by Calculated Risk on 4/15/2011 11:30:00 AM

Friday, April 15, 2011

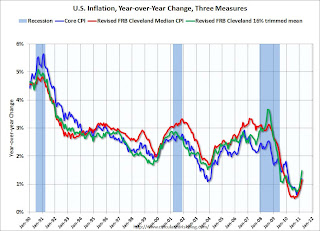

Core Measures show low inflation in March

Earlier today the BLS reported:

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.5 percent in March on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 2.7 percent before seasonal adjustment.The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

...

The index for all items less food and energy rose 0.1 percent in March, a smaller increase than in the previous two months. ... The shelter index increased 0.1 percent for the sixth month in a row, with rent and owners' equivalent rent both increasing 0.1 percent in March, as they did in February.

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.1% (1.6% annualized rate) in March. The 16% trimmed-mean Consumer Price Index increased 0.2% (3.0% annualized rate) during the month.Over the last 12 months, core CPI has increased 1.2%, median CPI has increased 1.2%, and trimmed-mean CPI increased 1.5%.

Note: The Cleveland Fed has a discussion of a number of measures of inflation: Measuring Inflation

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows these three measure of inflation on a year-over-year basis.

These measures all show that year-over-year inflation is still low, but increasing lately.

Note: You can see the median CPI details for March here.

A little good news: Core CPI increased at an annualized rate of 1.6% (down from 2.4% in February), median CPI 1.6% annualized in March, and trimmed-mean CPI increased 3.0% annualized (high, but down from 3.8% annualized last month).

With the slack in the system, I expect these core measures to stay below 2% this year.