by Calculated Risk on 8/03/2011 07:44:00 AM

Wednesday, August 03, 2011

MBA: Mortgage Applications Increase, But Still Low

The MBA reports: Mortgage Applications Increase, But Still Low in Latest MBA Weekly Survey

The Refinance Index increased 7.8 percent from the previous week. The seasonally adjusted Purchase Index increased 5.1 percent from one week earlierThe following graph shows the MBA Purchase Index and four week moving average since 1990.

...

"Mortgage rates fell, with the rate on 15-year mortgages reaching a new low in our survey. Refinance application volume increased, but even though 30-year mortgage rates are back below 4.5 percent, the refinance index is still almost 30 percent below last year's level. Factors such as negative equity and a weak job market continue to constrain borrowers. Purchase activity increased off of a low base, returning to levels of one month ago, but remains weak by historical standards." [said Michael Fratantoni, MBA's Vice President of Research and Economics].

...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 4.45 percent from 4.57 percent, with points decreasing to 0.78 from 1.14 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The four week average of the purchase index is at best moving sideways at about 1997 levels. Of course this doesn't include the large number of cash buyers ... but this suggests purchase activity remains fairly weak.

Mortgage rates fell last week - and will be even lower this week.

Tuesday, August 02, 2011

Misc: Europe is a Mess, House For Sale Listings Decline

by Calculated Risk on 8/02/2011 07:36:00 PM

• Europe is a mess. Here is a graph of the 10 year spread (Italy to Germany) from Bloomberg. And for Spain to Germany. The Italian spread is at 3.713, and the Spanish spread is at 3.87. Both new highs ...

• As we've been discussing for several months ... from Nick Timiraos at the WSJ: Sliding Sales Listings Lift Housing Outlook

The number of homes listed for sale declined sharply in a number of U.S. cities during the second quarter, offering glimmers of hope that some housing markets are starting to recover.Earlier:

• Recession Measures (Graphs showing how little the economy has recovered).

• FHA sells record number of REO in June

• U.S. Light Vehicle Sales 12.23 million Annual Rate in July

U.S. Light Vehicle Sales 12.23 million Annual Rate in July

by Calculated Risk on 8/02/2011 03:47:00 PM

Based on an estimate from Autodata Corp, light vehicle sales were at a 12.23 million SAAR in July. That is up 6.1% from July 2010, and up 6.2% from the sales rate last month (June 2011).

Although still below the sales rate earlier this year - before the tragedy in Japan - this was above the consensus forecast of 11.9 million SAAR.

It appears most of the supply issues will be resolved over the next 30 to 60 days, and sales will probably be stronger in August.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and an estimate for July (red, light vehicle sales of 12.23 million SAAR from Autodata Corp).

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Note: dashed line is current estimated sales rate.

Note: dashed line is current estimated sales rate.

Growth in auto sales should make a solid contribution to Q3 GDP as sales bounce back from Q2, however further sales growth will obviously depend on the overall economy and jobs and income growth.

FHA sells record number of REO in June

by Calculated Risk on 8/02/2011 03:11:00 PM

Note: I'll post on vehicle sales soon.

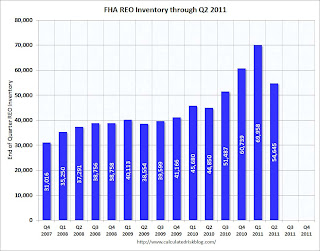

Earlier this year, Tom Lawler noted that the FHA was having REO inventory problems, and the FHA's REO inventory increased in Q1.

It now appears the FHA REO problem has been solved. The FHA sold a record number of REO in April, more in May, and another new record in June.

According to HUD, the FHA acquired 7,667 REO in June and sold a record 13,609 properties (breaking the record of 12,671 properties sold in May). The FHA REO inventory has declined from 69,958 at the end of Q1 2011, to 54,645 at the end of Q2.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

Fannie and Freddie are expected to release results including REO aquisitions and inventory later this week. From Diana Golobay at HousingWire: Fannie Earnings Expected Later This Week, Freddie After

Freddie Mac spokesperson Michael Cosgrove noted the company could release its Q210 earnings later this week but may wait until close of business Monday. Fannie Mae spokesperson Jason Vasquez also said earnings are anticipated "sometime this week," ... it is believed that Fannie will release Thursday, with Freddie to follow after, sources say.I expect Fannie and Freddie to report declines in REO inventory in Q2 too.

Recession Measures

by Calculated Risk on 8/02/2011 12:55:00 PM

By request, here are four key indicators used by the NBER for business cycle dating: GDP, Employment, Industrial production and real personal income less transfer payments.

Note: The following graphs are all constructed as a percent of the peak in each indicator. This shows when the indicator has bottomed - and when the indicator has returned to the level of the previous peak. If the indicator is at a new peak, the value is 100%.

These graphs show that no major indicator has returned to the pre-recession levels - and most are still way below the pre-recession peaks.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph is for real GDP through Q2 2011 and shows real GDP is still 0.4% below the previous pre-recession peak.

At the worst point, real GDP was off 5.1% from the 2007 peak.

And real GDP has performed better than other indicators ...

This graph shows real personal income less transfer payments as a percent of the previous peak.

This graph shows real personal income less transfer payments as a percent of the previous peak.

With the revisions, this measure was off almost 11% at the trough - a significant downward revision and shows the recession was much worse than originally thought.

Real personal income less transfer payments is still 5.1% below the previous peak.

It will be some time before this indicator returns to pre-recession levels.

This graph is for industrial production through June.

This graph is for industrial production through June.

Industrial production had been one of the stronger performing sectors because of inventory restocking and some growth in exports.

However industrial production is still 7.6% below the pre-recession peak, and it will probably be some time before industrial production returns to pre-recession levels.

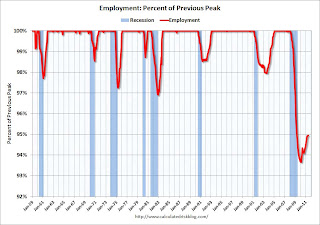

The final graph is for employment. This is similar to the graph I post every month comparing percent payroll jobs lost in several recessions.

The final graph is for employment. This is similar to the graph I post every month comparing percent payroll jobs lost in several recessions.

On the timing of the trough of the recession, GDP and industrial production would suggest the end of Q2 2009 (and June 2009). The other two indicators would suggest later troughs.

And of course the recovery in all indicators has been very sluggish compared to recent recessions.

Personal Income less Transfer Payments Revised Down Sharply

by Calculated Risk on 8/02/2011 10:41:00 AM

On Friday, the BEA released revisions for GDP that showed the recession was significantly worse than originally estimated. This morning the BEA released revisions for Personal Income and Outlays.

One of the key measures of the economy is personal income less transfer payments, in real terms. This is also one of the measures the National Bureau of Economic Research (NBER) uses in business cycle dating:

The committee places particular emphasis on two monthly measures of activity across the entire economy: (1) personal income less transfer payments, in real terms and (2) employment.The following graph shows personal income less transfer payments as a percent of the previous peak.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.Prior to the revisions, the BEA reported this measure was off close to 7% from the previous peak at the trough of the recession.

With the revisions, this measure was off almost 11% at the trough - a significant downward revision and shows the recession was much worse than originally thought.

Real personal income less transfer payments is still 5.1% below the previous peak.

Personal Income increased 0.1% in June, PCE decreased 0.2%

by Calculated Risk on 8/02/2011 09:03:00 AM

The BEA released the Personal Income and Outlays report for June:

Personal income increased $18.7 billion, or 0.1 percent ... Personal consumption expenditures (PCE) decreased $21.9 billion, or 0.2 percent.The following graph shows real Personal Consumption Expenditures (PCE) through June (2005 dollars). Note that the y-axis doesn't start at zero to better show the change.

...

Real PCE decreased less than 0.1 percent. ... The price index for PCE decreased 0.2 percent in June

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.PCE decreased 0.2 in June, and real PCE decreased less than 0.1% as the price index for PCE decreased 0.2 percent in June. On a quarterly basis, PCE barely increased in Q2 from Q1 (this was in the GDP report Friday).

Note: The PCE price index, excluding food and energy, increased 0.1 percent.

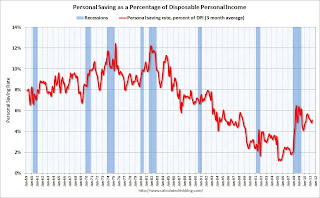

The personal saving rate was at 5.4% in June.

Personal saving -- DPI less personal outlays -- was $620.6 billion in June, compared with $581.7 billion in May. Personal saving as a percentage of disposable personal income was 5.4 percent in June, compared with 5.0 percent in May.

This graph shows the saving rate starting in 1959 (using a three month trailing average for smoothing) through the June Personal Income report.

This graph shows the saving rate starting in 1959 (using a three month trailing average for smoothing) through the June Personal Income report.Real PCE has declined for three straight months - this was expected based on the weak GDP report, but this is very weak.

Monday, August 01, 2011

A "Run to the Bank"

by Calculated Risk on 8/01/2011 09:00:00 PM

Over the last couple of weeks, we saw extreme caution by businesses and consumers. CEOs were warning about a sharp slowdown. Lawyers were telling their clients to wait before signing contracts. Corporations were stockpiling cash ... and there was even a "run to the banks"!

From Francesco Guerrera at the WSJ: Washington's Haggling Left Wall Street Dangling

U.S. companies large and small also chose an extraordinary playbook, stashing cash in the corporate equivalent of mattresses—bank accounts that yield no interest ... Banks, for their part, looked at the influx of deposits with mixed feelings.Some of this move to cash is due to the European financial crisis (the Italy to Germany 10 year spread hit another record high today). But most of the move was probably due to the political uncertainty. A key question is how quickly consumer and business confidence returns to the already low pre-debt ceiling debate levels.

On one hand, the unexpected bounty provides them with cheap funding that can be put to work in the form of loans. At the same time, the new deposits swelled their liabilities ... One executive even suggested that if this "run to the bank" continues, lenders might consider introducing negative interest rates on deposits (savers would have to pay a fee to park the money in the bank) to keep money out.

Misc: Fiscal Drag, House Vote, Stall Speed?

by Calculated Risk on 8/01/2011 05:27:00 PM

• From J.P. Morgan (this includes debt ceiling deal, expiring EUB, payroll tax cut. etc.):

Impending fiscal drag for 2012 remains intact. The deal does nothing to extend the various stimulus measure which will expire next year: we continue to believe federal fiscal policy will subtract around 1.5%-points from GDP growth in 2012. Its possible the fiscal commission could do something to extend some measure such as the one-year 2% payroll tax holiday, though we think unlikely, as it would need to be paid for, which would be tough. If anything, the debt deal may add modestly to the fiscal drag we have penciled in for next year.• From the WSJ: House Closes In on Vote as Deadline Approaches

The U.S. House began debate Monday afternoon, and voted 249-178 on a procedural measure to allow final debate on the bill, expected Monday evening. The procedural vote is a test of support for the underlying bill. As the House moved forward, the Senate scheduled its vote on the debt ceiling for Tuesday ...• From David Altig at Macroblog: Is the economy hitting stall speed?

[R]esearch shows that things could become considerably less comfortable if the 2 percent threshold persists, or the yield curve flattens, or the housing market tanks again. At that point, history is on the side of the recessionists. While Lockhart and our Reserve Bank don't believe we're there yet, it's fair to say we'd feel more comfortable if the incoming third quarter data were a little more positive. And on that count, this morning's Institute for Supply Management report for manufacturing isn't a very promising first step.Many people (myself included) keep looking for a little pickup in activity that never seems to materialize. Of course the slowdown in July can be blamed on a self inflicted wound to an already fragile economy. I wonder what the excuse will be in August?

The Economic Drag

by Calculated Risk on 8/01/2011 03:25:00 PM

It looks like the spending cuts in the deal through the end of 2012 will be $22 billion, although there could be more after the special committee fails makes their recommendations later this year.

These spending cuts will only have a small negative impact on the economy, but we have to remember that the original stimulus is almost over - and that the payroll tax cut expires at the end of the year - as do the emergency unemployment benefits. Plus state and local governments are continuing to cut spending.

Brad Delong estimates:

A first guess: -0.4% off of fiscal 2012 real GDP growth, with an unemployment rate in November 2012 0.2% above the baseline.That seems high based on the above spending cuts, but that is only part of the drag. I'll try to find some other estimate of the economic drag.

Floyd Norris writes in the NY Times that this could lead to a larger deficit Could This Deal Raise Budget Deficits

[T]his deal could manage to do the exact opposite of what it promises — raise the deficit.It is not just this deal, but the winding down of all the programs that will be a drag on the economy.

... This could damage the economy enough to send tax receipts down again. Although you never would have guessed it from the rhetoric, tax receipts are at the lowest level in years, as a percentage of gross domestic product. Get a healthy economy and tax revenues rise while a lot of spending, on such things as unemployment benefits, goes away.

As far as confidence, I do think there will be some boost from the deal. Not because it reduces the deficit - that does nothing for confidence - but because the deal takes not paying the bills off the table.