by Calculated Risk on 1/22/2012 09:20:00 PM

Sunday, January 22, 2012

Greece: Still no deal on debt

Another update ... still a mess.

From Landon Thomas at the NY Times: Greek Talks Hit a Snag Over Rates

While considerable progress has been made, Greece’s financial backers — Germany and the International Monetary Fund — have been unyielding in their insistence that the longer-term bonds that would replace the current securities must carry yields in the low 3 percent range, officials involved in the negotiations said on Sunday.Earlier:

...

Also holding up discussions was the question of what to do about the European Central Bank’s 55 billion euros in Greek bonds. ... To get around this, officials are now discussing the possibility that Europe’s rescue fund might lend money to Greece to allow it to buy the bonds back from the European Central Bank at the price the bank paid for them — thought to be about 75 cents on the euro.

• Summary for Week ending January 20th

• Schedule for Week of Jan 22nd

• FOMC Meeting Preview

FOMC Meeting Preview

by Calculated Risk on 1/22/2012 03:20:00 PM

There will be a two day meeting of the Federal Open Market Committee (FOMC) this coming Tuesday and Wednesday. I expect no changes to the Fed Funds rate, or to the program to "extend the average maturity of its holdings of securities" (scheduled to end in June 2012), or to the program to "reinvest principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities". I don't expect further accommodation (aka "QE3") to be announced at this meeting.

On Wednesday the FOMC statement will be released around 12:30PM and Fed Chairman Ben Bernanke will hold a quarterly press briefing at 2:15 PM ET.

A few things to look for:

1) FOMC participants' projections of the appropriate target federal funds rate. This will the first quarterly release of the participants' view of the appropriate path for the Fed funds rate. On Friday the Fed released blank templates for reporting participants' views. The first chart "Appropriate Timing of Policy Firming" will show when participants judge that the first increase in the target federal funds rate from its current range will occur. The second chart will the participants' view of the "Appropriate Pace of Policy Firming".

These charts will probably show that most participants judge that the first rate increase will occur in 2014 or later, and that most participants believe the appropriate policy path through 2013 will be no change in the Fed's fund rate.

2) Fed Chairman Press Briefing. At the press briefing, Chairman Bernanke will discuss the new FOMC forecasts including the two new charts on the Fed funds rate. Growth forecasts were routinely revised down all through 2011, and it is likely that GDP growth for 2012 will be revised down slightly again this month. However the unemployment rate for 2012 might be revised down or left unchanged.

I expect Bernanke will be asked about the possibility of a large scale MBS purchase program, but it appears too early for "QE3".

Here are the updated forecasts from the November meeting. The GDP projection for 2012 will probably be revised down slightly from the 2.5% to 2.9% range.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Change in Real GDP1 | 2011 | 2012 | 2013 | 2014 |

| November 2011 Projections | 1.6 to 1.7 | 2.5 to 2.9 | 3.0 to 3.5 | 3.0 to 3.9 |

The unemployment rate declined to 8.5% in December, and the projection for 2012 will probably be revised down slightly.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Unemployment Rate2 | 2011 | 2012 | 2013 | 2014 |

| November 2011 Projections | 9.0 to 9.1 | 8.5 to 8.7 | 7.8 to 8.2 | 6.8 to 7.7 |

The forecasts for overall and core inflation will probably be mostly unchanged.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| PCE Inflation1 | 2011 | 2012 | 2013 | 2014 |

| November 2011 Projections | 2.7 to 2.9 | 1.4 to 2.0 | 1.5 to 2.0 | 1.5 to 2.0 |

Here is core inflation:

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Core Inflation1 | 2011 | 2012 | 2013 | 2014 |

| November 2011 Projections | 1.8 to 1.9 | 1.5 to 2.0 | 1.4 to 1.9 | 1.5 to 2.0 |

If the economy under performs or even tracks the November projections, QE3 would seem likely at either of the two day meetings in April or June. Some have argued that QE3 could happen sooner, perhaps at the March meeting. If the economy performs better than expected, then the Fed will probably wait longer.

3) Possible Statement Changes. The FOMC met in December, and not much has changed - so the statement will probably be very similar to the December statement.

Investors will probably focus on any change to the sentence in the second paragraph: "Strains in global financial markets continue to pose significant downside risks to the economic outlook."

The FOMC will probably reiterate that they stand ready to take further action: "The Committee will continue to assess the economic outlook in light of incoming information and is prepared to employ its tools to promote a stronger economic recovery in a context of price stability."

The sentence "The Committee ... currently anticipates that economic conditions ... are likely to warrant exceptionally low levels for the federal funds rate at least through mid-2013" will be removed and replaced with the Fed funds rate projections.

I expect the focus will be on the press briefing and the FOMC forecasts.

Yesterday:

• Summary for Week ending January 20th

• Schedule for Week of Jan 22nd

Q4 GDP Forecasts: Sluggish Growth

by Calculated Risk on 1/22/2012 10:53:00 AM

The advance Q4 GDP report will be released on Friday. The consensus is that real GDP increased 3.0% annualized in Q4. Here are a few forecasts:

From Merrill Lynch:

We expect real GDP advanced 2.7% annualized in the fourth quarter after rising 1.8% in Q3. Nearly a full percentage of the growth last quarter stemmed from inventory accumulation, which means that domestic final sales rose just 1.7%. ... Stepping back, the broader story is that as the shocks of last summer have dissipated, the economy has picked up momentum. However, the bounce we’ve seen is fairly feeble ...From Goldman Sachs:

We estimate that real GDP increased by 3.2% (annualized) in Q4, up from 1.8% in Q3. Despite this momentum in the recent data, we still expect growth to slow somewhat in the first half of 2012. ... we expect the Euro-area crisis to weigh somewhat more heavily on growth than it has done so far, mainly via financial channels.And a few more forecasts from a week ago via the WSJ MarketBeat:

Macroeconomic Advisers cut their estimate of fourth-quarter GDP from 3.3% to 3% today on the trade news. ... J.P. Morgan economists also cut their fourth-quarter estimates ... to 3% from 3.5%.Still sluggish growth.

Bank of America Merrill Lynch economist Neil Dutta cut his estimate ... "A wider trade gap implies weaker GDP; our Q4 tracking estimate is running 2.7% from 3.0% post retail sales. The broader story is that growth net of inventory accumulation – domestic demand – is softening as we head into 2012."

Saturday, January 21, 2012

Greek Debt Deal Update: Talks Continue

by Calculated Risk on 1/21/2012 08:37:00 PM

The talks are continuing, but it is unclear if a deal will be reached before the eurozone finance minister meeting on Monday.

From the Athens News: Dallara leaves Athens, talks to continue: sources

The representatives of Greece's private creditors have left Athens and debt swap talks will continue over the phone during the weekend, sources close to the negotiations said, adding that it was unlikely that a deal would be clinched before next week.From the Financial Times: Bondholders face additional losses on Greek debt

...

Athens is anxious to strike a deal before a meeting on Monday of eurozone finance ministers, just in time to set in motion the paperwork and approvals necessary to receive a new injection of aid to avoid a messy bankruptcy in March.

"The elements of an unprecedented voluntary PSI are coming into place," the Institute of International Finance said in a statement after Friday's three-hour evening negotiation session, referring to the bond swap scheme.

The Institute of International Finance, representing holders of some €200bn of Greek debt, on Saturday denied rumours the talks had stalled, saying that experts from its steering committee “will be working with Greek government officials on many aspects of the PSI."Earlier:

excerpt with permission

• Summary for Week ending January 20th

• Schedule for Week of Jan 22nd

Unofficial Problem Bank list declines to 963 Institutions

by Calculated Risk on 1/21/2012 05:24:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Jan 20, 2012. (table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

With the FDIC back to closings and the OCC releasing its enforcement actions through mid-December 2011, the Unofficial Problem Bank List underwent several changes during the week. In all, there were seven removals and one addition, which leaves the list standing at 963 institutions with assets of $389.2 billion. A year ago, the list held 937 institutions with assets of $409.4 billion.Earlier:

Five of the seven removals were rehabilitations as the OCC terminated actions against Central National Bank, Junction City, KS ($834 million); Citizens National Bank of Paintsville, Paintsville, KY ($563 million); National Bank of Commerce, Superior, WI ($534 million); The First National Bank of Wynne, Wynne, AR ($255 million); and The First National Bank of Ipswich, Ipswich, MA ($276 million), which had been under an action since 2006.

There were three failures this week, but only two were on the Unofficial Problem Bank List -- Central Florida State Bank, Belleview, FL ($79 million Ticker: CEFB); and American Eagle Savings Bank, Boothwyn, PA ($20 million). The other failure, The First State Bank, Stockbridge, GA ($537 million), was not on the list. It seems unusual for a bank to fail these days without being under a formal action. After some research, the bank in a 10-Q filing on August 13, 2010 disclosed the entering of a Consent Order with the FDIC on May 7, 2010. What is odd is this action does not seem to appear in an FDIC monthly press release or on its website (http://www.fdic.gov/bank/individual/enforcement/begsrch.html). Should anyone have luck finding this action at the FDIC let us know, otherwise it appears they were on double secret probation. First State Bank was costly as the FDIC estimates it will cost around 40 percent of the failed bank's assets.

Added this week was Naugatuck Valley Savings and Loan, Naugatuck, CT ($582 million Ticker: NVSL). Other changes include the OCC issuing Prompt Corrective Action Orders against Home Savings of America, Little Falls, MN ($440 million); and Charter National Bank and Trust, Hoffman Estates, IL ($98 million). Next week, we anticipate the FDIC to release its actions through December 2011.

• Summary for Week ending January 20th

• Schedule for Week of Jan 22nd

Schedule for Week of Jan 22nd

by Calculated Risk on 1/21/2012 01:15:00 PM

Earlier:

• Summary for Week Ending January 20th

The key U.S. economic report for the coming week is the Q4 advance GDP report to be released on Friday. Also New Home sales will be released on Thursday.

The Fed's FOMC holds a two day meeting on Tuesday and Wednesday, and Fed Chairman Ben Bernanke will hold a press conference following the FOMC announcement on Wednesday. The FOMC will release participants' projections of the appropriate target federal funds rate along with the usual quarterly economic projections.

On Tuesday, President Obama will present the State of the Union address. This might include mention of several housing initiatives.

No economic releases scheduled.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for January. The consensus is for an increase to 6 for this survey from 3 in December (above zero is expansion).

10:00 AM: Regional and State Employment and Unemployment (Monthly) for December 2011

9:00 PM: State of the Union Address. President Obama will probably mention some housing policy initiatives such as the new HARP program (refinance activity will increase in March), an REO to rental program for Fannie and Freddie, and possibly the long rumored mortgage settlement agreement.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index was especially weak last year, although it has increased a little recently.

10:00 AM: FHFA House Price Index for November 2011. This is based on GSE repeat sales and is no longer as closely followed as Case-Shiller (or CoreLogic).

10:00 AM: Pending Home Sales Index for December. The consensus is for a 1.0% decrease in the index.

12:30PM: FOMC Meeting Announcement. No changes are expected to interest rates. The key change will be the release of Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

2:15 PM: Fed Chairman Ben Bernanke holds a press briefing following the FOMC announcement.

8:30 AM: The initial weekly unemployment claims report will be released.

8:30 AM: The initial weekly unemployment claims report will be released. The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased last week to 379,000.

The consensus is for an increase to 370,000 from 352,000 last week.

8:30 AM: Durable Goods Orders for December from the Census Bureau. The consensus is for a 2.0% increase in durable goods orders.

8:30 AM ET: Chicago Fed National Activity Index (December). This is a composite index of other data.

10:00 AM ET: New Home Sales for December from the Census Bureau.

10:00 AM ET: New Home Sales for December from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the current sales rate.

The consensus is for a slight increase in sales to 320 thousand Seasonally Adjusted Annual Rate (SAAR) in December from 315 thousand in November. The consensus might be a little low based on the homebuilder confidence survey.

10:00 AM: Conference Board Leading Indicators for December. The consensus is for a 0.7% increase in this index.

11:00 AM: Kansas City Fed regional Manufacturing Survey for January. This survey was at -4 in December (contraction).

8:30 AM: Q4 GDP (advance release). This is the advance release from the BEA. The consensus is that real GDP increased 3.0% annualized in Q4.

8:30 AM: Q4 GDP (advance release). This is the advance release from the BEA. The consensus is that real GDP increased 3.0% annualized in Q4.This graph shows the quarterly GDP growth (at an annual rate) for the last 30 years.

The Red column is the forecast for Q3 GDP.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (final for January). The consensus is for no change from the preliminary reading of 74.0.

Summary for Week ending January 20th

by Calculated Risk on 1/21/2012 08:11:00 AM

The economic data last week wasn't strong, but it was mildly encouraging. Although housing starts declined in December, the decline was due to the volatile multifamily sector - in fact single family housing starts were at the highest level of the year. This followed an increase in the homebuilder confidence index; the builders are still depressed, but not quite as pessimistic as before.

The existing home sales report showed a sharp decline in inventory - an important story for housing. Economist Tom Lawler commented:

[O]ne of the more startling trends is the sharp decline in the estimated number of existing homes for sale. ... While the argument some make that the declining inventory trend in part reflects discouraged would-be sellers from taking their home off the market until “better times” arrive has some merit, it would be inane to dismiss completely the sharp decline in inventories – just as it was inane to dismiss the explosive jump in inventories in 2006 and 2007.There was good news on initial weekly unemployment claims too. The DOL reported initial weekly claims declined to 352,000 - the lowest level since April 2008. And two regional manufacturing surveys showed expansion in January. Also the Architecture Billings Index was positive for the 2nd consecutive month (a leading indicator for commercial real estate). All and all, the US economic reports were mildly encouraging last week.

One other reason for the drop in listings is the sharp decline in REO listings from the end of 2010 to the end of 2011. While the foreclosure/robo-signing mess resulted in a significant decline in bank repossessions in 2011 compared to 2010, there wasn’t any corresponding slowdown in REO sales. ... As a result, REO inventories probably fell by close to 150,000. This, of course, would only explain a modest part of the huge drop in listings last year, but it was a factor.

In addition, anecdotal evidence indicates that a decent share of investors who have purchase REO – and the investor share of purchase is significant – have purchased properties not for a “quick flip,” but as a rental investment. As a result, fewer properties purchased by investors have quickly come back on the market than was the case several years ago.

Here is a summary in graphs:

• Housing Starts declined in December

Click on graph for larger image.

Click on graph for larger image.Total housing starts were at 657 thousand (SAAR) in December, down 4.1% from the November rate of 685 thousand (SAAR). Most of the increase this year has been for multi-family starts, but single family starts have been increasing recently too.

Single-family starts increased 4.4% to 470 thousand in December - the highest level in 2011, and the highest since the expiration of the tax credit.

This was below expectations of 680 thousand starts in December, although the decline in December was related to the volatile multifamily sector.

• Existing Home Sales in December: 4.61 million SAAR, 6.2 months of supply

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993. Sales in December 2011 (4.61 million SAAR) were 5.0% higher than last month, and were 3.6% above the December 2010 rate.

According to the NAR, inventory decreased to 2.38 million in December from 2.62 million in November. This is the lowest level of inventory since March 2005.

The next graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change.

The next graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change.Inventory decreased 21.2% year-over-year in December from December 2010. This is the tenth consecutive month with a YoY decrease in inventory.

Months of supply decreased to 6.2 months in December, down from 7.2 months in November. This is still a little higher than normal.

• Industrial Production increased 0.4% in December, Capacity Utilization increased

From the Fed: Industrial production and Capacity Utilization

From the Fed: Industrial production and Capacity Utilization This graph shows Capacity Utilization. This series is up 10.8 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 78.1% is still 2.3 percentage points below its average from 1972 to 2010 and below the pre-recession levels of 81.3% in December 2007.

This graph shows industrial production since 1967.

This graph shows industrial production since 1967.Industrial production increased in December to 95.3, and previous months were revised up slightly.

The consensus was for a 0.5% increase in Industrial Production in December, and for an increase to 78.1% for Capacity Utilization. This was close to consensus.

• AIA: Architecture Billings Index indicated expansion in December

From AIA: Architecture Billings Index Positive for Second Straight Month

This graph shows the Architecture Billings Index since 1996. The index was unchanged at 52.0 in December. Anything above 50 indicates expansion in demand for architects' services.

This graph shows the Architecture Billings Index since 1996. The index was unchanged at 52.0 in December. Anything above 50 indicates expansion in demand for architects' services.According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. So this suggests further declines in CRE investment in early 2012, but perhaps stabilizing later in 2012.

• NAHB Builder Confidence index increased in January

From the NAHB: Builder Confidence Rises Fourth Consecutive Time in January

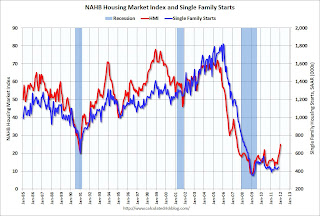

The National Association of Home Builders (NAHB) reported the housing market index (HMI) increased in January to 25 from 21 in December. Any number under 50 indicates that more builders view sales conditions as poor than good.

The National Association of Home Builders (NAHB) reported the housing market index (HMI) increased in January to 25 from 21 in December. Any number under 50 indicates that more builders view sales conditions as poor than good.This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the January release for the HMI and the November data for starts.

Both confidence and housing starts had been moving sideways at a very depressed level for several years - but confidence has been moving up. This is still very low, but this is the highest level since June 2007.

• Weekly Initial Unemployment Claims declined to 352,000

This graph shows the 4-week moving average of weekly claims since January 2000.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week to 379,000.

This graph shows the 4-week moving average of weekly claims since January 2000.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week to 379,000.The 4-week moving average is well below 400,000.

This is the lowest level for weekly claims since April 2008.

• Regional Fed Surveys show expansion in January

From the Philly Fed: January 2012 Business Outlook Survey

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, edged up slightly from a revised reading of 6.8 in December to 7.3 in January.From the NY Fed: Empire State Manufacturing Survey

The Empire State Manufacturing Survey indicates that manufacturing activity expanded in New York State in January. The general business conditions index climbed five points to 13.5.

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through January. The ISM and total Fed surveys are through December.

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through January. The ISM and total Fed surveys are through December.The average of the Empire State and Philly Fed surveys increased again in January, and is at the highest level since early 2011.

• Key Measures of Inflation moderated in December

This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.3%, the trimmed-mean CPI rose 2.5%, and core CPI rose 2.2%. Core PCE is for November and increased 1.7% year-over-year.

This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.3%, the trimmed-mean CPI rose 2.5%, and core CPI rose 2.2%. Core PCE is for November and increased 1.7% year-over-year. On a monthly basis, the median Consumer Price Index increased 2.9% at an annualized rate, the 16% trimmed-mean Consumer Price Index increased 1.5% annualized, and core CPI increased 1.8% annualized.

These measures show inflation has moderated.

• Other Economic Stories ...

• Housing: Record Low Total Completions in 2011

• Lawler: Housing Forecast for 2012

• LA area Port Traffic increases slightly year-over-year in December

• Residential Remodeling Index declines seasonally in November

Friday, January 20, 2012

Fed releases templates for FOMC Fed Funds rate projections

by Calculated Risk on 1/20/2012 08:05:00 PM

From the Federal Reserve: Federal Reserve releases templates for reporting FOMC participants' projections of the appropriate target federal funds rate

The Federal Reserve on Friday released blank templates showing the format of the two charts it will use on January 25 to report Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate. It also released a draft of an explanatory note that will accompany the projections.From Luca Di Leo and Jon Hilsenrath at the WSJ: Fed Details How It Will Release Rate Forecasts

The first chart, which will have shaded bars when released on January 25, will show FOMC participants’ projections for the timing of the initial increase in the target federal funds rate. The second chart, which will have dots representing policymakers’ individual projections when released on January 25, will show participants’ views of the appropriate path of the federal funds rate over the next several years and in the longer run.

One of the new charts is a bar chart showing in which year officials expect to see the first short-term interest rate increase, with options ranging from 2012 all the way out to 2016. ... It was striking that the Fed charts go all the way out to 2016 — suggesting that some officials don’t see rate hikes for many more years.These projections will be released next Wednesday as part of the usually quarterly economic projections.

Earlier:

• Existing Home Sales in December: 4.61 million SAAR, 6.2 months of supply

• Existing Home Sales: Inventory and NSA Sales Graph

• Existing Home Sales graphs

Bank Failure #3 in 2012: American Eagle Savings Bank, Boothwyn, PA

by Calculated Risk on 1/20/2012 06:11:00 PM

Houston, we have a problem.

Eagle has landed

by Soylent Green is People

From the FDIC: Capital Bank, National Association, Rockville, Maryland, Assumes All of the Deposits of American Eagle Savings Bank, Boothwyn, Pennsylvania

As of September 30, 2011, American Eagle Savings Bank had approximately $19.6 million in total assets and $17.7 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $3.2 million. ... American Eagle Savings Bank is the third FDIC-insured institution to fail in the nation this year, and the first in Pennsylvania.That makes 3 today so far. The FDIC is back to work.

Bank Failures #1 & 2 in 2012: Florida and Georgia

by Calculated Risk on 1/20/2012 05:08:00 PM

Florida, Georgian failures

Wash, then rinse, repeat

by Soylent Green is People

From the FDIC: CenterState Bank of Florida, National Association, Winter Haven, Florida, Assumes All of the Deposits of Central Florida State Bank, Belleview, Florida

As of September 30, 2011, Central Florida State Bank had approximately $79.1 million in total assets and $77.7 million in total deposits ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $24.4 million. ... Central Florida State Bank is the first FDIC-insured institution to fail in the nation this year, and the first in Florida.From the FDIC: Hamilton State Bank, Hoschton, Georgia, Assumes All of the Deposits of the First State Bank, Stockbridge, Georgia

As of September 30, 2011, The First State Bank had approximately $536.9 million in total assets and $527.5 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $216.2 million. ... The First State Bank is the second FDIC-insured institution to fail in the nation this year, and the first in Georgia.And so it begins in 2012.