by Calculated Risk on 5/06/2011 06:12:00 PM

Friday, May 06, 2011

Bank Failure #40 in 2011: Coastal Bank, Cocoa Beach, Florida

Dreaming of lamps and Genie's

To wish trouble gone

by Soylent Green is People

From the FDIC: Premier American Bank, National Association, Miami, Florida, Assumes All of the Deposits of Coastal Bank, Cocoa Beach, Florida

As of March 31, 2011, Coastal Bank had approximately $129.4 million in total assets and $123.9 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $13.4 million. ... Coastal Bank is the 40th FDIC-insured institution to fail in the nation this year, and the fifth in Florida.It is Friday!

Misc: Greece, Consumer Credit, Housing Inventory

by Calculated Risk on 5/06/2011 03:50:00 PM

A few stories:

• Earlier today there was a rumor that Greece was considering leaving the Euro. This was based on a story in Der Spiegel. Greece has denied the report, from Reuters:

A small group of European finance ministers was meeting on Friday to discuss the euro zone debt crisis, official sources told Reuters ... "The report about Greece leaving the euro zone is untrue," [Greece's Deputy Finance Minister Filippos] Sachinidis told Reuters. "Such reports undermine Greece and the euro and serve market speculation games."• On consumer credit, the Federal Reserve reported:

Jean-Claude Juncker, head of the group of euro zone finance ministers, also said the report was wrong. "I totally deny that there is a meeting, these reports are totally wrong," Juncker's spokesman, Guy Schuller, told Reuters by telephone.

Consumer credit increased at an annual rate of 3 percent in March, with revolving and nonrevolving credit increasing at a similar rate. In the first quarter, consumer credit also increased at an annual rate of 3 percent.• On housing inventory from Tom Lawler:

[A]ccording to HousingTracker.net active listings in the week ended May 2nd in the Cape Coral, Jacksonville, Miami, Orlando, and Tampa metro areas were down a combined 20.5% from a year ago. For all of the 54 metro areas tracked by HousingTracker (which combined accounted for listings of about 1.1 million), active listings were down 8.1% from a year ago.I watch inventory closely, and I just wanted to pass that on.

Employment: A dirty little secret and more graphs

by Calculated Risk on 5/06/2011 01:25:00 PM

First, anyone who adds (or subtracts) the Not Seasonally Adjusted (NSA) birth/death model numbers from the headline SA payroll employment is clueless. Someone sent me this "analysis" today: "... you exclude the 62K from McDonalds hirings, and 175K from the Birth Death Adjustment, and end up with.... +7K jobs". That is complete nonsense. The key issue with the birth/death model is it misses turning points; otherwise it is an important part of the monthly estimate.

Second, I was reminded of a "dirty little secret" when I read Paul Krugman's column this morning. Krugman wrote about how the "D.C. economic discourse is saturated with fear" of "invisible monsters", but that no one seems to care about the very real plight of the millions of unemployed.

Actually it really isn't much of a secret that Wall Street and corporate America like the unemployment rate to be a little high. But it is "dirty" in the sense that it is unspoken. Higher unemployment keeps wage growth down, and helps with margins and earnings - and higher unemployment also keeps the Fed on the sidelines. Yes, corporations like to see job growth, so people have enough confidence to spend (and they can have a few more customers). And they definitely don't want to see Depression era unemployment - but a slowly declining unemployment rate (even at 9%) with some job growth is considered OK.

I just want to be clear: I don't think 9% unemployment is OK. It is pretty $%^# far from OK. (think Marsellus Wallace in "Pulp Fiction" for my non-G rated reaction). I'm amazed that unemployment isn't the key topic in D.C., but the unemployed don't make political contributions. (Ok, enough rant).

Here are a few more graphs based on the employment report ...

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

In general, all four categories are trending down, althoug the "less than 5 weeks" category increased this month. Note that the "less than 5 weeks" used to be much higher, even during periods of strong job growth. This is probably because of a change in hiring practices that resulted in less turnover.

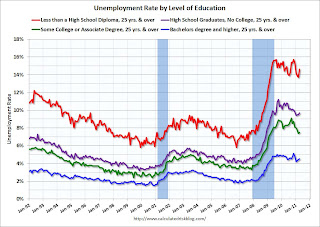

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).Unfortunately this data only goes back to 1992 and only includes one previous recession (the stock / tech bust in 2001). Clearly education matters with regards to the unemployment rate - and it appears all four groups are generally trending down, although all categories saw an increase in April.

This is a little more technical. The BLS diffusion index for total private employment was at 64.6 in April, and for manufacturing, the diffusion index increased to 65.4.

This is a little more technical. The BLS diffusion index for total private employment was at 64.6 in April, and for manufacturing, the diffusion index increased to 65.4. Think of this as a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.The level of both indexes was a clear positive in the April employment report.

What we want is a large number of high paying jobs added each month, spread across many industries. What we got was some improvement in jobs added, although not high paying jobs - but fairly widespread.

Best to all

Here are the earlier employment posts (with graphs):

• April Employment Report: 244,000 Jobs, 9.0% Unemployment Rate

• Employment Summary, Part Time Workers, and Unemployed over 26 Weeks

• Employment Graph Gallery

Employment Summary, Part Time Workers, and Unemployed over 26 Weeks

by Calculated Risk on 5/06/2011 10:19:00 AM

A common question is why the unemployment rate increased to 9.0% even though 244 thousand payroll jobs were added? This is because the data comes from two separate surveys. The establishment survey showed a gain of 244,000 payroll jobs in April, but the household survey showed a loss of 190,000 jobs.

The number to use for jobs is the establishment survey, but the unemployment rate is based on the household survey. The two surveys can diverge over the short period, but over time it will all work out.

Here are a few more graphs based on the employment report ...

Percent Job Losses During Recessions

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows the job losses from the start of the employment recession, in percentage terms - this time aligned at the start of the recession.

In the previous post, the graph showed the job losses aligned at maximum job losses.

In terms of lost payroll jobs, the 2007 recession is by far the worst since WWII.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) was little changed over the month, at 8.6 million. These individuals were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of workers only able to find part time jobs (or have had their hours cut for economic reasons) increased to 8.6 million in April from 8.43 million in March.

These workers are included in the alternate measure of labor underutilization (U-6) that increased to 15.9% in April from 15.7% in March. This is very high.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 5.839 million workers who have been unemployed for more than 26 weeks and still want a job. This was down from 6.122 million in March. This remains very high, and is one of the defining features of this employment recession.

Summary

This was another mixed report.

So far the economy has added 854,000 private sector jobs this year, or 213,500 per month. There have been 768,000 total non-farm jobs added this year or 192,000 per month.

This is a much better pace of payroll job creation than last year, but the economy still has 6.955 million fewer payroll jobs than at the beginning of the 2007 recession. At this pace, it will take 3 years just to get back to the pre-recession level, or sometime in 2014! Considering the depth of the recession, this remains a sluggish jobs recovery (not unexpected following a financial crisis).

This pace of job growth is just more than enough to keep up with the growth in the labor force, so it will only push down the unemployment rate slowly. The unemployment rate has declined from 9.4% in December 2010 to 9.0% in April.

The increase in the unemployment rate from 8.8% to 9.0% in April, was bad news, especially since the participation rate was unchanged at 64.2%. Note: This is the percentage of the working age population in the labor force. I expect the participation rate to move a little higher as the job market improves, and that will keep the unemployment rate elevated all year.

The increase in the the number of part time workers for economic reasons, and the increase in U-6 to 15.9% were more bad news. There are a total of 13.75 million Americans unemployed.

The average workweek was unchanged at 34.3 hours, and average hourly earnings increased slightly.

Overall this was another small step in the right direction for payroll jobs, but this report reminds us that unemployment and underemployment are critical problems in the U.S.

• Earlier Employment post: April Employment Report: 244,000 Jobs, 9.0% Unemployment Rate

April Employment Report: 244,000 Jobs, 9.0% Unemployment Rate

by Calculated Risk on 5/06/2011 08:30:00 AM

From the BLS:

Nonfarm payroll employment rose by 244,000 in April, and the unemployment rate edged up to 9.0 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in several service-providing industries, manufacturing, and mining.The following graph shows the employment population ratio, the participation rate, and the unemployment rate.

...

The change in total nonfarm payroll employment for February was revised from +194,000 to +235,000, and the change for March was revised from +216,000 to +221,000.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The unemployment rate increased to 9.0% (red line).

The Labor Force Participation Rate was unchanged at 64.2% in April (blue line). This is the percentage of the working age population in the labor force. The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although some of the decline is due to the aging population.

The Employment-Population ratio decreased slightly to 58.4% in April (black line).

The second graph shows the job losses from the start of the employment recession, in percentage terms aligned at maximum job losses. The dotted line is ex-Census hiring.

The second graph shows the job losses from the start of the employment recession, in percentage terms aligned at maximum job losses. The dotted line is ex-Census hiring. The current employment recession is by far the worst recession since WWII in percentage terms, and 2nd worst in terms of the unemployment rate (only the early '80s recession with a peak of 10.8 percent was worse).

This was above expectations for payroll jobs, and below expectations for the unemployment rate. I'll have much more soon ...

Thursday, May 05, 2011

Japan: Fukushima Daiichi Reactor Update

by Calculated Risk on 5/05/2011 10:07:00 PM

I haven't posted an update for some time. John Glionna and Kenji Hall at the LA Times provide a rough timeline: Workers enter damaged Fukushima reactor

The recovery team began a project to lower radiation levels by installing six ventilation machines that would absorb isotopes from the air in the No. 1 reactor ...A long slow process.

Tomikawa said it should take two or three days to put in the ventilation system. He estimated that the work to install the reactor's new cooling system could begin as soon as May 16.

... The company plans to add cooling equipment for reactors Nos. 2 and 3 sometime in the next two months ...

Under a two-phase plan, the company expects to spend three months cooling the reactors and plugging radiation leaks. ...

During the second phase, which is expected to take about six months, Tepco hopes to put the reactors into a stable state ... but deactivating the reactors could take years to complete.

Earlier:

• Weekly Initial Unemployment Claims sharply higher

• NMHC Quarterly Apartment Survey: Market Conditions Tighten

• Clear Capital Home Price Index shows Double Dip

Survey: Small Business Hiring in April "Disappointing"

by Calculated Risk on 5/05/2011 05:43:00 PM

The National Federation of Independent Business (NFIB) will release their April survey on Tuesday, May 10th. Here is a pre-release of the employment results from NFIB: NFIB Jobs Statement: Hiring Trends Inconsistent and Disappointing

“Four months into 2011, the trajectory for small-business hiring appears inconsistent and disappointing. February and March gave us some hope, but in April, the average number of net new jobs slipped from 0.17 per firm to 0.04. With fewer increases in new hires and more reports of shrinkage in workforces, we can expect the April job numbers to be a disappointment.

Drilling down into the (seasonally adjusted) numbers:

• 8 percent of those surveyed increased employment;

• 15 percent reduced employment; and,

• 14 percent reported unfilled job openings, down 1 point from last month.

“And the outlook for future employment growth remains unchanged from March: Only 16 percent plan to increase employment, and 6 percent plan to reduce their workforce, yielding a seasonally adjusted net 2 percent of owners planning to create new jobs in the next three months.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the net hiring plans for the next three months.

Hiring plans were unchanged in April and still slightly positive.

Small businesses have a larger percentage of real estate and retail related companies than the overall economy. With the high percentage of real estate (including small construction companies), I expect small business hiring to remain sluggish for some time.

This is another somewhat disappointing employment indicator along with the ISM surveys, the ADP employment report and initial weekly claims.

The consensus for the April employment report is 185,000 with the unemployment rate unchanged at 8.8% (to be released tomorrow at 8:30 AM ET).

Lawler: Census Releases Demographic Profile of 12 States and DC: Confirms Bias of HVS

by Calculated Risk on 5/05/2011 02:47:00 PM

CR Note: The Census Bureau is releasing the demographic profile data for every state this month. Many analysts use the quarterly Census HVS to track the homeownership rate - and to calculate the excess supply of housing units. Important: Estimates using the HVS appear to overstate the excess supply. When all the data is released (by the end of May), we will probably have a better estimate of the excess supply as of April 1, 2010.

From economist Tom Lawler: The Census Bureau released the “Demographic Profile” from Census 2010 for 12 states and DC today, and the release confirmed several of the biases I have noted in the Census’ quarterly Housing Vacancy Survey. As I’ve shown before, the HVS showed higher homeownership rates than either the 2000 decennial Census or the American Community Survey, and that overstatement continued for 2010. Below is a comparison of the homeownership rate from the decennial Census for April 1, 2010 with the HVS average homeownership for the first half of 2010. (The HVS quarterly data are monthly averages). Also shown are the homeownership rates for April 1, 2000 from Census 2000.

| Homeownership Rate (%), Census 2010, Census 2000, and Housing Vacancy Survey | |||||

|---|---|---|---|---|---|

| Census 2010, April 1 | HVS, First Half 2010 | Census vs. HVS | Census 2000, April 1 | Census 2010 vs. Census 2000 | |

| DC | 42 | 45.1 | -3.1 | 40.8 | 1.2 |

| Florida | 67.4 | 70.3 | -2.9 | 70.1 | -2.7 |

| Kentucky | 68.7 | 71.3 | -2.6 | 70.8 | -2.1 |

| Maine | 71.3 | 73.6 | -2.3 | 71.6 | -0.3 |

| Massachusetts | 62.3 | 64.4 | -2.1 | 61.7 | 0.6 |

| Michigan | 72.1 | 74.5 | -2.4 | 73.8 | -1.7 |

| Mississippi | 69.6 | 73.5 | -3.9 | 72.3 | -2.7 |

| New Mexico | 68.5 | 68.8 | -0.3 | 70 | -1.5 |

| North Dakota | 65.4 | 67.4 | -2 | 66.6 | -1.2 |

| Rhode Island | 60.7 | 63.6 | -2.9 | 60 | 0.7 |

| South Carolina | 69.3 | 74.5 | -5.2 | 72.2 | -2.9 |

| Tennessee | 68.2 | 71 | -2.8 | 68.2 | 0 |

| West Virginia | 73.4 | 79.1 | -5.7 | 75.2 | -1.8 |

This early look strongly suggests that there are material sampling problems with the HVS that need to be addressed, and suggests that the HVS data probably should not be used to analyze the US housing stock, or estimate the “excess supply” of housing.

CR Note: A key number for the U.S. economy is the excess supply of vacant housing units. The decennial Census probably provides the best estimate, and that is already over a year out of date.

NMHC Quarterly Apartment Survey: Market Conditions Tighten

by Calculated Risk on 5/05/2011 11:29:00 AM

From the National Multi Housing Council (NMHC): Apartment Sector Sets Records In Market Tightness And Equity Availability, NMHC Market Conditions Survey Finds

The Market Tightness Index, which examines vacancies and rents, rose to a record 90 from 78 last quarter. ... Almost four in five respondents (79%) said markets were tighter (lower vacancies and/or higher rents) and—for the first time ever—not a single respondent thought conditions were looser.

“The apartment industry rebounded strongly in 2010 as demand for apartment residences outpaced the sluggish recovery in the job market nationally,” said NMHC Chief Economist Mark Obrinsky. “These results show the apartment industry continues to do well even though the nation’s overall rate of economic growth has slowed. This is driven largely by the increased appeal of renting generally but also by the large number of young people entering the housing market for the first time—and young people are much more likely to rent than buy.”

Click on graph for larger image in graph gallery.

This graph shows the quarterly Apartment Tightness Index.

The index has indicated tighter market conditions for the last five quarters and increased to a record 90 in April. A reading above 50 suggests the vacancy rate is falling and / or rents are rising. This data is a survey of large apartment owners only.

This fits with the recent Reis data showing apartment vacancy rates fell in Q1 2011 to 6.2%, down from 6.6% in Q4 2010, and 8% in the Q1 2010.

Two key points I've made over and over are 1) with falling vacancy rates and rising rents, the number of multi-family starts will pick up sharply this year (but still be well below normal), and 2) this pickup will lead to a positive contribution to GDP and payroll jobs for construction in 2011, the first positive contribution for either since 2005. This survey reinforces both points.

A final note: This index helped me call the bottom for effective rents (and the top for vacancy rate) a year ago.

Clear Capital Home Price Index shows Double Dip

by Calculated Risk on 5/05/2011 09:41:00 AM

This is one of several house prices indexes I follow in addition to Case-Shiller and CoreLogic. This is especially interesting this month for two reasons: 1) the index is showing a double dip in house prices, and 2) the graph showing house prices and REO saturation.

From Clear Capital: Clear Capital® Reports National Double Dip

Clear Capital (www.clearcapital.com) today released its monthly Home Data Index™ (HDI) Market Report, and reports prices have double dipped nationally 0.7 percent below prior lows experienced in March 2009.

...

“The latest data through April shows a continued increase in the proportion of distressed sales that are taking hold in markets nationwide,” said Dr. Alex Villacorta, director of research and analytics at Clear Capital. “With more than one-third of national home sales being REO, market prices are being weighed down ..."

Click on graph for larger image in new window.

Click on graph for larger image in new window.These graphs from Clear Capital show their home price index and the percent REO saturation.

We know that a higher percentage of distress sales put downward pressure on house prices, and these graphs make that relationship pretty clear.

Note: REO saturation usually peaks early in the year - so some of the recent increase is seasonal.

From Clear Capital:

This comparison leads to concern over home price declines through the rest of 2011. The trends of 2008 were quickly reversed with the introduction of stimulus measures. However, home prices today are already down nearly 25 percent since the 2008 period, creating increasing home affordability, in addition to gradually improving employment measures. Unlike the 2008 period where the downward trend ended in the winter, we're now heading into the home buying seasons of spring and summer. Regardless, the housing market still faces many challenges that will only be solved through increased buying activity or a reduction in the distressed segment―neither of which is assured in 2011.