by Calculated Risk on 1/21/2012 08:11:00 AM

Saturday, January 21, 2012

Summary for Week ending January 20th

The economic data last week wasn't strong, but it was mildly encouraging. Although housing starts declined in December, the decline was due to the volatile multifamily sector - in fact single family housing starts were at the highest level of the year. This followed an increase in the homebuilder confidence index; the builders are still depressed, but not quite as pessimistic as before.

The existing home sales report showed a sharp decline in inventory - an important story for housing. Economist Tom Lawler commented:

[O]ne of the more startling trends is the sharp decline in the estimated number of existing homes for sale. ... While the argument some make that the declining inventory trend in part reflects discouraged would-be sellers from taking their home off the market until “better times” arrive has some merit, it would be inane to dismiss completely the sharp decline in inventories – just as it was inane to dismiss the explosive jump in inventories in 2006 and 2007.There was good news on initial weekly unemployment claims too. The DOL reported initial weekly claims declined to 352,000 - the lowest level since April 2008. And two regional manufacturing surveys showed expansion in January. Also the Architecture Billings Index was positive for the 2nd consecutive month (a leading indicator for commercial real estate). All and all, the US economic reports were mildly encouraging last week.

One other reason for the drop in listings is the sharp decline in REO listings from the end of 2010 to the end of 2011. While the foreclosure/robo-signing mess resulted in a significant decline in bank repossessions in 2011 compared to 2010, there wasn’t any corresponding slowdown in REO sales. ... As a result, REO inventories probably fell by close to 150,000. This, of course, would only explain a modest part of the huge drop in listings last year, but it was a factor.

In addition, anecdotal evidence indicates that a decent share of investors who have purchase REO – and the investor share of purchase is significant – have purchased properties not for a “quick flip,” but as a rental investment. As a result, fewer properties purchased by investors have quickly come back on the market than was the case several years ago.

Here is a summary in graphs:

• Housing Starts declined in December

Click on graph for larger image.

Click on graph for larger image.Total housing starts were at 657 thousand (SAAR) in December, down 4.1% from the November rate of 685 thousand (SAAR). Most of the increase this year has been for multi-family starts, but single family starts have been increasing recently too.

Single-family starts increased 4.4% to 470 thousand in December - the highest level in 2011, and the highest since the expiration of the tax credit.

This was below expectations of 680 thousand starts in December, although the decline in December was related to the volatile multifamily sector.

• Existing Home Sales in December: 4.61 million SAAR, 6.2 months of supply

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993. Sales in December 2011 (4.61 million SAAR) were 5.0% higher than last month, and were 3.6% above the December 2010 rate.

According to the NAR, inventory decreased to 2.38 million in December from 2.62 million in November. This is the lowest level of inventory since March 2005.

The next graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change.

The next graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change.Inventory decreased 21.2% year-over-year in December from December 2010. This is the tenth consecutive month with a YoY decrease in inventory.

Months of supply decreased to 6.2 months in December, down from 7.2 months in November. This is still a little higher than normal.

• Industrial Production increased 0.4% in December, Capacity Utilization increased

From the Fed: Industrial production and Capacity Utilization

From the Fed: Industrial production and Capacity Utilization This graph shows Capacity Utilization. This series is up 10.8 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 78.1% is still 2.3 percentage points below its average from 1972 to 2010 and below the pre-recession levels of 81.3% in December 2007.

This graph shows industrial production since 1967.

This graph shows industrial production since 1967.Industrial production increased in December to 95.3, and previous months were revised up slightly.

The consensus was for a 0.5% increase in Industrial Production in December, and for an increase to 78.1% for Capacity Utilization. This was close to consensus.

• AIA: Architecture Billings Index indicated expansion in December

From AIA: Architecture Billings Index Positive for Second Straight Month

This graph shows the Architecture Billings Index since 1996. The index was unchanged at 52.0 in December. Anything above 50 indicates expansion in demand for architects' services.

This graph shows the Architecture Billings Index since 1996. The index was unchanged at 52.0 in December. Anything above 50 indicates expansion in demand for architects' services.According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. So this suggests further declines in CRE investment in early 2012, but perhaps stabilizing later in 2012.

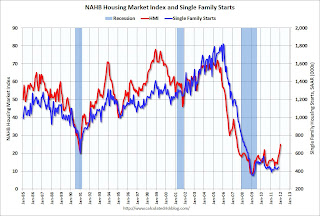

• NAHB Builder Confidence index increased in January

From the NAHB: Builder Confidence Rises Fourth Consecutive Time in January

The National Association of Home Builders (NAHB) reported the housing market index (HMI) increased in January to 25 from 21 in December. Any number under 50 indicates that more builders view sales conditions as poor than good.

The National Association of Home Builders (NAHB) reported the housing market index (HMI) increased in January to 25 from 21 in December. Any number under 50 indicates that more builders view sales conditions as poor than good.This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the January release for the HMI and the November data for starts.

Both confidence and housing starts had been moving sideways at a very depressed level for several years - but confidence has been moving up. This is still very low, but this is the highest level since June 2007.

• Weekly Initial Unemployment Claims declined to 352,000

This graph shows the 4-week moving average of weekly claims since January 2000.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week to 379,000.

This graph shows the 4-week moving average of weekly claims since January 2000.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week to 379,000.The 4-week moving average is well below 400,000.

This is the lowest level for weekly claims since April 2008.

• Regional Fed Surveys show expansion in January

From the Philly Fed: January 2012 Business Outlook Survey

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, edged up slightly from a revised reading of 6.8 in December to 7.3 in January.From the NY Fed: Empire State Manufacturing Survey

The Empire State Manufacturing Survey indicates that manufacturing activity expanded in New York State in January. The general business conditions index climbed five points to 13.5.

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through January. The ISM and total Fed surveys are through December.

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through January. The ISM and total Fed surveys are through December.The average of the Empire State and Philly Fed surveys increased again in January, and is at the highest level since early 2011.

• Key Measures of Inflation moderated in December

This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.3%, the trimmed-mean CPI rose 2.5%, and core CPI rose 2.2%. Core PCE is for November and increased 1.7% year-over-year.

This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.3%, the trimmed-mean CPI rose 2.5%, and core CPI rose 2.2%. Core PCE is for November and increased 1.7% year-over-year. On a monthly basis, the median Consumer Price Index increased 2.9% at an annualized rate, the 16% trimmed-mean Consumer Price Index increased 1.5% annualized, and core CPI increased 1.8% annualized.

These measures show inflation has moderated.

• Other Economic Stories ...

• Housing: Record Low Total Completions in 2011

• Lawler: Housing Forecast for 2012

• LA area Port Traffic increases slightly year-over-year in December

• Residential Remodeling Index declines seasonally in November