by Calculated Risk on 4/06/2012 04:01:00 PM

Friday, April 06, 2012

AAR: Rail Traffic "mixed" in March

From the Association of American Railroads (AAR): AAR Reports Mixed Rail Traffic for March

The Association of American Railroads (AAR) today reported reported U.S. rail carloads originated in March 2012 totaled 1,123,298, down 69,190 carloads or 5.8 percent, compared with March 2011. Intermodal volume in March 2012 was 928,350 containers and trailers, up 31,348 units or 3.5 percent compared with March 2011.

...

Commodities with carload declines in March were led by coal, down 84,854 carloads or 15.8 percent from March 2011. Other commodities with declines included grain, down 9,088 carloads or 9.7 percent; chemicals, down 4,278 carloads or 3.4 percent; nonmetallic minerals, down 1,863 carloads or 9.7 percent; and farm products excluding grain, down 479 carloads or 13.3 percent. Carloads excluding coal and grain were up 4.4 percent or 24,752 carloads in March 2012 over March 2011.

...

“There is no denying that coal is a crucial commodity for railroads, and there’s also no denying that recent declines in coal traffic are presenting significant challenges to railroads right now,” said AAR Senior Vice President John T. Gray. “That said, it’s encouraging that many commodities that are better indicators of the state of the economy than coal is — things like motor vehicles, lumber and wood products, and crushed stone — saw higher rail carloadings in March.”

Click on graph for larger image.

Click on graph for larger image.This graph shows U.S. average weekly rail carloads (NSA).

U.S. railroads originated 1,123,298 total carloads in March 2012, down 5.8% (69,190 carloads) from the same period in 2011. Total carloads averaged 280,825 per week in March 2012, down from 298,122 in March 2011. Coal and, to a lesser extent, grain were the main reasons for the decline. Excluding coal and grain, U.S. rail carloads were up 4.4% (24,752 carloads) in March 2012 over March 2011, though the 4.4% gain is the smallest gain for this category of rail traffic in six monthsAccording to the AAR, the decline in coal is because coal is being used less for electricity generation.

The second graph is for intermodal traffic (using intermodal or shipping containers):

Graphs reprinted with permission.

Graphs reprinted with permission.Intermodal traffic is now above the peak year in 2006.

Intermodal continued to impress in March. U.S. railroads originated 928,350 containers and trailers in March 2012, up 3.5% (31,348 units) over March 2011 and the 28th straight year-over-year monthly increase. Average weekly U.S. intermodal loadings in March 2012 were the highest of any March in history.

Earlier Employment posts:

• March Employment Report: 120,000 Jobs, 8.2% Unemployment Rate

• Employment Summary and Discussion

• Construction Employment, Duration of Unemployment, Unemployment by Education and Diffusion Indexes

• All Employment Graphs

Construction Employment, Duration of Unemployment, Unemployment by Education and Diffusion Indexes

by Calculated Risk on 4/06/2012 01:09:00 PM

The first graph below shows the number of total construction payroll jobs in the U.S. including both residential and non-residential since 1969.

Construction employment decreased by 7 thousand jobs in March, giving back some of the gains from January. Last year was the first year with an increase in construction employment since 2006, and the first with an increase in residential construction employment since 2005.

Unfortunately this graph is a combination of both residential and non-residential construction employment. The BLS only started breaking out residential construction employment fairly recently (residential specialty trade contractors in 2001).

Usually residential investment (and residential construction) leads the economy out of recession, and non-residential construction usually lags the economy. Because this graph is a blend, it masks the usual pickup in residential construction following previous recessions. Of course there was no pickup for residential construction this time because of the large excess supply of vacant homes - although that appears to be changing and residential construction employment will probably increase this year.

Click on graph for larger image.

Click on graph for larger image.

Construction employment is now generally increasing, and construction will add to both GDP and employment growth in 2012.

As I've noted for years, there are usually two bottoms for housing following a bubble: 1) when housing starts, new home sales, and residential construction bottoms, and 2) when house prices bottom. The bottom is in for construction and construction employment.

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.All categories are generally moving down (the less than 5 week category is back to normal levels). The other categories are still high.

The the long term unemployed declined to 3.4% of the labor force - this is still very high, but the lowest since September 2009.

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).Unfortunately this data only goes back to 1992 and only includes one previous recession (the stock / tech bust in 2001). Clearly education matters with regards to the unemployment rate - and it appears all four groups are generally trending down.

Note: This says nothing about the quality of jobs - as an example, a college graduate working at minimum wage would be considered "employed".

This is a little more technical. The BLS diffusion index for total private employment was at 59.6 in March, down slightly from 60.7 in January. For manufacturing, the diffusion index increased to 67.9, up from 59.9 in February.

This is a little more technical. The BLS diffusion index for total private employment was at 59.6 in March, down slightly from 60.7 in January. For manufacturing, the diffusion index increased to 67.9, up from 59.9 in February. Think of this as a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.It appears job growth was still fairly widespread in March.

We'd like to see the diffusion indexes consistently above 60 - and even in the 70s like in the '1990s.

Earlier Employment posts:

• March Employment Report: 120,000 Jobs, 8.2% Unemployment Rate

• Employment Summary and Discussion

• All Employment Graphs

Employment Summary and Discussion

by Calculated Risk on 4/06/2012 10:17:00 AM

The number of payroll jobs added in March was disappointing, and this is reminding many observers of the slowdown in 2011.

But we also have to remember that this is just one month, and that there were clear reasons for the slowdown last year. In 2011, the economy was negatively impacted by the tsunami, bad weather, high oil prices and the debt ceiling debate. Of course oil prices are high again, but hopefully there will be no natural disasters, and also no threats of defaulting on the debt.

The report wasn't all bad news. It looks like the drag from state and local layoffs is nearing the end, the unemployment rate declined (although partially because of workers leaving the labor force), the number of people working part time for economic reasons declined, and the number of people unemployed for more than 6 months declined - and hourly wages increased a little faster.

Some numbers: There were 120,000 payroll jobs added in March, with 121,000 private sector jobs added, and 1,000 government jobs lost. The unemployment rate declined to 8.2%. U-6, an alternate measure of labor underutilization that includes part time workers and marginally attached workers, declined to 14.5% from 14.9% in February. This remains very high - U-6 was in the 8% range in 2007 - but this is the lowest level of U-6 since early 2009.

The participation rate decreased slightly to 63.8% (from 63.9%) and the employment population ratio also decreased slightly to 58.5%.

The change in January payroll employment was revised down from +284,000 to +275,000, and February was revised up from +227,000 to +240,000.

The average workweek declined 0.1 hours to 34.5 hours, and average hourly earnings increased 0.2%. "The average workweek for all employees on private nonfarm payrolls edged down by 0.1 hour to 34.5 hours in March. ... In March, average hourly earnings for all employees on private nonfarm payrolls rose by 5 cents, or 0.2 percent, to $23.39." This is sluggish earnings growth, and earnings are still being impacted by the large number of unemployed and marginally employed workers.

There are a total of 12.67 million Americans unemployed and 5.3 million have been unemployed for more than 6 months. These numbers are declining, but still very high.

Overall this report was disappointing, and this report will make the April report even more important as analysts try to determine if this is the beginning of slower growth - or if this was just a one month slowdown in hiring.

Percent Job Losses During Recessions

Click on graph for larger image.

Click on graph for larger image.

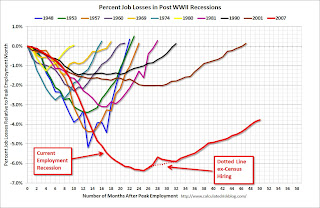

This graph shows the job losses from the start of the employment recession, in percentage terms - this time aligned at maximum job losses.

In the previous post, the graph showed the job losses aligned at the start of the employment recession.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) fell from 8.1 to 7.7 million over the month. These individuals were working part time because theirThe number of part time workers decreased sharply in March - and is back to 2008 levels - but this is still very high.

hours had been cut back or because they were unable to find a full-time

job.

These workers are included in the alternate measure of labor underutilization (U-6) that declined to 14.5% in March from 14.9% in February - the lowest level since early 2009.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 5.308 million workers who have been unemployed for more than 26 weeks and still want a job. This was down from 5.426 million in February. This is very high, but this is the lowest number since 2009.

More graphs coming ...

March Employment Report: 120,000 Jobs, 8.2% Unemployment Rate

by Calculated Risk on 4/06/2012 08:30:00 AM

From the BLS:

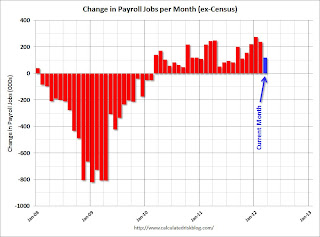

Nonfarm payroll employment rose by 120,000 in March, and the unemployment rate was little changed at 8.2 percent, the U.S. Bureau of Labor Statistics reported today.This graph shows the jobs added or lost per month (excluding temporary Census jobs) since the beginning of 2008.

...

The civilian labor force participation rate (63.8 percent) and the employment-population ratio (58.5 percent) were little changed in March.

...

The change in total nonfarm payroll employment for January was revised from

+284,000 to +275,000, and the change for February was revised from +227,000

to +240,000.

Click on graph for larger image.

Click on graph for larger image.Job growth started picking up early last year, but then the economy was hit by a series of shocks (oil price increase, tsunami in Japan, debt ceiling debate) - and then growth started picking up again. This is only one month, but the concern is job growth will slow again.

The second graph shows the employment population ratio, the participation rate, and the unemployment rate. The unemployment rate was declined to 8.2% (red line).

The Labor Force Participation Rate decreased to 63.8% in March (blue line). This is the percentage of the working age population in the labor force. The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although most of the decline is due to demographics.

The Labor Force Participation Rate decreased to 63.8% in March (blue line). This is the percentage of the working age population in the labor force. The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although most of the decline is due to demographics.The Employment-Population ratio decreased slightly to 58.5% in March (black line).

The third graph shows the job losses from the start of the employment recession, in percentage terms. The dotted line is ex-Census hiring.

The third graph shows the job losses from the start of the employment recession, in percentage terms. The dotted line is ex-Census hiring.This shows the depth of the recent employment recession - much worst than any other post-war recession - and the relatively slow recovery due to the lingering effects of the housing bust and financial crisis.

This was weaker payroll growth than expected (expected was 201,000). More later ...

Reis: Strip Mall Vacancy Rate declines slightly in Q1

by Calculated Risk on 4/06/2012 12:44:00 AM

From Reuters: US strip-mall vacancy falls 1st time in 7 yrs

The average vacancy rate at U.S. strip malls fell for the first time in nearly seven years in the first quarter and rents inched up, but it is too early to call a rebound for a sector battered by the housing bust and recession, a report by Reis Inc showed.

During the first quarter, the national vacancy rate for strip malls fell to 10.9 percent from 11 percent the prior quarter, according to preliminary figures from Reis. ... "This is really only the first quarter where the vacancy rate declined. We need to see something a little bit more sustained than just a quarter or two before it really signals the beginning of a trend," Severino said.

...

At regional malls, the first-quarter vacancy rate fell to 9 percent from 9.2 percent the prior quarter. It was the second consecutive quarterly decline for the big malls.

Click on graph for larger image.

Click on graph for larger image.This graph shows the vacancy rate for regional and strip malls since Q1 2000.

It appears the vacancy rate is starting to decline, but very slowly. Just like for office space, there is almost no new supply of malls being built.

Thursday, April 05, 2012

Existing Home Inventory declines 20% year-over-year in early April

by Calculated Risk on 4/05/2012 09:33:00 PM

Another update: I've been using inventory numbers from HousingTracker / DeptofNumbers to track changes in inventory. Tom Lawler mentioned this last year.

According to the deptofnumbers.com for (54 metro areas), inventory is off 20.4% compared to the same week last year. Unfortunately the deptofnumbers only started tracking inventory in April 2006.

This graph shows the NAR estimate of existing home inventory through February (left axis) and the HousingTracker data for the 54 metro areas through early April.

Click on graph for larger image.

Click on graph for larger image.

Since the NAR released their revisions for sales and inventory, the NAR and HousingTracker inventory numbers have tracked pretty well.

Seasonally housing inventory usually bottoms in December and January and then starts to increase again through mid to late summer. So seasonally inventory should increase over the next several months.

The second graph shows the year-over-year change in inventory for both the NAR and HousingTracker.

HousingTracker reported that the early April listings - for the 54 metro areas - declined 20.4% from the same period last year. The year-over-year decline will probably start to slow since listed inventory is getting close to normal levels. Also if there is an increase in foreclosures (as expected), this will slow the year-over-year decline.

HousingTracker reported that the early April listings - for the 54 metro areas - declined 20.4% from the same period last year. The year-over-year decline will probably start to slow since listed inventory is getting close to normal levels. Also if there is an increase in foreclosures (as expected), this will slow the year-over-year decline.

This is just inventory listed for sale, there is also a large "shadow inventory" that is currently not on the market, but is expected to be listed in the next few years. But this year-over-year decline remains a significant story.

Federal Reserve Issues Statement on Rental of REOs

by Calculated Risk on 4/05/2012 05:20:00 PM

This statement makes it clear that the Fed (and probably other regulators) will allow banks to rent residential Real Estate Owned (REO) for longer periods due to market conditions. I expect we will see more rental programs like the pilot program recently announced by BofA.

From the Federal Reserve:

The Federal Reserve Board on Thursday released a policy statement reiterating that statutes and Federal Reserve regulations permit rental of residential properties acquired in foreclosure as part of an orderly disposition strategy. The statement also outlines supervisory expectations for residential rental activities.Here is the statement.

The general policy of the Federal Reserve is that banking organizations should make good faith efforts to dispose of foreclosed properties (also known as "other real estate owned" or "OREO"), including single-family homes, at the earliest practicable date. In this context, and in light of the extraordinary market conditions that currently prevail, the policy statement explains that banking organizations may rent residential OREO properties within legal holding-period limits without demonstrating continuous active marketing of the property for sale, provided that suitable policies and procedures are followed.

Moreover, to the extent that OREO rental properties meet the definition of community development under the Community Reinvestment Act (CRA) regulations, the banking organizations would receive favorable CRA consideration. In all respects, banking organizations that rent OREO properties are expected to comply with all applicable federal, state, and local statutes and regulations, some of which the policy statement highlights. The policy statement, in providing guidance to banking organizations and examiners, also describes specific supervisory expectations for banking organizations with a larger number of rental OREO properties, generally more than 50 properties available for rent or rented.

The policy statement applies to banking organizations for which the Federal Reserve is the primary federal supervisor, including state member banks, bank holding companies, non-bank subsidiaries of bank holding companies, savings and loan holding companies, non-thrift subsidiaries of savings and loan holding companies, and U.S. branches and agencies of foreign banking organizations.

Employment Situation Preview

by Calculated Risk on 4/05/2012 02:55:00 PM

Tomorrow (Friday) the BLS will release the March Employment Situation Summary at 8:30 AM ET. Bloomberg is showing the consensus is for an increase of 201,000 payroll jobs in March, and for the unemployment rate to remain unchanged at 8.3%.

Note:

• The weather was mild in January and February, and it is possible that some hiring was pulled forward. Several analysts have pointed out that the BLS reported that few people were "not at work due to bad weather" in January and February. I looked back at previous years with mild weather (using the BLS "not at work, bad weather" measurement), and employment gains in March were solid following mild weather during January and February. So I don't expect much payback due to the weather.

• The economic questions for tomorrow (see pickem game on top right sidebar) is to take the over or under on the consensus for payroll jobs and to forecast the unemployment rate.

Here is a summary of recent data:

• The ADP employment report showed an increase of 209,000 private sector payroll jobs in March. Although ADP seems to track the BLS over time, the ADP report hasn't been very useful in predicting the BLS report. Also note that government payrolls declined by about 18,000 over the last three months (about 6,000 per month), so the ADP report suggests 209,000 private nonfarm payroll jobs added, minus 6,000 government workers - or around 203,000 total jobs added in March (close to the consensus).

• The ISM manufacturing employment index increased to 56.1% from 53.2% in February. A historical correlation between the ISM index and the BLS employment report for manufacturing, suggests that private sector BLS reported payroll jobs for manufacturing increased about 14,000 in March.

The ISM service employment index increased to 56.7% from 55.7% in March. Based on a historical correlation between the ISM non-manufacturing employment index and the BLS employment report for service, this reading suggests the gain of around 240,000 private payroll jobs for services in March.

Combined the ISM surveys suggest an employment report somewhat above the consensus.

• Initial weekly unemployment claims averaged about 366,000 in March, down slightly from 374,000 average in January and February.

For the BLS reference week (includes the 12th of the month), initial claims were at about the same level as in January and February when the economy added 284,000 and 227,000 payroll jobs respectively.

• The final March Reuters / University of Michigan consumer sentiment index increased to 76.2, up slightly from the February reading of 75.3. This is frequently coincident with changes in the labor market, but also strongly related to gasoline prices and other factors. This suggests a weak but improving labor market.

• And a little optimism from the NFIB (small business): NFIB Jobs Statement: Job Creation Shows Mixed Signals

“March came in like a lion on the job-front, but went out tempered by future job growth indicators. Overall, the March survey anticipates some strength in the job creation number with little change in the unemployment rate. With job openings and plans for job creation both falling, prospects for a surge in job creation in the small business sector are still not promising.The participants in the NFIB surveys still aren't doing much hiring, however the small business index from Intuit showed 65,000 small business jobs created in March.

Building on February’s increased jobs numbers, March’s survey gives us the best readings since January and February of 2011. The net change in employment per firm (seasonally adjusted) was 0.22, double the reading for February.

• And on the unemployment rate from Gallup: U.S. Unemployment Declines in March

U.S. unemployment, as measured by Gallup without seasonal adjustment, declined to 8.4% in March from 9.1% in February, while Gallup's seasonally adjusted rate fell to 8.1% from 8.6% in February.NOTE: The Gallup poll results are Not Seasonally Adjusted (NSA), so use with caution.

...

Gallup's monitoring of the unemployment situation includes the entire month, while the BLS uses a mid-month reference week.

Gallup's seasonally adjusted unemployment rate was essentially unchanged at 8.5% in mid-March from 8.6% in February, but then fell to 8.1% for all of March. How much of the sharp decline in unemployment during the second half of March will be picked up in the government's mid-month reference week is unclear.

There always seems to be some randomness to the employment report, but the overall situation has improved (lower initial weekly unemployment claims, more job openings). The ADP report suggests the consensus is close, and the ISM reports suggest the consensus is a little low.

Once again I'll take the over (above 201,000 payroll jobs), and I think a further decline in the unemployment rate is possible (this depends on the participation rate and if discouraged workers return to the labor force).

More: Office Vacancy Rate declines slightly to 17.2% in Q1

by Calculated Risk on 4/05/2012 12:43:00 PM

Early this morning I noted that Reis reported the office vacancy rate declined slightly to 17.2% in Q1 from 17.3% in Q4 2011. The vacancy rate was at 17.6% in Q1 2011.

Here are a few more comments and a long term graph from Reis.

Comments from Reis Senior Economist Ryan Severino:

National vacancies continued falling at a very modest pace in the first quarter, mirroring the tepid improvement in the labor market. The sector absorbed 5.998 million SF, the fifth consecutive quarterly gain in occupied stock since the beginning of 2011.

Although net absorption levels remain muted, five consecutive quarters of positive net absorption provide convincing evidence that the sector is indeed recovering. ... Given the rate of improvement that the sector is experiencing, it will be years before it is able to recover the space that was vacated during the recession and early stages of the economic recovery. The national vacancy rate has regressed back to levels unseen since 1993 and remains well above the cyclical low of 12.5% from 2007 before the onset of the recession.

...

National asking and effective rent growth improved slightly in the first quarter, continuing the slow upward trend that began in the first quarter of 2011. Annual gains of 1.6 and 2.1 percent, respectively, also indicate a moderate pace of improvement, but are unimpressive.

...

Weak supply growth remains a tailwind for improvement in the office sector. During the first quarter of 2012 only 1.917 million square feet of office space were completed. This represents the lowest quarterly level on record since Reis began tracking quarterly market data in 1999. ... With little supply being delivered, even the low levels of absorption that we are observing are sufficient enough to generate vacancy rate declines and rent growth.

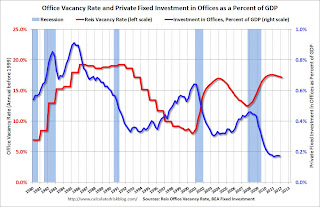

Click on graph for larger image.

Click on graph for larger image.This graph shows the office vacancy rate starting in 1980 (prior to 1999 the data is annual). Back in the early '80s, there was overbuilding in the office sector even as the vacancy rate was rising. This was due to the very loose lending that led to the S&L crisis.

In the '90s, office investment picked up as the vacancy rate fell. Following the bursting of the stock bubble, the vacancy rate increased sharply and office investment declined.

During the housing bubble, office investment started to increase even before the vacancy rate had fallen below 14%. This was due to loose lending - again. Investment essentially stopped following the financial crisis.

The good news is, as Severino noted, there is very little new office construction right now and the vacancy rate will probably continue to decline.

Office vacancy data courtesy of Reis.

Trulia announces new "mix adjusted" House Asking Price Monitor, Prices up 1.4% from Q4

by Calculated Risk on 4/05/2012 10:00:00 AM

This is an interesting new asking price monitor from Trulia. Usually people report median asking prices, but unfortunately the median is impacted by the mix of homes. However Trulia adjusts the asking prices both for the mix of homes listed for sale and for seasonal factors. Of course this is just asking prices, not sales prices, but this might provide an early hint at changes in house prices.

This has the advantage of giving a much earlier look at prices than the repeat sales indexes. As an example, the recent Case-Shiller report was for "January". But that was really a three month average of November, December and January - and the index is based on recorded closing prices - so some of this index was based on contracts signed last September. That is 6 or even 7 months ago.

The Trulia monitor will be released monthly, and the report today is for asking prices in March.

From Trulia:

Trulia today launched the Trulia Price Monitor and the Trulia Rent Monitor, the earliest leading indicators available of trends in home prices and rents. Based on the for-sale homes and rentals listed on Trulia.com, these Monitors take into account changes in the mix of listed homes, reflecting trends in prices and rents for similar homes in similar neighborhoods through March 31, 2012.

Nationally, asking prices on for-sale homes – which lead sales prices by approximately two or more months – were 1.4 percent higher in March than one quarter ago. Prices increased month over month 0.9 percent in March and 0.6 percent in February. The Trulia Price Monitor is seasonally adjusted, so these monthly and quarterly increases are on top of typical springtime price jumps. Unadjusted for seasonality, asking prices rose 2.4 percent quarter over quarter. According to the Monitor, asking prices had been declining prior to February and reached a low in January.

...

“Asking prices rose in February and March, but this doesn’t mean that the bottom is forever behind us. The robo-signing settlement will accelerate the foreclosure process, pushing more homes onto the market and dragging down prices in areas that suffered most from the housing crash,” said Jed Kolko, Trulia’s Chief Economist.

Click on graph for larger image.

Click on graph for larger image.The first graph from Trulia shows the month over month prices changes (seasonally adjusted) as reported by the monitor. This shows asking prices were falling for most of 2011, but have turned up in early 2012.

Here is a list of price and rent changes for the 100 largest metro areas.

And here is a map from Trulia showing the year-over-year change in asking prices.

And here is a map from Trulia showing the year-over-year change in asking prices.On a year-over-year basis many MSAs are still in the red (as opposed to quarter-over-quarter or month-over-month). According to the list of cities, 41 MSAs (out of 100) had increasing asking prices year-over-year, and 67 quarter-over-quarter.

There are still many more distressed sales to come, and asking prices could turn down again - but this does suggest prices have turned up recently.