by Calculated Risk on 4/18/2011 08:29:00 AM

Monday, April 18, 2011

Greece Bond Yields at Record High following Default Comments

The yield on Greece ten year bonds jumped to 14.4% today and the two year yield is up to 19.6%.

From Reuters: Greece asked EU/IMF at Ecofin to restructure debt-paper

Greece told the IMF and the European Union earlier this month that it wants to restructure its debt and discussions on the issue are expected to start in June, Greek daily Eleftherotypia said on Monday.This report has been "dismissed" by Greek, EU and IMF officials, but it is widely expected that Greece will default (aka restructure). Many analysts expect the restructuring to include extending the duration.

...

The paper said U.S. Treasury Secretary Timothy Geithner is also in favour of stretching out repayments of Greece's debt.

"You have to do it, he told Papaconstantinou," the paper said

Here are the ten year yields for Ireland up to 9.8%, Portugal up to a record 9.1%, and Spain at 5.6%.

Sunday, April 17, 2011

Residential Remodeling Index shows strong increase year-over-year in February

by Calculated Risk on 4/17/2011 10:19:00 PM

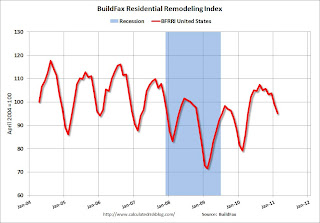

The BuildFax Residential Remodeling Index was at 95.1 in February. This is based on the number of properties pulling residential construction permits in a given month.

From BuildFax:

The Residential BuildFax Remodeling Index rose 20% year-over-year—and for the sixteenth straight month—in February to 95.1, the highest February number in the index since 2006. Residential remodels in February were down month-over-month 3.9 points (4%) from the January value of 99.0 ...

All regions posted year-over-year gains, although the West posted a much higher year-over-year gain than the other regions, reaching well above index values for the West in February 2010, 2009, 2008, and 2007.

...

According to Joe Masters Emison, vice president of research and development at BuildFax, “February 2011 was a strong month for the industry, despite the fact that remodeling activity traditionally dips during the winter months. February 2011 was better than or equal to February 2010 in every region of the country.”

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.Although down month-to-month (off 4% from January) this is the highest level for a February since 2006 - and above the level of 2005 (during the home equity and remodel boom).

Note: permits are not adjusted by value, so this doesn't mean there is more money being spent, just more permit activity. Also some smaller remodeling projects are done without permits and the index will miss that activity.

Since there is a strong seasonal pattern for remodeling, the second graph shows the year-over-year change from the same month of the previous year.

Since there is a strong seasonal pattern for remodeling, the second graph shows the year-over-year change from the same month of the previous year.The remodeling index is up 20% from February 2010.

Although new home construction is still moving sideways, it appears that two other components of residential investment are increasing in 2011: multi-family construction and home improvement (based on this index). This fits with other reports too.

Data Source: BuildFax, Courtesy of Index.BuildFax.com

Earlier:

• First Look at 2012 Cost-Of-Living Adjustments and Maximum Contribution Base

• Summary for Week ending April 15th

• Schedule for Week of April 17th

Quote of the Day: 15 years of house price appreciation "It's gone"

by Calculated Risk on 4/17/2011 06:17:00 PM

"I bought my first house in 1996, a four-bedroom for $124,000, and I could probably buy that same house for $124,000. All the appreciation we've gained in the last 15 years, it's gone."

Chuck Whitehead, general manager for Coldwell Banker's Southwest Riverside operations, via Eric Wolff at the NC Times.

Earlier:

• First Look at 2012 Cost-Of-Living Adjustments and Maximum Contribution Base

• Summary for Week ending April 15th

• Schedule for Week of April 17th

Q4 2010: Mortgage Equity Withdrawal strongly negative

by Calculated Risk on 4/17/2011 02:03:00 PM

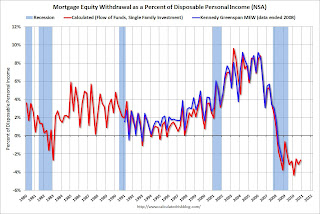

Special Note: Dr. James Kennedy has a new method for calculating equity extraction: "A Simple Method for Estimating Gross Equity Extracted from Housing Wealth". I haven't evaluated his method yet (here is a companion spread sheet), so the following is using my old "simple" method.

Note 2: This is not Mortgage Equity Withdrawal (MEW) data from the Fed. The last MEW data from Fed economist Dr. Kennedy was for Q4 2008.

The following data is calculated from the Fed's Flow of Funds data and the BEA supplement data on single family structure investment. This is an aggregate number, and is a combination of homeowners extracting equity (hence the name "MEW", but there is little MEW right now!), normal principal payments and debt cancellation.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

For Q4 2010, the Net Equity Extraction was minus $77 billion, or a negative 2.7% of Disposable Personal Income (DPI). This is not seasonally adjusted.

This graph shows the net equity extraction, or mortgage equity withdrawal (MEW), results, using the Flow of Funds (and BEA data) compared to the Kennedy-Greenspan method.

The Fed's Flow of Funds report showed that the amount of mortgage debt outstanding declined sharply in Q4. Mortgage debt has declined by $550 billion over the last eleven quarters. This decline is mostly because of debt cancellation per foreclosures and short sales, and some from modifications. There has also been some reduction in mortgage debt as homeowners paid down their mortgages so they could refinance. Note: most homeowners pay down their principal a little each month unless they have an IO or Neg AM loan, so with no new borrowing, equity extraction would always be slightly negative.

Earlier:

• First Look at 2012 Cost-Of-Living Adjustments and Maximum Contribution Base

• Summary for Week ending April 15th

• Schedule for Week of April 17th

Schedule for Week of April 17th

by Calculated Risk on 4/17/2011 08:15:00 AM

Earlier:

• Summary for Week ending April 15th

• First Look at 2012 Cost-Of-Living Adjustments and Maximum Contribution Base

Three key housing reports will be released this week: April homebuilder confidence on Monday, March housing starts on Tuesday, and March existing home sales on Wednesday.

8:00 AM ET: Citigroup First Quarter 2011 Results (included for possible comments on foreclosures)

10 AM: The April NAHB homebuilder survey. The consensus is for a reading of 17, unchanged from March. Any number below 50 indicates that more builders view sales conditions as poor than good. This index has been below 25 for forty five consecutive months (almost 4 years).

8:00 AM ET: Goldman Sachs First Quarter 2011 Results

8:30 AM: Housing Starts for March. After collapsing following the housing bubble, housing starts have mostly moved sideways at a very depressed level for over two years.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows total and single unit starts since 1968.

Total housing starts were at 479 thousand (SAAR) in February, down 22.5% from the revised January rate of 618 thousand, and barely up from the all time record low in April 2009 of 477 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959). Single-family starts decreased 11.8% to 375 thousand in February - the lowest level since early 2009.

The consensus is for an increase to 525,000 (SAAR) in March.

10:00 AM: Regional and State Employment and Unemployment for March 2011

Early: The AIA's Architecture Billings Index for March (a leading indicator for commercial real estate).

This graph shows the Architecture Billings Index since 1996. The index showed billings were slightly higher in February (at 50.6).

This graph shows the Architecture Billings Index since 1996. The index showed billings were slightly higher in February (at 50.6).This index usually leads investment in non-residential structures (hotels, malls, office) by 9 to 12 months.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index has been very weak over the last couple months suggesting weak home sales through May 2011.

8:00 AM: Wells Fargo First Quarter 2011.

10:00 AM: Existing Home Sales for March from the National Association of Realtors (NAR). The consensus is for sales of 5.0 million at a Seasonally Adjusted Annual Rate (SAAR) in March, up about 2.5% from the 4.88 million SAAR in February. Economist Tom Lawler is projecting sales of 5.08 million in March.

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993. Sales in February 2011 (4.88 million SAAR) were 9.6% lower than last month, and were 2.8% lower than February 2010.

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993. Sales in February 2011 (4.88 million SAAR) were 9.6% lower than last month, and were 2.8% lower than February 2010. In addition to sales, the level of inventory and months-of-supply will be very important (since months-of-supply impacts prices).

7:30 AM: Morgan Stanley First Quarter 2011

8:30 AM: The initial weekly unemployment claims report will be released. The number of initial claims increased last week to 412,000, but the trend has been down over the last few months. The consensus is for a decrease to 390,000 from 412,000 last week.

10:00 AM: Philly Fed Survey for April. This survey was at the highest level since 1984 in March. The consensus is for a strong reading of 36.8, down from the very high 43.4 in last month.

10:00 AM: Conference Board Leading Indicators for March. The consensus is for a 0.3% increase for this index.

10:00 AM: FHFA House Price Index for February. This is based on GSE repeat sales and is no longer as closely followed as Case-Shiller (or CoreLogic).

All US markets will be closed for Good Friday.

After 4:00 PM: The FDIC might be working Friday afternoon ...

Best Wishes to All!

Saturday, April 16, 2011

Jim the Realtor: More REOs hitting Market, Half Off Sale

by Calculated Risk on 4/16/2011 11:59:00 PM

Earlier:

• Summary for Week ending April 15th

• First Look at 2012 Cost-Of-Living Adjustments and Maximum Contribution Base

This house sold for $1.8 million in 2006. The asking price is $902 thousand. Half off! Also Jim says REO activity is picking up ...

CoStar: Commercial Real Estate prices increased slightly in February

by Calculated Risk on 4/16/2011 09:15:00 PM

From CoStar: CoStar Pricing Performance Varies Significantly Between Different Regions and Property Types

• The Composite Index, which is an equal-weighted analysis repeat sale pricing index incorporating both the Investment Grade and General Grade indices and a reflection of the broad overall market, posted a slight increase in property value for the month of February of 0.6%, reflecting the strong monthly increase in the General Grade repeat sale index. The Composite Index is down 7.5% year over year. [this is off 30.5 from the peak in August 2007]

• At the national level, CoStar’s Investment Grade Commercial Repeat-Sale Index is up 6.8% compared with the same period last year, even after four consecutive months of declines, including a very slight 0.3% decline in February. [this is off 34.8% from the peak in June 2007]

• CoStar’s General Grade Index is down 10.9% compared with the same period last year, although this pricing index has trended upward recently, posting two consecutive months of increases, including a strong 0.8% increase from January to February. [this is off 29.0% from the peak in June 2007]

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph from CoStar shows the indexes for investment grade, general commercial and a composite index. The Investment Grade was down, the other two were up slightly in February.

It is important to remember that there are very few CRE transactions (compared to residential), and that there is a high percentage of distressed sales, so prices are very volatile. Also CoStar is seeing significant variations in pricing performance between different regions and property types. A couple of examples:

• Multifamily pricing in the Northeast at the end of 2010 stood within 4.8% of its peak level according to CoStar’s Northeast Multifamily pricing index.With apartment vacancy rates falling rapidly, and rents rising, it is no surprise that multifamily is the best performing property type.

• At the other end of the spectrum, CoStar’s West Office pricing index remains 43% below its peak-pricing level.

Earlier:

• Summary for Week ending April 15th

• First Look at 2012 Cost-Of-Living Adjustments and Maximum Contribution Base

IMF: Greek Debt Unsustainable

by Calculated Risk on 4/16/2011 04:38:00 PM

Getting closer to default ...

From the WSJ: IMF Believes Greece Should Consider Debt Restructuring By 2012

The International Monetary Fund believes Greece's debt is unsustainable and has told European government and central bank officials that Athens should consider restructuring by next year, three people familiar with the situation said Saturday.Earlier:

... The scenario to be examined first will involve extending debt repayments by as much as 30 years, the first official said, where private bondholders could be offered new bonds in exchange for old bonds with the same coupon, but with a longer maturity. Another scenario could involve reducing Greece's coupon payments and extending maturity dates.

• Summary for Week ending April 15th

Summary for Week ending April 15th

by Calculated Risk on 4/16/2011 11:15:00 AM

It now appears that Q1 real GDP growth will be less than 2%, but recent data suggests a pickup in March and into April. We will see.

Overall the U.S. story remains the same: manufacturing is the leading the recovery with the NY Fed index (for April) and the Industrial Production report (for March) both showing solid expansion. For more downbeat news, we will hear from housing next week (housing starts and existing home sales). Headline inflation has picked up, although core inflation remains below the Fed’s target. Oil prices are still high, with WTI crude futures near $110 per barrel, and gasoline near $4 per gallon, and these prices are impacting retail sales and are a drag on U.S. and global growth.

Unfortunately there are also several international headwinds. Officials are now talking openly about Greece defaulting, Ireland debt was downgraded, Portugal is negotiating a bailout ... Japan is still struggling, the middle-east and North Africa unrest continues, and China is overheating again. Interesting times.

Below is a summary of economic data last week mostly in graphs:

• Retail Sales increased 0.4% in March

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

On a monthly basis, retail sales increased 0.4% from February to March (seasonally adjusted, after revisions), and sales were up 7.1% from March 2010.

This graph shows retail sales since 1992. This is monthly retail sales, seasonally adjusted (total and ex-gasoline).

Retail sales are up 16.0% from the bottom, and now 2.5% above the pre-recession peak.

The second graph shows the year-over-year change in retail sales (ex-gasoline) since 1993.

The second graph shows the year-over-year change in retail sales (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 5.8% on a YoY basis (7.1% for all retail sales).

This was below expectations for a 0.5% increase. Retail sales ex-autos were up 0.8%; slightly above expectations of a 0.7% increase. Retail sales ex-gasoline were only up 0.1% in March - and this shows the impact of higher gasoline prices.

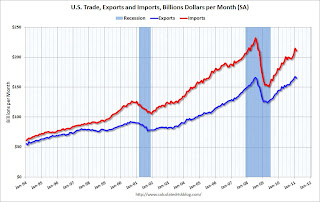

• Trade Deficit decreased in February to $45.8 billion

"February exports were $2.4 billion less than January exports of $167.5 billion. February imports were $3.6 billion less than January imports of $214.5 billion."

"February exports were $2.4 billion less than January exports of $167.5 billion. February imports were $3.6 billion less than January imports of $214.5 billion."

This graph shows the monthly U.S. exports and imports in dollars through January 2011.

Both imports and exports declined slightly in February (seasonally adjusted). Still exports are now above the pre-recession peak.

The next graph shows the U.S. trade deficit, with and without petroleum, through February.

"[T]otal February exports of $165.1 billion and imports of $210.9 billion resulted in a goods and services deficit of $45.8 billion, down from $47.0 billion in January, revised."

"[T]otal February exports of $165.1 billion and imports of $210.9 billion resulted in a goods and services deficit of $45.8 billion, down from $47.0 billion in January, revised."

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The petroleum deficit decreased in February as the quantity declined even as import prices continued to rise - averaging $87.17 in February. Prices will be even higher in March and April. The trade deficit was larger than the expected $44 billion.

• Industrial Production, Capacity Utilization increased in March

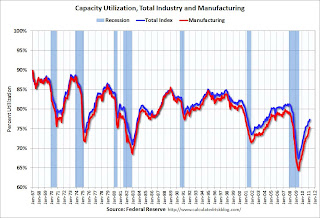

This graph shows Capacity Utilization. This series is up 10 percentage points from the record low set in June 2009 (the series starts in 1967).

This graph shows Capacity Utilization. This series is up 10 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 77.4% is still "3.0 percentage points below its average from 1972 to 2010" - and below the pre-recession levels of 81.2% in November 2007.

The next graph shows industrial production since 1967.

The next graph shows industrial production since 1967.

Industrial production increased in March to 93.6, however February was revised down from 93.0 to 92.8. So the increase was reported at 0.8% but would have been 0.6% without the downward revision.

Production is still 7.0% below the pre-recession levels at the end of 2007.

The consensus was for a 0.5% increase in Industrial Production in March, and an increase to 77.4% (from 76.3%) for Capacity Utilization. So this was close to expectations.

• NFIB: Small Business Optimism Index decreases in March

From National Federation of Independent Business (NFIB): Hiring Up, But Optimism Down in March

Note: Small businesses have a larger percentage of real estate and retail related companies than the overall economy.

From NFIB: "The Index of Small Business Optimism gave up 2.6 points in March, falling to 91.9. Four components rose or were unchanged, while six lost ground. The “hard” components of the Index (job creation, job openings, capital spending plans and inventory plans) added two points while the “soft” components (the other six in the table above) gave up 31 points".

From NFIB: "The Index of Small Business Optimism gave up 2.6 points in March, falling to 91.9. Four components rose or were unchanged, while six lost ground. The “hard” components of the Index (job creation, job openings, capital spending plans and inventory plans) added two points while the “soft” components (the other six in the table above) gave up 31 points".

This graph shows the small business optimism index since 1986. The index decreased to 91.9 in March from 94.5 in February.

This has been trending up, although the level is still very low.

• BLS: Job Openings increase in February, Highest since 2008

The following graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the Job Openings and Labor Turnover Summary

Notice that hires (purple) and total separations (red and blue columns stacked) are pretty close each month. When the purple line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Notice that hires (purple) and total separations (red and blue columns stacked) are pretty close each month. When the purple line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

In general job openings (yellow) has been trending up - and are up 23% from February 2010. However the overall turnover remains low.

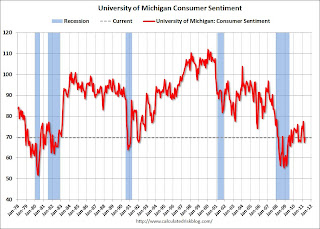

• Consumer Sentiment increases slightly in April

The preliminary April Reuters / University of Michigan consumer sentiment index increased to 69.6 in April from 67.5 in March.

The preliminary April Reuters / University of Michigan consumer sentiment index increased to 69.6 in April from 67.5 in March.

This was slightly above the consensus forecast of 69.0.

In general consumer sentiment is a coincident indicator and is usually impacted by employment (and the unemployment rate) and gasoline prices.

This low reading is probably due to $4 per gallon gasoline prices.

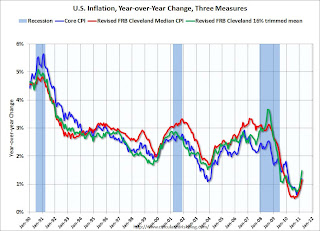

• Core Measures show low inflation in March

The Cleveland Fed released the median CPI and the trimmed-mean CPI: Over the last 12 months, core CPI has increased 1.2%, median CPI has increased 1.2%, and trimmed-mean CPI increased 1.5%.

This graph shows these three measure of inflation on a year-over-year basis.

This graph shows these three measure of inflation on a year-over-year basis.

These measures all show that year-over-year inflation is still low, but increasing lately.

A little good news: Core CPI increased at an annualized rate of 1.6% (down from 2.4% in February), median CPI 1.6% annualized in March, and trimmed-mean CPI increased 3.0% annualized (high, but down from 3.8% annualized last month).

• Other Economic Stories ...

• From Reuters: Fed's Yellen says too soon to start reversing policy

• From Bloomberg: Dudley Says Fed Shouldn’t Rush to Tighten Policy ‘Too Early’

• From Fed Vice Chair Janet Yellen: Commodity Prices, the Economic Outlook, and Monetary Policy

• Press Release: Pulse of Commerce Index Jumps 2.7% in March

• Beige Book: Fed sees economic improvement

• From the Empire State Manufacturing Survey indicates faster growth in April

• From Bloomberg: Greece May Need Debt Restructuring, Schaeuble Tells Die Welt

• Unofficial Problem Bank list at 978 Institutions

Best wishes to all!

Unofficial Problem Bank list at 978 Institutions

by Calculated Risk on 4/16/2011 08:29:00 AM

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Apr 15, 2011.

Changes and comments from surferdude808:

The FDIC remembered how to close banks by shuttering six this Friday and the OCC released its enforcement actions through mid-March 2011, which contributed to many changes to the Unofficial Problem Bank List.

In all, there were 13 removals and nine additions that leave the Unofficial Problem Bank List with 978 institutions and assets of $429.4 billion this week, compared to 982 institutions and assets of $433.2 billion last week.

Only five of the six failures were on the list and it is interesting how three years into the current crisis institutions are failing wherein a formal enforcement action may not be found in the public domain. The removals because of failure include Superior Bank, Birmingham, AL ($3.0 billion Ticker: SUPR); Nexity Bank, Birmingham, AL ($794 million Ticker: NXTYQ); Bartow County Bank, Cartersville, GA ($330 million); Heritage Banking Group, Carthage, MS ($226 million); and Rosemount National Bank, Rosemount, MN ($38 million). The two failures in Georgia push total failures in that state to 59, which have an estimated resolution cost of $8.3 billion. Perhaps if the FDIC Atlanta Region was more diligent in its supervision of the out-sized construction lending exposures during the boom the number and cost of these failures in Georgia could have been lower.

The other eight removals resulted from action terminations or unassisted mergers. Actions were terminated against First National Bank of Platteville, Platteville, WI ($127 million); and Congaree State Bank, West Columbia, SC ($121 million). The following were removed because of unassisted mergers: Maryland Bank and Trust Company, National Association, Lexington Park, MD ($348 million); and First National Bankers Bank, Alabama, Homewood, AL ($224 million). Premier Financial Bancorp, Inc. merged two of its subsidiaries on the list, Adams National Bank, Washington, DC. ($284 million) and Consolidated Bank and Trust Company, Richmond, VA, (77 million) into the newly named Premier Bank, Inc. Also, the multi-bank holding company Metropolitan Bank Group, Inc., which has seven subsidiaries on the list, merged two subsidiaries -- The First Commercial Bank, Chicago, IL ($269 million) and Edens Bank, Wilmette, IL ($249 million) – into North Community Bank, Chicago, IL ($499 million).

Among the nine new additions are Suburban Bank & Trust Company, Elmhurst, IL ($623 million); The Kishacoquillas Valley National Bank of Belleville, Belleville, PA ($554 million Ticker: KISB); The First National Bank of Polk County, Cedartown, GA ($163 million Ticker: SCSG); and Chino Commercial Bank, N.A., Chino, CA ($114 million Ticker: CCBC). The other notable change this week is a Prompt Corrective Action order issued by the Federal Reserve against First Chicago Bank & Trust, Chicago, IL ($1.0 billion).