by Calculated Risk on 8/24/2011 01:20:00 PM

Wednesday, August 24, 2011

FHFA Introduces Expanded House Price Index

A common criticism of the FHFA house price index (HPI) is that the index only includes GSE properties. Today the FHFA announced (PDF) an expanded series:

To further enhance public understanding of house price changes, FHFA is introducing in this release a new set of house price indexes that make use of additional sales price information from external data sources. The new indexes, denoted as the “expanded-data” HPI, use a data sample that has been augmented with sales price information for homes with mortgages endorsed by the Federal Housing Administration (FHA) and real property county recorder information licensed from DataQuick Information Systems. In the past, price trends sometimes have been different for homes with Fannie Mae or Freddie Mac financing than for properties with alternate financing. To the extent those differences exist, the new data sources will allow the expanded-data HPI to reflect price trends for a larger set of homes.These expanded-data indexes are quarterly for states, census divisions, and the United States. The FHFA is considering introducing MSA indexes too. Here is the Q2 expanded series data.

Using the standard FHFA HPI:

U.S. house prices were 0.6 percent lower in the second quarter than in the first quarter of 2011 according to the Federal Housing Finance Agency’s (FHFA) seasonally adjusted purchase-only house price index (HPI). ... While the national, purchase-only house price index fell 5.9 percent from the second quarter of 2010 to the second quarter of 2011, prices of other goods and services rose 4.5 percent over the same period. Accordingly, the inflation-adjusted price of homes fell approximately 10.0 percent over the last year.The expanded FHFA national series was down 1.1 percent in Q2 (Seasonally adjusted), and down 6.1% from Q2 2010 - and down 24.2% from the peak.

For comparison, the Case-Shiller national quarterly index was off 32.7% from the peak in Q1 2011.

In 2005, most reporting focused on NAR median house prices - however median prices can be distorted by the mix of homes sold. The most followed repeat sales price index in 2005 was the OFHEO HPI (now FHFA). The Case-Shiller index gained popularity in early 2007 since it seemed to better reflect observed changes in house prices. (as an example, the first mention of the Case-Shiller index in the LA Times appears to be on June 27, 2007)

Now the most followed house price indexes are Case-Shiller and CoreLogic; both repeat sales indexes. There are several other house price indexes that I track: RadarLogic (based on a house price per square foot method), FNC Residential Price Index (a hedonic price index), Clear Capital, Altos Research and Zillow.

With the addition of the expanded quarterly HPI, I will probably mention the FHFA indexes more often in the future. Also the NAR is rumored to be considering introducing a repeat sales index. The "most followed" indexes might change again ...

Europe Update: Greek Bond Yields Surge

by Calculated Risk on 8/24/2011 10:31:00 AM

The Greek bailout deal is under pressure ... and the Greek 2 year yield increased to 44% and the 10 year yield increased to 18% this morning.

From the WSJ: German Adviser: We Must Help Greece

The euro zone must continue to stand by Greece while it carries out a decade of reforms ... Wolfgang Franz, chairman of the independent council of economic advisers to the federal government ... said in a telephone interviewFrom the Telegraph: Finland threatens to withdraw Greek bailout support

Mr. Franz struck ... said he was "horrified" by the Finnish government's request for collateral against its next tranche of aid, saying that this could cause the whole deal to unravel.

"This is a discussion that should be ended as soon as possible," he said. "This is the exact opposite of solidarity."

Jyrki Katainen, the Finnish prime minister ... said that if Finland's bilateral agreement with Greece over collateral payments was overruled, the Nordic country could back out of the rescue programme.The Portuguese 2 year yield is up some to 13.3%, otherwise there is no panic in the European bond markets. Right now this is just an issue for Greece.

He told reporters that the private collateral agreement, in which Greece agreed to give Finland €1bn (£875m) in cash in return for its support, was "our parliament's decision that we demand it as a condition for us joining in".

Here is a graph of the 10 year spread (Italy to Germany) from Bloomberg. And for Spain to Germany. The Italian spread is at 282, down from 389 on Aug 4th, and the Spanish spread is at 279, down from 398 on Aug 4th.

Also the Irish 2 year yield is at 8.9%. And the French 10 year is at 2.87%.

Here are the links for bond yields for several countries (source: Bloomberg):

| Greece | 2 Year | 5 Year | 10 Year |

| Portugal | 2 Year | 5 Year | 10 Year |

| Ireland | 2 Year | 5 Year | 10 Year |

| Spain | 2 Year | 5 Year | 10 Year |

| Italy | 2 Year | 5 Year | 10 Year |

| Belgium | 2 Year | 5 Year | 10 Year |

| France | 2 Year | 5 Year | 10 Year |

| Germany | 2 Year | 5 Year | 10 Year |

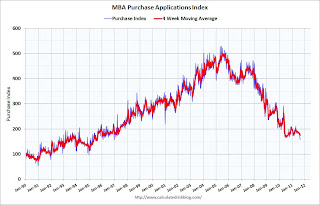

MBA: Mortgage Purchase Activity at Lowest Level Since 1996

by Calculated Risk on 8/24/2011 07:28:00 AM

The MBA reports: Mortgage Applications Decrease with Purchase Index at Lowest Level Since 1996

The Refinance Index decreased 1.7 percent from the previous week. The seasonally adjusted Purchase Index decreased 5.7 percent from one week earlier and is at the lowest level in the survey since December 1996.The following graph shows the MBA Purchase Index and four week moving average since 1990.

...

"Another week of volatile markets and rampant uncertainty regarding the economy kept prospective homebuyers on the sidelines, with purchase applications falling to a 15-year low," said Mike Fratantoni, MBA's Vice President of Research and Economics. "This decline impacted borrowers across the board, with purchase applications for jumbo loans falling by more than 15 percent, and purchase applications for the government housing programs (FHA, VA, and USDA) falling by 8.2 percent. Although mortgage rates remain quite low, they increased over the week, bringing refinance application volumes down slightly."

...

The average contract interest rate for 30-year fixed-rate mortgages increased to 4.39 percent from 4.32 percent, with points increasing to 0.88 from 0.86 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The four week average of the purchase index has been moving down recently and is at about 1997 levels. Of course this doesn't include the large number of cash buyers ... but purchase application activity was especially weak over the last two weeks.

Tuesday, August 23, 2011

DOT: Vehicle Miles Driven decreased -1.4% in June compared to June 2010

by Calculated Risk on 8/23/2011 11:15:00 PM

The Department of Transportation (DOT) reported:

Based on preliminary reports from the State Highway Agencies, travel during June 2011 on all roads and streets in the nation changed by -1.4 percent (-3.8 billion vehicle miles) resulting in estimated travel for the month at 259.1** billion vehicle-miles.This was before the recent slowdown.

Cumulative Travel changed by -1.1 percent (-15.5 billion vehicle miles).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the rolling 12 month total vehicle miles driven.

In the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months. Currently miles driven has been below the previous peak for 43 months - so this is a new record for longest period below the previous peak - and still counting!

Note: some people have asked about miles driven on a per capita basis (or per registered driver), and I'm still looking at the data.

The second graph shows the year-over-year change from the same month in the previous year. So far the current decline is not as a severe as in 2008.

The second graph shows the year-over-year change from the same month in the previous year. So far the current decline is not as a severe as in 2008.With the slowdown at the end of July and in August, miles driven might decline further.

On July Home Sales:

• New Home Sales in July at 298,000 Annual Rate

• Last week: Existing Home Sales in July: 4.67 million SAAR, 9.4 months of supply

• Graph Galleries: New Home Sales and Existing Home Sales

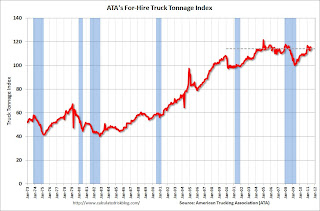

ATA Trucking index decreased 1.3% in July

by Calculated Risk on 8/23/2011 06:20:00 PM

From ATA: ATA Truck Tonnage Index Fell 1.3% in July

The American Trucking Associations’ advance seasonally adjusted (SA) For-Hire Truck Tonnage Index decreased 1.3% in July after rising a revised 2.6% in June 2011. ... The latest pullback put the SA index at 114 (2000=100) in July, down from the June level of 115.5.

...

Compared with July 2010, SA tonnage was up 3.9%. In June, the tonnage index was 6.5% above a year earlier.

...

“We had heard that freight weakened from a robust June, that that was true,” ATA Chief Economist Bob Costello said. Tonnage has fallen in three of the last four months on a sequential basis.

“Despite a solid June, our truck tonnage index fits with an economy that is growing very slowly,” Costello noted.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.Here is a long term graph that shows ATA's Fore-Hire Truck Tonnage index.

The dashed line is the current level of the index. From ATA:

Trucking serves as a barometer of the U.S. economy, representing 67.2% of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods. Trucks hauled 9 billion tons of freight in 2010. Motor carriers collected $563.4 billion, or 81.2% of total revenue earned by all transport modes.When the June index was released it was already obvious that July would be weak based on comments from UPS and others. August will probably show a decline too.

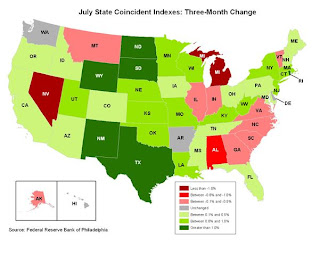

Philly Fed State Coincident Indexes for July

by Calculated Risk on 8/23/2011 03:05:00 PM

I haven't post this in some time, but the map is turning red again ...

Click on map for larger image.

Above is a map of the three month change in the Philly Fed state coincident indicators. Several states have turned red again. This map was all red during the worst of the recession, and all green not long ago. Here is the Philadelphia Fed state coincident index release (pdf) for July 2011.

In the past month, the indexes increased in 29 states, decreased in 13, and remained unchanged in eight for a one-month diffusion index of 32. Over the past three months, the indexes increased in 34 states, decreased in 12, and remained unchanged in four (Arkansas, Delaware, Hawaii, and Washington) for a three-month diffusion index of 44.

The second graph is of the monthly Philly Fed data for the number of states with one month increasing activity.

The second graph is of the monthly Philly Fed data for the number of states with one month increasing activity. The indexes increased in 29 states, decreased in 13, and remained unchanged in 8. Note: this graph includes states with minor increases (the Philly Fed lists as unchanged).

Note: These are coincident indexes constructed from state employment data. From the Philly Fed:

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.On July Home Sales:

• New Home Sales in July at 298,000 Annual Rate

• Last week: Existing Home Sales in July: 4.67 million SAAR, 9.4 months of supply

• Graph Galleries: New Home Sales and Existing Home Sales

Misc: Richmond Fed, FDIC Problem Banks, Home Sales Distressing Gap

by Calculated Risk on 8/23/2011 12:15:00 PM

• Richmond Fed: Manufacturing Activity Pulled Back Markedly in August; Shipments and New Orders Declined

In August, the seasonally adjusted composite index of manufacturing activity — our broadest measure of manufacturing — declined nine points to −10 from July's reading of −1.Another weak regional manufacturing survey.

...

Hiring activity at District plants slowed in August. The manufacturing employment index subtracted three points to 1 and the average workweek index moved down five points to −5. Moreover, wage growth eased, losing eight points to finish at 2.

• From the FDIC: Quarterly Banking Profile

The number of institutions on the FDIC's "Problem List" fell for the first time in 15 quarters. The number of "problem" institutions declined from 888 to 865. This is the first time since the third quarter of 2006 that the number of "problem" banks fell. Total assets of "problem" institutions declined from $397 billion to $372 billion. Twenty-two insured institutions failed during the second quarter, four fewer than in the previous quarter, and the fewest since the first quarter of 2009. This is the fourth quarter in a row that the number of failures has declined. Through the first six months of 2011, there have been 48 insured institution failures, compared to 86 failures in the same period of 2010.• Distressing Gap: The following graph shows existing home sales (left axis) and new home sales (right axis) through July. This graph starts in 1994, but the relationship has been fairly steady back to the '60s.

Then along came the housing bubble and bust, and the "distressing gap" appeared due mostly to distressed sales. The flood of distressed sales has kept existing home sales elevated, and depressed new home sales since builders can't compete with the low prices of all the foreclosed properties.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.I expect this gap to close over the next few years once the number of distressed sales starts to decline.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different. Also the National Association of Realtors (NAR) is working on a benchmark revision for existing home sales numbers and I expect significant downward revisions to sales estimates for the last few years - perhaps as much as 10% to 15% for 2009 and 2010. Even with these revisions, most of the "distressing gap" will remain.

On July Home Sales:

• New Home Sales in July at 298,000 Annual Rate

• Last week: Existing Home Sales in July: 4.67 million SAAR, 9.4 months of supply

• Graph Galleries: New Home Sales and Existing Home Sales

New Home Sales in July at 298,000 Annual Rate

by Calculated Risk on 8/23/2011 10:00:00 AM

The Census Bureau reports New Home Sales in July were at a seasonally adjusted annual rate (SAAR) of 298 thousand. This was down from a revised 300 thousand in June (revised from 312 thousand).

The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Sales of new single-family houses in July 2011 were at a seasonally adjusted annual rate of 298,000 ... This is 0.7 percent (±12.9%)* below the revised June rate of 300,000, but is 6.8 percent (±13.5%)* above the July 2010 estimate of 279,000.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The second graph shows New Home Months of Supply.

Months of supply was unchanged at 6.6 in July. The all time record was 12.1 months of supply in January 2009. This is still higher than normal (less than 6 months supply is normal).

The seasonally adjusted estimate of new houses for sale at the end of July was 165,000. This represents a supply of 6.6 months at the current sales rate.On inventory, according to the Census Bureau:

"A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."

Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.This graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale was at 61,000 units in July. The combined total of completed and under construction is at the lowest level since this series started.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In July 2011 (red column), 27 thousand new homes were sold (NSA). The record low for July was 26 thousand in 2010 (following the expiration of the homebuyer tax credit). The high for July was 117 thousand in 2005.

This was below the consensus forecast of 313 thousand, and was just above the record low for the month of July - and new home sales have averaged only 300 thousand SAAR over the 15 months since the expiration of the tax credit ... moving sideways at a very low level.

Mortgage Delinquencies by Loan Type

by Calculated Risk on 8/23/2011 08:58:00 AM

By request, the following graphs show the percent of loans delinquent by loan type: Prime, Subprime, FHA and VA. First a table comparing the number of loans in Q2 2007 and Q2 2011 so readers can understand the shift in loan types.

Both the number of prime and subprime loans have declined over the last four years; the number of subprime loans is down by about one-third. Meanwhile the number of FHA loans has increased sharply.

| MBA National Delinquency Survey Loan Count | ||||

|---|---|---|---|---|

| Q2 2007 | Q2 2011 | Change | Seriously Delinquent | |

| Prime | 33,916,830 | 31,888,314 | -2,028,516 | 1,839,956 |

| Subprime | 6,204,535 | 4,126,408 | -2,078,127 | 1,102,989 |

| FHA | 3,030,214 | 6,467,909 | 3,437,695 | 529,075 |

| VA | 1,096,450 | 1,402,208 | 305,758 | 64,502 |

| Survey Total | 44,248,029 | 43,729,247 | -518,782 | 3,536,521 |

Note: There are about 50 million total first-lien loans - the MBA survey is about 88% of the total.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The first graph is for all prime loans. This is the key category now ("We are all subprime!").

Since there are far more prime loans than any other category (see table above), over half the loans seriously delinquent now are prime loans - even though the overall delinquency rate is lower than other loan types.

The second graph is for subprime. This category gets all the attention - mostly because of all the terrible loans made through the Wall Street "originate-to-distribute" model and sold as Private Label Securities (PLS). Not all PLS was subprime, but the worst of the worst loans were packaged in PLS.

The second graph is for subprime. This category gets all the attention - mostly because of all the terrible loans made through the Wall Street "originate-to-distribute" model and sold as Private Label Securities (PLS). Not all PLS was subprime, but the worst of the worst loans were packaged in PLS.Although the delinquency rate is still very high, the number of subprime loans had declined sharply.

The third graph is for FHA loans. The delinquency rate increased in Q2 after declining for the last several quarters. Most of the FHA loans were made in the last couple of years.

The third graph is for FHA loans. The delinquency rate increased in Q2 after declining for the last several quarters. Most of the FHA loans were made in the last couple of years.Another reason for the previous improvement was eliminating Downpayment Assistance Programs (DAPs). These were programs that allowed the seller to give the buyer the downpayment through a 3rd party "charity" (for a fee of course). The buyer had no money in the house and the default rates were horrible.

The last graph is for VA loans.

The last graph is for VA loans.All four categories saw a slight increase in Q2.

There are still quite a few subprime loans that are in distress, but the real keys going forward are prime loans and FHA loans.

Yesterday:

• MBA: Mortgage Delinquencies increased slightly in Q2

• MBA Delinquency Survey: Comments and State Data

• Mortgage Delinquencies by State: Range and Current

Monday, August 22, 2011

Moody's: Commercial Real Estate Prices increased in June

by Calculated Risk on 8/22/2011 10:05:00 PM

From Bloomberg: Commercial Property Prices Rose 0.9% in June, Moody’s Says

U.S. commercial property prices rose 0.9 percent in June, the second straight monthly gain ... The index, which measures broad price trends, is down 6.6 percent from a year earlier and 45 percent below the peak of October 2007.The article mentions some of the events that have impacted commercial real estate since June, so July and August might be weaker:

Europe’s debt crisis, signs the U.S. will remain mired in sluggish growth through next year and the Standard & Poor’s downgrade of the nation’s credit rating roiled financial markets and triggered a selloff in securities linked to debt on commercial real estate. ...Below is a comparison of the Moodys/REAL Commercial Property Price Index (CPPI) and the Case-Shiller composite 20 index. Beware of the "Real" in the title - this index is not inflation adjusted.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.CRE prices only go back to December 2000. The Case-Shiller Composite 20 residential index is in blue (with Dec 2000 set to 1.0 to line up the indexes).

According to Moody's, CRE prices are down 6.6% from a year ago and down about 45% from the peak in 2007. Some of this is probably seasonal, although Moody's mentioned a price pickup "beyond trophy properties and major U.S. coastal cities". Note: There are few commercial real estate transactions compared to residential, so this index is very volatile.

Earlier:

• MBA: Mortgage Delinquencies increased slightly in Q2

• MBA Delinquency Survey: Comments and State Data

• Mortgage Delinquencies by State: Range and Current