by Calculated Risk on 6/12/2011 01:20:00 PM

Sunday, June 12, 2011

Freddie Mac: Very low Cash-Out Refinance Activity

When the Fed's Q1 Flow of Funds report was released on Thursday, I mentioned that some homeowners were paying down their loan amounts when they refinanced. I received some email questions about this, so I dug up the most recent Freddie Mac data.

Some borrowers are paying down their loans because they do not have sufficient equity in their homes to qualify for a loan (a downpayment in arrears). Others are probably paying down their loan amount to meet the conforming loan limits and obtain a better rate.

Here is some data from Freddie Mac as of Q1: 75 Percent of Refinancing Homeowners Maintain or Reduce Debt in First Quarter

• In the first quarter of 2011, 3-out-of-4 homeowners who refinanced their first-lien home mortgage either maintained about the same loan amount or lowered their principal balance by paying-in additional money at the closing table. Fifty-four percent maintained about the same loan amount, the highest share since 1985, when Freddie Mac began keeping records on refinancing patterns. In addition, 21 percent of refinancing homeowners reduced their principal balance.A couple of graphs ...

• “Cash-out” borrowers, those that increased their loan balance by at least five percent, represented 25 percent of all refinance loans; the average cash-out share over the past 25 years was 62 percent.

• The net dollars of home equity converted to cash as part of a refinance, adjusted for inflation, was at the lowest level in 15 years (third quarter of 1996). ...

• The median interest rate reduction for a 30-year fixed-rate mortgage was about 1.2 percentage points, or a savings of about 20 percent in interest costs.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the percent of loans with Cash-Out, no change and lower loan amounts. Obviously the percent of Cash-Out loans is very low.

Freddie definitions: "Higher Loan Amount" refers to loan amounts that were at least 5 percent greater than the amortized unpaid principal balance (UPB) of the original loan. "No Change In Loan Amount" refers to loans on which the principal balance was unchanged during refinance or loans that increased less than 5 percent of the original loan balance due to the inclusion of closing costs for the refinance. "Lower loan amount" refers to loan amounts that were less than the amortized UPB of the original loan.

The second graph shows the dollar amount of cash-out, and as a percent of the unpaid principal balance. The equity extraction boom in the 2004 through 2008 is obvious (too bad lending wasn't tightened up in 2005 or 2006).

The second graph shows the dollar amount of cash-out, and as a percent of the unpaid principal balance. The equity extraction boom in the 2004 through 2008 is obvious (too bad lending wasn't tightened up in 2005 or 2006).Here are the Freddie spreadsheets with additional data (from Freddie): Quarterly Cash-Out Statistics and Quarterly Cash-Out Volume

Hotels: Occupancy Rate increases 2.5 percent compared to same week in 2010

by Calculated Risk on 6/12/2011 09:30:00 AM

Here is the weekly update on hotels from HotelNewsNow.com: STR: US results for week ending 4 June

In year-over-year comparisons, occupancy rose 2.5 percent to 58.5 percent, average daily rate increased 2.7 percent to US$96.63, and revenue per available room finished the week up 5.2 percent to US$56.55.Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the seasonal pattern for the hotel occupancy rate using a four week average for the occupancy rate.

The summer leisure travel season is now starting, and the occupancy rate will increase over the next few of months. The question is: Will the occupancy rate be closer to normal (blue), or to 2010 (dashed purple)?

Note: ADR and RevPAR are still well below the pre-recession levels. ADR is about 7% below the level of the same week in 2008.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Earlier:

• Summary for Week Ending June 10th

• Schedule for Week of June 12th

• Updated List: Ranking Economic Data

Saturday, June 11, 2011

Schedule for Week of June 12th

by Calculated Risk on 6/11/2011 07:16:00 PM

Earlier:

• Summary for Week Ending June 10th

• Updated List: Ranking Economic Data

Several "B-List" reports will be released this week: Retail Sales, Industrial Production, Housing Starts and the Consumer Price Index (CPI). Some reports will clearly be impacted by the disaster in Japan - like May retail sales and Industrial Production - other reports might show some stabilization - like the June Empire State (NY Fed) and Philly Fed manufacturing surveys.

The Consumer Price Index (CPI) and the Producer Price Index (PPI) will probably show less inflation in May since energy prices declined last month.

Also two key housing reports will be released this week: June homebuilder confidence on Wednesday, and May housing starts on Thursday.

9:30 AM ET: Richmond Fed President Jeffrey Lacker, "Our History, Our Future: Manufacturing in the South" in Roanoke, Va.

7:30 AM: NFIB Small Business Optimism Index for May.

7:30 AM: NFIB Small Business Optimism Index for May. Click on graph for larger image in graph gallery.

This graph shows the small business optimism index since 1986. The index decreased to 91.2 in April from 91.9 in March. This has been trending up, although optimism has declined for two consecutive months now.

8:30 AM: Retail Sales for May.

8:30 AM: Retail Sales for May. This graph shows retail sales since 1992. This is monthly retail sales, seasonally adjusted (total and ex-gasoline).

Retail sales are up 17.0% from the bottom, and now 2.9% above the pre-recession peak.

The consensus is for retail sales to decrease 0.5% in May (0.3% increase ex-auto).

8:30 AM: Producer Price Index for May. The consensus is for a 0.1% increase in producer prices (0.2% core).

10:00 AM: Manufacturing and Trade: Inventories and Sales for April. The consensus is for a 0.9% increase in inventories.

2:30 PM: Speech by Fed Chairman Ben Bernanke, "Fiscal Sustainability", At the Committee for a Responsible Federal Budget Annual Conference, Washington, D.C.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index has been very weak over the last several months suggesting weak home sales through mid-year (not counting all cash purchases).

8:30 AM: Consumer Price Index for May. The consensus is for a 0.1% increase in prices. The consensus for core CPI is an increase of 0.2%.

8:30 AM ET: NY Fed Empire Manufacturing Survey for June. The consensus is for a reading of 13.0, up slightly from 11.9 in May.

9:15 AM ET: The Fed will release Industrial Production and Capacity Utilization for May.

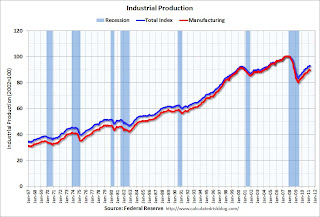

9:15 AM ET: The Fed will release Industrial Production and Capacity Utilization for May. This graph shows industrial production since 1967. Industrial production was unchanged in April at 93.1; previous months were revised down, so this was a decline from the previously reported level in March.

The consensus is for a 0.2% increase in Industrial Production in May, and an increase to 77.0% (from 76.9%) for Capacity Utilization.

10 AM: The June NAHB homebuilder survey. The consensus is for a reading of 16, unchanged from May. Any number below 50 indicates that more builders view sales conditions as poor than good. This index has been below 25 for forty seven consecutive months (almost 4 years).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a decrease to 420,000 from 427,000 last week.

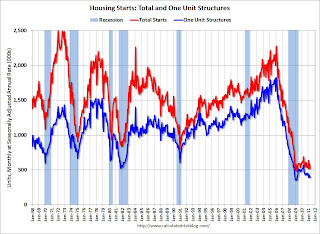

8:30 AM: Housing Starts for May. After collapsing following the housing bubble, housing starts have mostly been moving sideways for over two years - with slight ups and downs due to the home buyer tax credit.

8:30 AM: Housing Starts for May. After collapsing following the housing bubble, housing starts have mostly been moving sideways for over two years - with slight ups and downs due to the home buyer tax credit. This graph shows total and single unit starts since 1968.

Total housing starts were at 523 thousand (SAAR) in April, down 10.6% from the revised March rate of 585 thousand. Single-family starts decreased 5.1% to 394 thousand in April.

The consensus is for an increase to 547,000 (SAAR) in May.

10:00 AM: Philly Fed Survey for June. The consensus is for an increase to 7.0, up from 3.9 last month.

9:55 AM: Reuters/University of Mich Consumer Sentiment preliminary for June. The consensus is for a slight decrease to 74.0 from 74.3 in May.

10:00 AM: Conference Board Leading Indicators for May.

10:00 AM: Regional and State Employment and Unemployment for May 2011

Best wishes to All!

Summary for Week Ending June 10th

by Calculated Risk on 6/11/2011 11:13:00 AM

Last week was a light week for economic data. The trade balance report showed a decline in the April trade deficit as exports hit a new record high and imports declined. On the U.S. housing market, CoreLogic reported that 10.9 million residential properties had negative equity at the end of the first quarter of 2011 (the property owner owed more on their mortgage than the value of the property). These are the property owners most likely to default, especially those with loans greater than 125% of the value of the property.

Also, in a closely watched speech last week, Fed Chairman Ben Bernanke was somewhat downbeat on the U.S. economic outlook.

There will be much more data next week. Below is a summary of economic data last week mostly in graphs:

• Trade Deficit decreased to $43.7 billion in April

The first graph shows the monthly U.S. exports and imports in dollars through April 2011.

Click on graph for larger image.

Click on graph for larger image.

Exports increased in April and imports declined (seasonally adjusted). Exports are well above the pre-recession peak and up 19% compared to April 2010; imports are up about 16% compared to April 2010.

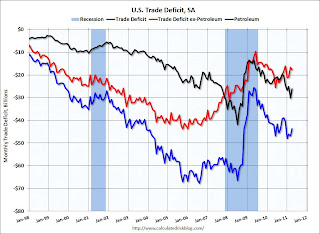

The second graph shows the U.S. trade deficit, with and without petroleum, through April.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The petroleum deficit decreased in April as the quantity imported decreased sharply even as prices increased. Oil averaged $103.18 per barrel in April, up from $77.13 in April 2010. There is a bit of a lag with prices, but it is possible prices will be a little lower in May.

The trade deficit was smaller than the expected $48.9 billion.

• CoreLogic: 10.9 Million U.S. Properties with Negative Equity in Q1

CoreLogic released the Q1 2011 negative equity report this week.

CoreLogic ... today released negative equity data showing that 10.9 million, or 22.7 percent, of all residential properties with a mortgage were in negative equity at the end of the first quarter of 2011, down slightly from 11.1 million, or 23.1 percent, in the fourth quarter. An additional 2.4 million borrowers had less than five percent equity, referred to as near-negative equity, in the first quarter.Here are a couple of graphs from the report:

This graph shows the distribution of negative equity (and near negative equity). The more negative equity, the more at risk the homeowner is to losing their home.

This graph shows the distribution of negative equity (and near negative equity). The more negative equity, the more at risk the homeowner is to losing their home. Close to 10% of homeowners with mortgages have more than 25% negative equity. This is trending down slowly - the decline is apparently mostly due to homes lost in foreclosure.

The second graph from CoreLogic shows the default rate by percent negative equity.

The second graph from CoreLogic shows the default rate by percent negative equity.The default rate increases the more 'underwater' the property, and the default rate really increases with Loan-to-values (LTV) of 125% or more.

Note that most homes with LTVs of 125% are still current. Many of these people will be stuck in their homes for years - or eventually default.

The third graph shows the break down of negative equity by state. Note: Data not available for Louisiana, Maine, Mississippi, South Dakota, Vermont, West Virginia and Wyoming.

The third graph shows the break down of negative equity by state. Note: Data not available for Louisiana, Maine, Mississippi, South Dakota, Vermont, West Virginia and Wyoming."Nevada had the highest negative equity percentage with 63 percent of all mortgaged properties underwater, followed by Arizona (50 percent), Florida (46 percent), Michigan (36 percent) and California (31 percent). ... Las Vegas led the nation with a 66 percent negative equity share, followed by Stockton (56 percent), Phoenix (55 percent), Modesto (55 percent) and Reno (54 percent)."

• Q1 Flow of Funds: Household Real Estate assets off $6.6 trillion from peak

The Federal Reserve released the Q1 2011 Flow of Funds report this week: Flow of Funds.

This is the Households and Nonprofit net worth as a percent of GDP.

This is the Households and Nonprofit net worth as a percent of GDP.The Fed estimated that the value of household real estate fell $339 billion in Q1 to $16.1 trillion in Q1 2011, from just under $16.5 trillion in Q4 2010. The value of household real estate has fallen $6.6 trillion from the peak - and is still falling in 2011.

Household net worth peaked at $65.8 trillion in Q2 2007. Net worth fell to $49.4 trillion in Q1 2009 (a loss of over $16 trillion), and net worth was at $58.1 trillion in Q1 2011 (up $8.7 trillion from the trough).

Note that this ratio was relatively stable for almost 50 years, and then we saw the stock market and housing bubbles.

This graph shows household real estate assets and mortgage debt as a percent of GDP.

This graph shows household real estate assets and mortgage debt as a percent of GDP. Mortgage debt declined by $85 billion in Q1. Mortgage debt has now declined by $634 billion from the peak. Studies suggest most of the decline in debt has been because of defaults, but some of the decline is from homeowners paying down debt (sometimes so they can refinance at better rates).

Assets prices, as a percent of GDP, have fallen significantly and are only slightly above historical levels. However household mortgage debt, as a percent of GDP, is still historically very high, suggesting more deleveraging ahead for households.

• BLS: Job Openings decline in April

This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS. In general job openings (yellow) has been trending up - however job openings declined slightly in April - and are actually down year-over-year compared to April 2010. However April 2010 included decennial Census hiring, so that isn't a good comparison.

Overall turnover remains low.

• Other Economic Stories ...

• From Fed Chairman Ben Bernanke: The U.S. Economic Outlook• Census Bureau on Homeownership Rate: We've got “Some 'Splainin' to Do”

• Fed's Beige Book: Economic activity continued to expand, "some deceleration"

• Ceridian-UCLA: Diesel Fuel index declines in May

• AAR: Rail Traffic mixed in May

• Lawler: Existing Home Active Listings show Big Declines in Wide Range of Metro Areas

Best wishes to all!

Friday Night: A list of economic data with sources and recent graphs.

• Updated List: Ranking Economic Data

Unofficial Problem Bank list over 1,000 Institutions

by Calculated Risk on 6/11/2011 08:50:00 AM

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for June 10, 2011. (new format)

Changes and comments from surferdude808:

With no closing or action terminations, the five additions this week finally push the Unofficial Problem Bank List over the 1,000 threshold. The list includes 1,002 institutions with assets of $417.4 billion, up from 997 and assets of $416.7 billion last week.Friday Night: A list of economic data with sources and recent graphs.

The five additions include The Washington Savings Bank, FSB, Bowie, MD ($408 million Ticker: WSB); Mutual Federal Savings Bank, A FSB, Sidney, OH ($119 million); Reliance Bank, FSB, Fort Myers, FL ($85 million); Covenant Bank, Chicago, IL ($69 million); and Vermont State Bank, Vermont, IL ($15 million).

We again send much love out to the Illinois State Banking Department for being the only state banking department to release its actions; others could learn from their promptness and transparency. Next week, we expect the OC to release their actions through mid-May 2011.

• Updated List: Ranking Economic Data

Friday, June 10, 2011

Updated List: Ranking Economic Data

by Calculated Risk on 6/10/2011 09:20:00 PM

FAQ: Why does CR give everything away for free? Because he feels like it ;-)

I'm frequently asked for sources of data, so here is an update to the list ranking economic data. For each indicator I've included a link to the source, and a link to the current graph gallery.

These lists are not exhaustive (I'm sure I've left a few off), and the rankings are not static. As an example, right now initial weekly unemployment claims is ‘B List’ data, but when (if) the expansion takes hold, weekly claims will move unceremoniously to the 'D List'.

I've marked several indicators with '***' indicating I think this data is currently more important than usual. This includes weekly claims and several real estate related releases (delinquency reports, negative equity, vacancy rates).

Some of the lower ranked data is useful as leading indicators. As an example, the Architecture Billings Index is a leading indicator for investment in commercial real estate. And the NMHC apartment survey leads changes in apartment rents and vacancy rates. Also some of the lower ranked data helps forecast some of the more important data.

Note: There has been some research (by Wall Street analysts) about how "surprises" for many of these indicators impact the stock market. In general the ranking is similar to this list, with the employment situation report being #1. Surprisingly (at least to me) investors tend to react more to "surprises" for existing home sales than new home sales, even though the later is far more important from an economic perspective.

And on Existing Home Sales: This was a tough choice. For me, the key to the NAR report is the inventory number - I watch it closely at times (I'd even say that existing home inventory would be 'B List' data right now - if it was more accurate), but the sales number is much less important than inventory. (Note: This summer I expect the NAR to revise down sales and inventory for the last few years).

A-List

• BLS: Employment Situation Report (Employment Graphs)

• BEA: GDP Report (quarterly) (GDP Graphs)

B-List

• Census: New Home Sales (New Home Graphs)

• Census: Housing Starts (Housing Graphs)

• ISM Manufacturing Index (ISM Graph)

• Census: Retail Sales (Retail Graphs)

• BEA: Personal Income and Outlays (graph)

• Fed: Industrial Production (graphs IP and Capacity Utilization)

• BLS: Core CPI (graph CPI)

• ***DOL: Weekly Initial Unemployment Claims (graph weekly claims)

C-List

• Philly Fed Index (Graph Philly Fed)

• NY Fed Empire State Manufacturing Index (Graph Empire Index)

• Chicago ISM: Chicago PMI

• Census: Durable Goods

• ISM Non-Manufacturing Index (Graphs)

• House Prices: Case-Shiller and CoreLogic (House Price Graphs)

• NAR: Existing Home Sales (Graphs Existing Home)

• NAHB: Housing Market Index (Graph NAHB HMI)

• Census: Trade Balance (Graph Trade Balance)

• ***MBA: Mortgage Delinquency Data (Quarterly) (Graph MBA delinquency)

• ***LPS: Mortgage Delinquency Data (Graphs LPS Delinquency)

• ***CoreLogic: Negative Equity Report (quarterly) (Graphs Negative Equity)

• ***AIA: Architecture Billings Index (Graph ABI)

• ***Reis: Office, Mall, Apartment Vacancy Rates (Quarterly) (Graphs REIS Vacancy Rate)

• ***NMHC Apartment Survey (Quarterly) (Graph NMHC Survey)

D-List

• Reuters / Univ. of Michigan Consumer Confidence Index (Graph Consumer Confidence)

• MBA: Mortgage Purchase Applications Index (Graph MBA Index)

• BLS: Job Openings and Labor Turnover Survey (Graph JOLTS)

• Census: Construction Spending (Graph Construction Spending)

• 1Census: Housing Vacancy Survey (Quarterly) (Graphs Homeownerhip, Vacancy Rates)

• Fed: Senior Loan Officer Survey (Quarterly)

• AAR: Rail Traffic (Graph Transportation)

• ATA: Trucking (Graph Transportation)

• Ceridian-UCLA: Diesel Fuel Index (Graph Transportation)

• NFIB: Small Business Survey (Graphs NFIB Survey)

• Fed: Flow of Funds (Quarterly) (Graph Household Net Worth)

• STR: Hotel Occupancy (Graph Hotel Occupancy)

• CRE Prices: CoStar, Moody’s (Graphs)

• Manufacturers: Light Vehicle Sales (Graph Vehicle Sales)

• NRA: Restaurant Performance Index (Graph)

• Fed: Consumer Credit (Graph Consumer Credit)

• DOT: Vehicle Miles Driven (Graph Miles Driven)

• LA Port Traffic (Graph Port Traffic)

• BLS: Producer Price Index

• ADP Employment Report

• Conference Board Confidence Index

• NAR: Pending Home Sales

• Census: State Unemployment Rates, (graph)

1: There are questions about the accuracy of the HVS.

Sources (Government):

BEA: Bureau of Economic Analysis

BLS: Bureau of Labor Statistics

Census: Census Bureau

DOL: Dept of Labor

DOT: Dept. of Transportation

Fed: Federal Reserve

Sources (Industry):

AAR: Association of American Railroads

AIA: American Institute of Architects

ISM: Institute for Supply Management

LPS: Lender Processing Services

MBA: Mortgage Bankers Association

NAHB: National Association of Homebuilders

NAR: National Association of Realtors

NFIB: National Federation of Independent Business

NRA: National Restaurant Association

STR: Smith Travel Research

Saudi Arabia promises more oil production

by Calculated Risk on 6/10/2011 06:45:00 PM

Professor Jim Hamilton nailed it again when he wrote that the OPEC announcement was "largely irrelevant".

From the NY Times: Saudi Arabia Defies OPEC and Raises Oil Output

The Saudi newspaper Al-Hayat reported on Friday that oil officials there had decided to increase production to 10 million barrels a day in July, from 9.3 million barrels ...Of course Hamilton also wrote that "if you're interested in what OPEC members really plan to produce, my view is that actions speak louder than words" - so we need to see if these extra barrels from Saudi Arabia are actually produced.

Brent crude futures fell a little to $118.78 per barrel (WTI futures are back under $100).

Meanwhile gasoline prices are still falling, and are now down about 25 cents per gallon from the recent peak nationally (down over 33 cents per gallon where I live). And it looks like gasoline prices will probably fall some more over the next few weeks ...

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Housing: Sacramento Distressed Sales at high level in May

by Calculated Risk on 6/10/2011 01:37:00 PM

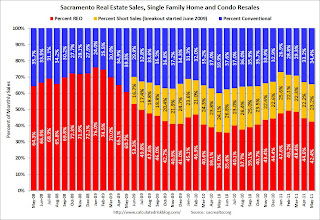

The percent of distressed sales in Sacramento decreased in May compared to April, but distessed sales are the highest percent of total sales for the month of May since Sacramento started breaking out REOs in May 2008, and short sales in June 2009.

This should be no surprise after Fannie and Freddie announced record REO sales in Q1. We should see a high level of REO and short sales all year (putting pressure on house prices).

Note: I've been following the Sacramento market to see the change in mix (conventional, REOs, short sales) in a distressed area. Here are the statistics.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows the percent of REO, short sales and conventional sales. There is a seasonal pattern for conventional sales (strong in the spring and summer), and distressed sales happen all year - so the percentage of distressed sales increases every winter.

Notes: Prior to June 2009, it is unclear if short sales were included as REO or as "conventional" - or some of both. The tax credits might have also boosted conventional sales in 2009 and early 2010.

In May 2011, 65.6% of all resales (single family homes and condos) were distressed sales. This is down from 66.8% in April (because of the seasonal pattern), but this is a very high percentage of distressed sales for May - and a high level of distressed sales suggests falling prices.

NY Fed's Dudley expects "Economic growth will pick up in the second half of 2011"

by Calculated Risk on 6/10/2011 10:10:00 AM

From NY Fed President William Dudley: The Road to Recovery: Brooklyn

On the national economy:

[E]conomic growth so far this year has been disappointing. Real GDP in the first quarter of 2011 grew at a tepid 1.8 percent annual rate, and the available data suggest that growth in the current quarter will not be much better.I think the downside key risk remains oil and gasoline prices. I'll have an update to my outlook soon ...

A major factor behind this slowdown is that real consumption growth (that is, spending on goods and services adjusted for price increases) has been slower than in the last quarter of 2010. This occurred, in part, because higher gasoline and food prices reduced the income that households could spend on other purchases. High energy prices also contributed to lower consumer confidence, which may have had an independent negative effect on consumer spending.

As noted, a number of economic indicators suggest that economic growth in the second quarter will also be subpar. Manufacturing production fell in April. Most business survey indicators, including the New York Fed's own Empire State Manufacturing Survey, also have declined recently, although most continue to signal some growth. The housing market remains very weak and home prices fell in early 2011. After a notable improvement earlier in the year, the labor market showed more softness recently: more workers filed for unemployment insurance in the past few weeks, firms added fewer jobs on net in May, and unemployment inched up in April and May.

In part, this softness is related to factors that I expect will prove transitory. These factors include the rapid rise in gas and food prices that I noted earlier, supply disruptions associated with the earthquake in Japan, and severe weather and flooding in parts of the United States. All three suggest that the soft patch may not persist. However, we continue to monitor the data for signs of more persistent weakness, whether related to the interaction of housing and consumption or some other factor.

Another reason to expect the economy to recover from this soft patch is that many fundamentals have improved since last year. In particular:

• Financial conditions have improved, albeit gradually, which makes it easier for larger, well-established firms to borrow and invest. However, new startups and smaller businesses continue to find credit difficult to access.

• With stock market prices higher than a year ago and household debt lower, household balance sheets are in better shape, which should support household spending.

• Demand abroad—particularly in Asia—still appears robust, supporting our exports.

• Most importantly, and notwithstanding the May jobs report, the labor market appears more solid than it was a year ago. Private firms added jobs at a faster pace over the last five months than they did last year. This growth has been strong enough to more than offset government layoffs. Unemployment is also noticeably lower than it was in November, after a decline that was rapid by historical standards.

Consequently, I anticipate that economic growth will pick up enough in the second half of 2011 to sustain a moderate economic recovery. Still, the pace of recovery probably will be painfully slow for the many unemployed and underemployed workers. Even if the economy added 300,000 jobs per month over the next year and a half, we would likely still have considerable labor market slack at the end of 2012.

Even though I expect a moderate economic recovery to be sustained, the recent disappointing data suggest that downside risks to the outlook have increased. Let me list some of them for you:

• As I mentioned earlier, high oil and commodity prices have further strained many families that already had tight budgets.

• The renewed decline in home prices could dampen consumer spending and housing activity more than I expect.

• The recent slowing of consumer spending growth could prompt businesses to limit hiring and investment.

• Finally, aggressive near-term government spending cuts or tax increases could slow economic growth at least in the short- to medium-term. I would emphasize, however, that a credible plan for long-term fiscal consolidation is sorely required and would have many economic benefits.

Although these issues bear watching, I still believe that they remain risks rather than the most likely outcomes. ... To sum up, despite the recent soft patch, economic conditions have improved in the past year. I expect a moderate recovery to continue.

Signs of financial distress?

by Calculated Risk on 6/10/2011 08:50:00 AM

A couple of stories. The first is about the recent selloff in risky assets (junk bonds), and the second is a little reminiscent of some of the funding issues back in 2008 (this time in Europe):

From the WSJ: 'Junk' Bond Market Hit by a Selloff (ht Brian)

A steep decline in prices of bonds backed by subprime mortgages has spread through the riskiest segments of the credit markets ... Weak economic data including falling home prices and disappointing jobs numbers have led investors to dump these securities ... The decline in high-yield, or "junk," corporate bonds accelerated after last week's employment figures, with prices falling nearly 1% on Thursday, the worst one-day loss in three months ...

And from the WSJ: Bond Deal May Augur More European Travails

Investors balked at buying a €1 billion ($1.46 billion) bond offering by Banco Santander SA that was backed by debt of Spanish local governments ... That left a group of big European banks that managed the deal holding roughly €500 million of the debt.Prior to the financial crisis, many banks were stuck with lousy Residential Mortgage Backed Security (RMBS) that they couldn't sell to investors (all that Alt-A and Wall Street subprime - the worst of the worst mortgage loans). This story, about European banks getting stuck with debt backed by local Spanish governments, reminds me of those problems (although the overall situation is not as dire).

The lack of demand ...underscores the jittery nature of the region's credit markets. That some of the biggest banks in Europe, including Commerzbank AG, HSBC Holdings PLC and Société Général SA, were left holding the bag also demonstrates how easily sovereign risk can spread around the euro zone.