by Calculated Risk on 10/14/2011 09:55:00 AM

Friday, October 14, 2011

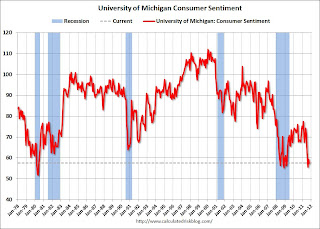

Consumer Sentiment declines in October

The preliminary October Reuters / University of Michigan consumer sentiment index declined to 57.5 from 59.4 in September.

Click on graph for larger image in graph gallery.

In general consumer sentiment is a coincident indicator and is usually impacted by employment (and the unemployment rate) and gasoline prices. In August, sentiment was probably negatively impacted by the debt ceiling debate. History suggests it usually takes 2 to 4 months to bounce back from an event (If we can call the threat of default an "event"). So sentiment might increase over the next couple of months.

And, of course, any bounce back from the debt ceiling debate would be to an already weak reading.

This was very weak, and below the consensus forecast of 60.0.

Retail Sales increased 1.1% in September

by Calculated Risk on 10/14/2011 08:30:00 AM

On a monthly basis, retail sales were up 1.1% from August to September (seasonally adjusted, after revisions), and sales were up 7.9% from September 2010. From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for September, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $395.5 billion, an increase of 1.1 percent (±0.5%) from the previous month and 7.9 percent (±0.7%) above September 2010. Total sales for the July through September 2011 period were up 8.0 percent (±0.7%) from the same period a year ago. The July to August 2011 percent change was revised from virtually unchanged (±0.5%)* to +0.3 percent (±0.2%).Retail sales excluding autos increased 0.6% in September. Sales for August were revised up to a 0.3% increase.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales are up 18.9% from the bottom, and now 4.5% above the pre-recession peak.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 6.4% on a YoY basis (7.9% for all retail sales).

Retail sales ex-gasoline increased by 6.4% on a YoY basis (7.9% for all retail sales). The consensus was for retail sales to increase 0.8% in September, and for a 0.4% increase ex-auto.

This was a strong report, especially with the upward revisions to both July and August.

Europe: Spain debt downgraded, Deadline for European Banks to raise capital

by Calculated Risk on 10/14/2011 12:02:00 AM

A few articles on Europe ...

From the Financial Times: S&P cuts Spain’s sovereign debt rating

[S&P] knocked Spain’s rating down one notch from double A ... to double A minus. It also kept the ... negative outlook.From the WSJ: Spain Deficit Raises EU Risks

S&P’s statement said ...there were “heightened risks to Spain’s growth prospects” due to high unemployment, tighter financial conditions, a high level of debt and a broader eurozone slowdown.

excerpt with permission

From the NY Times: European Banks Face Deadline to Raise Capital Levels

Europe’s banks face a deadline of three to six months to strengthen their balance sheets and to compensate for the decline in value of Greek and other south European sovereign debt, European officials said Thursday.

Thursday, October 13, 2011

DataQuick: SoCal Home sales increase slightly year-over-year in Sept

by Calculated Risk on 10/13/2011 07:30:00 PM

Existing home sales for September will be released on Thursday Oct 20th.

From DataQuick: Southland Home Sales Up – Barely – from Year Ago, Median Price Dips Again

A total of 18,149 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties in September. That was down 7.7 percent from 19,654 in August and up 0.3 percent from 18,091 in September 2010, according to San Diego-based DataQuick.So 32.3 percent were foreclosure resales and 18.5 percent were short sales - over 50% were distressed sales in September.

It’s normal for home sales to drop between August and September, partly because many home buyers try to close their deals before school starts in late summer.

...

Last month’s sales were 25.3 percent below the September average of 24,310 transactions since 1988.

...

“Last month’s Southland sales weren’t great but, like some other economic indicators of late, they came in a bit higher than some might have expected. Holding steady with a year ago isn’t so bad when you consider the hits the housing market has taken in recent months ...” said John Walsh, DataQuick president.

...

Foreclosure resales – properties foreclosed on in the prior 12 months – made up 32.3 percent of the Southland resale market in September, down from 32.4 percent in August and 33.6 percent a year earlier. Last month’s figure was the lowest since January 2008, when foreclosure resales were 28.6 percent. They peaked at 56.7 percent in February 2009.

Short sales, where the sale price fell short of what was owed on the property, made up an estimated 18.5 percent of Southland resales last month. That was up from 17.5 percent in August and 16.1 percent a year ago. Two years ago the estimate was 15.3 percent.

...

Southland buyers paying cash accounted for 28.5 percent of total September home sales, paying a median $210,000.

European Bond Spreads and Interbank Lending

by Calculated Risk on 10/13/2011 04:17:00 PM

Here is a look at European bond spreads and a measure of bank stress (Euribor-to-Eonia) from the Atlanta Fed weekly Financial Highlights released today (graphs as of Oct 12th).

The spread for Greece is at a record high. The spread for Portugal has been moving sideways, and the spread for Ireland has been declining.

The second graph below is a measure of European bank stress. This has declined a little in recent weeks, but is still elevated.

From the Atlanta Fed:

From the Atlanta Fed:

European bond spreads have narrowed over the past week for most sovereigns, except for Greece, which has seen its spread reach a record high.

• Since the September FOMC meeting, the 10-year yield spread between Greek and German bonds has widened by 267 basis points (bps) and is 472 bps higher since September 30. The yield spreads for Portugal and Ireland have both tightened, by 83 bps and 52 bps, respectively. Spanish and Italian spreads are also down, by 52 bps and 31 bps, respectively.

The second graph is the Euribor-to-Eonia spread: "Eonia is the Euro Overnight Index Average swap rate on unsecured interbank lending in the euro area."

The second graph is the Euribor-to-Eonia spread: "Eonia is the Euro Overnight Index Average swap rate on unsecured interbank lending in the euro area."The euro-based Euribor-to-Eonia spread has narrowed over the past week after rising steadily since late July. Since October 5, the spread has narrowed by 8 basis points (bps) to 14 bps, depending on the tenor, and is still elevated compared to July levels.

• The Euribor rates are offered interbank lending rates, denominated in euros and for a set of given maturities. The Euribor rate is determined by surveying 44 banks with the highest volume of business in the euro area, including four non-European banks.

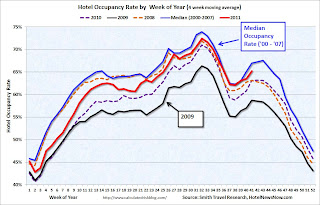

Hotels: Occupancy Rate shows slight year-over-year increase

by Calculated Risk on 10/13/2011 02:31:00 PM

Note: This is one of the industry specific measures that I follow.

From HotelNewsNow.com: STR: US hotels report slight performance gains

In year-over-year comparisons for the week, occupancy rose 1.5% to 64.4%, average daily rate increased 2.8% to US$104.48, and revenue per available room finished the week up 4.3% to US$67.32.Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

The slowdown in performance is attributable, in part, to Yom Kippur, the Jewish holiday which fell on 8 October this year. In 2010 the holiday was on 18 September.

The following graph shows the seasonal pattern for the hotel occupancy rate using a four week average for the occupancy rate.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.We are now in the fall business travel season. The 4-week average of the occupancy rate will increase again seasonally. In September, the 4-week average was back to the pre-recession median, but so far the fall business travel season has been weaker than the median - but better than last year.

Even though the occupancy rate has mostly recovered, ADR and RevPAR are still lower than before the recession for the comparable week.

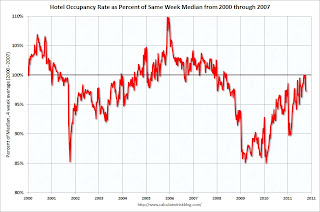

The second graph shows the 4-week average of the occupancy rate as a percent of the median since 2000. Note: Since this is a percent of the median, the number can be above 100%.

The second graph shows the 4-week average of the occupancy rate as a percent of the median since 2000. Note: Since this is a percent of the median, the number can be above 100%.This shows the decline in the occupancy rate during and following the 2001 recession. The sharp decline in 2001 was related to 9/11, and the sharp increase towards the end of 2005 was due to Hurricane Katrina.

The occupancy rate really fell off a cliff in 2008, and has slowly recovered back close to the median. This measure has declined over the last couple of weeks.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Misc: Mortgage Rates increase, Foreclosure Activity declines in September

by Calculated Risk on 10/13/2011 11:28:00 AM

Mortgage rates increased, but are still near 60 year lows.

• From Freddie Mac: Fixed Mortgage Rates Up Sharply Following Jobs Report

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing average fixed mortgage rates up sharply from the previous week's record-setting lows following a better than expected employment report. Despite the sharp increase, mortgage rates remain near their 60-year lows.• From RealtyTrac: Foreclosure Activity on Slow Burn

30-year fixed-rate mortgage (FRM) averaged 4.12 percent with an average 0.8 point for the week ending October 13, 2011, up from last week when it averaged 3.94 percent.

15-year FRM this week averaged 3.37 percent with an average 0.8 point, up from last week when it averaged 3.26 percent. A year ago at this time, the 15-year FRM averaged 3.62 percent.

RealtyTrac® (www.realtytrac.com) ... today released its U.S. Foreclosure Market Report™ for the third quarter of 2011, which shows foreclosure filings — default notices, scheduled auctions and bank repossessions — were reported on 610,337 properties in the third quarter, an increase of less than 1 percent from the previous quarter and a decrease of 34 percent from the third quarter of 2010. ...

Foreclosure filings were reported on 214,855 U.S. properties in September, a 6 percent decrease from August and a 38 percent decrease from September 2010. September marked the 12th straight month where foreclosure activity decreased on a year-over-year basis.

“U.S. foreclosure activity has been mired down since October of last year, when the robo-signing controversy sparked a flurry of investigations into lender foreclosure procedures and paperwork,” said James Saccacio, chief executive officer of RealtyTrac. “While foreclosure activity in September and the third quarter continued to register well below levels from a year ago, there is evidence that this temporary downward trend is about to change direction, with foreclosure activity slowly beginning to ramp back up.”

Trade Deficit unchanged at $45.6 billion in August

by Calculated Risk on 10/13/2011 09:15:00 AM

The Department of Commerce reports:

[T]otal August exports of $177.6 billion and imports of $223.2 billion resulted in a goods and services deficit of $45.6 billion, virtually unchanged from July, revised. August exports were $0.1 billion less than July exports of $177.7 billion. August imports were $0.1 billion less thanThe trade deficit was slightly below the consensus forecast of $46 billion.

July imports of $223.3 billion.

The first graph shows the monthly U.S. exports and imports in dollars through August 2011.

Click on graph for larger image.

Click on graph for larger image.Exports and imports were mostly unchanged in August (seasonally adjusted). Exports are well above the pre-recession peak and up 15% compared to August 2010; imports have stalled recently and are up about 11% compared to August 2010.

The second graph shows the U.S. trade deficit, with and without petroleum, through August.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil averaged $102.62 per barrel in August, down slightly from $104.27 per barrel in July. The trade deficit with China increased to a record $29 billion; trade with China remains a significant issue.

Imports have been moving sideways for the last several months - partially due to slightly lower oil prices. However the trade deficit with China continues to increase. Exports are still generally trending up.

Weekly Initial Unemployment Claims at 404,000

by Calculated Risk on 10/13/2011 08:38:00 AM

The DOL reports:

In the week ending October 8, the advance figure for seasonally adjusted initial claims was 404,000, a decrease of 1,000 from the previous week's revised figure of 405,000 [revised up from 401,000]. The 4-week moving average was 408,000, a decrease of 7,000 from the previous week's revised average of 415,000.The following graph shows the 4-week moving average of weekly claims since January 2000 (there is a longer term graph in graph gallery).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims declined this week to 408,000.

This is the lowest level for the 4-week average of weekly claims since August, and this was at the consensus forecast. This is still elevated, but the decline in the 4-week average is a positive.

Wednesday, October 12, 2011

Ireland: “mortgage to rent” scheme proposed

by Calculated Risk on 10/12/2011 11:31:00 PM

From the Irish Times: Up to 10,000 homeowners could enter 'mortgage to rent' scheme

The Inter-Departmental Working Group on Mortgage Arrears, which published its widely anticipated report yesterday, has proposed the introduction of two “mortgage to rent” social housing schemes. These would mean approved housing agencies taking ownership of homes in specific circumstances or the leasing of houses by banks to local authorities, which would in turn rent them to former owners.Dean Baker and others have proposed a similar plan for the U.S. (Here is Dean Baker's 2009 proposal). There was some discussion a few months ago about converting some homeowners to renters, but I haven't heard anything about it lately.

...

The report ... stressed that there would be no blanket debt or negative equity forgiveness. Defending the decision not to implement a blanket forgiveness scheme, the report states it would cost some €14 billion to clear negative equity in Irish mortgage portfolios, while tackling those home loans taken out between 2006 and 2008 would cost in the region of €10 billion.

The U.S. population is roughly 50 times the size of Ireland, so a similar plan would be for 500 thousand homeowners. A blanket forgiveness more would probably cost $1 trillion or more in the U.S. (won't happen in the U.S. either).