by Calculated Risk on 10/08/2011 02:15:00 PM

Saturday, October 08, 2011

Schedule for Week of Oct 9th

Earlier:

• Summary for Week Ending Oct 7th

The key economic releases this week are the September retail sales report on Friday, and the August trade balance report on Thursday. Retail sales should be strong - and possibly above the already strong consensus. Also consumer sentiment might recover some more in October (released on Friday).

The FOMC minutes (released on Wednesday) will be fairly downbeat as participants discuss the "significant downside risks" mostly due to the European crisis.

Monday is a federal government and bank holiday in observance of Columbus Day. The stock market will be open.

7:30 AM: NFIB Small Business Optimism Index for September.

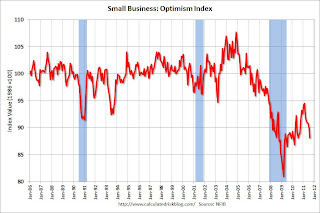

7:30 AM: NFIB Small Business Optimism Index for September. Click on graph for larger image in graph gallery.

This graph shows the small business optimism index since 1986. The index decreased to 88.1 in August from 89.9 in July. Small business optimism has declined for six consecutive months now.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index has been especially weak since early August.

9:00 AM: Ceridian-UCLA Pulse of Commerce Index™ This is the diesel fuel index for September (a measure of transportation).

10:00 AM: Job Openings and Labor Turnover Survey for August from the BLS. In general job openings have been trending up, however overall labor turnover remains low.

2:00 PM: FOMC Minutes, Meeting of September 20-21, 2011. These minutes will be fairly negative with a discussion of “significant downside risks” and the new program to extend maturities.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for an increase to 405,000 from 401,000 last week.

8:30 AM: Trade Balance report for August from the Census Bureau.

8:30 AM: Trade Balance report for August from the Census Bureau. This graph shows the monthly U.S. exports and imports in dollars through July 2011. The trade deficit declined sharply in July.

The consensus is for the U.S. trade deficit to be around $46 billion, up from from $44.8 billion in July.

8:30 AM: Retail Sales for September.

8:30 AM: Retail Sales for September. This graph shows retail sales since 1992. This is monthly retail sales, seasonally adjusted (total and ex-gasoline).

After a weak August, the consensus is for retail sales to increase 0.8% in September, and for a 0.4% increase ex-auto. Based on retailer reports and auto sales, this will be a fairly strong report.

8:30 AM: Import and Export Prices for September. The consensus is a for a 0.5% decrease in import prices.

9:55 AM: Reuters/University of Mich Consumer Sentiment preliminary for October.

9:55 AM: Reuters/University of Mich Consumer Sentiment preliminary for October. Consumer sentiment declined sharply in July and August - from 71.5 in June to 55.7 in August - the August reading was just above the crisis low of 55.3 in November 2008.

The consensus is for a slight increase in October to 60.0 from 59.4 in September.

10:00 AM: Manufacturing and Trade: Inventories and Sales for August. The consensus is for a 0.4% increase in inventories.