by Calculated Risk on 2/14/2012 08:00:00 AM

Tuesday, February 14, 2012

NFIB: Small Business Optimism Index increases slightly in January

From the National Federation of Independent Business (NFIB): Small Business Confidence in a Lull

Rising just one tenth of one percent in January, the Small-Business Optimism Index settled at 93.9, a slight increase from the December 2011 reading, according to the National Federation of Independent Business (NFIB). While the increase marks five consecutive months of improvement, the readings from January and February 2011 were higher, indicated no net gain for the calendar year. Historically, optimism remains at recession levels. While owners appeared less pessimistic about the outlook for business conditions and real sales growth, that optimism did not materialize in hiring or increased inventories plans.Note: Small businesses have a larger percentage of real estate and retail related companies than the overall economy.

“The most positive statement that can be made about January’s reading is that the Index did not go down; a change of 0.1 points is essentially no change and it is hardly indicative of a surge in economic activity,” said NFIB Chief Economist Bill Dunkelberg.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the small business optimism index since 1986. The index increased to 93.9 in January from 93.8 in December. This is the fifth increase in a row after declining for six consecutive months.

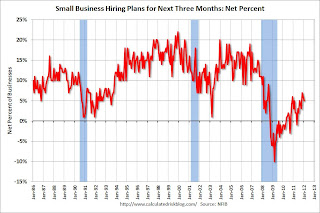

The second graph shows the net hiring plans for the next three months.

Hiring plans declined slightly in January, but the trend is up.

Hiring plans declined slightly in January, but the trend is up. According to NFIB: “Over the next three months, 13 percent plan to increase employment (up 4 points), and 7 percent plan to reduce their workforce (down 1 point), yielding a seasonally adjusted net 5 percent of owners planning to create new jobs, a 1 point decline from December. There is no surge in hiring indicated by these numbers..."

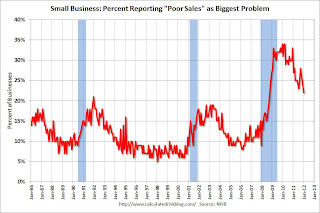

Twenty two percent of small business owners reported that weak sales continued to be their top business problem in January. Currently 18% are reporting taxes as the most important problem, and 20% are reporting regulations - just below the 23% reporting "poor sales".

In good times, small business owners usually report taxes and regulation as their biggest problems. This is another small sign of improvement for small businesses, but lack of demand is still the key problem.

In good times, small business owners usually report taxes and regulation as their biggest problems. This is another small sign of improvement for small businesses, but lack of demand is still the key problem.The optimism index declined sharply in August due to the debt ceiling debate and has now rebounded to about the same level as early in 2011. This index is still low - probably due to a combination of sluggish growth, and the high concentration of real estate related companies in the index.

Monday, February 13, 2012

SF Fed President Williams: "Vital that we keep the monetary policy throttle wide open"

by Calculated Risk on 2/13/2012 10:37:00 PM

From San Francisco Fed President John Williams: The Federal Reserve’s Mandate and Best Practice Monetary Policy. Excerpt:

What does this tell us about where monetary policy should be now? Inflation in 2012 and 2013 is likely to come in around 1½ percent, below the FOMC’s 2 percent target. And clearly, with unemployment at 8.3 percent, we are very far from maximum employment. At the San Francisco Fed, our forecast is that the unemployment rate will remain well over 7 percent for several more years.QE3 is coming.

This is a situation in which there’s no conflict between maximum employment and price stability. With regard to both of the Fed’s mandates, it’s vital that we keep the monetary policy throttle wide open. This will help lower unemployment and raise inflation back toward levels consistent with our mandates. And we want to do so quickly to minimize total economic damage. The longer we miss our objectives, the larger the cumulative loss to the economy.

Williams also provides an excellent discussion on "price stability":

What objective should we seek for the rate of increase of average prices? Should we strive for no change at all, that is, zero inflation? At first blush, that seems sensible. But, there are a number of reasons why aiming for zero inflation would be too low and inconsistent with our maximum employment mandate. Here I’ll mention two.

First, a small amount of inflation can help grease the wheels of the labor market. There is considerable evidence that nominal wages don’t easily fall even when demand is weak, something economists call downward wage rigidity. In other words, it’s unusual for workers to have the dollar value of their wages reduced. In this regard, wages are very different from, say, airline ticket prices, which are quickly discounted when seats can’t be filled. Weak labor demand may necessitate a reduction in real wages, that is, wages adjusted for inflation. Even if the nominal, or dollar value, of wages won’t budge, the real wage will fall as prices rise. As a result, a little bit of inflation can help the labor market adjust to negative shocks and, in this way, help keep employment closer to its maximum level.

Second, a small amount of inflation gives the Fed a little more maneuvering room to respond to negative shocks to the economy. The problem is that nominal interest rates can’t go below zero. Economists refer to that limit as the zero lower bound. Let me define terms. The nominal interest rate can be divided into its two components: the real, or inflation-adjusted, interest rate; and expected inflation. A little bit of inflation tends to raise nominal rates on average in order to provide a positive yield to investors. That gives the Fed more room to lower interest rates in a recession before hitting the zero lower bound.

Europe Update: Downgrades, Greek Aid may be conditional

by Calculated Risk on 2/13/2012 08:57:00 PM

From the NY Times: 6 European Nations Get Downgrades

Moody’s Investors Service cut the debt ratings on Monday of six European countries, including Italy, Spain and Portugal, and became the first big ratings agency to switch Britain’s outlook to negative.Via the Financial Times Alphaville, here is the Moody's document: Moody's adjusts ratings of 9 European sovereigns to capture downside risks

...

Moody’s downgraded Spain to A3 from A1 with a negative outlook; Italy to A3 from A2 with a negative outlook; and Portugal to Ba3 from Ba2 with a negative outlook. The agency also lowered the ratings for Malta, Slovakia and Slovenia.

Moody’s revised to negative its outlook on Britain, France and Austria, which have the agency’s top Aaa rating.

From the Financial Times: EU tries to finalise €130bn Greek bail-out. The FT reports that if Germany is not convinced that Greece is taking action, then the bail-out might be given "conditional approval" and be reassessed at the next week.

In that case, ministers would only give the go-ahead for a critical part of the new bail-out, a €200bn restructuring of privately held debt which must begin in a matter of days ...So the next key date is Wednesday (they are running out of time for the "Private Sector Involvement"), and then another key date next week if the approval is conditional.

excerpt with permission

Housing: Short Sales increase, Foreclosure Sales down Year-over-year

by Calculated Risk on 2/13/2012 03:39:00 PM

CR Note: There are only a few areas where the MLS breaks down monthly sales by foreclosure, short sales and conventional (non-distressed) sale. I've been tracking the Sacramento market to watch for changes in the mix over time. (here was my post this morning: Distressed House Sales using Sacramento Data)

Economist Tom Lawler sent me the following table today for several other areas. For most of the areas (with the exception of Reno), the distressed share of sales is down from January 2011. The share of short sales has increased in most areas, while the share of foreclosure sales are down - and down significantly in some areas.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | ||||

|---|---|---|---|---|---|---|

| 11-Jan | 12-Jan | 11-Jan | 12-Jan | 11-Jan | 12-Jan | |

| Las Vegas | 26.6% | 28.1% | 48.8% | 45.5% | 75.4% | 73.6% |

| Reno | 40.0% | 37.0% | 37.0% | 40.0% | 77.0% | 77.0% |

| Phoenix | 22.6% | 29.8% | 47.6% | 27.9% | 70.2% | 57.7% |

| Sacramento | 25.6% | 32.1% | 47.6% | 34.5% | 73.2% | 66.6% |

| Minneapolis | 15.6% | 16.2% | 45.3% | 39.1% | 60.9% | 55.3% |

| Mid-Atlantic (MRIS) | 14.7% | 16.4% | 26.7% | 16.9% | 41.4% | 33.3% |

Note: The table is a percentage of total sales.

The general trend is short sales are up, and foreclosure sales are down - and total distressed sales are down too, although this could be related to the foreclosure process issues.

Residential Remodeling Index increases 22.8% year-over-year in December

by Calculated Risk on 2/13/2012 12:41:00 PM

The BuildFax Residential Remodeling Index was at 127.4 in December, down from 137.9 in November, but up 22.8% from December 2010. This is based on the number of properties pulling residential construction permits in a given month.

From BuildFax Remodeling Index

The Residential BuildFax Remodeling Index is up 22.8% year-over-year in December 2011 at 127.4 points. Residential remodels in December were down month-over-month 10.5 points (7.6%) from the November value of 137.9, and up year-over-year 23.6 points from the December 2010 value of 103.8.

...

“Remodeling activity slowed from November to December 2011 as it did in 2010 ─ an expected change seen in previous years around the holidays. The BuildFax Remodeling Index is still showing notable year-over-year growth,” said Joe Emison, Vice President of Research and Development at BuildFax.

Click on graph for larger image.

Click on graph for larger image.Although the index declined in December from November, this is the highest level for a December since the index started in 2004, even above the levels from 2004 through 2006 during the home equity ("home ATM") withdrawal boom.

Starting next month, BuildFax will release a seasonally adjusted index.

Note: Permits are not adjusted by value, so this doesn't mean there is more money being spent, just more permit activity. Also some smaller remodeling projects are done without permits and the index will miss that activity.

Since there is a strong seasonal pattern for remodeling, the second graph shows the year-over-year change from the same month of the previous year.

Since there is a strong seasonal pattern for remodeling, the second graph shows the year-over-year change from the same month of the previous year.The remodeling index is up 22.8% from December 2010. This is the 26th consecutive month with a year-over-year increase.

For residential investment, multi-family construction and home improvement have already picked up, and it appears single family construction will increase in 2012.

Data Source: BuildFax, Courtesy of Index.BuildFax.com

Distressed House Sales using Sacramento Data for January

by Calculated Risk on 2/13/2012 09:53:00 AM

I've been following the Sacramento market to look for changes in the mix of house sales in a distressed area over time (conventional, REOs, and short sales). The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

This will be interesting once something changes significantly. So far there has been a shift from REO to short sales, and the percentage of distressed sales has declined year-over-year. The percent of distressed sales in Sacramento increased in January compared to December 2011; the normal seasonal pattern. Usually January has the largest percentage of short sales for the year.

In January 2012, 66.6% of all resales (single family homes and condos) were distressed sales. This was down from 73.1% in January 2011, and the lowest percentage of January distressed sales since Sacramento started breaking out the data.

Here are the statistics.

This graph shows the percent of REO sales, short sales and conventional sales. There is a seasonal pattern for conventional sales (stronger in the spring and summer), and distressed sales happen all year - so the percentage of distressed sales decreases every summer and the increases in the fall and winter.

Total sales were up 4.7% compared to January 2011. Active Listing Inventory declined 49.4% from last January, and total inventory, including "short sale contingent", was off almost 30% year-over-year.

Cash buyers accounted for 32.4% of all sales (frequently investors), and median prices are off 5.9% from last January.

This data might be helpful in determining when the market is improving. So far it looks like REO sales have declined, partially offset by an increase in short sales, and a small decline in the total percent of distressed sales. This data might also show if there is a surge in distressed sales following the mortgage servicer settlement.

Also inventory has plummeted - even inventory including "short sale contingent" listings.

Mortgage Servicer Settlement by State

by Calculated Risk on 2/13/2012 08:49:00 AM

SNL Financial put together a list of the settlement by state.

From Lindsey White and Sam Carr at SNL: In foreclosure deal, California, Florida come out on top

The accounting in the settlement is somewhat confusing. The much-quoted $25 billion figure includes $17 billion that banks must spend on a variety of programs to help beleaguered borrowers. Banks will receive credits for each dollar spent. "Sometimes they get a dollar for dollar credit, sometimes they get 45 cents on the dollar, sometimes they get 10 cents on the dollar," Iowa Attorney General Tom Miller explained during a press conference. "The benefit to homeowners on the full dollar amount is $32 billion." In addition, the deal includes $3 billion dedicated to refinancing loans and $5 billion to be paid to federal and state governments.See the article for the list.

Using these figures, the settlement totals closer to $40 billion. California will receive up to $18 billion ... Florida Attorney General Pam Bondi estimated that her state will get $8.4 billion in the deal.

The housing markets in Arizona and Nevada were also hit hard by the crisis. The states stand to receive $1.6 billion and $1.5 billion, respectively.

Weekend:

• Summary for Week ending February 10th

• Schedule for Week of February 12th

Sunday, February 12, 2012

Sunday Night Futures

by Calculated Risk on 2/12/2012 10:48:00 PM

From the Financial Times Alphaville: One Greek hurdle down, but more ahead

[F]rom the WSJ — here’s something we suspect ... won’t be viewed favourably by the EU and IMF:The Asian markets are mostly green tonight. The Nikkei is up about 0.5%, and the Hang Seng is up 0.7%.But in a sign of the intense public pressure facing Greek politicians, Antonis Samaras, leader of New Democracy and likely the next prime minister, said the measures should be renegotiated after national elections expected in April. ...The Euro rallied slightly on news of the vote, but as Reuters reported earlier in the day, there is much work left to be done:

Euro-zone finance ministers will meet on Wednesday in Brussels to sign off on the deal. Their expected approval will trigger an offer to private-sector holders of Greek government bonds, who will be asked to exchange their existing bonds for new bonds with half the face value.There are more immediate hurdles as euro zone finance ministers, who are expected to meet later in the week to sign off on the deal, have told Athens it must also explain 325 million euros ($430 million) out of this year’s total budget cuts will be achieved before the bailout is agreed.

Highlighting the exasperation on the side of paymaster, German Finance Minister Wolfgang Schaeuble said in an interview with German newspaper Welt am Sonntag that Greek promises on austerity measures are no longer good enough because so many vows have been broken and the country has to dramatically change its ways.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P 500 futures are up 8 and Dow futures are up 60.

Oil: WTI futures are up to $99.61 and Brent is up to $118.27 per barrel.

Yesterday:

• Summary for Week ending February 10th

• Schedule for Week of February 12th

Greece: NY Times reports Austerity has Passed

by Calculated Risk on 2/12/2012 06:00:00 PM

The vote just finished, and the NY Times is reporting the austerity bill has passed.

From Athens News: Live news blog, Feb 12-13

In the final tally, 199 MPs voted in favour and 74 against the second bailout memorandum.The next key date is Thursday. From the NY Times: Greek Protesters Clash With Police Before Vote

Parliament voted in favor of new austerity bill. All of KKE, Syriza and Democratic Left MPs voted No, as well as 21 New Democracy MPs (one in four- ND has 83 MPs in total) and 13 Pasok MPs. Laos MPs voted No, leader absent, the two former ministers voted Yes. All but one Democratic Alliance MPs voted Yes.

“The reason for the urgency is that by Thursday the euro group must approve the release of rescue funding,” Mr. Venizelos said.

The push was also needed, he said, to meet a March 5 deadline to swap bonds between the government and private debt holders. That debt swap, Mr. Venizelos said, would allow Greece to make a $19 billion bond payment on March 20 to avoid default.

Economic Analysis and Inaccurate Numbers

by Calculated Risk on 2/12/2012 01:05:00 PM

Someone sent me an article by Dylan Ratigan in the HuffPo: On the Mortgage Settlement: There Is No Political Solution to a Math Problem

Unfortunately some of the numbers are incorrect.

Ratigan wrote:

"Roughly half of homeowners with mortgages are underwater, which means they owe more than they own ..."This is way too high. According to Zillow, 28.6 percent of all single-family homes with mortgages had negative equity in Q3 2011. And according to CoreLogic, "10.7 million, or 22.1 percent, of all residential properties with a mortgage were in negative equity at the end of the third quarter of 2011".

And many of these homeowners were only slightly underwater, and will probably keep making their mortgages payments (especially if they are eligible for the new HARP program).

And on the employment-population ratio and the participation rate:

[T]his is by far the worst recovery we've had since the end of World War II. The best way to measure this is not through traditional unemployment indices (which can be gamed), but by asking the question of how many Americans are working as a percentage of the population. In 2007, this was 63 out of 100. Today, it's a full five percentage points lower. The ratio hasn't been this bad since the early 1980s recession, and remember, we're in a recovery. And the labor force participation rate is dropping, which is a long-term bigger crisis.Ratigan is referring to the employment-population ratio, but as I've pointed out several times, this ratio is being impacted by demographics. A decline in the participation rate has been predicted for years, and a decline in the participation rate pushes down the overall employment-population ratio. So the employment-population ratio is not "the best way" to measure the recovery, and the decline in the participation rate is not a "crisis".

Click on graph for larger image.

Click on graph for larger image. During this period of a significant shift in demographics, it helps to look at the employment-population ratio for the prime working age group (25 to 54 years old). This leaves out most changes in demographics (although this can be impacted by the ratio of men to women in the prime working age cohort and other factors).

For this key demographic, it appears the employment situation for men is improving a little, but the employment situation for women is still lagging behind.

Ratigan also wrote:

[R]oughly thirty million jobs ... will bring America back to full employment.Currently, according to the BLS household report, there are 12.8 million unemployed out of a labor force of 154.4 million, or about 8.3% unemployed. If full unemployment is 5% (structural unemployment is probably a little higher), then the US economy is short 5 million jobs - not 30 million.

Based on his comment about the employment-population ratio and the participation rate, Ratigan is probably expecting the participation rate to increase significantly. That isn't going to happen (see this post).

There are plenty of issues currently with negative equity and unemployment, but it is important to get the size of the problems correct.

Yesterday:

• Summary for Week ending February 10th

• Schedule for Week of February 12th