by Calculated Risk on 12/09/2011 03:43:00 PM

Friday, December 09, 2011

Europe Friday

A few details and articles.

From the EU: First session of the EU summit: Agreement on immediate action and on new fiscal rule for the eurozone

At a press conference Herman Van Rompuy, President of the European Council, and José Manuel Barroso, President of the European Commission, explained the short-term measures. Up to €200 billion will be made available to the IMF, the European Financial Stability Facility (EFSF) leverage "will be rapidly deployed" and the European Stability Mechanism (ESM) should enter into force in July 2012.Excerpts from the communiqué: "General government budgets shall be balanced or in surplus; this principle shall be deemed respected if, as a rule, the annual structural deficit does not exceed 0.5% of nominal GDP." CR note: there are several ways around this "principle".

For the medium and longer term, the 17 eurozone countries will conclude an international agreement. This fiscal compact, to be signed no later than March 2012, will establish a new, stronger fiscal rule, including more automatism in the excessive deficit procedure. The objective remains to incorporate these provisions into the treaties of the Union as soon as possible. The Heads of State or Government of Bulgaria, Czech Republic, Denmark, Hungary, Latvia, Lithuania, Poland, Romania and Sweden indicated the possibility to take part in this process after consulting their Parliaments where appropriate.

"A mechanism will be put in place for the ex ante reporting by Member States of their national debt issuance plans."

As far as rebalancing, there is mention of "the new macro-economic imbalances procedure".

From the WSJ: EU Leaders Forge Fiscal Pact

The 17 countries of the euro zone formally agreed to run only minimal budget deficits in the future and allowed the European Court of Justice the right to strike down national laws that don't enforce such discipline properly.From the NY Times: A Treaty to Save Euro May Split Europe

In a day of historic, seemingly tectonic shifts in the architecture of Europe, all 17 members of the European Union that use the euro agreed to the new treaty, along with six other countries that wish to join the currency union eventually. Three stragglers, the Czech Republic, Hungary and Sweden entered the fold later, after a strong diplomatic push.Gavyn Davies at the Financial Times is somewhat optimistic: Eurozone crisis might move from acute to chronic phase

My initial take on the deal is that it will be sufficient to dampen the acute phase of the crisis, but that the absence of a clear long-term strategy for growth means that there could still be a long period of chronic problems ahead.And from the FT Alphaville: The gap between summit rhetoric and reality

...

the communiqué ... does mention the “new macro-economic imbalances procedure” ... This is intended to increase the pressure on surplus countries (mainly Germany) ... But this resolution, unlike the fiscal rule, has no teeth ... The missing growth strategy, and the missing plan to eliminate competitiveness imbalances in the eurozone, could prove to be very serious omissions indeed.

AAR: Rail Traffic increased in November

by Calculated Risk on 12/09/2011 12:41:00 PM

The Association of American Railroads (AAR) reports carload traffic in November increased 2.3 percent compared with the same month last year, and intermodal traffic (using intermodal or shipping containers) increased 3.8 percent compared with November 2010.

The Association of American Railroads (AAR) today reported gains in November 2011 rail traffic compared with the same month last year, with U.S. railroads originating 1,476,635 carloads, up 2.3 percent, and 1,162,249 trailers and containers, up 3.8 percent. November 2011 saw the largest year-over-year percentage increase in carload traffic since March 2011.On a seasonally adjusted basis, carloads in November were up 0.9% from last month, and intermodal in Novmeber was up 0.8% from October.

...

“In November, U.S. rail carload traffic saw its highest year-over-year percentage increase in eight months, and year-over-year intermodal traffic grew for the 24th straight month,” said AAR Senior Vice President John Gray. “There are still clearly a lot of things that aren’t right with the economy, but we hope this improvement in rail traffic is a sign that the pace of economic growth is increasing.”

Click on graph for larger image.

Click on graph for larger image.This graph shows U.S. average weekly rail carloads (NSA).

Rail carload traffic collapsed in November 2008, and now, over 2 years into the recovery, carload traffic is about half way back to the pre-recession levels.

The second graph is for intermodal traffic (using intermodal or shipping containers):

Graphs reprinted with permission.

Graphs reprinted with permission.Intermodal traffic is close to the peak year in 2006. Usually October is the strongest month for intermodal shipping as retailers stock up for the holiday season. That was true again this year, but shipping held up pretty well in November too.

Overall rail traffic improved in November - and this suggests somewhat sluggish growth, and may indicate that the pace of growth is increasing a little.

Consumer Sentiment increases in December

by Calculated Risk on 12/09/2011 09:55:00 AM

The preliminary December Reuters / University of Michigan consumer sentiment index increased to 67.7, (typo corrected) up from the November reading of 64.1.

Click on graph for larger image.

Consumer sentiment is usually impacted by employment (and the unemployment rate) and gasoline prices.

However the recent sharp decline was event driven (the debt ceiling debate), and sentiment has rebounded as expected. Note: Back in August I looked at event driven declines in consumer sentiment.

Sentiment is still very weak, although above the consensus forecast of 66.0.

Trade Deficit declines in October

by Calculated Risk on 12/09/2011 08:30:00 AM

The Department of Commerce reports:

[T]otal October exports of $179.2 billion and imports of $222.6 billion resulted in a goods and services deficit of $43.5 billion, down from $44.2 billion in September,The trade deficit was at the consensus forecast of $43.5 billion.

revised. October exports were $1.5 billion less than September exports of $180.6 billion. October imports were $2.2 billion less than September imports of $224.8 billion.

The first graph shows the monthly U.S. exports and imports in dollars through October 2011.

Click on graph for larger image.

Click on graph for larger image.Both exports and imports decreased in October. Imports have been mostly moving sideways for the past six months (seasonally adjusted). Exports are well above the pre-recession peak and up 12% compared to October 2010; imports have stalled recently but are still up about 11% compared to October 2010.

The second graph shows the U.S. trade deficit, with and without petroleum, through October.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil averaged $98.84 per barrel in October, and import oil prices have been declining slowly from $108.70 per barrel in May. The trade deficit with China was unchanged at $28 billion.

Imports have been moving sideways for the last several months - partially due to slightly lower oil prices. However the trade deficit with China continues to be a significant issue.

Thursday, December 08, 2011

Europe Friday: Over promise, Under Deliver Again?

by Calculated Risk on 12/08/2011 11:51:00 PM

The ECB disappointed today, and the EU will probably under deliver again tomorrow.

The following is no surprise - no one expected all 27 countries to agree, just the 17 eurozone countries plus a few more ...

From CNBC: EU Fails to Agree on Treaty Change Among 27 States: Diplomats

The European Union failed to secure backing from all 27 countries to change the EU treaty at a summit on Friday, meaning any deal will now likely involve the 17 euro zone countries plus any others that want to join, three EU diplomats said.From the NY Times: After Rate Cut, Gloom as Europe Leaders Meet

Late Thursday, European leaders here were circulating the draft of a new “fiscal compact” for the currency union, including tighter control of public finances. Disagreement persisted about whether any deal would cover all 27 European Union member states or just the 17-member euro zone, and about whether it would involve amendments to the euro treaty. Leaders were also discussing whether a permanent bailout fund, set to begin operation as early as July, should function as a licensed banker.I'm sure there will be some sort of agreement, but it appears they will under deliver once again.

Earlier in the day in Washington, President Obama voiced frustration that Chancellor Angela Merkel of Germany and other European leaders were focusing on the wrong problem by negotiating long-term changes to the euro treaty, rather than reassuring the markets and staving off a recession by taking bold short-term action.

...

Adding to the anxiety, European regulators said on Thursday that many of the region’s biggest banks, including the German giants Deutsche Bank and Commerzbank, needed to raise more money as reserves against potential losses.

The amounts to be set aside are much higher than regulators had estimated as recently as October, and the inclusion of German banks in the roundup was a reminder that even the region’s richest nation was not immune from the debt crisis contagion.

President Nicolas Sarkozy of France, in Marseille on Thursday before heading here, said, “If we don’t have an agreement Friday, there won’t be a second chance.”

The Asian markets are all red tonight. The Nikkei is down about 1%, the Hang Seng is off 2.6%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P 500 futures are up slightly and the Dow futures are up 25.

Distressed House Sales using Sacramento Data for November

by Calculated Risk on 12/08/2011 07:30:00 PM

I've been following the Sacramento market to look for changes in the mix of house sales in a distressed area over time (conventional, REOs, and short sales). The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

This will be interesting once something changes - and not much has changed yet. At some point, the number and percent of distressed sales should start to decline (excluding seasonal factors and market distortions like the home buyer tax credit).

The percent of distressed sales in Sacramento was unchanged in November compared to October. In November 2011, 64.1% of all resales (single family homes and condos) were distressed sales. This was down slightly from 66.1% in November 2010.

Here are the statistics.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the percent of REO sales, short sales and conventional sales. There is a seasonal pattern for conventional sales (stronger in the spring and summer), and distressed sales happen all year - so the percentage of distressed sales decreases every summer and the increases in the fall and winter.

Total sales were up 14.6% compared to November 2010. Active Listing Inventory were down 38.1% from last November, although "short sale contingent" has increased. Cash buyers accounted for 27.4% of all sales (frequently investors), and median prices are off about 8% from last November.

This data might be helpful in determining when the market is improving. So far it looks like REO sales have declined (this is the lowest percentage of REO sales since Sacramento started breaking out REOs), offset by an increase in short sales, so overall there is no improvement.

Labor Force Participation Rate: The Kids are Alright

by Calculated Risk on 12/08/2011 04:38:00 PM

On Sunday I posted Comments on the Employment-Population Ratio with a follow up yesterday: Labor Force Participation Rate by Age Group

Some people have wondered why the participation rate has been declining for the younger age groups.

First below is a repeat of the graph from yesterday showing the trends by age group since 1990.

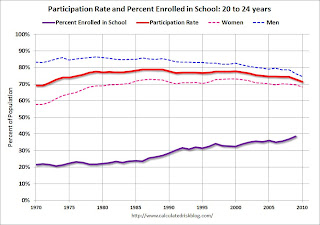

Note: The participation rate is the percentage of the working age population in the labor force.

Click on graph for larger image.

Click on graph for larger image.

Some of the recent decline in the participation rate for the '20 to 24' age group is probably related to the recession.

But probably the main reason for the decline in the participation rate for the younger age groups is that more people are pursuing higher education. (ht Rick Nevin) Nevin writes:

The decline in age-16-19 and age-20-24 labor force participation is the mirror image of the increase in school enrollment rates for those age groups. This trend is exactly what was anticipated by (promised by) research that supported the phase-out of lead in gasoline from the early-1970s through the mid-1980s, and subsequent lead paint hazard reduction requirements, including my 1999 Economic Analysis of HUD lead hazard reduction requirements.Note: I do not know Rick Nevin, but I have read some research about the link between lead and crime (and IQ). As an example, from Professor Jessica Wolpaw Reyes: Environmental Policy as Social Policy? The Impact of Childhood Lead Exposure on Crime makes a strong argument that removing lead from gasoline from 1975 to 1985 led to lower crime rates.

More from Nevin:

The decline in labor force participation for ages 16-24 might be partly due to a short term “bad news” story about discouraged workers, but it is mainly due to a longer term “great news” story about ongoing gains in school enrollment and academic attainment.

This graph uses data from the BLS on participation rate, and the National Center for Education Statistics (NCES) on enrollment rates.

This graph uses data from the BLS on participation rate, and the National Center for Education Statistics (NCES) on enrollment rates.This graph shows the participation and enrollment rates for the 18 to 19 year old age group. These two lines are a "mirror image".

Note: I added the participation rate for men and women too. One of the key labor stories in the 2nd half of the 1900s was the surge in participation by women.

The third graph shows the participation and enrollment rates for the 20 to 24 year old age group.

The third graph shows the participation and enrollment rates for the 20 to 24 year old age group.Once again the participation rate is declining as the enrollment rate is increasing. The participation rate (all) was rising in the '70s and early '80s because of the increase in women entering the labor force.

In the long run, more education is a positive for the economy (although I am concerned about the surge in student loans). This increase in education enrollment suggests we should look at the prime working age (25 to 54) for changes in the participation rate and employment-population ratio due to the recent recession.

But mostly it suggests that the kids are alright!

Q3 Flow of Funds: Household Net Worth declines $2.4 Trillion in Q3

by Calculated Risk on 12/08/2011 12:01:00 PM

The Federal Reserve released the Q3 2011 Flow of Funds report today: Flow of Funds.

The Fed estimated that household net worth declined $2.4 trillion in Q3. Household net worth peaked at $66.8 trillion in Q2 2007, and then net worth fell to $50.4 trillion in Q1 2009 (a loss of $16.4 trillion). Household net worth was at $57.4 trillion in Q3 2011 (up $7.0 trillion from the trough, but down $2.4 trillion in Q3).

The Fed estimated that the value of household real estate fell $98 billion to $16.1 trillion in Q3 2011. The value of household real estate has fallen $6.6 trillion from the peak - and is still falling in 2011.

Click on graph for larger image.

Click on graph for larger image.

This is the Households and Nonprofit net worth as a percent of GDP.

This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc) net of liabilities (mostly mortgages). Note that this does NOT include public debt obligations.

This ratio was relatively stable for almost 50 years, and then we saw the stock market and housing bubbles.

This graph shows homeowner percent equity since 1952.

This graph shows homeowner percent equity since 1952.

Household percent equity (as measured by the Fed) collapsed when house prices fell sharply in 2007 and 2008.

In Q3 2011, household percent equity (of household real estate) was at 38.7% - about the same as in Q2.

Note: about 30.3% of owner occupied households have no mortgage debt as of April 2010. So the approximately 52+ million households with mortgages have far less than 38.7% equity - and, according to CoreLogic, about 10.7 million households have negative equity.

The third graph shows household real estate assets and mortgage debt as a percent of GDP.

The third graph shows household real estate assets and mortgage debt as a percent of GDP.

Mortgage debt declined by $54 billion in Q3. Mortgage debt has now declined by $730 billion from the peak. Studies suggest most of the decline in debt has been because of foreclosures (or short sales), but some of the decline is from homeowners paying down debt (sometimes so they can refinance at better rates).

Assets prices, as a percent of GDP, have fallen significantly and are only slightly above historical levels. However household mortgage debt, as a percent of GDP, is still historically very high, suggesting more deleveraging ahead for households.

Europe: ECB cuts rates, Adopts further "non-standard measures"

by Calculated Risk on 12/08/2011 10:05:00 AM

From Mario Draghi, President of the ECB: Introductory statement to the press conference

Based on its regular economic and monetary analyses, the Governing Council decided to lower the key ECB interest rates by 25 basis points, following the 25 basis point decrease on 3 November 2011. [this lowers the rate to 1.0%]From the Financial Times: ECB launches new support for banks

...

In its continued efforts to support the liquidity situation of euro area banks, and following the coordinated central bank action on 30 November 2011 to provide liquidity to the global financial system, the Governing Council today also decided to adopt further non-standard measures. These measures should ensure enhanced access of the banking sector to liquidity and facilitate the functioning of the euro area money market. They are expected to support the provision of credit to households and non-financial corporations. In this context, the Governing Council decided:

First, to conduct two longer-term refinancing operations (LTROs) with a maturity of 36 months and the option of early repayment after one year. The operations will be conducted as fixed rate tender procedures with full allotment. The rate in these operations will be fixed at the average rate of the main refinancing operations over the life of the respective operation. Interest will be paid when the respective operation matures. The first operation will be allotted on 21 December 2011 and will replace the 12-month LTRO announced on 6 October 2011.

Second, to increase collateral availability by reducing the rating threshold for certain asset-backed securities (ABS). In addition to the ABS that are already eligible for Eurosystem operations, ABS having a second best rating of at least “single A” in the Eurosystem harmonised credit scale at issuance, and at all times subsequently, and the underlying assets of which comprise residential mortgages and loans to small and medium-sized enterprises, will be eligible for use as collateral in Eurosystem credit operations. Moreover, national central banks will be allowed, as a temporary solution, to accept as collateral additional performing credit claims (namely bank loans) that satisfy specific eligibility criteria. The responsibility entailed in the acceptance of such credit claims will be borne by the national central bank authorising their use. These measures will take effect as soon as the relevant legal acts have been published.

Third, to reduce the reserve ratio, which is currently 2%, to 1%. This will free up collateral and support money market activity. As a consequence of the full allotment policy applied in the ECB’s main refinancing operations and the way banks are using this option, the system of reserve requirements is not needed to the same extent as under normal circumstances to steer money market conditions. This measure will take effect as of the maintenance period starting on 18 January 2012.

Fourth, to discontinue for the time being, as of the maintenance period starting on 14 December 2011, the fine-tuning operations carried out on the last day of each maintenance period. This is a technical measure to support money market activity.

From the WSJ: Draghi Announces New ECB Crisis Moves

Also from the WSJ: EU Nearing IMF Loan Deal

The European Union is nearing a deal to lend €200 billion ($268.26 billion) to the International Monetary Fund—including €150 billion coming from the 17-nation euro zone—that the IMF could then use to shore up the troubled euro-zone sovereign debt market, euro-zone officials said Thursday.Bond yields for Italy and Spain increased this morning. The Italian 2 year yield is up sharply to 5.98%, and the 10 year yield is up to 6.31%.

The Spanish 2 year yield is up to 4.62%, and the 10 year yield is up to 5.67%.

Weekly Initial Unemployment Claims decline to 381,000

by Calculated Risk on 12/08/2011 08:30:00 AM

The DOL reports:

In the week ending December 3, the advance figure for seasonally adjusted initial claims was 381,000, a decrease of 23,000 from the previous week's revised figure of 404,000. The 4-week moving average was 393,250, a decrease of 3,000 from the previous week's revised average of 396,250.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week to 393,250.

This is the fourth week in a row with the 4-week average below 400,000, and this is the lowest level for claims since February.

And here is a long term graph of weekly claims: