by Calculated Risk on 6/16/2011 10:00:00 AM

Thursday, June 16, 2011

Philly Fed Survey: "Regional manufacturing activity weakened in June"

From the Philly Fed: June 2011 Business Outlook Survey

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, decreased from 3.9 in May to -7.7, its first negative reading since last September. [any reading below zero is contraction]. The demand for manufactured goods, as measured by the current new orders index, showed a similar decline: The index fell 13 points and recorded its first negative reading since last October. The current shipments index fell just 3 points but remained slightly positive. Firms reported declines in inventories and unfilled orders, and shorter delivery times.This indicates contraction in June for the first time since last September. This was well below the consensus of 7.0.

Firms’ responses suggested little overall improvement in the labor market this month. The current employment index remained positive for the ninth consecutive month ...

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through June. The ISM and total Fed surveys are through May.

This early reading suggests the ISM index could be below 50 in June - is so, this would be the lowest reading since mid-2009.

Earlier:

• Housing Starts increase in May

• Weekly Initial Unemployment Claims decrease to 414,000

Housing Starts increase in May

by Calculated Risk on 6/16/2011 08:58:00 AM

From the Census Bureau: Permits, Starts and Completions.

Housing Starts:

Privately-owned housing starts in May were at a seasonally adjusted annual rate of 560,000. This is 3.5 percent (±12.4%)* above the revised April estimate of 541,000, but is 3.4 percent (±8.7%)* below the May 2010 rate of 580,000.

Single-family housing starts in May were at a rate of 419,000; this is 3.7 percent (±9.5%)* above the revised April figure of 404,000. The May rate for units in buildings with five units or more was 134,000.

Building Permits:

Privately-owned housing units authorized by building permits in May were at a seasonally adjusted annual rate of 612,000. This is 8.7 percent (±1.5%) above the revised April rate of 563,000 and is 5.2 percent (±2.4%) above the May 2010 estimate of 582,000.

Single-family authorizations in May were at a rate of 405,000; this is 2.5 percent (±1.1%) above the revised April figure of 395,000. Authorizations of units in buildings with five units or more were at a rate of 190,000 in May.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.Total housing starts were at 560 thousand (SAAR) in May, up 3.5% from the revised April rate of 541 thousand.

Single-family starts increased 3.7% to 419 thousand in May.

The second graph shows total and single unit starts since 1968.

This shows the huge collapse following the housing bubble, and that housing starts have mostly been moving sideways for over two years - with slight ups and downs due to the home buyer tax credit.

This shows the huge collapse following the housing bubble, and that housing starts have mostly been moving sideways for over two years - with slight ups and downs due to the home buyer tax credit.This was above expectations of 547 thousand starts in May. Multi-family starts are beginning to pickup - although from a very low level - but single family starts are still moving sideways.

Weekly Initial Unemployment Claims decrease to 414,000

by Calculated Risk on 6/16/2011 08:30:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending June 11, the advance figure for seasonally adjusted initial claims was 414,000, a decrease of 16,000 from the previous week's revised figure of 430,000. The 4-week moving average was 424,750, unchanged from the previous week's revised average of 424,750.The following graph shows the 4-week moving average of weekly claims for the last 40 years.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims was unchanged this week at 424,750.

This is the tenth straight week with initial claims above 400,000, and the 4-week average is at about the same the level as in January. This suggests the labor market weakness in May continued into early June.

Wednesday, June 15, 2011

Misc: Q2 GDP Downgrades, Oil Prices decline, FHA REO Sales Surge

by Calculated Risk on 6/15/2011 10:39:00 PM

• Catherine Rampell at the NY Times Economix writes: The Great Growth Disappointment

Second verse, same as the first: The quarter when the economy was supposed to stage its comeback is looking just as bad as its disappointing predecessor.Rampell provides a graph that shows Q2 estimates are tracking the same downward path as Q1 projections. Now it is all about the 2nd half ...

... after a major bummer of an inflation report, Macroeconomic Advisers, the highly respected forecasting firm, lowered its annualized second quarter G.D.P. forecast to 1.9 percent.

For reference, when the quarter began, Macroeconomic Advisers was expecting 3.5 percent growth

• Oil prices fell sharply today. WTI futures are down to $95.31 per barrel and Brent is down to $113.92.

Gasbuddy.com shows gasoline prices are now down almost 30 cents per gallon nationally from the recent peak at the beginning of May, and prices are still falling.

• In Q1, Fannie and Freddie were foreclosing at record levels - and selling REO (Real Estate Owned) even faster - so their REO inventory actually declined.

However, the FHA was apparently having REO inventory problems and the FHA's REO inventory increased in Q1. Apparently the problem has been solved since the FHA reported 7,410 Conveyances (REO acquired) in April, about the recent pace, but REO sales surged to 11,375 (an all time record). So the FHA's REO inventory declined in April - and will probably decline in Q2.

Just something to remember - the F's (Fannie, Freddie and the FHA) are now foreclosing and selling REO at a record pace. The REOs are not "piling up" at the lenders. This increase in REO selling is why distressed sales are a high percentage of sales again.

Earlier:

• NAHB Builder Confidence index declines in June

• Industrial Production edged up in May, Capacity Utilization unchanged

• Empire State Survey indicates contraction

• MBA: Mortgage Purchase Application activity increases

May Update: 2012 Social Security Cost-Of-Living Adjustment

by Calculated Risk on 6/15/2011 06:45:00 PM

The BLS reported this morning: "The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) increased 4.1 percent over the last 12 months to an index level of 222.954 (1982-84=100). For the month, the index rose 0.5 percent ..."

CPI-W is the index that is used to calculate the Cost-Of-Living Adjustments (COLA). Here is an explanation ...

The calculation dates have changed over time (see Cost-of-Living Adjustments), but the current calculation uses the average CPI-W for the three months in Q3 (July, August, September) and compares to the average for the highest previous average of Q3 months. Note: this is not the headline CPI-U, and not seasonally adjusted.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows CPI-W since January 2000. The red lines are the Q3 average of CPI-W for each year.

• In 2008, the Q3 average of CPI-W was 215.495. In the previous year, 2007, the average in Q3 of CPI-W was 203.596. That gave an increase of 5.8% for COLA for 2009.

• In 2009, the Q3 average of CPI-W was 211.013. That was a decline of 2.1% from 2008, however, by law, the adjustment is never negative so the benefits remained the same in 2010.

• In 2010, the Q3 average of CPI-W was 214.136. That was an increase of 1.5% from 2009, however the average was still below the Q3 average in 2008, so the adjustment was zero.

Currently CPI-W is above the Q3 2008 average. CPI-W could be very volatile this year because of energy prices, but if the current level holds, COLA would be around 3.5% for next year (the current 222.954 divided by the Q3 2008 level of 215.495).

This is still early - and oil and gasoline prices are falling - but it appears that COLA will increase this year.

Contribution and Benefit Base

The law prohibits an increase in the contribution and benefit base if COLA is not greater than zero. However if the there is even a small increase in COLA, the contribution base will be adjusted using the National Average Wage Index.

From Social Security: Cost-of-Living Adjustment Must Be Greater Than Zero

... ... any amount that is directly dependent for its value on the COLA would not increase. For example, the maximum Supplemental Security Income (SSI) payment amounts would not increase if there were no COLA.This is based on a one year lag. The National Average Wage Index is not available for 2010 yet, but wages probably didn't increase much from 2009. If wages increased back to the 2008 level in 2010, and COLA is positive (seems likely right now), then the contribution base next year will be increased to around $109,000 to $110,000 from the current $106,800.

... if there were no COLA, section 230(a) of the Social Security Act prohibits an increase in the contribution and benefit base (Social Security's maximum taxable earnings), which normally increases with increases in the national average wage index. Similarly, the retirement test exempt amounts would not increase ...

Remember - this is an early look. What matters is CPI-W during Q3 (July, August and September).

Earlier:

• NAHB Builder Confidence index declines in June

• Industrial Production edged up in May, Capacity Utilization unchanged

• Empire State Survey indicates contraction

• MBA: Mortgage Purchase Application activity increases

Greece Update

by Calculated Risk on 6/15/2011 04:13:00 PM

A few articles:

• From the LA Times: Fighting breaks out in Athens as thousands of Greek workers protest

• From the WSJ: Greek Leader to Seek Vote of Confidence

Greek Prime Minister George Papandreou, facing mounting opposition to his plans for further austerity measures being demanded as a price for a new bailout needed to avoid a debt default, said Wednesday he would shuffle his cabinet and demand a vote of confidence in Parliament.• From the Financial Times: Greek contagion fears spread to other EU banks

The vote is likely to herald a further bout of intense uncertainty in financial markets already rattled by the disagreements over a new rescue package.

• From the WSJ, a list of banks and countries exposed to the debt of Greece, Ireland and Portugal (ht Pat): Greece, Ireland, Portugal: Who Holds the Debt?. This doesn't include the exposure to CDS that Kash outlined last week.

The yield for Greek 2 year bonds is over 28%; the 10 year yield is close to 18%. Portuguese and Irish yields are up too.

Here are the links for bond yields for several countries (source: Bloomberg):

| Greece | 2 Year | 5 Year | 10 Year |

| Portugal | 2 Year | 5 Year | 10 Year |

| Ireland | 2 Year | 5 Year | 10 Year |

| Spain | 2 Year | 5 Year | 10 Year |

| Italy | 2 Year | 5 Year | 10 Year |

| Belgium | 2 Year | 5 Year | 10 Year |

| France | 2 Year | 5 Year | 10 Year |

| Germany | 2 Year | 5 Year | 10 Year |

Core Measures of Inflation increased in May

by Calculated Risk on 6/15/2011 12:43:00 PM

Earlier today the BLS reported:

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.2 percent in May on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 3.6 percent before seasonal adjustment.The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

The index for all items less food and energy rose 0.3 percent in May after increasing 0.1 percent in March and 0.2 percent in April. The shelter index rose 0.2 percent in May after increasing 0.1 percent in each of the seven previous months. Both rent and owners' equivalent rent rose 0.1 percent; the acceleration in shelter was due to the index for lodging away from home, which rose 2.9 percent in May after being unchanged in April.

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.1% annualized rate) in May. The 16% trimmed-mean Consumer Price Index increased 0.2% (2.8% annualized rate) during the month.Over the last 12 months, core CPI has increased 1.5%, median CPI has increased 1.5%, and trimmed-mean CPI increased 1.9%.

Note: The Cleveland Fed has a discussion of a number of measures of inflation: Measuring Inflation

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows these three measure of inflation on a year-over-year basis.

These measures all show that year-over-year inflation is still low, but increasing.

Note: You can see the median CPI details for May here.

Although the year-over-year increases are below the Fed's inflation target, the annualized rates were above the target in May. However, with the slack in the system, the year-over-year core measures will probably stay near or be below 2% this year.

Earlier:

• NAHB Builder Confidence index declines in June

• Industrial Production edged up in May, Capacity Utilization unchanged

• Empire State Survey indicates contraction

• MBA: Mortgage Purchase Application activity increases

NAHB Builder Confidence index declines in June

by Calculated Risk on 6/15/2011 10:00:00 AM

The National Association of Home Builders (NAHB) reports the housing market index (HMI) declined to 13 in June from 16 in May. This is the lowest level since last September. Any number under 50 indicates that more builders view sales conditions as poor than good.

This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the June release for the HMI and the April data for starts (May housing starts will be released tomorrow).

Both confidence and housing starts have been moving sideways at a very depressed level for several years.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

Press release from the NAHB: Builder Confidence Declines Three Points in June

After holding at a low but steady level for the past six months, builder confidence in the market for newly built, single-family homes declined three points in June to a reading of 13 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI), released today. The last time the index was this low was in September of 2010.Builders are very depressed, and the HMI has been below 25 for forty-eight consecutive months - 4 years!

...

"Builder confidence has waned even further as economic growth has stalled, foreclosures have continued to hit the market and the cost of building a home has risen," agreed NAHB Chief Economist David Crowe. "Meanwhile, potential new-home buyers are being constrained by difficulty selling their existing homes, stringent lending requirements, and general uncertainty about the economy.”

...

Every component of the HMI fell in June. The component gauging current sales conditions and the component gauging traffic of prospective buyers each fell two points, to 13 and 12, respectively. The component gauging sales expectations in the next six months fell four points to tie its record low score of 15 set in February and March of 2009.

Industrial Production edged up in May, Capacity Utilization unchanged

by Calculated Risk on 6/15/2011 09:15:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production edged up 0.1 percent in May, the second consecutive month with little or no gain. Revisions to total industrial production in months before May were small. In May, manufacturing production rose 0.4 percent after having fallen 0.5 percent in April. The output of motor vehicles and parts has been held down in the past two months because of supply chain disruptions following the earthquake in Japan. Excluding motor vehicles and parts, manufacturing output advanced 0.6 percent in May and edged down 0.1 percent in April; the decrease in April in part reflected production lost because of tornadoes in the South at the end of the month. ... At 93.0 percent of its 2007 average, total industrial production in May was 3.4 percent above its year-earlier level. Capacity utilization for total industry was flat at 76.7 percent, a rate 3.7 percentage points below its average from 1972 to 2010.

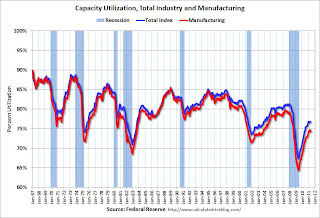

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows Capacity Utilization. This series is up 9.5 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 76.7% is still "3.7 percentage points below its average from 1972 to 2010" - and below the pre-recession levels of 81.2% in November 2007.

Note: y-axis doesn't start at zero to better show the change.

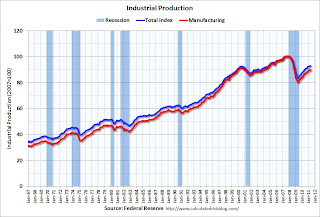

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production edged up slightly in May to 93.0.

Both industrial production and capacity utilization have stalled recently. The was below the consensus of a 0.2% increase in Industrial Production in May, and an increase to 77.0% for Capacity Utilization.

Misc: Empire State Survey indicates contraction, Inflation rate lower, French Bank Rating Reviewed

by Calculated Risk on 6/15/2011 08:30:00 AM

• From the NY Fed: Empire State Manufacturing Survey

The Empire State Manufacturing Survey indicates that conditions for New York manufacturers deteriorated in June. The general business conditions index slipped below zero for the first time since November of 2010, falling twenty points to -7.8.This was well below expectations of a reading of 13.0. This is the first regional survey released for June and shows that manufacturing is contracting.

The new orders and shipments indexes also posted steep declines and fell below zero. The index for number of employees dropped fifteen points to 10.2.

• From the BLS:

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.2 percent in May on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. ... The index for all items less food and energy increased 0.3 percent in May, its largest increase since July 2008.Even though the rate of inflation slowed, it was still higher than expected. The pickup in core inflation is bad news - I'll have more on inflation later.

• From the NY Times: Moody's to Review French Banks Over Greece Exposure

French banks were punished Wednesday for their exposure to the Greece after Moody’s Investors Service placed three of the largest on review for a possible downgrade.

Moody’s cited “concerns” about the exposure of BNP Paribas, Société Générale and Crédit Agricole to the Greek economy ...