by Calculated Risk on 6/10/2011 06:45:00 PM

Friday, June 10, 2011

Saudi Arabia promises more oil production

Professor Jim Hamilton nailed it again when he wrote that the OPEC announcement was "largely irrelevant".

From the NY Times: Saudi Arabia Defies OPEC and Raises Oil Output

The Saudi newspaper Al-Hayat reported on Friday that oil officials there had decided to increase production to 10 million barrels a day in July, from 9.3 million barrels ...Of course Hamilton also wrote that "if you're interested in what OPEC members really plan to produce, my view is that actions speak louder than words" - so we need to see if these extra barrels from Saudi Arabia are actually produced.

Brent crude futures fell a little to $118.78 per barrel (WTI futures are back under $100).

Meanwhile gasoline prices are still falling, and are now down about 25 cents per gallon from the recent peak nationally (down over 33 cents per gallon where I live). And it looks like gasoline prices will probably fall some more over the next few weeks ...

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Housing: Sacramento Distressed Sales at high level in May

by Calculated Risk on 6/10/2011 01:37:00 PM

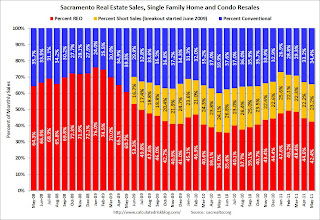

The percent of distressed sales in Sacramento decreased in May compared to April, but distessed sales are the highest percent of total sales for the month of May since Sacramento started breaking out REOs in May 2008, and short sales in June 2009.

This should be no surprise after Fannie and Freddie announced record REO sales in Q1. We should see a high level of REO and short sales all year (putting pressure on house prices).

Note: I've been following the Sacramento market to see the change in mix (conventional, REOs, short sales) in a distressed area. Here are the statistics.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows the percent of REO, short sales and conventional sales. There is a seasonal pattern for conventional sales (strong in the spring and summer), and distressed sales happen all year - so the percentage of distressed sales increases every winter.

Notes: Prior to June 2009, it is unclear if short sales were included as REO or as "conventional" - or some of both. The tax credits might have also boosted conventional sales in 2009 and early 2010.

In May 2011, 65.6% of all resales (single family homes and condos) were distressed sales. This is down from 66.8% in April (because of the seasonal pattern), but this is a very high percentage of distressed sales for May - and a high level of distressed sales suggests falling prices.

NY Fed's Dudley expects "Economic growth will pick up in the second half of 2011"

by Calculated Risk on 6/10/2011 10:10:00 AM

From NY Fed President William Dudley: The Road to Recovery: Brooklyn

On the national economy:

[E]conomic growth so far this year has been disappointing. Real GDP in the first quarter of 2011 grew at a tepid 1.8 percent annual rate, and the available data suggest that growth in the current quarter will not be much better.I think the downside key risk remains oil and gasoline prices. I'll have an update to my outlook soon ...

A major factor behind this slowdown is that real consumption growth (that is, spending on goods and services adjusted for price increases) has been slower than in the last quarter of 2010. This occurred, in part, because higher gasoline and food prices reduced the income that households could spend on other purchases. High energy prices also contributed to lower consumer confidence, which may have had an independent negative effect on consumer spending.

As noted, a number of economic indicators suggest that economic growth in the second quarter will also be subpar. Manufacturing production fell in April. Most business survey indicators, including the New York Fed's own Empire State Manufacturing Survey, also have declined recently, although most continue to signal some growth. The housing market remains very weak and home prices fell in early 2011. After a notable improvement earlier in the year, the labor market showed more softness recently: more workers filed for unemployment insurance in the past few weeks, firms added fewer jobs on net in May, and unemployment inched up in April and May.

In part, this softness is related to factors that I expect will prove transitory. These factors include the rapid rise in gas and food prices that I noted earlier, supply disruptions associated with the earthquake in Japan, and severe weather and flooding in parts of the United States. All three suggest that the soft patch may not persist. However, we continue to monitor the data for signs of more persistent weakness, whether related to the interaction of housing and consumption or some other factor.

Another reason to expect the economy to recover from this soft patch is that many fundamentals have improved since last year. In particular:

• Financial conditions have improved, albeit gradually, which makes it easier for larger, well-established firms to borrow and invest. However, new startups and smaller businesses continue to find credit difficult to access.

• With stock market prices higher than a year ago and household debt lower, household balance sheets are in better shape, which should support household spending.

• Demand abroad—particularly in Asia—still appears robust, supporting our exports.

• Most importantly, and notwithstanding the May jobs report, the labor market appears more solid than it was a year ago. Private firms added jobs at a faster pace over the last five months than they did last year. This growth has been strong enough to more than offset government layoffs. Unemployment is also noticeably lower than it was in November, after a decline that was rapid by historical standards.

Consequently, I anticipate that economic growth will pick up enough in the second half of 2011 to sustain a moderate economic recovery. Still, the pace of recovery probably will be painfully slow for the many unemployed and underemployed workers. Even if the economy added 300,000 jobs per month over the next year and a half, we would likely still have considerable labor market slack at the end of 2012.

Even though I expect a moderate economic recovery to be sustained, the recent disappointing data suggest that downside risks to the outlook have increased. Let me list some of them for you:

• As I mentioned earlier, high oil and commodity prices have further strained many families that already had tight budgets.

• The renewed decline in home prices could dampen consumer spending and housing activity more than I expect.

• The recent slowing of consumer spending growth could prompt businesses to limit hiring and investment.

• Finally, aggressive near-term government spending cuts or tax increases could slow economic growth at least in the short- to medium-term. I would emphasize, however, that a credible plan for long-term fiscal consolidation is sorely required and would have many economic benefits.

Although these issues bear watching, I still believe that they remain risks rather than the most likely outcomes. ... To sum up, despite the recent soft patch, economic conditions have improved in the past year. I expect a moderate recovery to continue.

Signs of financial distress?

by Calculated Risk on 6/10/2011 08:50:00 AM

A couple of stories. The first is about the recent selloff in risky assets (junk bonds), and the second is a little reminiscent of some of the funding issues back in 2008 (this time in Europe):

From the WSJ: 'Junk' Bond Market Hit by a Selloff (ht Brian)

A steep decline in prices of bonds backed by subprime mortgages has spread through the riskiest segments of the credit markets ... Weak economic data including falling home prices and disappointing jobs numbers have led investors to dump these securities ... The decline in high-yield, or "junk," corporate bonds accelerated after last week's employment figures, with prices falling nearly 1% on Thursday, the worst one-day loss in three months ...

And from the WSJ: Bond Deal May Augur More European Travails

Investors balked at buying a €1 billion ($1.46 billion) bond offering by Banco Santander SA that was backed by debt of Spanish local governments ... That left a group of big European banks that managed the deal holding roughly €500 million of the debt.Prior to the financial crisis, many banks were stuck with lousy Residential Mortgage Backed Security (RMBS) that they couldn't sell to investors (all that Alt-A and Wall Street subprime - the worst of the worst mortgage loans). This story, about European banks getting stuck with debt backed by local Spanish governments, reminds me of those problems (although the overall situation is not as dire).

The lack of demand ...underscores the jittery nature of the region's credit markets. That some of the biggest banks in Europe, including Commerzbank AG, HSBC Holdings PLC and Société Général SA, were left holding the bag also demonstrates how easily sovereign risk can spread around the euro zone.

Thursday, June 09, 2011

Las Vegas Lands sells for 15 percent of 2007 price

by Calculated Risk on 6/09/2011 08:32:00 PM

From Buck Wargo at the Las Vegas Sun: Land that sold for $30 million fetches $4.4 million after foreclosure

A 23.53-acre property at the Las Vegas Beltway and Hacienda Avenue that sold for $30.2 million in 2007 and was later foreclosed upon has been sold for $4.4 million.It is amazing that people were still paying crazy prices in 2007.

This is mixed use land, and the commercial real estate bust started later than the residential bust, but the usual pattern is for commercial real estate to follow residential real estate - both up and down. The housing bust was obvious to everyone by late 2006, so I'd think developers would have been avoiding commercial by then too. Apparently not ...

Earlier:

• Weekly Initial Unemployment Claims increase to 427,000

• Trade Deficit decreased to $43.7 billion in April

• Q1 Flow of Funds: Household Real Estate assets off $6.6 trillion from peak

• Graphs: Weekly Claims, Trade Deficit, Flow of Funds

Census Bureau on Homeownership Rate: We've got “Some 'Splainin' to Do”

by Calculated Risk on 6/09/2011 03:34:00 PM

CR Note: Economist Tom Lawler has written several articles on the different measures of homeownership and vacancy rates. Although some readers’ eyes will glaze over, this information is critically important for analyzing housing and the U.S. economy. I'm still thinking about the implications!

Ricky Ricardo, "I Love Lucy", 1951

From economist Tom Lawler:

My frustration with the conflicting data on US housing that comes from different reports from the Census Bureau, and the inability of Census analysts to explain the differences or even tell “private” analysts what time-series data they should use to analyze US housing trends, has existed for at least a decade. Occasionally that long-standing “frustration” has led me to write that it almost appears as if Census officials and analysts “don’t care” about the conflicting data.

Whether that was or was not the case in the past, it most certainly is not the case today. In fact, some Census folks called me up yesterday to discuss some of the issues, and to let me know that (1) they are “concerned” about the differences; (2) they understand that the differences in measures of key variables have significant implications for the outlook for housing and the outlook for construction employment, with potentially significant public policy implications; and (3) they are going to devote considerable time and effort to investigate the differences.

While this phone call was not “on the record” and as a result I won’t discuss any details, one senior Census official agreed that Census has got “some ‘splaining to do!” I view this as a most, most welcome sign!

As a reminder of the key differences, below is a summary table of a few vacancy rate and homeowner rates from the decennial Census, the Housing Unit Coverage Study (HUCs) estimates (reflecting post-decennial-Census analysis), and the Housing Vacancy Survey (first-half averages).

| Select Housing Measures: Decennial Census (4/1) | |||||

|---|---|---|---|---|---|

| 1990 | 2000 | 2010 | 2010 vs 1990 | 2010 vs 2000 | |

| Rental Vacancy Rate | 8.5% | 6.8% | 9.2% | 0.7% | 2.4% |

| Homeowner Vacancy Rate | 2.1% | 1.7% | 2.4% | 0.3% | 0.7% |

| Gross Vacancy Rate | 10.1% | 9.0% | 11.4% | 1.3% | 2.4% |

| Vacancy Rate ex Seasonal/Recreational/Occasional Use | 7.3% | 6.1% | 8.1% | 0.8% | 2.0% |

| Homeownership Rate | 64.2% | 66.2% | 65.1% | 0.9% | -1.1% |

| Gross Vacancy Rate, HUCS (4/1) | |||||

| 1990 | 2000 | 2010 | 2010 vs 1990 | 2010 vs 2000 | |

| Gross Vacancy Rate, HUCS1 | 10.5% | 9.2% | 11.4% | 0.9% | 2.1% |

| Select Housing Measures: HVS/CPS (H1) | |||||

| 1990 | 2000 | 2010 | 2010 vs 1990 | 2010 vs 2000 | |

| Rental Vacancy Rate | 7.2% | 7.9% | 10.6% | 3.4% | 2.7% |

| Homeowner Vacancy Rate | 1.7% | 1.5% | 2.6% | 0.9% | 1.1% |

| Gross Vacancy Rate | 11.4% | 11.7% | 14.5% | 3.1% | 2.8% |

| Vacancy Rate ex Seasonal/Recreational/Occasional Use | 7.5% | 7.5% | 9.9% | 2.4% | 2.4% |

| Homeownership Rate | 63.9% | 67.2% | 67.0% | 3.1% | -0.2% |

1 Obviously, there has not yet been a “Housing Unit Coverage Study” for Census 2010!!!

Q1 Flow of Funds: Household Real Estate assets off $6.6 trillion from peak

by Calculated Risk on 6/09/2011 12:45:00 PM

The Federal Reserve released the Q1 2011 Flow of Funds report this morning: Flow of Funds.

The Fed estimated that the value of household real estate fell $339 billion in Q1 to $16.1 trillion in Q1 2011, from just under $16.5 trillion in Q4 2010. The value of household real estate has fallen $6.6 trillion from the peak - and is still falling in 2011.

Household net worth peaked at $65.8 trillion in Q2 2007. Net worth fell to $49.4 trillion in Q1 2009 (a loss of over $16 trillion), and net worth was at $58.1 trillion in Q1 2011 (up $8.7 trillion from the trough).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This is the Households and Nonprofit net worth as a percent of GDP.

This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc) net of liabilities (mostly mortgages). Note that this does NOT include public debt obligations.

Note that this ratio was relatively stable for almost 50 years, and then we saw the stock market and housing bubbles.

This graph shows homeowner percent equity since 1952.

This graph shows homeowner percent equity since 1952.

Household percent equity (as measured by the Fed) collapsed when house prices fell sharply in 2007 and 2008.

In Q1 2011, household percent equity (of household real estate) declined to 38.1% as the value of real estate assets fell by $339 billion.

Note: something less than one-third of households have no mortgage debt. So the approximately 50+ million households with mortgages have far less than 38.1% equity - and 10.9 million households have negative equity.

The third graph shows household real estate assets and mortgage debt as a percent of GDP.

The third graph shows household real estate assets and mortgage debt as a percent of GDP.

Mortgage debt declined by $85 billion in Q1. Mortgage debt has now declined by $634 billion from the peak. Studies suggest most of the decline in debt has been because of defaults, but some of the decline is from homeowners paying down debt (sometimes so they can refinance at better rates).

Assets prices, as a percent of GDP, have fallen significantly and are only slightly above historical levels. However household mortgage debt, as a percent of GDP, is still historically very high, suggesting more deleveraging ahead for households.

Trade Deficit decreased to $43.7 billion in April

by Calculated Risk on 6/09/2011 09:15:00 AM

The Department of Commerce reports:

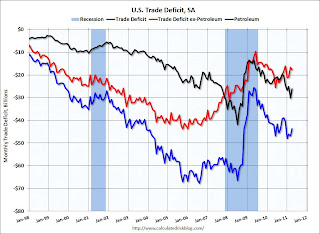

[T]otal April exports of $175.6 billion and imports of $219.2 billion resulted in a goods and services deficit of $43.7 billion, down from $46.8 billion in March, revised. April exports were $2.2 billion more than March exports of $173.4 billion. April imports were $1.0 billion less than March imports of $220.2 billion.The first graph shows the monthly U.S. exports and imports in dollars through April 2011.

Click on graph for larger image.

Click on graph for larger image.Exports increased in April and imports declined (seasonally adjusted). Exports are well above the pre-recession peak and up 19% compared to April 2010; imports are up about 16% compared to April 2010.

The second graph shows the U.S. trade deficit, with and without petroleum, through April.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.The petroleum deficit decreased in April as the quantity imported decreased sharply even as prices increased. Oil averaged $103.18 per barrel in April, up from $77.13 in April 2010. There is a bit of a lag with prices, but it is possible prices will be a little lower in May.

The trade deficit was smaller than the expected $48.9 billion.

Weekly Initial Unemployment Claims increase to 427,000

by Calculated Risk on 6/09/2011 08:30:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending June 4, the advance figure for seasonally adjusted initial claims was 427,000, an increase of 1,000 from the previous week's revised figure of 426,000. The 4-week moving average was 424,000, a decrease of 2,750 from the previous week's revised average of 426,750.The following graph shows the 4-week moving average of weekly claims for the last 40 years.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week to 424,000.

This is the ninth straight week with initial claims above 400,000, and the 4-week average is at about the same the level as in January. This suggests the labor market weakness in May is continuing into early June.

Wednesday, June 08, 2011

China: Another Year, Another Prediction of a Housing Bust

by Calculated Risk on 6/08/2011 08:54:00 PM

From the WSJ: The Great Property Bubble of China May Be Popping

Already, in nine major cities tracked by Rosealea Yao, an analyst at market-research firm Dragonomics, real-estate prices fell 4.9% in April from a year earlier. Last year, prices in those nine cities rose 21.5%; in 2009, the increase was about 10%, as China started to recover from the global economic crisis, with much steeper increases toward the end of that year.It is hard to tell what is happening in China - as I've mentioned over the years, at least from what we can tell, the amount of leverage in China is significant less than what we saw in the U.S. during the bubble (residential lending wasn't as crazy). So even if house prices dropped significantly, there wouldn't be as many homeowners with negative equity. Hopefully Professor Pettis will comment on this story!

...

If the Chinese housing market slows faster than people had expected, the impact would be felt in a number of markets that export heavily to China.

Earlier:

• CoreLogic House Price Graph, Real Prices, and Prices and Month-of-Supply