by Calculated Risk on 6/20/2011 11:30:00 AM

Monday, June 20, 2011

DOT: Vehicle Miles Driven decreased -2.4% in April compared to April 2010

This data is for April and gasoline prices were at the highest level of the year at end of April and in early May - so the YoY decline might be less in June.

Note: WTI future oil prices are down to $92.53 per barrel (down from $113.39 on April 29th), and Brent Crude is at $112.04 per barrel (down from $126.64). Gasoline prices are off over 30 cents per gallon from the recent peak.

The Department of Transportation (DOT) reported that vehicle miles driven in April were down 2.4% compared to April 2010:

Travel on all roads and streets changed by -2.4% (-6.1 billion vehicle miles) for April 2011 as compared with April 2010. Travel for the month is estimated to be 250.5 billion vehicle miles.

Cumulative Travel for 2011 changed by -0.8% (-7.1 billion vehicle miles). The Cumulative estimate for the year is 939.2 billion vehicle miles of travel.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the rolling 12 month total vehicle miles driven.

Note: in the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months. Currently miles driven has been below the previous peak for 41 months - so this is a new record for longest period below the previous peak - and still counting!

The second graph shows the year-over-year change from the same month in the previous year. So far the current decline is not as a severe as in 2008.

The second graph shows the year-over-year change from the same month in the previous year. So far the current decline is not as a severe as in 2008.With the decline in oil and gasoline prices, the YoY decline in miles driven will probably not be as large in June.

Morning Greece: Deal Postponed

by Calculated Risk on 6/20/2011 08:40:00 AM

From the NY Times: Deal on Lifeline to Avert Greek Bankruptcy Is Postponed

Europe’s finance ministers unexpectedly put off approval early Monday of the next installment of aid to debt-laden Greece, delaying the decision until July and demanding that the Greek Parliament first approve spending cuts and financial reforms ... Athens needs the next payout of 12 billion euros from its existing 110 billion euro bailout package by mid-July in order to remain solvent.From the WSJ: Finance Ministers Struggle With Long-Term Fix, but Get Closer on Short-Term Cash

Greece will run out of cash in the middle of next month unless funds earmarked under last year's bailout are released. Unwilling to let that happen, finance ministers are likely to approve disbursement of €8.7 billion; the International Monetary Fund, which is also contributing to the bailout, would likely agree to pay out €3.3 billion in the coming weeks.The Greek 2 year yield is at 28.4%. The ten year yields are up to 17.4%.

...

In the early hours of Monday morning, [finance ministers] released a statement saying they would decide on the "main parameters" of a new bailout package in July. The statement said the new bailout would include "informal and voluntary" arrangements with creditors that would produce a "substantial reduction" in the amount of new funding necessary—but without casting Greece into default.

Weekend:

• Summary for Week Ending June 17th

• Schedule for Week of June 19th

• FOMC Meeting Preview

Sunday, June 19, 2011

Housing Bust Winners: Some Farmers in Illinois

by Calculated Risk on 6/19/2011 07:03:00 PM

Here is a story about some farmers who sold land to home builders during the bubble - and are now buying back land at a fraction of the price ...

From Mary Ellen Podmolik at the Chicago Tribune: Shrewd investments enable farmers to live off the land they sold, then bought

... the [Baltz] brothers stood ... on 246 acres that, at their peak, sold for $65,000 an acre and in 2005 were annexed by the village and zoned for more than 400 single-family detached homes.And another example (not buying back the same land - but similar):

The Baltz brothers paid $3.6 million, or about $14,500 an acre, for land that already has subdivision utilities brought to the property line. This year, though, the only thing rising out of the dirt will be the corn that Bob Baltz planted last month.

Bob Dhuse, whose family has been farming southwest of Chicago since the 1850s, decided to split up the family's Kendall County land seven years ago, selling 90 acres for $34,000 to a housing developer.Nice timing!

... last fall he paid $12,000 to $15,000 an acre for land on the west side of Joliet that was to be a project of Neumann Homes, which, like competitors Kimball Hill, Kirk Corp. and Pasquinelli, all went bankrupt.

Earlier:

• Summary for Week Ending June 17th

• Schedule for Week of June 19th

• FOMC Meeting Preview

FOMC Meeting Preview

by Calculated Risk on 6/19/2011 12:15:00 PM

There will be a two day meeting of the Federal Open Market Committee (FOMC) this coming Tuesday and Wednesday. I expect no changes to the Fed Funds rate, or to the program to reinvest principal payments, or to the Large Scale Asset Purchase program that is scheduled to end this month (LSAP, aka "QE2"). Basically the Fed is on hold.

Jon Hilsenrath at the WSJ summed it up last week: No Fed Shift Seen at June Gathering

Fed officials are neither looking to tighten nor to ease monetary policy as they prepare for the meeting June 21 and 22 of the Federal Open Market Committee, the Fed's decision-making body.On Friday, Goldman Sachs economist Sven Jari Stehn argued that there is a large "zone of inaction" for the Fed, and it would take a large surprise (much slower economy or much higher inflation) to get the Fed to take action. From Stehn:

With job gains potentially slowing, housing prices sliding and consumers spending cautiously, officials don't want to tighten financial conditions. This means they will maintain short-term interest rates near zero and keep the central bank's $2.6 trillion of securities holdings from shrinking. At the same time, because inflation has picked up, they're reluctant to embrace new initiatives aimed at boosting growth.

"Our analysis ... suggests that larger surprises than those seen in recent weeks are needed for the FOMC to move out of its zone of inaction. We conclude that the ... weakness in growth and uncertainty about the effect of temporary factors will keep policy and, most likely, policy communication unchanged for the foreseeable future.Concerning the recent slowdown - it is difficult to distinguish between temporary factors or something worse - so the Fed will probably remain on hold until the situation is more clear. The temporary factors include the supply chain issues related to the tragic events in Japan, the sharp increase in oil and gasoline prices partially attributable to events in the Middle East and North Africa, and possibly the severe weather in the U.S.

The implication of this analysis for next week’s FOMC press conference is that Chairman Bernanke is likely to stay far away from indicating any changes in the policy stance. Most likely, he will be “balanced” by emphasizing both the disappointment in the activity indicators and the higher inflation data. So the press conference is unlikely to be pleasant for either the chairman or his audience."

Remember, in early April Bernanke said:

"I think the increase in inflation will be transitory," ... He attributed the strong gain in global energy and food prices to supply and demand conditions, adding he reckons these prices "will eventually stabilize."Since then oil and gasoline prices have fallen sharply, but core inflation has ticked up a little.

Some things to look for:

1) Fed Chairman Press Briefing. This is the second of the new press briefings. The FOMC statement will be released earlier than usual - around 12:30 PM ET on Wednesday, and the Chairman's press briefing will be held at 2:15 PM.

At the press briefing, Chairman Bernanke is expected to discuss the new FOMC forecasts (these forecasts used to be released a few weeks after the FOMC meeting with the minutes). Growth forecasts have probably been revised down since April, the unemployment rate revised up, and inflation forecasts might have been revised up.

Here are the updated forecasts through April. The FOMC GDP forecasts for 2011 were revised down in April, and will probably be revised down again in June.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Change in Real GDP1 | 2011 | 2012 | 2013 |

| Jan 2011 Projections | 3.4 to 3.9 | 3.5 to 4.4 | 3.7 to 4.6 |

| April 2011 Projections | 3.1 to 3.3 | 3.5 to 4.2 | 3.5 to 4.3 |

| June 2011 Projections | ??? | ??? | ??? |

The unemployment rate was revised down in April, but with the uptick in the unemployment rate over the last two months to 9.1%, the unemployment rate for Q4 2011 will probably be revised up this time.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Unemployment Rate2 | 2011 | 2012 | 2013 |

| Jan 2011 Projections | 8.8 to 9.0 | 7.6 to 8.1 | 6.8 to 7.2 |

| April 2011 Projections | 8.4 to 8.7 | 7.6 to 7.9 | 6.8 to 7.2 |

| June 2011 Projections | ??? | ??? | ??? |

I suspect inflation will be a key topic at the FOMC meeting. The forecasts for overall and core inflation were revised up in April and will probably be revised up again in June.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| PCE Inflation1 | 2011 | 2012 | 2013 |

| Jan 2011 Projections | 1.3 to 1.7 | 1.0 to 1.9 | 1.2 to 2.0 |

| April 2011 Projections | 2.1 to 2.8 | 1.2 to 2.0 | 1.4 to 2.0 |

| June 2011 Projections | ??? | ??? | ??? |

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Core Inflation1 | 2011 | 2012 | 2013 |

| Jan 2011 Projections | 1.0 to 1.3 | 1.0 to 1.5 | 1.2 to 2.0 |

| April 2011 Projections | 1.3 to 1.6 | 1.3 to 1.8 | 1.4 to 2.0 |

| June 2011 Projections | ??? | ??? | ??? |

2) Possible Statement Changes. I don't expect the key sentence "likely to warrant exceptionally low levels for the federal funds rate for an extended period" to be changed any time soon.

There will probably be some changes to the first paragraph to mention the recent softer economic data and pickup in inflation - however the statement will probably say the increase in inflation is expected to be transitory. I expect the phrase "the economic recovery is proceeding at a moderate pace" to be downgraded a little. And the word subdued might be changed in the phrase on inflation: "Inflation has picked up in recent months, but longer-term inflation expectations have remained stable and measures of underlying inflation are still subdued."

3) Timeline for the Fed. Remember all those "analysts" saying QE2 would end early and predicting the Fed would raise rates this year? Wrong again ...

QE2 will end in June as scheduled. It also appears the Fed will continue to reinvest maturing securities - at least for a couple of months following the end of QE2 (the next meeting is in August). This means the Fed's balance sheet will remain stable following the completion of QE2 - until the economy weakens further or the pace of growth picks up.

The next step for the Fed - after the end of QE2 - will be to either: 1) end the reinvestment (if economic growth improves), or 2) launch QE3 (if the economy weakens). I don't think either action is likely in the near term.

And this means the Fed will not raise rates for, well, an "extended period". If they do end reinvestment in the next few months, they will probably wait even longer to drop the "extended period" language, and then a couple more meetings (at least) before they raise rates.

Yesterday:

• Summary for Week Ending June 17th

• Schedule for Week of June 19th

NY Times on Backlog of Foreclosures

by Calculated Risk on 6/19/2011 09:27:00 AM

From David Streitfeld at the NY Times: Backlog of Cases Gives a Reprieve on Foreclosures

In New York State, it would take lenders 62 years at their current pace, the longest time frame in the nation, to repossess the 213,000 houses now in severe default or foreclosure, according to calculations by LPS Applied Analytics, a prominent real estate data firm.Of course, because the denominator has declined - and the numerator is still very high - these time frames seem absurd. As an example:

Clearing the pipeline in New Jersey, which like New York handles foreclosures through the courts, would take 49 years. In Florida, Massachusetts and Illinois, it would take a decade.

In the 27 states where the courts play no role in foreclosures, the pace is much more brisk — three years in California, two years in Nevada and Colorado — but the dynamic is the same: the foreclosure system is bogged down by the volume of cases ...

Last September, before the documentation crisis, nearly 1,500 New Yorkers lost their houses as a result of foreclosure, according to LPS. The average over the last six months: 286.So in New York, with 213,000 homes in severe default or foreclosure, and only 286 completed foreclosures per month, gives a backlog of 62 years.

Some of this is due to process delays for some lenders. Some is because lenders are trying to modify more loans. Some is because the lenders already have plenty of REOs (Real Estate Owned).

It won't take anything like 62 years to clear the backlog, but it does show there is a long way to go.

Note: This doesn't quite fit with the recent reports that Fannie, Freddie and the FHA are all completing foreclosures (and selling REO) at a record pace right now ...

Saturday, June 18, 2011

Some Stats on Income Inequality

by Calculated Risk on 6/18/2011 10:28:00 PM

Earlier:

• Summary for Week Ending June 17th

• Schedule for Week of June 19th

From the WaPo: With executive pay, rich pull away from rest of America

The top 0.1 percent of earners make about $1.7 million or more, including capital gains. Of those, 41 percent were executives, managers and supervisors at non-financial companies, according to the analysis, with nearly half of them deriving most of their income from their ownership in privately-held firms. An additional 18 percent were managers at financial firms or financial professionals at any sort of firm.Here is the most recent paper I could find from Saez: Striking it Richer: The Evolution of Top Incomes in the United States

...

Income inequality has been on the rise for decades in several nations, including the United Kingdom, China and India, but it has been most pronounced in the United States, economists say.

In 1975, for example, the top 0.1 percent of earners garnered about 2.5 percent of the nation’s income, including capital gains, according to data collected by University of California economist Emmanuel Saez. By 2008, that share had quadrupled and stood at 10.4 percent.

The phenomenon is even more pronounced at even higher levels of income. The share of the income commanded by the top 0.01 percent rose from 0.85 percent to 5.03 percent over that period. For the 15,000 families in that group, average income now stands at $27 million.

In world rankings of income inequality, the United States now falls among some of the world’s less-developed economies.

The WaPo article focuses on the incomes of non-financial business executives, but I'd focus more on the 18% who were managers at financial firms.

Schedule for Week of June 19th

by Calculated Risk on 6/18/2011 04:23:00 PM

Earlier:

• Summary for Week Ending June 17th

The key releases this week will be existing home sales on Tuesday, new home sales on Thursday, and durable goods and the final estimate for Q1 GDP on Friday.

The Fed's FOMC holds a two day meeting on Tuesday and Wednesday, and Fed Chairman Ben Bernanke will hold a press conference following the FOMC announcement on Wednesday.

No economic releases scheduled.

10:00 AM: Existing Home Sales for May from the National Association of Realtors (NAR). The consensus is for sales of 4.75 million at a Seasonally Adjusted Annual Rate (SAAR) in May, down from 5.05 million SAAR in April.

Click on graphs for larger image in graph gallery.

This graph shows existing home sales since 1993. Housing economist Tom Lawler is forecasting a decline to 4.8 millon (SAAR) in May. That would put the months-of-supply in the 9.4 months range.

This graph shows existing home sales since 1993. Housing economist Tom Lawler is forecasting a decline to 4.8 millon (SAAR) in May. That would put the months-of-supply in the 9.4 months range.Note: the NAR is working on benchmarking existing home sales for previous years with other industry data (expectations are for large downward revisions). Look for an update on when these revisions will be released.

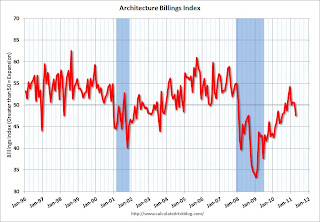

Early: The AIA's Architecture Billings Index for May (a leading indicator for commercial real estate).

Early: The AIA's Architecture Billings Index for May (a leading indicator for commercial real estate).This graph shows the Architecture Billings Index since 1996. The index indicated billings decreased in April (index at 47.6, anything below 50 indicates a decrease in billings).

This index usually leads investment in non-residential structures (hotels, malls, office) by 9 to 12 months.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index has been very weak over all year, suggesting weak home sales through early summer (not counting all cash purchases).

10:00 AM: FHFA House Price Index for April 2011. This is based on GSE repeat sales and is no longer as closely followed as Case-Shiller (or CoreLogic).

12:30PM: FOMC Meeting Announcement. No changes are expected to interest rates, and QE2 is expected to end on June 30th.

2:15 PM: Fed Chairman Ben Bernanke holds a press briefing following FOMC announcement.

Expected: The Moody's/REAL Commercial Property Price Indices (commercial real estate price index) for April.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for an increase to 415,000 from 414,000 last week.

8:30 AM ET: Chicago Fed National Activity Index (May). This is a composite index of other data.

10:00 AM: New Home Sales for May from the Census Bureau.

10:00 AM: New Home Sales for May from the Census Bureau. This graph shows New Home Sales since 1963.

The dashed line is the April sales rate of 323 thousand (SAAR).

The consensus is for a decrease in sales to a 305 thousand SAAR in May.

8:30 AM: Durable Goods Orders for May from the Census Bureau. The consensus is for a 1.6% increase in durable goods orders after decreasing 3.6% in March.

8:30 AM: Q1 GDP (third estimate). This is the third estimate for Q1 GDP from the BEA.

8:30 AM: Q1 GDP (third estimate). This is the third estimate for Q1 GDP from the BEA.This graph shows the quarterly GDP growth (at an annual rate) for the last 30 years.

The second estimate was for 1.8% annualized growth in Q1. The consensus is for an upward revision to 1.9% annualized real GDP growth.

Best wishes to All!

Summary for Week Ending June 17th

by Calculated Risk on 6/18/2011 11:11:00 AM

You know it was a tough week when the “good news” was a smaller than expected decline in retail sales, and also a minor increase in housing starts. Of course the headlines were mostly about the financial crisis in Europe, especially in Greece. The next "bailout" for Greece is expected very soon.

The negative U.S. economic news included both the New York and Philadelphia Fed manufacturing surveys indicating contraction in June. Also Industrial Production in May edged up only slightly and capacity utilization was flat.

At the same time, core inflation picked up a little in May – so we saw slowing growth and a little more inflation – not good news for the economy (although oil and gasoline prices have fallen sharply, so measured inflation will probably moderate in June). Meanwhile consumer sentiment declined in the preliminary June reading.

This continues the recent trend of weak economic news - something that will probably continue next week with the release of existing and new home sales for May. Below is a summary of economic data last week mostly in graphs:

• Retail Sales declined 0.2% in May

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

On a monthly basis, retail sales decreased 0.2% from April to May (seasonally adjusted, after revisions), and sales were up 7.7% from May 2010.

This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales are up 16.4% from the bottom, and now 2.3% above the pre-recession peak.

• Housing Starts increased in May

This graph shows total and single unit starts since 1968. Total housing starts were at 560 thousand (SAAR) in May, up 3.5% from the revised April rate of 541 thousand.

This graph shows total and single unit starts since 1968. Total housing starts were at 560 thousand (SAAR) in May, up 3.5% from the revised April rate of 541 thousand.

Single-family starts increased 3.7% to 419 thousand in May.

This was above expectations of 547 thousand starts in May. Multi-family starts are beginning to pickup - although from a very low level - but single family starts are still moving sideways.

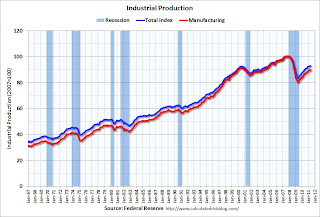

• Industrial Production edged up in May, Capacity Utilization unchanged

This graph shows industrial production since 1967.

This graph shows industrial production since 1967.

Industrial production edged up slightly in May to 93.0. Capacity utilization for total industry was flat at 76.7 percent.

Both industrial production and capacity utilization have stalled recently. The was below the consensus of a 0.2% increase in Industrial Production in May, and an increase to 77.0% for Capacity Utilization.

• Core Measures of Inflation increased in May

"According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.1% annualized rate) in May. The 16% trimmed-mean Consumer Price Index increased 0.2% (2.8% annualized rate) during the month."

"According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.1% annualized rate) in May. The 16% trimmed-mean Consumer Price Index increased 0.2% (2.8% annualized rate) during the month."

Over the last 12 months, core CPI has increased 1.5%, median CPI has increased 1.5%, and trimmed-mean CPI increased 1.9%.

This graph shows these three measure of inflation on a year-over-year basis.

These measures all show that year-over-year inflation is still low, but increasing. Although the year-over-year increases are below the Fed's inflation target, the annualized rates were above the target in May.

• Philly Fed and NY Fed Manufacturing Surveys showed contraction in June

From the Philly Fed: June 2011 Business Outlook Survey

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, decreased from 3.9 in May to -7.7, its first negative reading since last September.From the NY Fed: Empire State Survey indicates contraction

The general business conditions index slipped below zero for the first time since November of 2010, falling twenty points to -7.8.

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through June. The ISM and total Fed surveys are through May.

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through June. The ISM and total Fed surveys are through May.This early reading suggests the ISM index could be below 50 in June - if so, this would be the lowest reading since mid-2009.

• NFIB: Small Business Optimism Index decreased in May

From National Federation of Independent Business (NFIB): Consumer Spending Remains Weak: Small Business Optimism Dips Lower in May

From National Federation of Independent Business (NFIB): Consumer Spending Remains Weak: Small Business Optimism Dips Lower in May This graph shows the small business optimism index since 1986. The index decreased to 90.9 in May from 91.2 in April.

This has been trending up, although optimism has declined for three consecutive months now.

• Consumer Sentiment declines in June

The preliminary June Reuters / University of Michigan consumer sentiment index declined to 71.8 from 74.3 in May.

The preliminary June Reuters / University of Michigan consumer sentiment index declined to 71.8 from 74.3 in May.In general consumer sentiment is a coincident indicator and is usually impacted by employment (and the unemployment rate) and gasoline prices. However, even with gasoline prices falling, consumer sentiment is mostly moving sideways at a low level.

This was below the consensus forecast of 74.0.

• Other Economic Stories ...

• Residential Remodeling Index increased in April

• Hotels: Occupancy Rate increased 3.0 percent compared to same week in 2010

• Lawler: CAR vs. “Reality,” and the NAR Benchmarking

• State Unemployment Rates "little changed" in May

• Lawler: Early Read on Existing Home Sales in May

• NAHB Builder Confidence index declined in June

Best wishes to all!

Unofficial Problem Bank list at 996 Institutions

by Calculated Risk on 6/18/2011 08:30:00 AM

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for June 17, 2011.

Changes and comments from surferdude808:

This week a little bit of almost everything happened to the Unofficial Problem Bank List. There were three additions, two removals from failure, five removals from action termination, and two removals from unassisted mergers. The net of these changes leave the list with 996 institutions with assets of $416.7 billion.

The three additions include PBI Bank, Louisville, KY ($1.7 billion Ticker: PBIB); The Conway National Bank, Conway, SC ($942 million Ticker: CNBW); and Peoples National Bank, Niceville, FL ($ 121 million).

The failures include McIntosh State Bank, Jackson, GA ($340 million Ticker: MITB); and First Commercial Bank of Tampa Bay, Tampa, FL ($99 million). Action terminations include Heritage Bank of Commerce, San Jose, CA ($1.3 billion Ticker: HTBK); Cornerbank, National Association, Winfield, KS ($231 million); The First National Bank of Northfield, Northfield, MN ($126 million); First National Bank of Scottsdale, Scottsdale, AZ ($60 million); and Gladewater National Bank, Gladewater, TX ($31 million). Removals from unassisted mergers include Wilber National Bank, Oneonta, NY ($895 million Ticker: GIW); and First Community Bank of America, Pinellas Park, FL ($452 million Ticker: FCFL).

Perhaps next week the FDIC will release its actions issued during May 2011, until then practice safe & sound banking.

Friday, June 17, 2011

Here come the downgrades for Q2 GDP Growth

by Calculated Risk on 6/17/2011 10:04:00 PM

Another quarter, another round of growth downgrades ...

Earlier this week, Catherine Rampell at the NY Times Economix wrote: The Great Growth Disappointment

Second verse, same as the first: The quarter when the economy was supposed to stage its comeback is looking just as bad as its disappointing predecessor.And now from Jeff Cox at CNBC: Goldman Cuts GDP View to 2% as Economy Weakens (ht jb)

... after a major bummer of an inflation report, Macroeconomic Advisers, the highly respected forecasting firm, lowered its annualized second quarter G.D.P. forecast to 1.9 percent.

[Goldman Sachs] cut its second-quarter GDP outlook to 2 percent from 3 percent ... Goldman's move comes amid a week of disappointing manufacturing indicators from both the Philadelphia and New York Feds that compounded market fears over debt contagion from Greece and other peripheral eurozone nations. ...And Stehn concluded with this comment about Fed Chairman Ben Bernanke's press conference next week:

On the bright side, [economist Sven Jari] Stehn wrote that the firm still expects economic activity and GDP to pick up later in the year, though the bar has been raised.

"At this point, we still expect a bounceback in Q3 and beyond, but will need to see significant improvement in the data over the next few weeks to maintain that view," he said.

"Most likely, [Bernanke] will be 'balanced' by emphasizing both the disappointment in the activity indicators and the higher inflation data," Stehn said. "So the press conference is unlikely to be pleasant for either the chairman or his audience."Bernanke will also present the June FOMC forecasts and those forecasts should be weaker.