by Calculated Risk on 7/09/2011 08:21:00 AM

Saturday, July 09, 2011

Summary for Week Ending July 8th

The key story of the week was the June employment report - and the report was dismal.

There were only 18,000 total payroll jobs added in June, and 57,000 private sector payroll jobs. Also the BLS revised down April and May payrolls showing 44,000 fewer jobs were added than previously reported.

Basically every number was ugly: The unemployment rate increased from 9.1% to 9.2%, and the participation rate declined to 64.1%. The employment population ratio fell to 58.2%, matching the lowest level during the current employment recession. U-6, an alternate measure of labor underutilization that includes part time workers and marginally attached workers, increased to 16.2%, the highest level this year.

The average workweek declined slightly to 34.3 hours, and average hourly earnings ticked down.

As I noted yesterday, the only good news was that June is over.

Europe was also in the news, with more discussions about Greece, and bond yields rising sharply for Portugal, Ireland and even Italy. The results of the European bank stress tests will be released this coming Friday, and the European financial crisis will remain headline news.

Finally Reis released their Q2 office, mall and apartment vacancy rates. Apartment vacancy rates are declining, office vacancy rates are moving sideways, and mall vacancy rates are still increasing.

There wasn't much data last week, but it sure finished ugly.

Below is a summary of economic data last week mostly in graphs:

• June Employment Report: 18,000 Jobs, 9.2% Unemployment Rate

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

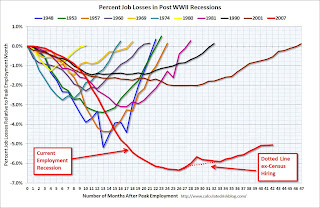

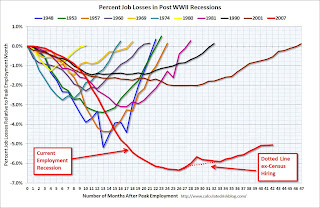

This graph shows the job losses from the start of the employment recession, in percentage terms aligned at the start of the recession.

In this post, the graph showed the job losses aligned at maximum job losses.

In terms of percentage payroll jobs, the 2007 recession is by far the worst since WWII.

This graph shows the employment population ratio, the participation rate, and the unemployment rate. The unemployment rate increased to 9.2% (red line).

This graph shows the employment population ratio, the participation rate, and the unemployment rate. The unemployment rate increased to 9.2% (red line).

The Labor Force Participation Rate declined to 64.1% in June (blue line). This is the percentage of the working age population in the labor force. This is the lowest level since the early '80s when

The Employment-Population ratio declined to 58.2% in June (black line). This ties the lowest level during the recession.

The number of workers only able to find part time jobs (or have had their hours cut for economic reasons) increased slightly to 8.552 million in June.

The number of workers only able to find part time jobs (or have had their hours cut for economic reasons) increased slightly to 8.552 million in June.

These workers are included in the alternate measure of labor underutilization (U-6) that increased to 16.2% in June from 15.8% in May. This is the highest level this year (highest since December 2010).

The next graph shows the duration of unemployment as a percent of the civilian labor force.

The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

Two key categories are moving up again. The 27 weeks and more (the long term unemployed) has moved up for two consecutive months and is now at 6.3 million workers, or 4.1% of the labor force.

Also, the 'less than 5 weeks' category is increasing again and that indicates recent weakness in the labor market.

Here are the employment posts from yesterday:

1) June Employment Report: 18,000 Jobs, 9.2% Unemployment Rate

2) Employment Summary, Part Time Workers, and Unemployed over 26 Weeks

3) Return of the Teen! and Unemployment by Duration and Education

4) Employment graph gallery

• ISM Non-Manufacturing Index indicates slower expansion in June

From the Institute for Supply Management: June 2011 Non-Manufacturing ISM Report On Business®

The June ISM Non-manufacturing index was at 53.3%, down from 54.6% in May. The employment index increased in June to 54.1%, up from 54.0% in May. Note: Above 50 indicates expansion, below 50 contraction.

The June ISM Non-manufacturing index was at 53.3%, down from 54.6% in May. The employment index increased in June to 54.1%, up from 54.0% in May. Note: Above 50 indicates expansion, below 50 contraction.

This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was below the consensus forecast of 54.0%.

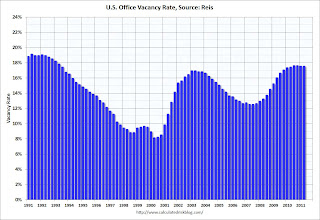

• Reis: Office, Mall and Apartment Vacancy Reports

Reis reported the Q2 office, mall and apartment vacancy rates. Apartment vacancy rates are declining, office vacancy rates are moving sideways, and mall vacancy rates are still increasing.

This graph shows the office vacancy rate starting in 1991.

This graph shows the office vacancy rate starting in 1991.

Reis reported the office vacancy rate was at 17.5% in Q2 2011, the same rate as in Q1, and up from 17.4% in Q2 2010. It appears the office vacancy rate might have peaked - and is now moving sideways. It will be a good sign when the vacancy rate starts falling.

From Reuters: Sluggish economy slows US office market rebound

Reis reported that the apartment vacancy rate (82 markets) fell to 6.0% in Q2 from 6.2% in Q1. The vacancy rate was at 7.8% in Q2 2010 and peaked at 8.0% at the end of 2009.

Reis reported that the apartment vacancy rate (82 markets) fell to 6.0% in Q2 from 6.2% in Q1. The vacancy rate was at 7.8% in Q2 2010 and peaked at 8.0% at the end of 2009.

From the WSJ: Rents Rise, Vacancies Go Down

This graph shows the apartment vacancy rate starting in 2005.

Reis is just for large cities, but this decline in vacancy rates is happening just about everywhere.

From Reuters: US mall vacancies rise in 2nd quarter, rents flat

From Reuters: US mall vacancies rise in 2nd quarter, rents flat

"Preliminary figures by real estate research firm Reis show the vacancy rate at ... regional malls rose to 9.3 percent ... up from 9.1 percent in the first quarter. ... The vacancy rate at these local retail strips was 11 percent versus 10.9 percent in the first quarter, almost matching the 11.1 percent record set 20 years ago"

• Other Economic Stories ...

• From the American Bankruptcy Institute: Consumer Bankruptcy Filings Down 8 Percent Through the First Half of 2011

• From National Federation of Independent Business (NFIB): NFIB Jobs Statement: June is a Bust, but July Looks Hopeful

• ADP: Private Employment increased by 157,000 in June

Have a great weekend!

Friday, July 08, 2011

Greece: More Discussions about Debt Reduction

by Calculated Risk on 7/08/2011 10:28:00 PM

From the WSJ: Greek Bailout Talks Shift to Attack on Debt

Discussions between bankers and government officials about Greece have undergone a fundamental shift in recent days, turning toward reducing the country's mountainous debt burden instead of just staving off a near-term financial crisis ... Finance ministers from the 17 nations that use the euro are expected to discuss the proposals at a meeting Monday in Brussels. They are expected to debate options that they previously discarded, including the use of European bailout funds to finance purchases of Greek debt.The key is to reduce the debt. This is similar to the problem mortgage lenders face in reducing mortgage principal - it might make sense for one borrower, but then many other borrowers will want a principal reduction.

If Greece gets a debt reduction, Portugal, Ireland, Spain and Italy will all get in line. Every one likes free money.

Some more from the Financial Times: EU leaders differ over Greek default

Here are the earlier employment posts:

• June Employment Report: 18,000 Jobs, 9.2% Unemployment Rate

• Employment Summary, Part Time Workers, and Unemployed over 26 Weeks

• Return of the Teen! and Unemployment by Duration and Education

• Employment graph gallery

Bank Failure #51: Signature Bank, Windsor, Colorado

by Calculated Risk on 7/08/2011 08:02:00 PM

"Where can we turn for more cash?"

Go Points West, young man.

by Soylent Green is People

From the FDIC: Points West Community Bank, Julesburg, Colorado, Assumes All of the Deposits of Signature Bank, Windsor, Colorado

As of March 31, 2011, Signature Bank had approximately $66.7 million in total assets and $64.5 million in total deposits ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $22.3 million. ... Signature Bank is the 51st FDIC-insured institution to fail in the nation this year, and the 4th in Colorado.

Bank Failures #49 & 50 in 2011

by Calculated Risk on 7/08/2011 07:16:00 PM

It's been tough but nicely done

Best to you Ms. Bair

Capital combust

Chicago concurrently

Cashless corpses crash

by Soylent Green is People

Farewell to Sheila Bair.

From the FDIC: Northbrook Bank & Trust Company, Northbrook, Illinois, Assumes All of the Deposits of First Chicago Bank & Trust, Chicago, Illinois

As of March 31, 2011, First Chicago Bank & Trust had approximately $959.3 million in total assets and $887.5 million in total deposits ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $284.3 million. ... First Chicago Bank & Trust is the 49th FDIC-insured institution to fail in the nation this year, and the fifth in Illinois.From the FDIC: First-Citizens Bank & Trust Company, Raleigh, North Carolina, Assumes All of the Deposits of Colorado Capital Bank, Castle Rock, Colorado

As of March 31, 2011, Colorado Capital Bank had approximately $717.5 million in total assets and $672.8 million in total deposits ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $283.8 million. ... Colorado Capital Bank is the 50th FDIC-insured institution to fail in the nation this year, and the third in Colorado.

European Financial Crisis: Italy

by Calculated Risk on 7/08/2011 06:04:00 PM

A top European analyst put out a research note last night calling Italy "the elephant in the room". Those fears sent the Italian 2 year yield to 3.5% - nothing compared to Greece, Portugal and Ireland, but a significant increase. The 10 year yield increased to 5.3%.

From the LA Times: Italy and Spain rocked by fears of spreading debt 'contagion'

The “contagion” that has forced Greece, Ireland and Portugal to seek bailouts from the rest of Europe now is threatening Italy, as investors demand ever-higher interest rates on Italian government bonds.The next round of European bank stress tests will be released next Friday, from Dow Jones: EU Fears For Stress Test Credibility As Deadline Nears

The yield on two-year Italian bonds surged to 3.51% on Friday, the fifth straight increase and up from 3.32% on Thursday. On Monday the yield was 3.04%.

Likewise, Spanish two-year government bond yields jumped to 3.77% on Friday from 3.66% on Thursday and 3.35% on Monday.

Under the terms of the tests, banks that fail to prove that they can preserve a certain capital ratio in the event of a severe downturn are supposed to fill the gap, at the latest, within six months of the results being published. That date has now been confirmed as next Friday, July 15.There are fears about some of the large Italian banks, however from the Dow Jones article:

In the event that those ailing the test also find themselves unable to raise the required capital, national governments are supposed to step in with "backstop mechanisms" to recapitalize or restructure the banks in question.

Mario Draghi, the incoming president of the European Central Bank, said Friday that he is sure that the five Italian banks taking the test will pass "with [a] rather meaningful, significant margin."I'm sure people will be asking if the stress tests were credible.

Here are the links for bond yields for several countries (source: Bloomberg):

| Greece | 2 Year | 5 Year | 10 Year |

| Portugal | 2 Year | 5 Year | 10 Year |

| Ireland | 2 Year | 5 Year | 10 Year |

| Spain | 2 Year | 5 Year | 10 Year |

| Italy | 2 Year | 5 Year | 10 Year |

| Belgium | 2 Year | 5 Year | 10 Year |

| France | 2 Year | 5 Year | 10 Year |

| Germany | 2 Year | 5 Year | 10 Year |

More Employment: Return of the Teen! and Unemployment by Duration and Education

by Calculated Risk on 7/08/2011 02:10:00 PM

First a reminder: The main reason employment growth is sluggish is because the U.S. is recovering from a housing and credit bubble, and the subsequent financial crisis. There is still too much excess capacity in most of the economy for a large contribution from new investment (except in equipment and software). We see this excess capacity in housing, and in overall industrial production. There is also excess capacity in office space, retail space, and other categories of commercial real estate. In addition, household debt, as a percent of income, remains very high and household deleveraging is ongoing. That is why so many companies identify their number one problem as "lack of customers".

Until the excess capacity is absorbed, and household balance sheets are back in order, the recovery will remain sluggish.

In addition there were some (hopefully) temporary factors that impacted employment in May and June: the supply chain disruption and high oil and gasoline prices.

But it is very disappointing to hear politicians incorrectly identify the reasons for the sluggish employment growth. From President Obama today:

[T]o put our economy on a stronger and sounder footing for the future, we’ve got to rein in our deficits and get the government to live within its means, while still making the investments that help put people to work right now and make us more competitive in the future. ...I know there are policymakers who think the problem is confidence and deficits. But this is incorrect. Misdiagnosing the causes of weak employment growth will lead to the wrong policies. Oh well ... this reminds me of 2005 when I couldn't get any policymakers to pay attention to the housing bubble. Frustrating.

The sooner we get this done, the sooner that the markets know that the debt limit ceiling will have been raised and that we have a serious plan to deal with our debt and deficit, the sooner that we give our businesses the certainty that they will need in order to make additional investments to grow and hire and will provide more confidence to the rest of the world as well, so that they are committed to investing in America.

Here are a few more graphs based on the employment report ...

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.Two key categories are moving up again. The 27 weeks and more (the long term unemployed) has moved up for two consecutive months and is now at 6.3 million workers, or 4.1% of the labor force.

Also the less than 5 weeks category is increasing again and that is very concerning.

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).Unfortunately this data only goes back to 1992 and only includes one previous recession (the stock / tech bust in 2001). Clearly education matters with regards to the unemployment rate - and it appears all four groups are generally trending down, although only High School Graduates, No College" and "Bachelors degree and higher" declined in June.

Although education matters for the unemployment rate, it doesn't appear to matter as far as finding new employment (all four categories are only gradually declining).

This is a little more technical. The BLS diffusion index for total private employment was at 53.4 in June, about the same as in May, and for manufacturing, the diffusion index increased slightly to 52.5.

This is a little more technical. The BLS diffusion index for total private employment was at 53.4 in June, about the same as in May, and for manufacturing, the diffusion index increased slightly to 52.5. Think of this as a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.

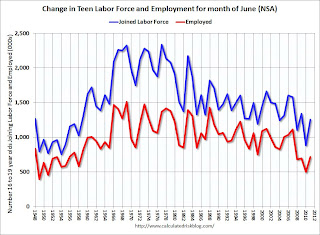

According to the BLS, 714,000 teens (ages 16 to 19) found jobs in June 2011 NSA compared to only 497,000 last year (June is the key months for summer employment). This is the most teen jobs added in June since 2007.

This graph shows the number of teens looking for work and the number of teens found jobs in June (data is not seasonally adjusted).

This graph shows the number of teens looking for work and the number of teens found jobs in June (data is not seasonally adjusted).The doesn't show the participation rate for teens, but that has been trending down for years.

The job market was so bad last summer few teens even bothered to look for work. Although the trend is still down for teen employment, this is a better summer for teenagers looking for work. A little silver lining ...

Best to all

Here are the earlier employment posts (with graphs):

• June Employment Report: 18,000 Jobs, 9.2% Unemployment Rate

• Employment Summary, Part Time Workers, and Unemployed over 26 Weeks

• Employment graph gallery

Employment Summary, Part Time Workers, and Unemployed over 26 Weeks

by Calculated Risk on 7/08/2011 10:25:00 AM

The only good news is that June is over.

There were few jobs created in June (only 18,000 total and 57,000 private sector). The unemployment rate increased from 9.1% to 9.2%, and the participation rate declined to 64.1%. Note: This is the percentage of the working age population in the labor force.

The employment population ratio fell to 58.2%, matching the lowest level during the current employment recession.

U-6, an alternate measure of labor underutilization that includes part time workers and marginally attached workers, increased to 16.2%, the highest level this year.

The BLS revised down April and May payrolls showing 44,000 fewer jobs were created than previously reported.

The average workweek declined slightly to 34.3 hours, and average hourly earnings ticked down. "In June, average hourly earnings for all employees on private nonfarm payrolls decreased by 1 cent to $22.99. Over the past 12 months, average hourly earnings have increased by 1.9 percent."

This is the second consecutive month with dismal numbers.

Through the first six months of 2011, the economy has added 757,000 total non-farm jobs or just 126 thousand per month. There have been 945,000 private sector jobs added, or about 158 thousand per month. This is a better pace of payroll job creation than last year, but the economy still has 6.98 million fewer payroll jobs than at the beginning of the 2007 recession.

There are a total of 14.1 million Americans unemployed and 6.3 million have been unemployed for more than 6 months. Very grim numbers.

Overall this was a weak report and reminds us that unemployment and underemployment are critical problems in the U.S.

Percent Job Losses During Recessions

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows the job losses from the start of the employment recession, in percentage terms - this time aligned at the start of the recession.

In the previous post, the graph showed the job losses aligned at maximum job losses.

In terms of lost payroll jobs, the 2007 recession is by far the worst since WWII.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) was essentially unchanged in June at 8.6 million. These individuals were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of workers only able to find part time jobs (or have had their hours cut for economic reasons) increased slightly to 8.552 million in June.

These workers are included in the alternate measure of labor underutilization (U-6) that increased to 16.2% in June from 15.8% in May. This is the highest level this year (highest since December 2010).

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 6.289 million workers who have been unemployed for more than 26 weeks and still want a job. This was up from 6.2 million in May. This is very high, and long term unemployment is one of the defining features of this employment recession.

This was a terrible report and the only good news is Q2 is over.

• Earlier Employment post: June Employment Report: 18,000 Jobs, 9.2% Unemployment Rate

June Employment Report: 18,000 Jobs, 9.2% Unemployment Rate

by Calculated Risk on 7/08/2011 08:30:00 AM

From the BLS:

Nonfarm payroll employment was essentially unchanged in June (+18,000), and the unemployment rate was little changed at 9.2 percent, the U.S. Bureau of Labor Statistics reported today. Employment in most major private-sector industries changed little over the month. Government employment continued to trend down.The following graph shows the employment population ratio, the participation rate, and the unemployment rate.

...

The change in total nonfarm payroll employment for April was revised from +232,000 to +217,000, and the change for May was revised from +54,000 to +25,000.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The unemployment rate increased to 9.2% (red line).

The Labor Force Participation Rate declined to 64.1% in June (blue line). This is the percentage of the working age population in the labor force. The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although some of the decline is due to the aging population.

The Employment-Population ratio declined to 58.2% in June (black line).

The second graph shows the job losses from the start of the employment recession, in percentage terms aligned at maximum job losses. The dotted line is ex-Census hiring.

The second graph shows the job losses from the start of the employment recession, in percentage terms aligned at maximum job losses. The dotted line is ex-Census hiring. The current employment recession is by far the worst recession since WWII in percentage terms, and 2nd worst in terms of the unemployment rate (only the early '80s recession with a peak of 10.8 percent was worse).

This was very weak and well below expectations for payroll jobs, and the unemployment rate was higher than expected (both worse). A terrible report. I'll have much more soon ...

Reis: Mall Vacancy Rates increase in Q2

by Calculated Risk on 7/08/2011 12:22:00 AM

From Reuters: US mall vacancies rise in 2nd quarter, rents flat

Preliminary figures by real estate research firm Reis show the vacancy rate at ... regional malls rose to 9.3 percent ... up from 9.1 percent in the first quarter.

The picture was even bleaker for U.S. strip malls where retailers gave up over half million more square feet than they rented. The vacancy rate at these local retail strips was 11 percent versus 10.9 percent in the first quarter, almost matching the 11.1 percent record set 20 years ago ...

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.As noted in the article, some tenants are still leaving as their leases expire. This is especially grim for strip malls.

To summarize the vacancy reports: Apartment vacancy rates are falling fast, office vacancy rates are moving sideways, and malls are still get crushed.

Earlier on vacancy rates:

• Reis: Office Vacancy Rate flat in Q2 at 17.5 Percent

• Reis: Apartment Vacancy Rate falls to 6% in Q2

Thursday, July 07, 2011

Cost of Living and CPI-Chained

by Calculated Risk on 7/07/2011 06:13:00 PM

I haven't been following the debate about using Chained-CPI instead of CPI-W for the Cost of Living Adjustment (COLA). (ht Andre).

Menzie Chinn at Econbrowser wrote today: Chained CPI

Recent reports ([WSJ RTE] [Bloomberg] [The Hill]) indicate that under consideration as one approach to curtailing entitlement spending growth is to resort to Chained CPI, as opposed to the current official CPI series, which is based on a quasi-Laspeyres formula.From the BLS: Frequently Asked Questions about the Chained Consumer Price Index for All Urban Consumers (C-CPI-U)

I haven't been following this, but chained CPI is a relatively new series (started in 2002), and measures inflation at a slightly lower rate than CPI or CPI-W - and over time this would add up both for Social Security payments and also for revenue (tax brackets would increase slower using chained CPI than using currently).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The graph shows the year-over-year change in headline CPI, CPI-W, and chained CPI.

There isn't much difference on a year-over-year basis, but notice the blue line is mostly below the other two all the time. Those small differences add up over time as the following table shows.

This table shows the 10 year change in each measure (from May 2001 to May 2011) and the annualized change over that period. If we were using chained CPI instead of CPI-W over the last 10 years, Social Security benefits would be about 3.6% lower than they are now.

| 10 Year Increase | Annualized | |

|---|---|---|

| CPI (headline) | 27.2% | 2.43% |

| CPI-W | 27.8% | 2.49% |

| CPI (chained) | 24.2% | 2.19% |