by Calculated Risk on 2/01/2012 11:32:00 AM

Wednesday, February 01, 2012

Construction Spending increased 1.5% in December

Catching up ... This morning the Census Bureau reported that overall construction spending increased in December:

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during December 2011 was estimated at a seasonally adjusted annual rate of $816.4 billion, 1.5 percent (±1.4%) above the revised November estimate of $804.0 billion. The December figure is 4.3 percent (±1.9%) above the December 2010 estimate of $782.9 billion.Private construction spending increased in December:

The value of construction in 2011 was $787.4 billion, 2.0 percent (±1.1%) below the $803.6 billion spent in 2010.

Spending on private construction was at a seasonally adjusted annual rate of $529.7 billion, 2.1 percent (±1.1%) above the revised November estimate of $518.8 billion. Residential construction was at a seasonally adjusted annual rate of $241.2 billion in December, 0.8 percent (±1.3%)* above the revised November estimate of $239.4 billion. Nonresidential construction was at a seasonally adjusted annual rate of $288.5 billion in December, 3.3 percent (±1.1%) above the revised November estimate of $279.4 billion.

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending is 64% below the peak in early 2006, and non-residential spending is 30% below the peak in January 2008.

Public construction spending is now 11% below the peak in March 2009.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, both private residential and non-residential construction spending have turned positive, but public spending is down on a year-over-year basis as the stimulus spending ends. The year-over-year improvements in private non-residential are mostly due to energy spending (power and electric).

The year-over-year improvement in private residential investment is an important change (the positive in 2010 was related to the tax credit).

Earlier:

• ISM Manufacturing index indicates faster expansion in January

ISM Manufacturing index indicates faster expansion in January

by Calculated Risk on 2/01/2012 10:00:00 AM

PMI was at 54.1% in January, up from a revised 53.1% in December. The employment index was at 54.3%, down from a revised 54.8%, and new orders index was at 57.6%, up from a revised 54.8%.

From the Institute for Supply Management: January 2012 Manufacturing ISM Report On Business®

Economic activity in the manufacturing sector expanded in January for the 30th consecutive month, and the overall economy grew for the 32nd consecutive month, say the nation's supply executives in the latest Manufacturing ISM Report On Business®.

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management™ Manufacturing Business Survey Committee. "The PMI registered 54.1 percent, an increase of 1 percentage point from December's seasonally adjusted reading of 53.1 percent, indicating expansion in the manufacturing sector for the 30th consecutive month. The New Orders Index increased 2.8 percentage points from December's seasonally adjusted reading to 57.6 percent, reflecting the 33rd consecutive month of growth in new orders. Prices of raw materials increased for the first time in the last four months. Manufacturing is starting out the year on a positive note, with new orders, production and employment all growing in January."

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was below expectations of 54.5%, but the consensus was before the revisions. This suggests manufacturing expanded at a faster rate in January than in December. It appears manufacturing employment expanded in January with the employment index at 54.3%.

On revisions: Yesterday the ISM released their annual revisions and addressed the seasonality issue that was raised by analysts at Nomura last year. It appears the ISM index (and other indexes) overstated the strength in December after understating the strength earlier in the year. Nomura analysts noted last night that they believe the ISM revision reduces, but does not eliminate, the seasonal adjustment bias due to the financial crisis.

ADP: Private Employment increased 170,000 in January

by Calculated Risk on 2/01/2012 08:15:00 AM

ADP reports:

Employment in the U.S. nonfarm private business sector increased by 170,000 from December to January on a seasonally adjusted basis. The estimated advance in employment from November to December was revised down to 292,000 from the initially reported 325,000.This was at the consensus forecast of an increase of 172,000 private sector jobs in January. The BLS reports on Friday, and the consensus is for an increase of 135,000 payroll jobs in January, on a seasonally adjusted (SA) basis.

Employment in the private, service-providing sector rose 152,000 in January, and employment in the private, goods-producing sector increased 18,000 in January, while manufacturing employment increased 10,000.

Government payrolls have been shrinking, so the ADP report suggests around 150,000 private nonfarm payroll jobs added in January. Of course ADP hasn't been very useful in predicting the BLS report.

ISM Seasonality

by Calculated Risk on 2/01/2012 12:09:00 AM

This is technical. Earlier this month there was some discussion about how the ISM manufacturing survey might be overstating the strength of manufacturing in December due to some seasonal adjustment issues. Here was a story from FT Alphaville: ‘Tis (still) the seasonality, ISM edition

Today the ISM addressed this issue and released some revisions: ISM Report On Business® Seasonal Adjustments 2012

Seasonal adjustment factors are used to allow for the effects of repetitive intra-year variations resulting primarily from normal differences in weather conditions, various institutional arrangements, and differences attributable to non-movable holidays. It is standard practice to project the seasonal adjustment factors used to calculate the indexes one year ahead (2012).For December, the ISM PMI was revised down to 53.1 from 53.9.

This year's seasonal factor revisions include greater attention to two areas: series with marginal seasonality and with improved outlier detection. Due to this focus, the Department of Commerce recommended that ISM no longer seasonally adjust the ISM Manufacturing Inventories Index. Additionally, they recommended making revisions to all seasonally adjusted data for a longer time period than what ISM has typically done in the past.

In response to concerns that the unusually large declines in autumn 2008 associated with the recent recession that may not have been adequately handled with default settings, this year the Department of Commerce used lower thresholds (critical values) for detecting outliers. As a result of moving averages, these changes in outlier detection affected seasonal factors both before and after 2008; therefore, ISM is making revisions to seasonally adjusted data for the past seven years rather than the customary four-year period.

For January, the consensus is for a reading of 54.5, and this revision probably means the ISM PMI released Wednesday will be a little lower than consensus.

Tuesday, January 31, 2012

Mortgage Settlement: Ally Takes $270 million charge for "foreclosure related matters"

by Calculated Risk on 1/31/2012 07:07:00 PM

Another sign that the mortgage settlement will be announced soon ... from Ally Financial 8-K filed today:

Ally Financial Inc. (“Ally”) has concluded that it will record a charge of approximately $270 million in the fourth quarter of 2011 for penalties expected to be imposed by certain of our regulators and other governmental agencies in connection with foreclosure related matters, which is anticipated to result in an overall net loss for Ally in the fourth quarter. This charge was recorded effective December 31, 2011, considering developments subsequent to year-end.The mortgage settlement (deadline for states is Friday) is one of several upcoming policy announcements that could impact the economy both in the US and in Europe.

Earlier on House Prices:

• Case Shiller: House Prices fall to new post-bubble lows in November (seasonally adjusted)

• Real House Prices and House Price-to-Rent

• All current house price graphs

Fannie Mae Serious Delinquency rate declines, Freddie Mac rate increases

by Calculated Risk on 1/31/2012 04:27:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency rate declined in December to 3.91%, down from 4.0% in November. This is down from 4.48% in December 2010. The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Freddie Mac reported that the Single-Family serious delinquency rate increased to 3.58% in December, up from 3.57% in November. This is the fourth month in a row with a small increase in the delinquency rate. Freddie's rate is down from 3.84% in December 2010. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are loans that are "three monthly payments or more past due or in foreclosure".

Click on graph for larger image

Click on graph for larger image

The serious delinquency rate has been declining, but declining very slowly (Freddie's decline seems to have stalled). The reason for the slow decline is most likely the backlog of homes in the foreclosure process due to processing issues (aka robo-signing).

I expect a mortgage servicer settlement agreement to be reached very soon, and that will probably lead to more modifications and foreclosures - so the delinquency rate should start to decline faster.

The "normal" serious delinquency rate is under 1%, so there is a long way to go.

Earlier on House Prices:

• Case Shiller: House Prices fall to new post-bubble lows in November (seasonally adjusted)

• Real House Prices and House Price-to-Rent

• All current house price graphs

Restaurant Performance Index highest in almost six years in December

by Calculated Risk on 1/31/2012 02:28:00 PM

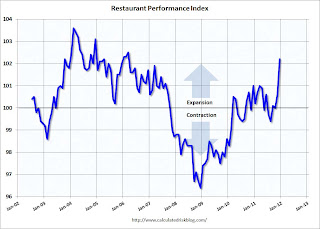

From the National Restaurant Association: Restaurant Performance Index Rose to Highest Level in Nearly Six Years in December

The RPI – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 102.2 in December, up 1.6 percent from November and its highest level in nearly six years. In addition, December represented the third time in the last four months that the RPI stood above 100, which signifies expansion in the index of key industry indicators.Blame in on the lack of snow!

“Aided by favorable weather conditions in many parts of the country, a solid majority of restaurant operators reported higher same-store sales and customer traffic levels in December,” said Hudson Riehle, senior vice president of the Research and Knowledge Group for the Association. “In addition, restaurant operators are solidly optimistic about sales growth in the months ahead, and their outlook for the economy is at its strongest point in nearly a year.”

...

Building on a solid November performance that saw the strongest same-store sales results in more than four years, restaurant operators reported even better numbers in December. ... Restaurant operators also reported solid customer traffic results in December. ... In addition to positive sales and traffic levels, capital spending activity among restaurant operators continues to trend upward. Forty-eight percent of operators said they made a capital expenditure for equipment, expansion or remodeling during the last three months, the highest level in six months.

Click on graph for larger image.

Click on graph for larger image.The index increased to 102.2 in December (above 100 indicates expansion).

The data for this index only goes back to 2002.

This is "D-list" data (at best), but restaurant spending is discretionary and can tell us a little something about the overall economy. This index showed contraction in July and August, but is now solidly positive.

Earlier on House Prices:

• Case Shiller: House Prices fall to new post-bubble lows in November (seasonally adjusted)

• Real House Prices and House Price-to-Rent

• All current house price graphs

Real House Prices and House Price-to-Rent

by Calculated Risk on 1/31/2012 11:47:00 AM

A monthly update: Case-Shiller, CoreLogic and others report nominal house prices. It is also useful to look at house prices in real terms (adjusted for inflation) and as a price-to-rent ratio.

Below are three graphs showing nominal prices (as reported), real prices and a price-to-rent ratio. Real prices are back to 1999/2000 levels, and the price-to-rent ratio is also back to 2000 levels.

Nominal House Prices

Click on graph for larger image.

Click on graph for larger image.

The first graph shows the quarterly Case-Shiller National Index SA (through Q3 2011), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through November) in nominal terms as reported.

In nominal terms, the Case-Shiller National index (SA) is back to Q4 2002 levels, the Case-Shiller Composite 20 Index (SA) is back to February 2003 levels, and the CoreLogic index is back to April 2003.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

In real terms, the National index is back to Q1 1999 levels, the Composite 20 index is back to April 2000, and the CoreLogic index back to February 2000.

In real terms, all appreciation in the '00s is gone.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller Composite 20 and CoreLogic House Price Index.

Here is a similar graph using the Case-Shiller Composite 20 and CoreLogic House Price Index.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Composite 20 index is back to April 2000 levels, and the CoreLogic index is back to February 2000.

In real terms - and as a price-to-rent ratio - prices are mostly back to 2000 levels and will probably be back to 1999 levels within the next few months.

Note: In late 2010 I guessed that prices would decline another 5% to 10% on these national indexes (from October 2010 prices). So far prices have fallen another 4% to 5% on these indexes.

Earlier:

• Case Shiller: House Prices fall to new post-bubble lows in November (seasonally adjusted)

HVS: Q4 Homeownership and Vacancy Rates

by Calculated Risk on 1/31/2012 10:15:00 AM

The Census Bureau released the Housing Vacancies and Homeownership report for Q4 this morning.

As Tom Lawler has been discussing, this is from a fairly small sample, and the homeownership and vacancy rates are higher than estimated in other reports (like Census 2010). This report is commonly used by analysts to estimate the excess vacant supply for housing, but it doesn't appear to be useful for that purpose.

It might show the trend, but I wouldn't rely on the absolute numbers.

Click on graph for larger image.

Click on graph for larger image.

The Red dots are the decennial Census homeownership rates for April 1st 1990, 2000 and 2010. The HVS homeownership rate declined to 66.0%, down from to 66.3% in Q3 2011.

I'd put more weight on the decennial Census numbers and that suggests the actual homeownership rate is probably in the 64% to 65% range.

The Census researchers are investigating differences in Census 2010, ACS 2010, and HVS 2010 vacant housing unit estimates, but there is no scheduled date for any report.

The Census researchers are investigating differences in Census 2010, ACS 2010, and HVS 2010 vacant housing unit estimates, but there is no scheduled date for any report.

The HVS homeowner vacancy rate declined to 2.3% from 2.4% in Q3. This is the lowest level since early 2006 for this report.

The homeowner vacancy rate has probably peaked and is now declining. However - once again - this probably shows that the trend is down, but I wouldn't rely on the absolute numbers.

The rental vacancy rate declined to 9.4% from 9.8% in Q3.

The rental vacancy rate declined to 9.4% from 9.8% in Q3.

I think the Reis quarterly survey (large apartment owners only in selected cities) is a much better measure of the overall trend in the rental vacancy rate - and Reis reported that the rental vacancy rate has fallen to the lowest level since 2001.

This is the most timely survey on households, but unfortunately the survey has serious issues - and sadly many analysts still use this survey to estimate the excess vacant supply. However this does suggest that the housing vacancy rates are falling.

Case Shiller: House Prices fall to new post-bubble lows in November (seasonally adjusted)

by Calculated Risk on 1/31/2012 09:00:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for November (a 3 month average of September, October, and November). This release includes prices for 20 individual cities and and two composite indices (for 10 cities and 20 cities).

Note: Case-Shiller reports NSA, I use the SA data.

From S&P: Home Prices Continued to Decline in November 2011 According to the S&P/Case-Shiller Home Price Indices

Data through November 2011, released today by S&P Indices for its S&P/Case-Shiller1 Home Price Indices ... showed declines of 1.3% for both the 10- and 20-City Composites in November over October. For a second consecutive month, 19 of the 20 cities covered by the indices also saw home prices decrease. The 10- and 20-City composites posted annual returns of -3.6% and -3.7% versus November 2010, respectively. These are worse than the -3.2% and -3.4% respective rates reported for October.

“Despite continued low interest rates and better real GDP growth in the fourth quarter, home prices continue to fall. Weakness was seen as 19 of 20 cities saw average home prices decline in November over October,” says David M. Blitzer, Chairman of the Index Committee at S&P Indices. “... Nationally, home prices are lower than a year ago. The 10-City Composite was down 3.6% and the 20-City was down 3.7% compared to November 2010. The trend is down and there are few, if any, signs in the numbers that a turning point is close at hand."

“The crisis low for the 10-City Composite was April 2009; for the 20-City Composite the more recent low was March 2011. The 10-City Composite is now about 1.0% above its low, and the 20-City Composite is only 0.6% above its low. From their 2006 peaks, both Composites are down close to 33% through November.

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 33.5% from the peak, and down 0.7% in November (SA). The Composite 10 is at a new post bubble low (Seasonally adjusted), but still above the low NSA.

The Composite 20 index is off 33.5% from the peak, and down 0.7% in November (SA). The Composite 20 is also at a new post-bubble low.

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is down 3.6% compared to November 2010.

The Composite 20 SA is down 3.7% compared to November 2010. This was a slightly larger year-over-year decline for both indexes than in October.

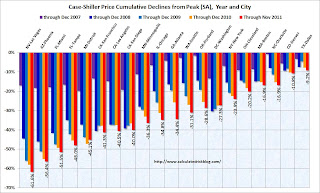

The third graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

Prices increased (SA) in 3 of the 20 Case-Shiller cities in November seasonally adjusted (only one city increased NSA). Prices in Las Vegas are off 61.6% from the peak, and prices in Dallas only off 9.2% from the peak.

Prices increased (SA) in 3 of the 20 Case-Shiller cities in November seasonally adjusted (only one city increased NSA). Prices in Las Vegas are off 61.6% from the peak, and prices in Dallas only off 9.2% from the peak.The NSA indexes are around 1% above the March 2011 lows - and these indexes will hit new lows in the next month or two since prices are falling again. Using the SA data, the Case-Shiller indexes are now at new post-bubble lows.