by Calculated Risk on 9/30/2011 09:55:00 AM

Friday, September 30, 2011

September Consumer Sentiment increases to 59.4, Chicago PMI fairly strong

• First on the Chicago PMI Chicago Business Barometer™ Rebounded: The overall index increased to 60.4 from 56.5 in August. This was above consensus expectations of 55.4. Note: any number above 50 shows expansion. The employment index increased to 60.6 from 52.1. "EMPLOYMENT expanded to highest level in 4 months". The new orders index increased to 65.3 from 56.9. "NEW ORDERS erased net declines accumulated since April"

• The final September Reuters / University of Michigan consumer sentiment index increased to 59.4 from 55.7 in August.

Click on graph for larger image in graphic gallery.

In general consumer sentiment is a coincident indicator and is usually impacted by employment (and the unemployment rate) and gasoline prices. In August, sentiment was probably negatively impacted by the debt ceiling debate.

Note: It usually takes 2 to 4 months to bounce back from an event driven decline in sentiment (if the August decline was event driven) - and any bounce back from the debt ceiling debate would be to an already weak reading.

This was still very weak, but above the consensus forecast of 57.8.

Personal Income decreased 0.1% in August, Spending increased 0.2%

by Calculated Risk on 9/30/2011 08:30:00 AM

The BEA released the Personal Income and Outlays report for August:

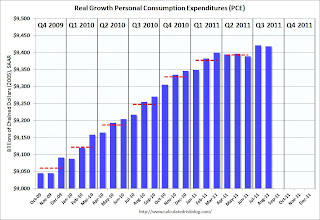

Personal income decreased $7.3 billion, or 0.1 percent ... in August ... Personal consumption expenditures (PCE) increased $22.7 billion, or 0.2 percent.The following graph shows real Personal Consumption Expenditures (PCE) through August (2005 dollars). Note that the y-axis doesn't start at zero to better show the change.

...

Real PCE -- PCE adjusted to remove price changes -- decreased less than 0.1 percent in August, in contrast to an increase of 0.4 percent in July. ... The price index for PCE increased 0.2 percent in August,compared with an increase of 0.4 percent in July. The PCE price index, excluding food and energy, increased 0.1 percent

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.PCE increased 0.2 in August, and real PCE decreased slightly as the price index for PCE increased 0.2 percent in August.

Note: The PCE price index, excluding food and energy, increased 0.1 percent.

The personal saving rate was at 4.5% in August.

Personal saving -- DPI less personal outlays -- was $519.3 billion in August, compared with $550.5 billion in July. Personal saving as a percentage of disposable personal income was 4.5 percent in August, compared with 4.7 percent in July.

This graph shows the saving rate starting in 1959 (using a three month trailing average for smoothing) through the August Personal Income report.

This graph shows the saving rate starting in 1959 (using a three month trailing average for smoothing) through the August Personal Income report.Using the two month method to estimate Q3 PCE gives a 1.1% annualized rate (another weak quarter), however it appears PCE increased in September (auto sales are up) and June was especially weak in Q2 - so real PCE growth will probably be in the 1.5% range in Q3 (still weak).

Misc: Foreclosure "Closer", One in Five Modifications Redefault and More

by Calculated Risk on 9/30/2011 12:29:00 AM

• A story about the guy that checks the house after foreclosure from the NY Times: The Closer

When a lender forecloses on a property, one of the first things he does is send somebody out to see if there is a house still standing and whether there’s anybody living there. That’s my job. Sometimes the houses are crack dens or meth labs, sometimes the sites of cock- or dog-fighting operations, sometimes the backyard is filled with pot. And sometimes the house is a waterfront mansion in a gated golf community worth well over seven figures. Variety is the rule.• From Bloomberg: One in Five Modified Loans Default Again, U.S. Comptroller Says (ht Mike in Long Island)

One in five homeowners whose mortgages were modified under a program aimed at reducing foreclosures defaulted again within a year after their payments were cut, the U.S. Comptroller of the Currency reported today.• From Catherine Rampell at Economix: Job Losses Across the Developed World (ht Picosec)

Across the developed world, the biggest job losses in the 2008-9 downturn were in mining, manufacturing and utilities, according to new data from the Organization for Economic Cooperation and Development.Check out the chart. Construction job losses in the U.S. were small compared to Spain, Ireland and Portugal.

Thursday, September 29, 2011

Freddie Mac: Record Low Mortgage Rates

by Calculated Risk on 9/29/2011 05:24:00 PM

Probably deserves a mention ... from Freddie Mac: Fixed-Rate Mortgages Lowest on Record

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), coming on the heels of the Federal Reserve's recent announcements. The conventional 30-year fixed averaged an all-time record low at 4.01 percent; likewise the 15-year fixed averaged an all-time record low at 3.28 percent for the week.Earlier:

...

"Fixed mortgage rates fell to all-time record lows this week following the Federal Reserve's announcement of its Maturity Extension Program and additional purchases of mortgage-backed securities. Interest rates for ARMs, however, were nearly unchanged as the Federal Reserve plans to sell $400 billion in short-term Treasury securities, which serve as benchmarks for many ARMs." [said Frank Nothaft, vice president and chief economist, Freddie Mac]

• Weekly Initial Unemployment Claims decline sharply to 391,000

• Misc: GDP revised up, Employment to be revised up, Germany approves EFSF changes, Pending Home sales decline

• Kansas City Manufacturing Survey: Manufacturing activity expands "modestly" in September

• Employment: Comment on preliminary annual benchmark revision

Employment: Comment on preliminary annual benchmark revision

by Calculated Risk on 9/29/2011 01:45:00 PM

This morning the BLS released the preliminary annual benchmark revision of +192,000 payroll jobs. The final revision will be published next February when the January 2012 employment report is released February 3, 2012. Usually the preliminary estimate is pretty close to the final benchmark estimate.

The annual revision is benchmarked to state tax records. From the BLS:

Establishment survey benchmarking is done on an annual basis to a population derived primarily from the administrative file of employees covered by unemployment insurance (UI). The time required to complete the revision process—from the full collection of the UI population data to publication of the revised industry estimates—is about 10 months. The benchmark adjustment procedure replaces the March sample-based employment estimates with UI-based population counts for March. The benchmark therefore determines the final employment levels ...Using the preliminary benchmark estimate, this means that payroll employment in March 2011 was 192,000 higher than originally estimated. In February 2012, the payroll numbers will be revised up to reflect this estimate. The number is then "wedged back" to the previous revision (March 2010).

Click on graph for larger image.

Click on graph for larger image.This graph shows the impact of the preliminary benchmark revision on job losses in percentage terms from the start of the employment recession.

The red line on the graph is the current estimate, and the dotted line shows the impact of estimated coming benchmark revision. This puts the current payroll employment about 6.7 million jobs below the pre-recession peak in December 2007. Still very ugly.

For details on the benchmark revision process, see from the BLS: Benchmark Article and annual benchmark revision for the new preliminary estimate.

The following table shows the benchmark revisions since 1979.

| Year | Percent benchmark revision | Benchmark revision (in thousands) |

|---|---|---|

| 1979 | 0.5 | 447 |

| 1980 | -0.1 | -63 |

| 1981 | -0.4 | -349 |

| 1982 | -0.1 | -113 |

| 1983 | * | 36 |

| 1984 | 0.4 | 353 |

| 1985 | * | -3 |

| 1986 | -0.5 | -467 |

| 1987 | * | -35 |

| 1988 | -0.3 | -326 |

| 1989 | * | 47 |

| 1990 | -0.2 | -229 |

| 1991 | -0.6 | -640 |

| 1992 | -0.1 | -59 |

| 1993 | 0.2 | 263 |

| 1994 | 0.7 | 747 |

| 1995 | 0.5 | 542 |

| 1996 | * | 57 |

| 1997 | 0.4 | 431 |

| 1998 | * | 44 |

| 1999 | 0.2 | 258 |

| 2000 | 0.4 | 468 |

| 2001 | -0.1 | -123 |

| 2002 | -0.2 | -313 |

| 2003 | -0.2 | -122 |

| 2004 | 0.2 | 203 |

| 2005 | -0.1 | -158 |

| 2006 | 0.6 | 752 |

| 2007 | -0.2 | -293 |

| 2008 | -0.1 | -89 |

| 2009 | -0.7 | -902 |

| 2010 | -0.3 | -378 |

| 2011 | 0.1 | 192 (estimate) |

| * less than 0.05% | ||

Kansas City Manufacturing Survey: Manufacturing activity expands "modestly" in September

by Calculated Risk on 9/29/2011 11:00:00 AM

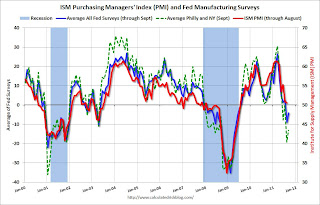

This is the last of the regional Fed surveys for September. The regional surveys provide a hint about the ISM manufacturing index - and the regional surveys were weak in September, but not as weak as in August.

From the Kansas City Fed: Growth in Manufacturing Activity Edged Higher

Growth in Tenth District manufacturing activity edged higher in September. Expectations moderated slightly, but producers on net still anticipated increased activity over the next six months. Price indexes moved up modestly, with slightly more producers planning to raise selling prices.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

The month-over-month composite index was 6 in September, up from 3 in August and 3 in July ... The employment index increased for the second straight month, but the new orders for exports index fell slightly after rising last month.

“Factory activity in our region continues to grow modestly, and firms generally expect this trend to continue,” said Wilkerson. “Price indexes also edged higher this month after generally decelerating earlier in the summer.”

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The New York and Philly Fed surveys are averaged together (dashed green, through September), and five Fed surveys are averaged (blue, through September) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through August (right axis).

The ISM index for September will be released Monday, Oct 3rd and this suggests another weak reading in September.

Earlier:

• Weekly Initial Unemployment Claims decline sharply to 391,000

• Misc: GDP revised up, Employment to be revised up, Germany approves EFSF changes, Pending Home sales decline

Misc: GDP revised up, Employment to be revised up, Germany approves EFSF changes, Pending Home sales decline

by Calculated Risk on 9/29/2011 10:00:00 AM

• From the BLS: Current Employment Statistics Preliminary Benchmark Announcement

In accordance with usual practice, the Bureau of Labor Statistics (BLS) is announcing the preliminary estimate of the upcoming annual benchmark revision to the establishment survey employment series. The final benchmark revision will be issued on February 3, 2012, with the publication of the January 2012 Employment Situation news release.Usually the final benchmark revision is pretty close to the preliminary revision.

Each year, the Current Employment Statistics (CES) survey employment estimates are benchmarked to comprehensive counts of employment for the month of March. These counts are derived from state unemployment insurance (UI) tax records that nearly all employers are required to file. ... The preliminary estimate of the benchmark revision indicates an upward adjustment to March 2011 total nonfarm employment of 192,000 (0.1 percent).

• The BEA reported that GDP increased at a 1.3% real annual rate in Q2 (third estimate), revised up from the previously reported 1.0% increase. It was still a weak quarter, but the internals were positive: the contributions from consumption and trade were revised up, and the contribution from "change in private inventories" was revised down.

• From the NAR: Pending Home Sales Decline in August

The Pending Home Sales Index,* a forward-looking indicator based on contract signings, declined 1.2 percent to 88.6 in August from 89.7 in July but is 7.7 percent above August 2010 when it stood at 82.3. The data reflects contracts but not closings.• From Bloomberg: German Parliament Backs Euro Rescue Fund

The lower house of parliament passed the measure with 523 votes in favor and 85 against, granting the fund powers to buy bonds in secondary markets, enable bank recapitalizations and offer precautionary credit lines.A key point: German Chancellor Merkel's ruling coalition party backed the bill.

Weekly Initial Unemployment Claims decline sharply to 391,000

by Calculated Risk on 9/29/2011 08:30:00 AM

The DOL reports:

In the week ending September 24, the advance figure for seasonally adjusted initial claims was 391,000, a decrease of 37,000 from the previous week's revised figure of 428,000. The 4-week moving average was 417,000, a decrease of 5,250 from the previous week's revised average of 422,250.The following graph shows the 4-week moving average of weekly claims since January 2000 (there is a longer term graph in graph gallery).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims declined this week to 417,000.

This is the lowest level for weekly claims since early April, although the 4-week average is still elevated.

Wednesday, September 28, 2011

Treasury: Mortgage loan fraud suspicious activity reports increased in Q2, Most occurred during bubble

by Calculated Risk on 9/28/2011 09:31:00 PM

From Treasury: Second Quarter Mortgage Loan Fraud Suspicious Activity Persists

The Financial Crimes Enforcement Network (FinCEN) today reported in its Second Quarter 2011 Analysis of mortgage loan fraud suspicious activity reports (MLF SARs) that financial institutions filed 29,558 MLF SARs in the second quarter of 2011 up from 15,727 MLF SARs reported in the same quarter of 2010.The most common mortgage loan fraud suspicious activity was the misrepresentation of income, occupancy, debts, or assets (about 30%). Some of the more current frauds are related to debt elimination and short sale fraud (unfortunately attempted short sale fraud is very common).

A large majority of the MLF SARs examined in the second quarter involved mortgages closed during the height of the real estate bubble. The upward spike in second quarter MLF SAR numbers is directly attributable to mortgage repurchase demands and special filings generated by several institutions. For instance, FinCEN noted that 81 percent of the MLF SARs filed during the quarter involved suspicious activities that occurred before 2008; 63 percent involved suspicious activities that occurred four or more years ago.

"We're continuing to see a large number of SARs filed on activity that occurred more than two years ago, an indication that financial institutions are uncovering fraud as they sift through defaulted mortgages," said FinCEN Director James H. Freis, Jr.

FinCEN has some Mortgage Fraud SAR Datasets breaking down the data by state, MSA and county. California was #1 in Q2 (Nevada or Florida have usually been #1). San Jose-Sunnyvale-Santa Clara, CA was the #1 MSA.

And in a related story from the AP: Santa Rosa Hells Angels leaders indicted on loan fraud. This involved a mortgage broker and false statement of income and assets to buy marijuana "grow houses". Oh my ...

Lawler: Best Guess for August Pending Home Sales

by Calculated Risk on 9/28/2011 05:31:00 PM

From economist Tom Lawler:

It is difficult to “work up” an estimate of the NAR’s Pending Home Sales Index from local Realtor associations/boards/MLS, for several reasons. First, many of these A/B/M’s don’t release “new” pending sales data (that is, data on contracts signed in a month). Indeed, many don’t track such data at all, and as a result the NAR’s PHSI is based on a sample size about half as large as that used to estimate closed existing home sales. And second, some publicly-released A/B/M reports are run early in the month, and have preliminary pending sales that are often revised by a lot in subsequent months.

As such, my estimate of the NAR’s PHSI is subject to far more uncertainty than are my estimates for closed existing home sales.

Based on the data I do have, however, I estimate that the NAR’s August Pending Home Sales Index will probably come in about 3.5% higher than the July PHSI on a seasonally adjusted basis. While, as always, reported YOY gains vary massively across various A/B/M’s, almost all showed YOY gains and many – including but not limited to several in the Midwest – showed hefty YOY increases. Of course, July’s PHSI on a seasonally adjusted basis was 9% higher than last August’s, and this August had one more business day than last August. As such, a national YOY gain in unadjusted pending sales for August of close to 12% would produce a flat seasonally adjusted reading versus July.

In looking at various regional reports, only a handful showed YOY declines (including a few but not even close to all Florida markets), several showed modest single-digit gains (including several in the Northeast), but quite a few showed YOY gains of 20% or more (and a few by a LOT more).

A 3.5% gain would be well above the “consensus” forecast of a moderate decline.

CR Note: The NAR is scheduled to release Pending Home sales for August tomorrow (Thursday) at 10 AM ET. The consensus is for a 2% decrease in the index.