by Calculated Risk on 1/28/2012 04:29:00 PM

Saturday, January 28, 2012

Unofficial Problem Bank list declines to 958 Institutions

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Jan 27, 2012. (table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

Busy week with many changes to the Unofficial Problem Bank List as the FDIC released its enforcement action activity for December 2011 and they closed several banks. In total, there were 11 removals and six additions, which leave the list with 958 institutions with assets of $389.0 billion. A year ago, there were 949 institutions with assets of $410.9 billion on the list. For the month of January 2012, changes to the list were nine cures, six failures, four unassisted mergers, one voluntary liquidation, and eight additions. The list fell by 12 institutions during the current month and it is the seventh consecutive monthly decline after the list peaked on a month-end basis at 1,001 institutions in June 2011.Earlier:

The FDIC terminated actions against Open Bank, Los Angeles, CA ($136 million Ticker: OPBK); Citizens Bank & Trust Company, Covington, LA ($110 million); First Security Bank & Trust Company, Norton, KS ($63 million); and West One Bank, Kalispell, MT ($44 million). Three banks were removed as they were acquired through unassisted deals including Ravalli County Bank, Hamilton, MT ($187 million); First State Bank of Red Bud, Red Bud, IL ($94 million); and Griffith Savings Bank, Griffith, IN ($89 million), which was acquired by United Federal Credit Union in the reportedly first successful acquisition of a commercial bank by a federally chartered credit union.

The FDIC stepped up its closing activities this week with four closures. The last time the FDIC closed this many banks in a week was on October 21, 2011. Failures include Tennessee Commerce Bank, Franklin, TN ($1.2 billion Ticker: TNCC); First Guaranty Bank and Trust Company of Jacksonville, Jacksonville, FL ($378 million); BankEast, Knoxville, TN ($273 million); and Patriot Bank Minnesota, Forest Lake, MN ($111 million). The failures in Tennessee are the first in that state since the on-set of the financial crisis. Conspicuously, the state stood out for not having yet experienced a failure. Ironically, the banking trade publication American Banker had an article today that questioned how much longer the state could remain failure free and said several lawyers thought the state banking commissioner wanted to avoid failures. While avoiding failures is laudable; however, some may say the delay in closing leads to higher resolution costs. As a share of their assets, the FDIC estimates the resolution of Tennessee Commerce Bank will cost 35.2% and BankEast 27.7%. Perhaps the reluctance for closings as mentioned in the article contributed to the high resolution costs of these banks.

The additions this week include Colorado East Bank & Trust, Lamar, CO ($829 million); Chambers Bank, Danville, AR ($722 million); American Gateway Bank, Port Allen, LA ($434 million); Pacific International Bank, Seattle, WA ($250 million Ticker: PIBW); Prairie Community Bank, Marengo, IL ($128 million); and Woodland Bank, Deer River, MN ($108 million).

The FDIC issued Prompt Corrective Action Orders against Mile High Banks, Longmont, CO ($1.0 billion) and Waukegan Savings Bank, Waukegan, IL ($88 million). Also, the FDIC issued an order terminating the deposit insurance of Fireside Bank, Pleasanton, CA ($278 million). Usually a chartering authority does not allow an institution to operate very long after receiving a deposit insurance termination order. Under a deposit insurance termination order, existing deposits eligible for insurance are covered for two years but any new deposits are not covered.

• Summary for Week Ending January 27th

• Schedule for Week of Jan 29th

Schedule for Week of Jan 29th

by Calculated Risk on 1/28/2012 01:07:00 PM

Earlier:

• Summary for Week Ending January 27th

This will be a very busy week for economic releases. The key report is the January employment report to be released on Friday, Feb 3rd. Other key reports include the Case-Shiller house price index on Tuesday, the ISM manufacturing index on Wednesday, vehicle sales on Wednesday, and the ISM non-manufacturing (service) index on Friday.

On Thursday, Fed Chairman Ben Bernanke provides testimony to Congress on the economic outlook.

8:30 AM ET: Personal Income and Outlays for December. The consensus is for a 0.4% increase in personal income in December, and a 0.1% increase in personal spending, and for the Core PCE price index to increase 0.1%.

10:30 AM: Dallas Fed Manufacturing Survey for January. The consensus is for expansion of 1.0 from contraction of -1.3 in December. This is the last of the regional Fed manufacturing surveys for January, and the other surveys have shown stronger expansion in January.

2:00 PM: The January 2011 Senior Loan Officer Opinion Survey on Bank Lending Practices from the Federal Reserve.

9:00 AM: S&P/Case-Shiller House Price Index for November. Although this is the November report, it is really a 3 month average of September, October and November.

9:00 AM: S&P/Case-Shiller House Price Index for November. Although this is the November report, it is really a 3 month average of September, October and November. This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indexes (the Composite 20 was started in January 2000).

The consensus is for a 0.4% decrease in prices in November. I expect a larger decline NSA, and a decline of 0.1% to 0.2% seasonally adjusted. The CoreLogic index declined 1.4% decrease in November (NSA).

9:45 AM: Chicago Purchasing Managers Index for January. The consensus is for an increase to 63.0, up from 62.5 in December.

10:00 AM: Conference Board's consumer confidence index for January. The consensus is for an increase to 68.0 from 64.5 last month.

10:00 AM: Q4 Housing Vacancies and Homeownership report from the Census Bureau. As a reminder: Be careful with the Housing Vacancies and Homeownership report. This report is frequently mentioned by analysts and the media to track the homeownership rate, and the homeowner and rental vacancy rates. Unfortunately the report is based on a fairly small sample, and does not track the decennial Census data.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index was especially weak last year, although this does not include all the cash buyers.

8:15 AM: The ADP Employment Report for January. This report is for private payrolls only (no government). The consensus is for 172,000 payroll jobs added in January, down from the 325,000 reported last month.

10:00 AM: Construction Spending for December. The consensus is for a 0.5% increase in construction spending.

10:00 AM ET: ISM Manufacturing Index for January.

10:00 AM ET: ISM Manufacturing Index for January. Here is a long term graph of the ISM manufacturing index. The consensus is for a slight increase to 54.5 from 53.9 in December.

All day: Light vehicle sales for January. Light vehicle sales are expected to increase to 13.6 million from 13.5 million in December (Seasonally Adjusted Annual Rate).

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the December sales rate.

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the December sales rate. Edmunds is forecasting:

[A] projected Seasonally Adjusted Annual Rate (SAAR) of 13.4 million units, forecasts Edmunds.com ... This sales pace is relatively flat from the 13.5 million SAAR recorded last month, but up from the 12.6 million SAAR from January 2011.And TrueCar is forecasting:

The January 2012 forecast translates into a Seasonally Adjusted Annualized Rate (SAAR) of 13.6 million new car sales, up from 12.7 million in January 2011Expected: National Multi Housing Council (NMHC) Quarterly Apartment Survey. This is a key survey for apartment vacancy rates and rents.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a dencrease to 370,000 from 377,000 last week.

10:00 AM: Testimony from Fed Chairman Ben Bernanke, "The Economic Outlook and the Federal Budget Situation", Before the Committee on the Budget, U.S. House of Representatives

8:30 AM: Employment Report for December. The consensus is for an increase of 135,000 non-farm payroll jobs in January, down from the 200,000 jobs added in December. Note: it appears the seasonal adjustment for "Transportation and warehousing" over-counted employment in December by about 42,000 and this should be unwound in January. So December payroll growth was probably overstated, and January will be understated.

8:30 AM: Employment Report for December. The consensus is for an increase of 135,000 non-farm payroll jobs in January, down from the 200,000 jobs added in December. Note: it appears the seasonal adjustment for "Transportation and warehousing" over-counted employment in December by about 42,000 and this should be unwound in January. So December payroll growth was probably overstated, and January will be understated.The consensus is for the unemployment rate to remain unchanged at 8.5%.

This second employment graph shows the percentage of payroll jobs lost during post WWII recessions through December.

This second employment graph shows the percentage of payroll jobs lost during post WWII recessions through December. The economy has added 2.65 million jobs since employment bottomed in February 2010 (3.16 million private sector jobs added, and 500 thousand public sector jobs lost).

There are still 5.7 million fewer private sector jobs now than when the recession started. (6.1 million fewer total nonfarm jobs).

10:00 AM: ISM non-Manufacturing Index for January. The consensus is for an increase to 53.3 in January from 52.6 in December. Note: Above 50 indicates expansion, below 50 contraction.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for December. The consensus is for a 1.5% increase in orders.

Summary for Week ending January 27th

by Calculated Risk on 1/28/2012 08:12:00 AM

The key story last week was that the Federal Open Market Committee (FOMC) noted that “economic conditions … are likely to warrant exceptionally low levels for the federal funds rate at least through late 2014.” This was a change from mid-2013.

In addition the FOMC released their inaugural forecasts of the appropriate path for the Fed Funds rate, and most participants expect rates to be low for a long long time. The FOMC also set a long run inflation target of 2 percent (this was understood, but now it is official).

The January Summary of Economic Projections (SEP) showed the FOMC is projecting inflation will remain below target through 2014, whereas the unemployment rate will remain too high for years. This suggest that further action is likely, and Fed Chairman Bernanke seemed to pave the way for QE3 with his comments at the press briefing. My view is QE3 could be announced as early as the next FOMC meeting in March, or perhaps at one of the two day meetings in April or June.

In general the economic data released last week was disappointing. The advance report showed that real GDP only increased at a 2.8% annual rate in Q4. Much of the increase was related to changes in private inventories, and PCE only increased at a 2.0% annual rate. New home sales also disappointed, with sales falling to 307 thousand annual rate in December.

There was some mild good news: two regional Fed manufacturing surveys (Richmond and Kansas City) showed faster expansion in January, and consumer sentiment increased again.

Overall this is consistent with sluggish growth.

Here is a summary in graphs:

• Real GDP increased 2.8% annual rate in Q4

The BEA reported that "Real gross domestic product ... increased at an annual rate of 2.8 percent in the fourth quarter of 2011"

Click on graph for larger image.

Click on graph for larger image.

This graph shows the quarterly GDP growth (at an annual rate) for the last 30 years. The dashed line is the current growth rate. Growth in Q4 at 2.8% annualized was below trend growth (around 3%) - and very weak for a recovery - but the best since Q2 2010.

PCE increased at a 2.0 percent annual rate. GDP was boosted significantly by the "change in private inventories" that added 1.94 percentage points. That was somewhat offset by a decline in government spending (subtracted 0.93 percentage points).

Another key story is that residential investment is now adding to GDP. Since RI is historically the best leading indicator for the economy, this suggests further growth in 2012 (although still sluggish).

• New Home Sales declined in December to 307,000 Annual Rate

The Census Bureau reports New Home Sales in December were at a seasonally adjusted annual rate (SAAR) of 307 thousand. This was down from a revised 314 thousand in November (revised down from 315 thousand).

The Census Bureau reports New Home Sales in December were at a seasonally adjusted annual rate (SAAR) of 307 thousand. This was down from a revised 314 thousand in November (revised down from 315 thousand).

This graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Starting in 1973 the Census Bureau broke down inventory into three categories: Not Started, Under Construction, and Completed. This graph shows the three categories of inventory starting in 1973.

Starting in 1973 the Census Bureau broke down inventory into three categories: Not Started, Under Construction, and Completed. This graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale was at 61,000 units in December. The combined total of completed and under construction is at the lowest level since this series started.

New home sales have averaged only 300 thousand SAAR over the 20 months since the expiration of the tax credit ... mostly moving sideways at a very low level.

• ATA Trucking Index increased sharply in December

"The American Trucking Associations’ advanced seasonally adjusted (SA) For-Hire Truck Tonnage Index jumped 6.8% in December after rising 0.3% in November 2011. The latest gain put the SA index at 124.5 (2000=100) in December, up from the November level of 116.6."

"The American Trucking Associations’ advanced seasonally adjusted (SA) For-Hire Truck Tonnage Index jumped 6.8% in December after rising 0.3% in November 2011. The latest gain put the SA index at 124.5 (2000=100) in December, up from the November level of 116.6."Here is a long term graph that shows ATA's For-Hire Truck Tonnage index.

The dashed line is the current level of the index. This index stalled early in 2011, but increased sharply at the end of the year.

• State Unemployment Rates "slightly lower" in December

This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). Every state has some blue - indicating no state is currently at the maximum during the recession.

This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). Every state has some blue - indicating no state is currently at the maximum during the recession.The states are ranked by the highest current unemployment rate. Only four states and the District of Columbia still have double digit unemployment rates. This is the fewest since early 2009. At the end of 2009, 18 states and D.C. had double digit unemployment rates.

• Weekly Initial Unemployment Claims increased to 377,000

The following graph shows the 4-week moving average of weekly claims since January 2000.

The following graph shows the 4-week moving average of weekly claims since January 2000.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week to 377,500.

The 4-week moving average remains below 400,000.

Weekly claims have been bouncing around lately - January is a period with large seasonal adjustments and that can lead to some large swings - but the 4-week average of weekly claims have been mostly trending down.

• Consumer Sentiment increased in January

The final January Reuters / University of Michigan consumer sentiment index increased to 75.0, up from the preliminary reading of 74.0, and up from the December reading of 69.9.

The final January Reuters / University of Michigan consumer sentiment index increased to 75.0, up from the preliminary reading of 74.0, and up from the December reading of 69.9.Sentiment is still fairly weak, although above the consensus forecast of 74.0.

• Other Economic Stories ...

• FOMC Statement: Rates likely exceptionally low through late 2014

• FOMC: Sets 2% Inflation Target, January Summary of Economic Projections (SEP) and Press Briefing

• Analysis: Bernanke paves the way for QE3

• Pending Home Sales Decline in December

• From the Richmond Fed: Manufacturing Activity Picks Up the Pace in January; Expectations Upbeat

• Kansas City Fed: Tenth District Manufacturing Activity Rebounded in January

• DOT: Vehicle Miles Driven declined 0.9% in November

Friday, January 27, 2012

Government to triple HAMP payments for principal reductions

by Calculated Risk on 1/27/2012 09:03:00 PM

From Jon Prior at HousingWire: Treasury to pay investors triple for HAMP principal reductions

The Treasury Department will triple payments to mortgage investors for reducing borrower principal through an expanded Home Affordable Modification Program announced Friday [CR note: Treasury will pay incentives ranging from .18 to .63 cents on the dollar - depending on the change in LTV]Based on DeMarco's comments, it doesn't sound like Fannie and Freddie will participate in the principal reductions.

Officials announced several critical changes to HAMP, including an enrollment extension to Dec. 31, 2013, from its original expiration date at the end of this year.

The Treasury will also require servicers to factor in second liens and other obligations in the debt-to-income ratio calculation. Previously, if a borrower's first-lien mortgage monthly payment was below 31% of the income, the borrower was deemed ineligible. Factoring other debts to the DTI evaluation will expand the pool of borrowers who could receive the assistance.

To combat blight, officials said they would also expand HAMP to investors who are renting properties to tenants.

...

Department of Housing and Urban Development Secretary Shaun Donovan said in the conference call Friday that the Treasury would make these payments to Fannie Mae and Freddie Mac if they participate in the principal reduction program.

To date, the GSEs have not committed to such a program.

...

"FHFA’s assessment of the investor incentives now being offered will follow its previous analysis, including consideration of the eligible universe, operational costs to implement such changes, and potential borrower incentive effects," said FHFA Acting Director Edward DeMarco in a statement Friday.

Bank Failure #6 & 7: Tennessee and Minnesota

by Calculated Risk on 1/27/2012 06:10:00 PM

Failure for all the small fish

Pardons for the whales

by Soylent Green is People

From the FDIC: First Resource Bank, Savage, Minnesota, Assumes All of the Deposits of Patriot Bank Minnesota, Forest Lake, Minnesota

As of September 30, 2011, Patriot Bank Minnesota had approximately $111.3 million in total assets and $108.3 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $32.6 million. ... Patriot Bank Minnesota is the sixth FDIC-insured institution to fail in the nation this year, and the first in Minnesota. The last FDIC-insured institution closed in the state was The Riverbank, Wyoming, Minnesota, on October 7, 2011.From the FDIC: U.S. Bank National Association, Cincinnati, Ohio, Assumes All of the Deposits of BankEast, Knoxville, Tennessee

As of September 30, 2011, BankEast had approximately $272.6 million in total assets and $268.8 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $75.6 million. ... BankEast is the seventh FDIC-insured institution to fail in the nation this year, and the second in Tennessee. The last FDIC-insured institution closed in the state was Tennessee Commerce Bank, Franklin, earlier today.That makes four today.

Bank Failures #4 and 5 in 2012: Florida and Tennessee

by Calculated Risk on 1/27/2012 05:13:00 PM

Sack Panther and Titan banks

A Patriots chore

by Soylent Green is People

From the FDIC: CenterState Bank of Florida, National Association, Winter Haven, Florida, Assumes All of the Deposits of First Guaranty Bank and Trust Company of Jacksonville, Jacksonville, Florida

As of September 30, 2011, First Guaranty Bank and Trust Company of Jacksonville had approximately $377.9 million in total assets and $349.5 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $82.0 million. ... First Guaranty Bank and Trust Company of Jacksonville is the fourth FDIC-insured institution to fail in the nation this year, and the second in Florida. The last FDIC-insured institution closed in the state was Central Florida State Bank, Belleview, on January 20, 2012.From the FDIC: Republic Bank & Trust Company, Louisville, Kentucky, Assumes All of the Deposits of Tennessee Commerce Bank, Franklin, Tennessee

As of September 30, 2011, Tennessee Commerce Bank had approximately $1.185 billion in total assets and $1.156 billion in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $416.8 million. ... Tennessee Commerce Bank is the fifth FDIC-insured institution to fail in the nation this year, and the first in Tennessee. The last FDIC-insured institution closed in the state was Bank of Alamo, Alamo, on November 8, 2002.Hey, Tennessee is on the board. Another failure in Florida? No surprise.

LPS: 2010, 2011 Mortgage Originations have record low default rates

by Calculated Risk on 1/27/2012 02:46:00 PM

From LPS Applied Analytics: LPS' Mortgage Monitor Shows 2010, 2011 Originations Among Best Quality on Record

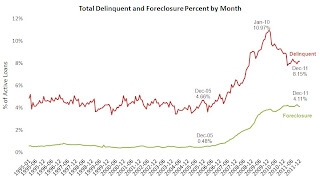

The December Mortgage Monitor report released by Lender Processing Services shows mortgage originations continued their decline from 2011’s September peak, down 10.1 percent from the month before. At the same time, those loans originated over the last two years have proven to be some of the best quality originations on record.According to LPS, 8.15% of mortgages were delinquent in December, unchanged from November, and down from 8.83% in December 2010.

...

Looking at judicial vs. non-judicial foreclosure states, LPS found that half of all loans in foreclosure in judicial states have not made a payment in more than two years. Foreclosure sale rates in non-judicial states stood at approximately four times that of judicial foreclosure states in December. Still, on average, pipeline ratios (the time it would take to clear through the inventory of loans either seriously delinquent or in foreclosure at the current rate of foreclosure sales) have declined significantly from earlier this year.

LPS reports that 4.11% of mortgages were in the foreclosure process, down from 4.16% in November, and down slightly from 4.15% in December 2010.

This gives a total of 12.26% delinquent or in foreclosure. It breaks down as:

• 2.31 million loans less than 90 days delinquent.

• 1.79 million loans 90+ days delinquent.

• 2.07 million loans in foreclosure process.

For a total of 6.17 million loans delinquent or in foreclosure in December.

Click on graph for larger image.

Click on graph for larger image.This graph shows the total delinquent and in-foreclosure rates since 1995.

The total delinquent rate has fallen to 8.15% from the peak in January 2010 of 10.97%, but the decline has "halted". A normal rate is probably in the 4% to 5% range, so there is a long ways to go.

The in-foreclosure rate was at 4.11%, down from the record high in October 2011 of 4.29%. There are still a large number of loans in this category (about 2.07 million). LPS reported that foreclosure starts were down nearly 40% in December, probably due to process issues.

This graph provided by LPS Applied Analytics shows foreclosure inventories by process.

This graph provided by LPS Applied Analytics shows foreclosure inventories by process. As LPS noted earlier: "Judicial vs. non-judicial foreclosure processes remain a significant factor in the reduction of foreclosure pipelines from state to state, with non-judicial foreclosure inventory percentages less than half that of judicial states. This is largely a result of the fact that foreclosure sale rates in non-judicial states have been proceeding at four to five times that of judicial. Non-judicial foreclosure states made up the entirety of the top 10 states with the largest year-over-year decline in non-current loans percentages."

The third graph shows the 90+ day default rate by vintage.

The third graph shows the 90+ day default rate by vintage.LPS noted "2010 and 2011 originations are among the best on record".

And this isn't just because of tighter lending standards, LPS also noted (see report) that there were vintage improvements for high risk cohorts too (high risk defined as "Credit Score less than 660 and LTV greater than 80").

Notice the early payment default for the bubble years. The jump in payment 3 means the buyer missed the first three payments!

Overall this means newer loans are performing very well, but that there are a large number of delinquent loans stuck in the pipeline - especially in the judicial states.

Q4 GDP: Residential Investment now making a positive contribution

by Calculated Risk on 1/27/2012 11:19:00 AM

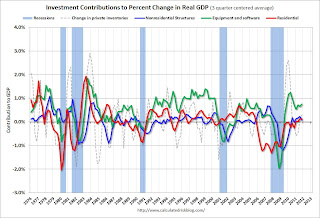

The following graph shows the contribution to GDP from residential investment, equipment and software, and nonresidential structures (3 quarter centered average). This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy.

For the following graph, red is residential, green is equipment and software, and blue is investment in non-residential structures. So the usual pattern - both into and out of recessions is - red, green, blue.

The dashed gray line is the contribution from the change in private inventories.

Click on graph for larger image.

Click on graph for larger image.

Residential Investment (RI) made a positive contribution to GDP in Q4 for the third consecutive quarter. Usually residential investment leads the economy, but not this time because of the huge overhang of existing inventory.

The contribution from RI will probably continue to be sluggish compared to previous recoveries. Still the positive contribution is a significant story.

Equipment and software investment has made a significant positive contribution to GDP for ten straight quarters (it is coincident). However the contribution from equipment and software investment in Q4 was the weakest since the recovery started.

The contribution from nonresidential investment in structures was negative in Q4. Nonresidential investment in structures typically lags the recovery, however investment in energy and power has masked the ongoing weakness in office, mall and hotel investment (the underlying details will be released next week).

Residential Investment as a percent of GDP increased slightly in Q4.

Residential Investment as a percent of GDP increased slightly in Q4.

Most of the increase was probably due to multifamily and home improvement investment. I'll break down Residential Investment (RI) into components after the GDP details are released this coming week. Note: Residential investment (RI) includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

Residential investment will increase further in 2012, and I expect investment in single family structures will also add to growth this year.

The last graph shows non-residential investment in structures and equipment and software.

The last graph shows non-residential investment in structures and equipment and software.

Equipment and software investment had been increasing sharply, however the growth slowed in Q4.

Non-residential investment in structures decreased in Q4 and is still near record lows as a percent of GDP. The recent small increase has come from investment in energy and power. I'll add details for investment in offices, malls and hotels next week.

The key story is that residential investment is starting to increase. This trend will probably continue in 2012 - although the recovery in RI will be sluggish.

Earlier ...

• Real GDP increased 2.8% annual rate in Q4

Consumer Sentiment increases in January

by Calculated Risk on 1/27/2012 09:55:00 AM

Real GDP increased 2.8% annual rate in Q4

by Calculated Risk on 1/27/2012 08:30:00 AM

Real gross domestic product -- the output of goods and services produced by labor and property located in the United States -- increased at an annual rate of 2.8 percent in the fourth quarter of 2011 (that is, from the third quarter to the fourth quarter), according to the "advance" estimate released by the Bureau of Economic Analysis.The following graph shows the quarterly GDP growth (at an annual rate) for the last 30 years. The dashed line is the current growth rate. Growth in Q4 at 2.8% annualized was below trend growth (around 3%) - and very weak for a recovery - but the best since Q2 2010.

The acceleration in real GDP in the fourth quarter primarily reflected an upturn in private inventory investment and accelerations in PCE and in residential fixed investment that were partly offset by a deceleration in nonresidential fixed investment, a downturn in federal government spending, an acceleration in imports, and a larger decrease in state and local government spending.

Click on graph for larger image.

A few key numbers:

• Real personal consumption expenditures increased 2.0 percent in the second quarter, compared with an increase of 1.7 percent in the third.

• Change in private inventories added 1.94 percentage point. This was partially ffset by a decline in government spending (subtracted 0.93 percentage points).

• Investment growth slowed, except residential investment: "Real nonresidential fixed investment increased 1.7 percent in the fourth quarter, compared with an increase of 15.7 percent in the third. Nonresidential structures decreased 7.2 percent, in contrast to an increase of 14.4 percent. Equipment and software increased 5.2 percent, compared with an increase of 16.2 percent. Real residential fixed investment increased 10.9 percent, compared with an increase of 1.3 percent."

I'll have more on GDP later ...