PM

From the WSJ: Rising Health, Pension Costs Top the List as Municipalities Struggle to Recover From the Recession

Fiscal woes that have caused high-profile bankruptcies in California are surfacing across the country as municipalities struggle with uneven growth and escalating health and pension costs ...These state and local layoffs have been a significant drag on employment. I still think the layoffs will slow, but clearly many of these cities still have severe budget shortfalls.

Moody's Investors Service recently said that while municipal bankruptcies are likely to remain rare, it warned of a "a small but growing trend in fiscally troubled cities unwilling to pay their debt obligations."

...

Local government cuts are one factor slowing the broader economic recovery, offsetting stronger private-sector growth. State and local government spending and investment fell at a rate of 2.1% in the second quarter, according to the Commerce Department, the 11th consecutive quarterly drop. Local governments also have cut 66,000 jobs in the past year, mostly teachers and other school employees.

Comparing Housing Recoveries

by Calculated Risk on 8/10/2012 03:22:00 PM

In the previous post, I noted that I think the housing recovery will continue to be sluggish relative to previous housing recoveries. There are several reasons for this.

First, the causes of this downturn were different than in most cycles. Usually housing down cycles are related to the Fed fighting inflation, and then housing comes back strongly when the Fed starts to ease again. But in this cycle, the housing downturn was the result of the bursting of the housing bubble and the financial crisis.

As everyone now knows (or should know by now), recoveries following a financial crisis are sluggish. This is especially true for housing as all the excesses have to be worked down before the recovery will become robust. In some areas of the country, housing is starting to recover, and in other areas there are still a large number of excess vacant houses (although the number is being reduced just about everywhere).

There are also a large number of houses in the foreclosure process, especially in certain states with a judicial foreclosure process (like New Jersey). This means there will be competition for homebuilders from foreclosures for an extended period in these areas.

Contrast this to a typical recovery were most areas recover at the same time.

There are other factors too. Employment gains are sluggish following a financial crisis, there is still quite a bit of consumer deleveraging ongoing, and lending standards are still tight (in a typical recovery, lending standards are loosened pretty quickly).

For a great piece today on mortgage lending standards, see from Cardiff Garcia at FT Alphaville: Still waiting on looser lending standards (for mortgages)

Click on graph for larger image.

Click on graph for larger image.

This graph compares the current housing recovery (single family starts) to previous recoveries. The bottom is set to 100 for each housing cycle.

Note: This doesn't even consider the depth of the current cycle (the deepest decline in housing starts since the Census Bureau started collecting data).

The only comparable sluggish recovery (first year) was the one that started in 1981, and that was sluggish because mortgage rates were around 17%. When mortgage rates fell to only 13%, housing took off.

With excess inventory, more foreclosures (especially in certain states), more consumer deleveraging, and tight lending standards, I expect this recovery to remains sluggish. The good news is - barring a significant policy mistake - this housing recovery will probably continue for several years (last for more years than usual).

The Housing Bottom and the Unemployment Rate

by Calculated Risk on 8/10/2012 11:55:00 AM

Early this year when I wrote The Housing Bottom is Here and Housing: The Two Bottoms, I pointed out there are usually two bottoms for housing: the first for new home sales, housing starts and residential investment, and the second bottom is for house prices.

For the bottom in activity, I presented a graph of Single family housing starts, New Home Sales, and Residential Investment (RI) as a percent of GDP.

When I posted that graph, the bottom wasn't obvious to everyone. Now it should be, so here is an update to that graph.

Click on graph for larger image.

Click on graph for larger image.

The arrows point to some of the earlier peaks and troughs for these three measures.

The purpose of this graph is to show that these three indicators generally reach peaks and troughs together. Note that Residential Investment is quarterly and single-family starts and new home sales are monthly.

For the current housing bust, the bottom was spread over a few years from 2009 into 2011. This was a long flat bottom - something a number of us predicted given the overhang of existing vacant housing units.

Now the question is: How strong will the recovery be? (I think it will be somewhat sluggish compared to previous recoveries).

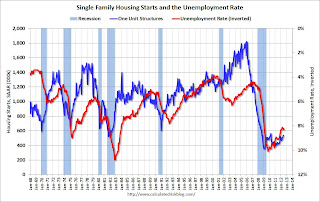

Housing plays a key role for employment too. Here is an update to a graph I've been posting for a few years. This graph shows single family housing starts (through June) and the unemployment rate (inverted) also through July. Note: there are many other factors impacting unemployment, but housing is a key sector.

You can see both the correlation and the lag. The lag is usually about 12 to 18 months, with peak correlation at a lag of 16 months for single unit starts. The 2001 recession was a business investment led recession, and the pattern didn't hold.

You can see both the correlation and the lag. The lag is usually about 12 to 18 months, with peak correlation at a lag of 16 months for single unit starts. The 2001 recession was a business investment led recession, and the pattern didn't hold.

Housing starts (blue) increased a little in 2009 with the homebuyer tax credit - and then declined again - but mostly starts moved sideways for two and a half years and only started increasing last year. This was one of the reasons the unemployment rate has remained elevated.

Usually near the end of a recession, residential investment (RI) picks up as the Fed lowers interest rates. This leads to job creation and also additional household formation - and that leads to even more demand for housing units - and more jobs, and more households - a virtuous cycle that usually helps the economy recover.

However, following the recent recession with the huge overhang of existing housing units, this key sector didn't participate. Going forward I expect housing activity to increase and help push down the unemployment rate. Unfortunately I expect the housing recovery to be somewhat sluggish.