by Calculated Risk on 5/06/2012 01:33:00 PM

Sunday, May 06, 2012

Exit Polls: Hollande Wins French Runoff, Greek vote split

Update: 2 PM ET from Le Monde: François Hollande élu président de la République

From the WSJ: Hollande Wins French Runoff, Early Polls Show

French Socialist candidate François Hollande won Sunday's presidential runoff ... according to estimates of preliminary results seen by The Wall Street Journal.The polls close at 2 PM ET, so this is just preliminary. Hollande is an experienced politician and will push for some growth initiatives as opposed to just austerity.

Mr. Sarkozy's defeat makes him the 11th euro-zone leader swept away in the sovereign-debt crisis.

The polls have closed in Greece and preliminary results will be released soon. The Athens News has a live blog of the results. The big surprise - so far - is it looks like Syriza will finish 2nd with Pasok 3rd. Here are some exit poll numbers (any party with 3% or more of the vote will receive seats):

Public Issue for SkaiThe 1st place party gets a 50 seat bonus (out of 300 total seats) and the parties split the remaining seats by the percent of the vote. So New Democracy will probably have around 110 to 120 seats (if I understand correctly), and they need a coalition partner to form a majority (probably Pasok). It is a mess.

(min-max, in %)

New Democracy 20.5-24.5

Radical Left Coalition (Syriza) 14-18

Pasok 13-17

Communist Party 7-10.5

Independent Greeks 7-10

Democratic Left 6-9

Golden Dawn 5-8

Ecogreens 2-4

Popular Orthodox Rally (Laos) 2-4

Drasi 1-3

Democratic Alliance 1-3

Mish on "Rentership" and House Prices

by Calculated Risk on 5/06/2012 10:44:00 AM

First, on a sad note, from Mish: My Wife Joanne Has ALS, Lou Gehrig's Disease

Today I'm going to share a personal struggle with you. This is news I've largely kept to a small circle of close friends over the past few years and is difficult to talk about. The time has now come to enlist the support of a wider community, and perhaps together, we can make a difference.I've known Mish for years, and he has kept me updated on Joanne's condition. As Mish notes, this is an "extremely cruel" disease. A few years ago, a close friend of mine - Ernie - one of my hiking and climbing partners, died from ALS. In a just a few short years, Ernie went from being a strong climber – we climbed a peak together in a winter white out just before he was diagnosed with the disease (a great adventure) - to barely being able to walk on the beach, and then being confined to a well chair, and finally passing away. Very sad.

Running this site and publishing commentary as frequently as I do demands a tremendous amount of my attention. However, my blog is not the #1 focus of my life. That would be my wife, Joanne.

Joanne has ALS, more commonly known as Lou Gehrig's disease. More specifically, she has Progressive Bulbar Palsy a particularly aggressive form of the disease.

For those interested, Mish is sponsoring a raffle for the benefit of ALS research.

Today Mish writes: New American Dream is Renting; Reflections on Renting Houses, Cars, Books, Clothes; Will Rentership Fuel the Next Boom? What About Home Prices?

Housing has now gone full circle. President Bush's "Ownership Society" has morphed into the "Rentership Society". The attitude applies to more than houses as noted in the Wall Street Journal article Renting Prosperity by Daniel Gross.Note: The graph was originally for Japan, but Mish is using it to show how sentiment changes. Mish thinks we are now in the lower right "purple" zone and back to "It's better to rent".

Americans are getting used to the idea of renting the good life, from cars to couture to homes. Daniel Gross explores our shift from a nation of owners to an economy permanently on the move—and how it will lead to the next boom. ...Renting cars and textbooks is the start of a trend that makes perfect economic sense. However, Zipcars, textbooks, clothes, and electronics are one thing, and housing is another.

When sentiment on houses reaches the widespread belief "It's Better to Rent", prices are bottoming. I expressed that thought on numerous occasions since 2005.

This is how I currently see things.

Elections: France and Greece

by Calculated Risk on 5/06/2012 08:38:00 AM

Note: The Greek polls will be open until noon ET Sunday, and the French polls will be open until 2 PM ET.

Here are a few articles:

From the Athens News: Angry Greeks vote in cliffhanger election

Greeks enraged by economic hardship voted on Sunday in a deeply uncertain election ... Leaders from all sides emphasised the importance of the vote - which pollsters say is impossible to call - for the future of Greece, now suffering one of the worst recessions in postwar Europe.From the WSJ: Greeks Head to Polls Amid Anger, Doubts Over Euro Future

The highly contested vote is expected to reflect the public's widespread anger with the political establishment after years of painful austerity and potentially usher in a prolonged period of unstable administrations and successive elections. ... anti-incumbent sentiment high and the country struggling through a fifth year of recessionFrom the Financial Times: France votes in presidential election

Millions of voters are casting their ballots in the second and final round of France’s presidential election with François Hollande favourite to win in what would be the first victory for a socialist candidate for 17 years.From the WSJ: France Heads to Polls in Key Election for Euro Zone

excerpt with permission

From Le Monde: Scrutin présidentiel : Sarkozy et Hollande suspendus au vote des Français

Saturday, May 05, 2012

France and Greece Election Times

by Calculated Risk on 5/05/2012 10:55:00 PM

The Greek polls will be open until noon ET Sunday, and the French polls will be open until 2 PM ET.

The Greek polls will be open from 7 AM to 7 PM local time according to the Athens News.

Voting in the 2012 general election will get underway at 7am on Sunday ... Polling stations will remain open until 7pm.No party will win a majority in Greece; the leading party (New Democracy) will try to form a collation government with one or more of the smaller parties - so the drama will probably drag on for some time.

Unofficial exit polls will be announced, via the media, by the country’s polling agencies shortly after the closing of polling stations.

The authorities say that they expect results from a quarter of polling stations by 9.30[pm], while the first indicative results are anticipated no sooner than 11[pm] on Sunday night.

The vote should be completed in the early hours of Monday morning

The French polls will be open from 8 AM to 8 PM local time (from 2 AM ET to 2 PM ET).

Unless there is a major surprise, the media will declare François Hollande the winner pretty early in France.

Earlier:

• Summary for Week Ending May 4th

• Schedule for Week of May 6th

Employment posts yesterday:

• April Employment Report: 115,000 Jobs, 8.1% Unemployment Rate

• April Employment Summary and Discussion

• More Graphs: Construction Employment, Duration of Unemployment, Unemployment by Education and Diffusion Indexes

• All Current Employment Graphs

AAR: Rail Traffic "mixed" in April

by Calculated Risk on 5/05/2012 08:35:00 PM

Once again rail traffic was "mixed". This was because of the sharp decline in coal traffic (mild winter, low natural gas prices), and also for grains. Other commodities were up, such as building related commodities such as lumber and crushed stone, gravel, sand.

From the Association of American Railroads (AAR): Reports Mixed Rail Traffic for April

The Association of American Railroads (AAR) reported U.S. rail carloads originated in April 2012 totaled 1,113,105, down 64,335 carloads or 5.5 percent, compared with April 2011. Intermodal volume in April 2012 was 946,951 trailers and containers, up 32,505 units or up 3.6 percent, compared with April 2011.

...

Commodities with carload declines in April were led by coal, down 85,719 carloads, or 16.6 percent compared with April 2011. This was coal’s biggest year-over-year percentage decline in rail traffic on record.

Click on graph for larger image.

Click on graph for larger image.This graph shows U.S. average weekly rail carloads (NSA).

Once again, coal was the main reason for the decline in total carloads. Coal carloads were down 16.6% (85,719 carloads) in April 2012, their biggest year-over-year percentage decline on record. A warm winter, low natural gas prices that make gas-based electricity generation more competitive vis-à-vis coal-based generation, and environmental pressures are all reducing U.S. coal consumption, and thus rail coal carloads.

Meanwhile, U.S. rail grain carloads were down 17.2% (16,402 carloads) in April 2012 from April 2011, their 10th straight significant decline. Grain carloads are hurting largely because U.S. grain exports are down.

The second graph is just for coal and shows the sharp decline this year.

The second graph is just for coal and shows the sharp decline this year.Just when you thought coal couldn’t get worse, it did. U.S. coal carloads fell 16.6% (85,719 carloads) in April 2012 from April 2011, the biggest monthly decline on record. (Our data begin in 1988.) Average U.S. coal carloads of 107,379 in April 2012 were the lowest of any month since July 1993. ...The third graph is for intermodal traffic (using intermodal or shipping containers):

Again this month, rail traffic is more encouraging if you forget about coal and grain. Excluding coal, U.S. rail carloads were up 3.2% (21,384 carloads) in April 2012 over April 2011.

Graphs reprinted with permission.

Graphs reprinted with permission.Intermodal traffic is now close to the peak year of 2006.

U.S. intermodal traffic — containers and trailers on railroad flat cars — was up 3.6% (32,505 units) in April 2012 over April 2011 to 946,951 units, its 29th straight year-over-year monthly increase. The average in April 2012 was 236,738 intermodal units per week, the second highest average of any April in history (just behind April 2006’s 237,062) and the 13th highest of any month in history. (Most of the top months are in the fall, when intermodal tends to peak.)

Earlier:

• Summary for Week Ending May 4th

• Schedule for Week of May 6th

Employment posts yesterday:

• April Employment Report: 115,000 Jobs, 8.1% Unemployment Rate

• April Employment Summary and Discussion

• More Graphs: Construction Employment, Duration of Unemployment, Unemployment by Education and Diffusion Indexes

• All Current Employment Graphs

Unofficial Problem Bank list declines to 925 Institutions

by Calculated Risk on 5/05/2012 04:47:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for May 4, 2012. (table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

Relatively quiet week for the Unofficial Problem Bank List with five removals. The removals lower the institution list count to 925 with assets of $361.1 billion. A year-ago, the list held 983 institutions with assets of $422.2 billion.Earlier:

One removal was due to failure -- Security Bank, National Association, North Lauderdale, Florida ($95 million); two removals from action termination by the Federal Reserve-- MidSouth Bank, Murfreesboro, TN ($239 million) and North Valley Bank, Zanesville, OH ($153 million); and two from unassisted mergers -- Farmers National Bank, Walton, KY ($85 million) and State Bank of Cokato, Cokato, MN ($53 million). Perhaps next week the OCC will release its actions through mid-April 2012.

• Summary for Week Ending May 4th

• Schedule for Week of May 6th

Employment posts yesterday:

• April Employment Report: 115,000 Jobs, 8.1% Unemployment Rate

• April Employment Summary and Discussion

• More Graphs: Construction Employment, Duration of Unemployment, Unemployment by Education and Diffusion Indexes

• All Current Employment Graphs

Schedule for Week of May 6th

by Calculated Risk on 5/05/2012 01:01:00 PM

Earlier:

• Summary for Week Ending May 4th

This will be a light week for economic releases. The key economic release is the March trade balance report to be released on Thursday.

There will be several speeches by Fed officials, including from Fed Chairman Ben Bernanke on bank regulation.

The elections in Europe will be a focus on Sunday.

On Sunday, France and Greece will hold elections. In France, François Hollande is expected to win, although recent polls are close.

In Greece, no party will win a majority and many of the minor parties are expected to get a boost from the anti-austerity vote.

3:00 PM: Consumer Credit for March. The consensus is for a $9.8 billion increase in consumer credit.

7:30 AM: NFIB Small Business Optimism Index for April.

7:30 AM: NFIB Small Business Optimism Index for April. Click on graph for larger image in graph gallery.

This graph shows the small business optimism index since 1986. The index declined to 92.5 in March from 94.3 in February.

The consensus is for an increase to 93.0 in April.

10:00 AM ET: Job Openings and Labor Turnover Survey for March from the BLS.

10:00 AM ET: Job Openings and Labor Turnover Survey for March from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased slightly in February, and the number of job openings (yellow) has generally been trending up. Quits also increased in February, and quits are now at the highest level since 2008. These are voluntary separations and more quits might indicate some improvement in the labor market.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index has been weak this year, although this does not include all the cash buyers.

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for March. The consensus is for a 0.6% increase in inventories.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims an increased to 366,000 from 365,000 last week.

8:30 AM: Trade Balance report for March from the Census Bureau.

8:30 AM: Trade Balance report for March from the Census Bureau. Exports increased slightly in February, while imports decreased sharply. Exports are well above the pre-recession peak and up 9% compared to February 2011; imports are near the pre-recession high and imports are up about 8% compared to February 2011.

The consensus is for the U.S. trade deficit to increase to $49.5 billion in March, up from from $46.0 billion in February. Export activity to Europe will be closely watched due to economic weakness.

8:30 AM: Import and Export Prices for March. The consensus is a for a 0.2% decrease in import prices.

9:30 AM: Speech by Fed Chairman Ben Bernanke, "Banks and Bank Lending: The State of Play", At the 48th Annual Conference on Bank Structure and Competition, Chicago, Illinois

8:30 AM: Producer Price Index for April. The consensus is for no change in producer prices (0.2% increase in core).

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (preliminary for May). The consensus is for sentiment to decline to 76.2 from 76.4 in April.

Summary for Week ending May 4th

by Calculated Risk on 5/05/2012 08:05:00 AM

The key report – the April employment report – was disappointing. With only 115 thousand jobs added in April, this has raised a key question: Is this a slowdown in hiring, or were the January and February numbers boosted by the mild weather, and the apparently slowdown in March and April was just some "payback"?

If the former, hiring has slowed to about 135,000 per month (or less); if the later, the economy is adding about 200,000 jobs per month. Note: Through the first four months of 2012, the economy has added 803 thousand payroll jobs, a better pace than in 2011.

There are some positives we’ve discussed lately: it appears state and local government layoffs are slowing (although there was a little increase in April), residential investment (and construction employment) is increasing from a very low level, and it appears the drag from several sectors of non-residential investment will end mid-year. So my guess is job growth will pick up from the March and April pace, but remain sluggish compared to the slack in the labor force.

The other data was mixed. The ISM manufacturing index was above expectations, but the ISM service index was below. The Chicago PMI was soft, but auto sales were solid at a 14.4 million seasonally adjusted annual rate (SAAR).

Here is a summary in graphs:

• April Employment Report: 115,000 Jobs, 8.1% Unemployment Rate

Click on graph for larger image.

Click on graph for larger image.

There were 115,000 payroll jobs added in April, with 130,000 private sector jobs added, and 15,000 government jobs lost. The unemployment rate declined to 8.1%. The participation rate decreased to 63.6% from 63.8% (a new cycle low) and the employment population ratio also decreased slightly to 58.4%.

The change in February payroll employment was revised up from +240,000 to +259,000, and February was revised up from +120,000 to +154,000.

This was below expectations of 165,000 payroll jobs added.

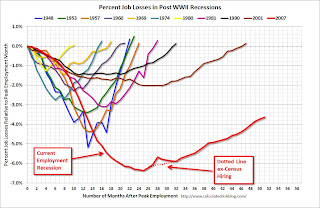

The second graph shows the job losses from the start of the employment recession, in percentage terms. The dotted line is ex-Census hiring.

The second graph shows the job losses from the start of the employment recession, in percentage terms. The dotted line is ex-Census hiring.

This shows the depth of the recent employment recession - worse than any other post-war recession - and the relatively slow recovery due to the lingering effects of the housing bust and financial crisis.

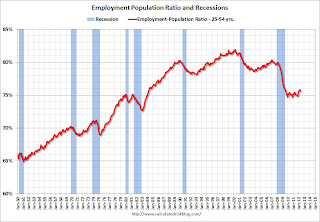

Since the participation rate has declined recently due to cyclical (recession) and demographic (aging population) reasons, an important graph is the employment-population ratio for the key working age group: 25 to 54 years old.

Since the participation rate has declined recently due to cyclical (recession) and demographic (aging population) reasons, an important graph is the employment-population ratio for the key working age group: 25 to 54 years old.

In the earlier period the employment-population ratio for this group was trending up as women joined the labor force. The ratio has been mostly moving sideways since the early '90s, with ups and downs related to the business cycle.

This ratio should probably move back to or above 80% as the economy recovers. So far the ratio has only increased slightly from a low of 74.7% to 75.7% in April (this was down slightly in April from March.)

• ISM Manufacturing index indicates faster expansion in April

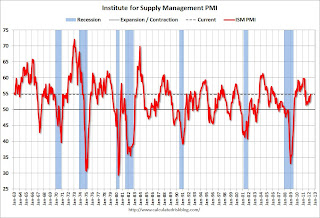

PMI was at 54.8% in April, up from 53.4% in March. The employment index was at 57.3%, up from 56.1%, and new orders index was at 58.2%, up from 54.5%.

PMI was at 54.8% in April, up from 53.4% in March. The employment index was at 57.3%, up from 56.1%, and new orders index was at 58.2%, up from 54.5%.Here is a long term graph of the ISM manufacturing index.

This was above expectations of 53.0%. This suggests manufacturing expanded at a faster rate in April than in March. It appears manufacturing employment expanded faster in April with the employment index at 57.3%.

• U.S. Light Vehicle Sales at 14.42 million annual rate

Based on an estimate from Autodata Corp, light vehicle sales were at a 14.42 million SAAR in April. That is up 9.8% from April 2011, and up 0.7% from the sales rate last month (14.3 million SAAR in March 2012).

Based on an estimate from Autodata Corp, light vehicle sales were at a 14.42 million SAAR in April. That is up 9.8% from April 2011, and up 0.7% from the sales rate last month (14.3 million SAAR in March 2012).This was at the consensus forecast of 14.4 million SAAR (seasonally adjusted annual rate).

This graph shows the huge collapse in sales in the 2007 recession. This also shows the impact of the tsunami and supply chain issues on sales, especially in May and June of last year.

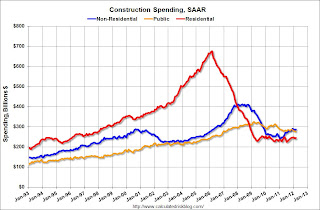

• Construction Spending increases slightly in March

This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.Private residential spending is 64% below the peak in early 2006, and up 8.4% from the recent low. Non-residential spending is 30% below the peak in January 2008, and up about 18% from the recent low.

Public construction spending is now 15% below the peak in March 2009 and at a new post-bubble low.

On a year-over-year basis, both private residential and non-residential construction spending are positive, but public spending is down on a year-over-year basis. The year-over-year improvements in private non-residential are mostly due to energy spending (power and electric).

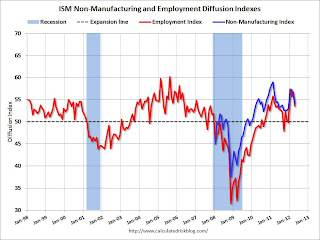

• ISM Non-Manufacturing Index indicates slower expansion in April

The April ISM Non-manufacturing index was at 53.5%, down from 56.0% in March. The employment index decreased in April to 54.2%, down from 56.7% in March. Note: Above 50 indicates expansion, below 50 contraction.

The April ISM Non-manufacturing index was at 53.5%, down from 56.0% in March. The employment index decreased in April to 54.2%, down from 56.7% in March. Note: Above 50 indicates expansion, below 50 contraction. This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was below the consensus forecast of 55.9% and indicates slower expansion in April than in March.

• Weekly Initial Unemployment Claims decline to 365,000

The DOL reports:

The DOL reports:In the week ending April 28, the advance figure for seasonally adjusted initial claims was 365,000, a decrease of 27,000 from the previous week's revised figure of 392,000. The 4-week moving average was 383,500, an increase of 750 from the previous week's revised average of 382,750.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 383,500.

This is the highest level for the 4-week moving average since last December.

This was below the consensus of 378,000. However, even though weekly claims declined, the 4-week average has increased for four straight weeks and is at the highest level this year.

• Other Economic Stories ...

• Trulia on Houses: Asking Prices increase slightly Year-over-year in April

• LPS: March Foreclosure Starts increase, Foreclosure Sales lowest since December 2010

• ADP: Private Employment increased 119,000 in April

• Chicago PMI declines to 56.2

• Personal Income increased 0.4% in March, Spending 0.3%

• Q1 2012 GDP Details: Office and Mall Investment falls to record low, Single Family investment increases

• Restaurant Performance Index increases in March

• Fannie Mae and Freddie Mac Serious Delinquency rates declined in March

Friday, May 04, 2012

Bank Failure #23 in 2012: Security Bank, National Association, North Lauderdale, Florida

by Calculated Risk on 5/04/2012 09:22:00 PM

Once graceful on a tight rope

Fell as gator chum

by Soylent Green is People

From the FDIC: Banesco USA, Coral Gables, Florida, Assumes All of the Deposits of Security Bank, National Association, North Lauderdale, Florida

As of March 31, 2012, Security Bank, National Association had approximately $101.0 million in total assets and $99.1 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $10.8 million. ... Security Bank, National Association is the 23rd FDIC-insured institution to fail in the nation this year, and the third in Florida.Earlier on the employment report:

• April Employment Report: 115,000 Jobs, 8.1% Unemployment Rate

• April Employment Summary and Discussion

• More Graphs: Construction Employment, Duration of Unemployment, Unemployment by Education and Diffusion Indexes

• All Current Employment Graphs

More Graphs: Construction Employment, Duration of Unemployment, Unemployment by Education and Diffusion Indexes

by Calculated Risk on 5/04/2012 05:43:00 PM

The first graph below shows the number of total construction payroll jobs in the U.S. including both residential and non-residential since 1969.

Construction employment decreased by 2 thousand jobs in April, but previous months were revised up slightly. Last year was the first year with an increase in construction employment since 2006, and the first with an increase in residential construction employment since 2005.

Unfortunately this graph is a combination of both residential and non-residential construction employment. The BLS only started breaking out residential construction employment fairly recently (residential specialty trade contractors in 2001).

Click on graph for larger image.

Click on graph for larger image.

Usually residential investment leads the economy out of a recession, and non-residential construction usually lags the economy. Because this graph is a blend, it masks the usual pickup in residential construction following previous recessions. Of course there was no pickup for residential construction this time because of the large excess supply of vacant homes - although that appears to be changing.

Construction employment is now generally increasing, and construction will add to both GDP and employment growth in 2012.

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.All categories are generally moving down. The less than 5 week category is back to normal levels, and the other categories are still elevated.

The the long term unemployed declined to 3.3% of the labor force - this is still very high, but the lowest since August 2009.

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).Unfortunately this data only goes back to 1992 and only includes one previous recession (the stock / tech bust in 2001). Clearly education matters with regards to the unemployment rate - and it appears all four groups are generally trending down. The unemployment rate for those with a bachelors degree has fallen to 4% for the first time since early 2009.

Note: This says nothing about the quality of jobs - as an example, a college graduate working at minimum wage would be considered "employed".

This is a little more technical. The BLS diffusion index for total private employment was at 56.8 in April, down from 64.7 in March. For manufacturing, the diffusion index declined to 59.9, down from 69.8 in March.

This is a little more technical. The BLS diffusion index for total private employment was at 56.8 in April, down from 64.7 in March. For manufacturing, the diffusion index declined to 59.9, down from 69.8 in March. Think of this as a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.Job growth was not as widespread in April as in March.

We'd like to see the diffusion indexes consistently above 60 - and even in the 70s like in the '1990s.

Earlier on the employment report:

• April Employment Report: 115,000 Jobs, 8.1% Unemployment Rate

• April Employment Summary and Discussion

• All Current Employment Graphs