by Calculated Risk on 3/31/2011 02:36:00 PM

Thursday, March 31, 2011

Employment Situation Preview: More Jobs, but still Grim

Tomorrow the BLS will release the March Employment Situation Summary at 8:30 AM ET. The consensus is for an increase of 195,000 payroll jobs in March, and for the unemployment rate to hold steady at 8.9%.

• The weak payroll report in January was blamed on the weather (only 63,000 jobs added after revision). So there might have been some bounce back in February (192,000 payroll jobs added). The two month average was 127,500 payroll jobs added (145,000 private). Anything less in March would be very disappointing.

• The BLS reference period is the calendar week that contains the 12th day of the month (or pay period including the 12th for the establishment survey). There were several significant world events in March, especially in Japan (the earthquake was on March 11th) and Libya. Sometimes hiring can be delayed due to world events, but based on the timing, I don't think there will be any impact on the March report.

• Usually the ISM manufacturing and service reports are released before the BLS employment report. Not this month because the first Friday of the month is on the 1st (Happy April Fools' Day!). However all of the regional Fed manufacturing surveys and the Chicago PMI indicated strong expansion in March.

• Weekly initial unemployment claims averaged 394,250 in March, about the same as in February (392,500). That is the good news (fewer layoffs), but so far hiring hasn't picked up.

• Weekly initial unemployment claims averaged 394,250 in March, about the same as in February (392,500). That is the good news (fewer layoffs), but so far hiring hasn't picked up.

Click on graph for larger image in graph gallery.

• ADP reported Private Employment increased by 201,000 from February to March on a seasonally adjusted basis, and has averaged 211,000 over the last four months.

And some less optimistic news:

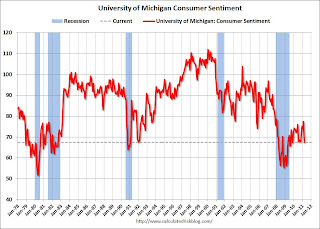

• Consumer Sentiment decreased sharply in March. This is frequently coincident with improvements in the labor market - but also strongly related to gasoline prices (Gasoline was probably the reason for the decline in March).

• Consumer Sentiment decreased sharply in March. This is frequently coincident with improvements in the labor market - but also strongly related to gasoline prices (Gasoline was probably the reason for the decline in March).

The final March Reuters / University of Michigan consumer sentiment index declined to 67.5 from the preliminary March reading of 68.2 - and down from 77.5 in February. This is the lowest level since November 2009.

• And on unemployment: Gallup Finds U.S. Unemployment Rate at 10.0% in March NOTE: The Gallup poll results are Not Seasonally Adjusted (NSA), so use with caution. But this does suggest a seasonally adjusted unemployment rate slightly higher than the 8.9% in February.

• Even if the payroll report shows improvement, the employment situation remains grim. There are 7.4 million fewer payroll jobs now than before the recession started in 2007 with 13.7 million Americans currently unemployed. Another 8.3 million are working part time for economic reasons, and about 4 million more workers have left the labor force. Of those unemployed, 6 million have been unemployed for six months or more.

If the BLS reports 200 thousand payroll jobs added tomorrow - that will be welcome - but it is just a small step in the right direction. Many of the unemployed and marginally employed will not see any improvement for some time.

My guess is in the 150,000 to 175,000 range for payroll jobs, with the unemployment rate increasing slightly.

Kansas City Manufacturing Survey at Record High, Chicago PMI Strong in March

by Calculated Risk on 3/31/2011 11:00:00 AM

• Note: The Irish bank stress test results will be released at 4:30 PM local time (11:30 AM ET). The Irish Times has a live blog discussing the results.

• From the Kansas City Fed: Survey of Tenth District Manufacturing

Growth in Tenth District manufacturing activity accelerated rapidly in March, posting a record high for the second straight month. Expectations moderated slightly from last month, but still remained solid. Price indexes for raw materials reached historically high levels, and more firms indicated plans to pass cost increases on to customers.This is the last of the regional Fed surveys for January. The regional surveys provide a hint about the ISM manufacturing index, as the following graph shows.

The month-over-month composite index was 27 in March, up from 19 in February and 7 in January. This reading set a new all time survey high. ... The employment index inched higher from 23 to 25, also a new survey record.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The New York and Philly Fed surveys are averaged together (dashed green, through March), and averaged five Fed surveys (blue, through March) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through February (right axis).

The regional surveys suggest the ISM manufacturing index will in the 60+ range (strong expansion). The ISM index for March will be released tomorrow, April 1st. The consensus is for a decrease to 61.2 from 61.4 in February.

And from earlier this morning ...

• From the Chicago Business Barometer™ Decelerated: The overall index decreased to 70.6 from 71.2 in February. This was slightly above consensus expectations of 70.0. Note: any number above 50 shows expansion, so this is a strong reading.

"EMPLOYMENT grew to its second-highest level since February 1973." The employment index increased sharply to 65.6 from 59.8. This is the highest level since December 1983.

"NEW ORDERS increased to the highest point since December 1983". The new orders index decreased to 74.5 from 75.9.

Prices were up sharply, but over all this was a strong report.

Ireland: Stress Test Results to be released at 11:30 AM ET

by Calculated Risk on 3/31/2011 10:16:00 AM

Weekly Initial Unemployment Claims at 388,000

by Calculated Risk on 3/31/2011 08:30:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending March 26, the advance figure for seasonally adjusted initial claims was 388,000, a decrease of 6,000 from the previous week's revised figure of 394,000. The 4-week moving average was 394,250, a increase of 3,250 from the previous week's revised average of 391,000.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the 4-week moving average of weekly claims for the last 40 years. The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased this week to 394,250.

The number of weekly claims for last week was revised up - so this was reported as a decline. But what really matters is this is the 5th consecutive week with the 4-week average below the 400,000 level. There is nothing magical about 400,000, but this is a small positive step for the labor market.

Wednesday, March 30, 2011

Irish Finance Minister: Bank stress test results of "major significance"

by Calculated Risk on 3/30/2011 10:37:00 PM

The Irish bank stress test results will be released tomorrow.

From the Irish Times: Noonan to propose 'radical' bank sector restructuring

... The results of the tests will lead [Finance Minister] Michael Noonan to undertake “a radical new approach” to fix the banks, a Government source said.Here are the Irish yields from Bloomberg for 2 year and 10 year bonds.

Mr Noonan will make a “watershed” argument for a EU-wide solution around passing bank losses on to bondholders ... The Minister will speak for 20 minutes in the Dáil immediately after the announcement of the test results by the Central Bank.

Mr Noonan told Fine Gael TDs and Senators at the party’s parliamentary party meeting last night that the test results would be of major significance and would dominate the news over the weekend.

...

ECB chief Jean-Claude Trichet chaired a teleconference meeting of the bank’s governing council from China yesterday to discuss the situation in the Irish banks. A further meeting may be held today as the ECB finalises its response.

Earlier:

• CoreLogic: Shadow Inventory Declines Slightly

• Lawler: The “Shrill Cry” from Lobbyists on QRM

Fannie Mae and Freddie Mac Delinquency Rates decline slightly

by Calculated Risk on 3/30/2011 07:46:00 PM

Fannie Mae reported that the serious delinquency rate decreased to 4.45% in January from 4.48% in December. This is down from 5.52% a year ago.

Freddie Mac reported that the serious delinquency rate decreased to 3.78% in February from 3.82% in January. (Note: Fannie reports a month behind Freddie). This is down from a record high 4.20% in February 2010.

These are loans that are "three monthly payments or more past due or in foreclosure".

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

Some of the rapid increase in 2009 was probably because of foreclosure moratoriums, and also because loans in trial mods were considered delinquent until the modifications were made permanent. As modifications have become permanent, they are no longer counted as delinquent.

The slowdown in the rate of decline in the 2nd half of last year was probably related to the new foreclosure moratoriums.

Earlier:

• CoreLogic: Shadow Inventory Declines Slightly

• Lawler: The “Shrill Cry” from Lobbyists on QRM

Lawler: The “Shrill Cry” from Lobbyists on QRM

by Calculated Risk on 3/30/2011 04:11:00 PM

Earlier on Shadow Inventory:

• CoreLogic: Shadow Inventory Declines Slightly

In the following long post, housing economist Tom Lawler clears up some misunderstandings and misinformation regarding the new proposed mortgage rules: The “Shrill Cry” from Lobbyists on QRM

Yesterday the Office of the Comptroller of the Currency, Treasury (OCC); Board of Governors of the Federal Reserve System (Board); Federal Deposit Insurance Corporation (FDIC); U.S. Securities and Exchange Commission (Commission); Federal Housing Finance Agency (FHFA); and Department of Housing and Urban Development (HUD) jointly issued their proposed rule on “credit risk retention” for assets collateralizing asset-backed securities pursuant to the Dodd-Frank Act, and the proposed rule included a proposed definition of a “qualified residential mortgage (QRM)” For ABS backed by QRMs, the DFA provides for an exemption of the risk-retention rule. For folks who don’t remember, the “inclusion” of an exemption for QRMs was in the act because of heavy lobbying by financial institutions and housing-related trade groups, and it put regulators in the uncomfortable position of trying to decide what types of mortgages were so inherently “low risk” that they should/could be excluded from the rule designed to ensure that ABS issuers had “skin in the game.”

Regulators yesterday proposed defining “QRM” much more restrictively than the lobbyists who had successfully gotten the concept of a “QRM” into the legislation, including a LTV restriction of 80% (and no piggybacks), front/back end DTIs of 28% and 36%, respectively, and other “borrower credit history” restrictions. Industry lobbyists quickly commented negatively.

A comment on Regional Fed Talk

by Calculated Risk on 3/30/2011 02:18:00 PM

Much has been made about recent comments by St Louis Fed President James Bullard and Philly Fed President Charles Plosser. Kansas City Fed president Thomas Hoenig added his voice today: Fed should head for the exit, Hoenig says

A few comments:

• When Plosser gave his EXIT speech last week, he started by saying: "As always, and perhaps particularly so today, the views I express are my own and do not necessarily represent those of the Federal Reserve System or my colleagues on the Federal Open Market Committee." Notice that he emphasized these are his views.

• Tim Duy wrote today: Fed Watch: Running the Fed Like an Economics Department

It seems to me that the Fed lacks a coherent communication strategy – there is no willingness on the part of the leadership to enforce talking points. As a consequence, there is enormous pointless chatter from Fed officials that might be interesting in some sense, but provide misleading guidance about policy direction. Recent talk about scaling back the size of the large scale asset program, for instance. Almost certainly not going to happen – so why talk about it? Sadly, it appears to be an almost deliberate effort to create uncertainty among market participants at a time when the opposite is so important.A key European analyst wrote to his clients today:

Professor Bernanke likes to allow his students to roam the campus and say what they think. This collegiate approach leads to vibrant debate, but debate that may have previously only occurred behind the closed doors of the FOMC.And that is the point: these comments are the opinions of a few regional presidents - some non-voting - and do not represent the views of the majority on the FOMC.

• The "big three", Fed Chairman Bernanke, Vice Chair Janet Yellen, and NY Fed President William Dudley will all speak over the next two weeks, starting with Dudley this Friday, Bernanke on April 4th, and Yellen on April 11th. I expect they will speak with one voice and stand behind the current QE2 policy stance and the "exceptionally low levels for the federal funds rate for an extended period" guidance. I also expect they will also argue that the increase in inflation is transitory.

Although I read all the regional Fed speeches, I'm not sure why some market participants have been paying closer attention to certain speeches. Perhaps they are unaware of Professor Bernanke's "collegiate approach"!

I believe the current policy will continue as planned.

CoreLogic: Shadow Inventory Declines Slightly

by Calculated Risk on 3/30/2011 10:25:00 AM

From CoreLogic: CoreLogic Reports Shadow Inventory Declines Slightly, However, Nine Months’ Worth of Supply Remains

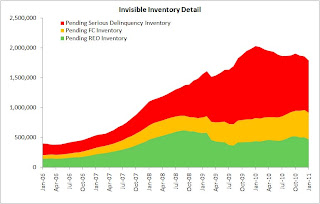

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph from CoreLogic shows the breakdown of "shadow inventory" by category. For this report, CoreLogic estimates the number of 90+ day delinquencies, foreclosures and REOs not currently listed for sale. Obviously if a house is listed for sale, it is already included in the "visible supply" and cannot be counted as shadow inventory.

CoreLogic estimates the "shadow inventory" (by this method) at about 1.8 million units.

CoreLogic ... reported today that the current residential shadow inventory as of January 2011 declined to 1.8 million units, representing a nine months’ supply. This is down slightly from 2.0 million units, also a nine

months’ supply, from a year ago.

CoreLogic estimates current shadow inventory, also known as pending supply, by calculating the number of distressed properties not currently listed on multiple listing services (MLS) that are seriously delinquent (90 days or more), in foreclosure and real estate owned (REO) by lenders. Transition rates of “delinquency to foreclosure” and “foreclosure to REO” are used to identify the currently distressed non-listed properties most likely to become REO properties. Properties that are not yet delinquent but may become delinquent in the future are not included in the estimate of the current shadow inventory. Shadow inventory is typically not included in the official metrics of unsold inventory.

...

Of the 1.8-million unit current shadow inventory supply, 870,000 units are seriously delinquent (4.2 months’ supply), 445,000 are in some stage of foreclosure (2.1 months’ supply) and 470,000 are already in REO (2.2 months’ supply).

The second graph shows the same information as "months-of-supply". This is in addition to the visible months-of-supply (inventory listed for sale). Note: It is the visible inventory that mostly impacts prices, but this suggests the visible inventory will stay elevated for some time (no surprise).

The second graph shows the same information as "months-of-supply". This is in addition to the visible months-of-supply (inventory listed for sale). Note: It is the visible inventory that mostly impacts prices, but this suggests the visible inventory will stay elevated for some time (no surprise).CoreLogic also notes:

In addition to the current shadow inventory supply, there are nearly 2 million current negative equity loans that are more than 50 percent “upside down” that will likely become shadow supply in the near future.This report provides a couple of key numbers: 1) there are 1.8 million homes seriously delinquent, in the foreclosure process or REO that are not currently listed for sale, and 2) there are about 2 million current negative equity loans that are more than 50 percent “upside down”.

ADP: Private Employment increased by 201,000 in March

by Calculated Risk on 3/30/2011 08:15:00 AM

ADP reports:

Private-sector employment increased by 201,000 from February to March on a seasonally adjusted basis, according to the latest ADP National Employment Report® released today. The estimated change of employment from January 2011 to February 2011 was revised down to 208,000 from the previously reported increase of 217,000.Note: ADP is private nonfarm employment only (no government jobs).

...

The average monthly increase in employment over the last four months – December through March – has been 211,000, consistent with a gradual if uneven decline in the unemployment rate. This is almost three times the average monthly gain of 74,000 over the preceding four months of August through November.

This was about at the consensus forecast of an increase of about 205,000 private sector jobs in March.

The BLS reports on Friday, and the consensus is for an increase of 195,000 payroll jobs in March, on a seasonally adjusted (SA) basis, and for the unemployment rate to hold steady at 8.9%.