by Calculated Risk on 2/09/2012 09:41:00 PM

Thursday, February 09, 2012

NAHB: Bernanke speaks on Friday, Multifamily and Remodeling expected to increase in 2012

The NAHB 2012 International Builders’ Show is currently being held in Orlando.

On Friday, Fed Chairman Ben Bernanke will speak at 12:30 PM ET: "Housing Markets in Transition". The speech will be streamed live at www.nahb.org/Bernanke

And the NAHB is expecting continued growth in 2012 for two components of residential investment: Multifamily and remodeling.

From the NAHB Multifamily Industry Stages Strong Recovery but Still Limited by Credit Constraints, Says NAHB

The apartment sector is a bright spot in the overall housing market leading the industry’s path to recovery. ... “[W]e are forecasting construction of 208,000 multifamily residences in 2012 ...” said Sharon Dworkin Bell, NAHB senior vice president for multifamily and 50+ housing.There were 167,400 5+ unit starts in 2011, and only 130,500 completions. 2012 will be another strong year. Economist Tom Lawler is forecasting 225,000 multifamily starts this year.

From the NAHB today: NAHB Foresees Measured Growth in Residential Remodeling

The residential remodeling market will continue to experience measured growth in 2012 after the Remodeling Market Index (RMI) rose to a five year-high at the end of 2011, according to panelists at a press conference held today at the National Association of Home Builders (NAHB) International Builders' Show (IBS) in Orlando, Fla.

...

“Spending on improvements to owner-occupied housing is nearly equal to that of new residential construction,” said Paul Emrath, NAHB’s vice president for survey and housing policy research. “NAHB predicts that residential remodeling will rise 8.9 percent in 2012.”

Mortgage Settlement and Negative Equity

by Calculated Risk on 2/09/2012 05:24:00 PM

I don't think the mortgage servicer settlement alone will have a huge impact on housing or the economy, but I do think the settlement will lead to an increase in the number of modifications, and also an increase in the pace of completed foreclosures.

I've seen several people argue the settlement is too small to have much of an impact on housing. They compare the size of the settlement to overall negative equity. As an example from the Financial Times:

The trouble is that the $32bn is small relative to estimates of a $700bn gap between house values and underwater mortgages: it is just 5 per cent of that total.Note: the $700 billion estimate comes from CoreLogic's Q3 negative equity report.

If we compare the principal reductions to total negative equity, it does seem like a drop in the bucket. However if we think of it terms of a reduction in the number of loans that are 90+ days delinquent and in the foreclosure process, this could be significant.

The FHFA estimates approximately 1 million borrowers will be offered principal reduction modifications, although that estimate may be a little high. Perhaps 500 thousand is a better estimate, and some of them would have received modifications anyway - but the overall number of principal reduction modifications will probably increase by several hundred thousand with the settlement.

Currently, according to LPS, there are 1.79 million loans 90+ days, and 2.07 million in the foreclosure process - or about 3.86 million total seriously delinquent. A few hundred thousand extra modifications would reduce the number of seriously delinquent loans, maybe by 10% (of course some will then re-default).

Also, since there are about 10.7 million borrowers with negative equity, this suggests around 7 million borrowers with negative equity are not seriously delinquent. And that brings us to HARP ...

With the new HARP automated refinancing program coming in March, the borrowers with negative equity and GSE loans will be able to refinance into lower rate mortgages. There borrowers are already current, and if they get a lower mortgage rate (with a faster amortization schedule), they will probably stay current. Not all borrowers with negative equity will eventually default - most won't - and one of the keys to HARP is the shorter amortization schedule that will reduce negative equity fairly quickly. From the FHFA last year:

An important element of these changes is the encouragement, through elimination of certain risk-based fees, for borrowers to utilize HARP to refinance into shorter-term mortgages. Borrowers who owe more on their house than the house is worth will be able to reduce the balance owed much faster if they take advantage of today’s low interest rates by shortening the term of their mortgage.So I expect the number of borrowers with negative equity to decline fairly quickly over the next several years. This will be combination of modifications, foreclosures and refinancing programs.

Another question is: Will the mortgage settlement lead to a flood of foreclosures? It does appear the number of completed foreclosures will increase following this settlement - especially in some judicial states with large backlogs - so there will probably be more REOs (lender Real Estate Owned) for sale. Some of the REO might be sold in bulk as rentals (REO-to-rental program), and the Fed will probably issue guidance to allow servicers to rent REO in heavily impacted areas. It isn't clear how many more REOs will be on the market, but I don't expect a flood of REO as happened in late 2008 and early 2009.

Hotels: RevPAR increases 8.7% compared to same week in 2011

by Calculated Risk on 2/09/2012 01:07:00 PM

From HotelNewsNow.com: STR: Upper-midscale hotels top weekly gains

Overall, the U.S. hotel industry’s occupancy was up 5.5% to 51.7%, its ADR increased 3.1% to US$100.45 and RevPAR was up 8.7% to US$51.98.This is the weak season for hotel occupancy, but this is solid improvement over the same week last year. Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

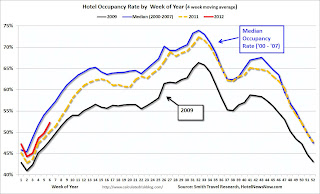

The following graph shows the seasonal pattern for the hotel occupancy rate using a four week average.

Click on graph for larger image.

Click on graph for larger image.The red line is for 2012, yellow is for 2011, blue is "normal" and black is for 2009 - the worst year since the Great Depression for hotels.

Hotel occupancy is running above 2011, but the 4-week average of the occupancy rate is still below normal. Looking forward, business travel usually increases in the March to May period, and it will be interesting to see if the occupancy rate gets close to 64% for that period.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Policy Updates: Mortgage Settlement Reached, Greek politicians agree on Debt Deal

by Calculated Risk on 2/09/2012 10:28:00 AM

Back in January I listed several policies and agreements that were expected soon.

There were several key announcements today:

• From the WSJ: U.S., Banks Agree on Foreclosure Pact

The agreement covers five banks: Ally Financial Inc., Bank of America Corp.,Citigroup Inc., J.P. Morgan Chase & Co., and Wells Fargo & Co. Together, the five handle payments on 55% of all outstanding home loans ...Following this agreement, I expect the lenders to start reducing the foreclosure backlog. This will be a combination of more modifications (with principal reductions) and more foreclosures. In some states - especially judicial states like New York and Florida - this will probably lead to more REO sales (lender Real Estate Owned), but overall I don't think there will be a large flood of REOs on the market.

The agreement will include at least 49 states, and officials were finalizing a separate accord with one remaining holdout, Oklahoma.

Here is the press release from the Dept of Justice: Federal Government and State Attorneys General Reach $25 Billion Agreement with Five Largest Mortgage Servicers to Address Mortgage Loan Servicing and Foreclosure Abuses

• From the WSJ: Greek Political Leaders Reach Austerity Deal

Leaders of political parties backing Greece's caretaker government agreed Thursday on an austerity package to comply with demands set by international creditors for another bailout deal ... Euro-zone finance ministers were set to meet here late Thursday to take stock of the latest political talks in Athens to decide whether to push ahead with new aid for Greece.It seems likely that Greece will receive another round of financing.

• And on the ECB's 3 year Long Term Refinancing Operation (LTRO) from the Financial Times Alphaville: Here be Draghi, on ECB collateral

RTRS-DRAGHI-NEW COLLATERAL RULES WILL BE MORE RISKYThis means more collateral will be acceptable for the second LTRO on Feb 29th. The first 3 year LTRO was for €489 billion, and the second one could be over €1 trillion.

RTRS-DRAGHI=BUT RISK IS BEING MANAGED VERY WELL

RTRS-ECB’S DRAGHI – HAIRCUTS WILL REDUCE NEW COLLATERAL BY TWO-THIRDS

RTRS-ECB’s DRAGHI – EXPECT SUBSTANTIAL TAKEUP IN SECOND 3-YR TENDER, AROUND SAME AS DEC ONE

A few other policies to come:

• A surge in refinance activity in March. Not a new policy - this was announced last October when the FHFA made changes to Home Affordable Refinance Program (HARP) to allow more homeowners with GSE loans and with negative or near negative equity - and who are current on their mortgages - to refinance into lower interest rate loans. But as I mentioned in the January post, the elimination of Reps and warrants for the original loans applies to Desktop Underwriter® (DU) and that will not be updated until March.

• Extension of payroll tax cut and extended unemployment benefits: The two month extension expires Feb 29th, and I expect these two programs will be extended through the end of the year.

Weekly Initial Unemployment Claims decline to 358,000

by Calculated Risk on 2/09/2012 08:30:00 AM

The DOL reports:

In the week ending February 4, the advance figure for seasonally adjusted initial claims was 358,000, a decrease of 15,000 from the previous week's revised figure of 373,000. The 4-week moving average was 366,250, a decrease of 11,000 from the previous week's revised average of 377,250.The previous week was revised up to 373,000 from 367,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week to 366,250.

The 4-week moving average is at the lowest level since May 2008.

And here is a long term graph of weekly claims:

The 4-week average of weekly claims is still moving down and is now well below 400 thousand.

Zillow: House prices declined 4.7% in 2011, Forecasts 3.7% decline in 2012

by Calculated Risk on 2/09/2012 12:01:00 AM

Another view on house prices from Zillow: Home Value Declines Pick Up in Fourth Quarter, But Zillow Forecasts Smaller Declines in 2012

The Zillow Real Estate Market Reports, released today, show home values decreased 1.1 percent from the third to the fourth quarter of 2011 to $146,900. On an annual basis, this represents a 4.7 percent decline. December’s data show that sequential improvements in year-over-year numbers have stopped, and the pace of monthly depreciation has once again picked up, with December’s monthly depreciation rate at 0.6 percent.And from a press release:

...

[W] believe 2012 will be a transitional year for real estate. Positive developments will include markets showing organic growth, and home sales increasing as the year proceeds. However, we maintain our forecast that home values will continue to fall in 2012, with the Zillow Home Value Forecast showing a 3.7 percent decline through December 2012.

...

Based on these forecasts, we expect more home value declines nationally in 2012. However, most markets will see improved trends over the course of the year.

“While it may be disconcerting for homeowners to see values nationally fell at a fairly rapid clip at the end of last year, that trend won’t last through 2012,” said Zillow Chief Economist Dr. Stan Humphries. “The fourth quarter’s weak performance proves that pronouncements of a bottom in home values have been premature, but the good news is that 2012 will prove to be a better year than 2011. In fact, many markets show signs of a bottom this year, although a bottom may continue to elude the nation as a whole in 2012. Fortunately, against a backdrop of modest further declines in home values, we expect that home sales will pick up briskly this year as affordable prices bring more buyers to the table – especially investors and second-home buyers.”

Wednesday, February 08, 2012

WSJ: Mortgage Settlement could be announced Thursday, to include Florida, California, New York

by Calculated Risk on 2/08/2012 07:20:00 PM

From the WSJ: Banks Near $25 Billion Pact on Foreclosure Probe

Government officials are on the verge of an agreement worth as much as $25 billion with five major banks ... Federal officials were planning to announce the accord Thursday morning, but the timing could yet be pushed back as some details had yet to be ironed out. Among them: the precise size of the agreement and the number and identity of participating states.

...

The Obama administration made a full-court press over the past four days to secure the support of key state attorneys general, including those from Florida, California and New York.

All three overcame misgivings about the plan in recent days, people familiar with the situation said.

Las Vegas House sales up 12% YoY in January, Inventory off sharply

by Calculated Risk on 2/08/2012 04:24:00 PM

This is a key distressed market to follow since Las Vegas has seen the largest price decline of any of the Case-Shiller composite 20 cities. Prices, as of the November report, were off 61.6% from the peak according to Case-Shiller, and off 9.2% over the last year. Prices just keep falling. Sales in 2011 were at record levels, more than during the bubble, and it looks like 2012 will be an even stronger year.

From the LVGAR: GLVAR January 2012 Housing Statistics

GLVAR reported that 48,186 local properties were sold in 2011, including 38,153 single-family homes and 10,033 condominiums and townhomes. That broke GLVAR’s all-time sales record set in 2009, when it reported 46,879 total sales. In 2010, GLVAR reported 43,877 total sales.So 73.6% of the sales were distressed, and over half were purchased with cash.

“At the rate we’re going, 2012 has the potential to be another record sales year,” she said.

According to GLVAR, the total number of local homes, condominiums and townhomes sold in the traditionally slow sales month of January was 3,591. That’s down from 4,250 in December 2011, but up from 3,214 total sales in January 2011.

...

The total number of homes listed for sale on GLVAR’s Multiple Listing Service decreased from December to January, with a total of 19,160 single-family homes listed for sale at the end of the month. That’s down 0.4 percent from 19,230 single-family homes listed for sale at the end of December and down 12.9 percent from one year ago. GLVAR reported a total of 4,133 condos and townhomes listed for sale on its MLS at the end of January. That’s up 1.8 percent from 4,061 condos and townhomes listed in December, but down 25.6 percent from one year ago.

...

In January, GLVAR reported that 52.5 percent of all existing homes sold in Southern Nevada were purchased with cash. That’s up from 50.8 percent in December. Meanwhile, 28.1 percent of all existing local homes sold during January were short sales ... Bank-owned homes accounted for 45.5 percent of all existing home sales in January, down from 46.0 percent in December 2011.

One of the keys is the decline in inventory. Note that the GLVAR reports both total inventory, and inventory excluding "contingent" listings (usually short sales). Total single family inventory was down 12.9% from a year ago, and excluding contingent listings, inventory was down 35.8%!

The impact of changes in the participation rate on the unemployment rate

by Calculated Risk on 2/08/2012 11:27:00 AM

Yesterday Goldman Goldman Sachs economist Sven Jari Stehn argued that the labor force participation rate would remain "broadly flat at 63.7% through the end of 2013". He argued there would be a cyclical boost to the participation rate this year from the recovering economy, but a structural decline in the participation rate due to demographics. (Note: some decline in the participation rate has been expected over the next couple of decades).

The updated population controls from the 2010 Census showed a higher percentage of younger and older workers compared to the prime working age group (25 to 54), and also more women (participation rate is lower for women) than originally estimated - so the aggregate participation rate is now at 63.7%. Stehn argues that structural factors alone could push the aggregate participation rate down further to 63.1% by the end of 2012, but that this will probably be offset by more people returning to the labor force as the economy recovers.

The participation rate plays a key role in calculating to unemployment rate. First a few definitions from the BLS Glossary:

• Civilian noninstitutional population: Included are persons 16 years of age and older residing in the 50 States and the District of Columbia who are not inmates of institutions (for example, penal and mental facilities, homes for the aged), and who are not on active duty in the Armed Forces.

• Labor force: The labor force includes all persons classified as employed or unemployed in accordance with the definitions contained in this glossary.

• Labor force participation rate: The labor force as a percent of the civilian noninstitutional population.

• Unemployment rate: The unemployment rate represents the number unemployed as a percent of the labor force.

So a lower participation rate - with the same level of employment - would mean a lower unemployment rate.

Below is a table showing the sensitivity of the unemployment rate to three levels of the participation rate (centered around Goldman's forecast) and three rates of job creation for 2012. (note: this is mixing two different surveys - the household survey for the participation rate and unemployment rate, and the establishment survey for payroll jobs. Over time these two surveys move together, but there can be significant variability in the short run).

| December 2012 Unemployment Rate based on Jobs added and Participation Rate | ||||

|---|---|---|---|---|

| Participation Rate | ||||

| 63.4% | 63.7% | 64.0% | ||

| Jobs added per month (000s) | 150 | 7.6% | 8.0% | 8.5% |

| 200 | 7.2% | 7.7% | 8.1% | |

| 250 | 6.9% | 7.3% | 7.8% | |

If the January pace of payroll employment growth continues (around 250 thousand jobs per month), and the participation rate stays at 63.7%, then the unemployment rate could fall to 7.3% in December 2012. But even at a slower pace of payroll growth, the unemployment rate could be at or below 8% by the end of the year - unless the participation rate rises or the economy slows sharply.

The recent FOMC projections (see below) are for the unemployment rate to be in the 8.2% to 8.5% range by Q4 2012, and perhaps the FOMC was expecting the participation rate to increase this year.

If the participation rate doesn't increase, and payroll growth continues (even at 150 thousand per month), then the FOMC projections are too high. But even if the FOMC revises down their unemployment rate forecast, they will still view a 7.5% to 8% unemployment rate at the end of 2012 as unacceptably high.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Unemployment Rate1 | 2012 | 2013 | 2014 |

| January 2012 Projections | 8.2 to 8.5 | 7.4 to 8.1 | 6.7 to 7.6 |

MBA: Refinance activity increases as mortgage rates fall to record low

by Calculated Risk on 2/08/2012 08:33:00 AM

From the MBA: Refinance Activity Increases as Rates Hit Survey Lows

The Refinance Index increased 9.4 percent from the previous week. The seasonally adjusted Purchase Index increased 0.1 percent from one week earlier.The purchase index is still moving sideways at a very low level, but I expect the changes to HARP to lead to a surge in refinance activity in March.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) decreased to 4.05 percent, the lowest rate in the history of the survey, from 4.09 percent ...

The average contract interest rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than $417,500)decreased to 4.29 percent, the lowest rate in the history of the survey, from 4.33 percent ...