by Calculated Risk on 4/30/2012 04:47:00 PM

Monday, April 30, 2012

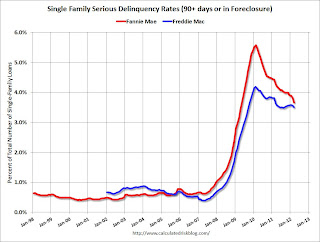

Fannie Mae and Freddie Mac Serious Delinquency rates declined in March

Fannie Mae reported that the Single-Family Serious Delinquency rate declined in March to 3.67%, down from 3.82% in February. The serious delinquency rate is down from 4.44% in March 2011, and is at the lowest level since April 2009. Some of the decline over the last two months is seasonal.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Freddie Mac reported that the Single-Family serious delinquency rate declined to 3.51% in March, down from 3.57% in February. Freddie's rate is down from 3.63% in Feburary 2010. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are loans that are "three monthly payments or more past due or in foreclosure".

Click on graph for larger image

Click on graph for larger image

With the mortgage servicer settlement, I'd expect the delinquency rate to start to decline faster over the next year or so.

The "normal" serious delinquency rate is under 1%, so there is a long way to go.

Note: LPS reported the serious delinquency rate (including in foreclosore) was about 7.5% in March. That includes the Fannie and Freddie loans with serious delinquency rates at less than half the industry average. This is also a reminder of how bad the non-Fannie/Freddie loans are performing.