by Calculated Risk on 9/09/2011 06:18:00 PM

Friday, September 09, 2011

G7 communique: "Central Banks stand ready to provide liquidity as required"

From the Telegraph: G7 communique: in full (ht jb)

Agreed terms of reference by G7 Finance Ministers and Central Bank Governors

We met at a time of new challenges to global economic recovery, with significant challenges to growth, fiscal deficits and sovereign debt, stemming from past accumulated imbalances. This is reflected in heightened tensions in financial markets. There are now clear signs of a slowdown in global growth. We are committed to a strong and coordinated international response to these challenges.

We are taking strong actions to maintain financial stability, restore confidence and support growth. In the US, President Obama has put forward a significant package to strengthen growth and employment through public investments, tax incentives, and targeted jobs measures, combined with fiscal reforms designed to restore fiscal sustainability over the medium term. Euro area countries are implementing the decisions taken on July 21 to address financial tensions, notably through the flexibilisation of the EFSF, reaffirming their inflexible determination to honor fully their own individual sovereign signatures and their commitments to sustainable fiscal conditions and structural reforms. Japan is implementing substantial fiscal measures for reconstruction from the earthquake while ensuring the commitment to medium-term fiscal consolidation.

Concerns over the pace and future of the recovery underscore the need for a concerted effort at a global level in support of strong, sustainable and balanced growth. We must all set out and implement ambitious and growth-friendly fiscal consolidation plans rooted within credible fiscal frameworks. Fiscal policy faces a delicate balancing act. Given the still fragile nature of the recovery, we must tread the difficult path of achieving fiscal adjustment plans while supporting economic activity, taking into account different national circumstances.

Monetary policies will maintain price stability and continue to support economic recovery. Central Banks stand ready to provide liquidity to banks as required. We will take all necessary actions to ensure the resilience of banking systems and financial markets. In this context we reaffirm our commitment to implement fully Basel III.

Misc: Market, Existing Home Sales forecast, ECB's Stark resigns, MERS

by Calculated Risk on 9/09/2011 04:07:00 PM

• S&P off 31+, Dow off 300+. Graph below ...

• From economist Tom Lawler: "[Based on incoming data] I’m upping my estimate for August existing home sales (as estimated by the NAR) to a SAAR of 4.91 million."

• From the WSJ: Economic, Debt Worries Mount in Euro Zone

The unexpected departure of European Central Bank chief economist Jürgen Stark intensified investors' worries about the euro-zone financial crisis Friday and unleashed a broad pullback from risk in European financial markets, sinking the euro to its lowest level in more than six months.Stark was an inflation hawk and opposed all EU bailouts and ECB bond buying.

• Another MERS court victory, this time at the 9th Circuit Court of Appeals (ht Mish). From the opinion:

The district court properly dismissed the plaintiffs’ First Amended Complaint without leave to amend. The plaintiffs’ claims that focus on the operation of the MERS system ultimately fail because the plaintiffs have not shown that the alleged illegalities associated with the MERS system injured them or violated state law. As part of their fraud claim, the plaintiffs have not shown that they detrimentally relied upon any misrepresentations about MERS’s role in their loans. Further, even if we were to accept the plaintiffs’ contention that MERS is a sham beneficiary and the note is split from the deed in the MERS system, it does not follow that any attempt to foreclose after the plaintiffs defaulted on their loans is necessarily “wrongful.” The plaintiffs’ claims against their original lenders fail because they have not stated a basis for equitable tolling or estoppel of the statutes of limitations on their TILA and Arizona Consumer Fraud Act claims, and have not identified extreme and outrageous conduct in support of their claim for intentional infliction of emotional distress.MERS is the Mortgage Electronic Registration System, and some people argued that MERS would lead to the total collapse of Western Civilization or something ... I've argued for years that those fear were way overblown.

Thus, we AFFIRM the decision of the district court.

AAR: Rail Traffic mixed in August

by Calculated Risk on 9/09/2011 02:25:00 PM

The Association of American Railroads (AAR) reports carload traffic in Auguest 2011 decreased 0.3 percent compared with the same month last year, and intermodal traffic (using intermodal or shipping containers) increased 0.4 percent compared with August 2010. On a seasonally adjusted basis, carloads in August 2011 were flat compared to July 2011; intermodal in August 2011 was up 0.3% from July 2011.

On a non-seasonally adjusted basis, total U.S. freight rail carloads were down 0.3% in August 2011 from August 2010. Railroads originated 1,482,570 carloads in August 2011, down from 1,486,378 in August 2010. ... As the chart [below] shows, for the past five months rail carload traffic has been joined at the hip with the same month in 2010.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows U.S. average weekly rail carloads (NSA).

Rail carload traffic collapsed in November 2008, and now, over 2 years into the recovery, carload traffic is only about half way back.

"Excluding coal, U.S. rail carloads in August 2011 were up 1.0% over August 2010. Excluding coal and grain, U.S. rail carloads in August 2011 were up 3.7% over August 2010"

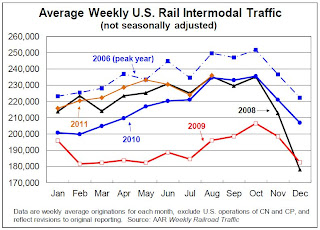

The second graph is for intermodal traffic (using intermodal or shipping containers):

The second graph is for intermodal traffic (using intermodal or shipping containers):Intermodal continued its upward march in August. U.S. railroads originated 1,179,838 trailers and containers in August 2011, an average of 235,968 units per week. That’s the highest weekly average for any month since October 2007. Less impressive is the fact that August 2011 was up just 0.4% (4,196 units) over August 2010.August was another soft month for rail traffic.

excerpts with permission

Hotels: Occupancy Rate increases 6.6% compared to same week in 2010

by Calculated Risk on 9/09/2011 11:17:00 AM

Note: This is one of the industry specific measures that I follow. I only post this every few weeks or so.

From HotelNewsNow.com: STR: US results for week ending 3 September

In year-over-year comparisons for the week, occupancy rose 6.6 percent to 61.1 percent, average daily rate increased 4.8 percent to US$99.04, and revenue per available room finished the week up 11.6 percent to US$60.53.Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

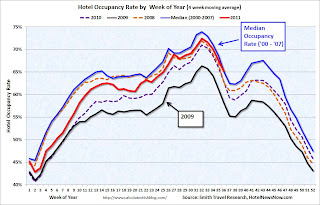

The following graph shows the seasonal pattern for the hotel occupancy rate using a four week average for the occupancy rate.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The summer leisure travel season has ended, and the 4-week average of the occupancy rate is starting to decrease seasonally. For the first time since early 2008, the 4 week average of the hotel occupancy rate is back to the pre-recession median level.

Even though the occupancy rate has recovered, ADR is still lower than before the recession.

The second graph shows the 4-week average of the occupancy rate as a percent of the median since 2000. Note: Since this is a percent of the median, the number can be above 100%.

The second graph shows the 4-week average of the occupancy rate as a percent of the median since 2000. Note: Since this is a percent of the median, the number can be above 100%.This shows the decline in the occupancy rate during and following the 2001 recession. The sharp decline in 2001 was related to 9/11, and the sharp increase towards the end of 2005 was due to Hurricane Katrina.

The occupancy rate really fell off a cliff in 2008, and has slowly recovered back to the median.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Europe: Greece Update

by Calculated Risk on 9/09/2011 08:38:00 AM

From Dow Jones: Greek Debt Rollover Process 'Satisfactory'

A debt rollover plan ... is making "satisfactory progress," a Greek government official said Friday as a deadline for euro-zone banks and funds to express interest expired.There is no clear "make or break" date for Greece but here are a few key dates via the WSJ: September Roadmap for the Euro Crisis.

"Progress is satisfactory, things are advancing in a positive manner," the official told AFP, declining to give a number of participants in the scheme.

Today:

• G-7 finance ministers meet in Marseilles.

• Deadline for non-binding commitments from private-sector creditors to participate in Greece’s proposed bond-exchange program

Saturday, Sept 10th:

• Greek Prime Minister George Papandreou delivers his annual economic policy speech.

Wednesday, Sept 14th

• Greece expected to resume talks with European Commission, IMF and ECB officials on fiscal, economic reforms

The Greek 2 year yield is at 55.3%.

The Portuguese 2 year yield is up to 15.2% (after falling below 12% in August). Also the Irish 2 year yield is at 9.4% (below 8% in August).

Here are the links for bond yields for several countries (source: Bloomberg):

| Greece | 2 Year | 5 Year | 10 Year |

| Portugal | 2 Year | 5 Year | 10 Year |

| Ireland | 2 Year | 5 Year | 10 Year |

| Spain | 2 Year | 5 Year | 10 Year |

| Italy | 2 Year | 5 Year | 10 Year |

| Belgium | 2 Year | 5 Year | 10 Year |

| France | 2 Year | 5 Year | 10 Year |

| Germany | 2 Year | 5 Year | 10 Year |

The American Jobs Act

by Calculated Risk on 9/09/2011 12:14:00 AM

Here is the fact sheet for The American Jobs Act

Some of the major proposals (total is around $450 billion):

1) Payroll tax cuts (approx $240 billion):

• Cutting payroll taxes in half for 160 million workers next year: The President’s plan will expand the payroll tax cut passed last year to cut workers payroll taxes in half in 2012 ...

• Cutting the payroll tax in half for 98 percent of businesses: The President’s plan will cut in half the taxes paid by businesses on their first $5 million in payroll ...

2) Schools and teachers / aid to states (approx $60 billion):

• Preventing up to 280,000 teacher layoffs, while keeping cops and firefighters on the job.

• Modernizing at least 35,000 public schools across the country,supporting new science labs, Internet-ready classrooms and renovations at schools across the country, in rural and urban areas.

3) Other infrastructure ($75 billion)

4) Extend unemployment insurance benefits ($49 billion).

5) Helping More Americans Refinance Mortgages (there are no details yet). "The President has instructed his economic team to work with Fannie Mae and Freddie Mac, their regulator the FHFA, major lenders and industry leaders to remove the barriers that exist in the current refinancing program (HARP) to help more borrowers benefit from today’s historically low interest rates."

More from Ezra Klein: What’s in the president’s jobs plan, and what comes next

Thursday, September 08, 2011

Lawler: Early Read on Existing Home Sales in August

by Calculated Risk on 9/08/2011 07:55:00 PM

From economist Tom Lawler: While normally I don’t put out an “early read” on existing home sales this early – mainly because not enough realtor associations/boards/MLS have released their stats to get a “good” national read – the reports that have come in so far suggest to me that existing home sales in August rebounded from July on a seasonally adjusted basis.

Last August the NAR estimated that existing home sales ran at a SAAR of 4.24 million. This August, of course, there was one more business day than last August, and this month’s seasonal factor will probably be 1.5%-2.0% higher than last August’s. The NAR estimated that July existing home sales – which came in south of “consensus,” and below what past pending home sales indices would have suggested (though it was right on top of my regional tracking) – ran at a SAAR of 4.67 million. A “flat” reading for seasonally adjusted existing home sales for August, then, would imply a YOY gain in NSA sales in the 11.8% to 12.3% range.

Incoming data, in my view, suggest a national YOY gain well above that – probably in the 16.8% range or so, which would imply that the NAR’s existing home sales estimate for August will probably come in at a seasonally adjusted annual rate of around 4.87 million, a gain from July of about 4.3%, and I think there may be more upside than downside risk to that forecast.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

Such an increase, by the way, is not broadly inconsistent with the latest pending home sales index, which showed a mild decline in July. After all, the gains in previous months didn’t show up in similar gains in closed sales, suggesting either (a) increased cancellations; (b) increased delays from contract to closing; or (c) a combination of both. Right now, the correct answer appears to be “c.” (August reflects Lawler forecast).

President Obama's Job Speech: 7:00 PM ET

by Calculated Risk on 9/08/2011 06:40:00 PM

Here are some excerpts (via the WSJ):

I am sending this Congress a plan that you should pass right away. It’s called the American Jobs Act. There should be nothing controversial about this piece of legislation. Everything in here is the kind of proposal that’s been supported by both Democrats and Republicans – including many who sit here tonight. And everything in this bill will be paid for. Everything.Cut payroll taxes in half? I'll be looking for details.

The purpose of the American Jobs Act is simple: to put more people back to work and more money in the pockets of those who are working. It will create more jobs for construction workers, more jobs for teachers, more jobs for veterans, and more jobs for the long-term unemployed. It will provide a tax break for companies who hire new workers, and it will cut payroll taxes in half for every working American and every small business. It will provide a jolt to an economy that has stalled, and give companies confidence that if they invest and hire, there will be customers for their products and services. You should pass this jobs plan right away.

WSJ: Greece's Recession Deepens

by Calculated Risk on 9/08/2011 04:48:00 PM

The Greek 2 year yield is at 55%!

From the WSJ: Greece's Recession Deepens

Greece's economy sank deeper into recession in the second quarter than previously forecast, with gross domestic product contracting by 7.3% on the year. ...Perhaps the headline should read "Greece's Depression Deepens".

Plunging domestic consumption was mostly responsible for the steep contraction rate ... With consumers bracing for the implementation of further austerity measures, promised in exchange for a fresh bailout to Greece ... Data showed Thursday that Greece's unemployment fell to 16% in June from 16.6% in May, but remained sharply above the rate of 11.6% a year earlier.

And there is more austerity to come, from the WSJ: Greek Officials Scramble to Find More Cuts

Greece's Socialist government is scrambling to cut public spending after receiving stark ultimatums from euro-zone governments that further rescue money will be withheld if Athens doesn't deliver on promises to reduce its budget deficit.The beatings will continue until morale improves.

The government now is looking at unprecedented public-sector layoffs and cuts in civil-service perks ...

Without the aid, Greece is expected to run out of money within weeks, say senior Greek government officials.

Bernanke: Inflation not "ingrained in the economy"

by Calculated Risk on 9/08/2011 01:30:00 PM

Note: Bernanke did not discuss monetary policy options.

From Fed Chairman Ben Bernanke: The U.S. Economic Outlook. Excerpts on inflation:

The Outlook for InflationBernanke is arguing inflation is not currently a problem - and that suggests the Fed will take action at the September meeting.

Let me turn now from the outlook for growth to the outlook for inflation. Prices of many commodities, notably oil, increased sharply earlier this year. Higher gasoline and food prices translated directly into increased inflation for consumers, and in some cases producers of other goods and services were able to pass through their higher costs to their customers as well. In addition, the global supply disruptions associated with the disaster in Japan put upward pressure on motor vehicle prices. As a result of these influences, inflation picked up significantly; over the first half of this year, the price index for personal consumption expenditures rose at an annual rate of about 3-1/2 percent, compared with an average of less than 1-1/2 percent over the preceding two years.

However, inflation is expected to moderate in the coming quarters as these transitory influences wane. In particular, the prices of oil and many other commodities have either leveled off or have come down from their highs. Meanwhile, the step-up in automobile production should reduce pressure on car prices. Importantly, we see little indication that the higher rate of inflation experienced so far this year has become ingrained in the economy. Longer-term inflation expectations have remained stable according to the indicators we monitor, such as the measure of households' longer-term expectations from the Thompson Reuters/University of Michigan survey, the 10-year inflation projections of professional forecasters, and the five-year-forward measure of inflation compensation derived from yields of inflation-protected Treasury securities. In addition to the stability of longer-term inflation expectations, the substantial amount of resource slack that exists in U.S. labor and product markets should continue to have a moderating influence on inflationary pressures. Notably, because of ongoing weakness in labor demand over the course of the recovery, nominal wage increases have been roughly offset by productivity gains, leaving the level of unit labor costs close to where it had stood at the onset of the recession. Given the large share of labor costs in the production costs of most firms, subdued unit labor costs should be an important restraining influence on inflation.