by Calculated Risk on 5/20/2011 10:00:00 AM

Friday, May 20, 2011

State Unemployment Rates "little changed or slightly lower": in April

From the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were generally little changed or slightly lower in April. Thirty-nine states recorded unemployment rate decreases, three states and the District of Columbia registered rate increases, and eight states had no rate change, the U.S. Bureau of Labor Statistics reported today.The following graph shows the current unemployment rate for each state (red), and the max during the recession (blue). If there is no blue, the state is currently at the maximum during the recession.

...

Nevada continued to register the highest unemployment rate among the states, 12.5 percent in April. California recorded the next highest rate, 11.9 percent. North Dakota reported the lowest jobless rate, 3.3 percent ...

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The states are ranked by the highest current unemployment rate.

Nevada saw the most improvement in April, but still has the highest state unemployment rate.

One states is still at the recession maximum (no improvement): Louisiana. Every other state has seen some improvement and only seven states have double digit unemployment now (19 states had double digit unemployment during the great recession).

Greece Bond Yields increase as Policymakers Disagree on Restructuring

by Calculated Risk on 5/20/2011 08:40:00 AM

From the Financial Times: ECB’s political tensions flare over Greece

This week, the ECB’s fierce opposition to Greece’s delaying debt repayments has erupted into a full-blown and public dispute. ... Jean-Claude Juncker, the Luxembourg prime minister who also chairs meetings of eurozone finance ministers, floated the idea of a “soft” restructuring ...From the FT Alphaville: The ECB goes all-in

In response, ECB policymakers accused him of “using meaningless phrases”.

Kash Mansori wonders Is the ECB Pushing Greece Out of the Euro-Zone?

The yield on Greece ten year bonds increased to a record 16.5% today and the two year yield was up slightly to 25.1%.

Yields for other European countries are not increasing - yet. Here are the ten year yields for Ireland at 10.5%, Portugal at 9.3%, and Spain at 5.5%.

Thursday, May 19, 2011

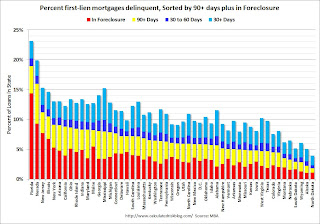

Mortgage Delinquencies by State: Percent and Number

by Calculated Risk on 5/19/2011 07:38:00 PM

Here are two more graphs based on the MBA Q1 National Delinquency Survey released this morning.

Earlier the MBA released a graph of the percent of loans "in foreclosure" by state. The following graph is similar, but includes all delinquent loans (sorted by percent seriously delinquent).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

Florida and Nevada have the highest percentage of serious delinquent loans, followed by New Jersey, Illinois, New York, Arizona and California.

Comment: It has always bothered me that several southern states always have an elevated percentage of mortgage loans 30+ day delinquent (Mississippi, Alabama, Texas, Georgia, and Louisiana all have a large percentage light blue). Most of these borrowers always seem to catch up - they just make their payments late. That means the lenders generate plenty of late fees in these states. This might be something for the Consumer Financial Protection Bureau to investigate.

The second graph shows the number of loans delinquent in each state (as opposed to the percent). California is the largest state, so it is no surprise that the number of delinquent loans is very high (I'd expect California to always be #1). In that sense this graph is misleading - in reality California is in about the same shape as New York, Arizona, Ohio and Rhode Island (first graph).

The second graph shows the number of loans delinquent in each state (as opposed to the percent). California is the largest state, so it is no surprise that the number of delinquent loans is very high (I'd expect California to always be #1). In that sense this graph is misleading - in reality California is in about the same shape as New York, Arizona, Ohio and Rhode Island (first graph).

There are plenty of problems in California, but nothing like Florida. Florida has 57% the number of mortgages as California, but more delinquent loans. In most ways, dividing this by states is arbitrary - except the foreclosure process matters. States with only judicial foreclosures tend to have many more loans in the foreclosure process (just because it takes longer).

Earlier:

• April Existing Home Sales: 5.05 million SAAR, 9.2 months of supply

• MBA: Total Delinquencies essentially unchanged in Q1 Seasonally Adjusted

• Philly Fed Survey shows "regional manufacturing activity grew slightly in May"

• Weekly Initial Unemployment Claims declines to 409,000, 4-Week average highest since November

• Existing Home Sales graphs

Existing Home Sales: Investors, Distressed Sales and First Time Buyers

by Calculated Risk on 5/19/2011 03:48:00 PM

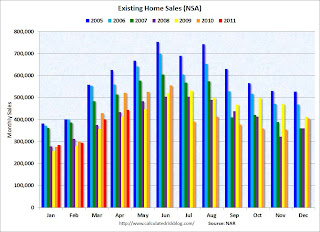

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

The red columns are for 2011.

Sales NSA are below the tax credit boosted level of sales in April 2010, but slightly above the level of March sales in 2008 and 2009.

The level of sales is elevated due to all the investor buying. The NAR noted:

All-cash transactions stood at 31 percent in April, down from a record level of 35 percent in March; they were 26 percent in March 2010; investors account for the bulk of cash purchases.Another survey, the Campbell/Inside Mortgage Finance HousingPulse Tracking Survey "showed the proportion of first-time homebuyers in the housing market fell to 35.7% in April compared to 43.4% a year earlier.

...

First-time buyers purchased 36 percent of homes in April, up from 33 percent in March; they were 49 percent in April 2010 when the tax credit was in place. Investors slipped to 20 percent in April from 22 percent of purchase activity in March; they were 15 percent in April 2010. The balance of sales was to repeat buyers, which were 44 percent in April.

...

[The] Distressed Property Index, a key measure of the health of the U.S. housing market, fell slightly to 47.7% in April, although sales of distressed properties continued to account for nearly half of the market."

This graph shows from Campbell/Inside Mortgage Finance HousingPulse Tracking Survey shows both distressed sales and first time buyers. From the survey:

This graph shows from Campbell/Inside Mortgage Finance HousingPulse Tracking Survey shows both distressed sales and first time buyers. From the survey: First-time homebuyers absorb housing supply, while move-up and move-down buyers produce no net take-up in inventory. When the supply of distressed properties exceeds the demand from first-time homebuyers, investors must step into the market to buy these properties, often at bargain-basement prices.Clearly investors are picking up the slack, and this has kept overall existing home sales elevated.

Investors accounted for 23.0% of the housing market in the month of April, up from 18.0% a year earlier, according to the HousingPulse Survey. A common business model for investors has been to buy damaged properties, renovate, and sell the properties to first-time homebuyers. But increasingly, investors are being forced to put renovated properties out as rental units as demand from first-time buyers drops.

Update for clarity: The Campbell press release suggets some investors are being "forced" to rent because they can't flip. I've spoken with several cash buyer investors who have told me they are buying for cash flow (to rent, not flip), so the word "forced" is probably inaccurate in many cases (not that it makes any difference). These buyers are helping clear out the excess inventory - although many of these properties are probably future supply.

Philly Fed Survey shows "regional manufacturing activity grew slightly in May"

by Calculated Risk on 5/19/2011 01:58:00 PM

Catching up ... from the Philly Fed this morning: May 2011 Business Outlook Survey

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, decreased from 18.5 in April to 3.9, its lowest reading since last October. [any reading above zero is expanion]. The demand for manufactured goods, as measured by the current new orders index, showed a similar slowing: The index fell 13 points while the shipments index declined 23 points; both remained positive, however, suggesting slight growth last month. For the first time in eight months, firms reported that unfilled orders and delivery times were falling — both indexes were slightly negative this month.This indicates continued expansion in May, but at a sharply slower pace. This was well below the consensus of 20.0.

Firms’ responses continue to indicate overall improvement in the labor market despite weaker activity, orders, and shipments. The current employment index increased nearly 10 points and has now remained positive for eight consecutive months.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through May. The ISM and total Fed surveys are through April.

This early reading suggests the ISM index will be in the mid 50s in May.

Note: It is possible that this survey was impacted by supply chain disruption issues related to the earthquake in Japan - but I didn't see any mention of it. Interesting that this is the fifth highest employment index since the survey began in 1968.

Earlier:

• April Existing Home Sales: 5.05 million SAAR, 9.2 months of supply

• MBA: Total Delinquencies essentially unchanged in Q1 Seasonally Adjusted

• Weekly Initial Unemployment Claims declines to 409,000, 4-Week average highest since November

• Existing Home Sales graphs

MBA: Total Delinquencies essentially unchanged in Q1 Seasonally Adjusted

by Calculated Risk on 5/19/2011 11:45:00 AM

The MBA reported that 12.84 percent of mortgage loans were either one payment delinquent or in the foreclosure process in Q1 2011 (seasonally adjusted). This is essentially the same as in Q4. There was a significant decline in Not Seasonally Adjusted (NSA) delinquencies, but that is the usual seasonal pattern.

The following graph shows the percent of loans delinquent by days past due.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

Loans 30 days delinquent increased to 3.35% from 3.26% in Q4. This is below the average levels of the last 2 years, but still higher than normal.

Delinquent loans in the 60 day bucket were unchanged at 1.35%; this is the lowest since Q2 2008.

There was a slight increase in the 90+ day delinquent bucket. This increased from 3.62% in Q4 to 3.65% in Q1 2011.

The percent of loans in the foreclosure process decreased to 4.52%.

Note: Because of the high level of delinquencies, there are some questions about the accuracy of the seasonal adjustment (similar to Q1 2010 - and also the problems with Case-Shiller House prices).

A couple of comments from MBA chief economist Jay Brinkmann on the conference call:

• "Bulk of problem loans were originated in 2005, 2006, and 2007." The lenders are still working through those loans.

• Brinkmann: "Outlook is good. Market is on the mend."

• Florida has 24% of all loans in the foreclosure process. California is 2nd with 11% (but based on the size of the state that is actually below the national average as the next graph shows).

Florida, Nevada, New Jersey and Illinois are the top four states with loan in the foreclosure process.

Note: the MBA's National Delinquency Survey (NDS) covered "MBA’s National Delinquency Survey covers about 43.7 million first-lien mortgages on one- to four-unit residential properties" and the "The NDS is estimated to cover around 88 percent of the outstanding first-lien mortgages in the market." This gives almost 50 million total first lien mortgages or about 6.4 million delinquent or in foreclosure.

From the MBA: Significant Declines in 90+ Day Delinquencies and Foreclosures in Latest MBA National Delinquency Survey

The delinquency rate for mortgage loans on one-to-four-unit residential properties increased to a seasonally adjusted rate of 8.32 percent of all loans outstanding as of the end of the first quarter of 2011, an increase of seven basis points from the fourth quarter of 2010, and a decrease of 174 basis points from one year ago, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey. The non-seasonally adjusted delinquency rate decreased 117 basis points to 7.79 percent this quarter from 8.96 percent last quarter.Note: 8.32% (SA) and 4.52% equals 12.84%.

...

The percentage of loans in foreclosure, also known as the foreclosure inventory rate, decreased 12 basis points overall to 4.52.

This data is a little confusing on a national basis because of the seasonal issues - and because of the concentration of problems in Florida and other states. Last year I thought overall delinquencies had peaked (that appears correct), and I think delinquencies will decline further this year as lenders work through the backlog of loans from 2005 through 2007. There was a slight increase in the 30 day delinquency bucket, possibly because of lower house prices - that is something to watch carefully over the next few quarters.

April Existing Home Sales: 5.05 million SAAR, 9.2 months of supply

by Calculated Risk on 5/19/2011 10:00:00 AM

The NAR reports: April Existing-Home Sales Ease

Existing-home sales1, which are completed transactions that include single-family, townhomes, condominiums and co-ops, eased 0.8 percent to a seasonally adjusted annual rate of 5.05 million in April from a downwardly revised 5.09 million in March, and are 12.9 percent below a 5.80 million pace in April 2010; sales surged in April and May of 2010 in response to the home buyer tax credit.

...

Total housing inventory at the end of April increased 9.9 percent to 3.87 million existing homes available for sale, which represents a 9.2-month supply4 at the current sales pace, up from an 8.3-month supply in March.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in April 2011 (5.05 million SAAR) were 0.8% lower than last month, and were 12.9% lower than in April 2010.

The second graph shows nationwide inventory for existing homes.

The second graph shows nationwide inventory for existing homes.According to the NAR, inventory increased to 3.87 million in April from 3.52 million in March.

Inventory is not seasonally adjusted and there is a clear seasonal pattern with inventory peaking in the summer and declining in the fall and winter. Inventory will probably increase over the next several months.

The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Inventory is not seasonally adjusted, so it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory - so the increase in months-of-supply during the Spring is expected.

Although inventory increased from March to April (as usual), inventory decreased 3.9% year-over-year in April from April 2010. This is the third consecutive month with a YoY decrease in inventory.

Although inventory increased from March to April (as usual), inventory decreased 3.9% year-over-year in April from April 2010. This is the third consecutive month with a YoY decrease in inventory.Inventory should increase over the next few months and peak in the summer (the normal seasonal pattern), and the YoY change is something to watch closely this year.

Months of supply increased to 9.2 months in April, up from 8.3 months in March. The months of supply will probably increase over the next few months as inventory increases. This is much higher than normal.

These sales numbers were below the consensus of 5.2 million SAAR, but the key number is the year-over-year change in inventory, and that suggests less downward pressure on house prices even though inventory is well above normal (I'll have more later - here is the NSA chart)

UPDATE: Some people misread what I wrote. There is STILL downward pressure on house prices from the high level of inventory, but the year-over-year decline suggests "less" downward pressure. "Less" does not mean "none". Of course there is also downward pressure from all the distressed sales.

Weekly Initial Unemployment Claims declines to 409,000, 4-Week average highest since November

by Calculated Risk on 5/19/2011 08:30:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending May 14, the advance figure for seasonally adjusted initial claims was 409,000, a decrease of 29,000 from the previous week's revised figure of 438,000. The 4-week moving average was 439,000, an increase of 1,250 from the previous week's revised average of 437,750.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the 4-week moving average of weekly claims for the last 40 years. The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased this week to 439,000.

This is the highest level for the 4-week average since last November.

Note: It appears there were some temporary factors over the last few weeks that led to higher weekly unemployment claims. I expect the 4-week average to decline over the next few weeks, but it is concerning that the average is above 400,000 again.

_________________________________________________________

Schedule Update: At 10 AM ET the following will be released:

1) April Existing home sales

2) MBA Q1 Delinquency report

3) Philly Fed manufacturing survey

4) Conference Board leading indicators

I plan on posting on existing home sales. Then I'll be on the MBA conference call - and post on that data - and then I'll get back to the Philly Fed.

Wednesday, May 18, 2011

Tough Job Market for recent College Graduates

by Calculated Risk on 5/18/2011 09:46:00 PM

From Catherine Rampell at the NY Times: Many With New College Degree Find the Job Market Humbling

Employment rates for new college graduates have fallen sharply in the last two years, as have starting salaries for those who can find work. What’s more, only half of the jobs landed by these new graduates even require a college degree ...And many of there recent graduates are saddled with excessive student debt - a difficult situation and a poor time to start a career.

The median starting salary for students graduating from four-year colleges in 2009 and 2010 was $27,000, down from $30,000 for those who entered the work force in 2006 to 2008, according to a study released on Wednesday ...

Among the members of the class of 2010, just 56 percent had held at least one job by this spring, when the survey was conducted. That compares with 90 percent of graduates from the classes of 2006 and 2007.

Three Releases Tomorrow: Mortgage Delinquencies, Existing Home Sales, Unemployment Claims

by Calculated Risk on 5/18/2011 05:48:00 PM

Tomorrow morning will be busy, and I just wanted to touch on these three releases:

• Weekly Initial Unemployment Claims. The number of claims jumped up in recent weeks and this raises a key question: Is this a sign of renewed weakness in the labor market, or was the increase temporary? Goldman Sachs put out a note earlier this week arguing the increase in claims was mostly temporary due to auto-sector layoffs (related to supply chain and the earthquake in Japan), some unusual seasonal factors mostly (timing of Easter and shifting school holidays) and a few other miscellaneous factors. There were probably also some storm / flooding related claims, so we might not see a huge decline in the report tomorrow. The consensus is for a decrease to 420,000 from 434,000 last week - and this will be important to watch over the next few weeks.

• The Mortgage Bankers Association (MBA) will release the Q1 National Delinquency Survey (NDS) survey. My guess is this will show a sharp decline in overall delinquencies, but probably a record percentage of loans in the foreclosure process. I expect this will be viewed as good news (because of the sharp decline in overall delinquencies). I'll be on the conference call at 10:30 AM and pass along the comments.

• Existing Home Sales for April. Tom Lawler is estimating that the NAR will report that "existing home sales ran at a seasonally adjusted annual rate of 5.15 million in April, up 1% from March’s pace, but down 11.2% from last April’s tax-credit-goosed pace".

Probably more important than sales is the change in inventory. This is hard to predict, but Lawler expects a modest 1.5-2.0% increase from March to April. However Tom has warned that the NAR seems to always show a huge inventory increase in April, and even though the number is suspect, inventory is probably the key number in tomorrow's report.

Last April, the NAR reported inventory at 4.029 million units, and NAR reported 3.549 million in March 2011. It would take a pretty large month-to-month increase to see a positive year-over-year change in inventory.

This graph based on the March shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Inventory is not seasonally adjusted, so it really helps to look at the YoY change.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

Although inventory increased from February to March (as usual), inventory decreased 2.1% year-over-year in March (from March 2010). This is the second consecutive month with a small YoY decrease in inventory.

Although inventory is already very high, if the trend of declining year-over-year inventory continues there would be less pressure on house prices. Note: There are also questions about "active" inventory since it seems more homes are "pending" or otherwise not active in the listings, but that will not be addressed in the release tomorrow.