by Calculated Risk on 6/11/2011 07:16:00 PM

Saturday, June 11, 2011

Schedule for Week of June 12th

Earlier:

• Summary for Week Ending June 10th

• Updated List: Ranking Economic Data

Several "B-List" reports will be released this week: Retail Sales, Industrial Production, Housing Starts and the Consumer Price Index (CPI). Some reports will clearly be impacted by the disaster in Japan - like May retail sales and Industrial Production - other reports might show some stabilization - like the June Empire State (NY Fed) and Philly Fed manufacturing surveys.

The Consumer Price Index (CPI) and the Producer Price Index (PPI) will probably show less inflation in May since energy prices declined last month.

Also two key housing reports will be released this week: June homebuilder confidence on Wednesday, and May housing starts on Thursday.

9:30 AM ET: Richmond Fed President Jeffrey Lacker, "Our History, Our Future: Manufacturing in the South" in Roanoke, Va.

7:30 AM: NFIB Small Business Optimism Index for May.

7:30 AM: NFIB Small Business Optimism Index for May. Click on graph for larger image in graph gallery.

This graph shows the small business optimism index since 1986. The index decreased to 91.2 in April from 91.9 in March. This has been trending up, although optimism has declined for two consecutive months now.

8:30 AM: Retail Sales for May.

8:30 AM: Retail Sales for May. This graph shows retail sales since 1992. This is monthly retail sales, seasonally adjusted (total and ex-gasoline).

Retail sales are up 17.0% from the bottom, and now 2.9% above the pre-recession peak.

The consensus is for retail sales to decrease 0.5% in May (0.3% increase ex-auto).

8:30 AM: Producer Price Index for May. The consensus is for a 0.1% increase in producer prices (0.2% core).

10:00 AM: Manufacturing and Trade: Inventories and Sales for April. The consensus is for a 0.9% increase in inventories.

2:30 PM: Speech by Fed Chairman Ben Bernanke, "Fiscal Sustainability", At the Committee for a Responsible Federal Budget Annual Conference, Washington, D.C.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index has been very weak over the last several months suggesting weak home sales through mid-year (not counting all cash purchases).

8:30 AM: Consumer Price Index for May. The consensus is for a 0.1% increase in prices. The consensus for core CPI is an increase of 0.2%.

8:30 AM ET: NY Fed Empire Manufacturing Survey for June. The consensus is for a reading of 13.0, up slightly from 11.9 in May.

9:15 AM ET: The Fed will release Industrial Production and Capacity Utilization for May.

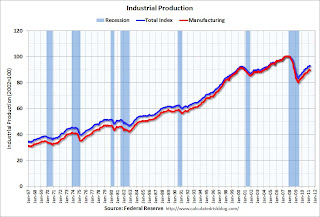

9:15 AM ET: The Fed will release Industrial Production and Capacity Utilization for May. This graph shows industrial production since 1967. Industrial production was unchanged in April at 93.1; previous months were revised down, so this was a decline from the previously reported level in March.

The consensus is for a 0.2% increase in Industrial Production in May, and an increase to 77.0% (from 76.9%) for Capacity Utilization.

10 AM: The June NAHB homebuilder survey. The consensus is for a reading of 16, unchanged from May. Any number below 50 indicates that more builders view sales conditions as poor than good. This index has been below 25 for forty seven consecutive months (almost 4 years).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a decrease to 420,000 from 427,000 last week.

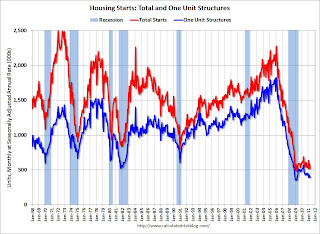

8:30 AM: Housing Starts for May. After collapsing following the housing bubble, housing starts have mostly been moving sideways for over two years - with slight ups and downs due to the home buyer tax credit.

8:30 AM: Housing Starts for May. After collapsing following the housing bubble, housing starts have mostly been moving sideways for over two years - with slight ups and downs due to the home buyer tax credit. This graph shows total and single unit starts since 1968.

Total housing starts were at 523 thousand (SAAR) in April, down 10.6% from the revised March rate of 585 thousand. Single-family starts decreased 5.1% to 394 thousand in April.

The consensus is for an increase to 547,000 (SAAR) in May.

10:00 AM: Philly Fed Survey for June. The consensus is for an increase to 7.0, up from 3.9 last month.

9:55 AM: Reuters/University of Mich Consumer Sentiment preliminary for June. The consensus is for a slight decrease to 74.0 from 74.3 in May.

10:00 AM: Conference Board Leading Indicators for May.

10:00 AM: Regional and State Employment and Unemployment for May 2011

Best wishes to All!