by Calculated Risk on 2/13/2012 09:53:00 AM

Monday, February 13, 2012

Distressed House Sales using Sacramento Data for January

I've been following the Sacramento market to look for changes in the mix of house sales in a distressed area over time (conventional, REOs, and short sales). The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

This will be interesting once something changes significantly. So far there has been a shift from REO to short sales, and the percentage of distressed sales has declined year-over-year. The percent of distressed sales in Sacramento increased in January compared to December 2011; the normal seasonal pattern. Usually January has the largest percentage of short sales for the year.

In January 2012, 66.6% of all resales (single family homes and condos) were distressed sales. This was down from 73.1% in January 2011, and the lowest percentage of January distressed sales since Sacramento started breaking out the data.

Here are the statistics.

This graph shows the percent of REO sales, short sales and conventional sales. There is a seasonal pattern for conventional sales (stronger in the spring and summer), and distressed sales happen all year - so the percentage of distressed sales decreases every summer and the increases in the fall and winter.

Total sales were up 4.7% compared to January 2011. Active Listing Inventory declined 49.4% from last January, and total inventory, including "short sale contingent", was off almost 30% year-over-year.

Cash buyers accounted for 32.4% of all sales (frequently investors), and median prices are off 5.9% from last January.

This data might be helpful in determining when the market is improving. So far it looks like REO sales have declined, partially offset by an increase in short sales, and a small decline in the total percent of distressed sales. This data might also show if there is a surge in distressed sales following the mortgage servicer settlement.

Also inventory has plummeted - even inventory including "short sale contingent" listings.

Mortgage Servicer Settlement by State

by Calculated Risk on 2/13/2012 08:49:00 AM

SNL Financial put together a list of the settlement by state.

From Lindsey White and Sam Carr at SNL: In foreclosure deal, California, Florida come out on top

The accounting in the settlement is somewhat confusing. The much-quoted $25 billion figure includes $17 billion that banks must spend on a variety of programs to help beleaguered borrowers. Banks will receive credits for each dollar spent. "Sometimes they get a dollar for dollar credit, sometimes they get 45 cents on the dollar, sometimes they get 10 cents on the dollar," Iowa Attorney General Tom Miller explained during a press conference. "The benefit to homeowners on the full dollar amount is $32 billion." In addition, the deal includes $3 billion dedicated to refinancing loans and $5 billion to be paid to federal and state governments.See the article for the list.

Using these figures, the settlement totals closer to $40 billion. California will receive up to $18 billion ... Florida Attorney General Pam Bondi estimated that her state will get $8.4 billion in the deal.

The housing markets in Arizona and Nevada were also hit hard by the crisis. The states stand to receive $1.6 billion and $1.5 billion, respectively.

Weekend:

• Summary for Week ending February 10th

• Schedule for Week of February 12th

Sunday, February 12, 2012

Sunday Night Futures

by Calculated Risk on 2/12/2012 10:48:00 PM

From the Financial Times Alphaville: One Greek hurdle down, but more ahead

[F]rom the WSJ — here’s something we suspect ... won’t be viewed favourably by the EU and IMF:The Asian markets are mostly green tonight. The Nikkei is up about 0.5%, and the Hang Seng is up 0.7%.But in a sign of the intense public pressure facing Greek politicians, Antonis Samaras, leader of New Democracy and likely the next prime minister, said the measures should be renegotiated after national elections expected in April. ...The Euro rallied slightly on news of the vote, but as Reuters reported earlier in the day, there is much work left to be done:

Euro-zone finance ministers will meet on Wednesday in Brussels to sign off on the deal. Their expected approval will trigger an offer to private-sector holders of Greek government bonds, who will be asked to exchange their existing bonds for new bonds with half the face value.There are more immediate hurdles as euro zone finance ministers, who are expected to meet later in the week to sign off on the deal, have told Athens it must also explain 325 million euros ($430 million) out of this year’s total budget cuts will be achieved before the bailout is agreed.

Highlighting the exasperation on the side of paymaster, German Finance Minister Wolfgang Schaeuble said in an interview with German newspaper Welt am Sonntag that Greek promises on austerity measures are no longer good enough because so many vows have been broken and the country has to dramatically change its ways.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P 500 futures are up 8 and Dow futures are up 60.

Oil: WTI futures are up to $99.61 and Brent is up to $118.27 per barrel.

Yesterday:

• Summary for Week ending February 10th

• Schedule for Week of February 12th

Greece: NY Times reports Austerity has Passed

by Calculated Risk on 2/12/2012 06:00:00 PM

The vote just finished, and the NY Times is reporting the austerity bill has passed.

From Athens News: Live news blog, Feb 12-13

In the final tally, 199 MPs voted in favour and 74 against the second bailout memorandum.The next key date is Thursday. From the NY Times: Greek Protesters Clash With Police Before Vote

Parliament voted in favor of new austerity bill. All of KKE, Syriza and Democratic Left MPs voted No, as well as 21 New Democracy MPs (one in four- ND has 83 MPs in total) and 13 Pasok MPs. Laos MPs voted No, leader absent, the two former ministers voted Yes. All but one Democratic Alliance MPs voted Yes.

“The reason for the urgency is that by Thursday the euro group must approve the release of rescue funding,” Mr. Venizelos said.

The push was also needed, he said, to meet a March 5 deadline to swap bonds between the government and private debt holders. That debt swap, Mr. Venizelos said, would allow Greece to make a $19 billion bond payment on March 20 to avoid default.

Economic Analysis and Inaccurate Numbers

by Calculated Risk on 2/12/2012 01:05:00 PM

Someone sent me an article by Dylan Ratigan in the HuffPo: On the Mortgage Settlement: There Is No Political Solution to a Math Problem

Unfortunately some of the numbers are incorrect.

Ratigan wrote:

"Roughly half of homeowners with mortgages are underwater, which means they owe more than they own ..."This is way too high. According to Zillow, 28.6 percent of all single-family homes with mortgages had negative equity in Q3 2011. And according to CoreLogic, "10.7 million, or 22.1 percent, of all residential properties with a mortgage were in negative equity at the end of the third quarter of 2011".

And many of these homeowners were only slightly underwater, and will probably keep making their mortgages payments (especially if they are eligible for the new HARP program).

And on the employment-population ratio and the participation rate:

[T]his is by far the worst recovery we've had since the end of World War II. The best way to measure this is not through traditional unemployment indices (which can be gamed), but by asking the question of how many Americans are working as a percentage of the population. In 2007, this was 63 out of 100. Today, it's a full five percentage points lower. The ratio hasn't been this bad since the early 1980s recession, and remember, we're in a recovery. And the labor force participation rate is dropping, which is a long-term bigger crisis.Ratigan is referring to the employment-population ratio, but as I've pointed out several times, this ratio is being impacted by demographics. A decline in the participation rate has been predicted for years, and a decline in the participation rate pushes down the overall employment-population ratio. So the employment-population ratio is not "the best way" to measure the recovery, and the decline in the participation rate is not a "crisis".

Click on graph for larger image.

Click on graph for larger image. During this period of a significant shift in demographics, it helps to look at the employment-population ratio for the prime working age group (25 to 54 years old). This leaves out most changes in demographics (although this can be impacted by the ratio of men to women in the prime working age cohort and other factors).

For this key demographic, it appears the employment situation for men is improving a little, but the employment situation for women is still lagging behind.

Ratigan also wrote:

[R]oughly thirty million jobs ... will bring America back to full employment.Currently, according to the BLS household report, there are 12.8 million unemployed out of a labor force of 154.4 million, or about 8.3% unemployed. If full unemployment is 5% (structural unemployment is probably a little higher), then the US economy is short 5 million jobs - not 30 million.

Based on his comment about the employment-population ratio and the participation rate, Ratigan is probably expecting the participation rate to increase significantly. That isn't going to happen (see this post).

There are plenty of issues currently with negative equity and unemployment, but it is important to get the size of the problems correct.

Yesterday:

• Summary for Week ending February 10th

• Schedule for Week of February 12th

Unofficial Problem Bank list unchanged at 958 Institutions

by Calculated Risk on 2/12/2012 09:25:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Feb 10, 2012. (table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

Something new and unusual happened to the Unofficial Problem Bank List since its publication, the institution count was unchanged for two consecutive weeks. This week there were two removals and two additions, which leaves the list at 958 institutions. Assets were virtually unchanged as well at $389.6 billion. A year ago, the list held 944 institutions with assets of $412.95 billion.Yesterday:

The two removals that came from failure are SCB Bank, Shelbyville, IN ($200 million Ticker: BRBI) and Charter National Bank and Trust, Hoffman Estates, IL ($98 million). The two additions are Alliance Bank & Trust Company, Gastonia, NC ($216 million Ticker: ABTO) and United Bank of Philadelphia, Philadelphia, PA ($78 million). Next week, we anticipate the OCC will release its actions through mid-January 2012.

• Summary for Week ending February 10th

• Schedule for Week of February 12th

Saturday, February 11, 2012

Greek Parliament to vote Sunday at Midnight (5 PM ET)

by Calculated Risk on 2/11/2012 10:52:00 PM

From the WSJ: Greek Party Leaders Urge Yes Vote on Austerity

The bills that will be voted on midnight Sunday include a set of austerity cuts, structural reforms and the terms of a debt restructuring. They need to get a majority in parliament if Greece is to receive a second, EUR130-billion ($171 billion) bailout from its official-sector creditors, the European Union, the European Central Banks and the International Monetary Fund.From the Athens News: PM warns of collapse if bailout deal rejected

"This agreement will decide the country's future," [Prime minister Lucas Papademos] said. "We are just a breath away from ground zero."From the New York Times: Greek Leaders Urge Lawmakers to Approve Debt Deal

"A disorderly default would set the country on a disastrous adventure," Papademos said. "Living standards would collapse and it would lead sooner or later to an exit from the euro."

Failing to adopt the bill, he said, "would disrupt imports of fuel, medicine and machinery".

Earlier:

• Summary for Week ending February 10th

• Schedule for Week of February 12th

Schedule for Week of February 12th

by Calculated Risk on 2/11/2012 01:36:00 PM

Earlier:

• Summary for Week ending February 10th

The key reports this week are January retail sales on Tuesday, and January housing starts on Thursday. The NAHB builder confidence report for February will be released on Wednesday.

For manufacturing, the February NY Fed (Empire state) and Philly Fed surveys, and the January Industrial Production and Capacity Utilization report will be released this week.

On prices, the January Producer Price index (PPI) will be released Thursday, and CPI will be released on Friday.

No economic releases scheduled.

7:30 AM: NFIB Small Business Optimism Index for January.

7:30 AM: NFIB Small Business Optimism Index for January. Click on graph for larger image in graph gallery.

This graph shows the small business optimism index since 1986. The index increased to 93.8 in December from 92.0 in November. That was the fourth increase in a row after declining for six consecutive months. The consensus is for an increase to 95.0.

8:30 AM: Retail Sales for January.

8:30 AM: Retail Sales for January. This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline). Retail sales are up 20.4% from the bottom, and now 5.9% above the pre-recession peak (not inflation adjusted).

The consensus is for retail sales to increase 0.7% in January, and for retail sales ex-autos to increase 0.5%.

9:00 AM: Ceridian-UCLA Pulse of Commerce Index™ This is the diesel fuel index for January (a measure of transportation).

10:00 AM: Manufacturing and Trade: Inventories and Sales for December (Business inventories). The consensus is for 0.4% increase in inventories.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index was especially weak last year, although this does not include all the cash buyers.

8:30 AM ET: NY Fed Empire Manufacturing Survey for February. The consensus is for a reading of +14.1, up from +13.5 in January (above zero is expansion).

9:15 AM ET: The Fed will release Industrial Production and Capacity Utilization for January.

9:15 AM ET: The Fed will release Industrial Production and Capacity Utilization for January. This shows industrial production since 1967. Industrial production increased in December to 95.3, and previous months were revised up slightly.

The consensus is for a 0.6% increase in Industrial Production in December, and for Capacity Utilization to increase to 78.6% (from 78.1%).

10:00 AM: The February NAHB homebuilder survey. The consensus is for a reading of 26, up slightly from 25 in January. Although this index has been increasing lately, any number below 50 still indicates that more builders view sales conditions as poor than good.

2:00 PM: FOMC Minutes, Meeting of January 24-25, 2010.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for an increase to 365,000 from 358,000 last week.

8:30 AM: Housing Starts for January.

8:30 AM: Housing Starts for January. This shows the huge collapse following the housing bubble, and that total housing starts have been increasing a little lately, but have mostly moved sideways for about two years and a half years. Multi-family starts increased in 2011 - although from a very low level. Single family starts appear to be increasing lately, but are still mostly "moving sideways".

The consensus is for an increase in total housing starts to 670,000 (SAAR) from 657,000 (SAAR) in December.

8:30 AM: Producer Price Index for January. The consensus is for a 0.3% increase in producer prices (0.1% increase in core).

9:00 AM: Fed Chairman Ben Bernanke speaks: "Community Banking" At the FDIC Conference on the Future of Community Banking, Arlington, Virginia

10:00 AM: Philly Fed Survey for February. The consensus is for a reading of 8.4, up from 7.3 last month (above zero indicates expansion).

10:00 AM: Mortgage Bankers Association (MBA) 4th Quarter 2011 National Delinquency Survey (NDS).

This graph shows the percent of loans delinquent by days past due in Q3. Based on other data, the delinquency rate probably was unchanged or only declined slightly in Q4.

This graph shows the percent of loans delinquent by days past due in Q3. Based on other data, the delinquency rate probably was unchanged or only declined slightly in Q4.However the key problem is the large number of seriously delinquent loans (90+ days and in the foreclosure process). With the mortgage servicer settlement, the delinquency rate will probably start falling faster by mid-2012 (a combination of more modifications and more foreclosures).

8:30 AM: Consumer Price Index for January. The consensus is a 0.3% increase in prices. The consensus for core CPI to increase 0.2%.

10:00 AM: Conference Board Leading Indicators for January. The consensus is for a 0.5% increase in this index.

Summary for Week ending February 10th

by Calculated Risk on 2/11/2012 08:05:00 AM

This was a light week for economic data; however there were two significant economic developments: 1) the long awaited mortgage servicer settlement agreement was announced, and 2) there was some progress with the Greek debt discussions – although there is more drama ahead.

A key economic question is the impact of the settlement on delinquencies and foreclosure activity, and by extension, on housing and the economy. This settlement should lead to both more modifications and more foreclosures, and for a decline in the number of seriously delinquent mortgages. It isn't clear how many more REOs will be on the market this year, but I don't expect a flood of REOs as happened in late 2008 and early 2009.

The data was mixed last week. The trade deficit was higher than expected, consumer confidence fell a little more than expected, but initial weekly unemployment claims fell again – and the four week average declined to the lowest level since May 2008.

Next week will be busy!

Here is a summary in graphs:

• Trade Deficit increased in December to $48.8 Billion

The trade deficit was slightly above the consensus forecast of $48.5 billion.

Click on graph for larger image.

Click on graph for larger image.

The first graph shows the monthly U.S. exports and imports in dollars through November 2011. Both exports and imports increased in December. Imports stalled in the middle of 2011, but increased towards the end of the year (seasonally adjusted). Exports are well above the pre-recession peak and up 9% compared to December 2010; imports are up about 11% compared to December 2010.

The second graph shows the U.S. trade deficit, with and without petroleum, through December.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

Oil averaged $104.13 per barrel in December. The trade deficit with China declined to $23 billion, but hit an annual record in 2011.

Exports to eurozone countries increased slightly in December after declining sharply in November.

• Weekly Initial Unemployment Claims decline to 358,000

Here is a long term graph of weekly claims:

Here is a long term graph of weekly claims:The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week to 366,250.

The 4-week moving average is at the lowest level since May 2008.

• BLS: Job Openings increased in December

From the BLS: Job Openings and Labor Turnover Summary

From the BLS: Job Openings and Labor Turnover Summary There were 3.4 million job openings on the last business day of December, up from 3.1 million in November, the U.S. Bureau of Labor Statistics reported today.This graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

Although the number of job openings remained below the 4.4 million openings when the recession began in December 2007, the number of job openings has increased 39 percent since the end of the recession in June 2009.

Jobs openings increased in December, and the number of job openings (yellow) has generally been trending up, and are up about 15% year-over-year compared to December 2010.

Quits declined slightly in December, but have mostly been trending up - quits are now up about 5% year-over-year. These are voluntary separations and more quits might indicate some improvement in the labor market. (see light blue columns at bottom of graph for trend for "quits").

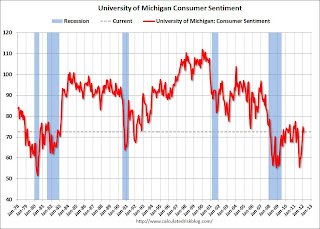

• Consumer Sentiment declines in February to 72.5

The preliminary Reuters / University of Michigan consumer sentiment index for February declined to 72.5, down from the January reading of 75.0.

The preliminary Reuters / University of Michigan consumer sentiment index for February declined to 72.5, down from the January reading of 75.0.Overall sentiment is still fairly weak, although sentiment has rebounded from the decline last summer. This was below the consensus forecast of a decline to 74.3.

• Other Economic Stories ...

• Hotels: RevPAR increases 8.7% compared to same week in 2011

• MBA: Refinance activity increases as mortgage rates fall to record low

• Goldman: No Labor Force Participation Rebound in Sight

• Housing: The Two Bottoms

Friday, February 10, 2012

Late Night Reading: Greek Agreement with Troika

by Calculated Risk on 2/10/2012 11:13:00 PM

For insomniacs, here is the 51 page Memorandum of Understanding on Specific Economic Policy Conditionality between Greece and the troika.

Enjoy.