by Calculated Risk on 4/16/2012 07:49:00 PM

Monday, April 16, 2012

LA area Port Traffic increases in March, Exports hit new record

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

Container traffic gives us an idea about the volume of goods being exported and imported - and possibly some hints about the trade report for March. LA area ports handle about 40% of the nation's container port traffic.

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

Click on graph for larger image.

Click on graph for larger image.

On a rolling 12 month basis, inbound traffic is up 0.9% from February, and outbound traffic is up 0.2%.

The rolling 12 months of imports started declining last year - and exports seemed to stall. But it now appears both imports and exports are increasing again (slightly).

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

For the month of March, loaded outbound traffic was up 2.6% compared to March 2011, and loaded inbound traffic was up 12.8% compared to March 2011.

For the month of March, loaded outbound traffic was up 2.6% compared to March 2011, and loaded inbound traffic was up 12.8% compared to March 2011.

This is a new record for exports (just above the pre-recession peak).

Note: Every year imports decline in February mostly because of the Chinese New Year and rebounds in March. February 2012 was an especially steep decline, and some of the February traffic was probably pushed into March.

Lawler: Early Read on Existing Home Sales in March

by Calculated Risk on 4/16/2012 04:59:00 PM

CR Note: Some interesting comments from Tom Lawler ...

From economist Tom Lawler: Early Read on Existing Home Sales in March: Not Much Change (SAAR) from February, but Aggregate Numbers Miss Strengthening Market

While I’m missing reports from several key markets, my current estimate based on regional tracking is that US existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 4.59 million in March, unchanged from February’s pace, and up 7.7% from last March’s seasonally adjusted pace. While the “flattish” sales in March relative to February (on a SAAR basis) might seem surprising to some given various anecdotal stories of strengthening markets, the “flat” reading does NOT negate the validity of many of these reports. Rather, a major reason for the “disappointing” sales readings for March (and February) relative to a year ago is the substantial decline in REO/foreclosure sales, which to a large extent is the result of sharply lower REO properties for sale.

Consider, e.g., sales reports from the Vegas, Phoenix, Sacramento, Minneapolis, Mid-Atlantic, and Orlando markets broken out by short sales, foreclosure sales, and “non-distressed” sales, shown on the table below.

| MLS-Reported Home Sales | ||||

|---|---|---|---|---|

| Mar-12 | Mar-11 | % chg | ||

| Phoenix | Total | 8869 | 9933 | -10.7% |

| Short Sales | 2275 | 1899 | 19.8% | |

| Bank-Owned Sales | 1872 | 4576 | -59.1% | |

| Non-Distressed Sales | 4722 | 3458 | 36.6% | |

| Las Vegas | Total | 4386 | 4316 | 1.6% |

| Short Sales | 1167 | 1019 | 14.5% | |

| Bank-Owned Sales | 1786 | 2054 | -13.0% | |

| Non-Distressed Sales | 1433 | 1243 | 15.3% | |

| Sacramento | Total | 1858 | 1914 | -2.9% |

| Short Sales | 638 | 427 | 49.4% | |

| Bank-Owned Sales | 570 | 927 | -38.5% | |

| Non-Distressed Sales | 750 | 560 | 33.9% | |

| Mid-Atlantic | Total | 7902 | 8059 | -1.9% |

| Short Sales | 1040 | 1057 | -1.6% | |

| Bank-Owned Sales | 1162 | 2123 | -45.3% | |

| Non-Distressed Sales | 5700 | 4879 | 16.8% | |

| Minneapolis | Total | 3523 | 3253 | 8.3% |

| Short Sales | 438 | 417 | 5.0% | |

| Bank-Owned Sales | 1296 | 1497 | -13.4% | |

| Non-Distressed Sales | 1789 | 1343 | 33.2% | |

| Orlando | Total | 2327 | 2613 | -10.9% |

| Short Sales | 768 | 762 | 0.8% | |

| Bank-Owned Sales | 593 | 1215 | -51.2% | |

| Non-Distressed Sales | 966 | 636 | 51.9% | |

Note that all of the above markets, save for Vegas, saw this March’s home sales come in below last March’s (and by more than the one-fewer-business day would have implied for a “flat” seasonally adjusted reading), and Vegas’ YOY gain was only 1.6%. Yet ALL of these markets saw double-digit YOY gains in non-distressed sales. For all of these markets combined, total home sales were down (YOY) by 4.1%; short sales were up 13.3%; foreclosure sales were down 41.3%; and non-distressed sales were up 26.7%.

Of course, the surge in “non-distressed” sales overstates the overall strength of many of these markets – folks, especially looking for a home to live in, who last year might have purchased a “distressed” home found the available inventory smaller and unattractive, and instead purchased a “non-distressed” home.

Still, the increase in “non-distressed” sales is an encouraging sign.

Below are a few other reports from associations/MLS that either only report “distressed” vs. “non-distressed,” or in Memphis’ case only report bank-owned vs. non-bank-owned sales (the Memphis report is based on property records, not MLS sales).

| Mar-12 | Mar-11 | % Chg | ||

|---|---|---|---|---|

| Northeast Florida | Total | 1419 | 1529 | -7.2% |

| Distressed Sales | 567 | 857 | -33.8% | |

| Non-Distressed Sales | 852 | 672 | 26.8% | |

| Hampton Roads | Total | 1547 | 1605 | -3.6% |

| Distressed Sales | 519 | 695 | -25.3% | |

| Non-Distressed Sales | 1028 | 910 | 13.0% | |

| Memphis (Existing) | Total | 1229 | 1014 | 21.2% |

| Bank-Owned Sales | 393 | 377 | 4.2% | |

| Non-Bank Sales | 836 | 637 | 31.2% |

Flipping back to estimates for the NAR EHS release, a decent number of associations/MLS (though by no means all) reported a monthly increase in listings for March, and “seasonally” listings typically increase significantly. Translating local data into NAR inventory estimates, however, is “tricky;” e.g., the NAR’s existing home inventory estimate in February was up 4.3% from January, WAY above what any inventory tracker would have “guessed” (NAR showed a monthly jump in the inventory of existing condos for sale in February of 27.3%!) I can’t tell ya why, but rather than trying to foot to the monthly changes regardless of past monthly “discrepancies,” I’m going with a YOY estimate based on tracking, which would suggest a YOY inventory drop of about 20.5%, and would imply a very slight monthly decline relative to February (though I expect February to be revised down).

Finally, on the median sales price side a much higher % of realtor associations/MLS reported YOY increases in median sales prices in March relative to any period since 2010, in many (but not all) cases likely because of the significant drop in the foreclosure share of home sales. Net, I expect that the NAR median existing SF home sales price in March will be 3.0 to 3.5% above last March’s MSP.

As always, of course, median sales prices are heavily influenced by the mix of sales – and by that I don’t mean just “distressed” vs. “non-distressed” – and one can’t really “translate” median sales price changes to changes in repeat-transactions home price indexes. By the same token, however, repeat-transactions HPIs that include all distressed sales do appear to be affected by the distressed sales share of home sales, and as such these HPIs should show a CONSIDERABLE YOY improvement using March transactions. In addition, in some markets there does appear to be overall home price improvement gains. As such, there is a pretty decent chance that many widely followed HPIs may show YOY gains. Of course, the most widely watched monthly HPIs – S&P/Case-Shiller – is really a 3-month moving average HPI, and as such one wouldn’t expect to see a YOY gain in the March report. But the April or May report just might!

NY Fed: Manufacturing Activity "improved modestly" in April

by Calculated Risk on 4/16/2012 04:03:00 PM

Catching up: This was released earlier from the NY Fed: April's Empire State Manufacturing Survey indicates manufacturing activity in New York State improved modestly

April’s Empire State Manufacturing Survey indicates that manufacturing activity in New York State improved modestly. Although the general business conditions index fell fourteen points, it remained positive at 6.6. The new orders and shipments indexes also remained positive, but showed only a small increase in orders and shipments. The prices paid index inched downward but remained high, and the prices received index climbed six points to 19.3. The index for number of employees rose to its highest level in nearly a year, indicating a significant increase in employment levels, while the average workweek index fell to a level that indicated only a small increase in hours worked. Future indexes remained quite positive, suggesting a strong and persistent degree of optimism about the six month outlook.The general business index was down sharply to 6.56 from 20.21 in March, and was significantly below the consensus forecast of 18.

The employment index was up to 19.28 from 13.58 in March.

Residential Remodeling Index increases 3% in February

by Calculated Risk on 4/16/2012 12:24:00 PM

From BuildFax:

Residential remodels authorized by building permits in the United States in February were at a seasonally-adjusted annual rate of 2,894,000. This is 3 percent above the revised January rate of 2,811,000 and is 23 percent above the February 2011 estimate of 2,362,000.

"February 2012 is the first month over the past twelve to show significant increases in residential remodeling activity across all U.S. regions," said Joe Emison, Vice President of Research and Development at BuildFax.

The BuildFax Remodeling Index (BFRI) is based on construction permits for residential remodeling projects filed with local building departments across the country. The index estimates the number of properties permitted. The national and regional indexes are based upon a subset of representative building departments in the U.S. and population estimates from the U.S. Census. The BFRI is seasonally-adjusted using the X12 procedure.

Click on graph for larger image.

Click on graph for larger image.This graph shows the Remodeling Index since January 2000 on a seasonally adjusted basis.

Remodeling is below the peak levels of the housing boom - with all the equity extraction - but up 25% from the bottom in May 2009.

Note: Permits are not adjusted by value, so this doesn't mean there is more money being spent, just more permit activity. Also some smaller remodeling projects are done without permits and the index will miss that activity.

The second graph shows the regional indexes. From BuildFax:

The second graph shows the regional indexes. From BuildFax: Seasonally-adjusted annual rates of remodeling across the country in February 2012 are estimated as follows: Northeast, 627,000 (up 24% from January and up 33% from February 2011); South, 1,194,000 (up 3% from January and up 25% from February 2011); Midwest, 516,000 (up 4% from January and up 22% from February 2011); West, 830,000 (up 9% from January and up 21% from February 2011).Some of the increase in February could be weather related (the index is seasonally adjusted, and the weather in February was warmer than normal). This might especially be true in the Northeast.

For overall residential investment, multi-family construction and home improvement have already picked up, and it appears single family construction will increase in 2012.

NAHB Builder Confidence declines in April

by Calculated Risk on 4/16/2012 10:00:00 AM

The National Association of Home Builders (NAHB) reports the housing market index (HMI) declined 3 points in April to 25. Any number under 50 indicates that more builders view sales conditions as poor than good.

From the NAHB: Builder Confidence Slips Three Notches in April

Builder confidence in the market for newly built, single-family homes declined for the first time in seven months this April, sliding three notches to 25 on the National Association of Home Builders/Wells Fargo Housing Market Index, released today. The decline brings the index back to where it was in January, which was the highest level since 2007.

"Although builders in many markets are noting increased interest among potential buyers, consumers are still very hesitant to go forward with a purchase, and our members are realigning their expectations somewhat until they see more actual signed sales contracts,” noted Barry Rutenberg, chairman of the National Association of Home Builders (NAHB) and a home builder from Gainesville, Fla.

“What we’re seeing is essentially a pause in what had been a fairly rapid build-up in builder confidence that started last September,” said NAHB Chief Economist David Crowe. “This is partly because interest expressed by buyers in the past few months has yet to translate into expected sales activity, but is also reflective of the ongoing challenges that are slowing the housing recovery – particularly tight credit conditions for builders and buyers, competition from foreclosures and problems with obtaining accurate appraisals.”

...

Each of the index’s components registered declines in April. The component gauging current sales conditions and the component gauging sales expectations in the next six months each fell three points, to 26 and 32, respectively, while the component gauging traffic of prospective buyers fell four points to 18. (Note, the overall index and each of its components are seasonally adjusted.)

Regionally, the HMI results were somewhat mixed in April, with the Northeast posting a four-point gain to 29 (its highest level since May of 2010), the West posting no change at 32, the South posting a three-point decline to 24 and the Midwest posting an eight-point decline to 23.

Click on graph for larger image.

Click on graph for larger image.This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the April release for the HMI and the February data for starts (March housing starts will be released tomorrow).

Retail Sales increased 0.8% in March

by Calculated Risk on 4/16/2012 08:30:00 AM

On a monthly basis, retail sales were up 0.8% from February to March (seasonally adjusted), and sales were up 6.5% from March 2011. From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for March, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $411.1 billion, an increase of 0.8 percent (±0.5%) from the previous month and 6.5 percent (±0.7%) above March 2011. ... The January to February 2012 percent change was revised from 1.1 percent (±0.5) to 1.0 percent(±0.2%).Ex-autos, retail sales increased 0.8% in March.

Click on graph for larger image.

Click on graph for larger image.Sales for February were revised down from a 1.1% increase to a 1.0% increase.

This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales are up 23.6% from the bottom, and now 8.6% above the pre-recession peak (not inflation adjusted)

The second graph shows the same data since 2006 (to show the recent changes). Excluding gasoline, retail sales are up 19.6% from the bottom, and now 7.7% above the pre-recession peak (not inflation adjusted).

The second graph shows the same data since 2006 (to show the recent changes). Excluding gasoline, retail sales are up 19.6% from the bottom, and now 7.7% above the pre-recession peak (not inflation adjusted).The third graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 6.3% on a YoY basis (6.6% for all retail sales). Retail sales ex-gasoline increased 0.7% in March.

This was above the consensus forecast for retail sales of a 0.3% increase in March, and above the consensus for a 0.6% increase ex-auto.

This was above the consensus forecast for retail sales of a 0.3% increase in March, and above the consensus for a 0.6% increase ex-auto. Sunday, April 15, 2012

Europe: Sarkozy calls on ECB to support growth

by Calculated Risk on 4/15/2012 06:35:00 PM

From the Financial Times: Sarkozy breaks silence over ECB role

“Europe must purge its debts, it has no choice. But between deflation and growth, it has no more choice. If Europe chooses deflation it will die. We, the French, will open the debate on the role of the central bank in the support of growth.” [Sarkozy said]Of course, while most of Europe is worried about deflation, Germany is worried about inflation.

excerpt with permission

And from the NY Times: In Spain and Italy, Signs of a Lingering Crisis for Europe

Neither Spain nor Italy seems a good candidate for meeting the deficit-reduction targets they have agreed to with the European Union, especially if the downturn deepens.And on Greece: the election is scheduled for May 6th, and the smaller parties will probably do very well.

...

While the austerity debate simmers, a more pressing concern is efforts by Italy and Spain to raise financing for government debt they will need to roll over this year. Italy has so far raised only a little more than one-third of the estimated 215 billion euros ($283 billion) it will need this year, according to Reuters calculations. Spain is about half of the way to its goal, the economy minister, Luis de Guindos, said last Tuesday. According to the 2012 budget, the Spanish treasury plans gross issuance of 186 billion euros of debt this year.

The European Central Bank relieved a great deal of pressure with two rounds of cheap, three-year loans to banks in December and February that pumped 1 trillion euros ($1.3 trillion) into the region’s banking system. Many banks, especially in the southern countries like Spain and Italy, turned around and used that money to buy their government’s debt.

That debt-buying is now tapering off, said Guntram Wolff, deputy director at Bruegel, a research organization in Brussels. That raises the question of who might step in to finance these governments. “Investors are starting to express big doubts,” Mr. Wolff said.

Yesterday:

• Summary for Week Ending April 13th

• Schedule for Week of April 15th

Krugman: "Insane in Spain"

by Calculated Risk on 4/15/2012 02:39:00 PM

From Paul Krugman: Insane in Spain

"the euro crisis is [now] ... centered on Spain — which in a way is a good thing, because now the essential craziness of the orthodox German-inspired diagnosis of the crisis is on full display.

For this is really, really not about fiscal irresponsibility. Just as a reminder, on the eve of the crisis Spain seemed to be a fiscal paragon:"

| Spain | Germany | |

|---|---|---|

| Budget Balance, % of GDP, 2007 | +1.9% | +0.3% |

| Net Debt, % of GDP, 2007 | 27% | 50% |

"What happened to Spain was a housing bubble — fueled, to an important degree, by lending from German banks — that burst, taking the economy down with it. ...The German argument falls apart when we look at Spain. Instead of focusing on government spending, we could look at capital flows. Oh well.

And the policy response is supposed to be even more austerity, with the European Central Bank, natch, obsessing over inflation ...

I’m really starting to think that we’re heading for a crackup of the whole system."

The ECB's LTRO has bought a little bit of time, but if the policymakers stay focused on austerity, they will fail. A key European analyst pointed out last week that essentially all recent sovereign issuance in the periphery has been purchased by in-country banks, and that was related to the LTRO from the ECB. In other words, there is no private market for peripheral sovereign debt. The key analyst concluded: "The EMU (Economic and Monetary Union) is over".

Lou Barnes on Boulder, Colorado Housing

by Calculated Risk on 4/15/2012 09:44:00 AM

Long term readers will remember the quote about "neutron loans" from mortgage banker Lou Barnes in 2007:

“All of the old-timers knew that subprime mortgages were what we called neutron loans — they killed the people and left the houses,” said Louis S. Barnes, 58, a partner at Boulder West, a mortgage banking firm in Lafayette, Colo.Here is what Lou Barnes wrote on Friday on housing in Boulder, Colorado:

"What would the turn look like, if really underway? My own back yard has turned in just the last 60 days. The Front Range of Colorado never had a housing bubble: we danced with the Technology Fairy 1999-2001, afterward built too many houses, and made too many stupid loans, but all of that was over by 2004 when we led the nation in foreclosures. Long time ago. We have the 6th-lowest level of mortgage delinquency of any state in the US. Our rental vacancy rate spiked to 12%, now below 5% for the first time since '99 (0% in Boulder!). Rents are moving up quickly. State population in the last dozen years has risen from 4.1 million to 5 million, and we're short of land to build (you could drop Rhode Island in here and never find it, but we are maniacs for "open space" reservations). Building permits have been off 85% since '07. Unemployment is down to 7%-ish. Our listed inventory of homes evaporated by 40% since last year. Buyers have lost their fear, the only problem finding something to show them.Yes, my local market looks like that.

Does your local market look like that? Mister housing-has-bottomed? Eh?

As perfect as our set-up, are prices rising? In rich, government- and tech-payrolled, land-starved Boulder County, yes. At last. Enough to unlock sellers? Ummmm... later.

Two philosophers have remarked incisively on speed. Stephen Hawking: "Time is what keeps everything from happening at once." Then, Satchel Paige's description of Cool Papa Bell: "He was so fast he could flip off the light switch and be in bed before the room got dark. One time he hit a line drive right past my ear. I turned around and saw the ball hit his ass just as he slid into second."

Housing is the polar opposite of Cool Papa Bell.

Here in Colorado, the 1980s were tougher than this patch, and in Boulder we had all the same, lovely conditions as above by the spring of 1990, and the first, timid price increases in nine years. It then took 18 months for prices to begin to rise on the far side of town. Bottom is one thing, better another, recovery something else entirely.

As Barnes notes, a bottom for prices is one thing, a recovery in prices "something else entirely" - and I doubt prices will rise significantly any time soon. However, in more and more areas, it appears prices have bottomed, and buyers have "lost their fear".

Saturday, April 14, 2012

Percent Job Losses: Great Recession and Great Depression

by Calculated Risk on 4/14/2012 08:27:00 PM

The causes of the Great Recession were similar to the Great Depression - as opposed to most post war recessions that were caused by Fed tightening to slow inflation - and I'm frequently asked if we could compare the percent job losses during the two periods. Unfortunately there is very little data for the Great Depression.

Back in February I posted a graph based on some rough annual data.

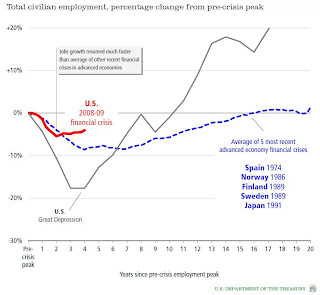

On Friday, Treasury released a slide deck titled Financial Crisis Response In Charts. One of the charts shows the percentage jobs lost in the current recession compared to the Great Depression.

This graph compares the job losses from the start of the employment recession, in percentage terms for the Great Depression, the 2007 recession, and the average for several recent recession following financial crisis.

Although the 2007 recession is much worse than any other post-war recession, the employment impact was much less than during the Depression. Note the second dip during the Depression - that was in 1937 and the result of austerity measures.

Earlier:

• Summary for Week Ending April 13th

• Schedule for Week of April 15th