by Calculated Risk on 1/27/2012 11:19:00 AM

Friday, January 27, 2012

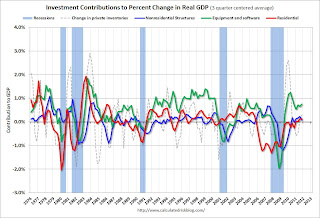

Q4 GDP: Residential Investment now making a positive contribution

The following graph shows the contribution to GDP from residential investment, equipment and software, and nonresidential structures (3 quarter centered average). This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy.

For the following graph, red is residential, green is equipment and software, and blue is investment in non-residential structures. So the usual pattern - both into and out of recessions is - red, green, blue.

The dashed gray line is the contribution from the change in private inventories.

Click on graph for larger image.

Click on graph for larger image.

Residential Investment (RI) made a positive contribution to GDP in Q4 for the third consecutive quarter. Usually residential investment leads the economy, but not this time because of the huge overhang of existing inventory.

The contribution from RI will probably continue to be sluggish compared to previous recoveries. Still the positive contribution is a significant story.

Equipment and software investment has made a significant positive contribution to GDP for ten straight quarters (it is coincident). However the contribution from equipment and software investment in Q4 was the weakest since the recovery started.

The contribution from nonresidential investment in structures was negative in Q4. Nonresidential investment in structures typically lags the recovery, however investment in energy and power has masked the ongoing weakness in office, mall and hotel investment (the underlying details will be released next week).

Residential Investment as a percent of GDP increased slightly in Q4.

Residential Investment as a percent of GDP increased slightly in Q4.

Most of the increase was probably due to multifamily and home improvement investment. I'll break down Residential Investment (RI) into components after the GDP details are released this coming week. Note: Residential investment (RI) includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

Residential investment will increase further in 2012, and I expect investment in single family structures will also add to growth this year.

The last graph shows non-residential investment in structures and equipment and software.

The last graph shows non-residential investment in structures and equipment and software.

Equipment and software investment had been increasing sharply, however the growth slowed in Q4.

Non-residential investment in structures decreased in Q4 and is still near record lows as a percent of GDP. The recent small increase has come from investment in energy and power. I'll add details for investment in offices, malls and hotels next week.

The key story is that residential investment is starting to increase. This trend will probably continue in 2012 - although the recovery in RI will be sluggish.

Earlier ...

• Real GDP increased 2.8% annual rate in Q4