by Calculated Risk on 10/20/2011 10:00:00 AM

Thursday, October 20, 2011

Existing Home Sales in September: 4.91 million SAAR, 8.5 months of supply

The NAR reports: Existing-Home Sales Off in September but Higher Than a Year Ago

Total existing-home sales, which are completed transactions that include single-family, townhomes, condominiums and co-ops, declined 3.0 percent to a seasonally adjusted annual rate of 4.91 million in September from an upwardly revised 5.06 million in August, but are 11.3 percent above the 4.41 million unit pace in September 2010.

...

Total housing inventory at the end of September declined 2.0 percent to 3.48 million existing homes available for sale, which represents an 8.5-month supply at the current sales pace, compared with an 8.4-month supply in August.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in September 2011 (4.91 million SAAR) were 3.0% lower than last month, and were 11.3% above the September 2010 rate.

The second graph shows nationwide inventory for existing homes.

The second graph shows nationwide inventory for existing homes.According to the NAR, inventory decreased to 3.48 million in September from 3.55 million in August.

The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, so it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 13.0% year-over-year in September from September 2010. This is the eight consecutive month with a YoY decrease in inventory.

Inventory decreased 13.0% year-over-year in September from September 2010. This is the eight consecutive month with a YoY decrease in inventory.Months of supply increased to 8.5 months in September, up from 8.4 months in August. This is much higher than normal. These sales numbers were close to the consensus.

I'll have more soon ...

Weekly Initial Unemployment Claims: 4-Week average lowest since April

by Calculated Risk on 10/20/2011 08:30:00 AM

The DOL reports:

In the week ending October 15, the advance figure for seasonally adjusted initial claims was 403,000, a decrease of 6,000 from the previous week's revised figure of 409,000. The 4-week moving average was 403,000, a decrease of 6,250 from the previous week's revised average of 409,250.The following graph shows the 4-week moving average of weekly claims since January 2000 (there is a longer term graph in graph gallery).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims declined this week to 403,000.

This is the lowest level for the 4-week average of weekly claims since April, and this was slightly above the consensus forecast. This is still elevated, and still above the post-recession lows of earlier this year.

Wednesday, October 19, 2011

Europe Update: Prepare to be underwhelmed

by Calculated Risk on 10/19/2011 09:35:00 PM

A few articles ahead of the meeting this weekend ...

From the Financial Times: Eurozone leaders meet in Frankfurt

France’s president Nicolas Sarkozy flew to Frankfurt on Wednesday night for an emergency meeting with leading players in the eurozone crisis including German chancellor Angela Merkel, as Franco-German differences bedevilled attempts to agree a comprehensive package of measures.From the NY Times: Leaders in Europe Take Time From a Farewell to Negotiate a Bailout Deal

excerpt with permission

Angela Merkel, the chancellor of Germany, tried to play down expectations, saying that it would not be possible “to erase the mistakes of the past in just one stroke.” A European summit meeting Sunday ... will be just “one point” in “a long journey.”From the WSJ: Doubts Grow on Euro Fund

European officials are discussing a scenario in which governments issuing bonds would borrow from the bailout fund to guarantee a portion of the bond issues—a move that would increase debts for already troubled economies.And from the Financial Times: EU bank recap could be only €80bn. The IMF was calling for a €200bn plan, and some estimates were for €275bn. Maybe they should do another stress test and announce all the banks passed - that has worked well before - Not!

Pressure is rising ahead of a weekend summit of European leaders billed as critical to stemming the region's deepening debt crisis.

Earlier:

• Housing Starts increased in September

• Rate of increase slows for Key Measures of Inflation in September

• AIA: Architecture Billings Index declined in September

• 2012 Social Security Cost-Of-Living Adjustment approximately 3.6% increase

LA Port Traffic in September: Exports increase year-over-year, Imports Down

by Calculated Risk on 10/19/2011 06:13:00 PM

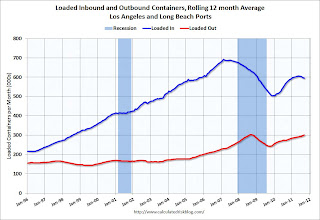

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

Although containers tell us nothing about value, container traffic does give us an idea of the volume of goods being exported and imported - and possible hints about the trade report for August. LA area ports handle about 40% of the nation's container port traffic.

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

On a rolling 12 month basis, inbound traffic is down 0.3% from August, and outbound traffic is up 0.9%.

Inbound traffic is "rolling over" and this might suggest that retailers are cautious about the coming holiday season. However, the National Retail Federation says that imports will be pick up in October:

[T]he [import] statistics were skewed because of high-than-normal numbers in 2010 when fears of shortages in shipping capacity caused many retailers to bring holiday merchandise into the country earlier than usual.The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

...

“After a summer of trying to compare apples to oranges, retail cargo is back to normal [in October],” NRF Vice President for Supply Chain and Customs Policy Jonathan Gold said. “October is the historic peak of the shipping cycle each year, and retailers are bringing merchandise into the country on their usual schedule and at normal levels again instead of being forced to move cargo early."

For the month of September, loaded inbound traffic was down 4% compared to September 2010, and loaded outbound traffic was up 12% compared to September 2010.

For the month of September, loaded inbound traffic was down 4% compared to September 2010, and loaded outbound traffic was up 12% compared to September 2010. Exports have been increasing, although bouncing around month-to-month. Exports are up from last year, but are still below the peak in 2008.

Imports have been soft - this is the 4th month in a row with a year-over-year decline in imports. However, if the NRF is correct, imports will pick up in October to the highest level this year.

Merle Hazard: "Diamond Jim"

by Calculated Risk on 10/19/2011 04:03:00 PM

Earlier:

• Housing Starts increased in September

• Rate of increase slows for Key Measures of Inflation in September

• AIA: Architecture Billings Index declined in September

• 2012 Social Security Cost-Of-Living Adjustment approximately 3.6% increase

A new song from blog favorite Merle Hazard about banking regulation. A creative joint venture of Merle Hazard & Marcy Shaffer (see Marcy's site for lyrics). Song by Merle Hazard, Marcy Shaffer and Curtis Threadneedle.

And from Paul Solman at the PBS NewsHour site, including a link to his 12 1/2 minute interview with former IMF chief economist Simon Johnson, discussing the song.

Fed's Beige Book: Pace of economic growth "modest" or "slight""

by Calculated Risk on 10/19/2011 02:00:00 PM

Reports from the twelve Federal Reserve Districts indicate that overall economic activity continued to expand in September, although many Districts described the pace of growth as "modest" or "slight" and contacts generally noted weaker or less certain outlooks for business conditions. The reports suggest that consumer spending was up slightly in most Districts, with auto sales and tourism leading the way in several of them. Business spending increased somewhat, particularly for construction and mining equipment and auto dealer inventories, but many Districts noted restraint in hiring and capital spending plans.And on real estate:

...

Consumer spending was up slightly in September. The majority of Districts reported increases in auto sales, with the largest improvements in San Francisco and New York.

...

Respondents indicated that labor market conditions were little changed, on balance, in September. ... Most Districts reported that wage pressures remained subdued.

All twelve Districts reported that real estate and construction activity was little changed on balance from the prior report. Residential construction remained at low levels, particularly for single-family homes. That said, Philadelphia, Cleveland, and Minneapolis noted small increases in single-family construction, and construction of multifamily dwellings continued to increase at a moderate pace in Boston, Philadelphia, Cleveland, Kansas City, Dallas, and San Francisco. Home sales remained weak overall, and home prices were reported to be either flat or declining across all of the Districts. In contrast, rental demand continued to rise in a number of Districts.This was based on data gathered on or before October 7th. More sluggish growth ...

Commercial real estate conditions remained weak overall, although commercial construction increased at a slow pace in most Districts.

Earlier:

• Housing Starts increased in September

• Rate of increase slows for Key Measures of Inflation in September

• AIA: Architecture Billings Index declined in September

• 2012 Social Security Cost-Of-Living Adjustment approximately 3.6% increase

Rate of increase slows for Key Measures of Inflation in September

by Calculated Risk on 10/19/2011 01:06:00 PM

Earlier today the BLS reported:

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.3 percent in September on a seasonally adjusted basis ... The index for all items less food and energy increased 0.1 percent in September, its smallest increase since March.The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.3% annualized rate) in September. The 16% trimmed-mean Consumer Price Index increased 0.2% (2.5% annualized rate) during the month.Note: The Cleveland Fed has a discussion of a number of measures of inflation: Measuring Inflation. You can see the median CPI details for September here.

Over the last 12 months, the median CPI rose 2.1%, the trimmed-mean CPI rose 2.5%, the CPI rose 3.9%, and the CPI less food and energy rose 2.0%

On a year-over-year basis, these measures of inflation are increasing, and are around the Fed's target.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.On a monthly basis, the median Consumer Price Index increased 2.3% at an annualized rate, the 16% trimmed-mean Consumer Price Index increased 2.5% annualized in July, and core CPI increased 0.7% annualized.

These key price measures increased at a lower rate than in August.

Earlier:

• Housing Starts increased in September

• AIA: Architecture Billings Index declined in September

• 2012 Social Security Cost-Of-Living Adjustment approximately 3.6% increase

AIA: Architecture Billings Index declined in September

by Calculated Risk on 10/19/2011 11:07:00 AM

Note: This index is a leading indicator for new Commercial Real Estate (CRE) investment.

From AIA: Another Drop for Architecture Billings Index

Following the first positive score in four months, the Architecture Billings Index (ABI) reversed direction again in September. ... The American Institute of Architects (AIA) reported the September ABI score was 46.9, following a score of 51.4 in August. This score reflects a sharp decrease in demand for design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 54.3, down from a reading of 56.9 the previous month.

“It appears that the positive conditions seen last month were more of an aberration,” said AIA Chief Economist, Kermit Baker, PhD, Hon. AIA. “The economy is weak enough at present that design activity is bouncing around more than usual; one strong month can be followed by a weak one. The economy needs to be stronger to generate sustained growth in design activity.”

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the Architecture Billings Index since 1996. The index declined to 46.9 in September from 51.4 in August. Anything below 50 indicates contraction in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. So the recent contraction suggests further declines in CRE investment in 2012.

2012 Social Security Cost-Of-Living Adjustment approximately 3.6% increase

by Calculated Risk on 10/19/2011 09:40:00 AM

I'll have more on prices later ...

The BLS reported this morning: "The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) increased 4.4 percent over the last 12 months to an index level of 223.688 (1982-84=100)."

CPI-W is the index that is used to calculate the Cost-Of-Living Adjustments (COLA). Here is an explanation:

The calculation dates have changed over time (see Cost-of-Living Adjustments), but the current calculation uses the average CPI-W for the three months in Q3 (July, August, September) and compares to the average for the highest previous average of Q3 months. Note: this is not the headline CPI-U, and not seasonally adjusted.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows CPI-W since January 2000. The red lines are the Q3 average of CPI-W for each year.

• In 2008, the Q3 average of CPI-W was 215.495. In the previous year, 2007, the average in Q3 of CPI-W was 203.596. That gave an increase of 5.8% for COLA for 2009.

• In 2009, the Q3 average of CPI-W was 211.013. That was a decline of 2.1% from 2008, however, by law, the adjustment is never negative so the benefits remained the same in 2010.

• In 2010, the Q3 average of CPI-W was 214.136. That was an increase of 1.5% from 2009, however the average was still below the Q3 average in 2008, so the adjustment was zero.

• In 2011, the Q3 average of CPI-W was 223.233. This is above the Q3 2008 average, and COLA will increase around 3.6% for next year (the current 223.233 divided by the Q3 2008 level of 215.495).

Of course medicare premiums will increase too.

Contribution and Benefit Base

Since COLA increased, the contribution base will be adjusted using the National Average Wage Index.

This is based on a one year lag. Since there was no increase in COLA for the last two years, the contribution base has remained at $106,800 for three years. Since COLA will be positive this year, the adjustment this year will use the 2010 National Average Wage Index compared to the 2007 Wage Index. The National Average Wage Index for 2010 was $41,673.83 and the index for 2007 was $40,405.48. So $41,673.83 divided by $40,405.48 multiplied by $106,800 is approximately $110,000.

So the contribution base will increase to around $110,000 in 2012.

NOTE on CPI-chained: There has been some discussion of switching from CPI-W to CPI-chained for COLA. This will not happen this year, but could impact future Cost-of-living adjustments, see: Cost of Living and CPI-Chained

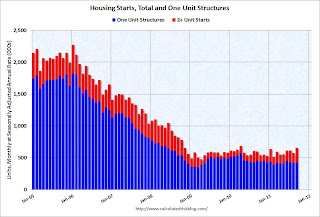

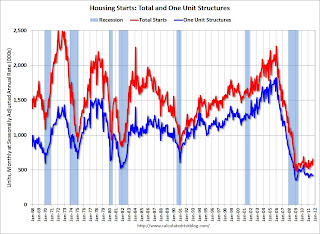

Housing Starts increased in September

by Calculated Risk on 10/19/2011 08:30:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in September were at a seasonally adjusted annual rate of 658,000. This is 15.0 percent (±13.7%) above the revised August estimate of 572,000 and is 10.2 percent (±13.3%)* above the September 2010 rate of 597,000.

Single-family housing starts in September were at a rate of 425,000; this is 1.7 percent (±9.4%)* above the revised August figure of 418,000. The September rate for units in buildings with five units or more was 227,000.

Building Permits:

Privately-owned housing units authorized by building permits in September were at a seasonally adjusted annual rate of 594,000. This is 5.0 percent (±1.3%) below the revised August rate of 625,000, but is 5.7 percent (±2.6%) above the September 2010 estimate of 562,000.

Single-family authorizations in September were at a rate of 417,000; this is 0.2 percent (±1.0%)* below the revised August figure of 418,000. Authorizations of units in buildings with five units or more were at a rate of 158,000 in September.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.Total housing starts were at 658 thousand (SAAR) in September, up 15.0% from the revised August rate of 572 thousand. Most of the increase was for multi-family starts.

Single-family starts increased 1.7% to 425 thousand in September.

The second graph shows total and single unit starts since 1968.

This shows the huge collapse following the housing bubble, and that housing starts have been mostly moving sideways for about two years and a half years - with slight ups and downs due to the home buyer tax credit.

This shows the huge collapse following the housing bubble, and that housing starts have been mostly moving sideways for about two years and a half years - with slight ups and downs due to the home buyer tax credit.Multi-family starts are increasing in 2011 - although from a very low level. This was well above expectations of 590 thousand starts in September.

Single family starts are still "moving sideways".