by Calculated Risk on 3/06/2012 03:05:00 PM

Tuesday, March 06, 2012

FHA Reduces Fees to Encourage Refinancing

From HUD: FHA ANNOUNCES PRICE CUTS TO ENCOURAGE STREAMLINE REFINANCING

Today, Acting Federal Housing (FHA) Commissioner Carol Galante announced significant price cuts to FHA’s Streamline Refinance Program that could benefit millions of borrowers whose mortgages are currently insured by FHA. Beginning June 11, 2012, FHA will lower its Upfront Mortgage Insurance Premium (UFMIP) to just .01 percent and reduce its annual premium to .55 percent for certain FHA borrowers.A comment from mortgage broker Soylent Green is People:

To qualify, borrowers must be current on their existing FHA-insured mortgages which were endorsed on or before May 31, 2009. Late last month, FHA also announced it will increase its upfront premiums on most other loans by 75 basis points to 1.75 percent. In addition, FHA will raise annual premiums 10 basis points and 35 basis points on mortgages higher than $625,500.

...

Currently, 3.4 million households with loans endorsed on or before May 31, 2009, pay more than a five percent annual interest rate on their FHA-insured mortgages. By refinancing through this streamlined process, it’s estimated that the average qualified FHA-insured borrower will save approximately $3,000 a year or $250 per month. FHA’s new discounted prices assume no greater risk to its Mutual Mortgage Insurance (MMI) Fund and will allow many of these borrowers to refinance into a lower cost FHA-insured mortgage without requiring additional underwriting.

Lenders were limited to refinancing only when a “benefit to borrower” existed. It was a pretty high wall to climb to make deals work. For example, a person with a 4.5% loan couldn’t refinance to 3.75% because the Mortgage Insurance was going to more than double. Now, with a .55 Mortgage Insurance limit, the refinance deals will really start to explode.

The down side is anyone after June 2009 is screwed. If you closed July 2009 to present day, any refinance they want to transact will have mortgage insurance RISE from 1.15 to 1.25!

Can’t wait to see everything in writing.

Greek Update: Collective action clause

by Calculated Risk on 3/06/2012 12:22:00 PM

From the Financial Times: Greece threatens default on PSI holdouts

The Greek public debt management agency said in a statement that Athens “does not contemplate the availability of funds to make payments to private sector creditors that decline to participate in PSI”.And the details from Financial Times Alphaville: Now witness the firepower of this fully armed and operational collective action clause, etc

The threat is aimed in particular at the 14 per cent of investors who own Greek bonds issued under international law.

excerpt with permission

The Republic’s representative noted that Greece’s economic programme does not contemplate the availability of funds to make payments to private sector creditors that decline to participate in PSI. Finally, the Republic’s representative noted that if PSI is not successfully completed, the official sector will not finance Greece’s economic programme and Greece will need to restructure its debt (including guaranteed bonds governed by Greek law) on different terms that will not include co-financing, the delivery of EFSF notes, GDP-linked securities or the submission to English law.The deadline is Thursday, March 8th.

LPS: Foreclosure Starts and Sales increase Sharply in January

by Calculated Risk on 3/06/2012 08:50:00 AM

LPS released their Mortgage Monitor report for January today.

According to LPS, 7.97% of mortgages were delinquent in January, down from 8.15% in December, and down from 8.90% in January 2011.

LPS reports that 4.15% of mortgages were in the foreclosure process, up from 4.11% in December, and down slightly from 4.16% in January 2011.

This gives a total of 12.13% delinquent or in foreclosure. It breaks down as:

• 2.23 million loans less than 90 days delinquent.

• 1.77 million loans 90+ days delinquent.

• 2.08 million loans in foreclosure process.

For a total of 6.08 million loans delinquent or in foreclosure in January.

This graph shows the total delinquent and in-foreclosure rates since 1995.

The total delinquent rate has fallen to 7.97% from the peak in January 2010 of 10.97%, but the decline has halted. A normal rate is probably in the 4% to 5% range, so there is a long ways to go.

The in-foreclosure rate was at 4.15%, down from the record high in October 2011 of 4.29%. There are still a large number of loans in this category (about 2.08 million).

Foreclosure starts and sales were up sharply in January. This is just one month, but it is possible that the lenders are finally working through the backlog of loans (and this was before the mortgage servicer settlement).

Monday, March 05, 2012

Housing: Year over Year change in Asking Prices

by Calculated Risk on 3/05/2012 09:04:00 PM

Earlier today I noted that existing home inventory, according to HousingTracker, is down 20.5% year-over-year in early March.

I mentioned that HousingTracker / DeptofNumbers also report asking prices for 54 markets, including the median, the 25th percentile, and the 75th percentile. Note: NDD at the Bonddad blog has been watching asking prices since last year.

According to housingtracker, median asking prices are up 3.9% year-over-year in early March. We can't read too much into this increase because these are just asking prices, and median prices can be distorted by the mix. As an example, the median asking price might have increased just because there are fewer low priced foreclosures listed for sale.

But with those caveats, here is a graph of asking prices compared to the year-over-year change in the Case-Shiller composite 20 index.

Click on graph for larger image.

Click on graph for larger image.

The Case-Shiller index is in red. The brief period in 2010 with a year-over-year increase in the repeat sales index was related to the housing tax credit (notice that asking prices showed a small year-over-year declines before Case-Shiller increased since Case-Shiller is for closed transactions).

Also note that the 25th percentile took the biggest hit (that was probably the flood of low end foreclosures on the market).

Now asking prices have turned positive. We have to be careful about the mix (fewer foreclosures on the market), but it appears sellers are a little more optimistic.

Lawler: Maryland and Foreclosures: Living for Free in the Free State?

by Calculated Risk on 3/05/2012 03:32:00 PM

From economist Tom Lawler:

Yesterday the Washington Post carried two stories on foreclosures that are definitely worth reading. One is entitled “We don’t believe in living for free: Md. couple fight foreclosure on million-dollar home for years without ever making a payment”. It basically chronicles how a Maryland couple (who were real-estate speculators) were (amazingly) able to buy a million dollar plus home with no money down in 2006 (getting a million dollar first mortgage from a now defunct Mississippi lender and a second mortgage from another lender) for their primary residence, and who have not made a mortgage payment in five years. They’ve been able to do this by “using every tactic in the book” to hold off foreclosure. It is a good but disturbing article, and can be read at A million-dollar mortgage goes unpaid for years while couple fights foreclosure. You will probably be amazed that the couple, one of whom was convicted of bankruptcy fraud (related to real estate transactions) in 2000, agreed to be interviewed for the article.

CR Note: These people bought the house with no money down and never made a single mortgage payment. It would NOT be a tragedy if they lost "their" house. Prior to the Depression, people usually put 50% down and financed their homes for 5 years with a balloon payment. During the Depression they couldn't refinance even if they could make their payment. Losing their homes WAS a tragedy. There is no comparison to this couple in Maryland.

Lawler: The second is entitled “The foreclosure crisis: Two strategies,” which discusses how various legislative and other actions have dramatically lengthened Maryland’s foreclosure timelines, which “some economists and housing experts contend” has worked to “stifle” a recovery in the “Free State.“ It also does a comparison of the housing busts in Prince George’s County, Maryland and Prince Williams County, Virginia, that is similar to my “A Tale of Two Counties” piece last year. See: Maryland vs. Virginia: Two different approaches to foreclosure

CR Note: From the 2nd article:

“The real issue is the length of time of the process. If you just keep pushing back foreclosures that would happen anyway, it just delays the inevitable,” said Thomas A. Lawler, whose firm, Lawler Economic & Housing Consulting, provides market data, analysis and forecasts. “I am not saying therefore everyone should have a fast process that is not fair, but a fair process should not leave a house in foreclosure for multiple years.”

Existing Home Inventory declines 21% year-over-year in early March

by Calculated Risk on 3/05/2012 12:55:00 PM

Another update: I've been using inventory numbers from HousingTracker / DeptofNumbers to track changes in inventory. Tom Lawler mentioned this last year.

According to the deptofnumbers.com for monthly inventory (54 metro areas), is off 20.5% compared to the same week last year. Unfortunately the deptofnumbers only started tracking inventory in April 2006.

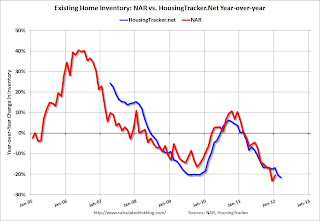

This graph shows the NAR estimate of existing home inventory through January (left axis) and the HousingTracker data for the 54 metro areas through early March.

Click on graph for larger image.

Click on graph for larger image.

Since the NAR released their revisions for sales and inventory, the NAR and HousingTracker inventory numbers have tracked pretty well.

Seasonally housing inventory usually bottoms in December and January and then starts to increase again through mid to late summer. So inventory should increase over the next 6 months.

The second graph shows the year-over-year change in inventory for both the NAR and HousingTracker.

HousingTracker reported that the early March listings - for the 54 metro areas - declined 20.5% from the same period last year. The year-over-year decline will probably start to slow since listed inventory is getting close to normal levels. Also if there is an increase in foreclosures (as expected), this will give some boost to listed inventory.

HousingTracker reported that the early March listings - for the 54 metro areas - declined 20.5% from the same period last year. The year-over-year decline will probably start to slow since listed inventory is getting close to normal levels. Also if there is an increase in foreclosures (as expected), this will give some boost to listed inventory.

This is just inventory listed for sale, sometimes referred to as "visible inventory". There is also a large "shadow inventory" that is currently not on the market, but is expected to be listed in the next few years. But this year-over-year decline is significant.

Note: HousingTracker also reports asking prices. They report the median, 25th percentile, and 75th percentile prices for each metro area. Of course these are just "asking" prices, and the median can be distorted by the mix - but asking prices are up 3.9% year-over-year (something to watch).

ISM Non-Manufacturing Index indicates faster expansion in February

by Calculated Risk on 3/05/2012 10:00:00 AM

The February ISM Non-manufacturing index was at 57.3%, up from 56.8% in January. The employment index decreased in February to 55.7%, down from 57.4% in January. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: February 2012 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in February for the 26th consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM Report On Business®.

The report was issued today by Anthony Nieves, C.P.M., CFPM, chair of the Institute for Supply Management™ Non-Manufacturing Business Survey Committee. "The NMI registered 57.3 percent in February, 0.5 percentage point higher than the 56.8 percent registered in January, and indicating continued growth at a faster rate in the non-manufacturing sector. The Non-Manufacturing Business Activity Index registered 62.6 percent, which is 3.1 percentage points higher than the 59.5 percent reported in January, reflecting growth for the 31st consecutive month. The New Orders Index increased by 1.8 percentage points to 61.2 percent, and the Employment Index decreased by 1.7 percentage points to 55.7 percent, indicating continued growth in employment, but at a slower rate. The Prices Index increased 4.9 percentage points to 68.4 percent, indicating prices increased at a faster rate in February when compared to January. According to the NMI, 14 non-manufacturing industries reported growth in February. The majority of comments from the respondents reflect a growing level of optimism about business conditions and the overall economy. There is a concern about inflation, rising fuel prices and petroleum-based product costs."

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was above the consensus forecast of 56.1% and indicates slightly faster expansion in February than in January.

HAMP for Investors

by Calculated Risk on 3/05/2012 09:03:00 AM

From Bloomberg: Boom-Era Property Speculators to Get Foreclosure Aid (ht Mike in Long Island)

The Obama administration will extend mortgage assistance for the first time to investors who bought multiple homes before the market imploded, helping some speculators who drove up prices and inflated the housing bubble.But this example doesn't seem to make sense:

Landlords can qualify for up to four federally-subsidized loan workouts starting around May, as long as they rent out each house or have plans to fill them, under the revamped Home Affordable Modification Program, also known as HAMP, according to Timothy Massad, the Treasury’s assistant secretary for financial stability.

John Russell, 61, of Northville, Michigan, said he was never a speculator seeking to flip houses. He bought four rental properties in neighborhoods in the state more than 10 years ago and said he planned to keep them for decades more. Now the houses are worth far less than he owes, his rents have tumbled, and he has to spend about $20,000 a year to keep them operating.How can this be? I'd like to know more. I wonder how far rents have fallen in "over 10 years", and if Russell took out money during the housing boom. This doesn't appear to add up ...

Russell ... said two houses are in foreclosure and he can’t afford to keep them without the federal government’s help.

Sunday, March 04, 2012

The Fed and QE3

by Calculated Risk on 3/04/2012 06:03:00 PM

I always read Jon Hilsenrath's articles on the Fed very closely. Right now the Fed seems uncertain about QE3, and the decision remains data dependent (as always) ... from Hilsenrath at the WSJ: Fed Takes a Break To Weigh Outlook

Fed officials meeting next week are unlikely to take any new actions to spur the recovery, and they are likely to emerge with a slightly more upbeat—but still very guarded—assessment of the economy's performance.Several economists still expect QE3 to be announced at one of the two day meetings in April or June - or maybe in Q3.

...

A big question is whether the Fed will launch a new bond-buying program in an effort to push down already low long-term interest rates.

...

Mr. Bernanke signaled to Congress last week that he had doubts about the sustainability of the employment gains. Fed officials aren't inclined to move while they try to solve the puzzle. "In light of the somewhat different signals received recently from the labor market than from indicators of final demand and production," he said, "it will be especially important to evaluate incoming information to assess the underlying pace of economic recovery."

Goldman Sachs economists wrote on Friday:

We expect that the Fed will ultimately announce a return to balance sheet expansion sometime in the first half of 2012, likely including purchases of mortgagebacked securities (MBS).And Merrill Lynch noted last week:

In our view, it is wishful thinking to believe the Fed will do QE when the data flow is healthy. We expect renewed QE only after Operation Twist ends in June ... only if the economy is slowing ... Under our growth forecast ... QE3 comes in September.If the economy slows, and key inflation measures start falling again - then QE3 is very likely. But right now, with most data a little better than expected, and inflation a little higher than the Fed's target, the Fed is back to "wait and see". The next FOMC meeting is on Tuesday March 13th.

Yesterday:

• Summary for Week ending March 2nd

• Schedule for Week of March 4th

Report: Small Businesses added 45,000 jobs in February

by Calculated Risk on 3/04/2012 01:17:00 PM

From Reuters: 45,000 Jobs Added By Small Businesses in US

U.S. small businesses added 45,000 employees in February and offered workers more money even as working hours were little changed ... payrolls processing firm Intuit said.Graphs for the Intuit Small Business index are here.

January's small business employment had previously been reported to have increased 50,000.

The Intuit survey is based on responses from about 72,000 small businesses with fewer than 20 employees that use the Intuit Online Payroll system.

Note: This is based on Intuit users, however, as Intuit notes: "Employment for Intuit Online Payroll customers is growing much faster than employment at the average small business." Another small business report, the monthly NFIB survey, has shown much slower growth for small businesses. But the NFIB survey has a very large percentage of real estate related small businesses - and that probably accounts for a large portion of the difference.

The BLS will report on Friday, and the consensus is for an increase of 204,000 non-farm payroll jobs in February.