by Calculated Risk on 10/09/2011 08:57:00 AM

Sunday, October 09, 2011

Construction Employment

The graph below shows the number of total construction payroll jobs in the U.S., including both residential and non-residential, since 1969.

Construction employment is down 2.175 million jobs from the peak in April 2006, but up 53 thousand this year through the September BLS report.

Unfortunately this graph is a combination of both residential and non-residential construction employment. The BLS only started breaking out residential construction employment fairly recently (residential building employees in 1985, and residential specialty trade contractors in 2001).

Click on graph for larger image.

Click on graph for larger image.

Usually residential investment (and residential construction) lead the economy out of recession, and non-residential construction usually lags the economy. Because this graph is a blend, it masks the usual pickup in residential construction following previous recessions. Of course residential investment didn't lead the economy this time because of the huge overhang of existing housing units.

This table below shows the annual change in construction jobs (total, residential and non-residential) and through September for 2011.

| Annual Change in Payroll jobs (000s) | |||

|---|---|---|---|

| Year | Total Construction Jobs | Residential Construction Jobs | Non-Residential |

| 2002 | -85 | 88 | -173 |

| 2003 | 127 | 161 | -34 |

| 2004 | 290 | 230 | 60 |

| 2005 | 416 | 268 | 148 |

| 2006 | 152 | -62 | 214 |

| 2007 | -198 | -273 | 75 |

| 2008 | -787 | -510 | -277 |

| 2009 | -1053 | -431 | -622 |

| 2010 | -149 | -113 | -36 |

| Through September 2011 | 53 | -6 | 59 |

After five consecutive years of job losses for residential construction (and four years for total construction), it looks like construction employment will increase this year (and residential will be close). However there will not be a strong increase in residential construction until the excess supply of housing is absorbed.

In addition residential investment has made a positive contribution to GDP so far this year for the first time since 2005.

Yesterday:

• Summary for Week Ending Oct 7th

• Schedule for Week of Oct 9th

Saturday, October 08, 2011

Unofficial Problem Bank list declines to 983 Institutions

by Calculated Risk on 10/08/2011 07:22:00 PM

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Oct 7, 2011.

Changes and comments from surferdude808:

As anticipated, it was a quiet week for changes to the Unofficial Problem Bank List. This week, there were three removals, which leaves the list with 983 institutions and assets of $404.1 billion. A year ago, there were 877 institutions with assets of $417.3 billion.

The removals include the Federal Reserve terminating an action against State Bank Financial, La Crosse, MN ($303 million) and the two failures this week -- The Riverbank, Wyoming, MN ($417 million); and Sun Security Bank, Ellington, MO ($356 million).

Schedule for Week of Oct 9th

by Calculated Risk on 10/08/2011 02:15:00 PM

Earlier:

• Summary for Week Ending Oct 7th

The key economic releases this week are the September retail sales report on Friday, and the August trade balance report on Thursday. Retail sales should be strong - and possibly above the already strong consensus. Also consumer sentiment might recover some more in October (released on Friday).

The FOMC minutes (released on Wednesday) will be fairly downbeat as participants discuss the "significant downside risks" mostly due to the European crisis.

Monday is a federal government and bank holiday in observance of Columbus Day. The stock market will be open.

7:30 AM: NFIB Small Business Optimism Index for September.

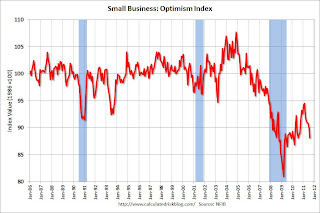

7:30 AM: NFIB Small Business Optimism Index for September. Click on graph for larger image in graph gallery.

This graph shows the small business optimism index since 1986. The index decreased to 88.1 in August from 89.9 in July. Small business optimism has declined for six consecutive months now.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index has been especially weak since early August.

9:00 AM: Ceridian-UCLA Pulse of Commerce Index™ This is the diesel fuel index for September (a measure of transportation).

10:00 AM: Job Openings and Labor Turnover Survey for August from the BLS. In general job openings have been trending up, however overall labor turnover remains low.

2:00 PM: FOMC Minutes, Meeting of September 20-21, 2011. These minutes will be fairly negative with a discussion of “significant downside risks” and the new program to extend maturities.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for an increase to 405,000 from 401,000 last week.

8:30 AM: Trade Balance report for August from the Census Bureau.

8:30 AM: Trade Balance report for August from the Census Bureau. This graph shows the monthly U.S. exports and imports in dollars through July 2011. The trade deficit declined sharply in July.

The consensus is for the U.S. trade deficit to be around $46 billion, up from from $44.8 billion in July.

8:30 AM: Retail Sales for September.

8:30 AM: Retail Sales for September. This graph shows retail sales since 1992. This is monthly retail sales, seasonally adjusted (total and ex-gasoline).

After a weak August, the consensus is for retail sales to increase 0.8% in September, and for a 0.4% increase ex-auto. Based on retailer reports and auto sales, this will be a fairly strong report.

8:30 AM: Import and Export Prices for September. The consensus is a for a 0.5% decrease in import prices.

9:55 AM: Reuters/University of Mich Consumer Sentiment preliminary for October.

9:55 AM: Reuters/University of Mich Consumer Sentiment preliminary for October. Consumer sentiment declined sharply in July and August - from 71.5 in June to 55.7 in August - the August reading was just above the crisis low of 55.3 in November 2008.

The consensus is for a slight increase in October to 60.0 from 59.4 in September.

10:00 AM: Manufacturing and Trade: Inventories and Sales for August. The consensus is for a 0.4% increase in inventories.

Summary for Week Ending Oct 7th

by Calculated Risk on 10/08/2011 08:15:00 AM

The U.S. economic data was still fairly weak last week, but the data was mostly better than expected. Of course the European financial crisis dominated the headlines, and the next few weeks will be critical in Europe.

The key U.S. story was the September employment report - and the report indicated sluggish employment growth. There were only 103,000 jobs added in September. This included 137,000 private sector jobs added, and 34,000 government jobs lost.

Employment for July and August were revised up. From the BLS: "The change in total nonfarm payroll employment for July was revised from +85,000 to +127,000, and the change for August was revised from 0 to +57,000." That is an additional 99,000 jobs.

The unemployment rate was unchanged at 9.1%, and the participation rate increased to 64.2% from 64.0%. The employment population ratio also increased to 58.3% from 58.2%. Note: The household survey showed an increase of 398,000 jobs in September. This increase in the household survey kept the unemployment rate from rising, even as more people participated in the workforce (labor force increase by 423,000).

U-6, an alternate measure of labor underutilization that includes part time workers and marginally attached workers, increased to 16.5%; this is at the high for the year.

The average workweek increased slightly to 34.3 hours, and average hourly earnings increase slightly - but that just reversed the decline in August.

Through the first nine months of 2011, the economy has added 1.074 million total non-farm jobs or just 119 thousand per month. This is a better pace of payroll job creation than last year, but the economy still has 6.6 million fewer payroll jobs than at the beginning of the 2007 recession. The economy has added 1.341 million private sector jobs this year, or about 149 thousand per month.

There are a total of 13.992 million Americans unemployed and 6.24 million have been unemployed for more than 6 months. These are very grim numbers.

Overall this was a weak employment report, and the report only looked decent because expectations were so low.

The other economic data was mostly weak, but for the most part also better than expected. The ISM manufacturing index increased in September. Auto sales were up significantly. And construction spending increased in August, and mortgage delinquencies decreased in August.

However the house price index from CoreLogic showed a seasonal decrease in prices in August – and this is probably the beginning of weak house prices through the winter months.

Overall the U.S. data "surprised to the upside" - and suggests sluggish growth. But right now the U.S. data is taking a backseat to the crisis in Europe.

Here is a summary in graphs:

• September Employment Report: 103,000 Jobs, 9.1% Unemployment Rate

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows the job losses from the start of the employment recession, in percentage terms aligned at the start of the recession.

In this post, the graph shows the job losses aligned at maximum job losses.

The red line is moving up slowly - and I'll need to expand the graph soon.

This graph shows the employment population ratio, the participation rate, and the unemployment rate. The unemployment rate was unchanged at 9.1% (red line).

This graph shows the employment population ratio, the participation rate, and the unemployment rate. The unemployment rate was unchanged at 9.1% (red line).

The Labor Force Participation Rate increased to 64.2% in September (blue line). This is the percentage of the working age population in the labor force.

The Employment-Population ratio increased to 58.3% in September (black line).

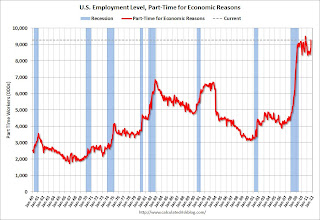

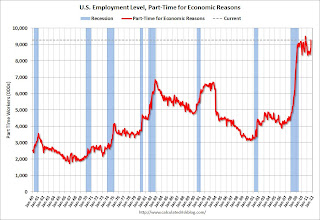

The number of workers only able to find part time jobs (or have had their hours cut for economic reasons) increased to 9.27 million in September from 8.826 million in August. This is the high for the year.

The number of workers only able to find part time jobs (or have had their hours cut for economic reasons) increased to 9.27 million in September from 8.826 million in August. This is the high for the year.

These workers are included in the alternate measure of labor underutilization (U-6) that increased to 16.5% in September from 16.2% in August.

The next graph shows the duration of unemployment as a percent of the civilian labor force.

The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

Two categories increased in August: The 27 weeks and more (the long term unemployed) increased to 6.242 million workers, or just over 4.0% of the labor force, and the less than '5 weeks' category increased slightly - this followed the recent increase in initial weekly unemployment claims.

The other two categories decreased. The decrease in the '15 to 26 weeks' group is probably from workers moving into the 27 weeks and more category.

The key point is the that number (and percent) of long term unemployed remains very high.

Here are the employment posts from yesterday:

1) September Employment Report: 103,000 Jobs, 9.1% Unemployment Rate

2) Employment Summary, Part Time Workers, and Unemployed over 26 Weeks

3) Duration of Unemployment, Unemployment by Education and Diffusion Indexes

4) Employment graph gallery

• U.S. Light Vehicle Sales at 13.1 million SAAR in September

Based on an estimate from Autodata Corp, light vehicle sales were at a 13.1 million SAAR in September. That is up 11.2% from September 2010, and up 8.3% from the sales rate last month (12.1 million SAAR in Aug 2011).

Based on an estimate from Autodata Corp, light vehicle sales were at a 13.1 million SAAR in September. That is up 11.2% from September 2010, and up 8.3% from the sales rate last month (12.1 million SAAR in Aug 2011).

This was well above the consensus forecast of 12.6 million SAAR.

Note: dashed line is current estimated sales rate.

Growth in auto sales should make a positive contribution to Q3 GDP as sales bounced back from the May and June lows. Sales in Q3 have averaged 12.5 million SAAR, above the 12.1 million SAAR average in Q2.

• ISM Manufacturing index increases in September

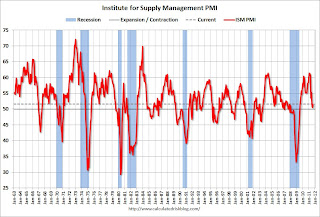

PMI was at 51.6% in September, up from 50.6% in August. The employment index was at 53.8%, up from 51.8%, and new orders index was unchanged at 49.6%.

PMI was at 51.6% in September, up from 50.6% in August. The employment index was at 53.8%, up from 51.8%, and new orders index was unchanged at 49.6%.

Here is a long term graph of the ISM manufacturing index.

This was above expectations of 50.5% and suggests manufacturing expanded at a slightly higher rate in September than in August. It appears manufacturing employment expanded in September with the employment index increasing to 53.8%, up from 51.8% in August.

• Reis: Vacancy Rates for Offices, Apartments and Malls

The vacancy rates is falling quickly for apartments, is declining slightly for offices and still increasing for malls.

Reis reported the Q3 vacancy rates for offices, apartments and malls.

Reis reported the Q3 vacancy rates for offices, apartments and malls.

This graph shows the office vacancy rate starting in 1991.

Reis is reporting the vacancy rate declined to 17.4% in Q3, down from 17.5% in Q2. The vacancy rate was at a cycle high of 17.6% in Q3 2010. It appears the office vacancy rate might have peaked in 2010 - and has only declined slightly since then.

This graph shows the apartment vacancy rate starting in 2005.

Reis is just for large cities, but this decline in vacancy rates is happening just about everywhere.

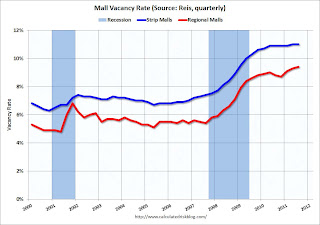

From Reuters: U.S. mall Q3 vacancy rate at 11-year high -report

From Reuters: U.S. mall Q3 vacancy rate at 11-year high -report

Preliminary figures by real estate research firm Reis Inc show the average vacancy rate at regional malls rose to 9.4 percent in the third quarter, the highest level since Reis began tracking regional mall vacancy rates in 2000 and up from 9.3 percent in the second quarter.• Construction Spending increased in August

...

The vacancy rate at ... local retail strips was 11 percent, flat with the second quarter, Reis said. ... "With demand remaining so weak and more new completions anticipated to come online in the remainder of 2011, there is still a good chance that the vacancy rate will match the 11.1 percent record high observed in 1990 sometime later this year," Reis senior economist Ryan Severino said.

This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.Private residential spending is 64.8% below the peak in early 2006, and non-residential spending is 34% below the peak in January 2008.

Public construction spending is now 11% below the peak in March 2009.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, both private residential and non-residential construction spending have turned positive, but public spending is now falling as the stimulus spending ends. The improvements in private non-residential are mostly due to energy spending (power and electric).

• ISM Non-Manufacturing Index indicates expansion in September

The September ISM Non-manufacturing index was at 53.0%, down from 53.3% in August. The employment index decreased in September to 48.7%, down from 51.6% in August. Note: Above 50 indicates expansion, below 50 contraction.

The September ISM Non-manufacturing index was at 53.0%, down from 53.3% in August. The employment index decreased in September to 48.7%, down from 51.6% in August. Note: Above 50 indicates expansion, below 50 contraction. This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was slightly above the consensus forecast of 52.9% and indicates slightly slower expansion in September than in August. However the employment index indicated contraction in September.

• LPS: Foreclosure Starts increased in August, Seriously Delinquent Mortgage Loans fall to 2008 levels

According to LPS, 8.13% of mortgages were delinquent in August, down from 8.34% in July, and down from 9.22% in August 2010.

According to LPS, 8.13% of mortgages were delinquent in August, down from 8.34% in July, and down from 9.22% in August 2010. LPS reports that 4.11% of mortgages were in the foreclosure process, unchanged from July, and up from 3.8% in August 2010. This gives a total of 12.24% delinquent or in foreclosure. It breaks down as:

• 2.38 million loans less than 90 days delinquent.

• 1.87 million loans 90+ days delinquent.

• 2.15 million loans in foreclosure process.

For a total of 6.40 million loans delinquent or in foreclosure in August.

This graph shows the total delinquent and in-foreclosure rates since 1995.

The total delinquent rate has fallen to 8.13% from the peak in January 2010 of 10.97%. A normal rate is probably in the 4% to 5% range, so there is a long long ways to go.

However the in-foreclosure rate at 4.11% is barely below the peak rate of 4.21% in March 2011. There are still a large number of loans in this category (about 2.15 million) - and the average loan in foreclosure has been delinquent for a record 611 days!

• CoreLogic: Home Price Index declined 0.4% in August

From CoreLogic: CoreLogic® August Home Price Index Shows Month-Over-Month and Year-Over-Year Decline

CoreLogic ... today released its August Home Price Index (HPI) which shows that home prices in the U.S. decreased 0.4 percent on a month-over-month basis, the first monthly decline in four months.

This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.The index was down 0.4% in August, and is down 4.4% over the last year, and off 30.4% from the peak - and up 4.8% from the March 2011 low.

As Mark Fleming noted, some of this decrease is seasonal (the CoreLogic index is NSA). Month-to-month prices changes will probably remain negative through February or March 2012 - the normal seasonal pattern. It is likely that there will be new post-bubble lows for this index late this year or early in 2012.

• Other Economic Stories ...

• ADP: Private Employment increased 91,000 in September

• Consumer Bankruptcy filings down 10 percent through Q3

• Europe Update: New Stress Tests and Bank Recapitalisation

• AAR: Rail Traffic increases in September

Friday Night Europe

by Calculated Risk on 10/08/2011 12:04:00 AM

A couple more stories on Europe ...

From the NY Times: Europe Seems to Agree on Recapitalizing Banks — but How?

European leaders are finally coming around to the view that banks must be compelled to replenish their capital reserves if the euro area is ever to emerge from the debt crisis. But whether the politicians can make it happen in a convincing manner is another question ... In the first signs of a split, France wants to draw on the European bailout fund, the European Financial Stability Facility, to rebuild bank capital. German leaders think national governments should take the lead.And from the Financial Times: Investors turn bears on Germany and France

Investors are taking increasingly bearish bets on Germany and France ... The cost of protecting German government bonds against default surged to a fresh record this week.The next few weeks should be very interesting in Europe.

excerpt with permission

Here are the earlier employment posts (with graphs):

• September Employment Report: 103,000 Jobs, 9.1% Unemployment Rate

• Employment Summary, Part Time Workers, and Unemployed over 26 Weeks

• Duration of Unemployment, Unemployment by Education and Diffusion Indexes

• Employment graph gallery

Friday, October 07, 2011

Bank Failures #75 & 76 in 2011

by Calculated Risk on 10/07/2011 07:10:00 PM

Here are the earlier employment posts (with graphs):

• September Employment Report: 103,000 Jobs, 9.1% Unemployment Rate

• Employment Summary, Part Time Workers, and Unemployed over 26 Weeks

• Duration of Unemployment, Unemployment by Education and Diffusion Indexes

• Employment graph gallery

From the FDIC: Central Bank, Stillwater, Minnesota, Assumes All of the Deposits of the RiverBank, Wyoming, Minnesota

As of June 30, 2011, The RiverBank had approximately $417.4 million in total assets and $379.3 million in total deposits.From the FDIC: Great Southern Bank, Springfield, Missouri, Assumes All of the Deposits of Sun Security Bank, Ellington, Missouri

...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $71.4 million. ... The RiverBank is the 75th FDIC-insured institution to fail in the nation this year

As of June 30, 2011, Sun Security Bank had approximately $355.9 million in total assets and $290.4 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $118.3 million. ... Sun Security Bank is the 76th FDIC-insured institution to fail in the nation this year, and the first in Missouri.

AAR: Rail Traffic increases in September

by Calculated Risk on 10/07/2011 06:40:00 PM

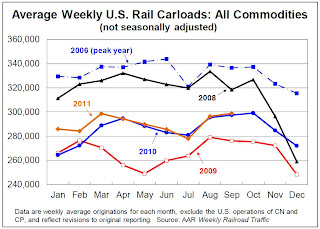

The Association of American Railroads (AAR) reports carload traffic in September 2011 1.1 percent compared with the same month last year, and intermodal traffic (using intermodal or shipping containers) increased 2.3 percent compared with September 2010. On a seasonally adjusted basis, carloads in were up 1.1% in September 2011 compared with August 2011; intermodal in September 2011 was up 1.0% from August 2011.

U.S. freight railroads originated 1,195,671 carloads in September 2011, an average of 298,918 carloads per week and up 1.1% over September 2010 (see charts below). During the last week of September — Week 39 of 2011 — U.S. railroads originated 312,170 carloads of freight, which is more carload traffic than in any week since Week 45 in November 2008.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows U.S. average weekly rail carloads (NSA).

Rail carload traffic collapsed in November 2008, and now, over 2 years into the recovery, carload traffic is only about half way back.

The second graph is for intermodal traffic (using intermodal or shipping containers):

U.S. rail intermodal traffic rose for the 22nd straight month in September 2011.1 U.S. railroads originated 949,606 containers and trailers for the month for an average of 237,402 units per week, up 2.3% from September 2010, up from an average of 235,968 in August 2011, and the highest weekly average for any month since October 2007 (see the chart on the top right of the next page). Week 39 of 2011, the last week of September, had intermodal volume of 250,864 intermodal units, the 12th highest-volume intermodal week ever for U.S. railroads and the highest of any week since Week 39 in September 2007.Rail traffic improved in September, and really picked up towards the end of the month.

excerpts with permission

Europe, again ...

by Calculated Risk on 10/07/2011 03:14:00 PM

Another day, same Europe.

• From Bloomberg: Fitch Cuts Spain, Italy Credit Ratings; Outlooks Negative

Spain had its foreign and local currency long-term issuer default ratings cut to AA- from AA+, while Italy had the same set of ratings to A+ from AA-, the company said in statements today. The outlook for both countries is negative. Fitch also maintained Portugal’s rating at BBB-, saying it would complete a review of that ranking in the fourth quarter.• From the WSJ: Moody's Cuts U.K. Lenders

Moody's Investors Service Friday downgraded 12 U.K. banks and building societies, and left the door open for further ratings cuts at three of the U.K.'s largest lenders as it reassesses the willingness of the U.K. government to support the institutions.• From the WSJ: EU Steps Up Crisis Response

European Commissioner for Economic Affairs Olli Rehn on Friday revealed among other things that there are talks to fast-forward plans for a permanent rescue vehicle while he expects a solution on recapitalizing European banks to come within a few days.Here are the earlier employment posts (with graphs):

"I am confident that the euro-zone summit and the European Council will be able to make a decision in mid-October on how a coordinated Europe can help to solve the distrust towards the banks' capitalization," Mr. Rehn told a conference in Helsinki.

His comments were echoed by German Chancellor Angela Merkel, who said Friday that EU leaders will discuss at the Oct. 17-18 summit how to proceed with possible bank recapitalizations.

• September Employment Report: 103,000 Jobs, 9.1% Unemployment Rate

• Employment Summary, Part Time Workers, and Unemployed over 26 Weeks

• Duration of Unemployment, Unemployment by Education and Diffusion Indexes

• Employment graph gallery

Duration of Unemployment, Unemployment by Education and Diffusion Indexes

by Calculated Risk on 10/07/2011 01:03:00 PM

Here are the earlier employment posts (with graphs):

• September Employment Report: 103,000 Jobs, 9.1% Unemployment Rate

• Employment Summary, Part Time Workers, and Unemployed over 26 Weeks

• Employment graph gallery

And a few more graphs based on the employment report:

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.Two categories increased in August: The 27 weeks and more (the long term unemployed) increased to 6.242 million workers, or just over 4.0% of the labor force, and the less than '5 weeks' category increased slightly - this followed the recent increase in initial weekly unemployment claims.

The other two categories decreased. The decrease in the '15 to 26 weeks' group is probably from workers moving into the 27 weeks and more category.

The key point is the that number (and percent) of long term unemployed remains very high.

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).Unfortunately this data only goes back to 1992 and only includes one previous recession (the stock / tech bust in 2001). Clearly education matters with regards to the unemployment rate - and it appears all four groups are generally trending down.

Although education matters for the unemployment rate, it doesn't appear to matter as far as finding new employment (all four categories are only gradually declining).

Note: This says nothing about the quality of job - as an example, a college graduate working at minimum wage would be considered "employed".

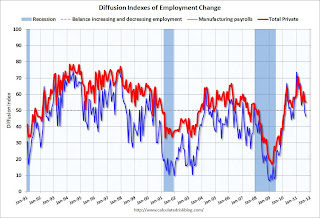

This is a little more technical. The BLS diffusion index for total private employment was at 55.4 in September, down slightly from 55.6 in August, and for manufacturing, the diffusion index decreased to 46.3 - the 2nd consecutive reading under 50.

This is a little more technical. The BLS diffusion index for total private employment was at 55.4 in September, down slightly from 55.6 in August, and for manufacturing, the diffusion index decreased to 46.3 - the 2nd consecutive reading under 50. Think of this as a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.This was the lowest diffusion index for total private employment since May, and the lowest for manufacturing since October 2010.

We'd like to see the diffusion indexes consistently above 60 - and even in the 70s like in the '1990s.

Employment Summary, Part Time Workers, and Unemployed over 26 Weeks

by Calculated Risk on 10/07/2011 10:11:00 AM

This was a weak report, but better than many expected. A few points:

• The Verizon labor dispute subtracted 45,000 payroll jobs in August and those jobs were added back in September. From the BLS: "The increase in employment partially reflected the return to payrolls of about 45,000 telecommunications workers who had been on strike in August."

• The household survey showed an increase of 398,000 jobs in September. This increase in the household survey kept the unemployment rate from rising, even as more people participated in the workforce (labor force increase by 423,000). The unemployment rate was unchanged at 9.1%, and the participation rate increased to 64.2% from 64.0%. The employment population ratio also increased to 58.3% from 58.2%.

• Employment for July and August were revised up. From the BLS: "The change in total nonfarm payroll employment for July was revised from +85,000 to +127,000, and the change for August was revised from 0 to +57,000." That is an additional 99,000 jobs.

This was still a weak employment report. There were only 103,000 jobs added in September. There were 137,000 private sector jobs added, and 34,000 government jobs lost.

U-6, an alternate measure of labor underutilization that includes part time workers and marginally attached workers, increased to 16.5%; this is at the high for the year.

The average workweek increased slightly to 34.3 hours, and average hourly earnings increase slightly - but this just reversed the decline in August. "The average workweek for all employees on private nonfarm payrolls edged up by 0.1 hour over the month to 34.3 hours following a decrease of 0.1 hour in August. The manufacturing workweek edged down by 0.1 hour in September to 40.2 hours. ... In September, average hourly earnings for all employees on private nonfarm payrolls increased by 4 cents, or 0.2 percent, to $23.12. This increase followed a decline of 4 cents in August."

Through the first nine months of 2011, the economy has added 1.074 million total non-farm jobs or just 119 thousand per month. This is a better pace of payroll job creation than last year, but the economy still has 6.6 million fewer payroll jobs than at the beginning of the 2007 recession. The economy has added 1.341 million private sector jobs this year, or about 149 thousand per month.

There are a total of 13.992 million Americans unemployed and 6.24 million have been unemployed for more than 6 months. Very grim.

Overall this was a weak report, and only looked decent because expectations were so low.

Percent Job Losses During Recessions

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows the job losses from the start of the employment recession, in percentage terms - this time aligned at maximum job losses.

In the previous post, the graph showed the job losses aligned at the start of the employment recession.

In terms of lost payroll jobs, the 2007 recession was by far the worst since WWII.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) rose to 9.3 million in September.The number of workers only able to find part time jobs (or have had their hours cut for economic reasons) increased to 9.27 million in September from 8.826 million in August. This is the high for the year.

These workers are included in the alternate measure of labor underutilization (U-6) that increased to 16.5% in September from 16.2% in August.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 6.242 million workers who have been unemployed for more than 26 weeks and still want a job. This was up from 6.034 million in August. This is very high - near the highest level this year, and long term unemployment remains a serious problem.

• Earlier Employment post: September Employment Report: 103,000 Jobs, 9.1% Unemployment Rate