by Calculated Risk on 12/01/2011 06:38:00 PM

Thursday, December 01, 2011

Employment Situation Preview: Better, but still Weak

Tomorrow (Friday) the BLS will release the November Employment Situation Summary at 8:30 AM ET. Bloomberg is showing the consensus is for an increase of 131,000 payroll jobs in November, and for the unemployment rate to remain unchanged at 9.0%. The consensus has been moving up all week and the "whisper" employment number is probably even higher.

Overall the economic data for November was fairly weak suggesting sluggish growth, but somewhat improved compared to recent months. So I'd expect a little better employment report - but that isn't saying much.

Here is a summary of recent data:

• The ADP employment report showed an increase of 206,000 private sector payroll jobs in November. Unfortunately ADP hasn't been very useful in predicting the BLS report. Also note that government payrolls have been shrinking by about 27,000 on average per month this year, so this suggests around 206,000 private nonfarm payroll jobs added, minus 27,000 government workers - or around 179,000 total jobs added in November.

• The ISM manufacturing employment index decreased to 51.8% from 53.5% in October. Based on a historical correlation between the ISM index and the BLS employment report for manufacturing, this reading suggests a loss of a few thousand private payroll jobs for manufacturing in October.

The ISM non-manufacturing index for November will be released next Monday.

• Initial weekly unemployment claims averaged about 396,000 in November, down from 404,000 per week in October, and down from 418,000 per week in September.

For the BLS reference week (includes the 12th of the month), initial claims were at the lowest level since March and April - and the BLS reported an average of 205,500 jobs added for those two months.

• The final November Reuters / University of Michigan consumer sentiment index increased to 64.1 from 60.9 in October. This is frequently coincident with changes in the labor market, but also strongly related to gasoline prices and other factors. In general this low level would suggest a weak labor market - but slightly better than in August, September and October (the BLS reported an average of 114,000 per month for those three months).

• And on the unemployment rate from Gallup: U.S. Unemployment Ticks Up in Mid-November

Unemployment, as measured by Gallup without seasonal adjustment, is 8.5% in mid-November -- up from 8.3% in mid-October, but down significantly from 9.2% in mid-November 2010. Gallup's mid-month unemployment measure suggests the government is likely to report no change in its seasonally adjusted unemployment rate for November 2011.NOTE: The Gallup poll results are Not Seasonally Adjusted (NSA), so use with caution. Usually the NSA unemployment rate increases in November - so this would suggest little change in the headline seasonally adjusted unemployment rate.

There always seems to be some randomness to the employment report, but it does seem the situation has improved somewhat (lower initial weekly unemployment claims, more job openings). I'll go with the consensus forecast this month.

U.S. Light Vehicle Sales at 13.6 million SAAR in November, Highest since Aug 2009

by Calculated Risk on 12/01/2011 03:53:00 PM

Based on an estimate from Autodata Corp, light vehicle sales were at a 13.63 million SAAR in November. That is up 11.4% from November 2010, and up 3.1% from the sales rate last month (13.22 million SAAR in Oct 2011).

This was above the consensus forecast of 13.4 million SAAR.

This graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and an estimate for November (red, light vehicle sales of 13.63 million SAAR from Autodata Corp).

Click on graph for larger image.

Click on graph for larger image.

This was the highest sales rate since August 2009 ("Cash-for-clunkers"), and other than August 2009, this was the highest since June 2008.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

This shows the huge collapse in sales in the 2007 recession. This also shows the impact of the tsunami and supply chain issues on sales, especially in May and June.

Note: dashed line is current estimated sales rate.

Note: dashed line is current estimated sales rate.

Growth in auto sales should make a strong positive contribution to Q4 GDP. Sales in Q3 averaged 12.45 million SAAR, and so far (October and November) sales have averaged 13.42 million SAAR in Q4, an increase of 7.6% over Q3.

Construction Spending increased in October

by Calculated Risk on 12/01/2011 02:12:00 PM

Note: I'll post a graph of November auto sales around 4 PM ET.

This morning the Census Bureau reported that overall construction spending increased in October:

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during October 2011 was estimated at a seasonally adjusted annual rate of $798.5 billion, 0.8 percent (±1.6%) above the revised September estimate of $792.1 billion. The October figure is 0.4 percent (±1.9%) below the October 2010 estimate of $802.0 billion.Private construction spending increased in October:

Spending on private construction was at a seasonally adjusted annual rate of $518.6 billion, 2.3 percent (±1.1%) above the revised September estimate of $507.1 billion. Residential construction was at a seasonally adjusted annual rate of $239.0 billion in October, 3.4 percent (±1.3%) above the revised September estimate of $231.2 billion. Nonresidential construction was at a seasonally adjusted annual rate of $279.6 billion in October, 1.3 percent (±1.1%) above the revised September estimate of $275.9 billion.

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending is 65% below the peak in early 2006, and non-residential spending is 32% below the peak in January 2008.

Public construction spending is now 14% below the peak in March 2009.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, both private residential and non-residential construction spending have turned positive, but public spending is now falling on a year-over-year basis as the stimulus spending ends. The year-over-year improvements in private non-residential are mostly due to energy spending (power and electric).

Earlier:

• ISM Manufacturing index indicates slightly faster expansion in November

• LPS: Mortgages In Foreclosure Process at an All-Time High

LPS: Mortgages In Foreclosure Process at an All-Time High

by Calculated Risk on 12/01/2011 11:33:00 AM

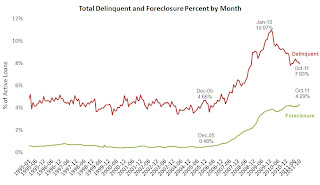

From LPS Applied Analytics: LPS' Mortgage Monitor Report Shows Delinquencies Down Nearly 30 Percent from Peak, Foreclosure Inventory at an All-Time High

The October Mortgage Monitor report released by Lender Processing Services, Inc. (NYSE: LPS) shows mortgage delinquencies continue their decline, now nearly 30 percent off their January 2010 peak. Meanwhile, foreclosure inventories are on the rise, reaching an all-time high at the end of October of 4.29 percent of all active mortgages. The average days delinquent for loans in foreclosure extended as well, setting a new record of 631 days since last payment, while the average days delinquent for loans 90 or more days past due but not yet in foreclosure decreased for the second consecutive month.According to LPS, 7.93% of mortgages were delinquent in October, down from 8.09% in September, and down from 9.29% in October 2010.

Judicial vs. non-judicial foreclosure processes remain a significant factor in the reduction of foreclosure pipelines from state to state, with non-judicial foreclosure inventory percentages less than half that of judicial states. ...

The October data also showed that mortgage originations are on the rise, reaching levels not seen since mid-2010. Mortgage prepayment rates have also spiked, as much of the new origination is related to borrower refinancing ...

LPS reports that a record 4.29% of mortgages were in the foreclosure process, up from 4.18% in September, and up from 3.92% in October 2010. This gives a total of 12.22% delinquent or in foreclosure. It breaks down as:

• 2.33 million loans less than 90 days delinquent.

• 1.76 million loans 90+ days delinquent.

• 2.21 million loans in foreclosure process.

For a total of 6.30 million loans delinquent or in foreclosure in October.

Click on graph for larger image.

Click on graph for larger image.This graph shows the total delinquent and in-foreclosure rates since 1995.

The total delinquent rate has fallen to 7.93% from the peak in January 2010 of 10.97%. A normal rate is probably in the 4% to 5% range, so there is a long ways to go.

However the in-foreclosure rate at 4.29% is a new record high. There are still a large number of loans in this category (about 2.21 million) - and the average days delinquent for loans in foreclosure set a "new record of 631 days since last payment" in October.

This graph provided by LPS Applied Analytics shows foreclosure inventories by process.

This graph provided by LPS Applied Analytics shows foreclosure inventories by process. As LPS noted "Judicial vs. non-judicial foreclosure processes remain a significant factor in the reduction of foreclosure pipelines from state to state, with non-judicial foreclosure inventory percentages less than half that of judicial states. This is largely a result of the fact that foreclosure sale rates in non-judicial states have been proceeding at four to five times that of judicial. Non-judicial foreclosure states made up the entirety of the top 10 states with the largest year-over-year decline in non-current loans percentages."

The third graph shows the origination percentage by product and year. This is a reminder that the worst of the worst loans were private label and were made in 2005 and 2006. Luckily the GSEs and FHA had a much smaller percentage of the market then.

The third graph shows the origination percentage by product and year. This is a reminder that the worst of the worst loans were private label and were made in 2005 and 2006. Luckily the GSEs and FHA had a much smaller percentage of the market then.As LPS notes: "FHA and the GSEs represent a much larger share, but of a smaller market."

The details in this report suggest slow improvement - with the exception of the large number of loans stuck in the foreclosure process.

Earlier:

• ISM Manufacturing index indicates slightly faster expansion in November

ISM Manufacturing index indicates slightly faster expansion in November

by Calculated Risk on 12/01/2011 10:00:00 AM

PMI was at 52.7% in November, up from 50.8% in October. The employment index was at 51.8%, down from 53.5%, and new orders index was at 56.7%, up from 52.4%.

From the Institute for Supply Management: November 2011 Manufacturing ISM Report On Business®

Economic activity in the manufacturing sector expanded in November for the 28th consecutive month, and the overall economy grew for the 30th consecutive month, say the nation's supply executives in the latest Manufacturing ISM Report On Business®.

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management™ Manufacturing Business Survey Committee. "The PMI registered 52.7 percent, an increase of 1.9 percentage points from October's reading of 50.8 percent, indicating expansion in the manufacturing sector for the 28th consecutive month. The New Orders Index increased 4.3 percentage points from October to 56.7 percent, reflecting the second month of growth after three months of contraction. While the Prices Index, at 45 percent, increased 4 percentage points from the October reading of 41 percent, prices of raw materials continued to decrease (registering below 50 percent) for the second consecutive month. Respondents cite continuing concerns about the general economic environment, government regulations and European financial conditions, but are cautiously more optimistic about the next few months based on lower raw materials pricing and favorable levels of new orders."

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was above expectations of 51.7%, and suggests manufacturing expanded at a slightly faster rate in November than in October. It appears manufacturing employment barely expanded in October with the employment index at 51.8%. New orders were up, and prices declined.

Weekly Initial Unemployment Claims increase to 402,000

by Calculated Risk on 12/01/2011 08:30:00 AM

The DOL reports:

In the week ending November 26, the advance figure for seasonally adjusted initial claims was 402,000, an increase of 6,000 from the previous week's revised figure of 396,000. The 4-week moving average was 395,750, an increase of 500 from the previous week's revised average of 395,250.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week to 395,750.

This is the third week in a row with the 4-week average below 400,000. This is still elevated, but an improvement over recent months.

And here is a long term graph of weekly claims:

Wednesday, November 30, 2011

China's stop-and-go measures

by Calculated Risk on 11/30/2011 09:45:00 PM

The post title is from a post Michael Pettis wrote last year: Beijing’s stop-and-go measures. It looks like China is back to pushing on the gas pedal ...

From the NY Times: China, in Surprising Shift, Takes Steps to Spur Bank Lending

China’s central bank, in a surprise move on Wednesday, shifted its economic focus from fighting inflation to stimulating growth by freeing the nation’s commercial banks to lend more money.From Reuters: China Factory Sector Shrinks First Time in Nearly 3 Years

...

For more than a year, the Chinese central bank tried to squeeze the country’s banking system in hopes of restraining inflation. Its action on Wednesday’s indicated that China’s government feared the country’s growth engine was starting to falter.

China's factory sector shrank in November for the first time in nearly three years, an official purchasing managers' index (PMI) showed on Thursday, underlining the central bank's move to cut bank reserve requirements to shore up the economy.The Asian markets are all green tonight. The Nikkei is up about 2%, the Hang Seng is up 5.4%.

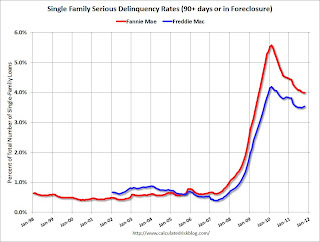

Fannie Mae and Freddie Mac Serious Delinquency Rates mostly unchanged in October

by Calculated Risk on 11/30/2011 05:27:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency rate was unchanged at 4.00% in October. This is down from 4.52% in October of 2010. The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Freddie Mac reported that the Single-Family serious delinquency rate increased to 3.54% in October, up from 3.51% in September. This is down from 3.82% in October 2010. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are loans that are "three monthly payments or more past due or in foreclosure".

Click on graph for larger image

Click on graph for larger image

Tracking this on a monthly basis this is kind of like watching grass grow, but the serious delinquency rates are generally falling - but only falling slowly. The reason for the slow decline is most likely the backlog of homes in the foreclosure process.

The "normal" serious delinquency rate is under 1%, and at this pace of decline, the delinquency rate will not be back to "normal" for a number of years.

Fed's Beige Book: "Economic activity increased at a slow to moderate pace"

by Calculated Risk on 11/30/2011 02:00:00 PM

Overall economic activity increased at a slow to moderate pace since the previous report across all Federal Reserve Districts except St. Louis, which reported a decline in economic activity.And on real estate:

...

District reports indicated that consumer spending increased modestly, on balance, during the reporting period.

...

Hiring was generally subdued, but some firms with open positions reported difficulty finding qualified applicants.

Overall residential real estate activity increased, but conditions were varied across Districts. Philadelphia, Richmond, Minneapolis, Kansas City, and Dallas noted increased activity. New York, Boston, Cleveland, and San Francisco reported flat activity at relatively low levels. Atlanta and St. Louis indicated decreased sales. Residential construction remained sluggish. Single-family home construction remained weak, while multifamily construction picked up in New York, Philadelphia, Cleveland, Chicago, and Minneapolis. San Francisco remained "anemic," while St. Louis and Kansas City reported decreased activity.This was based on data gathered on or before November 18th. More sluggish growth ...

Commercial real estate markets remained sluggish across most of the nation. Boston, New York, Chicago, Minneapolis, and San Francisco indicated roughly unchanged activity. Atlanta and Kansas City noted slight improvement. Philadelphia and Dallas indicated mixed activity. However, Richmond and St. Louis noted that vacancy rates increased. Commercial construction was somewhat mixed.

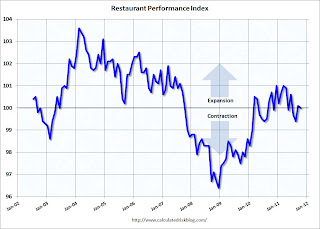

Restaurant Performance Index "essentially unchanged" in October

by Calculated Risk on 11/30/2011 11:31:00 AM

From the National Restaurant Association: Restaurant Performance Index Essentially Unchanged in October, Balanced by Softer Current Conditions and Stronger Future Optimism

The National Restaurant Association’s Restaurant Performance Index (RPI) – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 100.0 in October, essentially unchanged from September’s level of 100.1. October’s steady RPI level was the result of softer sales and customer traffic being offset by a more optimistic outlook among restaurant operators.

“Although sales results were somewhat softer in October, restaurant operators reported net positive same-store sales for the fifth consecutive month,” said Hudson Riehle, senior vice president of the Research and Knowledge Group for the Association. “In addition, each of the four forward-looking indicators improved in October, which pushed the Expectations Index to its highest level in four months.”

...

Restaurant operators reported positive same-store sales for the fifth consecutive month in October, although results were somewhat softer than September’s performance. ... Restaurant operators also reported softer customer traffic levels in October.

Click on graph for larger image.

Click on graph for larger image.The index decreased to 100.0 in October (above 100 indicates expansion).

Unfortunately the data for this index only goes back to 2002.

Restaurant spending is discretionary and is impacted by the overall economy. Right now this is moving sideways ...