by Calculated Risk on 8/08/2012 04:53:00 PM

Wednesday, August 08, 2012

House Prices will decline month-to-month Seasonally later in 2012

Sometimes it helps to state the obvious in advance ...

The Not Seasonally Adjusted (NSA) house price indexes will show month-to-month declines later this year. This should come as no surprise and will not be a sign of impending doom.

The key is to watch the year-over-year change and to compare to the NSA lows earlier this year. I think house prices have already bottomed, and will be up slightly year-over-year when prices reach the usual seasonal bottom in early 2013.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the month-to-month change in the CoreLogic and NSA Case-Shiller Composite 20 index over the last several years. There is a clear seasonal pattern. In recent years the seasonal pattern has been exaggerated by the large number of foreclosures - foreclosures tend to be fairly steady all year, but conventional sales are stronger in the spring and early summer, and weaker in the fall and winter. This leads to more downward pressure from foreclosures in the fall and winter.

Note: The CoreLogic index tends to lead Case-Shiller. Both are three month averages, but CoreLogic is weighted to the most recent month.

Right now I'm guessing both indexes will report negative month-to-month price changes for August or September (reported in October or November). Just something to be aware of ...

Las Vegas Real Estate: Sales decline, Inventory down sharply year-over-year

by Calculated Risk on 8/08/2012 02:23:00 PM

This is a key distressed market to follow since Las Vegas has seen the largest price decline of any of the Case-Shiller composite 20 cities.

From the GLVAR: GLVAR reports sixth straight month of increasing local home prices,record number of short sales, housing supply bouncing back a bit

According to GLVAR, the total number of local homes, condominiums and townhomes sold in July was 3,572. That’s down from 3,945 in June and down from 4,037 total sales in July 2011.A few key points:

...

Reversing a months-long trend, the total number of homes listed for sale on GLVAR’s Multiple Listing Service increased slightly from June to July, with a total of 16,944 single-family homes listed for sale at the end of the month. That’s up 0.1 percent from 16,930 single-family homes listed for sale at the end of June, but still down 24.5 percent from one year ago.

The number of available homes listed for sale without any sort of pending or contingent offer also rebounded compared to the previous month, but was still down considerably from last year. By the end of July, GLVAR reported 4,293 single-family homes listed without any sort of offer. That’s up 16.3 percent from 3,690 such homes listed in June, but down 60.9 percent from one year ago.

...

40 percent of all existing local homes sold during July were short sales, which occur when a lender agrees to sell a home for less than what the borrower owes on the mortgage. That’s up from 34.2 percent in June and the highest short sale percentage GLVAR has ever recorded.

Continuing a trend of declining foreclosure sales in recent months, bank-owned homes accounted for 20.7 percent of all existing home sales in July, down from 27.8 percent in June.

• Even with the slight increase in inventory in July, inventory is still down sharply from a year ago (down 60.9 percent year-over-year for single family homes without contingent offers).

• The decline in sales from the record levels in 2011 (even more sales than during the bubble!) is because of the decline in foreclosures. Some of the recent decline in foreclosures is due to new foreclosure rules in Nevada, but there is also a shift to short sales.

• Short sales are almost double foreclosures now. The GLVAR reported 40 percent of sales were short sales, and only 20.7% foreclosures. We've seen a shift from foreclosures to short sales in most areas (not just in areas with new foreclosure laws).

• The percent distressed sales was extremely high at 60.7% in July (short sales and foreclosures), but that was down from 62% in June.

Fannie, Freddie, FHA REO declined 18% Year-over-year

by Calculated Risk on 8/08/2012 12:02:00 PM

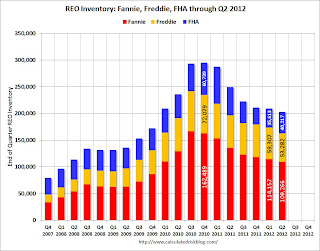

The combined Real Estate Owned (REO) by Fannie, Freddie and the FHA declined to 202,765 at the end of Q2 2012, down from 209,077 in Q1, and down 18% from 249,501 in Q2 2012. The peak for the combined REO of the F's was 295,307 in Q4 2010.

According to Fannie Mae, "foreclosures continue to proceed at a slow pace", even following the mortgage settlement:

Our foreclosure rates remain high; however, foreclosures continue to proceed at a slow pace caused by continuing foreclosure process issues encountered by our servicers and changing legislative, regulatory and judicial requirements. The delay in foreclosures, as well as a net increase in the number of dispositions over acquisitions of REO properties, has resulted in a decrease in the inventory of foreclosed properties since December 31, 2010.The bulk sales program has had a minimal impact so far:

In February 2012, FHFA announced the pilot of an REO initiative that solicited bids from qualified investors to purchase approximately 2,500 foreclosed properties from us with the requirement to rent the purchased properties for a specified number of years. The pilot involves the sale of pools of foreclosed homes including both vacant properties and occupied rental properties. The first pilot transaction involves the sale of pools of properties located in geographically concentrated locations across the United States. The winning bidders have been chosen and transactions are expected to close in the third quarter of 2012. We do not yet know whether this initiative will have a material impact on our future REO sales and REO inventory levels.

Click on graph for larger image.

Click on graph for larger image.This graph shows the REO inventory for Fannie, Freddie and the FHA.

This is only a portion of the total REO. There is also REO for private-label MBS, FDIC-insured institutions, VA and more. REO has been declining for those categories too. Most analysts expect an increase in foreclosures, and the number of REO might increase over the next several quarters.

Although REO was down for Fannie and Freddie in Q2 from Q1, but REO increased for the FHA - this is something to watch.

Fannie Mae reports $5.1 Billion Net Income, Improvement due to increase in house prices, REO sales prices

by Calculated Risk on 8/08/2012 10:05:00 AM

From Fannie Mae: Fannie Mae Reports Net Income of $5.1 Billion for Second Quarter 2012

The company’s continued improvement in financial results in the second quarter of 2012 was almost entirely due to credit-related income, resulting primarily from an improvement in home prices, improved sales prices on the company’s real-estate owned (“REO”) properties, and a decline in the company’s single-family serious delinquency rate. The company’s comprehensive income of $5.4 billion in the second quarter of 2012 is sufficient to pay its second-quarter dividend of $2.9 billion to the Department of the Treasury.These are key points - the improvement was due to 1) an increase in home prices, 2) improved sales prices of REO, and 3) decline in serious delinquency rate.

Here are some more details from the Fannie Mae's SEC filing 10-Q:

The significant improvement in our second quarter results was primarily due to recognition of a benefit for credit losses of $3.0 billion in the second quarter of 2012 compared with a provision for credit losses of $6.5 billion in the second quarter of 2011. This benefit for credit losses was due to a decrease in our total loss reserves driven primarily by an improvement in the profile of our single-family book of business resulting from an increase in actual home prices, including the sales prices of our REO properties. In addition, our single-family serious delinquency rate continued to decline, driven in large part by the quality and growth of our new single-family book of business, our modification efforts and current period foreclosures. Key factors impacting our credit-related results include:

• Home prices increased by 3.2% in the second quarter of 2012 compared with 1.2% in the second quarter of 2011. We historically see seasonal improvement in home prices in the second quarter; however, the home price increase in the second quarter of 2012 was larger than expected and the largest quarterly increase we have seen in the last few years. Higher home prices decrease the likelihood that loans will default and reduce the amount of credit loss on loans that do default.

• Sales prices on dispositions of our REO properties improved in the second quarter of 2012 as a result of strong demand. We received net proceeds from our REO sales equal to 59% of the loans’ unpaid principal balance in the second quarter of 2012, compared with 56% in the first quarter of 2012 and 54% in the second quarter of 2011.

• Our single-family serious delinquency rate declined to 3.53% as of June 30, 2012 from 3.67% as of March 31, 2012 and 4.08% as of June 30, 2011.

Click on graph for larger image.

Click on graph for larger image.This graph from the Fannie Mae Second-Quarter Credit Supplement shows the REO sales price divided by the Unpaid Principal Balance (UPB). Fannie is losing less on each REO due to a combination of slightly higher house prices and strong investor demand.

Also, Fannie Mae' REO inventory declined in Q2 to 109,266 houses, the lowest level since 2009. I'll have more REO soon.

MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

by Calculated Risk on 8/08/2012 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Refinance Index decreased 2 percent from the previous week. The seasonally adjusted Purchase Index decreased 1 percent from a week earlier.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) increased to 3.76 percent from 3.75 percent, with points decreasing to 0.46 from 0.51 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

Click on graph for larger image.

Click on graph for larger image.This graph shows the MBA mortgage purchase index. The purchase index has been mostly moving sideways over the last two years.

There is no evidence in this index of an increase in purchase applications. However the Fed Senior Loan Officer survey showed the opposite, from Nick Timiraos at the WSJ: Home Prices Climb as Supply Dwindles

The Federal Reserve said Monday demand for mortgages to purchase homes jumped during the second quarter by the largest amount in at least three years, according to a survey of bank lending officers.The following table is from the Senior Loan Officer survey:

Over half the banks surveyed reported moderately to substantially strong demand for mortgage to purchase homes. It isn't clear why the MBA index and the Fed survey results are different.

Tuesday, August 07, 2012

Monthly Economic Contest: New Login Added

by Calculated Risk on 8/07/2012 10:10:00 PM

The only economic release scheduled for Wednesday is the weekly MBA mortgage activity index at 7 AM ET.

By request, the monthly contest (on right sidebar and two questions below) uses both Facebook and OpenID logins. More new features soon.

For bloggers, you can contact Ehpik and add your own contest to your site. It is easy to use (people are using it for sports, American Idol and more).

Here are two more questions for August (both on Thursday):

The economic impact of a slight increase in house prices

by Calculated Risk on 8/07/2012 08:13:00 PM

If I’m correct about house prices bottoming earlier this year – and the CoreLogic report released this morning is another indicator that prices might be increasing a little - a key question is: What will be the economic impact of slightly increasing house prices?

We saw the impact on Freddie Mac this morning. Freddie reported net income of $3 billion compared to a $2.4 billion loss in Q2 2011. Freddie noted that the decline in its loss provision was due to “improvements in the number of newly impaired loans and to lower estimated future losses due to the positive impact of an increase in national home prices.”

Also I expect CoreLogic and Zillow to report a meaningful decline in the number of homeowners with negative equity in Q2. We might see something like 1 million households that regained a positive equity position at the end of Q2 2012. These are borrowers who might find it easier to refinance, or sell if needed.

We will probably also see a meaningful decline in the number of newer mortgage delinquencies. Note: The MBA Q2 National Delinquency Survey results will be released this Thursday.

Another impact that we've discussed before is the impact on listed “For sale” inventory. Seller psychology is very different if prices are perceived to be falling, as opposed to if prices are stabilizing or even increasing. If potential sellers think prices will fall further, then they will rush to sell and list their homes right away. That behavior pushes up inventory. But if potential sellers think prices are stabilizing, and may increase, then they are more willing to wait until it is more convenient to sell. I think we've been seeing this change in psychology for some time.

And private mortgage lenders and homebuilders will regain confidence in the mortgage and housing market. Flat to rising prices give homebuilders a better idea of the pricing needed to compete in the market - while more consumer confidence in house prices is leading to more demand for new homes. Note: Residential investment is the best leading indicator for the economy, so this pickup in new home sales and housing starts suggests a pickup in the overall economy (barring exogenous events - like the European crisis - or policy mistakes).

In conclusion: There are many positive economic impacts from flat to rising house prices and we are just beginning to see the positive impact on the overall economy.

Freddie Mac: Increase in Home Prices contributes to Lower Credit Losses

by Calculated Risk on 8/07/2012 03:30:00 PM

From Tom Lawler:

Freddie Mac reported that its GAAP net income “attributable” to Freddie Mac was $3.020 billion last quarter, up from $577 million in the previous quarter and a net loss of $2.371 billion in the second quarter of 2011. The biggest “swing” factor last quarter was a sharp drop in the provision for credit losses -- $155 million last quarter compared to $1.825 billion in the previous quarter and $2.529 billion in the comparable quarter of last year.

Freddie attributed the sharp drop in its loss provision – which fell far short of charge-offs, resulting in a steep drop in its loan loss reserves – to “improvements in the number of newly impaired loans and to lower estimated future losses due to the positive impact of an increase in national home prices.” Freddie’s internal national home price index, which is based on repeat transactions of homes backed by mortgages owned or guaranteed by Freddie or Fannie with state weights based on Freddie’s SF mortgage book, jumped by 4.8% from March to June, and the June HPI was up about 1.0% from a year ago.

Freddie’s GAAP net income “attributable” to stockholders last quarter was $1.212 billion, reflecting the $1.808 billion in dividends paid to Treasury’s senior preferred stock. Freddie’s GAAP net worth at the end of June was $1.086 billion, and as a result Freddie does not need another Treasury “draw.”

On the SF REO front, Freddie’s SF REO acquisitions last quarter totaled 20,003, down from 23,805 in the previous quarter and 24,788 in the second quarter of last year. Freddie’s SF REO dispositions last quarter totaled 26,069, up from 25,033 in the previous quarter but down from 29,348 in the second quarter of last year. As a result, Freddie’s SF REO inventory at the end of June was 53,271, down from 59,307 at the end of March and 60,599 a year ago.

Freddie attributed the relatively low level of REO acquisitions last quarter to (1) the length of the foreclosure process, especially in states that require a judicial foreclosure process; and (2) resource constraints on foreclosure activities for five large servicers involved in a recent settlement with a coalition of state attorneys general and federal agencies.

Click on graph for larger image.

Click on graph for larger image.

From CR: The following graph shows REO inventory for Freddie.

REO inventory for Freddie decreased in Q2. After Fannie announces results I'll post a graph of REO for the F's (Fannie, Freddie, and the FHA). FHA REO increased in Q2 to 40,217 from 35,613 in Q1.

Fed's Bernanke: Teacher Town Hall Meeting

by Calculated Risk on 8/07/2012 02:30:00 PM

Teacher town hall meeting with Fed Chairman Ben Bernanke: Financial Education

Follow on Twitter #FedTownHall

If Bernanke hints at QE3, it will probably happen in the Q&A.

Live broadcasting by Ustream

Trulia: Asking House Prices increased in July

by Calculated Risk on 8/07/2012 11:38:00 AM

Press Release: Trulia Reveals Asking Prices Up for Sixth Straight Month

Trulia today released the latest findings from the Trulia Price Monitor and the Trulia Rent Monitor ... Based on the for-sale homes and rentals listed on Trulia, these monitors take into account changes in the mix of listed homes and reflect trends in prices and rents for similar homes in similar neighborhoods through July 31, 2012.More from Jed Kolko, Trulia Chief Economist: Step Aside, Florida: Biggest Price Gains Now in the West

Asking prices on for-sale homes–which lead sales prices by approximately two or more months – increased 0.5 percent in July month over month (M-o-M), seasonally adjusted, for a sixth straight monthly gain. Meanwhile, asking prices rose nationally 1.2 percent quarter over quarter (Q-o-Q), seasonally adjusted. Year-over-year (Y-o-Y) asking prices rose by 1.1 percent; excluding foreclosures, asking prices rose Y-o-Y by 2.7 percent. For the first time, a majority (62 out of 100) of large metros had Y-o-Y price increases.

...

Rents increased Y-o-Y in 24 of the 25 largest rental markets, with rent increases topping 10 percent in San Francisco, Miami, Oakland, Denver, Seattle and Boston. Three months ago, only two large rental markets – San Francisco and Miami – had Y-o-Y rent increases of 10 percent or more. Rents are rising faster than asking prices in 21 of the 25 largest rental markets Y-o-Y.

Asking prices were up once again month over month in July, by 0.5%. Asking prices have moved up six straight months since February (the May number was revised slightly upward). This means that the sales price gains starting to be reported by Case-Shiller and other indexes should continue throughout the year.Note: In a few months, Case-Shiller, CoreLogic and others will probably report a month-over-month decline in house prices, Not Seasonally Adjusted (NSA). That is the normal seasonal pattern and doesn't mean prices are turning down. These asking prices are SA (Seasonally Adjusted) and suggest further house price increases through August and September on a SA basis. The key later this year will be to look at the SA indexes and the year-over-year change in prices.