by Calculated Risk on 6/18/2011 04:23:00 PM

Saturday, June 18, 2011

Schedule for Week of June 19th

Earlier:

• Summary for Week Ending June 17th

The key releases this week will be existing home sales on Tuesday, new home sales on Thursday, and durable goods and the final estimate for Q1 GDP on Friday.

The Fed's FOMC holds a two day meeting on Tuesday and Wednesday, and Fed Chairman Ben Bernanke will hold a press conference following the FOMC announcement on Wednesday.

No economic releases scheduled.

10:00 AM: Existing Home Sales for May from the National Association of Realtors (NAR). The consensus is for sales of 4.75 million at a Seasonally Adjusted Annual Rate (SAAR) in May, down from 5.05 million SAAR in April.

Click on graphs for larger image in graph gallery.

This graph shows existing home sales since 1993. Housing economist Tom Lawler is forecasting a decline to 4.8 millon (SAAR) in May. That would put the months-of-supply in the 9.4 months range.

This graph shows existing home sales since 1993. Housing economist Tom Lawler is forecasting a decline to 4.8 millon (SAAR) in May. That would put the months-of-supply in the 9.4 months range.Note: the NAR is working on benchmarking existing home sales for previous years with other industry data (expectations are for large downward revisions). Look for an update on when these revisions will be released.

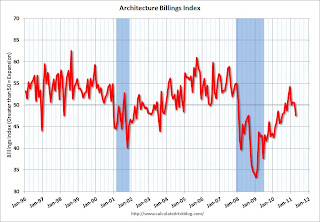

Early: The AIA's Architecture Billings Index for May (a leading indicator for commercial real estate).

Early: The AIA's Architecture Billings Index for May (a leading indicator for commercial real estate).This graph shows the Architecture Billings Index since 1996. The index indicated billings decreased in April (index at 47.6, anything below 50 indicates a decrease in billings).

This index usually leads investment in non-residential structures (hotels, malls, office) by 9 to 12 months.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index has been very weak over all year, suggesting weak home sales through early summer (not counting all cash purchases).

10:00 AM: FHFA House Price Index for April 2011. This is based on GSE repeat sales and is no longer as closely followed as Case-Shiller (or CoreLogic).

12:30PM: FOMC Meeting Announcement. No changes are expected to interest rates, and QE2 is expected to end on June 30th.

2:15 PM: Fed Chairman Ben Bernanke holds a press briefing following FOMC announcement.

Expected: The Moody's/REAL Commercial Property Price Indices (commercial real estate price index) for April.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for an increase to 415,000 from 414,000 last week.

8:30 AM ET: Chicago Fed National Activity Index (May). This is a composite index of other data.

10:00 AM: New Home Sales for May from the Census Bureau.

10:00 AM: New Home Sales for May from the Census Bureau. This graph shows New Home Sales since 1963.

The dashed line is the April sales rate of 323 thousand (SAAR).

The consensus is for a decrease in sales to a 305 thousand SAAR in May.

8:30 AM: Durable Goods Orders for May from the Census Bureau. The consensus is for a 1.6% increase in durable goods orders after decreasing 3.6% in March.

8:30 AM: Q1 GDP (third estimate). This is the third estimate for Q1 GDP from the BEA.

8:30 AM: Q1 GDP (third estimate). This is the third estimate for Q1 GDP from the BEA.This graph shows the quarterly GDP growth (at an annual rate) for the last 30 years.

The second estimate was for 1.8% annualized growth in Q1. The consensus is for an upward revision to 1.9% annualized real GDP growth.

Best wishes to All!