by Calculated Risk on 9/28/2011 03:54:00 PM

Wednesday, September 28, 2011

Europe Update

From the WSJ: Euro-Zone Bailout Plan Progresses

The euro zone is on track to expand its bailout fund ... But the debate ... has already moved on to two thornier issues: a more radical increase in the scope of bailouts, and possible debt restructuring for Greece.And a roundup of events from the Financial Times: Rolling blog: the eurozone crisis

Greece's failure to close its budget shortfall is prompting some European governments, led by Germany, to push for a re-examination of the international bailout program for Athens ... In return, Germany is under pressure to agree to "leverage" the euro-zone bailout fund ...

• José Manual Barroso, president of the European Commission, gave his annual State of the Union address ... in which he insisted Greece would remain a member of the euro, and formally approved proposals for a tax on financial transactions ...The Greek 2 year yield is at 70%. The Greek 1 year yield is at 131%.

• The European Commission confirmed that the troika would return to Athens on Thursday ... and said an additional ‘eurogroup meeting’ (where European finance ministers meet up) would be held in October to “consider the disbursement of the next tranche” of bailout money

• Finland voted to approve expanding the powers of the [EFSF]

• German inflation hit a 3-year high

• French president Nicolas Sarkozy pledged to [reduce the French] budget deficit to 3 per cent of gross domestic product in 2013

The Portuguese 2 year yield is up to 18% and the Irish 2 year yield was down sharply to 7.6%. Here are the links for bond yields for several countries (source: Bloomberg):

| Greece | 2 Year | 5 Year | 10 Year |

| Portugal | 2 Year | 5 Year | 10 Year |

| Ireland | 2 Year | 5 Year | 10 Year |

| Spain | 2 Year | 5 Year | 10 Year |

| Italy | 2 Year | 5 Year | 10 Year |

| Belgium | 2 Year | 5 Year | 10 Year |

| France | 2 Year | 5 Year | 10 Year |

| Germany | 2 Year | 5 Year | 10 Year |

Fed's Rosengren: Housing and Economic Recovery

by Calculated Risk on 9/28/2011 01:43:00 PM

From Boston Fed President Eric Rosengren: Housing and Economic Recovery

A few excepts and couple of graphs that highlight two topics we've discussed for years:

[E]even though residential investment is a small share of GDP (today only 2.2 percent), it is quite interest-sensitive – it can decline quite dramatically as interest rates rise, and expand quickly when interest rates are relatively low. So it has been a disproportionally important part of the monetary policy transmission mechanism.

In the current situation, however, U.S. mortgage rates are quite low but residential investment has not been the engine of growth that it normally is in economic recoveries. As shown in Figure 4, exports have been a source of strength in the first two years of the U.S. recovery, and business fixed investment has grown at approximately the same rate in this recovery as in the previous three. Yet the household sector has been particularly weak. Consumption, which accounts for approximately 70 percent of U.S. GDP, has grown only about half as much in the first two years of the recovery as it did in the previous three recoveries. And the shortfall for residential investment is even more striking. In the previous three recoveries, residential investment grew over 30 percent on average in the first years of the recovery – but has actually decreased in the first two years of this recovery. ...

CR Note: Residential investment (RI) is usually an engine of recovery, but with the huge overhang of existing vacant housing units, RI didn't contribute during the first two years this time. This is exactly what we've expected.

The weak housing sector also has an impact on employment. Figure 9 shows that far fewer jobs have been created in the first two years of this recovery (the left bar in each pair) than in previous recoveries (the right bar in the pair). In fact, construction jobs have continued to decline during the first two years of this recovery – we have lost over a half a million construction jobs since the recovery began. While construction employment is typically volatile during a recovery, on average the sector adds roughly 150,000 jobs.

Indeed, ... employment in construction has declined by 9 percent in the first two years of this recovery compared to growth over 4 percent during the previous three recoveries. And weak construction employment and activity also reduces the demand for labor in sectors that support construction.

CR Note: Employment is been especially weak in this recovery, and construction employment was especially hard hit. In addition to the excess housing inventory, there is excess capacity in most industries - and households have too much debt and are deleveraging.

The little bit of good news is that Residential Investment will make a positive contribution to growth this year (mostly from multi-family and home improvement), and construction employment will probably increase this year (not much).

Existing Home Inventory continues to decline year-over-year in September

by Calculated Risk on 9/28/2011 10:24:00 AM

In June, Tom Lawler posted on how the NAR estimates existing home inventory. The NAR does NOT aggregate data from the local boards (see Tom's post for how the NAR estimates inventory).

In a few months the NAR will revise down their estimates fpr inventory and sales of existing homes for the last few years. Also the NAR methodology for estimating sales and inventory will be changed.

I think the HousingTracker / DeptofNumbers data that Tom mentioned provides a timely estimate of changes in inventory. Ben at deptofnumbers.com is tracking the aggregate monthly inventory for 54 metro areas.

![]() Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows the NAR estimate of existing home inventory through August (left axis) and the HousingTracker data for the 54 metro areas through September. The HousingTracker data shows a steeper decline in inventory over the last few years (as mentioned above, the NAR will probably revise down their inventory estimates this fall).

![]() The second graph shows the year-over-year change in inventory for both the NAR and HousingTracker.

The second graph shows the year-over-year change in inventory for both the NAR and HousingTracker.

HousingTracker reported that the September listings - for the 54 metro areas - declined 16.7% from last year.

Of course there is a large percentage of distressed inventory, and various categories of "shadow inventory" too. But the decline in listed or "visible" inventory is a key story in 2011 - and listed inventory for September is probably down to the lowest level since September 2005.

Note: inventory surged in the late 2005 and early 2006 - a key sign that the housing bubble was bursting.

MBA: Mortgage Purchase Application Index increases

by Calculated Risk on 9/28/2011 07:22:00 AM

Note: The graph below includes the enhanced sample discussed last week. "The survey captures more than 75% of all U.S. retail and consumer direct mortgage applications, compared to 50% previously." For a discussion of the changes, see: Presentation to Discuss Enhancements to MBA’s Weekly Applications Survey.

There is also additional data. The weekly survey now includes mortgage rates for both conforming and jumbo loans. There is also a new Monthly Profile report (see sample here: Monthly Profile of State and National Mortgage Activity). This report breaks down the monthly application data by product type, size of loans, and state data. This appears very useful for short-term prepay modeling given the differences across states. This report is only available to subscribers.

The MBA reports: Mortgage Applications Increase in Latest MBA Weekly Survey

The Refinance Index increased 11.2 percent from the previous week. The seasonally adjusted Purchase Index increased 2.6 percent from one week earlier.The following graph shows the MBA Purchase Index and four week moving average since 1990.

...

"Mortgage rates declined last week, at least partially in response to the Fed's announcement that they would shift their portfolio towards longer-term Treasury securities, and that they would resume buying mortgage-backed securities," said Mike Fratantoni, MBA's Vice President of Research and Economics. "With lower rates, refinance application volume increased to its highest level since August 19, 2011. Purchase application volume also increased. However, the increase was in conventional purchase applications, which were up by 4.9 percent. Purchase applications for government loans fell by 0.6 percent over the week, likely influenced by the pending decline in FHA loan limits."

...

The average loan size of all loans for home purchase in the US was $212,700 in August 2011, up from $211,200 in July 2011. The average loan size for a refinance was $241,300, up from $209,200 in July.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) decreased to 4.25 percent from 4.29 percent, with points decreasing to 0.35 from 0.41 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

The average contract interest rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than $417,500) decreased to 4.51 percent from 4.55 percent, with points decreasing to 0.38 from 0.46 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.August was an especially weak month for this index. This increase was pretty small, and although this doesn't include the large number of cash buyers, this suggests fairly weak home sales in September and October.

Tuesday, September 27, 2011

Europe Update: Nothing Settled Yet

by Calculated Risk on 9/27/2011 08:34:00 PM

A few articles ...

From the WSJ: Greece Passes Property-Tax Law, Clearing a Path for Additional Aid

Greece's parliament approved a new property-tax law in a closely watched vote Tuesday ... The approval of the property tax is expected to open the way for the return to Athens this week of a troika of inspectors from the International Monetary Fund, the European Union and the European Central Bank.The next step will be the return of the inspectors ... and the vote on the EFSF in Germany.

From the NY Times: Merkel Rallies Wary Coalition Ahead of Vote on Greek Aid

[L]awmakers in Slovenia voted Tuesday to approve their share of the rescue fund’s guarantees. Finland’s Parliament is expected to reluctantly approve the fund measure in a vote on WednesdayThe German parliament will vote on Thursday and Friday.

[T]he German finance minister, Wolfgang Schäuble, ruled out an increase in the size of the euro zone bailout fund, though not necessarily an increase in its ability to borrow. ... Mr. Schäuble also said Tuesday that it was likely that the rescue mechanism would be further “enhanced,” though he would not give details.And the Financial Times is reporting: Split opens over Greek bail-out terms. Apparently some officials (Germany and a few others) are arguing that the private sector should take a larger haircut. So this isn't settled yet.

Eurozone finance ministers had originally hoped to sign off on the next aid tranche to Greece on Monday, but a decision is now expected to delay the next €8bn payment until an emergency meeting in two weeks.Greece apparently has enough cash until mid-October ...

excerpt with permission

Earlier:

• CoreLogic: Existing Home Shadow Inventory Declines to 1.6 million units

• Case Shiller: Home Prices increased Seasonally in July

• Real House Prices and House Price-to-Rent

ATA Trucking Index decreased slightly in August

by Calculated Risk on 9/27/2011 04:53:00 PM

From ATA: ATA Truck Tonnage Index Edged 0.2% Lower in August

The American Trucking Associations’ advance seasonally adjusted (SA) For-Hire Truck Tonnage Index declined 0.2% in August after falling a revised 0.8% in July 2011. July’s decrease was less than the 1.3% ATA reported on August 23, 2011. The latest drop put the SA index at 114.4 (2000=100) in August, down from the July level of 114.6.

...

Compared with August 2010, SA tonnage was up a solid 5.2%. In July, the tonnage index was 4.5% above a year earlier.

“Freight has been going sideways for much of this year, but it isn’t falling significantly either, which suggests the U.S. economy just might skirt another recession,” ATA Chief Economist Bob Costello said.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.Here is a long term graph that shows ATA's For-Hire Truck Tonnage index.

The dashed line is the current level of the index. From ATA:

Trucking serves as a barometer of the U.S. economy, representing 67.2% of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods. Trucks hauled 9 billion tons of freight in 2010. Motor carriers collected $563.4 billion, or 81.2% of total revenue earned by all transport modes.Moving sideways all year ...

Earlier:

• CoreLogic: Existing Home Shadow Inventory Declines to 1.6 million units

• Case Shiller: Home Prices increased Seasonally in July

• Real House Prices and House Price-to-Rent

Real House Prices and House Price-to-Rent

by Calculated Risk on 9/27/2011 01:42:00 PM

An update: Case-Shiller, CoreLogic and others report nominal house prices. However it is also useful to look at house prices in real terms (adjusted for inflation), as a price-to-rent ratio, and also price-to-income (not shown here).

Below are three graphs showing nominal prices (as reported), real prices and a price-to-rent ratio. Real prices are back to 1999/2000 levels, and the price-to-rent ratio is also back to 2000 levels.

Nominal House Prices

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

The first graph shows the quarterly Case-Shiller National Index SA (through Q2 2011), and the monthly Case-Shiller Composite 20 SA (through July) and CoreLogic House Price Indexes (through July) in nominal terms (as reported).

In nominal terms, the Case-Shiller National index is back to Q4 2002 levels, the Case-Shiller Composite 20 Index (SA) is back to June 2003 levels, and the CoreLogic index is back to July 2003.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

In real terms, the National index is back to Q3 1999 levels, the Composite 20 index is back to August 2000, and the CoreLogic index back to July 2000.

In real terms, all appreciation in the last decade is gone.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller Composite 20 and CoreLogic House Price Index.

Here is a similar graph using the Case-Shiller Composite 20 and CoreLogic House Price Index.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Composite 20 index is back to September 2000 levels, and the CoreLogic index is back to July 2000.

Earlier:

• CoreLogic: Existing Home Shadow Inventory Declines to 1.6 million units

• Case Shiller: Home Prices increased Seasonally in July

CoreLogic: Existing Home Shadow Inventory Declines to 1.6 million units

by Calculated Risk on 9/27/2011 11:15:00 AM

From CoreLogic: CoreLogic® Reports Shadow Inventory Continues to Decline

CoreLogic ... reported today that the current residential shadow inventory as of July 2011 declined slightly to 1.6 million units, representing a supply of 5 months. This is down from 1.9 million units, a supply of 6 months, from a year ago, and follows a decline from April 2011 when shadow inventory stood at 1.7 million units. The moderate decline in shadow inventory is being driven by a pace of new delinquencies that is slower than the disposition pace of distressed assets.

CoreLogic estimates the current stock of properties in the shadow inventory, also known as pending supply, by calculating the number of distressed properties not currently listed on multiple listing services (MLSs) that are seriously delinquent (90 days or more), in foreclosure and real estate owned (REO) by lenders.

...

Of the 1.6 million properties currently in the shadow inventory, 770,000 units are seriously delinquent (2.2-months’ supply) [down from 790,000 units in April], 430,000 are in some stage of foreclosure (1.2-months’ supply) [down from 440,000] and 390,000 are already in REO (1.1-months’ supply) [down from 440,000].

...

Mark Fleming, chief economist for CoreLogic, commented, “The steady improvement in the shadow inventory is a positive development for the housing market. However, continued price declines, high levels of negative equity and a sluggish labor market will keep the shadow supply elevated for an extended period of time.”

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph from CoreLogic shows the breakdown of "shadow inventory" by category. For this report, CoreLogic estimates the number of 90+ day delinquencies, foreclosures and REOs not currently listed for sale. Obviously if a house is listed for sale, it is already included in the "visible supply" and cannot be counted as shadow inventory.

So the key number in this report is that as of July, there were 1.6 million homes seriously delinquent, in the foreclosure process or REO that are not currently listed for sale.

Note: The unlisted REO seems a little high since total REO has dropped sharply over the last couple of quarters.

Earlier:

• Case Shiller: Home Prices increased Seasonally in July

Case Shiller: Home Prices increased Seasonally in July

by Calculated Risk on 9/27/2011 09:00:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for July (actually a 3 month average of May, June and July).

This includes prices for 20 individual cities and and two composite indices (for 10 cities and 20 cities).

Note: Case-Shiller reports NSA, I use the SA data. The composite indexes were up about 0.9% in July (from June) Not Seasonally Adjusted (NSA), but flat Seasonally Adjusted (SA).

From S&P: Home Prices Continue to Show Seasonal Strength According to the S&P/Case-Shiller Home Price Indices

Data through June 2011, released today by S&P Indices for its S&P/Case-Shiller Home Price Indices ... showed a fourth consecutive month of increases for the 10- and 20-City Composites, with both up 0.9% in July over June. Seventeen of the 20 MSAs and both Composites posted positive monthly increases; Las Vegas and Phoenix were down over the month and Denver was unchanged.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery. The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 32% from the peak, and down slightly in July (SA). The Composite 10 is 1.4% above the June 2009 post-bubble bottom (Seasonally adjusted).

The Composite 20 index is off 31.8% from the peak, and up slightly in July (SA). The Composite 20 is slightly above the March 2011 post-bubble bottom seasonally adjusted.

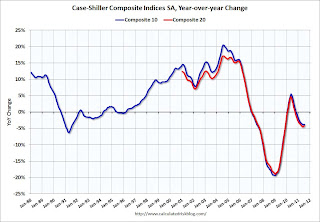

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is down 3.8% compared to July 2010.

The Composite 20 SA is down 4.2% compared to July 2010.

The third graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

Prices increased (SA) in 8 of the 20 Case-Shiller cities in July seasonally adjusted. Prices in Las Vegas are off 59.2% from the peak, and prices in Dallas only off 9.5% from the peak.

Prices increased (SA) in 8 of the 20 Case-Shiller cities in July seasonally adjusted. Prices in Las Vegas are off 59.2% from the peak, and prices in Dallas only off 9.5% from the peak.As S&P noted, prices increased in 17 of 20 cities not seasonally adjusted (NSA). However seasonally adjusted, prices only increased in 9 cities.

Most of this prices increase was mostly seasonal. As S&P's David Blitzer said: "This is still a seasonal period of stronger demand for houses, so monthly price increases are expected ... ". The question is what happens later this year. I'll have more later ...

Merkel: Germany will help stabilize Greece

by Calculated Risk on 9/27/2011 08:41:00 AM

From the NY Times: German Leader Reaffirms Backing for Greece

Promising that Athens would live up to its commitments, the Greek prime minister urged Europe to pull together to take the steps needed to head off a potentially disastrous escalation in the sovereign debt crisis.And from the Financial Times: Rolling blog: the eurozone crisis

In a speech to the same group of German business leaders, Chancellor Angela Merkel said Germany would provide all the help it could to stabilize Greece.

...

Mrs. Merkel urged lawmakers to back the bill “in a spirit of friendship, a spirit of partnership, not in a spirit of imposing something.”

“If Europe isn’t doing well, then over the medium term Germany won’t do well,” she said.

Our Athens reporter, Dimitris Kontogiannis, has set out the main details of the property tax ...It sounds like the property tax will pass - and that the German parliament will approve the changes to the EFSF on Thursday.

• The new tax will apply, with a few exceptions, to all electricity-powered buildings

• Those who refuse to pay will have their electricity cut off...

• The government estimates the new tax could raise €2bn-€2.5bn a year...