by Calculated Risk on 4/16/2011 11:15:00 AM

Saturday, April 16, 2011

Summary for Week ending April 15th

It now appears that Q1 real GDP growth will be less than 2%, but recent data suggests a pickup in March and into April. We will see.

Overall the U.S. story remains the same: manufacturing is the leading the recovery with the NY Fed index (for April) and the Industrial Production report (for March) both showing solid expansion. For more downbeat news, we will hear from housing next week (housing starts and existing home sales). Headline inflation has picked up, although core inflation remains below the Fed’s target. Oil prices are still high, with WTI crude futures near $110 per barrel, and gasoline near $4 per gallon, and these prices are impacting retail sales and are a drag on U.S. and global growth.

Unfortunately there are also several international headwinds. Officials are now talking openly about Greece defaulting, Ireland debt was downgraded, Portugal is negotiating a bailout ... Japan is still struggling, the middle-east and North Africa unrest continues, and China is overheating again. Interesting times.

Below is a summary of economic data last week mostly in graphs:

• Retail Sales increased 0.4% in March

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

On a monthly basis, retail sales increased 0.4% from February to March (seasonally adjusted, after revisions), and sales were up 7.1% from March 2010.

This graph shows retail sales since 1992. This is monthly retail sales, seasonally adjusted (total and ex-gasoline).

Retail sales are up 16.0% from the bottom, and now 2.5% above the pre-recession peak.

The second graph shows the year-over-year change in retail sales (ex-gasoline) since 1993.

The second graph shows the year-over-year change in retail sales (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 5.8% on a YoY basis (7.1% for all retail sales).

This was below expectations for a 0.5% increase. Retail sales ex-autos were up 0.8%; slightly above expectations of a 0.7% increase. Retail sales ex-gasoline were only up 0.1% in March - and this shows the impact of higher gasoline prices.

• Trade Deficit decreased in February to $45.8 billion

"February exports were $2.4 billion less than January exports of $167.5 billion. February imports were $3.6 billion less than January imports of $214.5 billion."

"February exports were $2.4 billion less than January exports of $167.5 billion. February imports were $3.6 billion less than January imports of $214.5 billion."

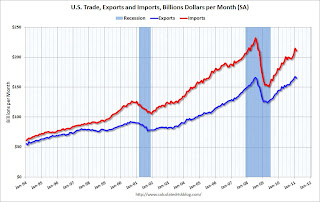

This graph shows the monthly U.S. exports and imports in dollars through January 2011.

Both imports and exports declined slightly in February (seasonally adjusted). Still exports are now above the pre-recession peak.

The next graph shows the U.S. trade deficit, with and without petroleum, through February.

"[T]otal February exports of $165.1 billion and imports of $210.9 billion resulted in a goods and services deficit of $45.8 billion, down from $47.0 billion in January, revised."

"[T]otal February exports of $165.1 billion and imports of $210.9 billion resulted in a goods and services deficit of $45.8 billion, down from $47.0 billion in January, revised."

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The petroleum deficit decreased in February as the quantity declined even as import prices continued to rise - averaging $87.17 in February. Prices will be even higher in March and April. The trade deficit was larger than the expected $44 billion.

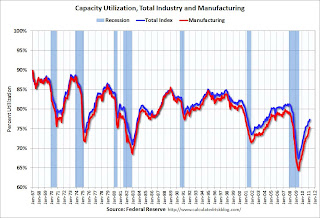

• Industrial Production, Capacity Utilization increased in March

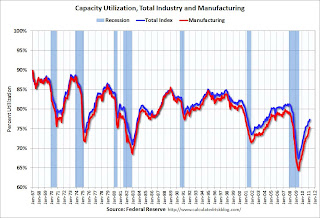

This graph shows Capacity Utilization. This series is up 10 percentage points from the record low set in June 2009 (the series starts in 1967).

This graph shows Capacity Utilization. This series is up 10 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 77.4% is still "3.0 percentage points below its average from 1972 to 2010" - and below the pre-recession levels of 81.2% in November 2007.

The next graph shows industrial production since 1967.

The next graph shows industrial production since 1967.

Industrial production increased in March to 93.6, however February was revised down from 93.0 to 92.8. So the increase was reported at 0.8% but would have been 0.6% without the downward revision.

Production is still 7.0% below the pre-recession levels at the end of 2007.

The consensus was for a 0.5% increase in Industrial Production in March, and an increase to 77.4% (from 76.3%) for Capacity Utilization. So this was close to expectations.

• NFIB: Small Business Optimism Index decreases in March

From National Federation of Independent Business (NFIB): Hiring Up, But Optimism Down in March

Note: Small businesses have a larger percentage of real estate and retail related companies than the overall economy.

From NFIB: "The Index of Small Business Optimism gave up 2.6 points in March, falling to 91.9. Four components rose or were unchanged, while six lost ground. The “hard” components of the Index (job creation, job openings, capital spending plans and inventory plans) added two points while the “soft” components (the other six in the table above) gave up 31 points".

From NFIB: "The Index of Small Business Optimism gave up 2.6 points in March, falling to 91.9. Four components rose or were unchanged, while six lost ground. The “hard” components of the Index (job creation, job openings, capital spending plans and inventory plans) added two points while the “soft” components (the other six in the table above) gave up 31 points".

This graph shows the small business optimism index since 1986. The index decreased to 91.9 in March from 94.5 in February.

This has been trending up, although the level is still very low.

• BLS: Job Openings increase in February, Highest since 2008

The following graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the Job Openings and Labor Turnover Summary

Notice that hires (purple) and total separations (red and blue columns stacked) are pretty close each month. When the purple line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Notice that hires (purple) and total separations (red and blue columns stacked) are pretty close each month. When the purple line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

In general job openings (yellow) has been trending up - and are up 23% from February 2010. However the overall turnover remains low.

• Consumer Sentiment increases slightly in April

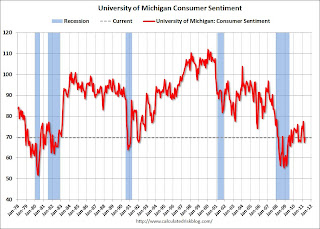

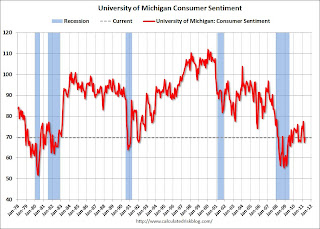

The preliminary April Reuters / University of Michigan consumer sentiment index increased to 69.6 in April from 67.5 in March.

The preliminary April Reuters / University of Michigan consumer sentiment index increased to 69.6 in April from 67.5 in March.

This was slightly above the consensus forecast of 69.0.

In general consumer sentiment is a coincident indicator and is usually impacted by employment (and the unemployment rate) and gasoline prices.

This low reading is probably due to $4 per gallon gasoline prices.

• Core Measures show low inflation in March

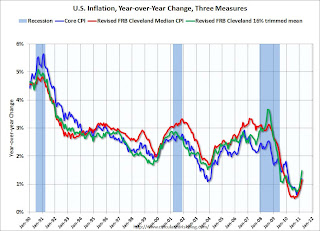

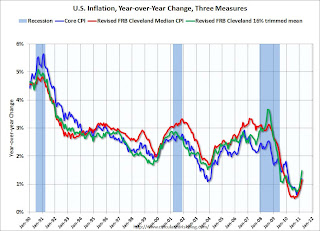

The Cleveland Fed released the median CPI and the trimmed-mean CPI: Over the last 12 months, core CPI has increased 1.2%, median CPI has increased 1.2%, and trimmed-mean CPI increased 1.5%.

This graph shows these three measure of inflation on a year-over-year basis.

This graph shows these three measure of inflation on a year-over-year basis.

These measures all show that year-over-year inflation is still low, but increasing lately.

A little good news: Core CPI increased at an annualized rate of 1.6% (down from 2.4% in February), median CPI 1.6% annualized in March, and trimmed-mean CPI increased 3.0% annualized (high, but down from 3.8% annualized last month).

• Other Economic Stories ...

• From Reuters: Fed's Yellen says too soon to start reversing policy

• From Bloomberg: Dudley Says Fed Shouldn’t Rush to Tighten Policy ‘Too Early’

• From Fed Vice Chair Janet Yellen: Commodity Prices, the Economic Outlook, and Monetary Policy

• Press Release: Pulse of Commerce Index Jumps 2.7% in March

• Beige Book: Fed sees economic improvement

• From the Empire State Manufacturing Survey indicates faster growth in April

• From Bloomberg: Greece May Need Debt Restructuring, Schaeuble Tells Die Welt

• Unofficial Problem Bank list at 978 Institutions

Best wishes to all!

Unofficial Problem Bank list at 978 Institutions

by Calculated Risk on 4/16/2011 08:29:00 AM

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Apr 15, 2011.

Changes and comments from surferdude808:

The FDIC remembered how to close banks by shuttering six this Friday and the OCC released its enforcement actions through mid-March 2011, which contributed to many changes to the Unofficial Problem Bank List.

In all, there were 13 removals and nine additions that leave the Unofficial Problem Bank List with 978 institutions and assets of $429.4 billion this week, compared to 982 institutions and assets of $433.2 billion last week.

Only five of the six failures were on the list and it is interesting how three years into the current crisis institutions are failing wherein a formal enforcement action may not be found in the public domain. The removals because of failure include Superior Bank, Birmingham, AL ($3.0 billion Ticker: SUPR); Nexity Bank, Birmingham, AL ($794 million Ticker: NXTYQ); Bartow County Bank, Cartersville, GA ($330 million); Heritage Banking Group, Carthage, MS ($226 million); and Rosemount National Bank, Rosemount, MN ($38 million). The two failures in Georgia push total failures in that state to 59, which have an estimated resolution cost of $8.3 billion. Perhaps if the FDIC Atlanta Region was more diligent in its supervision of the out-sized construction lending exposures during the boom the number and cost of these failures in Georgia could have been lower.

The other eight removals resulted from action terminations or unassisted mergers. Actions were terminated against First National Bank of Platteville, Platteville, WI ($127 million); and Congaree State Bank, West Columbia, SC ($121 million). The following were removed because of unassisted mergers: Maryland Bank and Trust Company, National Association, Lexington Park, MD ($348 million); and First National Bankers Bank, Alabama, Homewood, AL ($224 million). Premier Financial Bancorp, Inc. merged two of its subsidiaries on the list, Adams National Bank, Washington, DC. ($284 million) and Consolidated Bank and Trust Company, Richmond, VA, (77 million) into the newly named Premier Bank, Inc. Also, the multi-bank holding company Metropolitan Bank Group, Inc., which has seven subsidiaries on the list, merged two subsidiaries -- The First Commercial Bank, Chicago, IL ($269 million) and Edens Bank, Wilmette, IL ($249 million) – into North Community Bank, Chicago, IL ($499 million).

Among the nine new additions are Suburban Bank & Trust Company, Elmhurst, IL ($623 million); The Kishacoquillas Valley National Bank of Belleville, Belleville, PA ($554 million Ticker: KISB); The First National Bank of Polk County, Cedartown, GA ($163 million Ticker: SCSG); and Chino Commercial Bank, N.A., Chino, CA ($114 million Ticker: CCBC). The other notable change this week is a Prompt Corrective Action order issued by the Federal Reserve against First Chicago Bank & Trust, Chicago, IL ($1.0 billion).

Friday, April 15, 2011

Report: Protests in Syria Gaining Momentum

by Calculated Risk on 4/15/2011 09:54:00 PM

From the LA Times: Syria protests swell as tens of thousands turn out

Antigovernment demonstrations sweeping Syria appeared to have crossed a threshold in size and scope, with protesters battling police near the heart of the capital and the protest movement uniting people from different regions, classes and religious backgrounds against the regime.We live in interesting times.

Tens of thousands of people turned out across the country Friday, dismissing minor concessions offered a day earlier by President Bashar Assad. The demonstrators called for freedom, the release of political prisoners and, in some instances, the downfall of the government, echoing demands for change across the Arab world.

Momentum seemed to be with the protesters.

Earlier:

• Industrial Production, Capacity Utilization increased in March

• From the Empire State Manufacturing Survey indicates faster growth in April

• From Bloomberg: Greece May Need Debt Restructuring, Schaeuble Tells Die Welt

• First Look at 2012 Cost-Of-Living Adjustments and Maximum Contribution Base

Bank Failure #34: Heritage Banking Group, Carthage, Mississippi

by Calculated Risk on 4/15/2011 07:36:00 PM

Mississippi burning cash

Delta blues for bank.

by Soylent Green is People

Heritage Banking Group, Carthage, Mississippi

As of December 31, 2010, Heritage Banking Group had approximately $224.0 million in total assets and $196.2 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $49.1 million. ... Heritage Banking Group is the 34th FDIC-insured institution to fail in the nation this year, and the first in Mississippi.That makes six today ...

Bank Failures #29 through #33 in 2011

by Calculated Risk on 4/15/2011 06:16:00 PM

Hot money banks drop like flies

All pits and no peach.

Doom broom sweeps Eastward.

Two South and one North bank fails

West crest approaching?

by Soylent Green is People

Bartow County Bank, Cartersville, Georgia

As of December 31, 2010, Bartow County Bank had approximately $330.2 million in total assets and $304.1 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $69.5 million. ... Bartow County Bank is the 29th FDIC-insured institution to fail in the nation this year, and the seventh in Georgia.New Horizons Bank, East Ellijay, Georgia

As of December 31, 2010, New Horizons Bank had approximately $110.7 million in total assets and $106.1 million in total deposits ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $30.9 million. ... New Horizons Bank is the 30th FDIC-insured institution to fail in the nation this year, and the eighth in Georgia.Nexity Bank, Birmingham, Alabama

As of December 31, 2010, Nexity Bank had approximately $793.7 million in total assets and $637.8 million in total deposits ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $175.4 million. ... Nexity Bank is the 31st FDIC-insured institution to fail in the nation this year, and the first in Alabama.Superior Bank, Birmingham, Alabama

As of December 31, 2010, Superior Bank had approximately $3.0 billion in total assets and $2.7 billion in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $259.6 million. ... Superior Bank is the 32nd FDIC-insured institution to fail in the nation this year, and the second in Alabama.Rosemount National Bank, Rosemount, Minnesota

As of December 31, 2010, Rosemount National Bank had approximately $37.6 million in total assets and $36.6 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $3.6 million. ... Rosemount National Bank is the 33rd FDIC-insured institution to fail in the nation this year, and the first in Minnesota.Superior was a pretty big bank ...

First Look at 2012 Cost-Of-Living Adjustments and Maximum Contribution Base

by Calculated Risk on 4/15/2011 04:58:00 PM

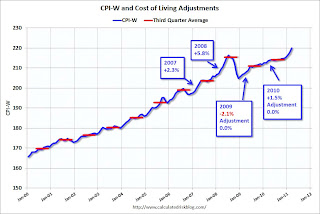

The BLS reported this morning: "The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) increased 3.0 percent over the last 12 months to an index level of 220.024 (1982-84=100). For the month, the index rose 1.1 percent ..."

CPI-W is the index that is used to calculate the Cost-Of-Living Adjustments (COLA). Here is an explanation ...

The calculation dates have changed over time (see Cost-of-Living Adjustments), but the current calculation uses the average CPI-W1 for the three months in Q3 (July, August, September) and compares to the average for the highest previous average of Q3 months. Note: this is not the headline CPI-U, and not seasonally adjusted.

• In 2008, the Q3 average of CPI-W was 215.495. In the previous year, 2007, the average in Q3 of CPI-W was 203.596. That gave an increase of 5.8% for COLA for 2009.

• In 2009, the Q3 average of CPI-W was 211.013. That was a decline of 2.1% from 2008, however, by law, the adjustment is never negative so the benefits remained the same in 2010.

• In 2010, the Q3 average of CPI-W was 214.136. That was an increase of 1.5% from 2009, however the average was still below the Q3 average in 2008, so the adjustment was zero.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows CPI-W since January 2000. The red lines are the Q3 average of CPI-W for each year.

The COLA adjustment is based on the increase from Q3 of one year from the highest previous Q3 average. So a 2.3% increase was announced in 2007 for 2008, and a 5.8% increase was announced in 2008 for 2009.

In Q3 2009, CPI-W was lower than in Q3 2008, so there was no change in benefits for 2010. And CPI-W in Q3 2010 was also lower than in Q3 2008, so once again there was no change in benefits.

Currently CPI-W is above the Q3 2008 average. The recent increase is mostly because of the surge in oil prices. CPI-W could be very volatile this year - and will depend on energy prices - but if the current level holds, COLA would be around 2.1% for next year (the current 220.024 divided by the Q3 2008 level of 215.495).

This is very early - if oil prices fall sharply, COLA might be zero again.

Contribution and Benefit Base

The law prohibits an increase in the contribution and benefit base if COLA is not greater than zero. However if the there is even a small increase in COLA, the contribution base will be adjusted using the National Average Wage Index.

From Social Security: Cost-of-Living Adjustment Must Be Greater Than Zero

... ... any amount that is directly dependent for its value on the COLA would not increase. For example, the maximum Supplemental Security Income (SSI) payment amounts would not increase if there were no COLA.This is based on a one year lag. The National Average Wage Index is not available for 2010 yet, but wages probably didn't change much from 2009. If wages increased back to the 2008 level in 2010, and COLA is positive (seems likely right now), then the contribution base next year will be increased to around $109,000 from the current $106,800.

... if there were no COLA, section 230(a) of the Social Security Act prohibits an increase in the contribution and benefit base (Social Security's maximum taxable earnings), which normally increases with increases in the national average wage index. Similarly, the retirement test exempt amounts would not increase ...

Remember - this is an early look. What matters is CPI-W during Q3 (July, August and September).

(1) CPI-W usually tracks CPI-U (headline number) pretty well. From the BLS:

The Bureau of Labor Statistics publishes CPIs for two population groups: (1)the CPI for Urban Wage Earners and Clerical Workers (CPI-W), which covers households of wage earners and clerical workers that comprise approximately 32 percent of the total population and (2) the CPI for All Urban Consumers (CPI-U) ... which cover approximately 87 percent of the total population and include in addition to wage earners and clerical worker households, groups such as professional, managerial, and technical workers, the self- employed, short-term workers, the unemployed, and retirees and others not in the labor force.

Europe Update: Ireland Downgraded, Greece to default?

by Calculated Risk on 4/15/2011 01:55:00 PM

• Possible Greece default.

From Bloomberg: Greece May Need Debt Restructuring, Schaeuble Tells Die Welt

German Finance Minister Wolfgang Schaeuble said Greece may have to seek debt restructuring if an audit in June questions its ability to pay creditors, Die Welt reported, citing an interview.And from Bloomberg: Germany Would Back Greece Debt Restructuring, Hoyer Says

Greece would have to negotiate to ease its debt burden since creditors can’t be forced to take losses until Europe’s permanent rescue system for the euro starts up in mid-2013, the Berlin-based newspaper cited Schaeuble as saying in comments published today.

“A haircut or a restructuring of the debt would not be a disaster,” said Hoyer, a member of the Free Democratic Party that’s the junior partner in Chancellor Angela Merkel’s government. If Greece’s creditors agreed that talks with the Greek government “would be helpful toward a restructuring of the debt, then of course this would be supported by us.”It seems like a matter of when, not if. The 2 year bond yields for Greece, at 18.5%, suggest this will happen fairly soon. If haircuts are coming, the sooner the better for the people of Greece.

...

The remarks by Hoyer were the most explicit by a European official showing a 110 billion-euro ($159 billion) bailout for Greece may fail to prevent the first default by a euro country.

• And from the WSJ: Moody's Downgrades Ireland

Moody's Investors Service Inc. downgraded Ireland's government debt by two notches Friday, taking the country to the brink of junk status, and kept its outlook negative.Here are the ten year yields for Greece at 13.8%, Ireland at 9.7%, Portugal at 9.0%, and Spain at 5.4%.

The agency, cutting Ireland's bond ratings to Baa3, one notch above junk, from Baa1, said it was responding to a likely deterioration in Ireland's fiscal position due to weak prospects for economic growth and higher borrowing costs as a result of rate rised by the European Central Bank.

If Greece defaults, will Portugal and/or Ireland be far behind?

Core Measures show low inflation in March

by Calculated Risk on 4/15/2011 11:30:00 AM

Earlier today the BLS reported:

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.5 percent in March on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 2.7 percent before seasonal adjustment.The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

...

The index for all items less food and energy rose 0.1 percent in March, a smaller increase than in the previous two months. ... The shelter index increased 0.1 percent for the sixth month in a row, with rent and owners' equivalent rent both increasing 0.1 percent in March, as they did in February.

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.1% (1.6% annualized rate) in March. The 16% trimmed-mean Consumer Price Index increased 0.2% (3.0% annualized rate) during the month.Over the last 12 months, core CPI has increased 1.2%, median CPI has increased 1.2%, and trimmed-mean CPI increased 1.5%.

Note: The Cleveland Fed has a discussion of a number of measures of inflation: Measuring Inflation

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows these three measure of inflation on a year-over-year basis.

These measures all show that year-over-year inflation is still low, but increasing lately.

Note: You can see the median CPI details for March here.

A little good news: Core CPI increased at an annualized rate of 1.6% (down from 2.4% in February), median CPI 1.6% annualized in March, and trimmed-mean CPI increased 3.0% annualized (high, but down from 3.8% annualized last month).

With the slack in the system, I expect these core measures to stay below 2% this year.

Consumer Sentiment increases slightly in April

by Calculated Risk on 4/15/2011 10:04:00 AM

The preliminary April Reuters / University of Michigan consumer sentiment index increased to 69.6 in April from 67.5 in March.

Click on graph for larger image in graphic gallery.

Click on graph for larger image in graphic gallery.

This was slightly above the consensus forecast of 69.0.

In general consumer sentiment is a coincident indicator and is usually impacted by employment (and the unemployment rate) and gasoline prices.

This low reading is probably due to $4 per gallon gasoline prices.

Industrial Production, Capacity Utilization increased in March

by Calculated Risk on 4/15/2011 09:15:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production increased 0.8 percent in March and rose at an annual rate of 6.0 percent for the first quarter as a whole. Manufacturing output advanced 0.7 percent in March, its fourth consecutive month of strong expansion; factory production climbed at an annual rate of 9.1 percent in the first quarter. Outside of manufacturing, the output of mines rose 0.6 percent in March, while the output of utilities increased 1.7 percent after declining significantly in the preceding two months. At 93.6 percent of its 2007 average, total industrial production was 5.9 percent above its year-earlier level. The rate of capacity utilization for total industry rose 0.5 percentage point to 77.4 percent, a rate 3.0 percentage points below its average from 1972 to 2010.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows Capacity Utilization. This series is up 10 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 77.4% is still "3.0 percentage points below its average from 1972 to 2010" - and below the pre-recession levels of 81.2% in November 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in March to 93.6, however February was revised down from 93.0 to 92.8. So the increase was reported at 0.8% but would have been 0.6% without the downward revision.

Production is still 7.0% below the pre-recession levels at the end of 2007.

The consensus was for a 0.5% increase in Industrial Production in March, and an increase to 77.4% (from 76.3%) for Capacity Utilization. So this was close to expectations.