by Calculated Risk on 9/15/2011 07:39:00 PM

Thursday, September 15, 2011

Report: Geithner to Propose using EFSF like TALF

On Friday, the European finance ministers will meet, and Timothy Geithner will make an appearance and probably propose using the EFSF like the TALF - from Reuters: Geithner Is Likely to Suggest Europe Leverage Bailout Fund (ht jb)

Treasury Secretary Timothy Geithner is likely to suggest to European finance ministers on Friday that they leverage their bailout fund along the lines of the U.S. TALF program, EU officials said.This might work, but the sovereign debt collateral haircuts have to be appropriate.

...

Under TALF, the New York Fed would lend out up to $200 billion, taking ABS as collateral with a haircut and the Treasury offered $20 billion credit protection for the Fed.

In this way, a little bit of public money leveraged a much larger central bank contribution and the same idea could work for the European Financial Stability Facility, which has 440 billion euros at its disposal, to offer credit protection to, for example, the ECB to buy euro zone sovereign bonds.

Note: Earlier today, the ECB announced three U.S. dollar liquidity-providing operations in coordination with the U.S. Federal Reserve, the Bank of England, the Bank of Japan and the Swiss National Bank.

The Greek 2 year yield declined sharply to 61%. The Greek 1 year yield is down to 129%!

The Portuguese 2 year yield declined slightly to 15.9% and the Irish 2 year yield was down to 9.1%.

Earlier:

• Weekly Initial Unemployment Claims increased to 428,000

• Industrial Production increased 0.2% in August, Capacity Utilization increases slightly

• NY and Philly Fed Manufacturing surveys show contraction

• Key Measures of Inflation increase in August

• Early Look: 2012 Social Security Cost-Of-Living Adjustment on track for 3.5% increase

Early Look: 2012 Social Security Cost-Of-Living Adjustment on track for 3.5% increase

by Calculated Risk on 9/15/2011 03:43:00 PM

The BLS reported this morning: "The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) increased 4.3 percent over the last 12 months to an index level of 223.326 (1982-84=100)."

CPI-W is the index that is used to calculate the Cost-Of-Living Adjustments (COLA). Here is an explanation (much of the following is a repeat from a previous post updated with current data):

The calculation dates have changed over time (see Cost-of-Living Adjustments), but the current calculation uses the average CPI-W for the three months in Q3 (July, August, September) and compares to the average for the highest previous average of Q3 months. Note: this is not the headline CPI-U, and not seasonally adjusted.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows CPI-W since January 2000. The red lines are the Q3 average of CPI-W for each year.

• In 2008, the Q3 average of CPI-W was 215.495. In the previous year, 2007, the average in Q3 of CPI-W was 203.596. That gave an increase of 5.8% for COLA for 2009.

• In 2009, the Q3 average of CPI-W was 211.013. That was a decline of 2.1% from 2008, however, by law, the adjustment is never negative so the benefits remained the same in 2010.

• In 2010, the Q3 average of CPI-W was 214.136. That was an increase of 1.5% from 2009, however the average was still below the Q3 average in 2008, so the adjustment was zero.

• CPI-W in July and August 2011 averaged 223.006. This is above the Q3 2008 average, although we still have to wait for the September CPI-W. But if the current level holds, COLA would be around 3.5% for next year (the current 223.006 divided by the Q3 2008 level of 215.495).

This is still early, but we can be pretty sure COLA will increase this year. Of course medicare premiums will increase too.

Contribution and Benefit Base

The law prohibits an increase in the contribution and benefit base if COLA is not greater than zero. However if the there is even a small increase in COLA, the contribution base will be adjusted using the National Average Wage Index.

This is based on a one year lag. Since there was no increase in COLA for the last two years, the contribution base has remained at $106,800 for three years. Since COLA will be positive this year, the adjustment this year will use the 2010 National Average Wage Index compared to the 2007 Wage Index. The National Average Wage Index is not available for 2010 yet, and it is possible that wages declined further in 2010 and are back to 2007 levels. If so, there will be no increase in the contribution base.

If wages increased to the 2008 level, then the contribution base next year will be increased to around $109,000 to $110,000 from the current $106,800.

Remember - this is an early look and is only for two months in Q3. What matters is average CPI-W during Q3 (July, August and September).

NOTE on CPI-chained: There has been some discussion of switching from CPI-W to CPI-chained for COLA. This will not happen this year, but could impact future Cost-of-living adjustments, see: Cost of Living and CPI-Chained

Earlier:

• Weekly Initial Unemployment Claims increased to 428,000

• Industrial Production increased 0.2% in August, Capacity Utilization increases slightly

• NY and Philly Fed Manufacturing surveys show contraction

• Key Measures of Inflation increase in August

Key Measures of Inflation increase in August

by Calculated Risk on 9/15/2011 01:31:00 PM

Earlier today the BLS reported:

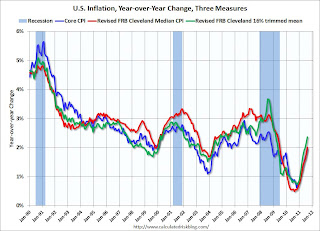

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.4 percent in August on a seasonally adjusted basis ... The gasoline index rose for the 12th time in the last 14 months and led to a 1.2 percent increase in the energy index, while the food index rose 0.5 percent, its largest increase since March. ... The index for all items less food and energy increased 0.2 percent in August, the same increase as the previous month.The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.3% (3.6% annualized rate) in August. The 16% trimmed-mean Consumer Price Index increased 0.3% (4.0% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed has a discussion of a number of measures of inflation: Measuring Inflation. You can see the median CPI details for August here.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.4% (4.6% annualized rate) in August. The CPI less food and energy increased 0.2% (3.0% annualized rate) on a seasonally adjusted basis.

Over the last 12 months, the median CPI rose 2.0%, the trimmed-mean CPI rose 2.4%, the CPI rose 3.8%, and the CPI less food and energy rose 2.0%

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.On a year-over-year basis, these measures of inflation are increasing, and are near the Fed's target.

On a monthly basis, the median Consumer Price Index increased 3.6% at an annualized rate, the 16% trimmed-mean Consumer Price Index increased 4.0% annualized in July, and core CPI increased 3.0% annualized.

Earlier:

• Weekly Initial Unemployment Claims increased to 428,000

• Industrial Production increased 0.2% in August, Capacity Utilization increases slightly

• NY and Philly Fed Manufacturing surveys show contraction

Philly Fed Survey: "Manufacturing activity is continuing to contract, but declines are less widespread"

by Calculated Risk on 9/15/2011 10:10:00 AM

First, from the WSJ: Central Banks Boost Dollar Liquidity

The ECB said that it will be joined by U.S. Federal Reserve, the Bank of England, the Bank of Japan and the Swiss National Bank to conduct three U.S. dollar liquidity-providing operations.From the Philly Fed: September 2011 Business Outlook Survey

The action addresses an acute shortage of dollar availability as U.S. lenders withheld funds [from European banks] ... The new dollar tenders, under which banks will be able to bid for unlimited funds, will have a maturity of approximately three months covering the end of the year, the ECB said.

The survey's broadest measure of manufacturing conditions, the diffusion index of current activity, increased from a very low reading of -30.7 in August to -17.5 in September. The index has been negative in three of the last four months (see Chart). The current new orders index paralleled the general activity index, increasing 16 points and remaining negative. The current shipments index fell 9 points.This indicates contraction in September and was slightly below the consensus forecast of -15.0.

...

Firms' responses suggest a slight improvement in hiring this month compared with August. The current employment index increased 11 points, after recording its first negative reading in 12 months in August. Over 22 percent of the firms reported an increase in employment, but 16 percent reported a decrease. The percentage of firms reporting a shorter workweek (23 percent) remained greater than the percentage reporting a longer one (9 percent).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through September. The ISM and total Fed surveys are through August.

The average of the Empire State and Philly Fed surveys rebounded in September, but is still well below zero - possibly indicating a further decline in the ISM index.

Industrial Production increased 0.2% in August, Capacity Utilization increases slightly

by Calculated Risk on 9/15/2011 09:25:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production increased 0.2 percent in August after having advanced 0.9 percent in July. Manufacturing rose 0.5 percent in August, after a similarly sized gain in July, and the rates of change were revised down slightly in April, May, and June. In August, the output of mines moved up 1.2 percent. The output of utilities decreased 3.0 percent, as temperatures moderated somewhat from the previous month. At 94.0 percent of its 2007 average, total industrial production for August was 3.4 percent above its year-earlier level. Capacity utilization for total industry edged up to 77.4 percent, a rate 1.9 percentage points above its level from a year earlier but 3.0 percentage points below its long-run (1972--2010) average.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows Capacity Utilization. This series is up 10.1 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 77.4% is still 3.0 percentage points below its average from 1972 to 2010 and below the pre-recession levels of 81.3% in Decebmer 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in August to 94.0 (although earlier months were revised down).

After the fairly rapid increase last year, increases in industrial production and capacity utilization have slowed recently.

Weekly Initial Unemployment Claims increased to 428,000

by Calculated Risk on 9/15/2011 08:30:00 AM

• From the NY Fed: Empire State Manufacturing Survey: "The Empire State Manufacturing

Survey indicates that conditions for New York manufacturers worsened for a fourth consecutive month in September. The general business conditions index inched down one point, to -8.8." This was lower than expectations of a reading of -3.6.

• CPI increased 0.4% in August (0.2% core). I'll have more later on the Fed survey and CPI.

• The DOL reports:

In the week ending September 10, the advance figure for seasonally adjusted initial claims was 428,000, an increase of 11,000 from the previous week's revised figure of 417,000. The 4-week moving average was 419,500, an increase of 4,000 from the previous week's revised average of 415,500.The following graph shows the 4-week moving average of weekly claims since January 2000 (longer term graph in graph gallery).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased this week to 419,500.

The 4-week average has been increasing recently and this is the highest level since early July.

Wednesday, September 14, 2011

First September Surveys

by Calculated Risk on 9/14/2011 11:41:00 PM

Tomorrow we will see if there is any improvement from the dismal August readings for both the Philly Fed and NY Fed (Empire state) manufacturing surveys. On Friday, the preliminary Reuters/University of Mich Consumer Sentiment for September will be released.

Thursday at 8:30 AM ET: NY Fed Empire Manufacturing Survey for September. The consensus is for a reading of -3.6, up from -7.7 in August (above zero is expansion).

10:00 AM: Philly Fed Survey for September. This index fell off a cliff in August. The consensus is for a reading of -15.0 (above zero indicates expansion), up from -30.7 last month.

Friday at 9:55 AM: Reuters/University of Mich Consumer Sentiment preliminary for September. The consensus is for a slight increase to 56.0 from 55.7 in August.

Last month I argued the sharp decline in sentiment - from an already low level - might be due to the debt ceiling debate. I looked at some of the previous spikes down in sentiment due to fairly short term events - and those events suggested sentiment should recover in 2 to 4 months. So maybe in October or November - but it is too early in September.

Of course sentiment - and the manufacturing surveys - could have declined because of other factors (weak labor market, European financial crisis, etc), and then the surveys might remain weak. We will get our first look tomorrow.

Europe Update: German and France back Greece and much more

by Calculated Risk on 9/14/2011 06:30:00 PM

The first of two key meetings this week was held earlier today via video conference with German Chancellor Angela Merkel, French President Nicolas Sarkozy and Greek prime minister George Papandreou. On Friday, the European finance ministers will meet with Timothy Geithner making an appearance.

From the WSJ: Greece's Future Is With Euro Zone, Say Merkel and Sarkozy

German Chancellor Angela Merkel and French President Nicolas Sarkozy are convinced that Greece's future is within the euro zone, Mrs. Merkel's spokesman said after the two leaders held a three-way conference call with Greek Prime Minister George Papandreou.From the NY Times: Germany and France Back Greece on Austerity Effort

But Mrs. Merkel and Mr. Sarkozy also stressed during the call the need for Greece to put into practice in a strict and effective way the already-agreed measures of its austerity program under a current bailout package, the spokesman, Steffen Seibert, said.

The Greek prime minister vowed to abide by austere cuts in the struggling country’s budget, and the leaders of France and Germany promised to support Greece as a central part of the euro zone, the three officials said Wednesday in a statement after a joint conference call.From the Irish Times: Commission prepares plans to introduce euro area bonds

...

Together, they are pushing all euro zone states to ratify as soon as possible decisions made on July 21, which would expand the European Financial Stability Facility and allow it increased flexibility to protect Greece and other heavily indebted members ...

European Commission president José Manuel Barroso said he is close to proposing options on joint euro-area bond sales, putting officials in Brussels on a collision course with Germany.From Reuters: EU warned of credit crunch threat, French banks hit (ht mp)

Speaking this morning, Mr Barroso said the commission is preparing options for the introduction of eurobonds. He called for much closer political integration and said the EU needed a "new federalist moment" to confront the most serious challenge for the union in a generation.

In a report prepared for ministers meeting in Poland on Friday and Saturday, senior EU officials said the 17-nation currency area faces a "risk of a vicious circle between sovereign debt, bank funding and negative growth."From the Economic Times: Dutch Finance Minister says has not given up on Greece (ht ghostfaceinvestah)

"While tensions in sovereign debt markets have intensified and bank funding risks have increased over the summer, contagion has spread across markets and countries and the crisis has become systemic," the influential Economic and Financial Committee said.

"A further reinforcement of bank resources is advisable," ministers were told ...

The Dutch government has not given up on the rescue of Greece and is determined to do everything possible to save the euro zone, the Dutch finance minister told members of parliament on Wednesday.From Bloomberg: Credit Agricole Debt Ratings Cut by Moody’s Along With Societe Generale’s

"To be clear ... this Cabinet has the firm will to do everything possible to save the euro or the euro zone," Finance Minister Jan Kees de Jager told members of parliament.

He strongly denied Dutch media reports that the government expected Greece to default ...

And from Bloomberg: ECB Will Lend Dollars to Two Euro-Region Banks as Market Funding Tightens

The European Central Bank said it will lend dollars to two euro-area banks tomorrow, a sign they are finding it difficult to borrow the U.S. currency in markets.The Greek 2 year yield declined slightly to 74.5%. The Greek 1 year yield is at 142%.

The ECB allotted $575 million in a regular seven-day liquidity-providing operation at a fixed rate of 1.1 percent. It’s the first time since Aug. 17 that a lender requested dollars from the ECB.

The Portuguese 2 year yield is up to 16.1% and the Irish 2 year yield is at 9.5%.

Here are the links for bond yields for several countries (source: Bloomberg):

| Greece | 2 Year | 5 Year | 10 Year |

| Portugal | 2 Year | 5 Year | 10 Year |

| Ireland | 2 Year | 5 Year | 10 Year |

| Spain | 2 Year | 5 Year | 10 Year |

| Italy | 2 Year | 5 Year | 10 Year |

| Belgium | 2 Year | 5 Year | 10 Year |

| France | 2 Year | 5 Year | 10 Year |

| Germany | 2 Year | 5 Year | 10 Year |

DataQuick: SoCal August Home Sales Climb

by Calculated Risk on 9/14/2011 03:57:00 PM

Existing home sales for August will be released on Weds Sept 21st. Economist Tom Lawler is estimating the NAR will report sales of 4.91 million on a seasonally adjusted annual rate (SAAR) basis. That would be an increase from 4.67 million in July.

Existing home sales are reported at closing, and new home sales are reported when the contract is signed, so the debt ceiling slowdown will negatively impact reported new home sales much more than existing home sales.

From DataQuick: Southland August Home Sales Climb, Median Price Falls Again

A total of 19,654 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties in August. That was up 8.6 percent from 18,090 in July and up 6.0 percent from 18,541 in August 2010, according to San Diego-based DataQuick.So 34.6 percent were foreclosure resales and 17.9 percent were short sales - over 50% were distressed sales in August!

...

August was the first month since June 2010 to post a year-over-year gain in home sales. Last month was also the first since November 2009 in which all six Southland counties logged higher sales than a year earlier. One reason it’s getting easier to beat the year-ago sales numbers: Home sales fell off sharply last summer after federal and state homebuyer tax credits expired.

...

Last month’s sales picture changes when viewed in terms of the average number of homes sold daily. Last month had 23 business days (the most for any August since 2007) on which home sales could be recorded, compared with 20 business days in July and 22 in August 2010. The average number of homes sold daily last month fell about 6 percent from July and rose less than 1 percent compared with a year earlier.

...

Foreclosure resales – properties foreclosed on in the prior 12 months – made up 34.6 percent of the Southland resale market in August, up from 34.5 percent in July but down from 37.6 percent a year earlier. Foreclosure resales peaked at 56.7 percent in February 2009.

Short sales, where the sale price fell short of what was owed on the property, made up an estimated 17.9 percent of Southland resales last month. That was up from 17.3 percent in July but down from 18.9 percent a year ago. Two years ago the estimate was 14.5 percent.

Households Doubling Up and Housing

by Calculated Risk on 9/14/2011 01:54:00 PM

Yesterday David Johnson at the Census Bureau wrote: Households Doubling Up

In coping with economic challenges over the past few years, many of us have combined households with other family members or individuals. These “doubled-up” households are defined as those that include at least one “additional” adult – in other words, a person 18 or older who is not enrolled in school and is not the householder, spouse or cohabiting partner of the householder.David Johnson reported the numbers for spring 2007 and spring 2011. Here are the numbers for all years from spring 2007 through spring 2011. This is based on a survey of "roughly 78,000 households" as part of the Annual Social and Economic Supplement to the Current Population Survey. (Source: Census Bureau research, "Income, Poverty and Health Insurance Coverage in the United States" report)

The Census Bureau reported today that the number and share of doubled-up households and adults sharing households across the country increased over the course of the recession, which began in December 2007 and ended in June 2009. In spring 2007, there were 19.7 million doubled-up households, amounting to 17.0 percent of all households. Four years later, in spring 2011, the number of such households had climbed to 21.8 million, or 18.3 percent.

| Year | Doubled-up Households (000s)1 | Percent of Households2 |

|---|---|---|

| 2007 | 19,747 | 17.0% |

| 2008 | 19,956 | 17.1% |

| 2009 | 20,683 | 17.7% |

| 2010 | 22,000 | 18.7% |

| 2011 | 21,766 | 18.3% |

It appears the percent of households that are doubled-up peaked in 2010, and is starting to decline. This is probably part of the reason for the pickup last year in demand for rental units since most people leaving a doubled-up household probably rent as opposed to buy.

If there were a strong increase in employment, there would probably be a sharp increase in households - both from normal growth and from people moving out of doubled-up households. And that would help absorb the excess supply of housing units. Of course there probably won't be a strong increase in employment until more of the excess housing supply is absorbed!

Notes:

1 The increase in the number and percent of doubled-up households between 2007 and 2011 was significant. The increase in the number of doubled up households was significant at the 10% level between 2008 and 2009 and between 2009 and 2010. The change in the number of doubled-up households between 2010 and 2011 was not statistically significant. The number of doubled-up households did not change significantly between either 2007 and 2008 or 2010 and 2011.

2 The percentage point increase in doubled up households was significant at the 10% level between 2008 and 2009 and between 2009 and 2010. The percentage point decline in doubled-up households between 2010 and 2011 was also significant at the 10% level. The percentage of doubled-up households as a proportion of all households did not change significantly between 2007 and 2008.