by Calculated Risk on 8/10/2012 03:22:00 PM

Friday, August 10, 2012

Comparing Housing Recoveries

In the previous post, I noted that I think the housing recovery will continue to be sluggish relative to previous housing recoveries. There are several reasons for this.

First, the causes of this downturn were different than in most cycles. Usually housing down cycles are related to the Fed fighting inflation, and then housing comes back strongly when the Fed starts to ease again. But in this cycle, the housing downturn was the result of the bursting of the housing bubble and the financial crisis.

As everyone now knows (or should know by now), recoveries following a financial crisis are sluggish. This is especially true for housing as all the excesses have to be worked down before the recovery will become robust. In some areas of the country, housing is starting to recover, and in other areas there are still a large number of excess vacant houses (although the number is being reduced just about everywhere).

There are also a large number of houses in the foreclosure process, especially in certain states with a judicial foreclosure process (like New Jersey). This means there will be competition for homebuilders from foreclosures for an extended period in these areas.

Contrast this to a typical recovery were most areas recover at the same time.

There are other factors too. Employment gains are sluggish following a financial crisis, there is still quite a bit of consumer deleveraging ongoing, and lending standards are still tight (in a typical recovery, lending standards are loosened pretty quickly).

For a great piece today on mortgage lending standards, see from Cardiff Garcia at FT Alphaville: Still waiting on looser lending standards (for mortgages)

Click on graph for larger image.

Click on graph for larger image.

This graph compares the current housing recovery (single family starts) to previous recoveries. The bottom is set to 100 for each housing cycle.

Note: This doesn't even consider the depth of the current cycle (the deepest decline in housing starts since the Census Bureau started collecting data).

The only comparable sluggish recovery (first year) was the one that started in 1981, and that was sluggish because mortgage rates were around 17%. When mortgage rates fell to only 13%, housing took off.

With excess inventory, more foreclosures (especially in certain states), more consumer deleveraging, and tight lending standards, I expect this recovery to remains sluggish. The good news is - barring a significant policy mistake - this housing recovery will probably continue for several years (last for more years than usual).

The Housing Bottom and the Unemployment Rate

by Calculated Risk on 8/10/2012 11:55:00 AM

Early this year when I wrote The Housing Bottom is Here and Housing: The Two Bottoms, I pointed out there are usually two bottoms for housing: the first for new home sales, housing starts and residential investment, and the second bottom is for house prices.

For the bottom in activity, I presented a graph of Single family housing starts, New Home Sales, and Residential Investment (RI) as a percent of GDP.

When I posted that graph, the bottom wasn't obvious to everyone. Now it should be, so here is an update to that graph.

Click on graph for larger image.

Click on graph for larger image.

The arrows point to some of the earlier peaks and troughs for these three measures.

The purpose of this graph is to show that these three indicators generally reach peaks and troughs together. Note that Residential Investment is quarterly and single-family starts and new home sales are monthly.

For the current housing bust, the bottom was spread over a few years from 2009 into 2011. This was a long flat bottom - something a number of us predicted given the overhang of existing vacant housing units.

Now the question is: How strong will the recovery be? (I think it will be somewhat sluggish compared to previous recoveries).

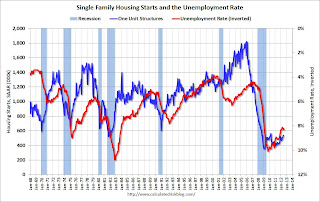

Housing plays a key role for employment too. Here is an update to a graph I've been posting for a few years. This graph shows single family housing starts (through June) and the unemployment rate (inverted) also through July. Note: there are many other factors impacting unemployment, but housing is a key sector.

You can see both the correlation and the lag. The lag is usually about 12 to 18 months, with peak correlation at a lag of 16 months for single unit starts. The 2001 recession was a business investment led recession, and the pattern didn't hold.

You can see both the correlation and the lag. The lag is usually about 12 to 18 months, with peak correlation at a lag of 16 months for single unit starts. The 2001 recession was a business investment led recession, and the pattern didn't hold.

Housing starts (blue) increased a little in 2009 with the homebuyer tax credit - and then declined again - but mostly starts moved sideways for two and a half years and only started increasing last year. This was one of the reasons the unemployment rate has remained elevated.

Usually near the end of a recession, residential investment (RI) picks up as the Fed lowers interest rates. This leads to job creation and also additional household formation - and that leads to even more demand for housing units - and more jobs, and more households - a virtuous cycle that usually helps the economy recover.

However, following the recent recession with the huge overhang of existing housing units, this key sector didn't participate. Going forward I expect housing activity to increase and help push down the unemployment rate. Unfortunately I expect the housing recovery to be somewhat sluggish.

Import Price declined 0.6 percent in July

by Calculated Risk on 8/10/2012 09:13:00 AM

I rarely mention import prices, but this suggests less price pressure ... from the BLS: U.S. Import and Export Price Indexes - July 2012

U.S. import prices declined 0.6 percent in July, the U.S. Bureau of Labor Statistics reported today, after decreasing 2.4 percent in June and 1.5 percent in May. In each of the past three months, falling prices for both fuel and nonfuel imports contributed to the overall drop. In contrast, U.S. export prices rose 0.5 percent in July following a 1.7 percent decline the previous month. ... Prices of U.S. imports fell 0.6 percent in July, the fourth consecutive monthly decline for the index following a 1.4 percent increase in March. Import prices also fell over the past 12 months, declining 3.2 percent after increasing 13.7 percent between July 2010 and July 2011. ... The price index for import fuel decreased 1.2 percent in July following declines of 8.8 percent, 5.6 percent, and 0.9 percent, respectively, in the previous three months.It wasn't just energy. On non-fuel prices:

Nonfuel prices also fell in July, declining 0.4 percent following a 0.3 percent decrease in June and a 0.1 percent drop in May. The July decline was the largest monthly drop since a 0.4 percent decrease in June 2010, and was driven by lower prices for nonfuel industrial supplies and materials and foods, feeds, and beverages. Despite the decline over the past three months, nonfuel import prices were unchanged for the year ended in July ...There will be more on prices next week with the PPI for July released on Tuesday and the CPI on Wednesday.

Thursday, August 09, 2012

NAHB: Builder Confidence in the 55+ Housing Market Increases in Q2

by Calculated Risk on 8/09/2012 09:24:00 PM

This is a quarterly index from the the National Association of Home Builders (NAHB) and is similar to the overall housing market index (HMI). The NAHB started this index in Q4 2008, so all readings are very low. This is expected to be key a demographic over the next couple of decades - if the baby boomers can sell their current homes.

From the NAHB: Builder Confidence in the 55+ Housing Market Shows Improvement in the Second Quarter

Builder confidence in the 55+ housing market for single-family homes showed improvement in the second quarter of 2012 compared to the same period a year ago, according to the National Association of Home Builders’ (NAHB) latest 55+ Housing Market Index (HMI) released today. The index more than doubled year over year from a level of 13 to 29, which is the highest second-quarter reading since the inception of the index in 2008.

The 55+ single-family HMI measures builder sentiment based on a survey that asks if current sales, prospective buyer traffic and anticipated six-month sales for that market are good, fair or poor (high, average or low for traffic). An index number below 50 indicates that more builders view conditions as poor than good. Although all index components remain below 50, they increased considerably from a year ago: Present sales more than doubled (from 12 to 30), while expected sales for the next six months increased 17 points to 35 and traffic of prospective buyers rose nine points to 22.

...

“We are seeing buyers slowly return to the 55+ housing market as home prices begin to improve” said NAHB Chief Economist David Crowe. “This helps unlock some of the pent-up demand from 55+ consumers who have been sitting on the sidelines until they are able to sell their current homes at a reasonable price.”

Click on graph for larger image.

Click on graph for larger image.This graph shows the NAHB 55+ HMI through Q2 2012. All of the readings are very low for this index, but there has been a fairly sharp increase over the last three quarters.

LPS: Mortgage Delinquencies increased slightly in June, HARP refinance activity increased

by Calculated Risk on 8/09/2012 04:15:00 PM

LPS released their Mortgage Monitor report for June today. According to LPS, 7.14% of mortgages were delinquent in June, up from 6.91% in May, and down from 7.71%% in June 2011.

LPS reports that 4.09% of mortgages were in the foreclosure process, down slightly from 4.17% in May, and down slightly from 4.13% in June 2011.

This gives a total of 11.23% delinquent or in foreclosure. It breaks down as:

• 2,012,000 loans less than 90 days delinquent.

• 1,590,000 loans 90+ days delinquent.

• 2,061,000 loans in foreclosure process.

For a total of 5,663,000 loans delinquent or in foreclosure in June. This is down from 6,114,000 in June 2011.

This following graph shows the total delinquent and in-foreclosure rates since 1995.

Click on graph for larger image.

Click on graph for larger image.

The total delinquency rate has fallen to 7.14% from the peak in January 2010 of 10.97%. A normal rate is probably in the 4% to 5% range, so there is a long ways to go.

The in-foreclosure rate was at 4.09%. There are still a large number of loans in this category (about 2.06 million).

The second graph shows percent of loans in the foreclosure process by process (Judicial vs. non-judicial).

The second graph shows percent of loans in the foreclosure process by process (Judicial vs. non-judicial).

Foreclosure inventory in judicial states is 6.42%, far above the level in non-judicial states (2.41%). The national average is 4.09%. A key change is that foreclosure inventory is now declining in judicial states too. Foreclosure inventory in non-judicial states has been falling since late 2010.

The third graph shows GSE prepayment speed by current LTV.

From LPS:

From LPS:

The June Mortgage Monitor report ... shows that while overall mortgage prepayment activity remains stable, despite historically low rates, the federal government’s Home Affordable Refinance Program (HARP) has seen considerable activity since the beginning of 2012.

“For this month’s Mortgage Monitor, we looked at Fannie Mae and Freddie Mac [GSE] 30-year fixed-rate loans across a variety of loan-to-value ratios,” explained Herb Blecher, senior vice president, LPS Applied Analytics. “Since the beginning of this year, high loan-to-value refinances have increased significantly. As an example, 2006 vintage GSE loans with six percent interest rates and LTV ratios between 100 and 125 percent increased from a 10 percent annualized prepayment rate at the end of 2011 to more than 40 percent in June 2012. Our data also shows that this rise in loan activity extends beyond that subsection – the same type of increase holds true across other vintages with the same characteristics.”

Q2 MBA National Delinquency Survey Graph and Comments

by Calculated Risk on 8/09/2012 12:13:00 PM

A few comments from Jay Brinkmann, MBA’s Chief Economist and Senior Vice President for Research and Education, on the Q2 MBA National Delinquency Survey conference call.

• The 30 day delinquency rate is back to normal (at the long term average). (This means a normal amount of loans are going delinquent each month)

• This was a slight increase in overall delinquencies (Seasonally Adjusted), and he wouldn't read too much into the increase because the seasonal adjustment might be a little off right now.

• Foreclosure inventory continues to decline. In previous quarters the decline in non-judicial state inventory was offset by increases in judicial states. The change this quarter is the non-judicial states are also a decrease in foreclosure inventory.

• There was a sharp increase in FHA foreclosure starts, and this is probably a result of the mortgage settlement.

This graph is from the MBA and shows the percent of loans in the foreclosure process by state. Posted with permission.

The top states are Florida (13.70% in foreclosure down from 14.31% in Q1), New Jersey (7.65% down from 8.37%), Illinois (7.11% down from 7.46%), New York (6.47% up from 6.17%) and Nevada (the only non-judicial state in the top 13 at 6.09% down from 6.47%).

As Jay Brinkmann noted, California (3.07% down from 3.29%) and Arizona (3.24% down from 3.57%) are now a percentage point below the national average.

The second graph shows the percent of loans delinquent by days past due.

The second graph shows the percent of loans delinquent by days past due.

Loans 30 days delinquent increased to 3.18% from 3.13% in Q1. This is at about 2007 levels and around the long term average.

Delinquent loans in the 60 day bucket increased to 1.22% in Q2, from 1.21% in Q1.

The 90 day bucket increased to 3.19% from 3.06%. This is still way above normal (around 0.8% would be normal according to the MBA).

The percent of loans in the foreclosure process decreased to 4.27% from 4.39% and is now at the lowest level since Q1 2010.

A final comment: I asked Jay Brinkmann if he thought the pace of improvement for the foreclosure inventory would pickup - or stay at this rate (about 6 to 7 years back to normal). Mr Brinkmann said that this is now more of a judicial state problem, with states like New York and New Jersey having very high levels of foreclosure inventory, and non-judicial states (except Nevada) in much better shape.

Note: "MBA’s National Delinquency Survey covers 42.5 million loans on one-to-four-unit residential properties, representing approximately 88 percent of all “first-lien”

residential mortgage loans outstanding in the United States. This quarter’s loan count saw a decrease of about 337,000 loans from the previous quarter, and a decrease

of 1,378,000 loans from one year ago. Loans surveyed were reported by approximately 120 lenders, including mortgage banks, commercial banks and thrifts."

MBA: Mortgage Delinquencies increased in Q2

by Calculated Risk on 8/09/2012 10:00:00 AM

The MBA reported that 11.85 percent of mortgage loans were either one payment delinquent or in the foreclosure process in Q2 2012 (delinquencies seasonally adjusted). This is up slightly from 11.79 percent in Q1 2012..

From the MBA: Mortgage Delinquencies Increase in Latest MBA Survey

The delinquency rate for mortgage loans on one-to-four-unit residential properties increased to a seasonally adjusted rate of 7.58 percent of all loans outstanding as of the end of the second quarter of 2012, an increase of 18 basis points from the first quarter, but a decrease of 86 basis points from one year ago, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey.Note: 7.58% (SA) and 4.27% equals 11.85%.

The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans on which foreclosure actions were started during the second quarter was 0.96 percent, unchanged from last quarter and from one year ago. The percentage of loans in the foreclosure process at the end of the second quarter was 4.27 percent, down 12 basis points from the first quarter and 16 basis points lower than one year ago. The serious delinquency rate, the percentage of loans that are 90 days or more past due or in the process of foreclosure, was 7.31 percent, a decrease of 13 basis points from last quarter and a decrease of 54 basis points from one year ago.

...

Jay Brinkmann, MBA’s Chief Economist said, “Mortgage delinquencies were up only slightly over the last quarter. Perhaps more important than the small size of the increase, however, is the fact that it reversed the trend of fairly steady drops in delinquencies we have seen over the last year. This is consistent with the slowdown in the economy during the first half of the year and our stubbornly high unemployment rate. Whether this is just a temporary blip or a sign of a true change in direction for mortgage performance will fundamentally depend on the direction of employment over the remainder of the year.”

I'll have more later after the conference call this morning.

Trade Deficit declined in June to $42.9 Billion

by Calculated Risk on 8/09/2012 09:09:00 AM

The Department of Commerce reported:

[T]otal June exports of $185.0 billion and imports of $227.9 billion resulted in a goods and services deficit of $42.9 billion, down from $48.0 billion in May, revised. June exports were $1.7 billion more than May exports of $183.3 billion. June imports were $3.5 billion less than May imports of $231.4 billion.The trade deficit was below the consensus forecast of $47.5 billion.

The first graph shows the monthly U.S. exports and imports in dollars through June 2012.

Click on graph for larger image.

Click on graph for larger image.Exports increased in June and imports decreased. Exports are 11% above the pre-recession peak and up 7% compared to June 2011; imports are just below the pre-recession peak, and up about 2% compared to June 2011.

The second graph shows the U.S. trade deficit, with and without petroleum, through June.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil averaged $100.13 in June, down from $107.91 per barrel in May. The decline in oil prices contributed to the overall decline in the trade deficit. The trade deficit with China increased to $27.4 billion in June, up from $26.6 billion in June 2011. Once again most of the trade deficit is due to oil and China.

Exports to the euro area were $17.4 billion in June, up from $16.4 billion in June 2011; so the euro area recession didn't lead to less US exports to the euro area in June.

Weekly Initial Unemployment Claims decline to 361,000

by Calculated Risk on 8/09/2012 08:30:00 AM

The DOL reports:

In the week ending August 4, the advance figure for seasonally adjusted initial claims was 361,000, a decrease of 6,000 from the previous week's revised figure of 367,000. The 4-week moving average was 368,250, an increase of 2,250 from the previous week's revised average of 366,000.The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 368,250.

This was below the consensus forecast of 367,000 and is near the lowest level for the four week average this year.

And here is a long term graph of weekly claims:

And here is a long term graph of weekly claims:Wednesday, August 08, 2012

Thursday: Trade Deficit, Unemployment Claims, Mortgage Delinquency Survey

by Calculated Risk on 8/08/2012 09:19:00 PM

First, a little rent relief coming? From Brady Dennis and Amrita Jayakumar the WaPo: A renter’s respite: In Washington area, thousands of new units to open soon

Thousands of new rental units under construction are scheduled to open in the coming months, the first such wave of new building in the area since the financial crisis hit in 2008.Thursday will be busy ...

The coming surge — which includes a whopping 6,000 new units by the end of this year — will give prospective renters a slew of new options and could even halt the upward march of monthly rental payments ...

The projected number of new units would be more than double the number that went on the market in the Washington area during each of the past two years.

• At 8:30 AM ET, the Trade Balance report for June will be released by the Census Bureau. The consensus is for the U.S. trade deficit to decrease to $47.5 billion in June, down from from $48.7 billion in May.

• Also at 8:30 AM, the initial weekly unemployment claims report will be released. The consensus is for claims to increase slightly to 367 thousand from 365 thousand. This report has been showing some improvement recently, although it might have been distorted by the timing of auto plant shutdowns.

• At 10:00 AM, the Mortgage Bankers Association's (MBA) will release their 2nd Quarter 2012 National Delinquency Survey.

• Also at 10:00 AM, the Monthly Wholesale Trade: Sales and Inventories report for June will be released. The consensus is for a 0.3% increase in inventories.

Here are two more questions for the August economic contest (both on Thursday).

More game updates: The red line shows the relative number of picks for each option, and people can now login using twitter.