by Calculated Risk on 8/27/2011 08:10:00 AM

Saturday, August 27, 2011

Summary for Week Ending August 26th

The focus last week was on Fed Chairman Ben Bernanke’s speech at Jackson Hole. Although Bernanke did not discuss additional monetary easing, he did note that the September meeting will be expanded to two days to allow for a "fuller discussion" of policy options. For more on his speech, see: A few articles on Bernanke's Speech

The data last week was weak again. Second quarter GDP growth was revised down to a 1.0% annual rate, from the already weak 1.3% advance estimate. July New Home sales were under 300 thousand on a seasonally adjusted annual rate (SAAR) basis. And mortgage delinquencies increased slightly in Q2.

Two more regional manufacturing surveys for August were released; the Richmond Fed survey indicated activity declined in August; however the Kansas City survey showed modest growth.

In Europe, the negotiations over the Greek bailout plan heated up, and the Greek bond yields are soaring. Otherwise the European bond markets were relatively quiet for the week.

Here is a summary in graphs:

• Q2 real GDP growth revised down to 1.0% annualized rate

From the BEA: Gross Domestic Product, Second Quarter 2011 (second estimate "Real gross domestic product -- the output of goods and services produced by labor and property located in the United States -- increased at an annual rate of 1.0 percent in the second quarter of 2011". Growth was revised down from 1.3%, and was slightly below the consensus of 1.1%.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows the quarterly GDP growth (at an annual rate) for the last 30 years. The current quarter is in blue.

The dashed line is the current growth rate. Growth in Q2 at 1.0% annualized was below trend growth (around 3%) - and very weak for a recovery, especially with all the slack in the system.

The alternate measure of GDP - Gross Domestic Income - grew at a 1.6% annualized rate in Q2 and is now back above the pre-recession peak.

• New Home Sales in July at 298,000 Annual Rate

The Census Bureau reported New Home Sales in July were at a seasonally adjusted annual rate (SAAR) of 298 thousand. This was down from a revised 300 thousand in June (revised from 312 thousand).

The Census Bureau reported New Home Sales in July were at a seasonally adjusted annual rate (SAAR) of 298 thousand. This was down from a revised 300 thousand in June (revised from 312 thousand).

This graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

On inventory, according to the Census Bureau:

"A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."

Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.This graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale was at 61,000 units in July. The combined total of completed and under construction is at the lowest level since this series started.

This graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

This graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In July 2011 (red column), 27 thousand new homes were sold (NSA). The record low for July was 26 thousand in 2010 (following the expiration of the homebuyer tax credit). The high for July was 117 thousand in 2005.

This was below the consensus forecast of 313 thousand, and was just above the record low for the month of July. New home sales have averaged only 300 thousand SAAR over the 15 months since the expiration of the tax credit ... moving sideways at a very low level.

• MBA: Mortgage Delinquencies increased slightly in Q2

The MBA reported that 12.87 percent of mortgage loans were either one payment delinquent or in the foreclosure process in Q2 2011 (seasonally adjusted). This is up slightly from 12.84 percent in Q1 2011. From the MBA: Delinquencies Rise, Foreclosures Fall in Latest MBA Mortgage Delinquency Survey

This graph shows the percent of loans delinquent by days past due.

This graph shows the percent of loans delinquent by days past due.Loans 30 days delinquent increased to 3.46% from 3.35% in Q1. This is probably related to the increase in the unemployment rate. Delinquent loans in the 60 day bucket increased slightly to 1.37% from 1.35%.

There was a slight decrease in the 90+ day delinquent bucket. This decreased to 3.61% from 3.65% in Q1 2011. The percent of loans in the foreclosure process decreased to 4.43%.

So short term delinquencies ticked up, and the 90+ day and in-foreclosure rates declined.

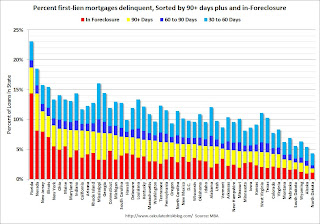

This graph shows the percent of loans in the foreclosure process by state and by foreclosure process. Red is for states with a judicial foreclosure process. Because the judicial process is longer, those states typically have a higher percentage of loans in the process. Nevada is an exception.

This graph shows the percent of loans in the foreclosure process by state and by foreclosure process. Red is for states with a judicial foreclosure process. Because the judicial process is longer, those states typically have a higher percentage of loans in the process. Nevada is an exception.Florida, Nevada, New Jersey and Illinois are the top four states with percent of loans in the foreclosure process.

This graph shows all delinquent loans by state (sorted by percent seriously delinquent).

This graph shows all delinquent loans by state (sorted by percent seriously delinquent).Florida and Nevada have the highest percentage of serious delinquent loans, followed by New Jersey, Illinois, New York, Ohio and Maine.

Note: the MBA's National Delinquency Survey (NDS) covered "MBA’s National Delinquency Survey covers about 43.9 million first-lien mortgages on one- to four-unit residential properties" and the "The NDS is estimated to cover around 88 percent of the outstanding first-lien mortgages in the market." This gives almost 50 million total first lien mortgages or about 6.4 million delinquent or in foreclosure.

This graph shows the range of percent seriously delinquent and in-foreclosure for each state (dashed blue line) since Q1 2007. The red diamond indicates the current serious delinquency rate (this includes 90+ days delinquent or in the foreclosure process).

This graph shows the range of percent seriously delinquent and in-foreclosure for each state (dashed blue line) since Q1 2007. The red diamond indicates the current serious delinquency rate (this includes 90+ days delinquent or in the foreclosure process). Some states have made progress: Arizona, Michigan, Nevada and California. Other states, like New Jersey and New York, have made little or no progress in reducing serious delinquencies.

Arizona, Michigan, Nevada and California are all non-judicial foreclosure states. States with little progress like New Jersey, New York, Illinois and Florida are all judicial states.

Note: This data is for 42 states only and D.C.

• Regional Manufacturing Surveys

There were two more regional manufacturing surveys released this week: Richmond Fed and Kansas City Fed. From the Richmond Fed: Manufacturing Activity Pulled Back Markedly in August; Shipments and New Orders Declined. And from the Kansas City Fed: Manufacturing Sector Continues to Expand Modestly

Here is a table of the regional surveys in July and August; the Dallas Fed Texas Manufacturing will be released on Monday, August 29th.

| Manufacturing Survey | July | August |

|---|---|---|

| Empire State | -3.76 | -7.7 |

| Philly Fed | 3.2 | -30.7 |

| Richmond Fed | -1 | -10 |

| Kansas City Fed | 3 | 3 |

| Dallas Fed | 10.8 | --- |

Most of the regional surveys were very weak in August. The ISM index for August will be released Thursday, Sept 1st.

• Final August Consumer Sentiment at 55.7, Down Sharply from July

The final August Reuters / University of Michigan consumer sentiment index increased slightly to 55.7 from the preliminary reading of 54.9. This was down sharply from 63.7 in July.

The final August Reuters / University of Michigan consumer sentiment index increased slightly to 55.7 from the preliminary reading of 54.9. This was down sharply from 63.7 in July. In general consumer sentiment is a coincident indicator and is usually impacted by employment (and the unemployment rate) and gasoline prices. I think consumer sentiment declined sharply in August because of the heavy coverage of the debt ceiling debate.

This was slightly below the consensus forecast of 56.0.

• Weekly Initial Unemployment Claims increased to 417,000

This graph shows the 4-week moving average of weekly claims since January 2000 (longer term graph in graph gallery).

This graph shows the 4-week moving average of weekly claims since January 2000 (longer term graph in graph gallery).The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased this week to 407,500.

Weekly claims have increased for two consecutive weeks and the 4-week average is still elevated.

• Moody's: Commercial Real Estate Prices increased in June

From Bloomberg: Commercial Property Prices Rose 0.9% in June, Moody’s Says. Here is a comparison of the Moodys/REAL Commercial Property Price Index (CPPI) and the Case-Shiller composite 20 index. Beware of the "Real" in the title - this index is not inflation adjusted.

From Bloomberg: Commercial Property Prices Rose 0.9% in June, Moody’s Says. Here is a comparison of the Moodys/REAL Commercial Property Price Index (CPPI) and the Case-Shiller composite 20 index. Beware of the "Real" in the title - this index is not inflation adjusted. CRE prices only go back to December 2000. The Case-Shiller Composite 20 residential index is in blue (with Dec 2000 set to 1.0 to line up the indexes).

According to Moody's, CRE prices are down 6.6% from a year ago and down about 45% from the peak in 2007. Some of this is probably seasonal, although Moody's mentioned a price pickup "beyond trophy properties and major U.S. coastal cities". Note: There are few commercial real estate transactions compared to residential, so this index is very volatile.

• Other Economic Stories ...

• Chicago Fed: Economic growth below trend in July

• ATA Trucking index decreased 1.3% in July

• Europe Update: Greek Bond Yields Surge

• Update on Q2 REO Inventory

• FHFA Introduces Expanded House Price Index

Have a great weekend. Stay safe on the East Coast!

Friday, August 26, 2011

A few articles on Bernanke's Speech

by Calculated Risk on 8/26/2011 09:46:00 PM

• From Jon Hilsenrath at the WSJ: Speech Hints at Options for Fed

The next big moment comes on Sept. [20 and 21] when Fed policy makers meet in Washington in a session, Mr. Bernanke disclosed Friday, that has been expanded to two days from one "to allow a fuller discussion" of the options.• From Binyamin Appelbaum at the NY Times: Bernanke Blames Politics for Financial Upheaval

...

The Fed chairman, who was appointed by a Republican and reappointed by a Democrat, aimed his sharpest remarks at U.S. lawmakers and the White House, scolding them for a divisive debate about raising the federal debt limit earlier this month that, he said, "disrupted financial markets and probably the economy as well."

Mr. Bernanke said he remained optimistic about future growth — he gave no indication that the Fed would increase its economic aid programs, though he said the central bank’s policy-making board would revisit the issue at a scheduled meeting in September — but he warned that the government had emerged as perhaps the greatest threat to recovery.• From Neil Irwin at the WaPo: Fed chief scolds Congress on debt-ceiling showdown

...

“The country would be well served by a better process for making fiscal decisions,” he said.

Federal Reserve Chairman Ben S. Bernanke chided Congress on Friday for its contentious approach to the national debt, saying the brinksmanship displayed by lawmakers could endanger the U.S. economy.• My earlier post: Analysis: Bernanke highlights September FOMC meeting, Suggests more Fiscal Stimulus

I think it is quite clear the debt ceiling debate disrupted the economy. The key is the September meeting has been expanded to two days to allow for a "fuller discussion" of policy options - and the FOMC will be watching the incoming data over the next few weeks to see if the economy is bouncing back a little for the debate induced slowdown.

Real Gross Domestic Income above Pre-Recession Peak

by Calculated Risk on 8/26/2011 06:15:00 PM

There are really two measures of GDP: 1) real GDP, and 2) real Gross Domestic Income (GDI). The BEA also released Q2 GDI today as part of the second estimate for Q2 GDP. Recent research suggests that early releases of GDI is often more accurate than GDP.

For a discussion on GDI, see from Fed economist Jeremy Nalewaik, “Income and Product Side Estimates of US Output Growth,” Brookings Papers on Economic Activity. An excerpt:

The U.S. produces two conceptually identical official measures of its economic output, currently called Gross Domestic Product (GDP) and Gross Domestic Income (GDI). These two measures have shown markedly different business cycle fluctuations over the past twenty five years, with GDI showing a more-pronounced cycle than GDP. These differences have become particularly glaring over the latest cyclical downturn, which appears considerably worse along several dimensions when looking at GDI. ...The following graph is constructed as a percent of the previous peak in both GDP and GDI. This shows when the indicator has bottomed - and when the indicator has returned to the level of the previous peak. If the indicator is at a new peak, the value is 100%.

In discussing the information content of these two sets of estimates, the confusion often starts with the nomenclature. GDP can mean either the true output variable of interest, or an estimate of that output variable based on the expenditure approach. Since these are two very different things, using “GDP” for both is confusing. Furthermore, since GDI has a different name than GDP, it may not be initially clear that GDI measures the same concept as GDP, using the equally valid income approach.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery. It appears that GDP bottomed in Q2 2009 and GDI in Q3 2009. Real GDP is still below the pre-recession peak in Q2 2011, but real GDI is finally above the previous peak. Also real GDI increased 2.7% annualized in Q1 (GDP increased only 0.4%), and real GDI increased 1.6% in Q2 (GDP increased 1.0%).

Note: Mark Thoma and Justin Wolfers mentioned this earlier today.

However, by other measures - like real personal income less transfer payments and employment - the economy is still far below the pre-recession peak.

Hurricane Tracking Resources

by Calculated Risk on 8/26/2011 02:48:00 PM

Here are some excellent sites for the weekend:

National Hurricane Center

U.S. Navy Storm Site

Weather Underground Note: See Jeff Master's blog

Here is an active discussion board for hurricanes. This includes reports, recon, tracking, etc.

For real time: here is the radar site for Newport/Morehead City, NC.

And StormPulse ht HomeGnome (cool maps)

Stay safe!

Analysis: Bernanke highlights September FOMC meeting, Suggests more Fiscal Stimulus

by Calculated Risk on 8/26/2011 11:04:00 AM

Fed Chairman Ben Bernanke made several key points in his speech today:

• Economic growth has been very disappointing, but the FOMC expects growth to pickup in the 2nd half. Bernanke believes some, but not all, of the weakness this year is due to specific events:

Temporary factors, including the effects of the run-up in commodity prices on consumer and business budgets and the effect of the Japanese disaster on global supply chains and production, were part of the reason for the weak performance of the economy in the first half of 2011; accordingly, growth in the second half looks likely to improve as their influence recedes. However, the incoming data suggest that other, more persistent factors also have been at work.Bernanke also mentioned additional situations and events:

[C]oncerns about both European sovereign debts and ... the controversy concerning the raising of the U.S. federal debt ceiling.• Although Bernanke didn't outline additional policy choices, as he did in his speech last year, he highlighted the next meeting of the FOMC if growth doesn't improve:

[T]he Federal Reserve has a range of tools that could be used to provide additional monetary stimulus. We discussed the relative merits and costs of such tools at our August meeting. We will continue to consider those and other pertinent issues, including of course economic and financial developments, at our meeting in September, which has been scheduled for two days (the 20th and the 21st) instead of one to allow a fuller discussion. The Committee will continue to assess the economic outlook in light of incoming information and is prepared to employ its tools as appropriate to promote a stronger economic recovery in a context of price stability.• Bernanke argued that the economy will be fine in the long run, but more fiscal stimulus is needed in the short run:

Notwithstanding the severe difficulties we currently face, I do not expect the long-run growth potential of the U.S. economy to be materially affected by the crisis and the recession if--and I stress if--our country takes the necessary steps to secure that outcome.• In summary: On monetary policy, the FOMC will consider further monetary easing at the September meeting based on incoming data. There are only a few major economic releases before the next FOMC meeting (August employment, retail sales and CPI), and there are also some high frequency reports that the Fed might watch to see if there is a pickup after the debt ceiling economic freeze (like the Empire State and Philly Fed manufacturing surveys for September). If there is no pickup in activity - and CPI is benign - the FOMC is prepared to act.

...

Normally, monetary or fiscal policies aimed primarily at promoting a faster pace of economic recovery in the near term would not be expected to significantly affect the longer-term performance of the economy. However, current circumstances may be an exception to that standard view--the exception to which I alluded earlier. Our economy is suffering today from an extraordinarily high level of long-term unemployment, with nearly half of the unemployed having been out of work for more than six months. Under these unusual circumstances, policies that promote a stronger recovery in the near term may serve longer-term objectives as well. In the short term, putting people back to work reduces the hardships inflicted by difficult economic times and helps ensure that our economy is producing at its full potential rather than leaving productive resources fallow. In the longer term, minimizing the duration of unemployment supports a healthy economy by avoiding some of the erosion of skills and loss of attachment to the labor force that is often associated with long-term unemployment.

Notwithstanding this observation, which adds urgency to the need to achieve a cyclical recovery in employment, most of the economic policies that support robust economic growth in the long run are outside the province of the central bank.

...

Although the issue of fiscal sustainability must urgently be addressed, fiscal policymakers should not, as a consequence, disregard the fragility of the current economic recovery. Fortunately, the two goals of achieving fiscal sustainability--which is the result of responsible policies set in place for the longer term--and avoiding the creation of fiscal headwinds for the current recovery are not incompatible.

Bernanke is arguing strongly for more fiscal stimulus in the short term aimed at helping the unemployed - combined with a long term plan to bring U.S. fiscal policy on a sustainable path. Politically he couldn't argue any stronger for more short term fiscal stimulus.

Bernanke: The Near- and Longer-Term Prospects for the U.S. Economy

by Calculated Risk on 8/26/2011 10:04:00 AM

From Fed Chairman Ben Bernanke: The Near- and Longer-Term Prospects for the U.S. Economy

Monetary policy must be responsive to changes in the economy and, in particular, to the outlook for growth and inflation. As I mentioned earlier, the recent data have indicated that economic growth during the first half of this year was considerably slower than the Federal Open Market Committee had been expecting, and that temporary factors can account for only a portion of the economic weakness that we have observed. Consequently, although we expect a moderate recovery to continue and indeed to strengthen over time, the Committee has marked down its outlook for the likely pace of growth over coming quarters. With commodity prices and other import prices moderating and with longer-term inflation expectations remaining stable, we expect inflation to settle, over coming quarters, at levels at or below the rate of 2 percent, or a bit less, that most Committee participants view as being consistent with our dual mandate.

In light of its current outlook, the Committee recently decided to provide more specific forward guidance about its expectations for the future path of the federal funds rate. In particular, in the statement following our meeting earlier this month, we indicated that economic conditions--including low rates of resource utilization and a subdued outlook for inflation over the medium run--are likely to warrant exceptionally low levels for the federal funds rate at least through mid-2013. That is, in what the Committee judges to be the most likely scenarios for resource utilization and inflation in the medium term, the target for the federal funds rate would be held at its current low levels for at least two more years.

In addition to refining our forward guidance, the Federal Reserve has a range of tools that could be used to provide additional monetary stimulus. We discussed the relative merits and costs of such tools at our August meeting. We will continue to consider those and other pertinent issues, including of course economic and financial developments, at our meeting in September, which has been scheduled for two days (the 20th and the 21st) instead of one to allow a fuller discussion. The Committee will continue to assess the economic outlook in light of incoming information and is prepared to employ its tools as appropriate to promote a stronger economic recovery in a context of price stability.

Final August Consumer Sentiment at 55.7, Down Sharply from July

by Calculated Risk on 8/26/2011 09:55:00 AM

The final August Reuters / University of Michigan consumer sentiment index increased slightly to 55.7 from the preliminary reading of 54.9. This is down sharply from 63.7 in July.

Click on graph for larger image in graphic gallery.

In general consumer sentiment is a coincident indicator and is usually impacted by employment (and the unemployment rate) and gasoline prices. I think consumer sentiment declined sharply in August because of the heavy coverage of the debt ceiling debate.

This was slightly below the consensus forecast of 56.0.

Q2 real GDP growth revised down to 1.0% annualized rate

by Calculated Risk on 8/26/2011 08:30:00 AM

From the BEA: Gross Domestic Product, Second Quarter 2011 (second estimate

Real gross domestic product -- the output of goods and services produced by labor and property located in the United States -- increased at an annual rate of 1.0 percent in the second quarter of 2011, (that is, from the first quarter to the second quarter), according to the "second" estimate released by the Bureau of Economic Analysis.This was revised down from 1.3% and slightly below the consensus of 1.1%.

Exports subtracted more from GDP - as did changes in private inventories. Consumption of services and fixed investment were revised up slightly.

The following graph shows the quarterly GDP growth (at an annual rate) for the last 30 years. The current quarter is in blue.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The dashed line is the current growth rate. Growth in Q2 at 1.0% annualized was below trend growth (around 3%) - and very weak for a recovery, especially with all the slack in the system.

Here is a table of the changes (contribution to GDP):

| Contributions to Percent Change in Q2 Real Gross Domestic Product | |||

|---|---|---|---|

| 2nd Estimate | Advance | Change | |

| Percent change at annual rate: | |||

| Gross domestic product | 1.0 | 1.3 | -0.3 |

| Percentage points at annual rates: | |||

| Personal consumption expenditures | 0.3 | 0.07 | 0.23 |

| Goods | -0.34 | -0.33 | -0.01 |

| Durable goods | -0.4 | -0.35 | -0.05 |

| Nondurable goods | 0.07 | 0.02 | 0.05 |

| Services | 0.64 | 0.4 | 0.24 |

| Gross private domestic investment | 0.78 | 0.87 | -0.09 |

| Fixed investment | 1.01 | 0.69 | 0.32 |

| Nonresidential | 0.94 | 0.61 | 0.33 |

| Structures | 0.38 | 0.2 | 0.18 |

| Equipment and software | 0.55 | 0.41 | 0.14 |

| Residential | 0.08 | 0.08 | 0 |

| Change in private inventories | -0.23 | 0.18 | -0.41 |

| Net exports of goods and services | 0.09 | 0.58 | -0.49 |

| Exports | 0.41 | 0.81 | -0.4 |

| Imports | -0.33 | -0.23 | -0.1 |

| Government consumption expenditures | -0.18 | -0.23 | 0.05 |

| Federal | 0.16 | 0.18 | -0.02 |

| National defense | 0.38 | 0.39 | -0.01 |

| Nondefense | -0.21 | -0.21 | 0 |

| State and local | -0.34 | -0.41 | 0.07 |

Thursday, August 25, 2011

Misc: Friday and Greece

by Calculated Risk on 8/25/2011 09:25:00 PM

The focus tomorrow is on Fed Chairman Bernanke's speech at Jackson Hole, but there will be some economic data too:

8:30 AM: Q2 GDP (second estimate). The first estimate was for 1.3% annualized real growth in Q2. The consensus is for a downward revision to 1.1% GDP growth.

9:55 AM: Reuters/University of Mich Consumer Sentiment final for August. The consensus is for a slight increase to 56.0 from the preliminary August reading of 54.9.

10:00 AM: Fed Chairman Ben Bernanke speaks at the Federal Reserve Bank of Kansas City Economic Symposium, Jackson Hole, Wyoming, "Near- and Long-Term Prospects for the U.S. Economy"

And on Europe:

From the WSJ: Bailout for Greece Falters Over Demand for Collateral. The Greek 2 year bond yield is almost to 46%.

From the Telegraph: Greece forced to tap emergency fund

In a move described as the "last stand for Greek banks", the embattled country's central bank activated Emergency Liquidity Assistance (ELA) for the first time on Wednesday night.And from Bloomberg: France, Spain, Italy Extend Bans on Short-Selling

Update on Q2 REO Inventory

by Calculated Risk on 8/25/2011 04:40:00 PM

With the release of the Q2 FDIC Quarterly Banking Profile, we can estimate the number of REOs held by FDIC insured banks and thrifts. From economist Tom Lawler:

"On the residential REO front, FDIC-insured institutions’ 1-4 family property REO holdings (in $’s of carrying value) declined to $12.0895 billion on June 30th, 2011 from $13.2795 billion on March 31st, 2011 and $13.7221 billion last June. The drop reflected the continued slow pace of REO acquisitions related to foreclosure delays, as well as a likely pick-up in REO dispositions last quarter.

While the FDIC does not collect data on the NUMBER of properties held by FDIC-insured institutions, a reasonable “guess” is that their average carrying value is about 50% higher than the GSEs, or in recent years around $150,000."

This gives an estimate of 80.6 thousand REO at FDIC insured institutions at the end of Q2, down from 88.5 thousand in Q1.

This graph shows REO inventory for Fannie, Freddie, FHA, Private Label Securities (PLS), and FDIC insured institutions. (economist Tom Lawler has provided some of this data).

Total REO decreased to 493,000 in Q2 from almost 550,000 in Q1.

Total REO decreased to 493,000 in Q2 from almost 550,000 in Q1.

As Tom Lawler noted: "This is NOT an estimate of total residential REO, as it excludes non-FHA government REO (VA, USDA, etc.), credit unions, finance companies, non-FDIC-insured banks and thrifts, and a few other lender categories." However this is the bulk of the REO - probably 90% or more. Rounding up the estimate (using 90%) suggests total REO is around 548,000 in Q2.

Important: REO inventories have declined over the last couple of quarters. This is a combination of more sales and fewer acquisitions due to the slowdown in the foreclosure process. There are many more foreclosures coming - see my earlier post on Mortgage Delinquencies and REOs.

Tom Lawler wrote today: "[I]f in fact REO inventories have declined in line with the Fannie, Freddie, FHA, and bank/thrift data, one shouldn’t view that as a “bullish” signal – after all, the main reason for the drop has been the artificially low pace of REO acquisitions associated with increasing foreclosure timelines/delays.

[I]n quite a few markets the lower REO inventories have reduce the REO shares of overall sales as well as the number of REO properties for sale, which has temporarily improved various measures of home prices. Many markets in Florida are prime examples, as judicial foreclosure delays have reduced substantially the pace of REO acquisitions as well as the inventory of REO properties for sale, even as the number of properties in the foreclosure process has remained at nosebleed levels."